Why do confident sales conversations still result in stalled or lost deals?

Sean O’Shaughnessey, the CEO of New Sales Expert, LLC, and a professional B2B salesperson with three decades of experience, says:

“Salespeople need to understand the theory of sales. Without knowing the frameworks—like the pain chain or solution selling—you’re just saying, ‘I’m a nice guy, buy from me.’”

Enter the MEDDIC sales framework.

MEDDIC forces sales and product management teams to validate economic impact, authority, and process before deals advance. The framework reduces time spent on deals that won’t close and improves sales forecast accuracy through verified buying signals.

In this article, I’ll break down the MEDDIC sales framework, show how it works in modern SaaS teams, and explain what mistakes to avoid while implementing it.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is MEDDIC?

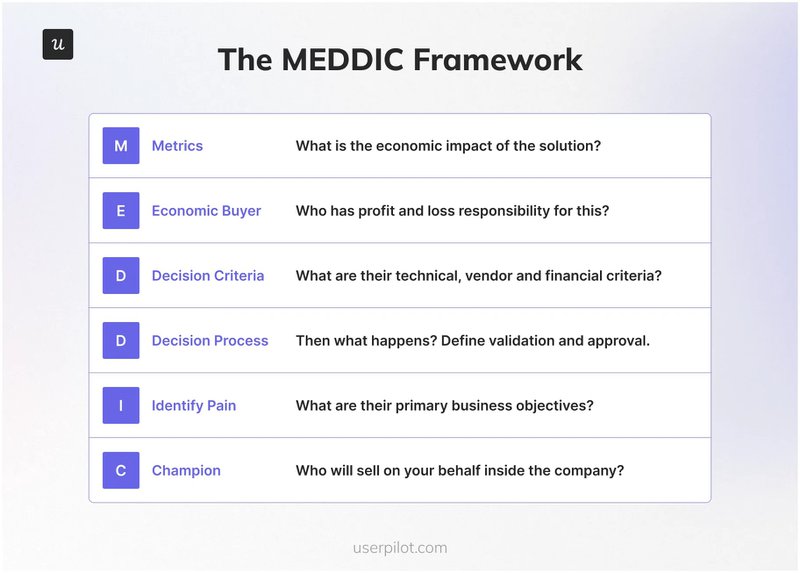

MEDDIC is a sales-qualification framework designed at PTC (Parametric Technology Corporation) in the 1990s to qualify, progress, and forecast deals accurately. It helps teams identify gaps in buying authority, economic impact, and decision readiness, so deals move forward based on evidence.

The framework comprises six elements that together determine whether a deal is truly qualified. The six elements are Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, and Champion.

Why does MEDDIC exist? And what does it fix?

MEDDIC exists because modern B2B buying is rarely linear or individual-led. According to Gartner’s 2025 survey of 632 B2B buying teams, 74% of buyer groups experience “unhealthy conflict” during the decision-making process.

In this research, buying groups with internal consensus were 2.5 times more likely to report their deal as high-quality and on track. Meanwhile, teams with unresolved conflict saw deals stall or weaken despite positive early signals.

As organizational complexity grows, simple qualification questions like “Who controls the budget?” or “Has the deal been approved by all key stakeholders?” stop being reliable indicators to close deals.

MEDDIC exists to impose structure on this complexity. It forces teams to validate who owns the problem financially, how value is measured, what criteria define success, and how a decision will actually be approved.

It addresses the hidden gaps that make deals stall in complex B2B sales:

- Metrics: Ensures ROI is quantified rather than assumed.

- Economic Buyer: Identifies who controls the budget early.

- Decision Criteria: Validates what matters across departments.

- Decision Process: Maps approvals, legal, and procurement steps.

- Identify Pain: Connects interest to urgent business problems.

- Champion: Confirms internal advocates can actively drive the deal forward.

The cost of poorly qualified deals

The Gong State of Sales Productivity 2024 report shows that 35% of sellers struggle with poor lead quality, and 56% of their time is wasted on unqualified, low-potential leads.

Deals that aren’t properly qualified create hidden costs across the sales cycle. A prospect may engage with demos or ask questions, giving the impression of a ready-to-close opportunity. But if the decision-makers aren’t identified, that momentum might collapse.

When approval processes aren’t mapped, the cost is:

- Wasted cycles: Teams spend weeks on deals that never had the budget, authority, or urgency to close.

- Late-stage surprises: Hidden approvals or procurement steps emerge late, stalling revenue and forcing repeated follow-ups.

- “Verbal yes” deals that die in procurement: Stakeholders may agree early, but without confirmed decision pathways, deals collapse silently at the finish line.

Ultimately, if you don’t understand how a buyer decides, all the effort spent on demos, follow-ups, and conversations won’t influence the outcome.

Why legacy qualification frameworks fall apart in complex buying groups

We know that modern B2B buying rarely follows a linear path. Consider a legacy framework like BANT (Budget, Authority, Need, Timing) that assumes the budget already exists, a single person controls the decision, and the buying process is linear.

That’s not how real SaaS deals work today. Gartner’s research on B2B buying cycles shows that purchasing decisions involve multiple stakeholders, distributed authority, and iterative steps. In SaaS, you often create the budget by proving ROI. For instance, a prospect may not have a budget for your tool, but if you show a 500% ROI to the CFO, they will increase the budget.

This gap is where legacy frameworks fall apart. Active product usage doesn’t mean budget ownership, and early enthusiasm doesn’t guarantee a signed contract. Legacy frameworks’ assumptions don’t hold in complex, consensus-driven deals, leaving teams chasing opportunities that never close.

The MEDDIC framework: A breakdown

Now, let’s break down MEDDIC, one element at a time.

M: Metrics

In MEDDIC, “metrics” define the economic impact of the solution, like revenue growth and cost savings, not surface-level KPIs, like page views, logins, and clicks. Until a deal is tied to revenue gained, cost saved, or risk avoided, it remains opinion-based and easy to deprioritize.

Strong metrics shift the conversation from adoption to business outcomes that buyers can defend internally. This means if a solution costs $50,000, it must justify at least $200,000 in impact. Without this 4:1 (or 5:1) return, finance and leadership will resort to responding “not now.”

A common mistake I see teams make is accepting proxy metrics like “active users” or “engagement” as proof of value. A CFO will not approve spending based on interest or usage alone. They consider:

- Revenue impact: Expansion potential, churn reduction, conversion lift.

- Cost savings: Fewer manual hours and reduced support load.

- Efficiency gains: Time saved per workflow, fewer handoffs, faster execution.

Sales organizations that master these data-driven processes reduce cost-to-serve by up to 20% while boosting revenue.

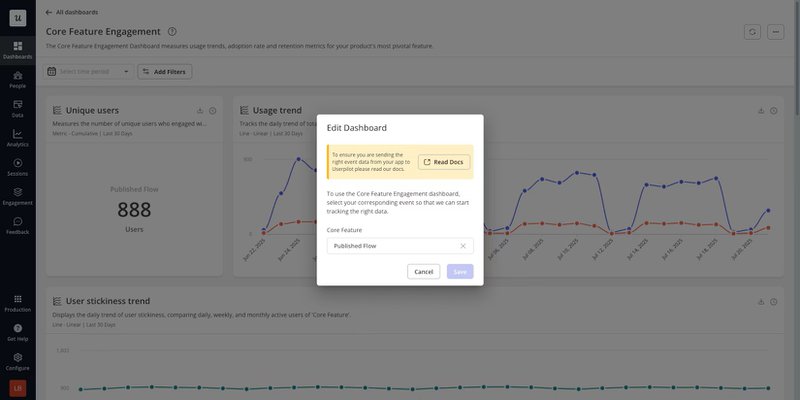

An important thing to understand here is that product usage analytics support metrics by translating real behavior into economic terms. Userpilot features a usage analytics dashboard to visualize product adoption for MEDDIC:

- Feature adoption: Track which workflows and features are actually used.

- User engagement: See who frequently uses the product and where friction occurs.

- Pain validation: Identify drop-offs and struggles that indicate real business problems.

- Internal buy-in: Monitor which users drive adoption and influence decisions.

- ROI insights: Translate usage into measurable impact, like time saved or cost reduced.

What matters isn’t just activity inside the product, but what that activity represents in economic terms, such as 10 hours lost per week translates into $26,000 annually in lost productivity.

E: Economic buyer

The economic buyer is the person who owns the budget and carries the financial risk of the decision. They are not the most active user or the internal advocates; they are the ones who approve spending.

This distinction matters because B2B buying involves multiple stakeholders. Research indicates an average of 13 stakeholders are involved in B2B purchase decisions, each influencing the deal differently:

- Users evaluate day-to-day usefulness.

- Influencers shape preferences and comparisons.

- Signers execute contracts.

- Buyers decide whether the investment is justified.

Note: These labels describe decision roles, not job titles. One stakeholder may play multiple roles, but only one owns the budget risk.

Many SaaS deals fail because teams engage deeply with users or influencers without validating who actually controls the budget. Sometimes, sellers don’t even speak to the economic buyer directly. Ideally, you must know that person, what they care about, and how they evaluate risk and return.

Clear warning signs appear when the qualification is weak:

- The budget owner cannot be named.

- Unclear approval process.

- Contacts resist involving leadership.

Product-led teams can reduce this blind spot using user segmentation in Userpilot. The feature lets you segment users by role or behavior and see updates in real time, making it easy to identify buyers and support MEDDIC qualification.

At this stage, the objective is to find certainty that real financial ownership exists.

D: Decision criteria

Decision criteria refer to how buyers compare options, including competitors and the status quo. They go beyond stated preferences and reflect the technical, financial, and legal standards a solution must meet to win approval.

Decision criteria fall into two categories:

1. Functional criteria: This covers what the product must do and how well it performs. This includes core features, integrations, scalability, reliability, and performance thresholds.

2. Non-functional criteria: This focuses on risk and viability rather than the product’s capability. Buyers assess security, compliance, vendor reputation, implementation effort, switching costs, and long-term support risk.

A critical MEDDIC insight is that decision criteria can change mid-deal. New stakeholders, budget pressure, and risk reviews can introduce additional requirements that were not discussed upfront.

To uncover hidden decision criteria, ask a simple question:

“Besides price, which features or requirements are essential for this deal to move forward?”

The red flags to watch for here are:

- Requirements are vague, unclear, or keep changing.

- Requirements appear copied from a competitor without clear justification.

- Evaluation focuses only on price, ignoring measurable business impact.

For SaaS and PLG teams, product behavior can reveal hidden criteria. Using Userpilot, you can track feature adoption data to see what matters most before buyers say it out loud. Here’s how Userpilot tracks feature adoption:

- No‑code analytics: Mark the key features or actions you want to track without writing any code. This gives you a clear view of which features matter most to users.

- Core feature engagement dashboard: Visualize adoption rates and usage trends over time to see which features are widely used and which are ignored.

- Unique user metrics: Track how many individual users engage with each feature and how often, helping you spot patterns of repeated adoption or friction.

- Usage patterns: Compare activity across days, weeks, or accounts to understand which workflows drive real value and where users struggle.

D: Decision process

The decision process explains how a deal actually gets approved internally. It covers the sequence of steps, reviews, and sign-offs required to move from verbal agreement to a signed contract.

I divide the complete decision process into two phases:

First is validation, which confirms the solution is acceptable to use. This includes:

- Product demo, pilot, or proof of concept.

- Technical or architecture review.

- Security or InfoSec assessment.

Second is authorization, which determines whether the solution is legally and financially an ideal fit. This includes:

- Procurement and vendor registration.

- Legal review of contracts (MSA, DPA, terms).

- Finance and executive sign-off.

Risk appears when sellers assume decision-makers are the only stakeholders.

In reality, technical operators, IT, or compliance teams review the solution as part of the SaaS sales process, and their feedback can add extra steps or requirements before procurement sign-off. Mapping the full authorization process in MEDDIC helps avoid delays and ensures all approvals are completed.

I: Identify pain

In MEDDIC, pain represents a business problem with consequences that create urgency. If there is no pain, there is no urgency, and without urgency, deals stall. In fact, demos that run without a proper discovery phase are 73% less effective, because buyers have no urgent reason to change.

The goal is to move the buyer’s mindset from seeing the issue as a minor inconvenience to recognizing it as a critical problem that must be addressed. That requires uncovering pain that is specific, current, and tied to business outcomes.

I do this by separating surface pain from real pain:

- Surface pain: It is a minor issue that users notice but doesn’t directly impact business results. For example, users complain that the interface feels cluttered, yet adoption remains stable, and leadership decisions aren’t affected.

- Real pain: This is a critical problem that blocks business outcomes, causes measurable losses, and prevents teams from hitting goals. For example, low activation rates delay time-to-value, resulting in lost revenue and increased churn risk.

A strong way to validate pain is to explore implications. What happens if the issue remains unresolved for the next six months? Which goals are missed, which costs grow, or which teams take the hit?

Customer churn analysis can reveal specific areas where users struggle repeatedly, uncovering pain points that obstruct critical business outcomes. You can use Userpilot to validate these pain points by analyzing churn patterns.

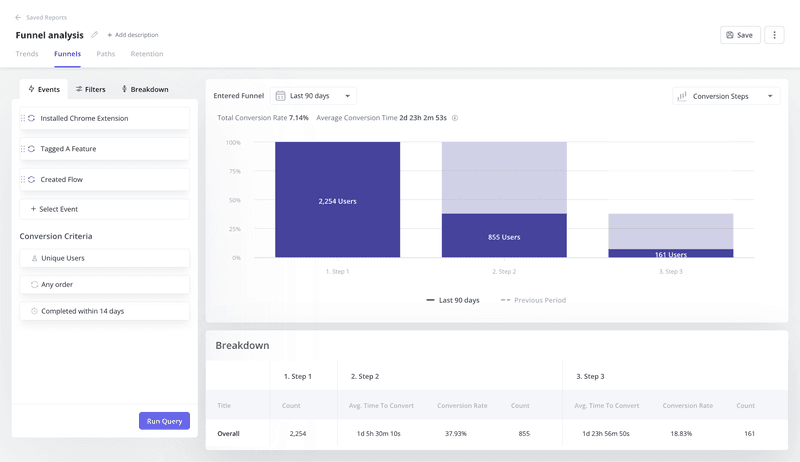

- Funnel analysis: Track the steps users take in your product to see where they drop off or disengage.

- Behavior patterns: Combine usage data with in-app survey responses to understand why users churn.

- Cohort trends: Compare retention across different user groups to identify which segments experience the most friction.

These insights provide concrete evidence that the pain is real, measurable, and urgent enough to demand immediate action.

C: Champion

Your champion is an internal advocate with influence and incentive to advance the deal toward a purchase decision. They actively sell on your behalf inside the organization when you’re not in the room. Even a fully qualified opportunity can lose momentum without a champion guiding it through internal debates and approvals.

A real champion demonstrates three key qualities:

- Influence: They can shape decisions and provide access to the economic buyer.

- Incentive: Their goals are tied to solving the problem your solution addresses.

- Access: They willingly share decision criteria, internal priorities, and organizational context.

Strong customer advocacy signals, such as frequent product use, inviting colleagues, or driving internal adoption, indicate that the person is actively advocating for your solution.

Red flags include contacts who refuse to involve leadership, won’t review proposals, or lack insight into approval processes.

MEDDIC vs. MEDDPICC vs. MEDDICC

With longer sales cycles and more stakeholders, MEDDIC needed a few extra pieces to keep up. While the core MEDDIC elements laid the foundation of structured qualification, real‑world challenges exposed two blind spots: approvals often slowed deals, and competitive alternatives stole opportunities.

As noted in the Norwest 2024 Sales and Marketing Benchmark Report, 44 % of sales leaders use either MEDDIC or MEDDPICC to manage deals, showing that tracking approvals, compliance, and competitive risks has become essential to keep deals on track.

The additional letters in MEDDPICC stepped in to cover these blind spots:

Paper Process (P): Covers procurement, legal review, security and compliance assessments, vendor onboarding, and contract approvals. Understanding these steps upfront prevents costly surprises, as delays in any of these areas can add weeks or even months to the sales cycle.

Competition (C): Highlights alternatives the buyer is evaluating, including other vendors, internal solutions, or doing nothing. A clear competitive analysis helps you identify threats early, shape positioning, and differentiate effectively.

MEDDICC emerged to emphasize competition as a distinct element. While MEDDPICC highlights both paper process and competition, MEDDICC explicitly draws attention to competitive dynamics. In practice, both frameworks are used interchangeably for the same expanded qualification model.

Now you might question, which version should your team use? Here’s my take:

- Stick with MEDDIC for complex deals with straightforward approvals and limited competition. For example, a mid-market SaaS company purchasing an annual analytics platform, where the VP owns the budget and legal review is just a standard protocol.

- Move to MEDDPICC or MEDDICC when you face longer procurement cycles, regulatory or compliance requirements, and multiple competitors. For example, an enterprise rollout requires security reviews, finance approval, legal sign-off, and a competitive evaluation against two other vendors.

The rule of thumb is to use the simplest version that addresses your biggest qualification risks. This means implementing MEDDIC for most deals and adding letters ‘P’ or ‘C’ only when extra steps are needed to handle complex approval processes and competitive situations.

How MEDDIC works in modern SaaS teams

In modern SaaS, where revenue is subscription‑based and usage data is abundant, MEDDIC shows up at every stage of the customer journey.

Let’s discuss how MEDDIC fits into hybrid sales and product-led models, and how it continues to guide deals beyond the first contract.

MEDDIC in product-led and hybrid sales models

Userpilot’s Product Metrics Benchmark Report 2025 found that 79 % of SaaS companies follow a product‑led growth strategy.

In product-led and hybrid sales models, buyers often start experiencing the product before sales even enter the conversation. They explore features, run trials, and see value firsthand. Even though deals gain momentum organically, without structure, they can lose alignment with the decision-makers.

The MEDDIC sales process adapts to these scenarios. Metrics track real impact through product usage, and pain shows up in friction and drop-offs. Champions and economic buyers reveal themselves through engagement and user segmentation.

However, product usage doesn’t replace MEDDIC. Usage data supports the methodology, providing evidence for metrics, pain, and champion identification, but the MEDDIC framework is still needed to:

- Validate decision criteria and internal approvals.

- Identify the real economic buyer.

- Track the paper process and competitive risks.

By combining product-led signals with MEDDIC’s structured qualification, SaaS teams can accelerate adoption, reduce stalled deals, and translate early interest into long-term revenue growth.

In Userpilot, you can do this by analyzing new user activation metrics. By tracking sign-ups, activation rates, and the steps users take to complete onboarding, teams can identify where users struggle or drop off.

MEDDIC beyond new deals

After purchase, buyers reassess value continuously. Renewals and expansions depend on whether the product is still solving a meaningful problem and whether the right people remain aligned. MEDDIC provides a structured way to reassess value, ownership, and urgency post-sale, instead of relying on assumptions.

But, how to apply MEDDIC after the deal closes?

- Metrics: Track ongoing value delivered, such as reduced churn, faster onboarding, and cost savings.

- Economic buyer: Reconfirm who controls the renewal or expansion budget, such as a new VP or finance lead.

- Decision criteria: Understand what now drives renewal decisions, such as adoption across teams or measurable ROI over the past year.

- Decision process: Map the current approval path, like finance review and purchase approval.

- Identify pain: Validate current business pain, such as usage dropping in a critical workflow.

- Champion: Ensure internal advocacy is intact, like a user encouraging others to adopt a core feature.

In many organizations, renewals trigger fresh procurement, finance, or compliance reviews. Mapping this with MEDDIC keeps you ahead of surprises and ensures approvals don’t stall the deal.

Is MEDDIC right for your team?

If your team faces complex sales cycles, distributed decision-making, or high-value contracts, MEDDIC can give you clarity and control. That said, it can feel like overkill in some situations:

- High-velocity SMB sales, like entry-level SaaS plans, basic renewals, and add-ons, where deals close in minutes or a few days.

- Deals handled by a single decision-maker, like a small business owner purchasing a self-serve plan, where additional approvals aren’t required.

- Low ACV, transactional deals that don’t require deep qualification rarely benefit from the full MEDDIC framework.

What are some common MEDDIC mistakes?

The framework itself is solid, but mistakes happen when it’s applied like a rigid checklist or too late in the cycle. Here are the classic mistakes that turn a winning framework into a headache:

Confusing enthusiasm with qualification (“happy ears”)

Happy ears means mistaking positive signals like excitement, praise, or frequent engagement for real buying intent. Just because a user shows interest in your product doesn’t mean they can buy it. Watch out for:

- Fans vs. buyers: Users may cheer and engage, but don’t control the budget.

- Friendly users vs. economic buyers: Friends guide you, but only economic buyers can approve.

- Verbal agreement without authority: Hearing “yes” doesn’t mean the deal is actually moving forward.

Use Userpilot to create custom events that track specific in-app actions in real-time, such as completion of onboarding steps, and core feature usage. You can understand how different users interact with your product to identify potential champions and economic buyers.

Skipping disqualification to protect pipeline optics

Sometimes, teams skip the MEDDIC rigor to keep the pipeline looking healthy. It feels safer to assume every lead is viable than risk making the pipeline look smaller. This happens because of:

- Fear of shrinking pipeline: Disqualifying weak opportunities feels like losing coverage, even if it prevents wasted effort.

- Pressure to hit coverage ratios: Managers expect certain numbers, so reps stretch deals instead of verifying fit.

- Optimism bias: Reps want every “maybe” to become a win and often convince themselves a hesitant buyer is ready.

Asking MEDDIC questions without trading value

Running down questions like “Who is the economic buyer?” or “What are your metrics?” feels like an interrogation and shuts down the conversation. The optimal way is to trade value for information.

Weave questions into natural dialogue using customer discovery questions rather than extracting answers mechanically. Contrast the approaches:

- Bad (Interrogation): “Who signs the contract?” This sounds direct, extractive, and likely to irritate the prospect.

- Good (Consultative): “Typically, when we work with companies of your size, the CFO usually reviews compliance before signing. Is that how your process works, or is it handled differently? I want to make sure we get the right documents early so we don’t delay your launch.” A more contextual approach, backed by experience, which validates your understanding.

Prospects often reveal decision criteria while discussing frustrations with their current solution. Note it down and verify later. For example, if the client comments on the UI. You can lead the conversation this way: “You mentioned the current UI is clunky. Is ease of use a top-three priority for this switch?”

Early rigor saves late pain

MEDDIC helps you move forward in the sales process with facts. To kick off MEDDIC without the headache, lead with these steps:

- Update your CRM: Add MEDDIC fields with simple scorecards to keep evaluations clear.

- Set deal checkpoints: Make sure metrics and economic buyer info are filled before moving a deal forward.

- Check lost deals: Review your last 10 losses to see which MEDDIC pieces were missing.

- Weekly deal reviews: Go over one deal a week with your team and ask questions like “Do we know the real buyer?” or “Is this pain serious or just annoying?”

Userpilot supports this process by providing visibility into how users interact with the product. Teams can use in-app behavior data and usage insights to validate whether core features are being adopted and where users struggle.

FAQ

What is the difference between MEDDIC and MEDDPICC?

MEDDIC lays the foundation with Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, and Champion. MEDDPICC adds two elements:

- Paper Process (P): Covers approvals, legal, compliance, and procurement steps that can delay deals.

- Competition (C): Highlights alternative solutions the buyer may consider.

MEDDPICC is an expanded version designed for longer, more complex sales cycles with multiple stakeholders.

Is MEDDIC outdated?

No. While MEDDIC was born in traditional sales environments, it adapts well to modern SaaS and PLG models. Teams now use it to track deals post-signup, identify expansion opportunities, and prevent churn.

What is the difference between MEDDPICC and Bant?

BANT (Budget, Authority, Need, Timing) is a simple, fast filter for leads, but it assumes a budget already exists. MEDDPICC, on the other hand, is built for complex, multi-stakeholder deals, tracking metrics, pain, champions, paper process, and competition to navigate every stage of the deal.

What is the MEDDIC sales checklist?

A quick MEDDIC checklist ensures you cover:

- Metrics: Is there a measurable business impact?

- Economic Buyer: Who controls the budget?

- Decision Criteria: What factors drive the buying decision?

- Decision Process: Who’s involved and what steps are required?

- Identify Pain: What real problem does your solution solve?

- Champion: Who actively advocates for your solution?

Optional for MEDDPICC:

- Paper Process: Are approvals, compliance, and contracts aligned?

- Competition: Who else is in the running?