With so many options out there for consumers, the FinTech onboarding process is crucial for any FinTech company looking to set itself apart.

As with every digital product, the first few minutes on your app will determine whether the user sticks with it or abandons it. A seamless onboarding experience, thus, creates the right first impression, setting you up for success.

In this piece, we examine the importance of FinTech onboarding and dive into best practices that make for a successful onboarding experience.

What is FinTech onboarding?

FinTech onboarding is the process of welcoming and acclimating new users to your financial technology (FinTech) product or service. It is like onboarding in any industry but with the added complexity of navigating financial regulatory requirements and security concerns for a FinTech app.

Why focus on the FinTech onboarding process?

A stellar FinTech onboarding process isn’t just a formality; it’s the cornerstone of user success and the key to a successful business. Indeed, focusing on onboarding unlocks three key benefits:

- Building user trust: The onboarding process is the first interaction users have with your platform. It is your chance to build trust through a clear, secure, and efficient process. Clearly explaining your data usage and security measures while integrating a seamless KYC check can foster the trust you desire.

- Improving the customer experience: Good onboarding is tailored to each user’s needs and goals. Offering targeted guides, demos, and tutorials can make users feel valued. The clear instructions and helpful prompts you provide will eliminate user frustration and improve their experience.

- Reducing customer churn: A quick and friction-free onboarding process keeps users motivated enough to proceed with your app. By streamlining onboarding processes and keeping users engaged, you significantly reduce the risk of churn.

As you build user trust, enhance the customer experience, and minimize churn, you will foster loyalty and fuel sustainable growth in the ultra-competitive FinTech landscape.

Best practices for creating efficient onboarding process for FinTech apps

Now that we understand the advantages of customer onboarding for your FinTech app, let’s dive into the steps FinTech companies could follow to create a great onboarding process.

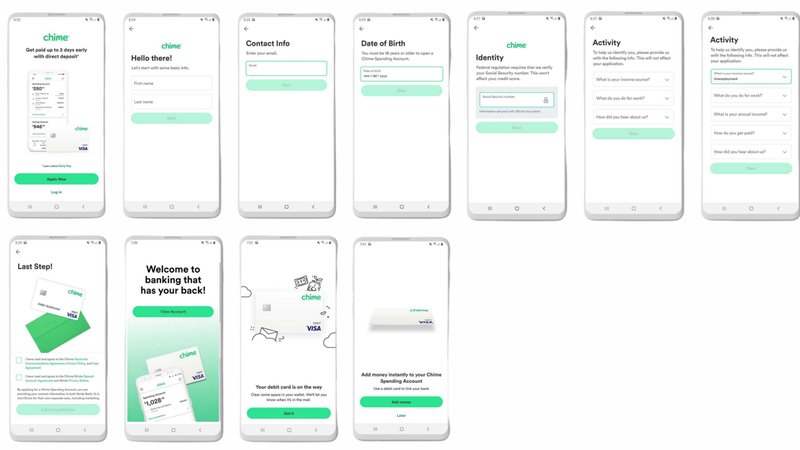

Simplify the signup process

The first step to a seamless onboarding experience is a simplified signup process. Only ask for necessary information, such as the user’s name, email address, etc.

It’s important to note, though, that the FinTech signup process must follow certain steps and collect more data than other SaaS companies.

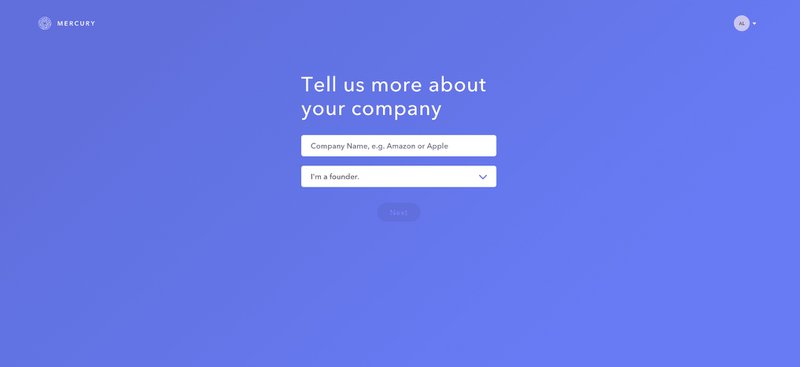

For example, financial institutions like Mercury, which offers banking services to startups, need to know which company they will be serving. This data will also help you know which services or products they’ll need.

Once you’ve got all the data you need, you’ll also need to perform KYC (know your customer) verification to achieve regulatory compliance.

Still, they simplified the process by breaking it into small, easy-to-follow steps.

What’s your biggest FinTech onboarding challenge right now?

Understanding your primary hurdle helps tailor the perfect solution for a seamless user journey.

How are you currently guiding new users through your FinTech app?

The right guidance is key to successful FinTech onboarding and building user trust from day one.

How personalized is your current FinTech onboarding experience?

Personalization drives engagement and helps users find value faster.

Ready to build a world-class FinTech onboarding experience?

Stop losing users to clunky, confusing, and generic onboarding. See how Userpilot can help you build personalized, frictionless flows that boost activation and retention.

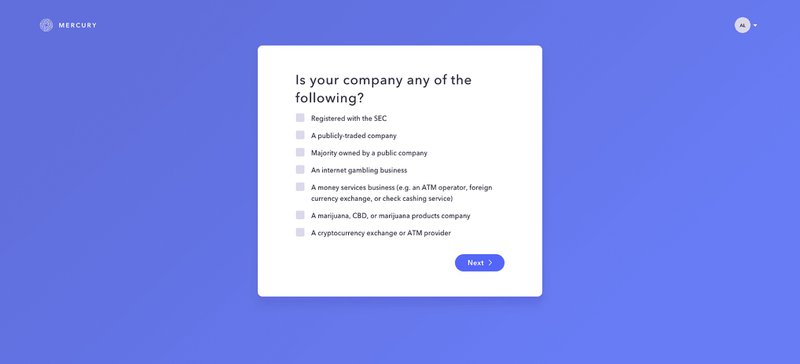

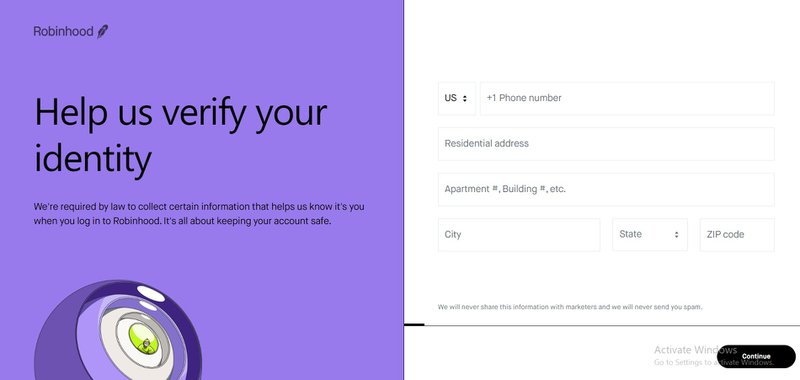

Simplify KYC process

To meet regulatory requirements, financial institutions must implement KYC and Anti-money Laundering (AML) checks as required by law. These checks help prevent the illegal use of global financial services, ensuring compliance with global best practices.

Although you can’t escape this step, you can simplify it by:

- Explaining the need to verify customer identification.

- Requesting only necessary information.

- Using automation to streamline identity verification.

- Incorporating biometric authentication for a more secure and faster verification process.

- Flagging missing documentation before submission.

Ensure a seamless user experience

With the signup and KYC processes completed, the user can now get into the app. The first step to creating a seamless user experience is creating a user-friendly interface that is easy to navigate.

You’ll also need to provide clear instructions and guidance through the onboarding process. Your goal during onboarding should be to highlight relevant security measures and help users succeed with your FinTech app.

Personalize the customer journey

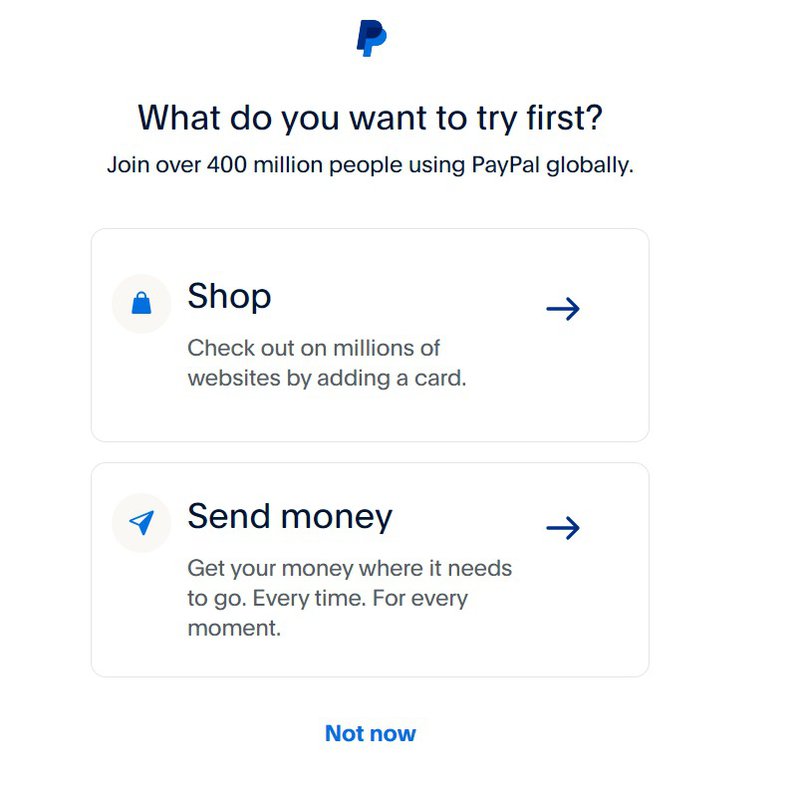

Before you begin the onboarding process, though, you need to learn about the user’s main goal with your product. This is especially important for FinTech apps with multiple use cases.

For example, a payment app like PayPal can be used for either shopping or money transfer. To tailor their onboarding information to the user’s needs, they use the welcome screen to learn the user’s main goal.

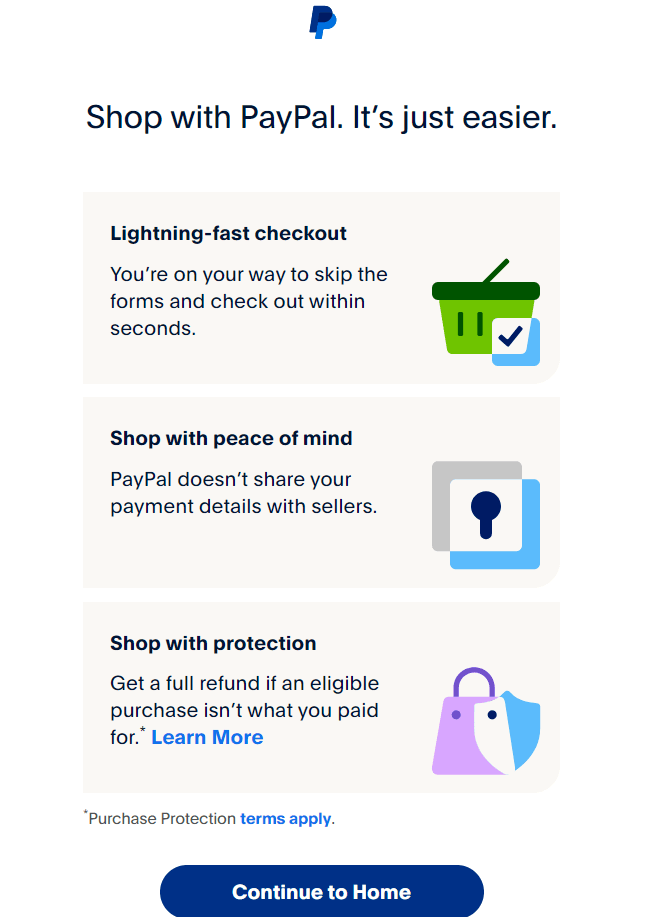

Next, they personalize the onboarding process based on the customer’s response.

Establish trust from the beginning of the customer onboarding

The key to a successful customer onboarding journey is trust. You can gain this trust by maintaining transparency when requesting information. Always explain why any information is needed.

You should reassure users about the security of their personal information by highlighting your data protection practices.

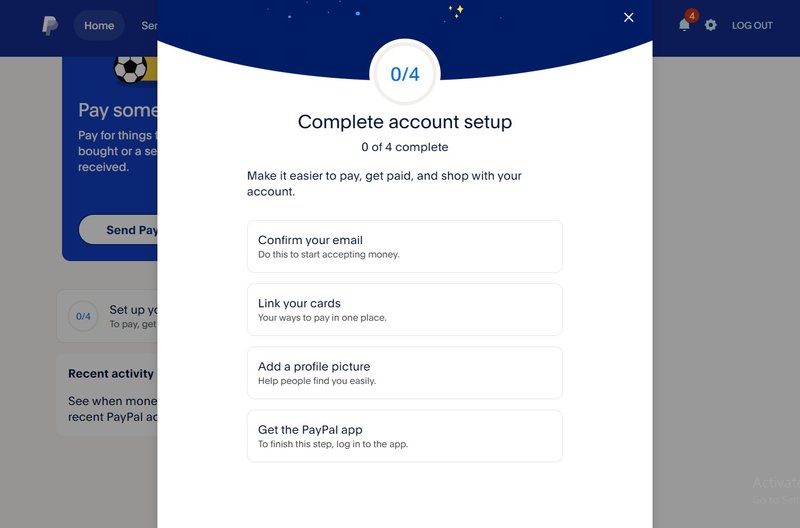

Automate the onboarding process with self-services

You simply can’t provide all of the info the user needs at once. This is where automation comes in. As part of your onboarding strategies, automation helps customers get information on demand, eliminating friction.

For example, you can use automated tooltips to explain complex processes or terms the first time a user interacts with them. You can also provide on-demand educational resources and tutorials to help users troubleshoot.

Finally, you can create an onboarding checklist like PayPal that is automatically ticked off to ensure customers complete the initial onboarding setup.

Thankfully, Userpilot simplifies all of these processes for you. With Userpilot, you can create a checklist or trigger a banner, tooltip, or modal based on custom events. And you can do all these without writing any code.

Optimize the onboarding process for mobile devices

Mobile devices account for about 60% of the world’s internet usage. This means that a good chunk of your customers will access your FinTech app on their mobile devices.

It’s important, therefore, that you prepare a mobile-friendly user interface for your app from the beginning.

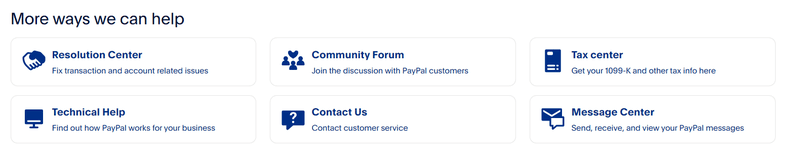

Offer multichannel support to improve customer experience

Creating a multichannel support system helps ensure a seamless and consistent customer journey across a variety of channels and devices. It ensures your availability at all times to resolve customer issues.

Your integrated support system could include a resource center or knowledge base, as well as in-person support through chat, email, or phone.

Use automation to drive new customers through the onboarding experience

Use automation to trigger personalized notifications and reminders across channels. This will help you offer personalized guidance to customers through the onboarding process.

For example, when a user creates an account, you can use an automated onboarding email to help them get started.

Gamify the onboarding process to drive customer engagement

Gamification involves using game-like elements to drive engagement in non-game contexts. As part of the FinTech onboarding process, gamification makes onboarding more appealing.

For instance, French FinTech service provider, Shine, boasts an 80% onboarding conversion rate thanks to onboarding gamification. This includes:

- Progress bars that let users know how far they’ve come

- A big call-to-action button that invites users to click

- Digital confetti to celebrate free, unlimited accounts, and

- Simple onboarding screens that limit one screen to one action.

Collect customer feedback to improve the onboarding process

One way to ensure your onboarding strategy is successful is by asking users what they thought of it. Did they experience any pain points?

Conduct customer surveys to identify common pain points in the process. As you do, make iterative improvements and changes based on the feedback you receive.

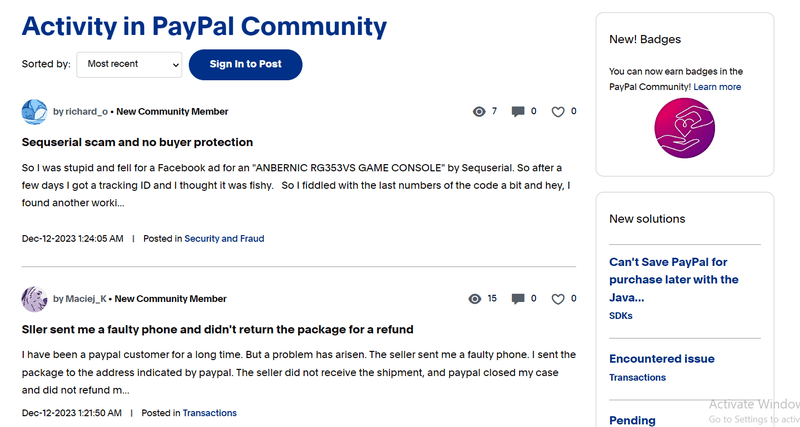

Create a community for users

A community forum creates a space for users to connect with your brand. For starters, an active forum is a source of valuable user-generated content, reducing your content and support burden.

An active forum also fosters a sense of belonging and loyalty among users. As active users share tutorials, tips, and best practices, they motivate and inspire others to use your product.

A community forum can also be a good source of information about what your users need – including feature opportunities and bug identification. Ultimately, when used correctly, it boosts engagement and reduces churn.

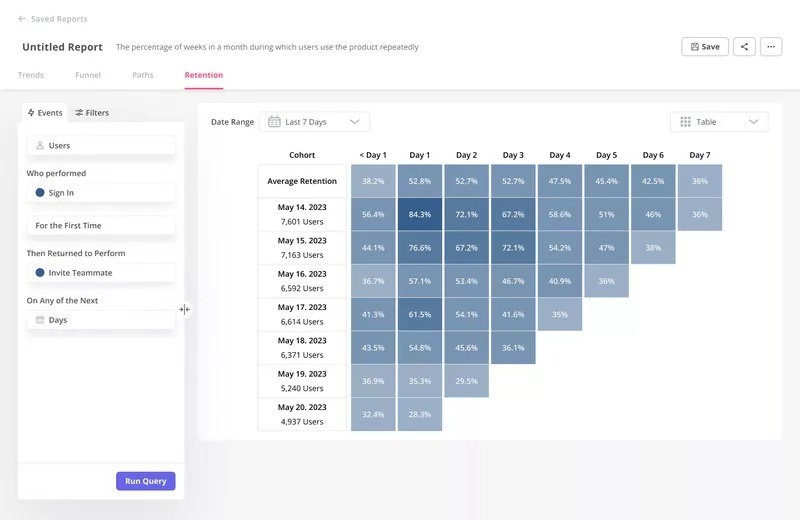

Constantly monitor and improve onboarding metrics

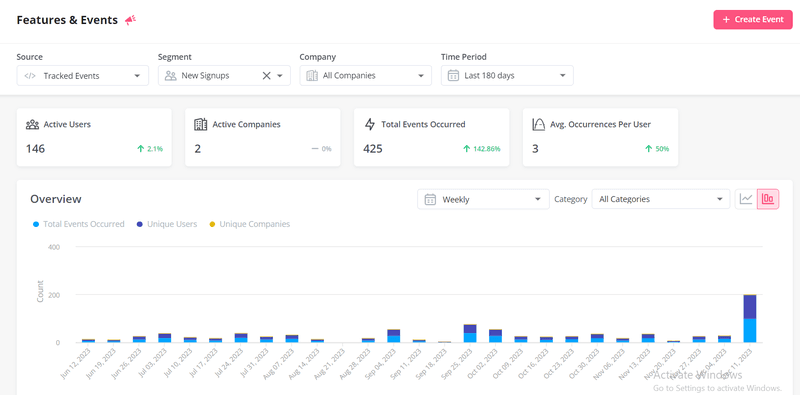

Finally, after setting up your onboarding processes, you must keep an eye on it to ensure it functions correctly. As you monitor key onboarding metrics, watch out for and analyze drop-off points to identify areas for improvement.

Conduct periodic reviews of the onboarding process to adapt it to your evolving product and changing customer needs. Some metrics to watch include:

- Time to value: Measures the amount of time it takes for new customers to get value from your product or service.

- Engagement rate: Measures the portion of your users that actively engage with your product.

- Activation rate: The percentage of users who complete a desired milestone (such as adding their first contact) in your onboarding process.

- Adoption rate: Measures the percentage of users that ‘adopt’ and actively use your product or service.

- Churn rate: The percentage of customers who stop using your product over some time.

How to measure the success of your FinTech onboarding process

Creating a seamless and effective FinTech onboarding experience is crucial for your success. But how can you be sure your efforts are paying off? Consider three key steps you can follow:

Measure customer satisfaction and retention

Measure customer retention during onboarding and launch customer satisfaction (CSAT) surveys right after to see how effective it was. Surveys measuring user satisfaction provide you with direct feedback.

The higher your CSAT score, the higher the positive perception of your onboarding strategy. Similarly, a high retention rate and low churn rate among users who just completed onboarding indicates successful onboarding.

If either of these metrics begins to dip at some point, conduct an even deeper analysis to identify the reason and make corrections.

Monitor continued engagement

A high engagement rate during onboarding is proof that new users are finding value in your FinTech app. You can measure the engagement rate by looking at 4 key metrics:

- Session duration: Alongside the app open rate, session duration tells you how frequently and how well users engage with your app. Longer sessions indicate consistent engagement.

- Feature usage: Analyze which features users interact with the most. If feature interaction is high for key features of your product, your onboarding has succeeded.

- Completion rates: Track the number of users who complete key onboarding milestones or tasks. The higher the number, the more effective your onboarding.

- Support tickets: High support tickets during onboarding indicate a lack of clarity. Conversely, fewer inquiries signify a smoother and more intuitive process.

Compare your results with FinTech onboarding benchmarks

Identifying benchmarks within the wider FinTech market gives you something to compare your performance against. The benchmarks help you identify areas of strength and weakness in your process.

For example, according to a recent industry report, the typical FinTech app converts 21% of new users within a week of installation. Additionally, 95% of new customers become paying customers within a month of signup.

If your FinTech app isn’t getting anywhere close to these numbers, then you’ve got some work to do.

Conclusion

Making your FinTech onboarding processes efficient and seamless is well worth the effort. By following the steps outlined in this article, you can enhance user satisfaction and foster customer loyalty.

To begin, Userpilot helps you drive personalized in-app engagement, analyze product usage data, and collect user feedback. Book a demo today to learn how Userpilot can supercharge your onboarding strategies.