What are microsurveys and how can you use them to understand customer sentiment and collect actionable user feedback insights?

Compared to long-form surveys, microsurveys help to understand your users’ needs in a more contextual way.

In this article, we’re going to cover everything you need to know about them and cover types, examples, and best practices.

Get The Insights!

The fastest way to learn about Product Growth, Management & Trends.

TL;DR

- A microsurvey (also known as a popup survey) is a short form consisting of 1 to 3 questions, often displayed in-app, that enables you to collect the user feedback you need to make product decisions for sustainable growth.

- The advantages of microsurveys are that they receive better submission rates, higher quality responses, and you get the information quicker.

- There are many different uses for microsurveys, including NPS, CES, CSAT, PMF feature requests, competitor research, personalization, and churn feedback using cancellation flows.

- When creating your user surveys, you should make sure you target specific customer segments and keep the survey questions focused on what you want to find out.

- The design of your microsurveys should match the design of your product to maintain brand consistency, and your microcopy should be clear and easy to understand.

- Userpilot enables you to create microsurveys in line with your brand and UI design and also analyze and act on the feedback you collect.

What is a microsurvey?

Microsurveys are bit-sized questionnaires that are generally shown in-app to specific segments of users.

A microsurvey is a fast and easy way of collecting contextual user feedback compared to traditional longer surveys used for user research.

Microsurveys vs traditional surveys

The nature of a microsurvey means that it’s often a much better approach than traditional long surveys or sending questions via other methods, such as email.

In a nutshell, in comparison to traditional surveys, microsurveys :

- Microsurveys allow you to collect more data: In the past, the only way to collect data and feedback from your customers was to ask directly or send traditional surveys using email. Of course, the problem with an email survey is that it doesn’t scale. The other issue is that not everyone will open the email, and of those who do, not everyone will click the link to the survey. That’s why microsurveys are so effective. They appear in-app, which means you’ll get a much higher submission rate and survey responses.

- Micro surveys are context-specific and accurate: With in-app microsurveys, you can target users based on actual product usage and collect meaningful data across the entire customer journey. For example, if you needed to get feedback from customers who had used a specific feature, then you could do that by setting up triggers within your product, and then showing the microsurvey when the trigger is fired.

Microsurvey types and examples

Microsurveys are so adaptable that you can use them to gather feedback on virtually any topic.

Here are some types of microsurveys you can use in your app – and what you can achieve with it

- Passive customer feedback microsurveys – for gathering feedback on a specific page, product, or feature

- Customer satisfaction microsurveys (NPS, Customer satisfaction score, Customer effort score, Product-market fit survey) – for collecting user sentiment levels of your users and continue improving your product to reduce churn

- Feature surveys – to help you make data-informed product decisions

- Competitor analysis microsurveys – to find out why the user has chosen you over a bigger player

- Welcome screen microsurveys (aka use case/ persona microsurveys) – for collecting that precious demographic, use case, and goals

- Churn microsurveys (aka exit surveys) – so you can learn why your users are leaving you (and draw conclusions that will help you reduce the churn) and even bring them back!

Now – let’s see what each of these microsurveys saas widgets looks like.

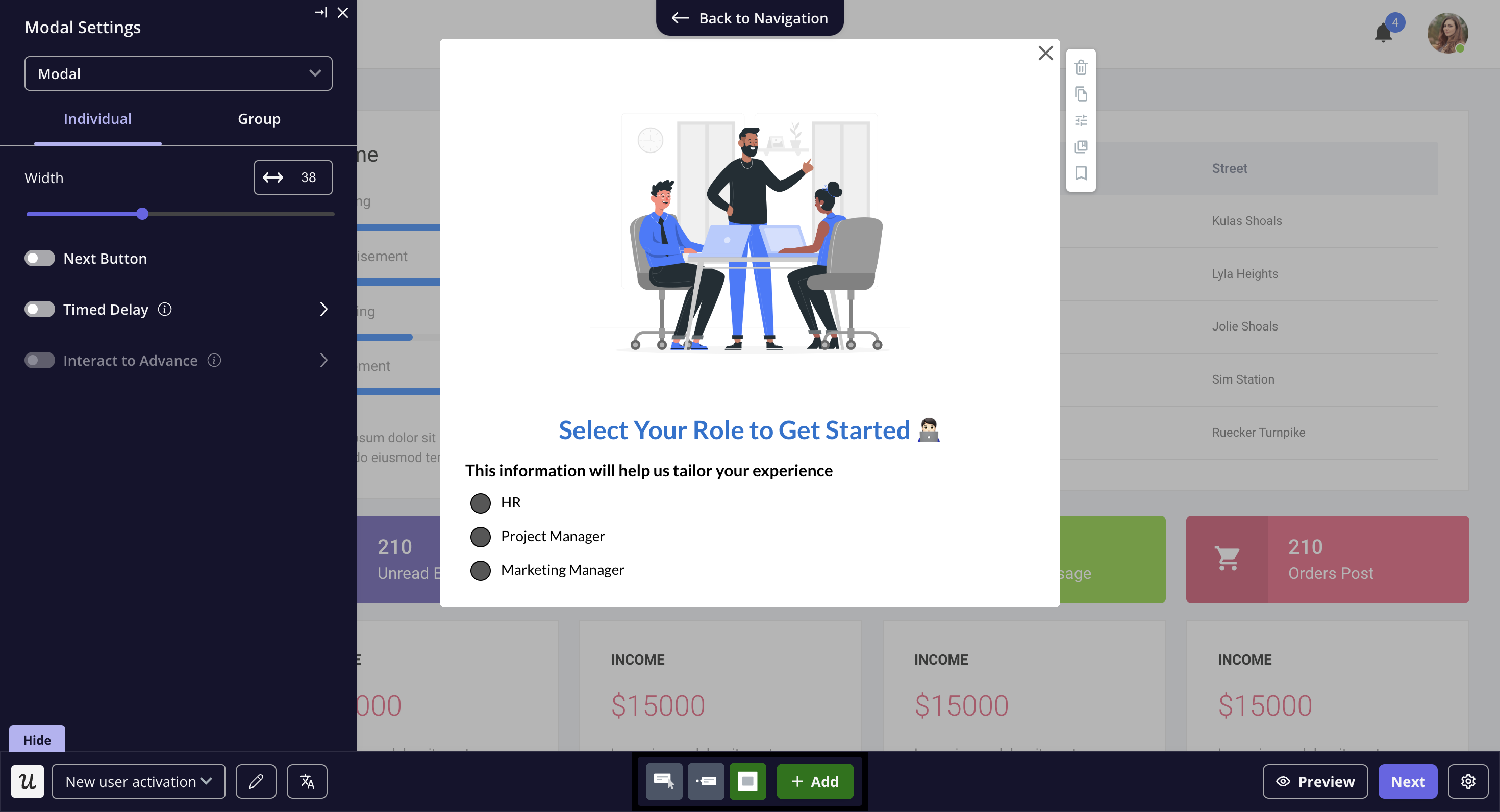

1. Welcome screen microsurveys

The most common mistake we found SaaS companies make in our ‘State of SaaS Onboarding Research’ on over 1000 SaaS companies is the lack of a welcome screen.

Welcome screen surveys are perfect for improving your product’s onboarding flow – as they allow you to provide a more personalized experience for your users.

Simply ask a couple of questions about their job role, their goals, and what they want to achieve with your product.

Users can choose one of the options and then will be shown the most relevant onboarding flow and product walkthroughs based on their responses. This will drive customer success and improve retention as the user gets to experience the value of your product faster.

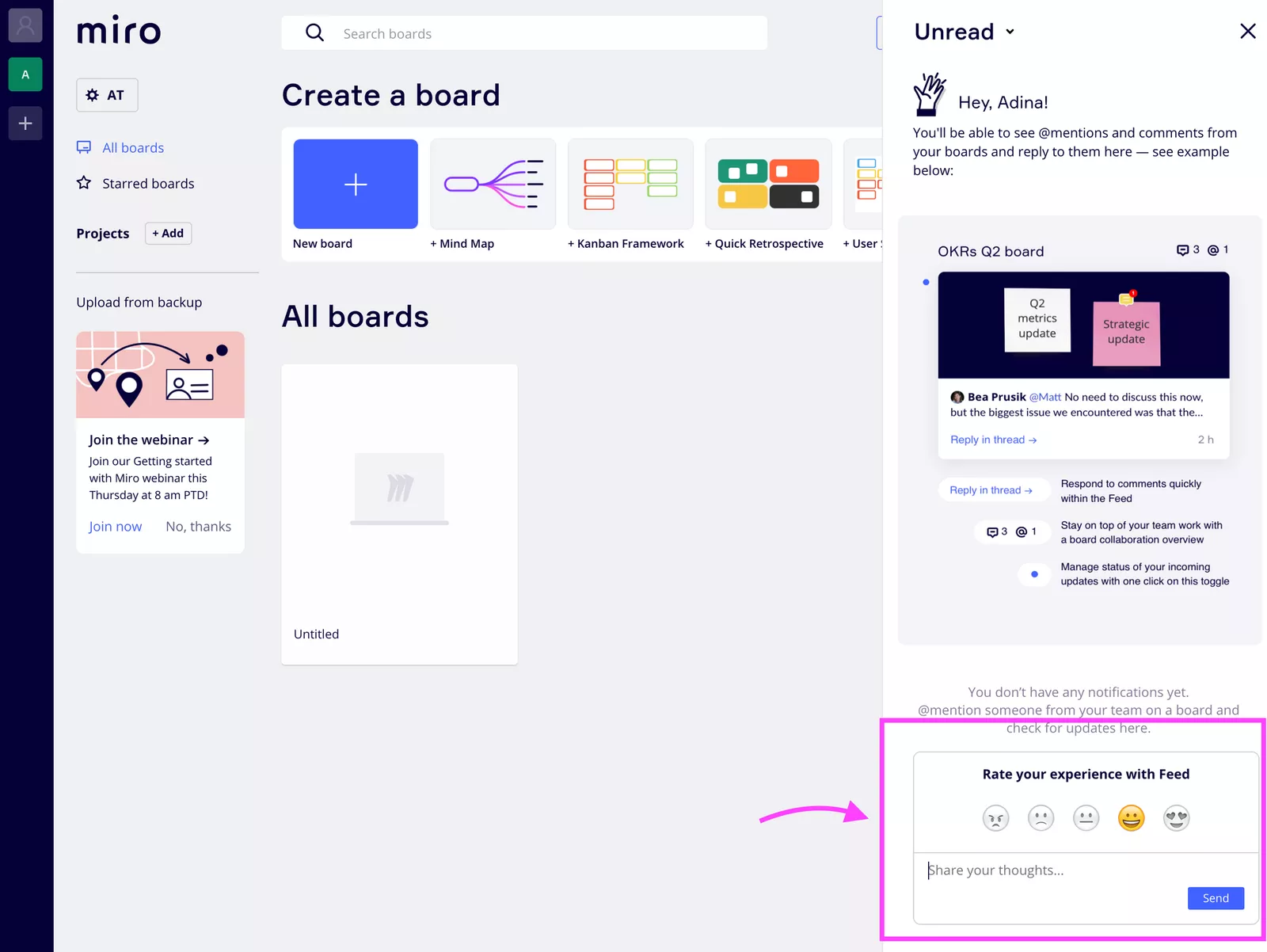

2. Passive customer feedback microsurveys

Passive feedback is the one initiated by the users. It refers to insights a customer provides without being prompted by the company in question, through on-demand surveys or other channels.

The most used method for collecting passive customer feedback is using always-on feedback widgets embedded on specific pages of your app.

It’s a useful way of seeing how you can improve the customer experience and add more value to your product.

Here’s a great example from Miro:

A microsurvey focused on the user experience with a specific feature.

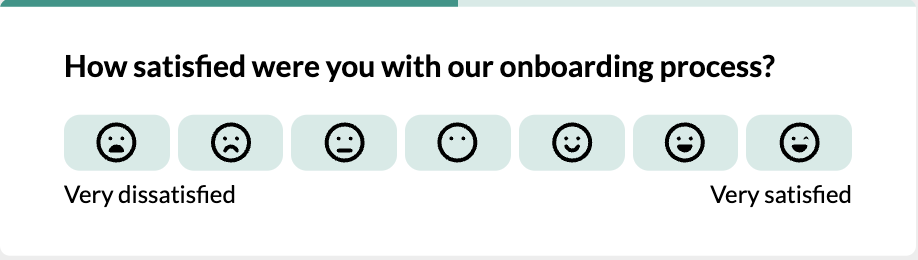

3. Customer satisfaction microsurveys (NPS, CSAT, CES, PMF)

Customer satisfaction surveys typically have one main question that focuses on asking the users to rate a specific experience or agree or disagree with a statement.

Net promoter score (NPS) surveys

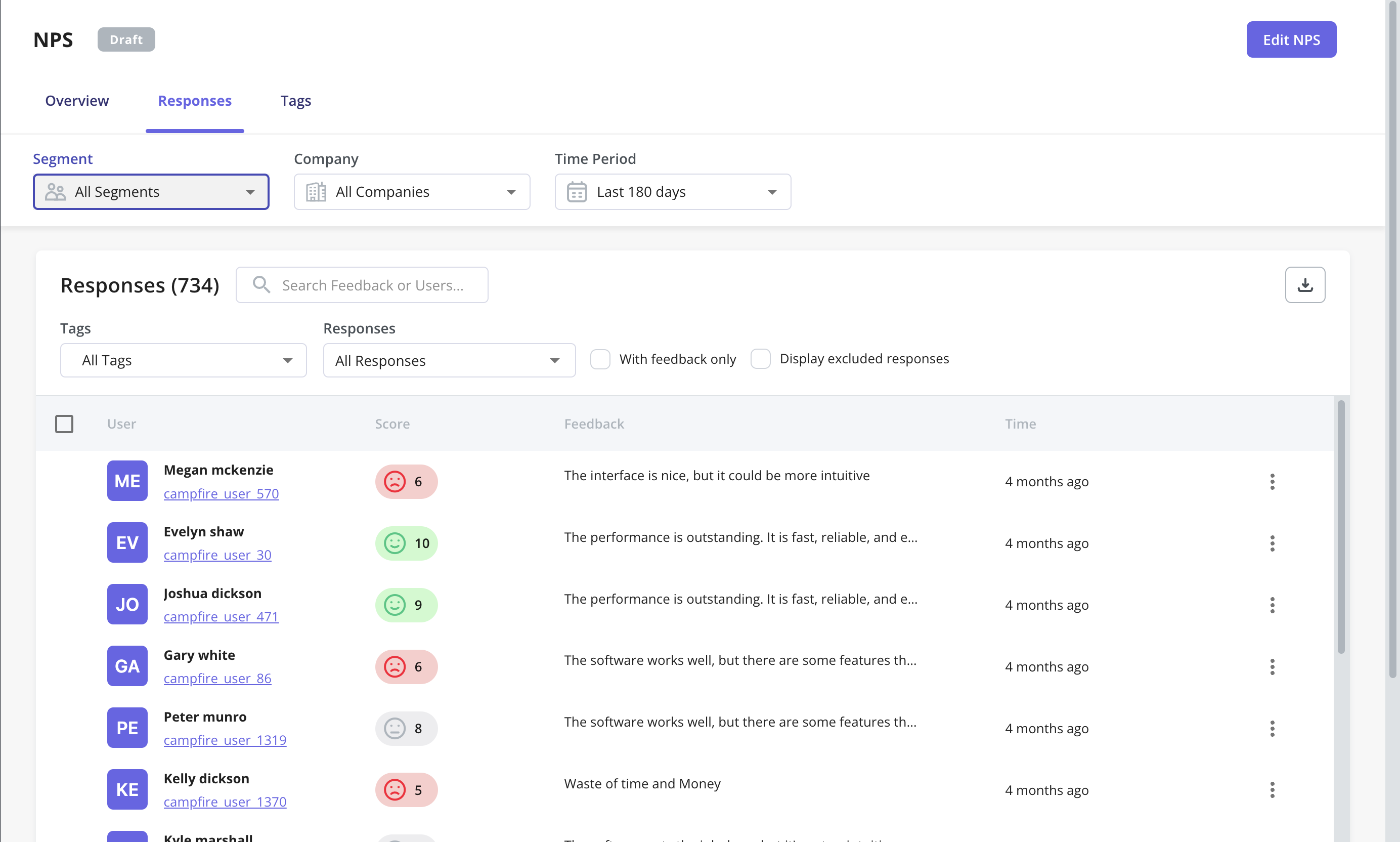

One of the most common uses for microsurveys is to measure your NPS (Net Promoter Score).

Net Promoter score surveys are designed to gather customer loyalty data – how users feel about your product.

CES (Customer Effort Score)

CES surveys measure the perceived effort in completing a task.

For example, how easy it was for a user to use a feature or achieve something within your product, helping you find points of friction in the customer experience.

Customer satisfaction surveys (CSAT)

CSAT (customer satisfaction score) is a more focused survey asking to gather specific feedback on the customer experience while interacting with the product features or support team.

Product market fit (PMF) survey

PMF (Product-Market Fit), a survey asking “How disappointed would you feel if you could no longer use this product?” enables you to adjust your product to the market’s needs. by understanding if there’s any perceived value in your current offering.

PMF surveys are used to build and tailor minimum viable products but can also be helpful to test your product-market fit after multiple product enhancements to see if you are going in the right direction,

Source: Userpilot- Get a demo now and build yours!

4. Feature experience microsurveys

Microsurveys can provide you with the information you need to make data-informed product development decisions and drive growth for your product.

You can create a product features request survey asking the user what they are missing in the product and what they are trying to achieve. These should be used for informational purposes only. They help you understand a need the user has but each request shouldn’t just go on the product roadmap.

The most commonly used feature surveys are the ones you use to collect feedback with only a few questions after a new feature launch or once a new user has engaged with it for the first time.

5. Competitor analysis microsurveys

Competitor research can often be tricky and generally relies on you looking at what your competitors’ products do and how they position themselves.

But it doesn’t have to be that way.

You can use a microsurvey to simply ask users why they choose your tool over a competitor, once they convert to paid customers. Triggering these at the right time in the customer journey is key.

6. Churn feedback microsurveys

A final – but probably most important of all – use case for microsurveys is to gather insights into why customers have churned.

This is something all SaaS companies and product managers want to know. Your product team can use the insights from these surveys to drive product development and remove potential friction in the product.

The simplest way to find out is to trigger a microsurvey modal when a user hits the ‘cancel’ button.

Provide a list of pre-defined reasons why they want to cancel – this should be based on insights you already have or educated assumptions that you want to test out.

Here’s an example of a cancellation flow from Userpilot.

The advantage of churn surveys is that you can instantly follow up on your user’s selection in the last-ditch effort to change their mind: sometimes it may be that they simply didn’t realize there already was a solution to the problem with your product.

For example, if they select “too expensive” as their main reason or “my project has ended” you can consider offering an alternative to canceling such as pausing their account or a discount.

Best practices to improve your user feedback survey?

So, now you’ve started thinking about gathering feedback, you might be wondering how to make your microsurveys as effective as possible.

Here are three things you can do to improve your microsurveys:

Context: keep your surveys focused

Keep your surveys completely focused on one aspect of your product.

That means you need to think about a couple of different things.

Firstly, what information you’re trying to collect?

If it’s feature requests, then focus on that. If it’s Net Promoter (NPS scores), then focus on that.

Never combine two different areas on one microsurvey, that just leads to poor data.

Secondly, think about who you want to collect the data. The answer should never be “everybody”. You want to narrow it down to a very specific user segment.

For example, it doesn’t make sense to send a feedback survey to a user who has never used a new feature that you’ve added to your product.

That focus is what will make your microsurvey work. It’s what will increase your submission rate, and it means you get the most accurate feedback.

Design: brand and user experience matters

The design of your microsurveys is very important when it comes to keeping your brand consistent. In the same way, you’d want your emails to match your brand, you need your user surveys to stay consistent too.

When using tools like Userpilot you can set themes and customize them to match your brand. that way every survey you launch will offer a consistent brand experience.

It’s also worth pointing out that you often want your surveys to stand out visually in some way.

Perhaps by changing the background color, or adding a high-contrast border. This way the user is more likely to engage with your surveys.

Microcopy: use simple language in your surveys

As well as the design of your microsurveys, it’s worth spending time on the microcopy that you use.

Bad copy can make your surveys unintelligible. This can reduce the quality of the insights you collect, and even reduce the number of survey responses.

Consider the wording of this question:

“What did you think when you used this feature?”

That might seem okay, but there are ways you can improve it to make it clear and easier to understand.

For example, saying “this feature” isn’t enough, because they might start questioning which feature you’re talking about.

Here’s a better version of the same question:

“How easy was it to use our bulk uploading feature?”

Notice how the question is more specific (talking about ease of use) and also explains exactly which feature your feedback microsurvey is asking about.

Making some tweaks to your microsurvey’s microcopy can make all the difference when it comes to collecting customer insights.

Target audience: go granular with your user segmentation

Target your customer surveys based on user behavior and other user persona attributes and make your surveys relevant to where each customer is in the journey.

- type of user– new users, power users, and enterprise users have very different activity patterns.

- time-based– before a trial expires, after they’ve used a certain feature for the first time, or after repeated usage.

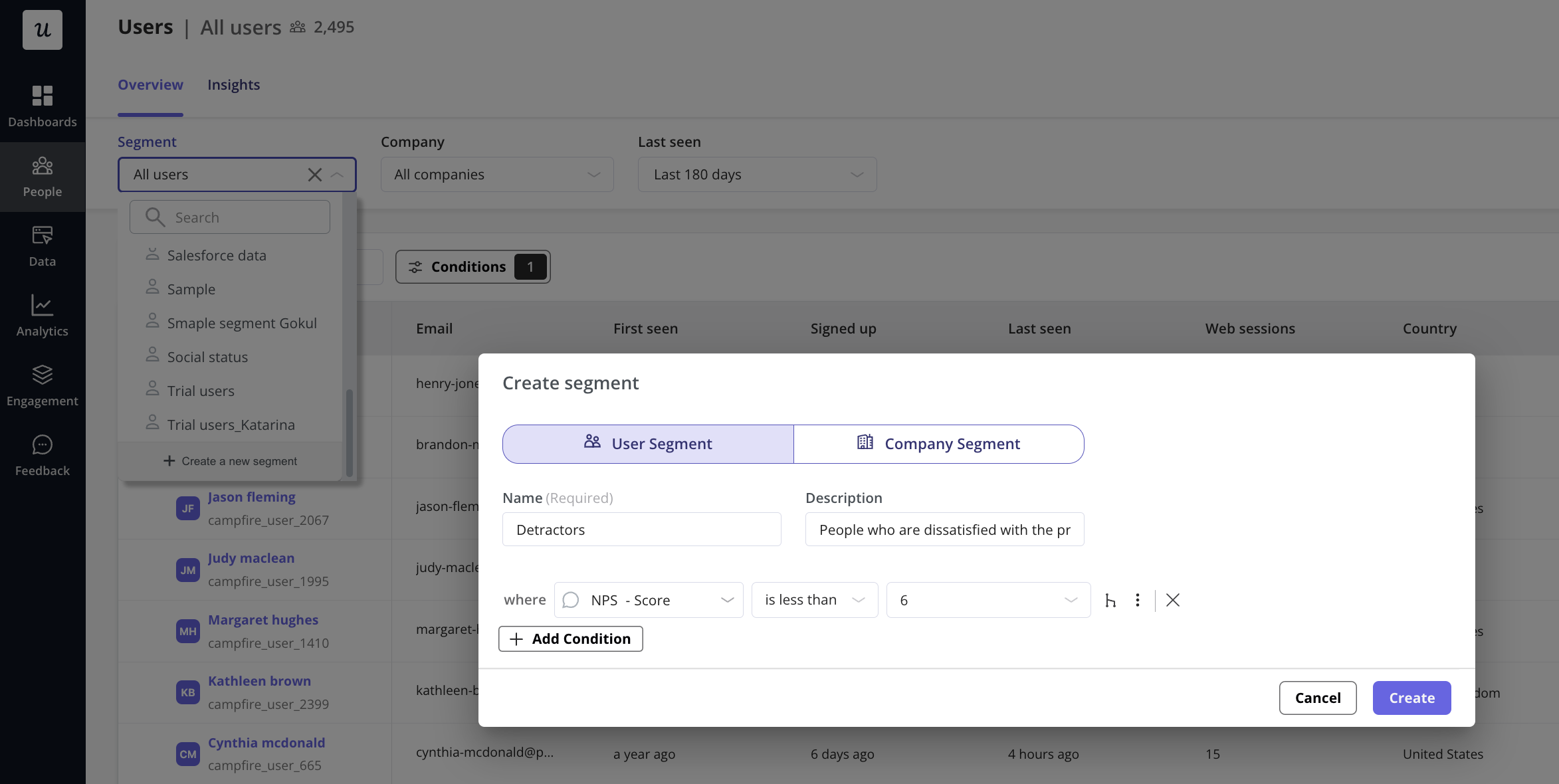

You can easily achieve this by targeting your microsurveys using granular segmentation like signed-up date and plan type.

Track, analyze, and improve

Let’s not forget tracking and improving. You shouldn’t set your surveys and forget about them. Always analyze responses, test different question types, and see which received more engagement from the customer.

Also, respond to the customer who engaged with your user surveys and close the loop. This helps your users feel like you care and that their opinions matter. You can turn your net detractors into promoters by personalizing responses to NPS surveys based on scores or creating different follow-up in-app experiences based on other survey responses.

How to create microsurveys with Userpilot?

Userpilot is a product growth tool that helps you gauge customer loyalty with a built-in NPS dashboard on top of collecting meaningful feedback with different types of popup surveys.

You can also access a library of survey templates of the most used microsurveys (CSAT, CES, PMF, etc) to quickly collect actionable insights with minimal effort.

Or, use a range of different user survey elements, including text inputs and radio buttons, and create specific surveys from scratch.

After creating the survey, target a specific customer segment with it so you can collect contextual feedback.

Additionally, Userpilot enables product teams to localize survey content and analyze survey results with a dashboard.

Conclusion

If you want to go micro and be contextual, where your users are and drive product growth based on key takeaways on what your users value, microsurveys are the way to go.

Ready to drive growth? Get a Userpilot Demo and see how you can use microsurveys and act on feedback to drive product growth.