Customer retention vs acquisition cost: Which metric matters more?

While it’s important to acquire new customers for growth, retaining existing customers is imperative to ensure long-term success. Thus, striking the right balance between acquisition and retention costs significantly improves profitability and sustainability.

So let’s see when you should prioritize one metric over the other and how you can boost your customer retention rates.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is customer acquisition?

Customer acquisition is the process of attracting and converting potential customers into paying customers. It generally involves creating brand awareness and driving prospects down the marketing funnel until they convert to paying customers.

What is customer retention?

Customer retention is the process of using activities and strategies to nurture and build strong relationships with customers, which in turn, encourage repeat purchases.

The higher the customer retention rates, the more customers are satisfied with your product, and vice versa.

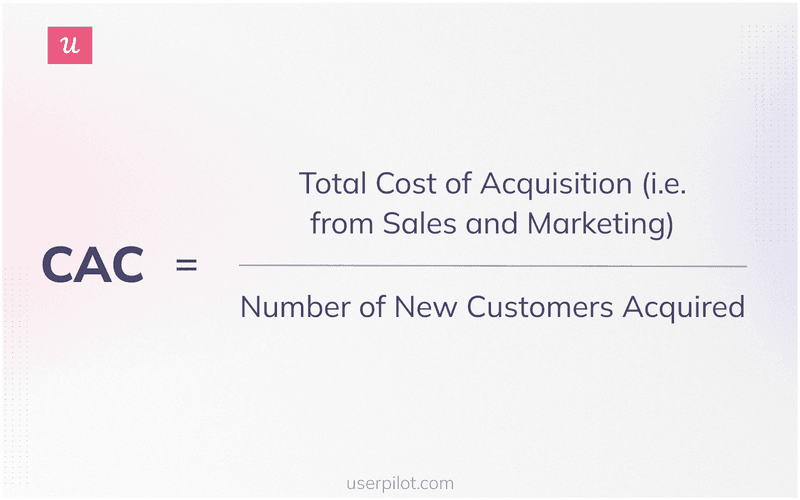

How to calculate customer acquisition cost?

Customer acquisition cost (CAC) is the amount spent by a business on acquiring new customers. In other words, the metric measures the average cost incurred in acquiring one customer.

To calculate the CAC, you need to divide the total cost of acquisition by the number of new customers acquired. The cost of acquisition typically includes the expenses associated with marketing and sales, such as promotional campaigns, sales commissions, and advertising.

Suppose you gained 1,000 new customers in 2022 and your total cost of acquiring them was $90,000. This would make your CAC = $90,000/1,000 = $90.

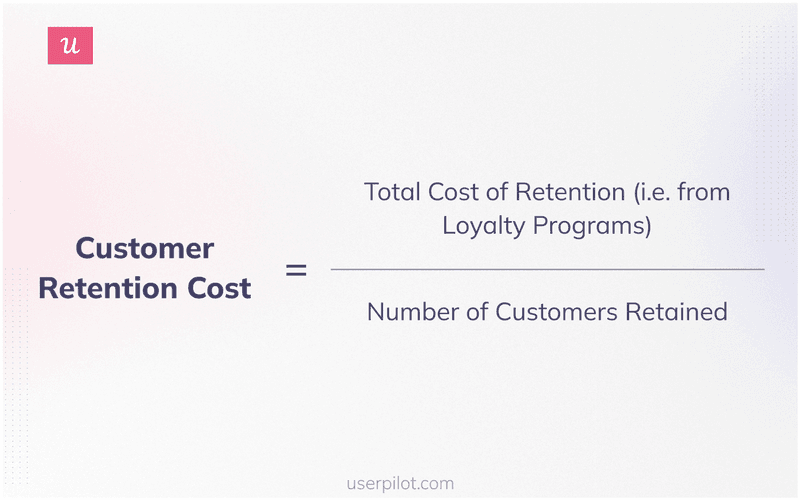

How to calculate customer retention cost?

Customer retention cost is the total expenses incurred in retaining a specific number of existing customers over a given period. Put simply, it’s the cost of retaining an existing customer.

To measure the customer retention cost, you have to divide the total cost of retention by the number of customers retained. The total cost of retention includes expenses like loyalty programs, personalized offers/discounts, customer retention campaigns and other retention initiatives.

Suppose you spent $100,000 on customer retention and retained 2,500 existing customers by the end of the year 2022. Your customer retention cost for the year would be = $100,000/2,500 = $40.

The metric directly affects the customer lifetime value (LTV), which is the expected revenue you can earn from one customer over the course of their business with you. The higher the retention costs, the lower the average revenue per account, thus the lower the LTV.

What are the differences between customer acquisition and retention costs?

Both acquisition and retention costs are key SaaS metrics and equally important aspects of your customer acquisition and retention efforts. Both metrics help drive business growth, making it crucial for you to understand how they differ.

Customer acquisition vs retention costs:

- Customer acquisition costs focus on attracting and converting prospective customers, whereas retention costs focus on nurturing relationships with current customers and boosting customer loyalty.

- CAC is typically incurred upfront, at the start of the customer relationship. On the other hand, CRC is ongoing and incurred throughout the customer relationship.

Now let’s see when you should prioritize customer retention over acquisition and vice versa.

When to prioritize customer acquisition over retention?

Although SaaS businesses can’t sustain without high customer retention, there are some instances when you should focus more on gaining new customers than retaining customers.

- Launching new features/new products (market penetration): If you plan to launch new features/products or penetrate untapped market segments, acquisition efforts are critical for increasing brand visibility.

- Market share is low: A limited customer reach can lead to competitors’ dominance and lower your revenue. Therefore, if your market share is low, customer acquisition would take priority over retention.

- The customer churn rate is low: This means your business already has a high retention rate, so you should acquire customers to grow your revenue. Consistently low churn rates signal that you’re capable of driving high value for customers, making it more likely to retain new users in the long run.

- Expand customer base: If your aim is simply to grow your customer base and generate more revenue, you need to put more emphasis on your customer acquisition strategy.

When to prioritize customer retention over acquisition?

After a certain point, you may end up spending more on customer acquisition than you’re earning from existing users. To avoid this, here’s when you should more emphasis on customer retention.

- Declining customer base (high churn rate): This indicates dissatisfaction with your product/service, in which case you need to double down on your retention efforts.

- The cost of acquisition is high: You must increase the retention rates to make sure your customer lifetime value is greater than your acquisition cost.

- Business relies on recurring revenue: Subscription-based business models demand high retention rates. So you should keep increasing retention rates as long as you’re not facing situations that require more focus on acquisition.

How to improve customer retention and increase customer lifetime value?

Let’s discuss the best customer retention strategies you can use to boost customer retention and, in turn, your customer lifetime value.

Offer contextual help using in-app guidance

Your customers should find it easy to navigate your product and use its features to get their work done. This is where you can provide contextual in-app guidance at the right time to increase engagement and drive greater value for customers.

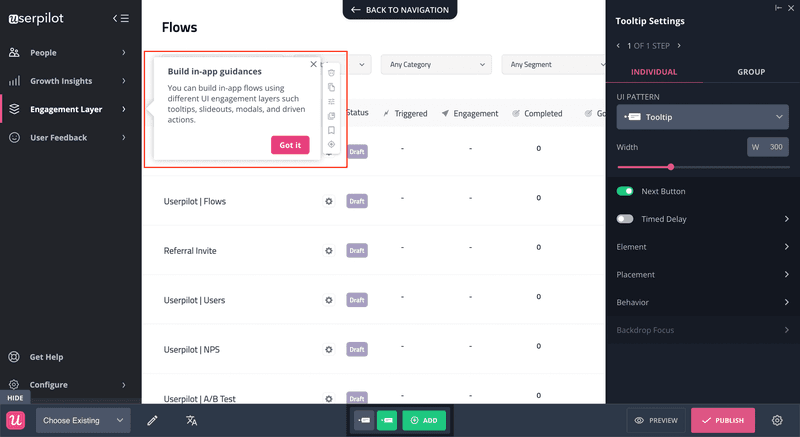

You can build guides like tooltips, modals, checklists, slideouts, and drive actions. They convey short, readable messages to steer users in the right direction, as shown in the tooltip example below. Then you can trigger them at multiple touchpoints across different onboarding phases.

Segment existing customers to personalize experiences

Personalization plays a major role in boosting customer satisfaction.

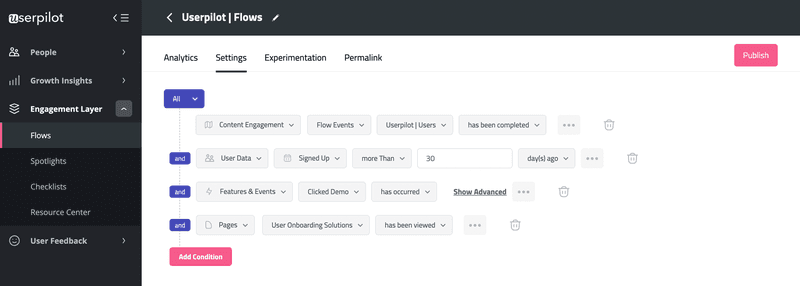

To personalize the user experience, you should start by segmenting customers based on their common characteristics like product usage, user role, content engagement, etc.

Then, you can trigger relevant customized in-app experiences for each segment. For example, you can prompt in-app help/feature announcements for specific user segments during secondary onboarding to increase engagement for new/advanced features.

Use path analysis to identify and remove friction

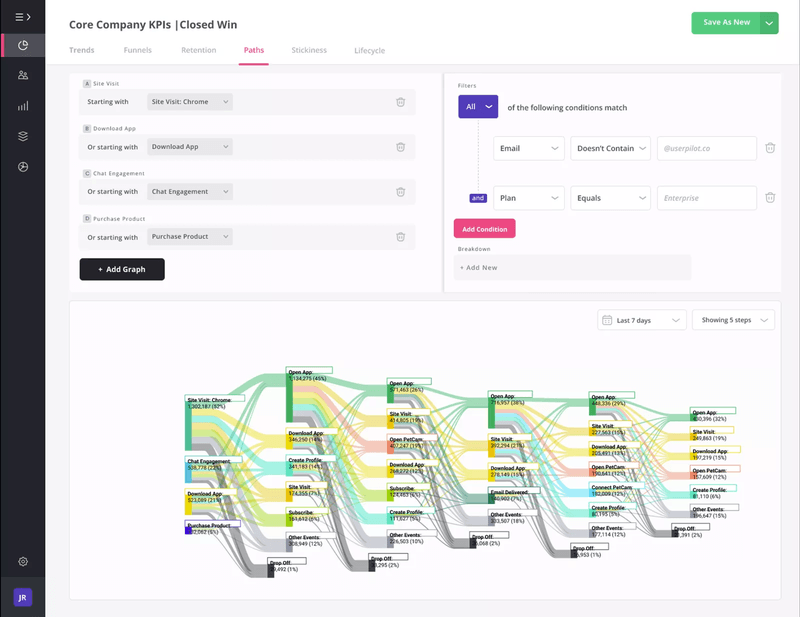

Path analysis allows you to observe how customers navigate through the product. This helps you find the happy paths, ie. the touchpoints that users pass to achieve their desired results without any error. You can replicate these experiences by guiding users to their relevant happy paths.

Furthermore, you can use path analysis to discover friction points in the user journey and eliminate them to help customers move from one touchpoint to the other smoothly.

Collect customer feedback and work on improvements

Customer feedback will offer deeper insights into customer satisfaction and their pain points. Therefore, you should trigger in-app microsurveys at multiple touchpoints across the user journey to collect feedback on the overall product or particular user experiences.

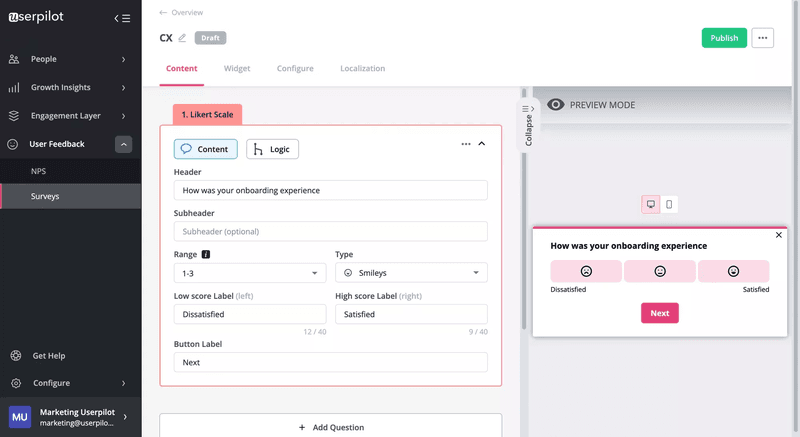

For example, you can send a customer satisfaction survey on the onboarding experience after new users complete their primary onboarding phase.

You should analyze the survey responses to get valuable insights and act on them to close the feedback loop.

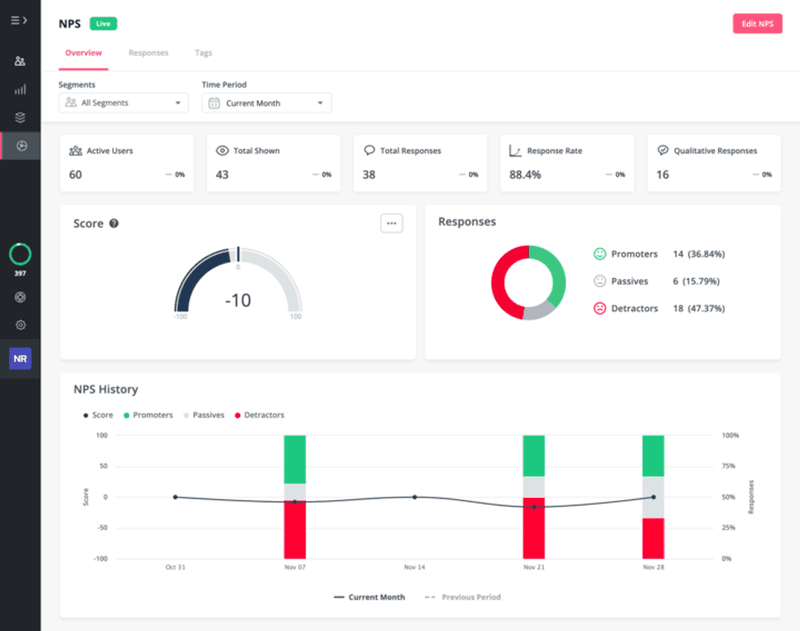

Measure customer loyalty using NPS surveys

The Net Promoter Score (NPS) is a great measure of customer loyalty. NPS surveys enable you to identify promoters (satisfied, loyal customers) and detractors (dissatisfied customers).

Therefore, you can analyze NPS survey responses using an NPS dashboard to identify happy patterns among promoters and highlight the highly engaging features/touchpoints to other customers.

Moreover, you can include a qualitative follow-up question to know the exact reason behind each score. NPS response tagging lets you analyze the qualitative data and understand your promoters and detractors better. You can then reach out to detractors with personalized solutions to re-engage them.

Conclusion

Both customer acquisition and retention are necessary to grow your business. However, sometimes you may need to allocate more resources to acquiring customers than retaining them, and vice versa. Therefore, you should balance customer acquisition and retention to reach an optimal growth level.

Want to improve your customer retention rate? Get a Userpilot demo and achieve sustainable business growth.