For over 70 years, sales teams have used BANT questions to qualify prospects. The framework covers budget, authority, need, and timeline. According to a 2023 Gartner survey, 52% of sales professionals still rely on BANT to qualify leads.

In a product-led growth, many argue that the BANT sales qualification framework is outdated, too aggressive, and too seller-focused.

I disagree.

BANT is not dead. It just does not work the way most sales teams use it.

If you treat BANT questions as a script and interrogate prospects in the first five minutes of a call, you will lose the deal. But when you stop interrogating and start observing, BANT becomes useful again. Used to interpret user behavior and buying signals, the BANT qualification process helps sales organizations focus on truly sales-ready prospects.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is BANT?

To understand how BANT works today, it is helpful to examine why it was created in the first place. IBM introduced the BANT framework in the 1960s to support high-stakes enterprise sales, where sales cycles were complex, long-running, and resource-intensive. BANT gave sales reps a straightforward way to focus their time on opportunities that could realistically move forward.

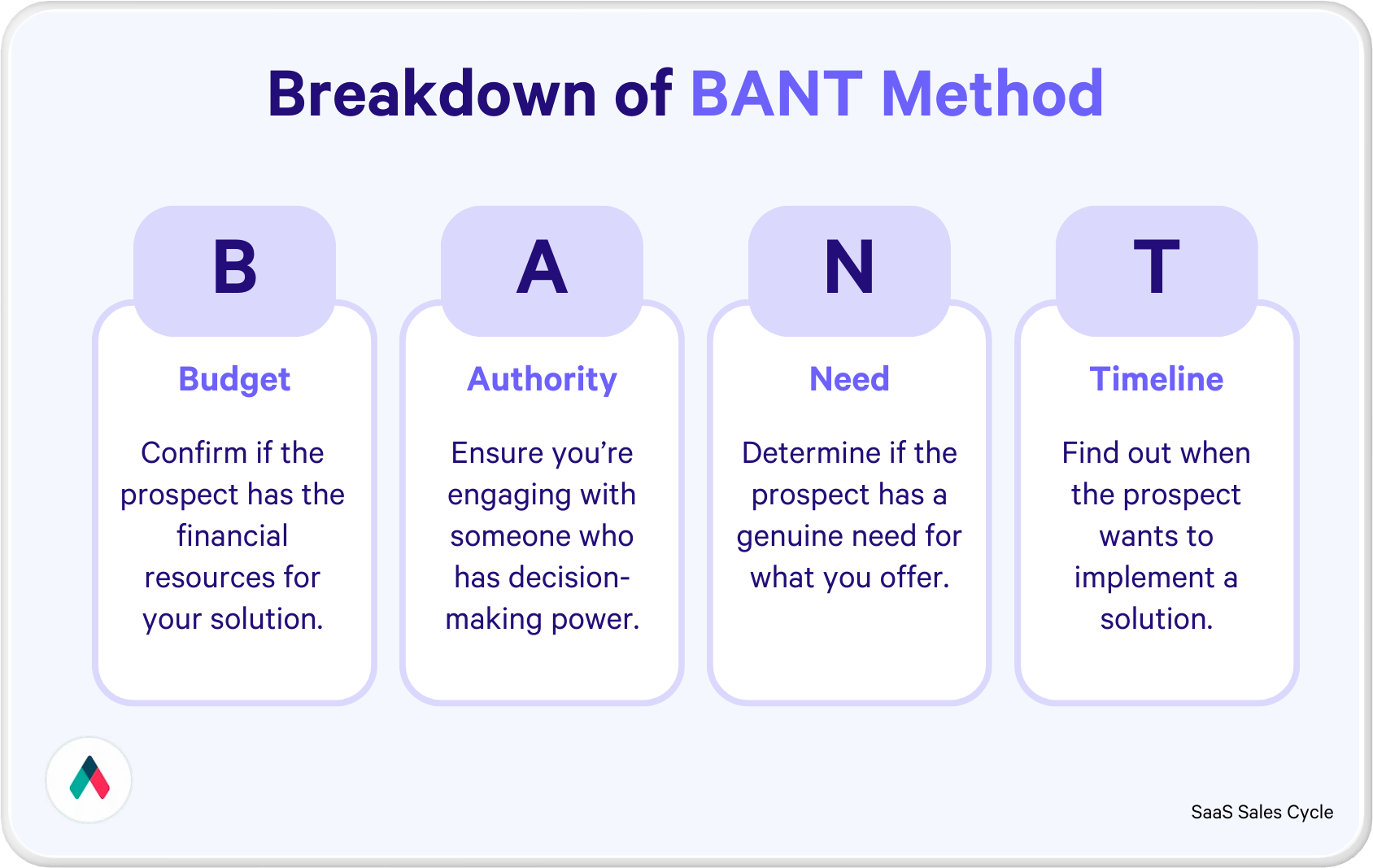

At its core, BANT is a sales qualification process built around four signals every deal ultimately needs:

- Budget: Does the organization have the financial capacity to invest?

- Authority: Are the right decision-makers involved in the conversation?

- Need: Is there a real problem the product or service is meant to solve?

- Timing: Is there a defined window for making a purchasing decision?

These fundamentals still apply. Every closed-won deal, whether sales-led or product-led, satisfies all four conditions in one way or another.

What has changed is how teams uncover them. For SaaS companies, the sales qualification process is not only about filtering leads out. It is about guiding the right accounts forward at the right moment. The BANT process provides the structure for that, while today’s tools and data determine how those signals are identified.

When used as a framework rather than a script, BANT remains one of the clearest ways to understand who is ready for sales help and who still needs time to explore value.

Why sales teams still use BANT (and when it breaks)

Sales teams still use BANT because it’s a simple, time-tested qualification framework that helps avoid chasing prospects who can’t buy, but in product-led growth environments, it often breaks when reps treat it as an opening checklist instead of a closing tool.

BANT itself isn’t the problem; the issue is using interrogation rather than observation. Today’s buyers arrive already educated from documentation, reviews, and walkthroughs, so jumping into surface-level budget and authority questions feels out of sync with where they are in their journey.

Traditional BANT also prioritizes qualification over problem clarity, yet in SaaS and product-led sales, establishing real need and value should come first, because if the product solves meaningful pain, budget and decision-making pathways usually follow.

Early BANT questioning can also disrupt product-led momentum when users are still exploring a trial, pulling the sales process ahead of value discovery. The framework still works, but the approach evolves: instead of rigidly asking BANT questions upfront, modern teams infer budget, authority, need, and timing through product engagement and behavior before entering a sales conversation.

BANT explained: What each letter actually means

I don’t think of BANT as four questions to ask in sequence. I think of it as four signals to confirm. In a product-led motion, those signals are already visible if you know where to look.

B – Budget: Determine financial capacity and willingness

Talking about money is uncomfortable. Junior sales reps often avoid it because they fear rejection, while experienced reps risk sounding pushy by raising it too early. In a product-led sales motion, I don’t uncover budget through direct questioning. I look for digital tools and behavioral proxies that signal financial capacity.

Budget often correlates with company size. A 500-person organization operates under very different constraints than a five-person startup.

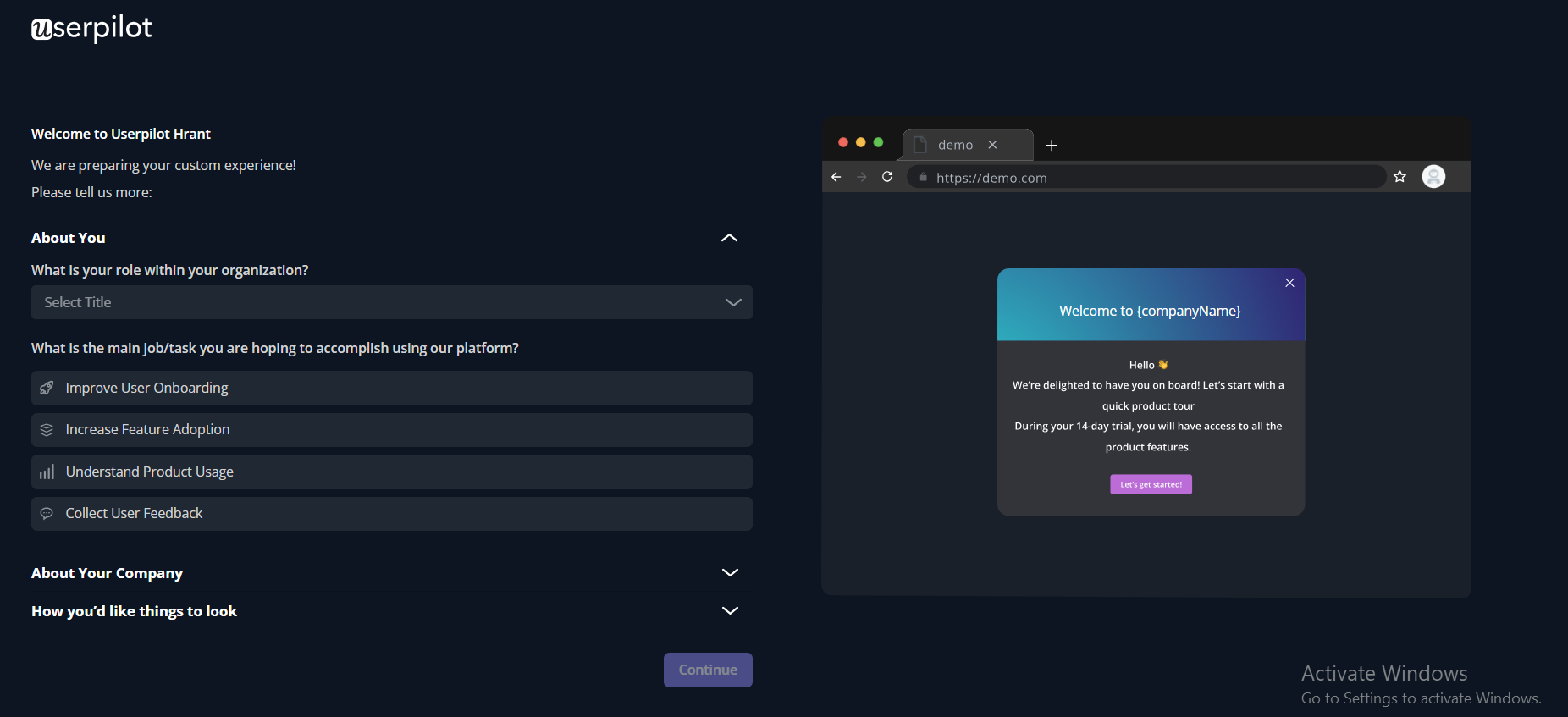

I capture this information early through a short welcome survey during signup.

Instead of directly asking about the prospect’s budget, questions like ‘How big is your team?‘. At the same time, they give you a reliable signal about the budget range in the background. You can enrich this data further by integrating tools like Clearbit (now part of Hubspot) with your Userpilot Users Dashboard to view company size and revenue.

A – Authority: Identify decision makers and influencers

Authority used to mean identifying the person who could sign the contract. Today, B2B buying decisions involve multiple stakeholders across roles and teams. The decision-making process rarely follows a linear path.

The challenge is distinguishing between the champion and the decision maker. Champions advocate for your product. The economic buyer approves the purchase. Confusing the two is one of the most common reasons deals slow down.

One of the clearest behavioral signals of authority is the act of inviting others. Individual contributors tend to explore tools alone. Managers and leaders invite teammates to evaluate workflows together.

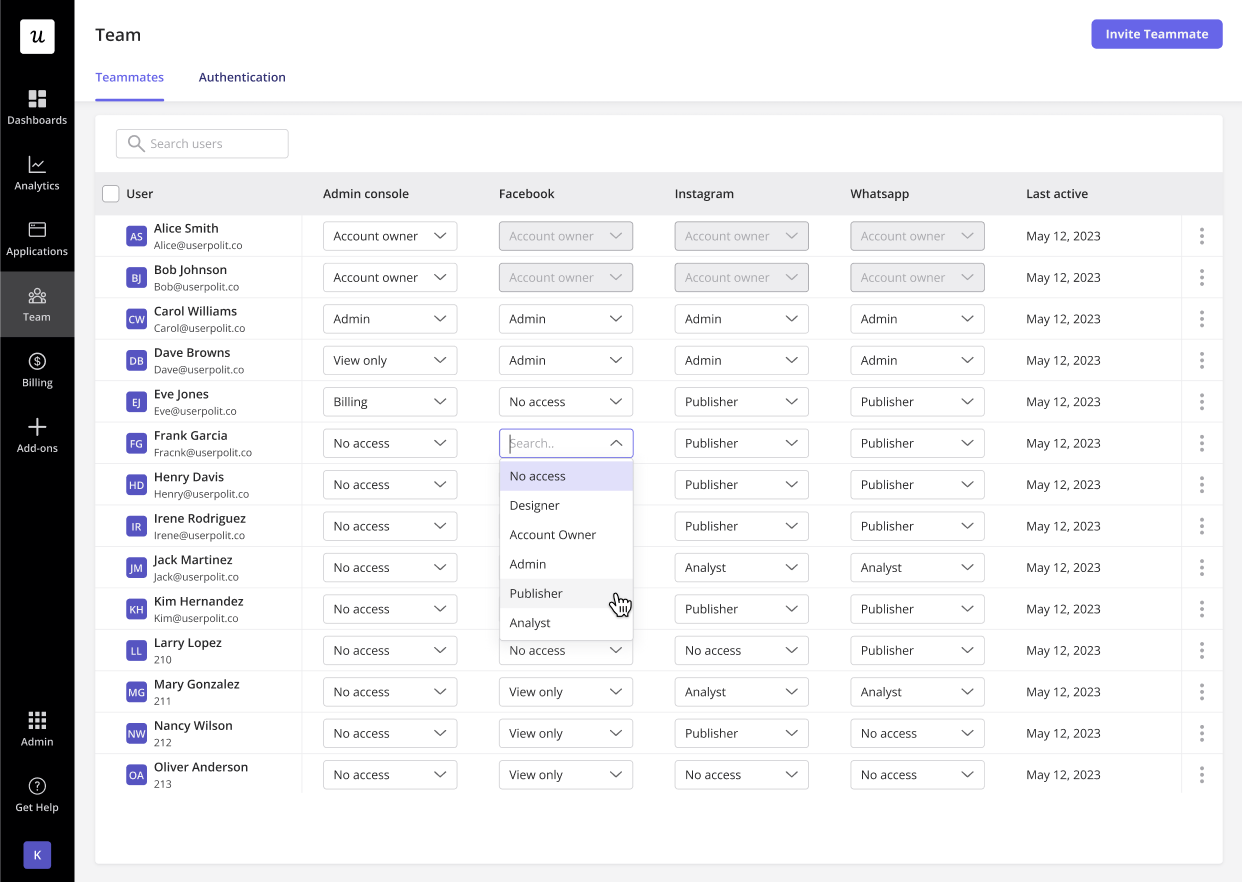

Tracking invited team members in Userpilot helps accurately identify users who can drive adoption internally. A user who invites multiple colleagues isn’t just experimenting. They’re testing a rollout. That behavior often signals both authority and expansion potential.

N – Need: Confirm the prospect’s problem or opportunity

Prospects don’t always articulate need accurately. Sometimes a request reflects curiosity rather than urgency. Other times, a stated problem sounds important but doesn’t justify a purchase.

In product-led sales, I validate need through user behavior. What users do inside the product matters more than what they say.

If a user claims to need a feature but rarely interacts with it during a trial, the need may be weak. On the other hand, repeated use of a core feature signals real dependency.

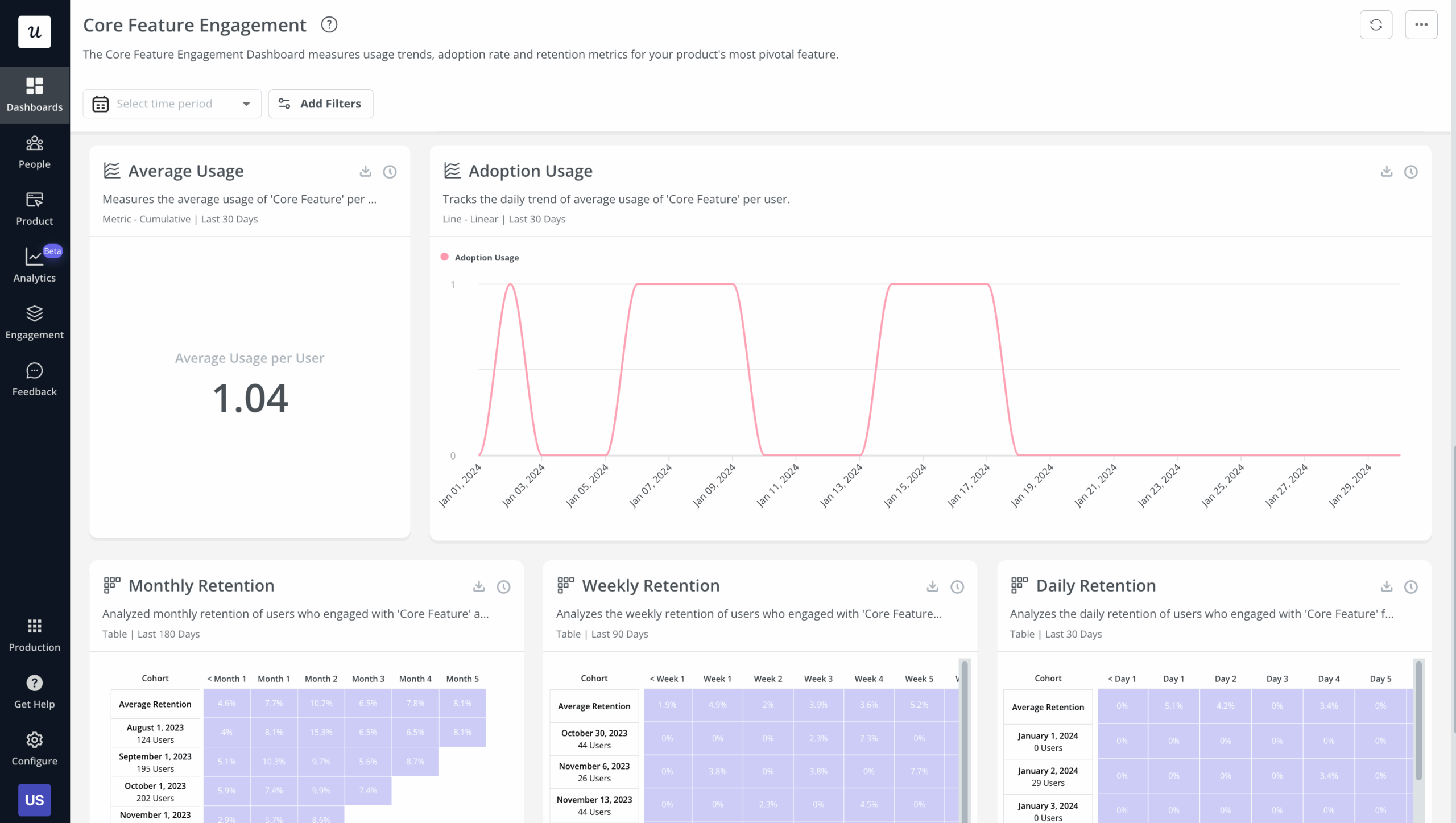

Tracking feature adoption in Userpilot helps you understand which pain points matter most. For a project management tool, that may be task creation and completion. For an email platform, it may be campaign sends. When feature usage is high and consistent, need is both stated and proven.

T – Timeline: Gauge urgency and decision timeframe

The timeline determines when sales involvement makes sense. Even when budget, authority, and need exist, timing can delay a deal.

In product-led sales, I see timing through usage velocity rather than stated dates. Urgency leaves patterns. Users with pressing needs tend to move quickly. They complete onboarding, invite teammates, and use core features shortly after signup.

Tracking time to value in Userpilot helps identify these moments. Fast progression often signals an active initiative or deadline, which is the right moment for sales outreach.

Pay attention to login frequency. Daily logins mean they’re actively trying to solve something. If they’re logging in sporadically, the urgency isn’t there yet. Those first few days show you whether to prioritize the deal now or give it more time.

Best BANT questions to ask (with examples)

The goal of BANT questions in lead qualification is not to extract information. It is to move the conversation forward without breaking trust. The strongest questions sound like problem-solving rather than qualification.

Need questions

Move beyond surface-level feature requests. Focus on the impact of the pain points, not the functionality being asked for.

Stop asking: “What features do you need?”

Start asking:

- “What happens if this problem is not fixed by Q4?”

- “How is this manual process affecting your team’s day-to-day work?”

These questions shift the discussion from preferences to consequences.

Timing questions

Tie timing to the prospect’s goals, not your sales quota.

Stop asking: “When are you planning to buy?”

Start asking:

- “To hit your Q3 launch date, we would need to start implementation by 2026. Does that timeline work for you?”

- “Are there any upcoming internal deadlines where having this in place becomes critical?”

This approach frames timing as coordination, not pressure.

Authority questions

Avoid blunt or condescending phrasing. Use implementation assumptions to surface stakeholders naturally.

Stop asking: “Are you the decision maker?”

Start asking:

- “To get this through security or procurement, who usually needs to sign off?”

- “When teams like yours roll this out, the VP of Marketing often wants visibility into reporting. Should we loop them in?”

These questions acknowledge real buying processes without putting the prospect on the spot.

Budget questions

Focus on ownership and value rather than raw numbers.

Stop asking: “How much money do you have set aside?”

Start asking:

- “Which team’s P&L does a tool like this typically sit under in your organization?”

- “We usually see a return within three months. How does that align with your team’s financial priorities this quarter?”

Budget conversations work best when they are framed around alignment, not affordability.

💡 A few tips for cold calling: When you’re doing cold calling or early outreach, lead with the N (Need) in your BANT questions before touching budget or timeline.

How to ask BANT questions without sounding pushy

The key to effective BANT questions is moving from “Closed Interrogation” to “Open Consultation.” The best sales reps uncover qualification criteria naturally throughout the sales process.

In a PLG motion, I’ve found you can answer BANT questions by analyzing product usage before you ever get on a call. This provides valuable insight into whether a prospect is worth pursuing.

Tracking need (Behavior)

Instead of asking what their current solution lacks, I look at what they’re doing. Are they hitting paywalls? Using core features repeatedly? In Userpilot, we use feature tagging to see interaction depth. If a user clicks “Premium Analytics” five times in two days, I know the Need is established.

Tracking timing (Velocity)

Session frequency reveals urgency better than any timeline question. When I see high velocity in the first 48 hours (completing onboarding in hour one, logging in 3x in 24 hours), I know they’re actively seeking a solution now.

Tracking authority (Expansion)

Authority questions like “Are you the decision maker?” put prospects on the defensive. I watch account expansion instead. If a user invites their manager or finance team, they’re building the buying committee for me. When I see the economic buyer join the account, the purchasing decision is moving forward.

Tracking budget (Firmographics)

I integrate tools like Clearbit with our Userpilot Users Dashboard to view company size and revenue. If the prospect is from an Enterprise with $50M+ revenue, I can quickly determine budget fit and craft a tailored proposal without asking pushy budget questions.

BANT alternatives and add-ons sales teams use

BANT, sometimes reversed as NTAB, works well for transactional and mid-market SaaS deals. As deal size and complexity increase, sales teams often layer in additional frameworks to capture deeper buying dynamics that go beyond basic BANT questions.

MEDDIC and MEDDPICC (Enterprise)

For larger, six-figure deals, many teams rely on MEDDIC or MEDDPICC. This qualification process focuses on Metrics, the Economic Buyer, Decision Criteria, Decision Process, Identified Pain, and a Champion.

Compared to the BANT framework, MEDDIC goes deeper into how a deal gets approved and why it matters to the business. It forces reps to identify a champion inside the organization who can advocate internally and to understand the success metrics that drive the purchasing decision. This approach provides valuable insight into complex buying decisions that simple BANT questions might miss.

CHAMP (Consultative)

CHAMP stands for Challenges, Authority, Money, and Prioritization. It intentionally puts challenges first, shifting the conversation toward problem clarity before qualification.

This framework fits well with consultative sales motions, where the primary goal is helping buyers articulate and prioritize their pain points before discussing budget or timing. CHAMP questions feel less transactional than traditional BANT questions because they focus on understanding the prospect’s current solution gaps rather than rapid qualification.

Common mistakes with BANT (and how to avoid them)

BANT isn’t the problem. How you use it is. Even when you’ve defined your ideal customer, these mistakes can derail qualification:

- Running through BANT questions like a checklist: If you ask for budget, authority, need, and timeline in that exact order within the first five minutes, you’ll sound like you’re reading from a script. Your prospect will feel interrogated, not understood. Use the BANT framework as a mental model to guide your discovery, not a rigid sequence.

- Asking about the budget before you’ve proven value: When you open with “What’s your budget?” before the prospect understands their pain points or your proposed solution, they’ll lowball you or shut down entirely. Build value first. Budget conversations get easier once urgency is clear.

- Mistaking engagement for decision-making authority: Just because someone is excited about your product doesn’t mean they’re the final decision maker. Look for signals like invite behavior or whether the economic buyer has joined the account before you dig deeper.

- Ignoring timing signals: You can nail budget, authority, and need, but without urgency, the sales cycle extends indefinitely. Monitor usage velocity to quickly determine if they’re sales-ready now or need follow-up in three months.

- Only using BANT to qualify leads in: The BANT sales qualification framework should also help you qualify out. If the budget is way off or the timing is vague, cut the deal loose. Focus on potential clients worth pursuing.

- Trusting what prospects say without verifying: Combine BANT questions with product usage data for valuable insight into the real decision-making process.

The right way to use BANT

BANT is a tool, not a script. Use it as a rigid checklist early in a call, and you’ll create friction. Use it to validate readiness afterthe value is established, and it becomes essential.

The strongest sales teams don’t ask prospects if they’re qualified. They confirm what product usage already shows. How someone interacts with your product reveals need and timing. Authority and budget come out when you talk.

Qualification isn’t about exclusion. It’s about focus. When you apply BANT through observation rather than interrogation, sales conversations shift from probing to problem-solving.

If you want to qualify leads based on how they actually use your product, you need visibility into those signals. Userpilot helps teams track the behaviors that surface budget, authority, need, and timing so sales can engage when buyers are truly ready for help.

Book a free demo with Userpilot and see how feature tagging, session tracking, and invite metrics help you validate BANT before picking up the phone.

FAQ

What does BANT stand for?

BANT stands for Budget, Authority, Need, and Timing. It’s a sales qualification framework used to assess whether a prospect is realistically positioned to buy.

What is the BANT criteria?

The BANT criteria help sales teams evaluate four core signals:

- Budget: Whether the organization has the financial capacity to invest.

- Authority: Whether the right decision-makers are involved.

- Need: Whether the product solves a real, prioritized problem.

- Timing: Whether there is urgency or a defined window for action.

A deal does not need all four signals at once, but it will not close without all four being satisfied eventually.

Is BANT outdated?

No. BANT is not outdated, but how it is applied has changed.

Used as a rigid checklist early in a conversation, BANT can create friction. Used as a framework to validate readiness after value is established, it remains effective. Modern teams often infer BANT signals through behavior, product usage, and firmographic data before engaging in direct sales conversations.

What are the 5 W questions in sales?

The 5 W questions are a separate discovery framework used to understand context:

- Who is involved in the decision?

- What problem is being solved?

- Why does this problem matter now?

- When adoes decision need to be made?

- Where does the solution fit into existing workflows or systems?

While the 5 W questions help uncover context and intent, BANT helps determine whether an opportunity is ready for sales involvement.