Marketing research is the process of gathering and analyzing data about your target customers, competitors, and the overall business environment.

Without proper research, your company is basically operating in the dark. You’ll struggle to understand customer needs and build products that fail to hit the mark. Also, a lack of market awareness can cause missed opportunities, poor timing, and ineffective strategies that ultimately hinder growth.

So, how do you turn the table around and make business decisions with confidence? We’ll cover:

- Different research methods proven to work for SaaS businesses.

- A 5-step guide to conduct marketing research effectively.

- Real-life examples of successful market research.

Why marketing research matters: A foundation for SaaS business success

Done well, a proper marketing research plan helps you:

- Identify market opportunities: Instead of relying on assumptions, a systematic approach leads you to discover unmet customer needs and spot trends in consumer behavior. It also makes it easier to step out of the proverbial red ocean and explore new markets.

- Reduce risks: A 2023 study by Wilburlabs found that the number one reason new businesses fail is because they run out of money. While many things go into business expenses, well-grounded research helps you test new ideas and validate assumptions before spending on development and marketing. This allows you to avoid costly mistakes and allocate resources more effectively.

- Improve decision-making: An objective understanding of the market, gained through thorough research, allows you to make better decisions about core aspects of your business like pricing strategies, feature prioritization, and go-to-market strategies.

- Gain a competitive advantage: Crayon’s yearly competitive intelligence survey shows a steady rise in the number of business leaders who believe their industry is getting more competitive. And it’s not a baseless fear; 2024 saw a 33% surge in SaaS VC investments ($119B to $159B), a significant growth when you compare VC investments in other business models. All these trends point to one thing: established companies and new players are competing fiercely for customer attention. The only way to thrive is to conduct in-depth market research and find opportunities to differentiate yourself.

What are the types of market research?

We’ve categorized SaaS marketing research techniques into four types based on the source of information:

- Primary research.

- Secondary research.

- Qualitative research.

- Quantitative research.

Let’s dive deep into each type and the kind of data they help you collect.

Primary research

This type of research involves gathering original data directly from your target market. You can conduct it yourself or outsource it to a market research firm, but the key here is that the data is collected firsthand, specifically for your research objectives.

Methods for conducting primary market research

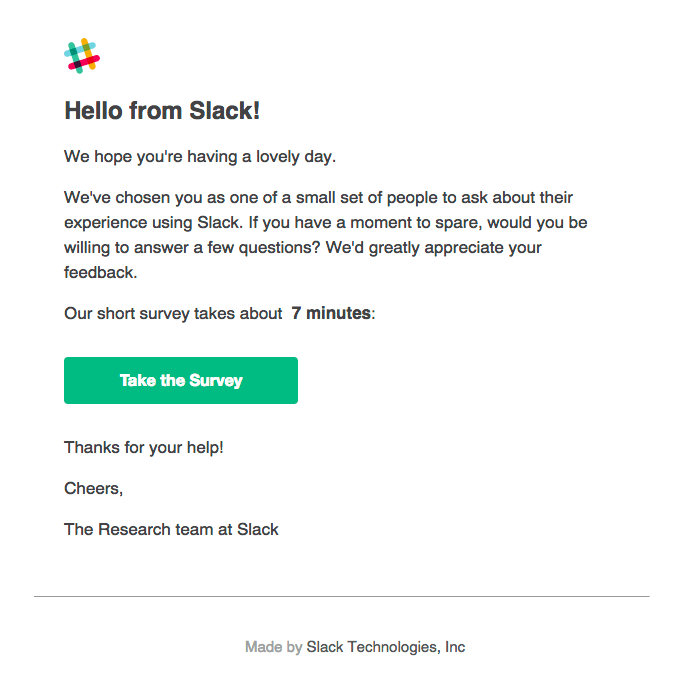

- Surveys: Segment your ideal audience and send them a targeted questionnaire in-app or via email. Irrespective of the channel, aim to quickly explain the survey’s purpose and provide an estimate of how long it might take. Here’s an example from Slack:

- Interviews: While surveys are great for collecting quick data, one-on-one interviews offer an opportunity to gather richer, more in-depth qualitative insights. These conversations can take various forms, from structured interviews with pre-defined questions to open-ended user interviews that give respondents enough room to express themselves.

- Online focus groups: Choose a dedicated online platform and invite a sample of your target market to discuss specific topics. It’s always good to have a skilled focus group moderator who directs the conversation and sees to it that participants don’t go off-topic.

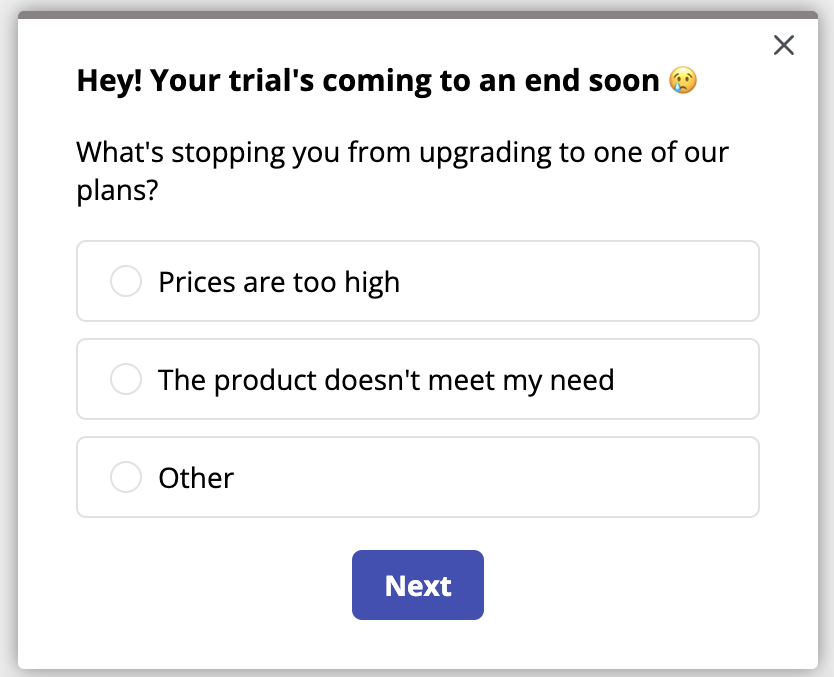

- Product trials: Got an existing product? That’s a market research goldmine! Allow people to try it for a limited period without even telling them you’re conducting research. Trigger automatic exit surveys and gather why some users aren’t willing to upgrade after the trial period. You can also survey users who successfully upgraded to learn what they love about your tool.

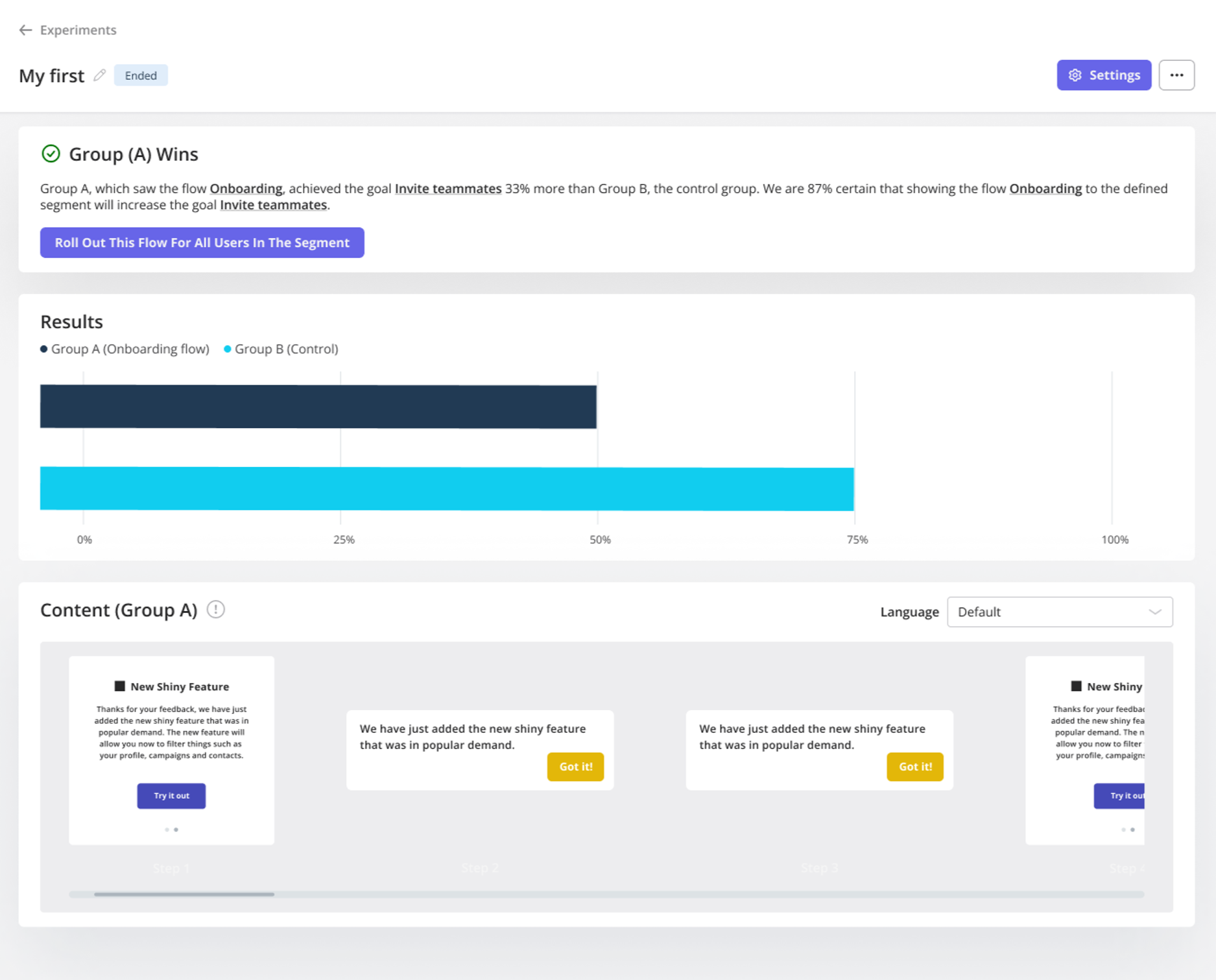

- Experiments: Test cause-and-effect relationships by manipulating variables through A/B and multivariate testing. Compare variables like UX design, microcopy, user flows, and other in-app elements and view the test results in real time. Here’s an example:

Secondary research

Secondary market research uses existing data that has already been collected by others. It’s a great way to understand the broader context of a topic before diving into specifics through primary market research.

Methods for conducting secondary market research

- Government publications: Government agencies generally have a mandate to collect accurate data for policy-making and public interest purposes, so you can be sure to get something that has passed rigorous quality checks. The best part? They’re easily accessible. With a few Google searches, you can find information related to demographics, technology adoption trends, industry regulations, and economic forecasts.

- Industry reports: Go over publications that provide detailed research into topics you’re interested in. This is usually the simplest way to access competitor data, market analysis, and trend reports for free. For example, our benchmark report shows that 79% of the 547 SaaS companies we analyzed are using the PLG strategy instead of the sales-led approach. This might get you wondering why companies favor PLG. Then, after seeing OpenView’s report that PLG companies are 2X more likely to experience 100% YoY revenue growth, it might get you thinking about adopting the same approach for your tool. Your next research step will be to see if PLG works for every company type. See how data is helping you shape business decisions? That’s the power of research.

- Academic research: If you’re looking to connect marketing research findings with existing theories and frameworks, then academic research is often your best bet. Search university libraries, online research databases, and platforms like ResearchGate for recent materials on your topic of interest.

- Trade association: Trade associations are composed of businesses within a particular industry, so they typically possess a deep understanding of specific market dynamics. This expertise allows them to gather and analyze data that is highly relevant and targeted to the needs of businesses within that industry. For SaaS, you can check out SaaS Capital, the Technology & Services Industry Association (TSIA), and the Software & Information Industry Association (SIIA).

- Company websites: Even a few minutes on competitor websites can reveal key information like product details, customer testimonials, and marketing strategies. These insights will be useful when it’s time to create a strong(er) positioning for your company.

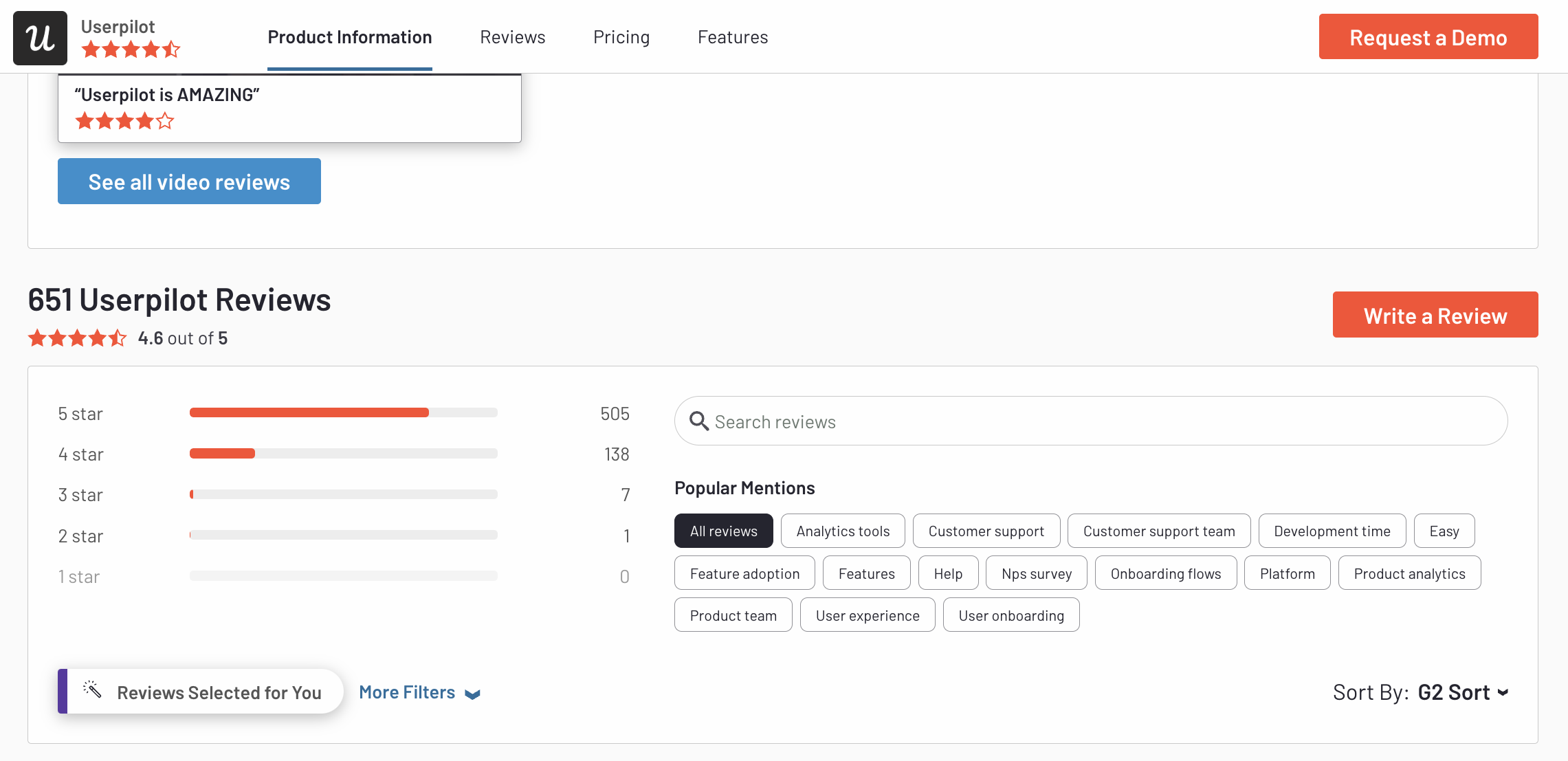

- Market research databases: Use subscription-based databases and market research companies like Gartner and Forrester to gather comprehensive data on growth trends. Software review platforms like G2 also offer a wealth of data for user research and competitive analysis. For example, here’s a G2 page with customer reviews:

Qualitative research

Qualitative market research focuses on exploring opinions, attitudes, and motivations to understand the “why” behind consumer behavior.

Methods for conducting qualitative market research

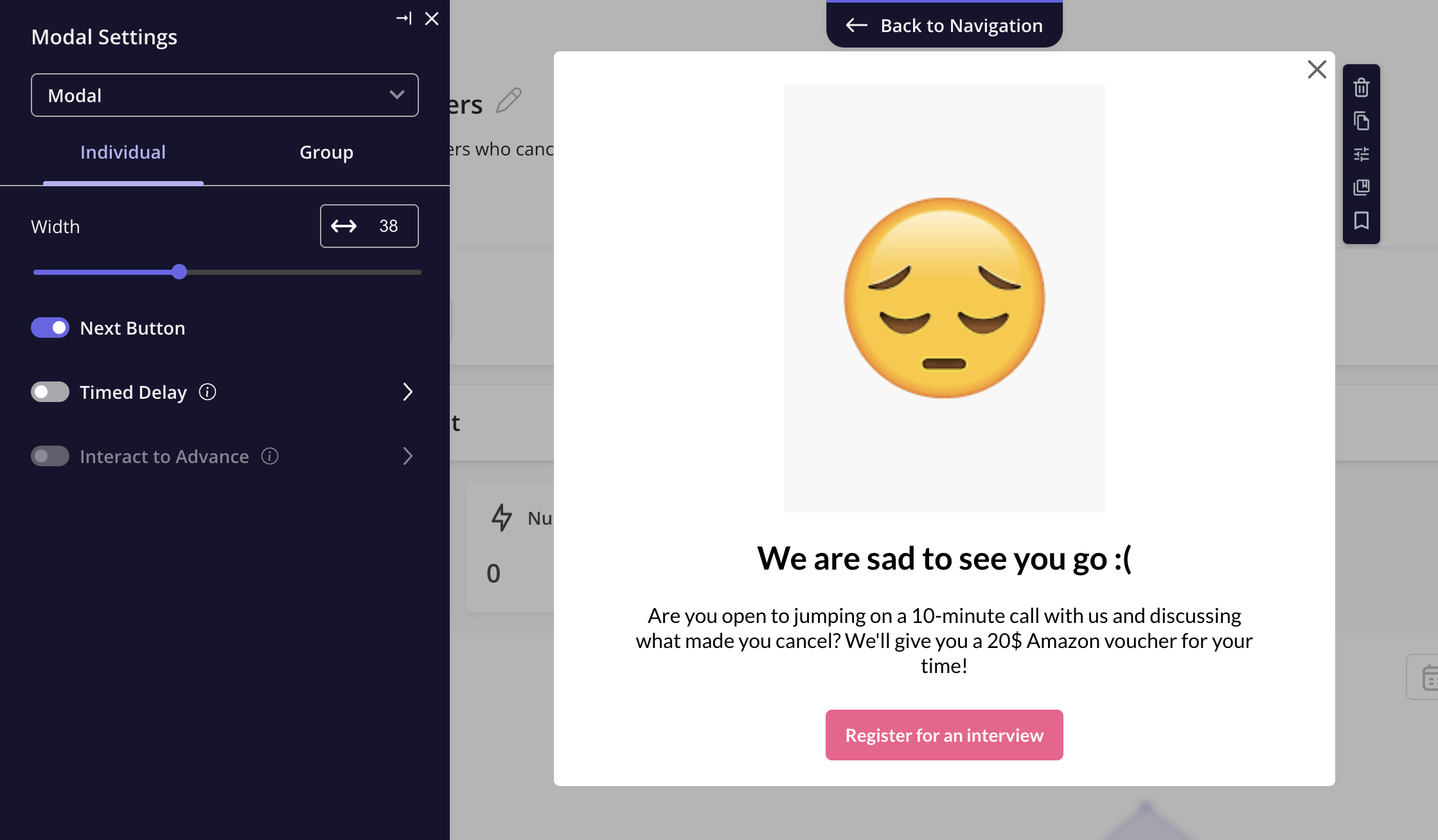

- Customer interviews: Host one-on-one unstructured interviews with customers to understand individual perspectives and note product improvement points. You can invite users by triggering targeted modals like these:

- Focus groups: Beyond individual interviews, invite several users to focus group discussions that let you gather diverse viewpoints and generate business ideas in a shorter time.

- Ethnographic research: Use screen-sharing tools and video interviews to observe how users interact with your product in their natural environments. The main advantage here is uncovering pain points that users themselves may not be consciously aware of or able to articulate.

- Case studies: Choose a specific business situation and conduct an in-depth analysis of it. For example, this could be a specific customer, a successful marketing campaign, a product launch, or a particular market segment. Gather as much data as you can about that case and aim to identify themes and key factors that contribute to the observed outcomes.

uantitative research

This marketing research approach aims to use numbers to spot patterns and trends. It’s the kind of research you use when you need to measure something specific (like customer satisfaction) or identify statistical relationships between variables (e.g., how specific features correlate with customer retention).

Methods for conducting quantitative market research

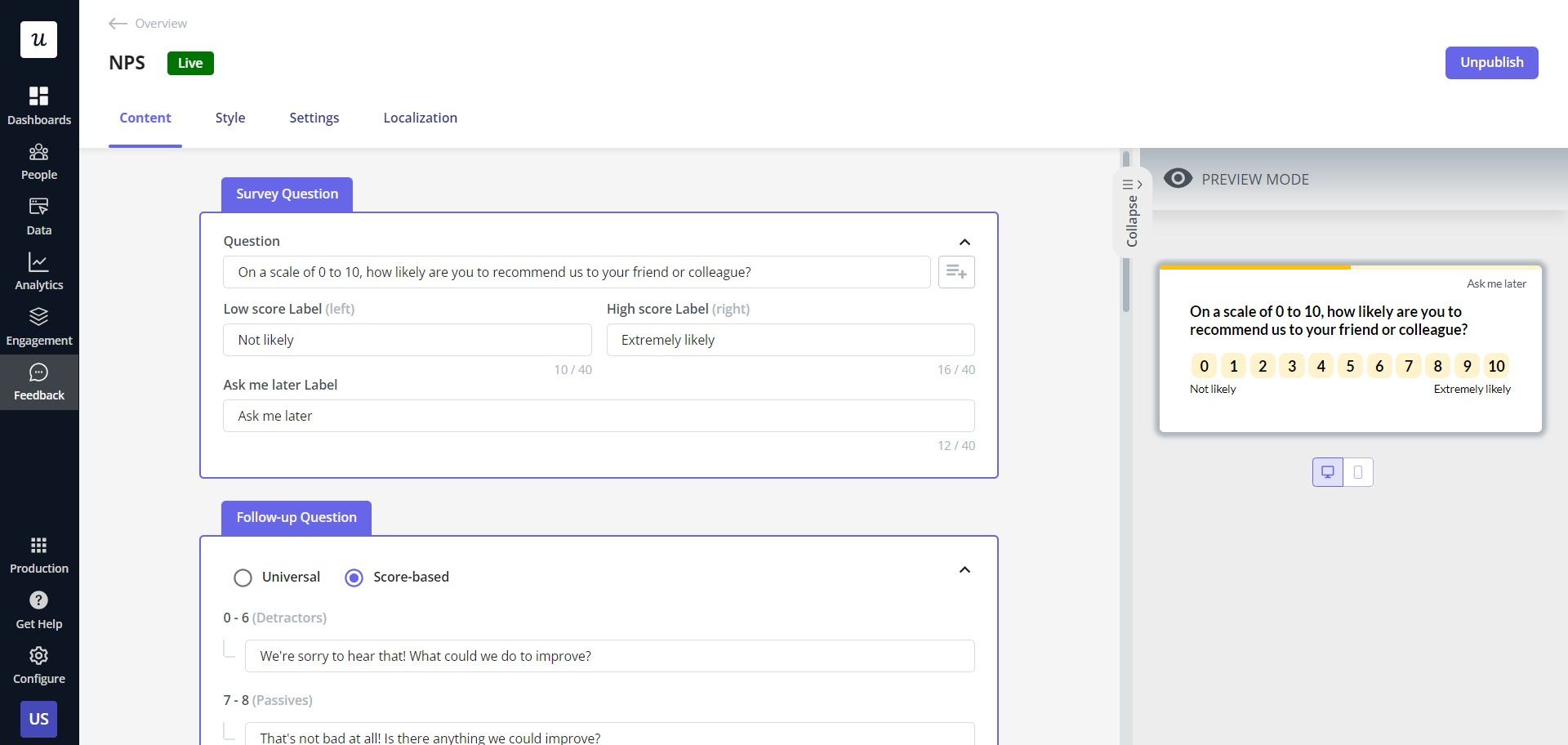

- Surveys: Use structured questionnaires with rating scales, multiple choice questions, or ranking questions to gather numerical data on user needs and experiences. For example, build an NPS survey that asks customers to rate their likelihood of recommending you to others:

- Mobile surveys: You can also trigger these NPS surveys directly within your mobile app, effortlessly gathering valuable user insights on-the-go.

- Experiments: Conduct A/B or multivariate tests to validate hypotheses and measure the impact of variables.

- Statistical analysis: Use statistical methods like regression analysis to extract meaningful insights and identify correlations between data points.

- Data visualization: Lastly, present your findings in charts or graphs to reveal key insights.

The 5-step guide to the marketing research process

Here’s a step-by-step guide to help you make informed business decisions:

1. Defining the problem and research objectives

“Your market research process is going to do a deeper dive into the areas of the problem that you’re trying to solve for, but at least at a high level, you should have a very good understanding of the problem statement” —Ankit Desai, Staff Product Manager, LinkedIn.

Say you’re a mid-stage SaaS company that offers a web analytics tool. While you have a decent market share, you’re noticing a plateau in user growth and hypothesize it could be due to missing key features.

Use the SMART goal-setting framework to set your marketing research objectives:

- Specific: Identify the top 3 most desired advanced analytics features currently missing from your tool.

- Measurable: Quantify the percentage of your target market that expresses a need for each advanced feature.

- Achievable: Use a combination of marketing research methods that are feasible within your budget and timeframe.

- Relevant: Focus on gathering data that will inform product development, marketing, and pricing decisions.

- Timebound: Set a clear timeframe for completing the marketing research process, for example, within 3 months.

2. Developing the research plan

With your goals in place, the next step is to develop a concise marketing research plan outlining the specific methods you’d use to collect data.

In our hypothetical example, it might be beneficial to combine primary and secondary research methods to gain a rounded understanding of your users and the market.

3. Collecting data

The third stage is where you gather the necessary information using your chosen marketing research methods.

For secondary data, dig into government publications and industry reports to spot trends.

When gathering primary data, send out online surveys and hold focus group discussions around how users interact with your product and competitor tools. As previously mentioned, Userpilot lets you send automatic surveys and track the results code-free. Here’s an example of an exit survey you could use to track user data:

4. Analyzing data

Collecting marketing research data is just half the battle; the next step is analyzing this data to extract actionable insights. The analysis methods you employ will depend on your objectives and the type of research data you’re handling.

In our hypothetical example, you might use statistical analysis to identify correlations in user preferences for features, integrations, and pricing. You can also use qualitative analysis to interpret open-ended survey responses and insights from focus group discussions.

After employing these analysis techniques, you’ll likely be faced with a significant amount of data from various sources. Manually combining this data can be time-consuming and error-prone.

To streamline your analysis process, consider using an analytics dashboard that can centralize your data, visualize key metrics, and help you identify insights more efficiently.

The final step in the market research process is to interpret the results of your analysis and draw conclusions.

Start by revisiting your research objectives and hypotheses. Does your data support or refute your initial assumptions? For example, you might find that your web analytics tool isn’t actually missing key features, but there’s a feature discovery problem as many users aren’t aware of the new features you rolled out last quarter. Alternatively, your analysis might reveal that users are highly satisfied with the existing features but struggle with specific aspects of the user interface.

Once you’ve drawn conclusions, it’s time to present your findings in a clear and concise report. This report should include an executive summary, a description of your research methodology, key findings, and actionable recommendations.

3 Real-life examples of successful market research

We’ve explored the market research process for an example SaaS company, but how have real-world businesses applied these principles to achieve remarkable success?

Here are three case studies:

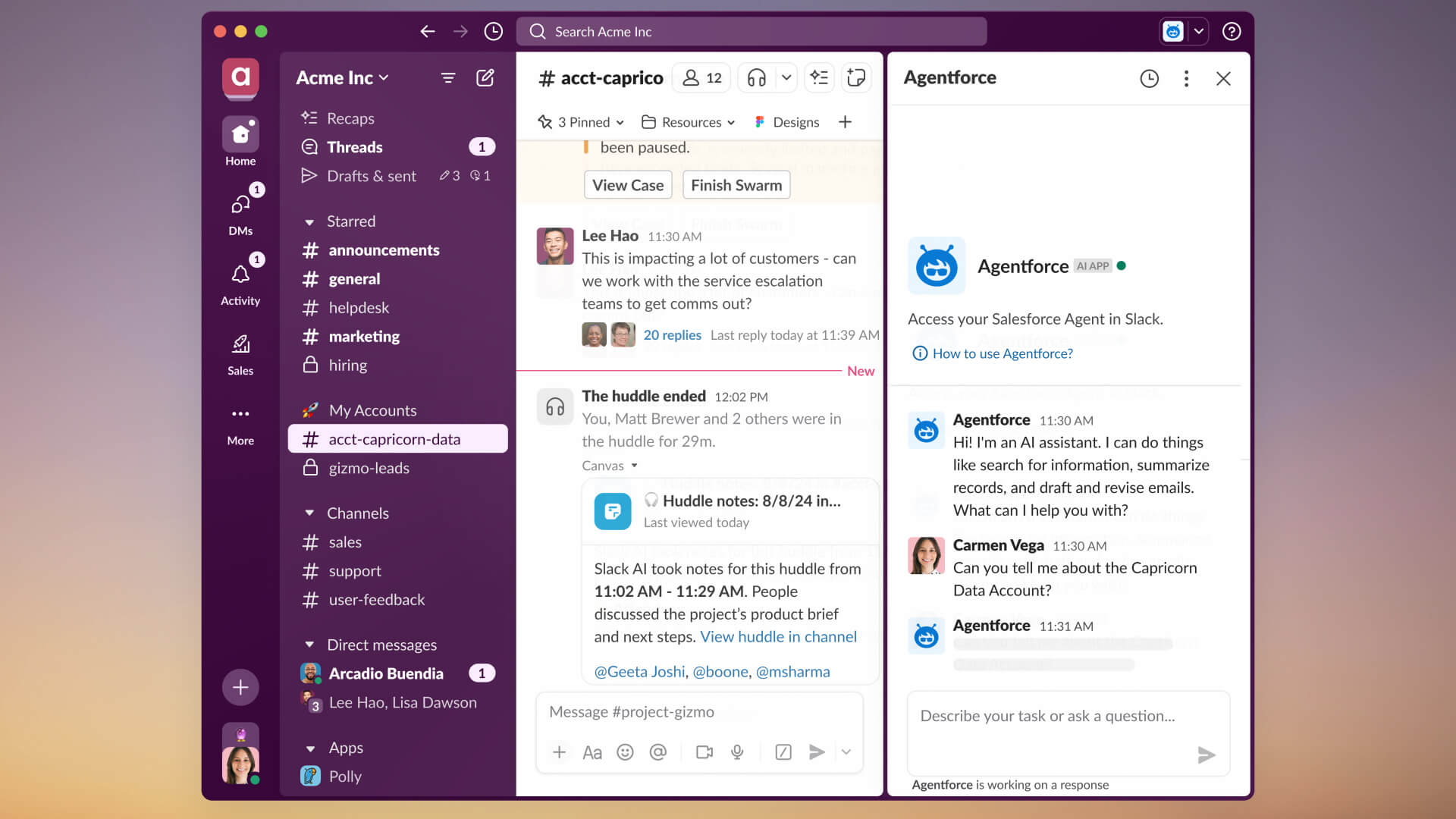

1. Slack identified the need for real-time communication

Did you know Slack originated from a failed multiplayer game called “Glitch?”

While the game didn’t succeed, the development team realized the internal communication tool they built for themselves had potential.

Through market research and focus group testing, they discovered a widespread need for a real-time communication platform that could replace inefficient email threads and fragmented communication channels. This led them to pivot and launch Slack, which quickly gained traction with its beta program and grew to millions of users. 12 years later, Slack is sitting on a $26+ Billion valuation and generated over $4B in revenue in 2024 alone, all because the team paid attention to market needs.

2. Zoom capitalized on the rise of remote work

Zoom wasn’t the first video conferencing tool, but it managed to leverage the remote work surge of 2020 to grow its revenue by over 300% within the same year.

How did they do it? Through extensive market research, Zoom’s founder, Eric Yuan, identified key shortcomings of existing solutions and focused on delivering a superior user experience.

Their research revealed the need for:

- Ease of use: A simple and intuitive interface accessible to everyone.

- Reliability: Stable and high-quality video and audio, regardless of meeting size or bandwidth.

- Mobile-first experience: Seamless support for various devices and a user-friendly mobile experience.

- Affordability: Potential customers desired a solution that was accessible to individuals and small businesses, not just large enterprises with big budgets.

3. Userpilot focuses on product-led growth for its competitive edge

“At Userpilot, we were determined to be user-centric from day 0. Long before we even wrote a single line of code, we were conducting user interviews and experimenting.” —Yazan Sehwail, Userpilot co-founder and CEO during an interview with CEO World Magazine.

The Userpilot team saw that more and more product teams needed powerful tools, but didn’t always have the coding skills to build them. So we went all-in on creating a no-code platform to empower anyone on a product team to understand customers and create amazing in-app experiences.

For example, you can use our path analysis tool to identify your product’s happy path and trigger in-app guidance to put the rest of your users on that frictionless path, all without writing code.

Another part of our PLG approach is sharing testimonials and case studies of how our platform has helped companies achieve their product goals:

Beyond the guesswork: Using research to shape your business strategy

As we’ve seen, market research is crucial for SaaS success. It helps you identify unmet needs, validate assumptions, and make informed decisions about key aspects of your business.

Ready to level up? From in-app surveys and user behavior tracking to path analysis and feature tagging, Userpilot provides the tools you need to conduct marketing research effectively. Book a free demo to begin.

FAQ

What are some tools that can help me conduct marketing research?

Market research involves various methods, and there are many tools to help. Here are some examples:

- Survey platforms: SurveyMonkey, Typeform, Google Forms, Userpilot.

- User feedback tools: Userpilot, Hotjar, Qualtrics.

- Data analysis tools: Google Analytics, Mixpanel, Tableau, Userpilot.

What are some common mistakes to avoid in marketing research?

Common pitfalls include:

- Poorly defined market research objectives.

- Inadequate sample size.

- Biased questions.

- Improper data analysis.

- Misinterpretation of findings.