Customer Lifetime Value: 4 Ways To Calculate the Lifetime Value in SaaS

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is a Customer Lifetime Value (LTV)?

Customer Lifetime Value (LTV) is a business metric that measures how much profit a company can expect from its customers over the course of their relationship.

It accounts for the revenue generated by a user and compares this figure to the predicted customer lifespan of your business. The longer customers stick to your product, the higher their lifetime value.

Why is tracking Customer Lifetime Value important?

LTV improves the overall profitability of your business.

SaaSScout found out that retaining 5% of users boosts profits by at least 25%! In general, the longer customers stay with you, the lower their cost per customer, and the more they spend with you, the greater your LTV will be.

Let’s now look at some of the benefits that can be gained from tracking the LTV.

Provides an overview of the company’s financial viability

LTV lets you see the bigger picture using its predictive power. Keeping track of LTV can help you estimate future revenue and investments. As a result, you will be able to make financially responsible investment decisions in the future.

Helps you identify and target loyal customers

Tracking LTV allows you to identify your most loyal customers and provide them with an even better customer experience. This gives you more power users – the users who are most active and willing to become brand advocates.

Helps you to reduce customer acquisition costs

Using the LTV:CAC ratio, you can compare your LTV with your customer acquisition costs. To ensure good business health, this ratio should be at least 3. The higher the LTV, the lower the CAC.

This ratio can be measured by segmenting users based on acquisition channels in order to identify the ones that convert the most profitable users. You can then prioritize the right channels to lower your customer acquisition costs.

What metrics do you need for customer lifetime value calculation?

Before we get into the LTV calculations, let’s look at the metrics you need to measure it.

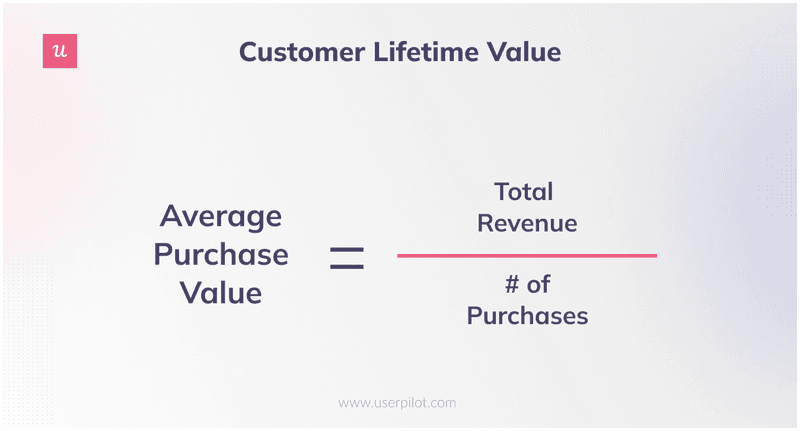

Average Purchase Value

The average purchase value is the average value of a customer transaction. It equals the ratio of total revenue to the total number of purchases. Using the metric allows you to forecast revenues and understand customer purchasing behavior to meet demand and develop engagement strategies.

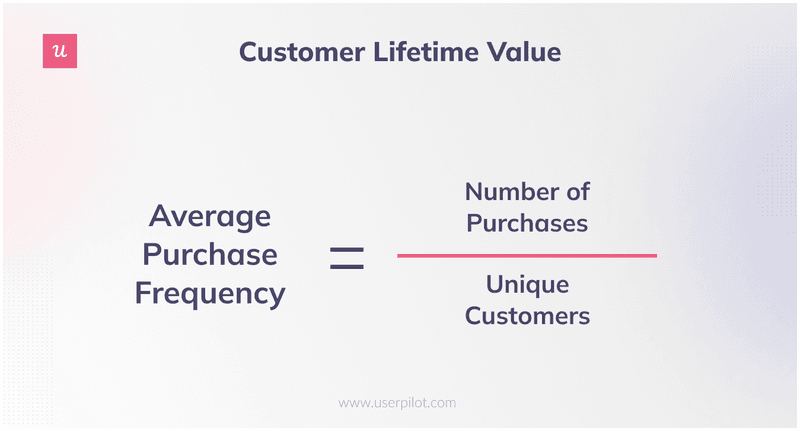

Average Purchase Frequency Rate

This is the average number of transactions made by a user over a specific time period, usually a year. Divide the number of purchases by the number of unique customers or the average number of customers to calculate the average purchase frequency rate.

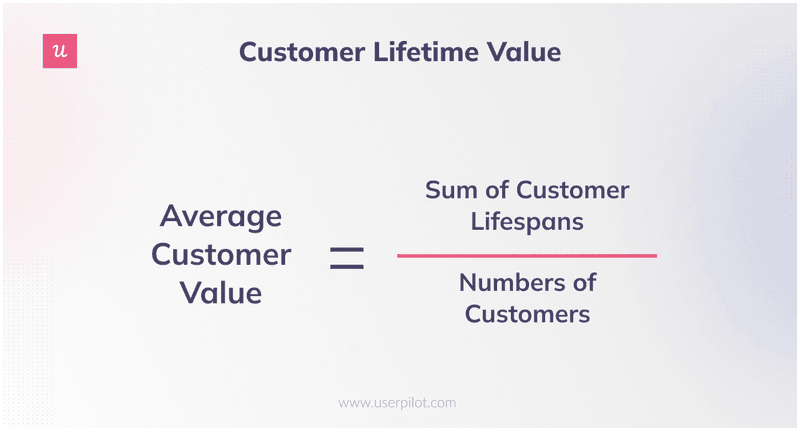

Customer Value

The customer value is equal to the ratio of the total lifespan of a customer to the total number of customers. This is a measure of how much revenue a customer generates for your business. This allows you to concentrate your resources on the most revenue-generating users.

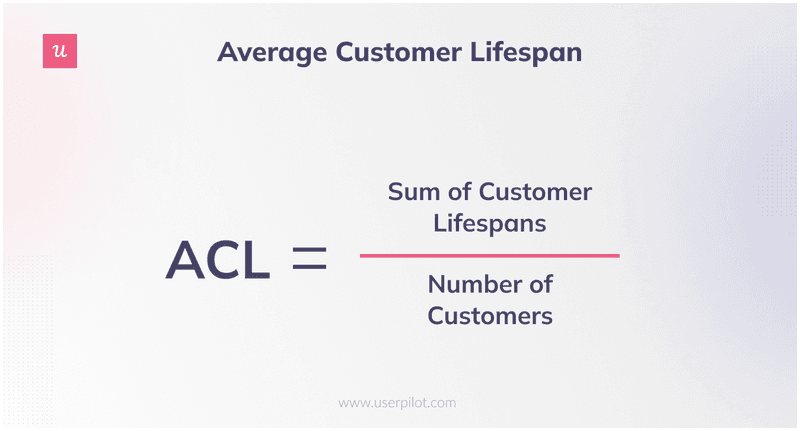

Average Customer Lifespan

The average customer lifespan is the sum of customer lifespans divided by the total number of customers. You can use it to find out how long an average customer relationship with your business is. Your LTV is likely to increase as your customer lifespan increases.

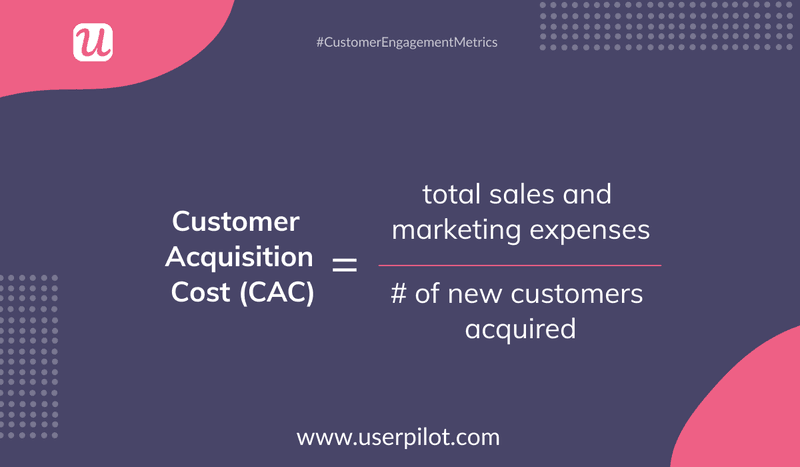

Customer Acquisition Cost

The customer acquisition cost refers to the average amount of money spent on acquiring a user. It is equal to the ratio of total sales and marketing expenses to the total number of new users acquired. As mentioned before, the lower the CAC, the better.

4 Ways to calculate the customer lifetime value

The customer lifetime value can be calculated in four different ways. The right way to measure this metric depends on your business’s nature and resources.

Let’s get into details!

#1 Calculate lifetime value with a traditional approach

The traditional LTV formula incorporates the average gross margin per customer lifespan (GML), retention rate, and discount rate.

Traditional customer lifetime value formula:

LTV = (GML * Retention rate) / (1 + Discount rate – Retention rate)

What does each of these components mean?

- Gross margin per lifespan (GML) is the profit you can expect to earn over the average lifespan of a single customer.

- R or Retention rate is the percentage of users you retain over a specific period, usually a month.

- D or Discount rate is a percentage required to account for inflation and is usually taken as 10%.

#2 Calculate lifetime value with a historical approach

A historical approach estimates a customer’s value based on past data, regardless of whether they remain your existing customer in the future.

In order to find out your customer’s value, you need to take their average order value into account. Using this method works especially well if most of your users interact with your company on a short-term basis.

Historical CLV = (Transaction 1 + Transaction 2 + … + Last transaction) * Average gross margin

Before calculating it, there are certain things you need to do:

- Find the touchpoints where the user drives value for you.

- Track and record the revenue at every touchpoint.

- Integrate the records and build a user journey map.

- Add everything over the customer’s lifetime.

This model, however, has certain drawbacks because most customer journeys are not identical. The data may become skewed if active customers (considered valuable by the historical model) become inactive. In contrast, you might overlook inactive customers who become active again after a period of inactivity.

#3 Calculate lifetime value with a predictive approach

The predictive method is more efficient for determining the customer lifetime value.

It relies on predictive analysis for calculations. The lifetime value of a customer is calculated by taking into account all previous transactions and several behavioral indicators.

Here’s a simple predictive LTV formula

LTV = (Average customer lifespan * Average gross margin) (Average monthly transactions * Average order value)

But first, you have to:

- Find the touchpoints where users generate value.

- Identify the determinants of value and whether they vary from user to segment.

- Figure out why a user moved from one touchpoint to the other.

Note that the predictive LTV will never have 100% accuracy since it’s just a future projection. Plus, it does not consider the money spent on retaining a user.

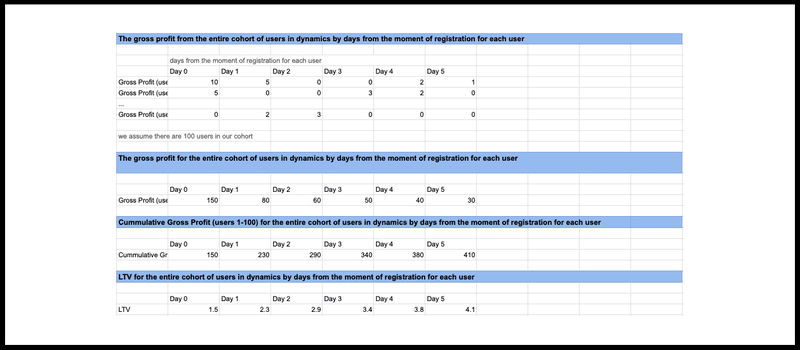

#4 Calculate lifetime value based on cohort analysis

When you have a large number of customers, how can you accurately measure customer lifetime value?

Cohort analysis allows you to separate customers into different groups according to shared experiences or common characteristics. This results in emerging behavioral patterns across the user journey.

Cohort analysis can be applied in LTV calculation as well. You can create segments based on business metrics and criteria, and traits and measure how much an average customer from that cohort is worth to your business over time.

So here is how you can calculate LTV with the help of cohort analysis.

- We take a cohort of users and calculate the gross profit for each user day by day from the point at which they register.

- Based on the date of registration for each user, we compute the gross profit for the entire cohort of users.

- On the basis of the previous result, we calculate the cumulative gross profit of each cohort of users day-by-day. For day N, the gross profit will equal the gross profit for days 0 to N.

- Using the cumulative gross profit divided by the number of users in the cohort, we are able to calculate the daily LTV dynamics for the cohort.

How to increase customer lifetime value with Userpilot?

If your customer lifetime value is not high enough for your business to survive, the future may not be as bright for you. What can you do to improve the numbers in that case?

Here are four ways Userpilot can increase your LTV.

Create UI elements for secondary onboarding to keep customers engaged

Primary onboarding is just the beginning. Onboarding is a continuous process of familiarizing users with your product and helping them get more benefits from it.

Once users reach the activation point and convert, you need to make sure they keep experiencing value as they move forward in their journey. This is where secondary onboarding comes in.

The secondary onboarding focuses on highlighting the secondary features relevant to specific use cases so you can drive retention.

With Userpilot’s mobile SDK, you can create targeted onboarding flows using slideouts, carousels, and push notifications without writing extra code.

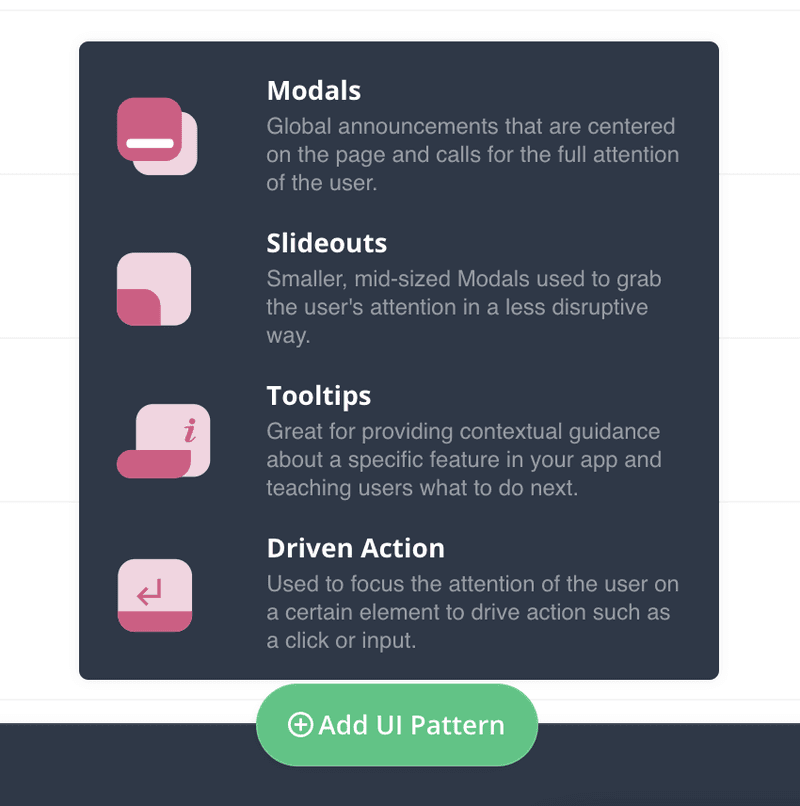

Userpilot lets you create various UI elements of secondary onboarding to send in-app messages to customers, code-free:

- Checklists

- Experience flows

- Modals

- Mobile onboarding carousel

- Mobile push notifications

- Mobile personalized messaging

- Automated localization

- Tooltips, and more.

For example, you can use modals to make new feature announcements and tooltips to point out a key feature that customers might be missing out on.

This way, you can keep customers engaged and ensure they get the maximum benefit from your product.

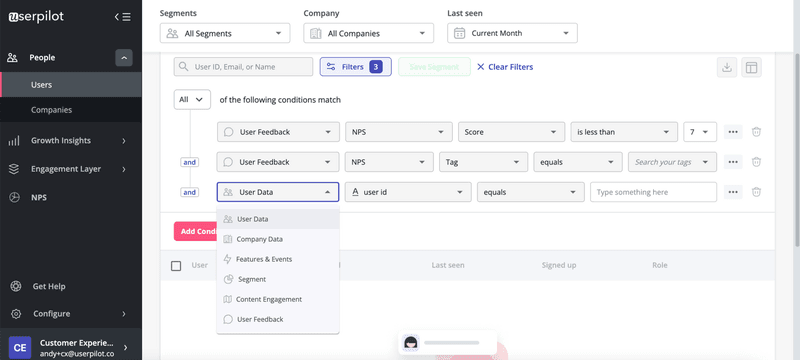

Segment customers to send them the right upgrade messages to drive account expansion

You must have a better understanding of your customers’ needs in order to provide contextual upselling opportunities.

Userpilot’s advanced segmentation feature lets you segment customers based on their user behavior or use case. This way, you can understand their perception of value better and send them the right messages contextually.

Personalizing the onboarding experiences for each segment can open up opportunities for account expansion. After all, it’s easier to sell to existing customers than attract new ones.

When users wish to keep using a particular feature, you can use modals to ask them to upgrade. This message won’t appear to users without specific triggers. By doing this, they won’t be bombarded with messages at the wrong time.

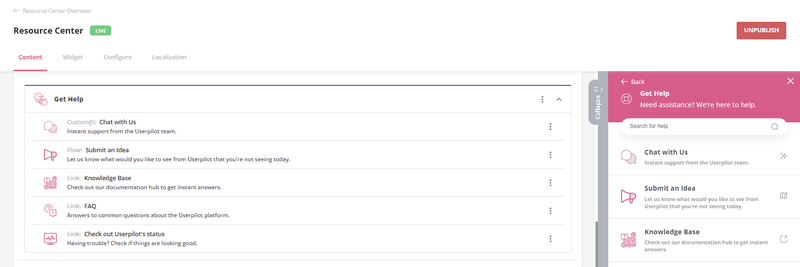

Create an in-app resource center to provide self-service support

An in-app help center or resource center is a perfect way to provide self-support to your customers.

This is an example of self-serve onboarding, where customers can find solutions without leaving the app. As a result, solving problems inside the app can enhance user engagement.

Help centers can include FAQs, webinars, tutorials, open chat options, documentation, and even a link to your knowledge base.

Giving customers easy access to these resources will boost customer satisfaction because users won’t have to depend on your support team every time they run into an issue.

Furthermore, this will decrease the number of support tickets, and your support agents can pay more attention to relatively complex issues.

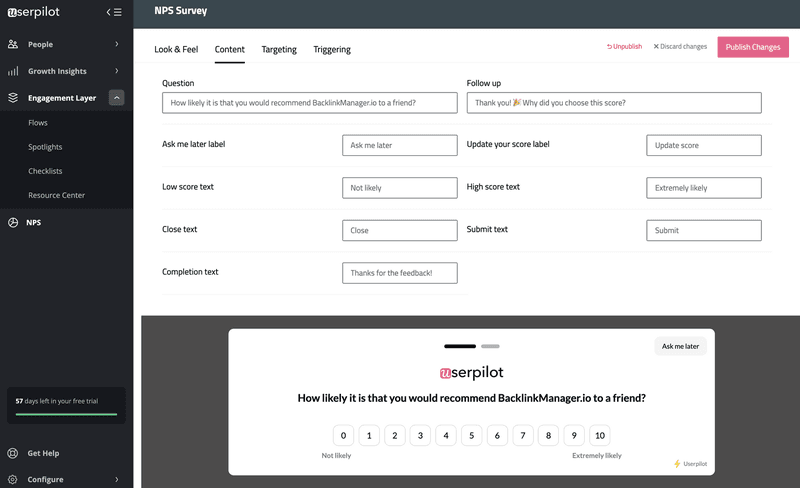

Use microsurveys to collect feedback and improve the customer experience

Last but not least, your efforts will be incomplete without the use of direct feedback from customers. You can’t know all the improvements customers want to see unless you ask them directly.

Userpilot enables you to create microsurveys like customer satisfaction (CSAT) surveys, Net Promoter Score (NPS) surveys, and customer effort score (CES) surveys. You can prompt users to participate in these surveys at multiple stages of their journey and collect valuable customer feedback.

In addition to creating microsurveys with Userpilot, you can also ask qualitative follow-up questions to get deeper insights.

This helps you pinpoint the areas that need attention and eliminate any friction points. This will help you enhance the customer experience and increase your LTV.

Conclusion

Customer lifetime value might be tricky to measure, but it is one of the best indicators of your company’s future profitability.

LTV can be measured in a variety of ways. Choose the one that’s most relevant to your SaaS. You can even follow different approaches simultaneously to compare their results.

Want to track your customer lifetime value and improve it? Get a Userpilot demo to see how can achieve sustainable growth.