How AI Products Can Nail Their Positioning?

Goldman Sachs estimates that global AI investment could approach $200 billion by 2025. Nearly all the companies you love are building AI features and products, and ¾ of the founders in my go-to-market community are launching AI agents or copilots at the moment.

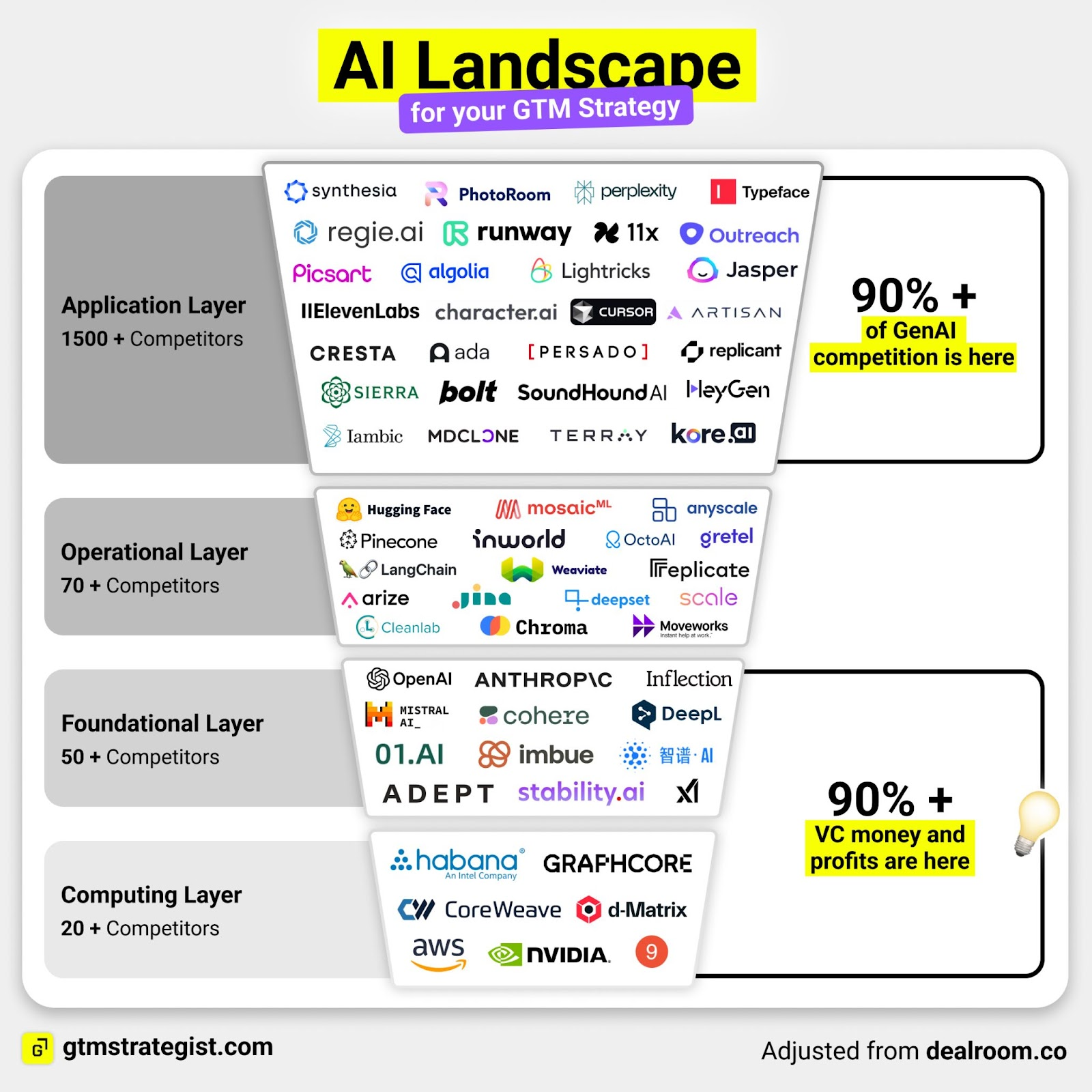

The AI landscape is becoming crowded, and it is increasingly difficult, yet mission-critical, to stand out in the ever-more-competitive landscape. But the billion-dollar question is – how?

The gold rush of AI agents and copilots

In the gold rush, you won if you sold shovels, so companies that are building AI infrastructure and AI models will most likely thrive. Also, a bunch of educational products and services will benefit from the hype curve, which will only get steeper in 2025.

Most competition in this arena is at the application layer (AI-powered apps, copilots, and agents). For this reason, it is mission-critical to stand out and find a compelling and defensible value proposition for your target audience and communicate it effectively. How do we win?

AI LinkedIn Prophets like Kyle Poyar, Kieran Flanagan, and Greg Isenberg believe that in 2025 and beyond:

- Bigger teams will win by pricing per outcome – aka jobs to be done. Kyle Poyar has done an interesting analysis of innovative pricing for AI products. Instead of good old subscription-based pricing based on product access (beginner, intermediate, pro) or the number of seats, best-in-class companies are experimenting with newer pricing models that are more fairly measuring and capturing added value for the customer. For example, Intercom’s Fin AI Agent is priced at $0.99 per ticket resolution. Following Fin’s last answer in a conversation, a resolution is counted when the customer confirms the answer provided is satisfactory (hard resolution) or exits the conversation without requesting further assistance (soft resolution).

- Smaller teams and innovations have the best fighting chance to start small. They call it the year of Vertical AI Agents, a solution purposefully built for getting the job done or solving a specific use case for a well-defined ICP. Simply put, you can start by serving an underserved or neglected market segment in your category.

Let’s quickly touch upon the difference between horizontal and vertical products before going further. We will use a simple fishing analogy to make sure it sticks 🎣.

In the world of tech, horizontal products cast a wide net. They’re built to solve universal problems—think productivity, automation, or communication—across industries. Tools like Notion, Canva, Grammarly, and Zapier thrive here, delivering versatility that works for everyone, from marketers, wannabe entrepreneurs, bloggers, and product managers to engineers.

But vertical products? They go deep, not wide – like a harpoon. These tools solve niche, high-value problems within specific roles, use cases, and jobs to be done. Two examples of vertical products using AI agents are Keyplay (ICP modeling and account scoring – disrupting Zoominfo with AI) and Swan (identifying website visitors with an AI SDR for outreach).

The choice isn’t just about features—it’s about focus. Horizontal tools scale breadth. Vertical tools scale expertise. Which type aligns with your strategy?

The genius of Vertical AI Agents: Will they replace humans?

Most of the teams starting with limited funding will most likely start to look vertically because they do not have product excellence, resources, and audacity to get 1 million users in just 5 days after the launch like ChatGPT or 2 months like it took Claude.

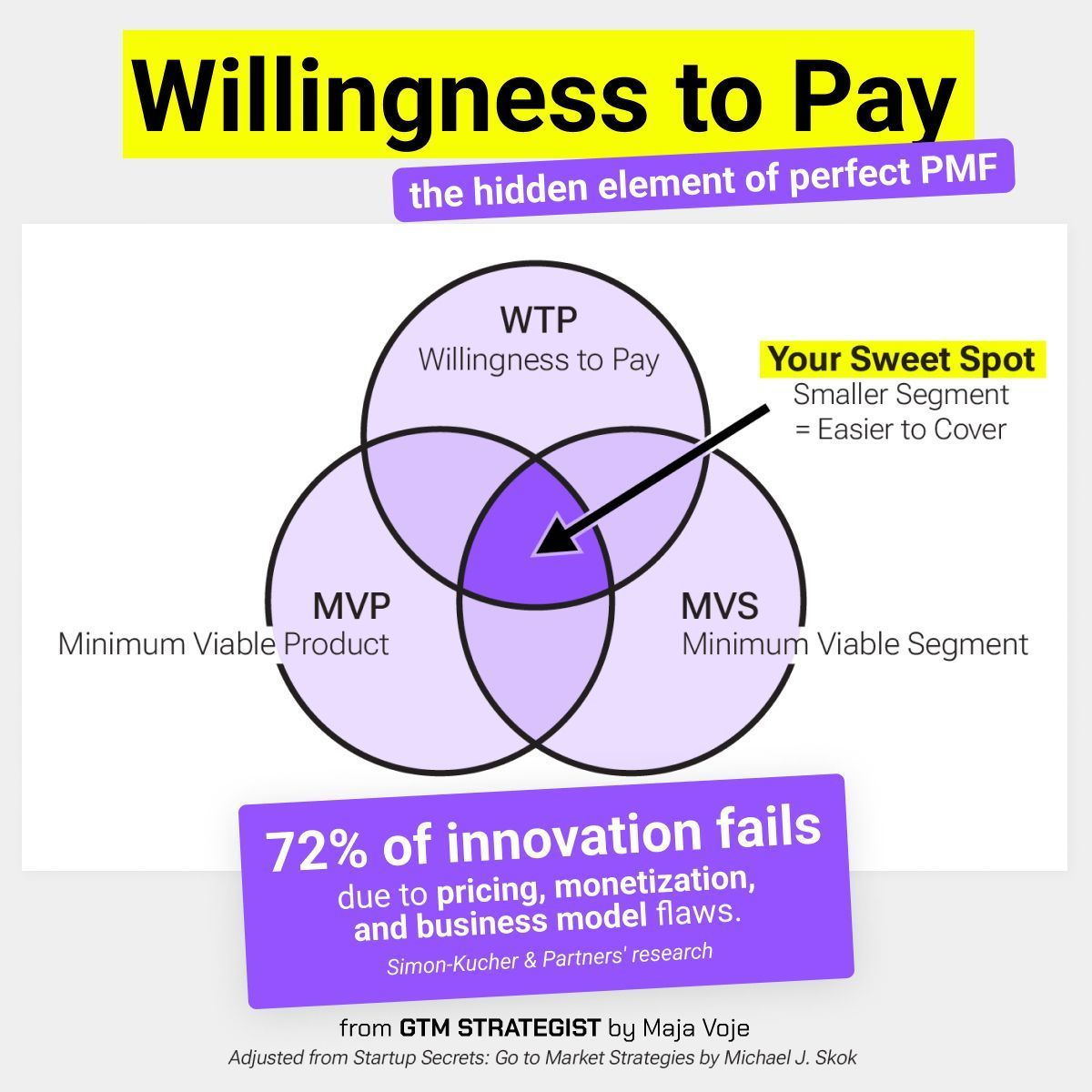

Most of us will start by selecting a narrow segment with a burning pain point, reasonable willingness to pay, great capacity to produce relevant case studies and testimonials to move upmarket, and healthy growth potential – a beachhead segment to win early traction.

And the good news is – even if you start small, with a narrower focus, you can still charge considerably more as vertical AI than your horizontal competitors because you can create much more value-added for your target market and become a hot target for investors – why?

Customers and capital markets value Vertical AI agents differently than traditional SaaS products.

AI agents can get higher valuations than traditional SaaS because they are not just tools but potential game-changers. Unlike static software, AI agents learn, adapt, and get smarter with every interaction, delivering compounding efficiency gains that SaaS can’t achieve.

They thrive in high-value niches, scale across industries, and create unstoppable network effects by leveraging real-time data (moat). With massive R&D barriers and potential for revenue streams like APIs and integrations, they’re seen as future-proof investments driving innovation. AI isn’t just a buzzword here—it’s the engine behind faster growth, smarter decisions, and the ultimate competitive edge, which makes them much harder to copy than traditional SaaS.

So – AI or die? Most of us are probably more aligned with the idea that AI changes the way we work. As a company adapting new tech tools all the time, Userpilot’s CMO Emilia Korczyńska brilliantly pointed out:

“AI tools are used and adopted in a way that is different from how other tools are adopted – because AI often works on top of existing solutions as a value add, rather than standalone.”

And sometimes, yes – they do replace humans. Consider an example of a startup or scaleup. How bloody difficult is it to kick off the sales function – you have no idea what you are doing, and you do not have money to hire proper people who know what you are doing. What should the founder do – should they hire a freshman who sold supplements in a gym before and hope that his sales generosity will transform into talking to accounting firms in Asia? Well, that is a long shot … Justin Kistner, founder of CopyClub.ai and CopySub, made a beautiful comparison – talking (prompting) to AI is like talking to a junior, not a senior at this stage.

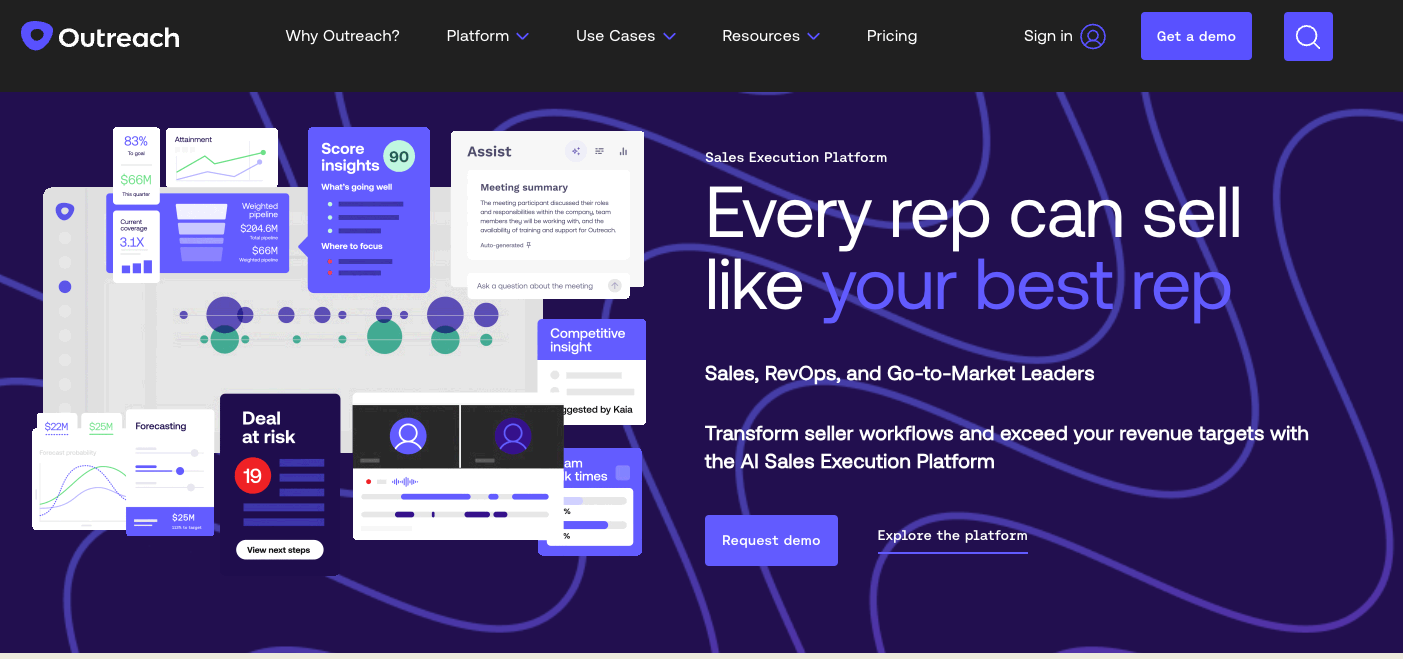

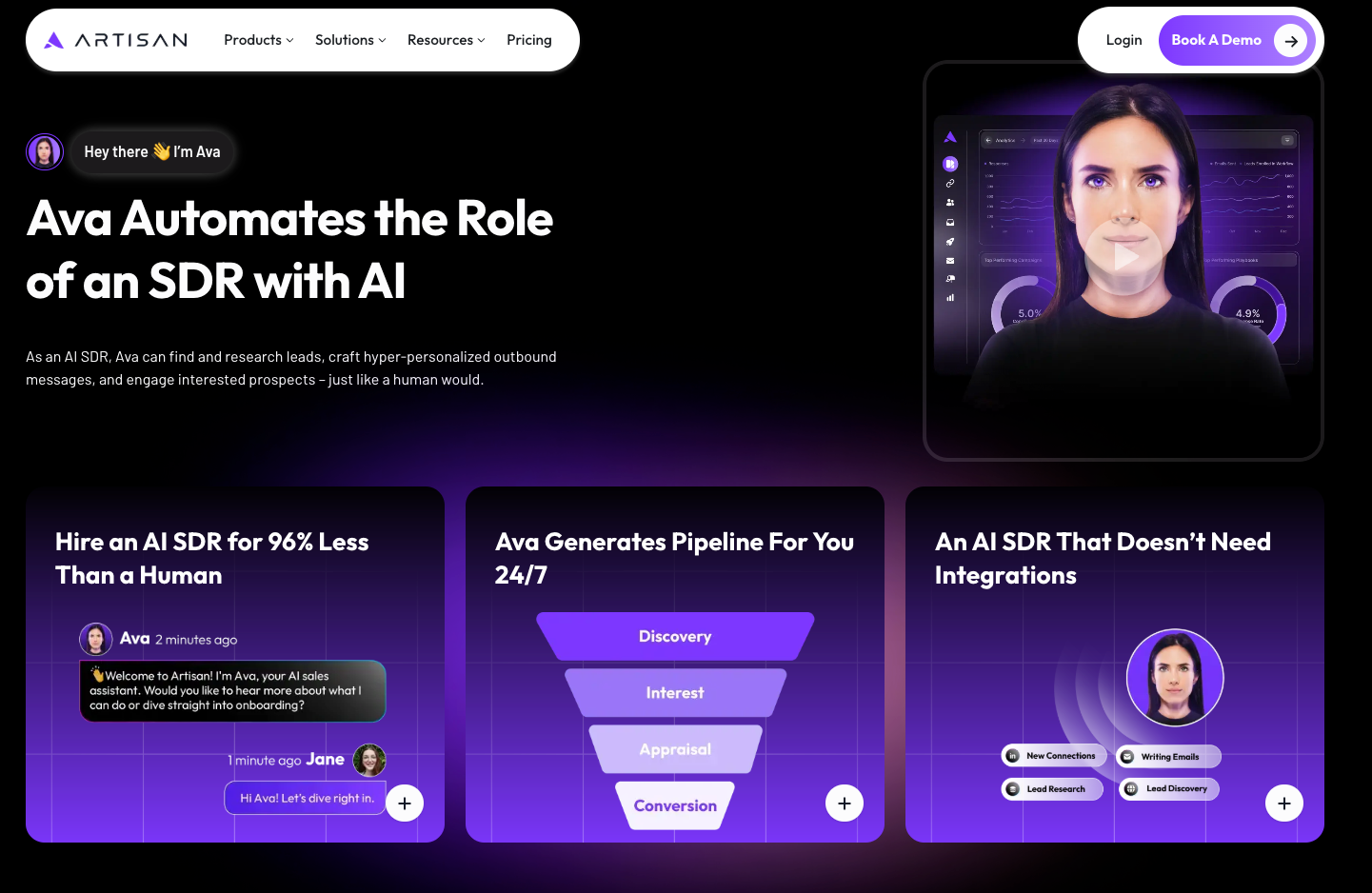

Check this out – Outreach is the sales engagement platform that achieved $300.8M in revenue with 6,000 customers, reflecting 45.63% year-over-year growth. Founded in 2014, it attracted $488.7M in funding.

Their promise – their value proposition is: Every rep can sell like your best rep (human-centric).

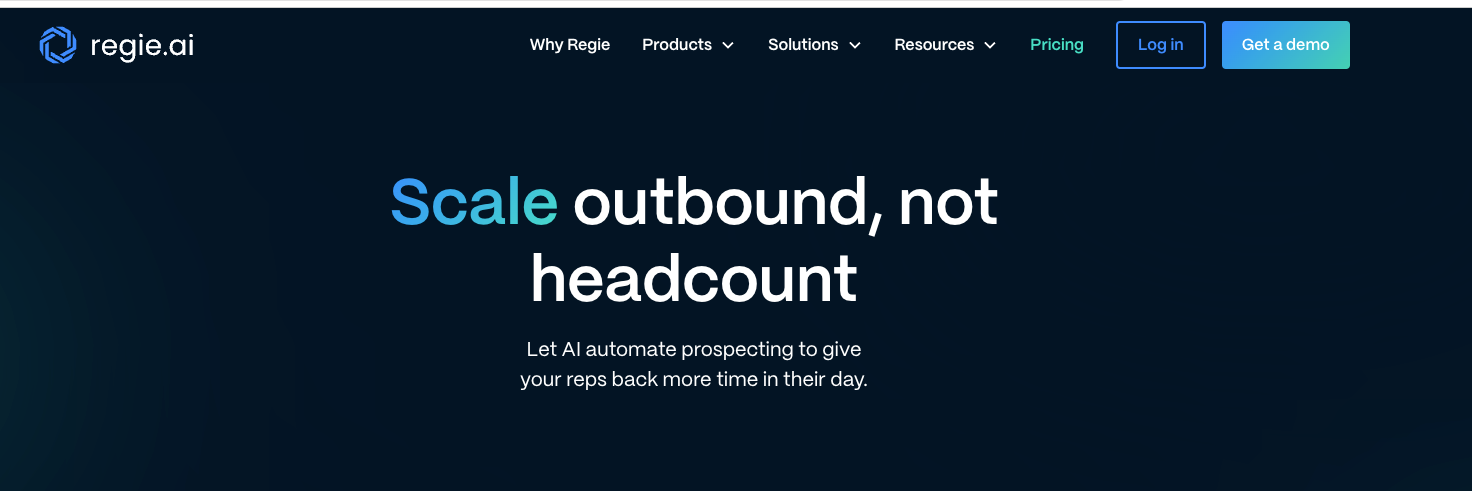

Now check out the new cool kid on the SDR AI block – regie.ai. He is scary 😱 – or is he?

Outreach helps SDRs do a better job, and Regie does the job.

They do not target the same ICP at this moment.

Yet, they both target the exact pinpoint: inefficient SDR or addressing the need for companies to make more sales. How we are tackling this is different.

At this point, most decision-makers will compare AI agents to “getting the job done” in FTEs or service fees. As long as the tool can provide evidence that the job can be as good or better executed at comparable costs, it can spark interest. With increasing pressure to be more productive and efficient, AI vertical agents, often packaged as “digital workers,” can demand prices that normal SaaS competitors would struggle to justify.

Speculating whether the utopia of the future of work involves teams of digital workers is beyond my qualifications, but the promise of having “someone” answering your phone 24/7 with comparable or better satisfaction rates than a person who has to sleep, eat, have a bad day, go on vacation, is sick, etc. sounds like one hell of a deal to business owners who would struggle to pay for three shifts of receptionists.

Let me walk you through the process that I am using for my AI agent’s clients and top-secret in-house projects. 🤠 Zero theory – just action. 🎬

5 Steps to DIY “Positioning v01” for testing and refining

I love and hate doing positioning work.

On the one hand, I learned that it makes a massive difference in business (targeting, conversion rates, success of marketing and sales materials) because it answers the key questions for your ICP, such as:

- What is this?

- Why should I care?

- Is it for me (will it work for me)?

- How is it better/different than existing alternatives?

On the other hand, I have never seen a team that would nail positioning from the get-go. It is dynamic and it is evolving with time, your market knowledge, product development, experiences with your customers, and your vision for the future.

Therefore – pragmatically – how much do I really want to invest in “v01 positioning” before hitting the market to learn more?

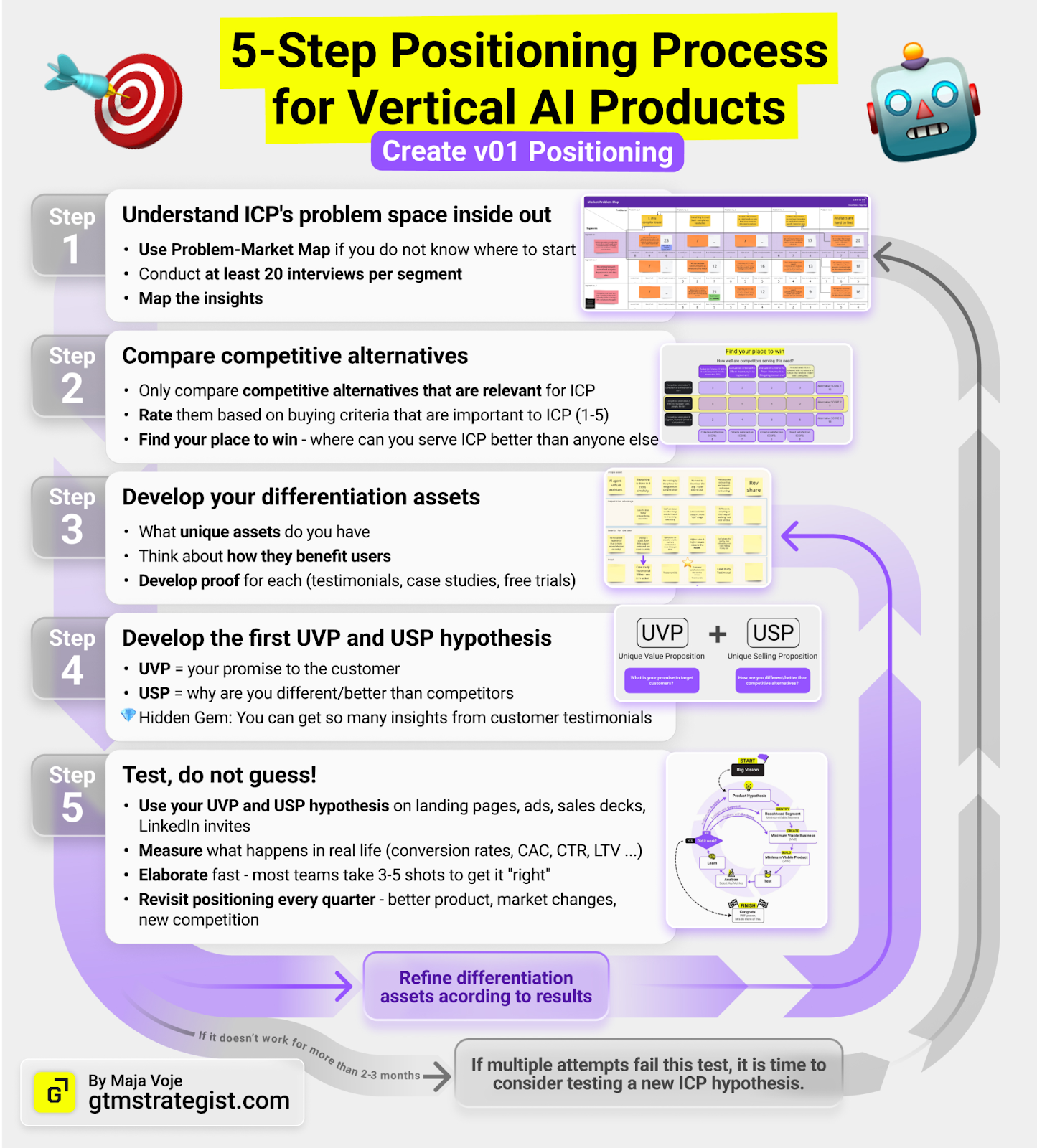

Embracing this nature of uncertainty and dealing with highly innovative technologies such as vertical AI agents that have fewer direct competitive alternatives than your normal “red ocean CRM” – I recommend following this framework:

Next, we will dive into all the steps using digital worker AI SDR Ava by Artisan as an example.

Step 1: Understand your ICP’s problem space inside out

Since we are talking about AI vertical agents here, let’s assume that you have done the discovery work already and focused on a specific target market that you want to win first.

If you need more input here, one of my best practices is to test more segments and reverse engineer based on retention or monetization after I get the initial results.

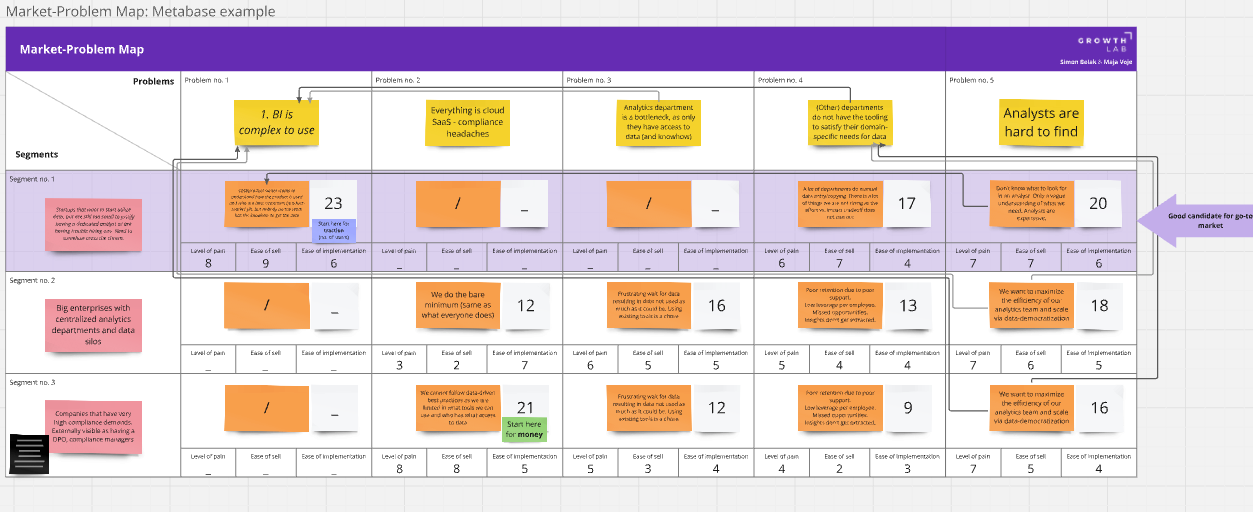

If you are not in a position to do so, the Market-Problem Map framework can help you make an educated selection between multiple segments that could benefit from your product.

A bounty 🥥 – if this sounds boring and draining to you – there is a prompt at the end of the article that will remove some of this heavy lifting … But please do not skip the “talk to your customers” part – it makes all the difference.

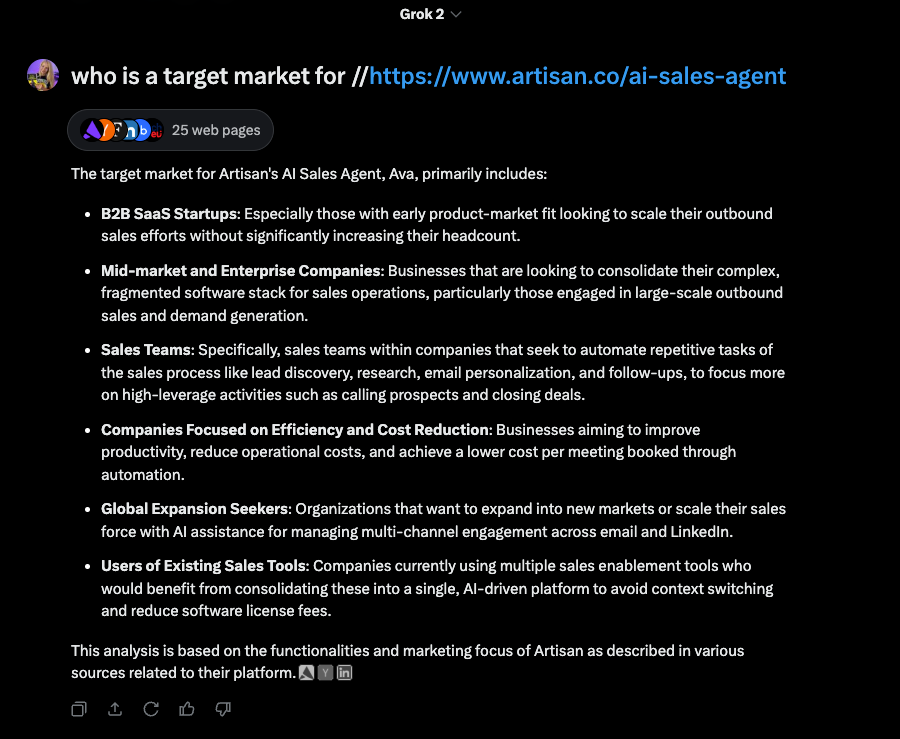

Ava example: Ideal Customer Profile (ICP):

Let’s ask Grok – yup, this answer looks good to me. I was on a demo with Artisan and it is very coherent with the narrative. 👌

Step 2: Compare competitive alternatives (HUGELY IMPORTANT FOR AI PRODUCTS)

No buying decision is taken in isolation. Your prospects always compare you against something or someone – which may be “doing nothing”, an Excel sheet, Zapier flow, Notion automation, or just doing the work themselves by putting more hours in. In this step, you need to figure out what, or, very frequently true for AI agents who you are competing against.

Forget desktop research of competition at this point. The only competition that matters here is “How else would your ICP solve this problem – what are they comparing you against? After you figure that out, next in line you need to understand the evaluation criteria – what is essential to your ICP, and how are they making this decision. With some simple scoring, you can quickly navigate to the potential place to win – what can you double down on in your messaging so you have a fighting chance to be uniquely positioned in your target customers’ minds and hearts?

I quickly drafted this example for Ava, having a technical SaaS founder in mind who would like to scale the company’s sales function. Based on scoring these criteria, it became clear that the alternative that does not solve the problem effectively for their ICP would be to “hire more people” – again- competence, costs, ability to onboard – so this is what they can (and did) double down in the communication.

Step 3: Develop your differentiation assets

After understanding the real competitive landscape, you can start transitioning into “why us” assets.

In short, why would your ICP choose you instead of a competitive alternative? What can you do/have that would make you a go-to choice for your ICP?

For each asset that you can come up with, translate it into a benefit (why is this good for the user) and proof (how can you prove that what you claim is true – think testimonials, case studies, screenshots, independent ratings, experts endorsements, free tools, and trials).

The logic is very simple – whatever you say that is true requires more evidence – build trust.

Step 4: Develop the first UVP and USP hypothesis

Now, your brain is beautifully warmed up to establish new syntaxes – the next step is to create a Unique Value Proposition (UVP) and Unique Selling Proposition (USP) hypothesis. The most simple definition is:

UVP = Your promise to the customer – what will you do for them?

USP = How are you better – different from competitive alternatives?

Want some drama? Why are you a solution to solve this problem/get the job done for your ICP, and you are so good that you squeeze the competition into oblivion of irrelevance? 🤠 That is the beauty of vertical positioning – you can go all in when you know your ICP inside out.

Ava example:

Unique Value Proposition (UVP):

Ava is your AI-powered SDR, automating the entire outbound sales process to deliver hyper-personalized, high-quality leads on autopilot, freeing your team to focus on closing deals.

Unique Selling Propositions (USPs):

- Cost Efficiency: Ava operates at 96% less cost than a human SDR, delivering unparalleled savings.

- Comprehensive Automation: With an all-in-one outbound platform, Ava eliminates the need for additional tools or integrations, simplifying workflows.

Self-Optimization: Ava learns and improves over time, refining outreach strategies to maximize engagement and response rates.

Bonus: AI prompt to help you develop strong UVP and USPs

💡You might decide to skip steps 3 and 4 and use this AI prompt instead:

- Choose your top 5 competitors (that are relevant for your target customer).

- Prompt Claude or ChatGPT to analyze their UVP and USPs, then instruct it to suggest a couple of potential UVPs and USPs you can test.

Some tips for using this prompt effectively:

- Share competitor content one at a time to allow for focused analysis.

- Provide as much raw website content as possible, not just summaries.

- Include competitor pricing pages if available.

- When sharing your website content, include any customer feedback or testimonials.

- If you have specific target segments or industries in mind, mention those upfront.

Prompt template:

I need you to act as a Senior Product Manager. Prepare a competitive positioning analysis and develop strong UVP/USP candidates for our AI B2B product. Here’s what I want you to do:

- First, I’ll share content from 5 competitor websites [will paste each separately]. For each competitor, please:

– Extract their explicit and implicit value propositions.

– Identify their primary unique selling points.

– Define their key target audience and positioning.

– Highlight any gaps or weaknesses in their positioning.

- Then I’ll share our current website copy. Please analyze it to:

– Extract our current value propositions and USPs.

– Identify our key differentiators.

– Note any gaps or missed opportunities.

– Map how we’re currently positioning ourselves vs competitors.

- Based on this analysis, please:

– Propose 3-5 potential UVP candidates that would resonate with our B2B audience.

– For each UVP candidate:

* Explain the key customer pain point it addresses.

* Show how it differentiates us from competitors.

* Suggest how we could validate it.

– Recommend 2-3 supporting USPs for each UVP.

– Highlight any risks or potential challenges with each option.

Please structure your analysis step by step and explain your reasoning throughout.

Here’s the first competitor’s website content: [paste content]

Step 5: Test, do not guess

Now, go and advertise, sell, and pitch on LinkedIn – try to get feedback from the market as soon as possible.

I am a die-hard believer in experimentation and making decisions with confidence, and for confidence, I need evidence.

Once you think like this, it takes off the pressure to do it right – since you can iterate and get to the winning positioning in each iteration. I believe that as long as you are purposefully moving, you win.

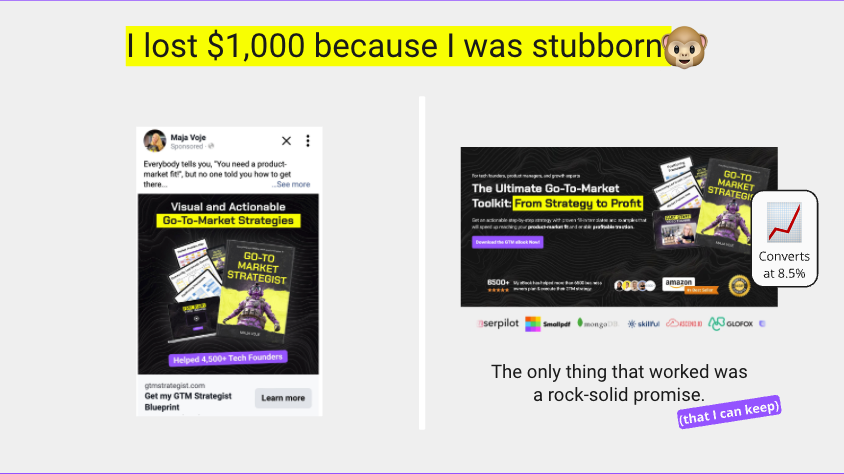

And I am totally eating my dog food here. I am putting my money into figuring out the positioning for my products. My first idea for the headline of my best-selling Go-to-Market Strategist book was “From overwhelmed to hyperfocused”.

As a founder, I felt it beautifully captures the mental transformation of the reader and the dynamic nature of the go-to-market stage. The problem was … it did not mean s***. It DOES NOT COMMUNICATE the value added of my offer to my ICP in any reasonable manner.

But I was stubborn and in love with my idea … So much so that I titled my workshop at Miro “From Overwhelmed to Hyperfocused”. I put it as a tagline to Meta ads only to see my money burning – the conversion rate of the campaign was <1% …I was sad – does no one want my product? 😢

A miracle happened after my “funnel guy” talked some direct sales sense to me.

The taglines: “Everything you need to get to product-market fit” and “A guideline to get to your first 100 customers” suddenly worked, and sales started to appear. We even got the conversion rate to 9% at campaign high points on my landing page. The core difference is that I communicate what is in it for my ICP – well, learning by doing. 🤠

Userpilot, sincere thanks for giving me a voice here.

There are so many teams who are trapped in analysis paralysis when it comes to messaging and positioning, and I firmly believe that the only way to get to the right answers is to test the s*** out of what one day will be our winning positioning and a true driver of differentiation. We know what we know – the rest we can learn and my best teacher so far has been an empirical method.

I am happy to continue the discussion – do you have some amazing vertical AI products to highlight? Did you come up with an alternative, different solution for finding the positioning that converts well 🤠?

Would love to continue the discussion on LinkedIn. If you like this pragmatic and empirical approach to making go-to-market decisions with empirical evidence, you are welcome to subscribe to my GTM Strategist newsletter, where I am building in public and sharing new results and insights every single week.

Learning by doing with you & sharing best practices from companies that are doing it right here, right now.