Monetizing in the AI Era: Kyle Poyar on New Pricing Models for a Changing SaaS Landscape

Since the launch of ChatGPT in 2022, more and more non-AI-native SaaS products have integrated Generative AI into their offerings, sometimes only for the buzz, and sometimes as a genuine value-add. According to Simon-Kucher’s 2024 Global Software Study, 92% of B2B SaaS leaders plan to roll out new AI-powered features within the next year and a half.

But although AI adoption has been swift, the same can’t be said about monetization. Is AI a new revenue source or just something you need to integrate into pricing packages to check a box? How do you monetize AI in a way that delivers value to customers without infrastructure costs eroding business margins? The truth is, there is no uniform pricing strategy. Nearly 70% of SaaS companies that offer AI features are still experimenting with different methods and iterating based on their learnings.

In this article, I’ll share practical AI monetization lessons from Kyle Poyar, a PLG expert who has guided dozens of SaaS companies in this process. You’ll learn what’s working, what’s not, and how to capture AI’s value without alienating customers.

You can also join Kyle Poyar’s upcoming session at his Product Drive webinar on October 7th to discover more hands-on examples and detailed action plans.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

How and why is AI transforming SaaS pricing?

Unlike traditional software, where product usage has minimal impact on variable costs, AI tools consume compute, storage, and inference resources with every interaction. One user on an AI-powered platform might consume 10x more resources than another and generate 10x more value.

Flat-rate or per-seat pricing structures fail to balance AI infrastructure costs with customer value. They’re either too expensive for casual users, who churn, or too cheap for power users, who erode margins and become wildly unprofitable.

To protect themselves, companies are moving toward usage- and outcome-based pricing models where costs reflect how customers consume and benefit from AI-powered tools. Here’s what this may look like in practice:

- An AI tool for sales teams might charge per lead scored or email drafted.

- A customer support platform might price based on the number of AI-suggested responses used by agents.

- A product analytics platform might charge for automated reports created.

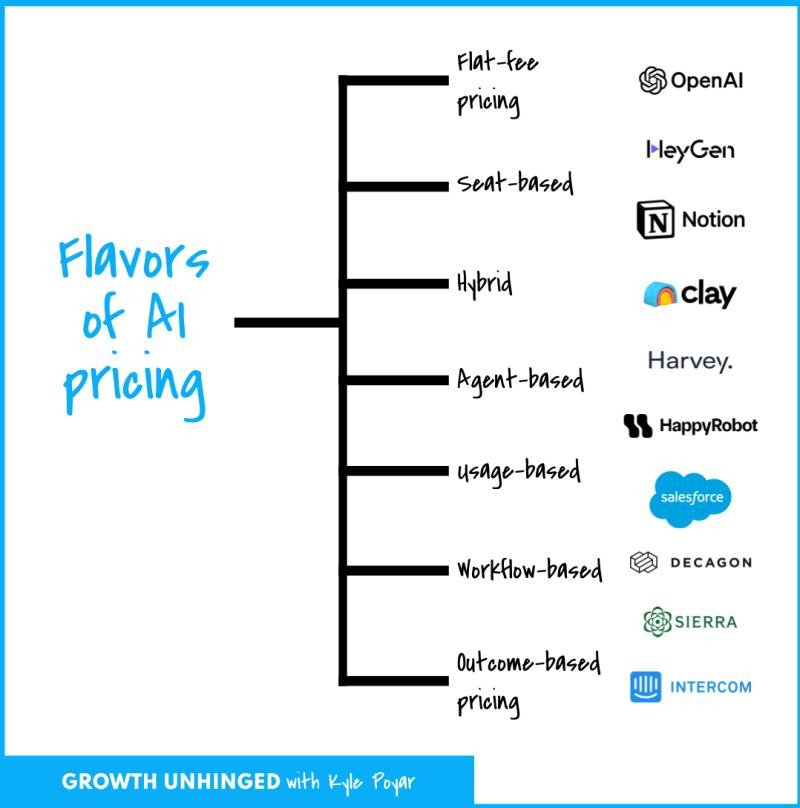

The different flavors of AI pricing

As already said, there is no one-size-fits-all AI pricing strategy; companies are experimenting with a variety of pricing models. While there are still companies that use traditional pricing models like flat-fee or seat-based, most are now using new models like:

- Usage-based pricing: Customers pay based on how much they use the AI, whether that’s measured in credits, queries, or tokens. This model fits best when infrastructure costs scale with activity, like in AI APIs, chatbot tools, or analytics platforms. It suits teams that want to recover costs directly while keeping entry points flexible.

- Agent-based pricing: AI products are priced like full-time employees with a fixed monthly fee for each deployed agent. This model is ideal for companies targeting enterprise customers who need predictable budgeting. Also, fits for AI startups’ positioning as labor replacement. This aligns pricing with messaging; it’s easy for buyers to understand, e.g., “1 AI agent costs $1,200/month vs $4,000/month for a human FTE.”

- Workflow-based pricing: Vendors charge for each end-to-end workflow the AI completes. That might include generating content, publishing it, and routing it for approval. This model fits tools that automate multi-step processes and deliver value by saving time across the entire flow.

- Outcome-based pricing: Companies charge based on the business results their AI delivers, such as revenue growth, cost reduction, or completed resolutions. This model works when outcomes are easily measurable, like the number of tickets resolved, leads contacted, and contracts drafted.

More often than not, companies use hybrid models, mixing 2 or more of these models, but more on that later.

How to embrace AI monetization: 6 Lessons from Kyle Poyar

From choosing a pricing strategy to communicating the pricing changes to customers, there is a lot that goes into successful monetization. In his research and advisory work, Kyle Poyar has surfaced six key patterns from fast-moving SaaS companies that are already pricing their AI products with confidence.

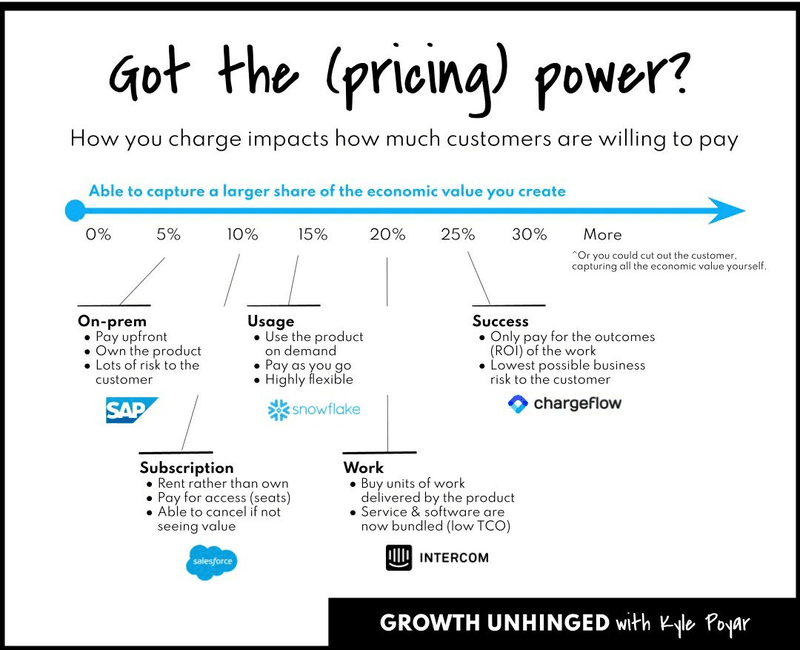

1. How you charge impacts how much customers will pay

SaaS companies used to offer feature-based pricing, packaged into Good-Better-Best tiers to encourage value-based growth. Logic was clear: customers pay more to unlock more features, which equated to more value.

But this model doesn’t translate well to AI products. When customers hire an AI agent, they expect full access to the tools required to complete the task. If you gate those features behind a paywall, the agent can’t complete its task, and the customer can’t realize the value they’re paying for. On top of that, AI pricing is often tied to the number of credits and tokens, which can feel abstract and complex to grasp for customers. This makes it hard to close deals and even harder to drive account expansion.

The solution is skill-based pricing. Just as customers are willing to pay more for a PhD employee than for a junior intern, they are ready to pay more for superior AI outcomes. Instead of charging for access to features or token usage, companies should charge based on the quality of work delivered. For example, a “basic” AI agent might handle repetitive, low-stakes tasks at a lower price point, while an “advanced” agent, trained on higher-quality data and for complex workflows, could handle critical work at a higher price point.

2. Avoid flat fees unless you have the margins to support them

Flat-fee pricing is easy to sell to customers and may appeal to vendors because revenue is predictable, but for most AI tools, it likely will backfire. When you promise unlimited usage at a fixed rate, a handful of power users can burn through compute, spike infrastructure, and eat into your margins quickly. You may still offer a flat fee if you have predictable usage patterns across your customer base. Even if some people “overuse” the product, their costs don’t meaningfully change your expense base because most others under-use it.

Before offering a flat fee, run a unit-economics check. Map out your variable costs per account and model three scenarios (light, average, and heavy usage). If the high-usage scenario drops your gross margin below about 50–60%, you likely don’t have the room to offer a true flat fee.

But if you still want to go with this pricing structure due to marketing and revenue forecasting reasons, at least add some guardrails:

- Make it an adaptive flat and renegotiate the tier at renewal based on actual usage. Or add fair-use limits tied to outcomes

- Bake in usage allowance that covers 80% of typical customers. When someone outgrows it, you can meter the extra usage or trigger an early upgrade. This keeps things simple for buyers while still protecting your margins from unexpected overuse.

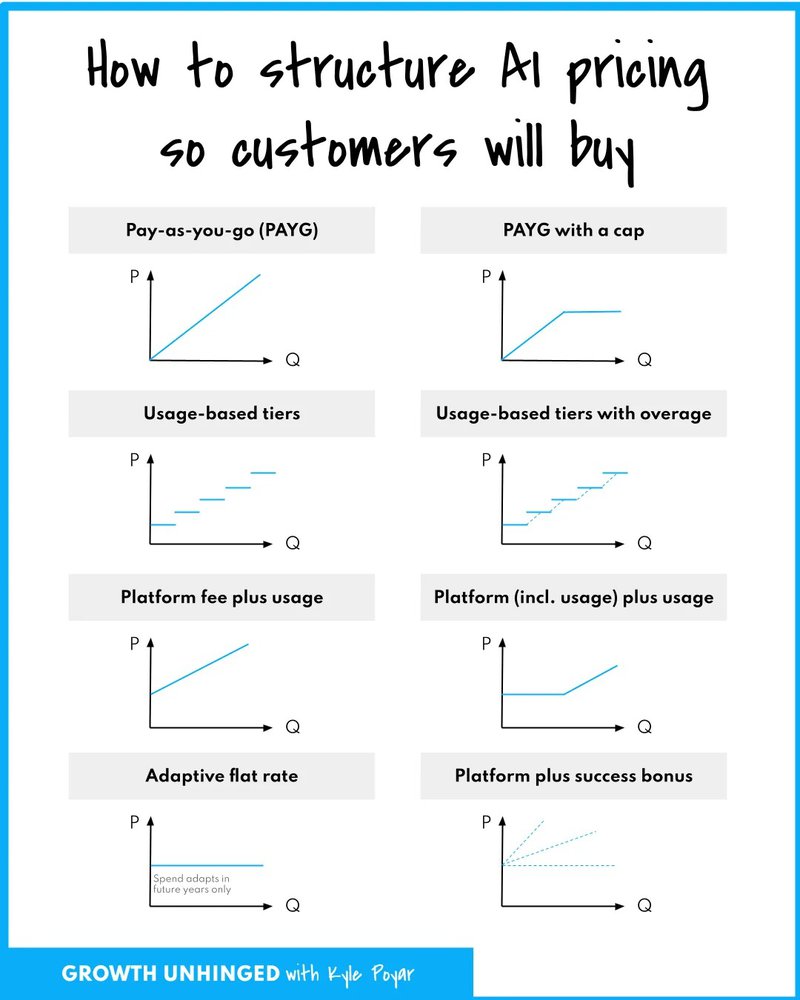

3. Adopt an intentional hybrid model

According to Kyle, hybrid pricing is quickly becoming the default. And the appeal is clear: it allows for combining predictability with variability, so both buyers and suppliers can better forecast costs and revenue.

There is no one way to do hybrid pricing; there are infinite combinations, and it’s up to you to pick the mix that fits your product model and sales motion. Here are a few common ones:

- Pay-as-you-go (PAYG): Customers pay based on what they use, without any upfront commitment. This model works best when billing stays light or the product fits into operational budgets. For larger contracts, it often raises procurement concerns.

- PAYG with a cap: This gives buyers flexibility, but also sets a clear ceiling on what they’ll pay. It’s useful for outcome-based models where the result isn’t easy to predict.

- Usage-based tiers: Customers commit to a tier that covers a set volume of usage. If they use more, they either hit overages or upgrade early. This model encourages commitment, but it can also lead to over-buying if customers fear surprise charges.

- Platform fee plus usage: Vendors charge a base fee for access to core features and support, then add variable usage costs on top. This structure works well when the pricing unit itself feels too commoditized to stand alone.

- Platform fee with included usage plus overages: The subscription includes a fixed amount of usage, with extra volume billed separately. This gives customers a buffer while still driving expansion when they go beyond the plan.

- Adaptive flat rate: Customers get unlimited access within a tier, and the tier resets at renewal based on actual usage. This allows for flexibility without adding mid-contract billing changes, but vendors need to watch their margins closely.

- Platform fee plus success bonus: Customers pay a fixed platform fee. If results go above expectations, they pay a bonus tied to outcomes. This model anchors pricing in ROI and works well when the product has a measurable impact.

Hybrid pricing gives you options, but it also raises the stakes. If the structure feels confusing or inconsistent, buyers lose trust, and sales slow down. Kyle’s advice is simple: don’t add flexibility for its own sake. Make sure every pricing element ties back to a clear outcome, cost, or value signal that the customer can understand.

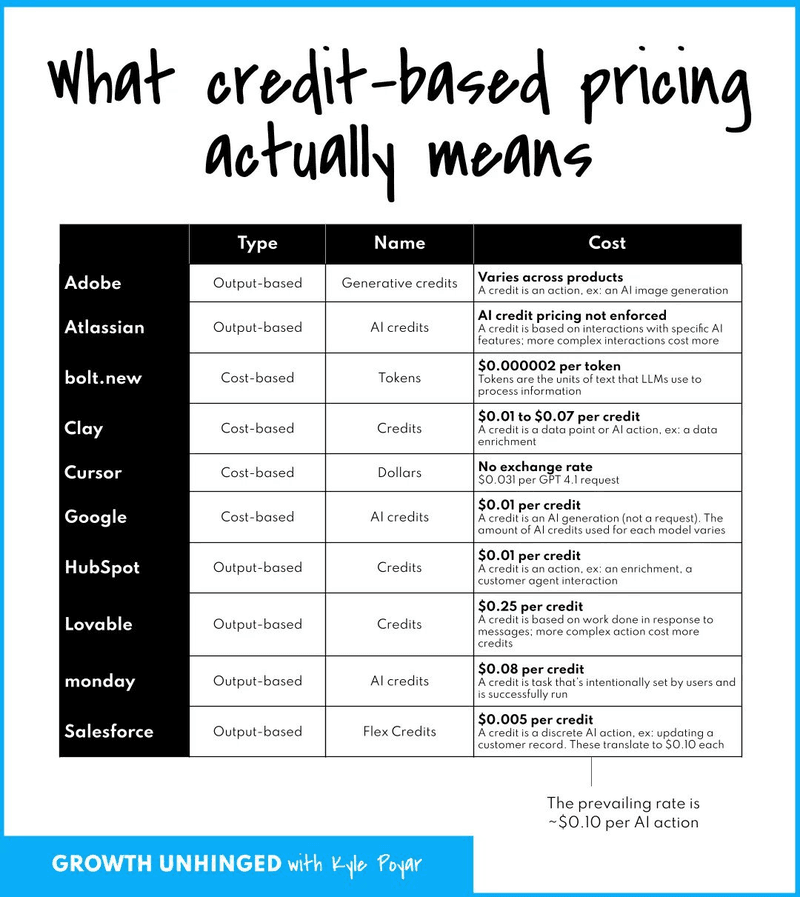

4. Use credits as your bridge to value-based pricing

Value-based pricing sounds great in theory, but most companies aren’t ready to pull it off yet. That’s why Kyle sees credits as a practical in-between step. They move you away from flat-fee models and help tie pricing to actual usage without locking you into rigid metrics.

Big players like Salesforce, OpenAI, and Microsoft have already adopted credit systems, which signals to buyers that this model is here to stay. But credits only work when they’re simple to understand and clearly tied to value. Done well, they build trust and create expansion opportunities. Done poorly, they confuse customers and trigger procurement pushback.

Here’s how you can make them work:

- Define credits clearly: Tie credits to visible outcomes, like completed tasks or resolved actions. Avoid vague units like tokens or API calls unless your buyers know what they mean.

- Add baseline credits to every plan: Let customers use the product meaningfully before asking them to upgrade. Kyle recommends covering the first month’s needs for most users.

- Use output-based pricing, not just cost pass-through: Charge for value delivered and not resources consumed. This keeps the focus on what customers get, not how much infrastructure you’re running.

- Switch to annual drawdowns or offer rollovers: Rollover credits reduce churn, reward loyalty, and give users time to learn what normal usage looks like.

- Show credit usage clearly in-product: Help admins track usage, set limits, and understand what drives spend. The more predictable it feels, the easier it is to expand.

Credits aren’t perfect, but they help connect pricing to real outcomes. And that’s the direction SaaS is moving.

5. Have the pricing talk with your customers

Pricing isn’t something to present to customers. It’s something to build with them.

Many teams build pricing models in a vacuum, then share them with customers post-factum. Kyle suggests flipping that: talk to your customers first, then shape your pricing around how they define value.

If you skip this step, you risk building a model that looks clean on paper but feels disconnected in practice. When customers don’t see how pricing ties to outcomes, or when bills jump unexpectedly, trust erodes quickly.

To avoid that, bring pricing into your customer research. These don’t need to be formal discovery calls. You can include a few targeted questions in onboarding surveys, NPS follow-ups, or post-purchase interviews. The goal is to understand:

- What customers already track or budget for?

- How do they think about ROI or value over time?

- What do they expect to pay more for?

- Where your pricing model feels aligned and where it doesn’t?

This helps you surface important patterns. For example, a customer might be happy to pay per transaction but resist per-user pricing. Or they might value output-based pricing because it mirrors how they bill their own clients.

6. Build with pricing agility in mind

New AI models launch every few months, usage patterns shift, and so do costs. To keep up, companies should set up internal systems that allow them to quickly adapt pricing as market expectations change.

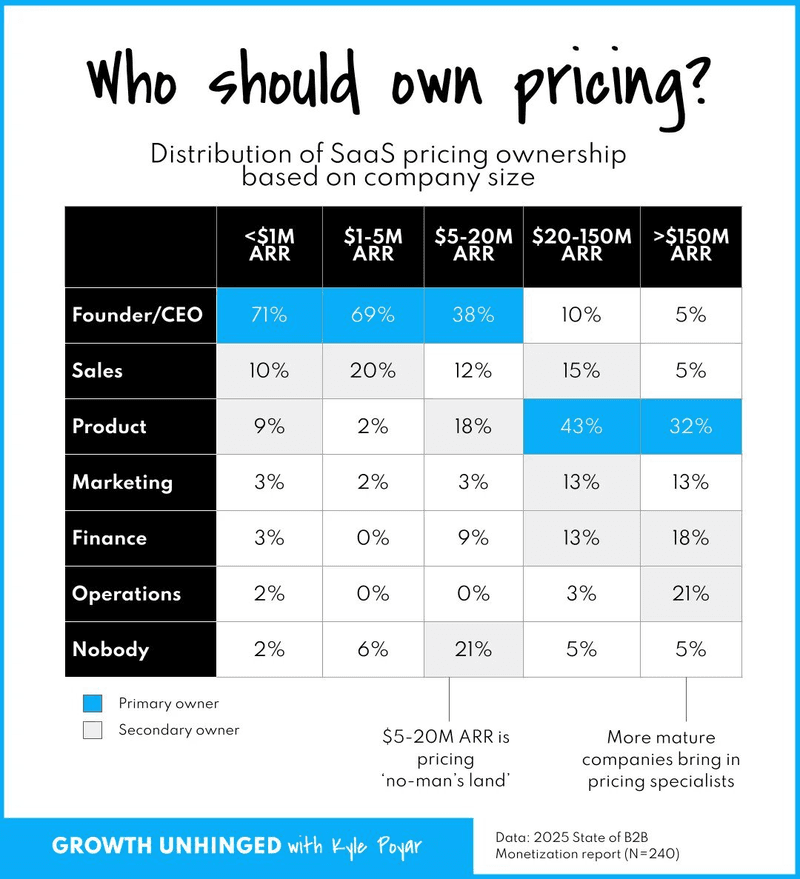

Kyle suggests creating a Monetization Council, a cross-functional group of product, sales, marketing, and finance people that come together biweekly to discuss pricing bottlenecks and opportunities. Pricing decisions become part of product operations.

You also need to measure the right signals. Start tracking:

- Gross margin at the customer level.

- Plan mix and how it shifts over time.

- Gross and net retention by plan.

- Expansion and contraction by pricing tier.

- Customer outcomes in dollar terms, not just usage volume.

Don’t rely only on backend data. Use surveys or interviews to learn how customers define success and whether your pricing reflects it.

And if you’d like to learn practical, example-based ways for monetizing AI, join Kyle Poyar’s talk at Product Drive. The conference is free, but seats are limited, so sign up fast!