White Space Analysis: What Is It and How To Collect Data To Map the White Space Opportunities?

What is a white space analysis?

White space analysis is the means to identify gaps in existing services on a market or internal processes and to unveil hidden sales opportunities. Put simply, white space analysis helps customer success and sales managers discover unmet customer needs and fulfill them accordingly.

What are the benefits of a white space analysis?

Now let’s see how can you benefit from a white space analysis.

Identify unmet needs of existing customers

White space analysis helps project managers and customer success agents understand whether your product meets your existing customers’ requirements. It also highlights the customer service gaps that need to be filled.

Spot cross- and upselling opportunities with a refined sales strategy

For a sales process, “white spaces” translate into cross-selling and upselling opportunities. When a sales team performs white space analysis, it breaks down the existing sales pipeline and tries to find areas to leverage account expansion.

Spark product innovation

White space analysis is about exploring external, internal, and future perspectives. The outcome of the analysis fuels innovation and informs strategic initiatives. Once a company knows it has found white space, it can develop solutions to fill it and gain a competitive advantage.

Improve customer satisfaction and retention

For product and CS teams, white space analysis gives insights into product friction. Fix those to make your customers happy and drive retention.

Stick to the CS mantra, “Happy customers = loyal customers = improved retention = revenue growth.”

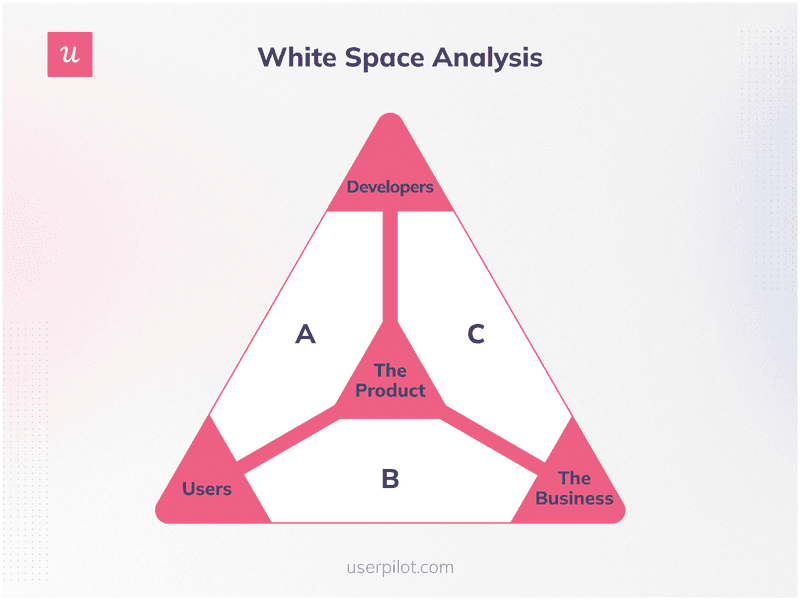

What is white space mapping?

White-space mapping is the process used to categorize and visualize all findings (aka white space analysis). This makes it easy to read, digest, and work with the data collected. Mapping white space begins with determining its type.

Let’s break it down.

White space mapping types

There may be some confusion around white space mapping types or it may be challenging to understand them from the start. Think of mapping types as directions a company wants to dig down to find its growth opportunities.

So we have two types of mapping: internal and external.

Internal mapping

Internal mapping translates your company’s strengths, weaknesses, and competitive threats. It’s based on an analysis of the internal processes of a company. And it helps businesses pinpoint areas to hone.

External mapping

External mapping is literally about analyzing your market and reflecting your product on it. This way, you can identify white spaces in a global arena, such as new product opportunities, failing and winning trends, etc.

To conduct external mapping, you need data from competitor analysis and market research (e.g., surveying, discovery calls, social listening, etc.).

How to collect data for white space analysis?

Here, we’ll describe five methods to collect data for internal mapping and act on it.

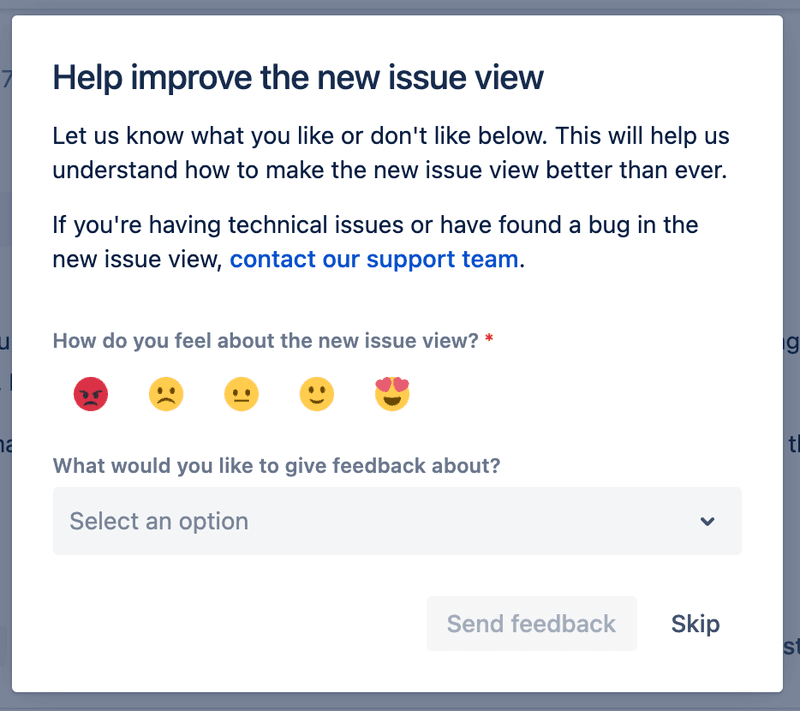

Use CSAT surveys across the journey and collect customer feedback

Customer satisfaction surveys are the means to put abstract “customer satisfaction” into numbers. This opens an opportunity to measure customer happiness and identify what parts of your product upset customers, i.e., spot friction points across the product that impair customer experience.

Measure customer satisfaction across different customer journey stages to detect as many hiccups (aka white space opportunities) as possible.

Use in-app microsurveys to collect feedback and identify whether customers have any issues.

For example, Jira’s team uses a CSAT survey to gauge how happy users are with a new feature. They ask users to rate their state of happiness with emojis and leave detailed feedback on the tool.

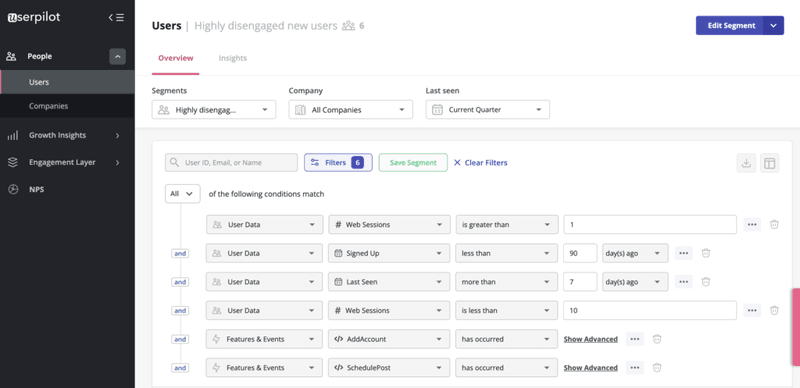

Track in-app feature usage and identify how customers are using your app

Another way to frame already existing customer data for white space analysis is to monitor feature usage. With this, you will understand how customers interact with your app:

- What features do they like and dislike?

- What features get abandoned?

- How often do they engage with particular features?

- What does look your inactive users?

- What are the most active users, and what features do they use?

Segment users based on feature usage, activity, and contribution to revenue. Identifying which users need your close attention will help prevent churning and reveal cross-selling opportunities.

Then reach out to inactive users to understand the root cause of their inactivity. Thus identifying potential gaps.

To monitor feature usage, use Userpilot’s Feature Tagging tool. Briefly explained, this tool counts every click on pre-defined features and records the number of clicks. On top of that, the tool gathers other invaluable metrics about users, such as session duration, company, NPS score, subscription plan, etc.

Conduct user interviews to get an in-depth understanding of customers’ current investments

Feedback from indirect sources, like feature usage, gives you insights at scale. However, that allows you to identify only the “whats,” i.e., common customer behavior patterns. To dig deeper, you need to understand the “whys.” You want to understand what triggers that behavior and why some users abandon your product.

Directly talking to customers is a surefire way to get extensive knowledge on that topic. To do so, run a series of user interviews with your customers.

Ask them:

- What features do they not like and why?

- Do they understand the use cases of feature X?

- If it were for them, what features would they implement?

- Is there anything else they would want to improve in the product or about the overall customer experience?

In-person interviews are a powerful tool for identifying gaps and business opportunities alike. People tend to be more open and feel comfortable sharing their true opinions. Use acquired knowledge to make informed decisions regarding future product updates.

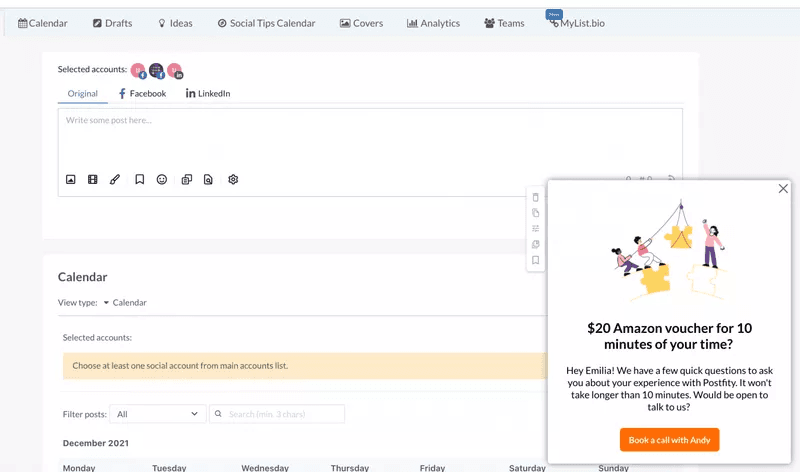

A good way to invite customers to participate in interviews is to offer some incentives for their time. It can be anything from a personal discount and extra days to a product subscription or gift cards. See how Postfity uses the latter tactic.

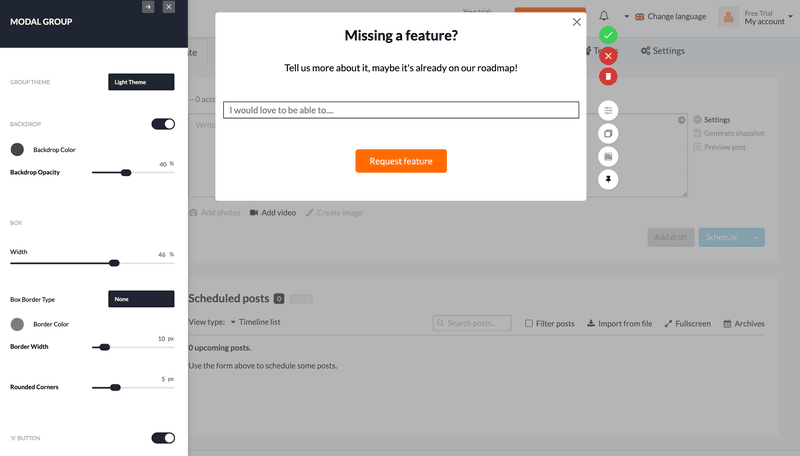

Send microsurveys to collect data on missing features

Microsurveys are a great means to discover both pain points and new opportunities for product development. A microsurvey is a small pop-up appearing in-app due to pre-defined triggers.

Use such surveys to ask all your users at once about missing features. What would they like to see in the tool’s functionality?

Maybe it’s something that’s already on the product roadmap or can be easily implemented.

Plus, conducting such surveys shows customers that you care about their opinion and want to build a product that serves customers. Hence, it influences customer retention.

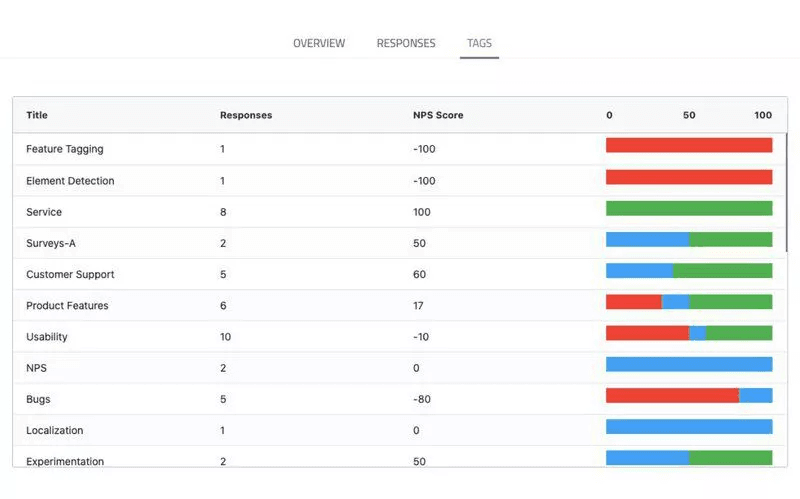

Tag NPS responses to understand the reason behind the scores

Send NPS surveys to measure customer loyalty and see how many customers are likely to recommend you. Tie an NPS survey back to a particular feature you want to gauge customer loyalty.

Add a follow-up question to get qualitative data. For example, you can ask customers why they gave such a score.

You can also tag NPS responses to get more insights into the given scores.

Userpilot lets you group the NPS survey responses into separate themes so that you can learn what makes your customers loyal and what does not.

For instance, you may find that 90% of the promoters love your product’s usability, or that 80% of the detractors have issues with your customer support (check out the screenshot of the report).

How to use analytics data to map the white space opportunities?

Once we collect customer data, it’s time to move over to organizing the data.

Combine your internal white space analysis data with external and future-focused sources

When you gather data on different customer touchpoints, you end up with various metrics and numbers. When it comes to white space analysis, it becomes even more complex. Since you study the gaps in existing markets and business processes, the results you get could have a big impact on business growth.

Combine your internal white space analysis data with external and future-focused sources to elicit top-priority areas for improvement or hot spots on the market.

Let’s imagine you’ve found out that users struggle to transfer data from your product to their CRM when analyzing internal white spaces. The solution will be to create an integration between the two services.

On the other hand, external white space analysis showed that the market lacks products for deep personalization for LinkedIn In Mails for automated outreach. And the kicker is that you know how to build it.

However, one more factor impacts the final decision on whether you should build a new tool/feature or focus on improving the existing or secure resources for doing both. This is a feature-focused analysis. Think long-term, in a 3-5 year time horizon, and calculate the outcomes you will gain from one or the other decision.

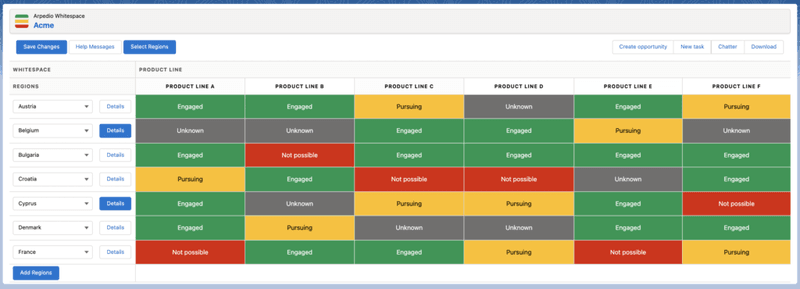

Use a white space mapping tool to visualize the data

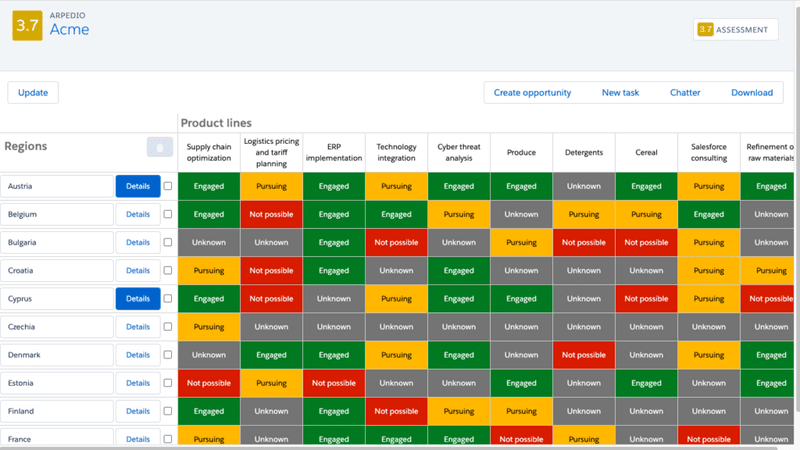

To facilitate the perception of the data (i.e., what white space the team should pursue), visualize it. Use tools like Arpedio to get a visual representation of your white space opportunities.

Group and prioritize them according to your business goals.

Here’s an example of analyzing possible product lines across different countries. Each country and product is assigned a specific status.

Best tools to help you conduct a white space analysis

White space analysis requires a special toolkit so you’re able to collect the data you need. We will focus on the three tools for gathering internal data.

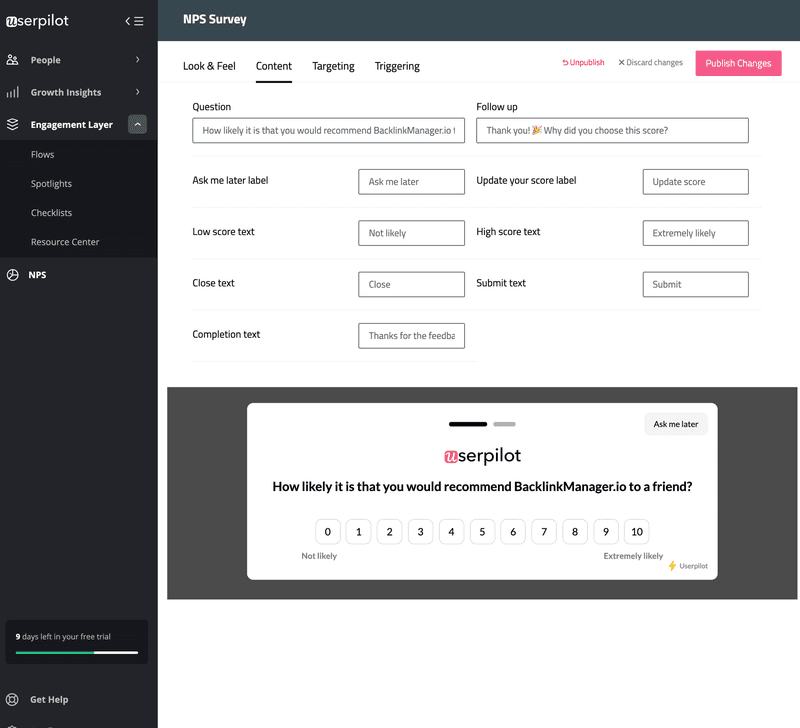

Userpilot — for collecting in-app feature usage data and creating microsurveys

Userpilot is a versatile tool for analyzing in-app user behavior, creating microsurveys and onboarding checklists, and for in-app engagement with customers.

For white space analysis, Userpilot helps measure feature engagement and run NPS surveys and other microsurveys such as CSAT or CES. This tool is also effective for advanced customer segmentation.

You can also customize and launch in-app surveys of different types with Userpilot to gain insights into the mobile app experience.

Ultimately, you can find out:

- Most/least likable features.

- Honest opinion about your product via microsurveys.

- What features do existing customers want to see soon.

- Cross-selling opportunities.

- How different customer segments perceive your product.

Pricing:

- Get fully featured access to Userpilot for the 14-day trial.

- Start working with Userpilot from $299/mo (billed annually).

Arpedio — for visualizing white space analysis

Arpedio is a tool designed specifically for discovering and mapping out blind spots in the sales process. The tool analyzes the sales pipeline and gives recommendations on cross-selling and up-selling. It’s integrated with Salesforce, so white space analysis is on the fly.

Pricing:

- Customized 30-day trial period (you’ll get access to features you want to test).

- Pricing is available upon request and tailored to your specific case.

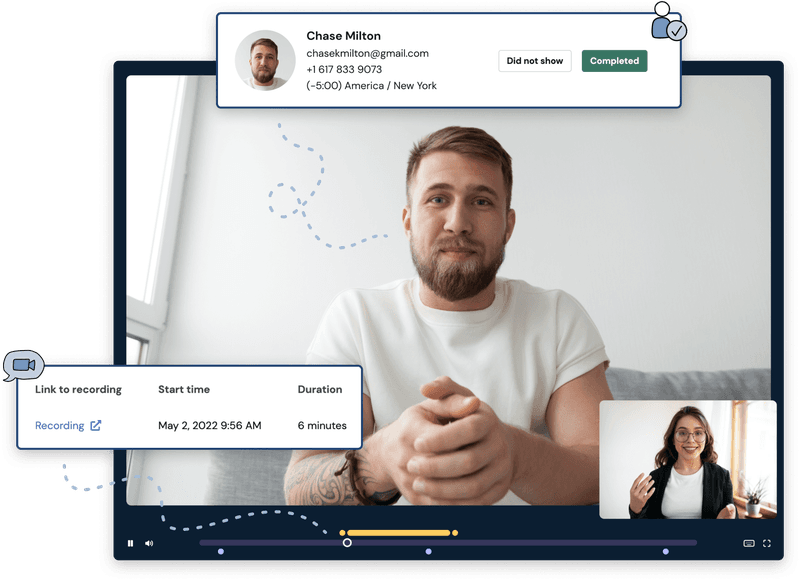

Lookback — for conducting user interviews

Lookback helps record, transcribe, take notes and analyze user interviews. It’s especially useful for conducting UX research interviews for apps. With the app, users can share their screens and walk through them together while speaking. Using this method, you can monitor customer engagement with your app and take note of what upsets them.

Pricing:

- Start with 5 free sessions during 60 days trial.

- The cheapest plan includes 10 sessions per year, $204/year.

Conclusion

White space analysis is crucial for collecting powerful insights into what’s going on in the market. It enables you to look at your services from another perspective and uncover growth opportunities.

Want to monitor what users are doing in the app, create microsurveys and uncover friction points? Get a Userpilot demo to get started right away!