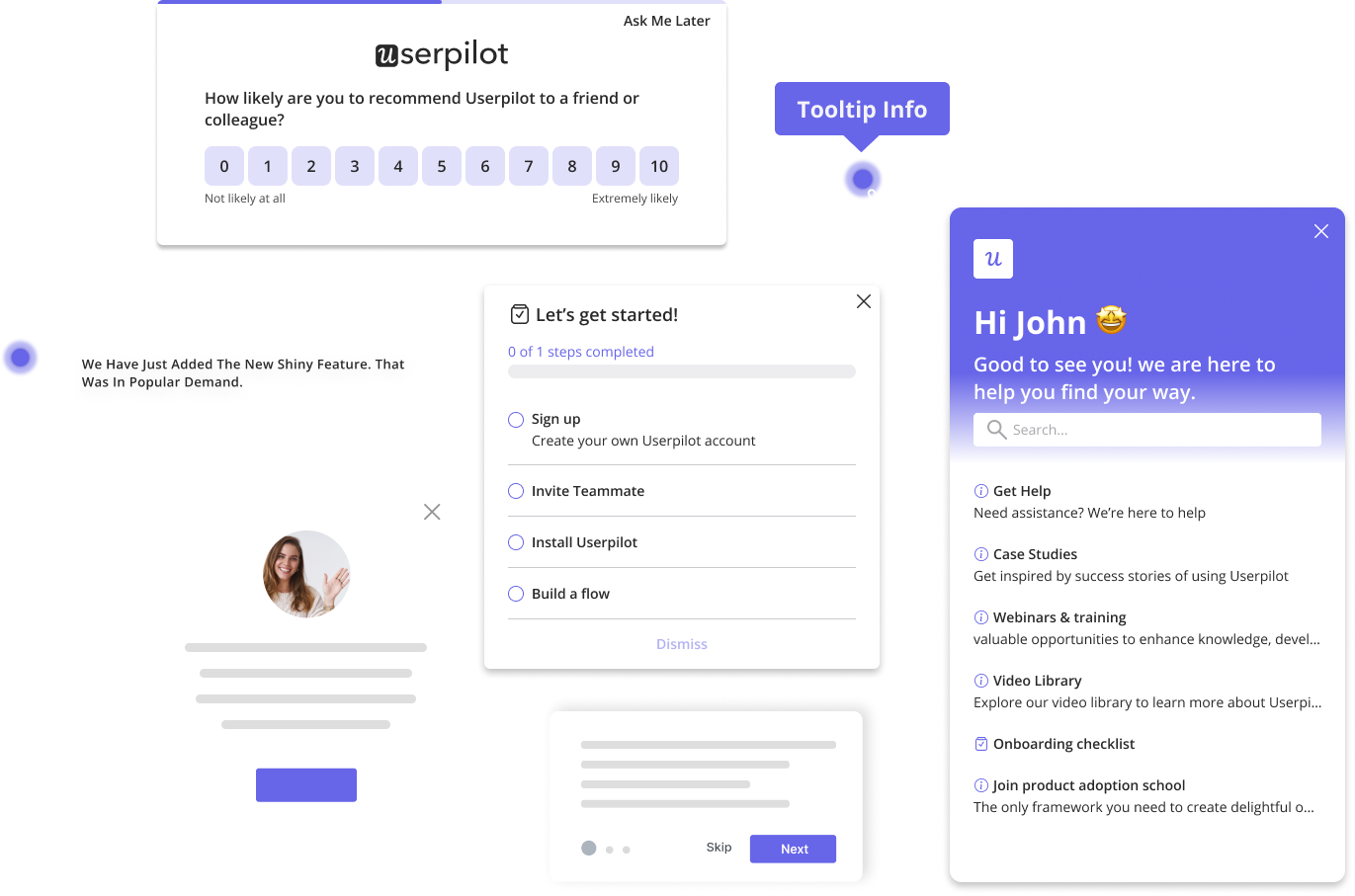

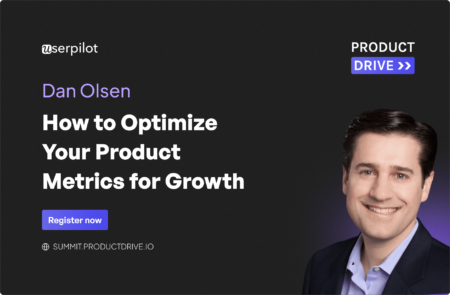

Many companies invest heavily in acquiring new customers, yet still struggle with growth. Why? According to product expert Dan Olsen, it’s because their “bucket” — the product itself — is leaky. Customers leave as fast as new ones come in. Dan, a Stanford-trained engineer with experience guiding companies like Intuit, understands how to optimize your product metrics for growth by focusing on retention and building a product users truly value.

In his recent talk at Product Drive, Dan shared actionable strategies from his book, The Lean Product Playbook, for making products people love to use.

We’ll discuss these strategies here, but to get the full scope of Dan’s proven methods, you can watch his talk:

Let’s dive in!

The product manager’s roles and responsibilities

Being a product manager often means balancing multiple priorities. We’re everywhere at once – crafting product vision, digging into customer research, and somehow keeping engineering, marketing, and sales teams all moving in the same direction.

Here’s the kicker, though – we have to do all this without actual authority. You might have heard our favorite motto: “With great responsibility comes no power.” Funny because it’s painfully true. We’re tasked with achieving product-market fit and driving growth, but we have no direct control over the people who build, market, and support it.

And let’s be honest – the odds aren’t exactly in our favor. Most new products never find their product-market fit. And many features we ship with high hopes end up missing their targets completely. Research also shows that about 90% of startups fail, and poor product-market fit is often the culprit.

But don’t worry – we’ll show you how to optimize your product metrics for growth, and more importantly, which to prioritize between acquisition, conversion, and retention.

Understanding the product metrics

Let’s have two products – A and B. At first glance, they look identical. Both show the same number of active users over time, and their growth curves could be considered twins.

But here’s where it gets interesting. “Active users” combines two distinct metrics: new users and returning users. It isn’t an atomic metric or a single, standalone measurement.

When we split into these two metrics, we see something fascinating: Product A gets new users regularly, but these users slip away faster than ice cream on a hot day. Their marketing team might be crushing it, but users haven’t discovered their Aha! moment.

While Product B may not attract as many new users, the ones it does acquire have high retention rates. When asked, most product managers would pick Product B every time.

What’s the optimal order between acquisition, conversion and retention

To prioritize your growth metrics effectively, let’s use the “leaky bucket” analogy — Dan’s favorite for explaining why some products struggle even with substantial spending on growth. When your product metrics show high user churn, adding more users through marketing is like pouring water into a bucket full of holes.

Only when you see users consistently staying engaged – when your “bucket” holds water – should you scale up your user acquisition efforts. This way, your marketing spend actually contributes to sustainable growth rather than just temporarily inflating your user numbers.

Here’s what this looks like in practice: if you’re losing 80% of users within the first week, spending money on ads is mostly wasting resources.

Instead, focus on understanding why users leave. Are they dropping off after specific actions? Are they never reaching key features? Your product analytics will tell this story.

The optimal order of metrics to focus on after launching a new product is:

1. Retention

The first step is defining what value means for your specific product. This means identifying your core features and understanding how customers actually use them.

For example, if you’re running a note-taking app, don’t just track if someone clicked the “create note” button. Look deeper – are they writing substantial notes? Do they come back to review them? Are they sharing notes with others? This is what real feature usage looks like.

You’ll want to track these core events and set clear benchmarks. Let’s say you expect users to create at least one note per week – if you see users falling below this, it’s a clear signal that they’re not getting consistent value from your product.

The key is to go beyond surface-level metrics. Anyone can click a button once, but sustained engagement shows true product value. Look at patterns like:

- How frequently users return to key features.

- Whether usage aligns with your expected use cases.

- If users are achieving their goals through your product

Once you identify where users are dropping off, you can focus on fixing those specific friction points. Maybe your mobile app is too slow, or perhaps users can’t find important features. These are the “holes” you need to plug in before thinking about getting more users.

Retention should always be your primary focus because it signals product-market-fit (PMF) — the key to long-term growth.

2. Conversion

Once you have retention under control, move on to conversion. This step is about turning interested visitors into active users or paying customers. High conversion rates show that your messaging, onboarding, and pricing resonate.

But conversion is not just about getting users to sign up – it’s about getting them to experience your product’s value. I’ve seen many products with great sign-up rates but poor activation because they focused on the wrong metrics.

Think about your user’s journey. When someone lands on your product, what’s the shortest path to their “Aha! moment“? For a video editing app, this might be completing their first edit. For a project management tool, it might be setting up their first project board with their team.

Your onboarding should focus on this core value moment. Cut out everything else. If users don’t need to fill out their profile immediately, don’t ask them to. If they don’t need to invite team members yet, save it for later. Guide them to that first win as quickly as possible. This means really understanding what makes users stick around.

Tip 💡: Look at your most engaged users – what did they do in their first session? That’s often your best clue for what your onboarding should prioritize.

3. Acquisition

Acquisition is the final step, but it only makes sense once retention and conversion are solid. With a leak-proof bucket and easy conversion path, every dollar spent on marketing will yield better returns.

Focus on acquisition when:

- You’ve achieved strong retention and conversion.

- Your product-market fit is validated.

- Each new user has a higher chance of sticking around.

Using the same bucket metaphor above, here’s how it relates:

- Conversion: How much of that water makes it into the bucket (visitors becoming customers).

- Acquisition: The amount of water aimed at the bucket (potential users you attract).

- Retention: How well the water stays in the bucket over time (users who keep returning to your product).

Remember, don’t drive acquisition until you’re confident in your product-market fit.

How to track your product-market fit with 1 metric?

Here’s a fun thought experiment: if you could only track one metric to measure product-market fit, what would it be?

Drumroll, please… It’s retention rate.

Retention rate is the percentage of your customers who stay active over time.

Imagine having the world’s best sales team – they’re so good they convert 100% of prospects. Sounds amazing, right? But if your product doesn’t solve real problems, those perfectly-converted users won’t stick around.

Now imagine having the world’s worst sales process, but a product that genuinely helps people. Even with a clunky acquisition process, users who discover the value will keep coming back. They might even tell their friends, “Look, the signup was a pain, but trust me – this thing is worth it.”

That’s why retention rate should be your North Star metric for product-market fit.

How to track PMF with cohort analysis

Don’t let the fancy term “cohort analysis” scare you. A cohort analysis is a technique that groups users based on shared characteristics and analyzes how they behave over time.

Cohort analysis identifies what factors contribute to user retention, pinpoints stages where users drop off, and evaluates your marketing campaign’s effectiveness.

For instance, we can use a cohort analysis to track and study users of a product in two ways: by when they join and by what they do.

Here’s how it works:

- Acquisition cohort: This means grouping users by when they first sign up. It lets us see if people who join in different months or weeks behave differently. We often use this to track how many new users stay active over time.

- Behavioral cohort: This means grouping users by the actions they take, like when they try a new feature or finish setting up their account. It helps us see how different actions affect whether users keep coming back.

To conduct a cohort analysis, follow these steps:

Step 1: Create cohorts by time periods or other segments

This is where we get organized. Here’s how:

- Group users by their sign-up month (your January cohort, February cohort, etc.).

- Start each cohort at 100% and track how that number changes.

Alternatively, you can consider other grouping factors like:

- Acquisition channel (did users come from ads, organic search, or referrals?).

- User type (free vs. paid, small business vs. enterprise).

- Feature usage (users who used specific features in their first week).

The key is consistency – pick meaningful groups and track them the same way every time.

Step 2. Track retention over time

Now comes the detective work. For each cohort:

- Monitor weekly or monthly active users.

- Track how many users complete key actions in your product.

- Look for patterns in when users typically drop off.

- Measure how long it takes to reach the “terminal value” (where the retention curve flattens).

Step 3: Compare cohorts

This is where the insights start coming together. Watch out for:

- Are newer cohorts retaining better than older ones? (This suggests your product is improving)

- Do certain types of users stick around longer? (This helps target your ideal customer)

- Is there a specific period where you lose most users? (This highlights critical drop-off points)

- Which features are used most by your retained users? (This shows what drives stickiness)

For example, we’re looking at three cohorts: Cohort A (blue diamonds), Cohort B (red squares), and Cohort C (green triangles).

According to Dan, “If you were the project manager, which cohort would you choose? When I ask this, most people pick Cohort C. I then ask them why, and I get different responses. One common answer is that Cohort C has the smallest drop-off between week one and week five.

Then I follow up with, “What if I lowered the week one value of the blue curve to 10%?” This would make the blue curve’s drop-off even smaller. But people still prefer Cohort C, so we know drop-off size isn’t the main factor.

Others mention the area under the curve as a reason, but eventually, someone says, “I want the highest retention rate.”

I then point to the graph, saying, “This shows the highest rate here at 50%.” But they clarify that they mean the highest rate on the right side of the graph.”

Remember, if your retention curve hits zero, you don’t have product-market fit. But if it flattens out at a healthy level (which varies by industry), you’re on the right track.

The final value where the retention curve flattens out is known as the “terminal value.” This is an indicator of how well your product retains users in the long term. A higher terminal value indicates better product-market fit.

Conclusion

Growing a successful product isn’t about throwing money at acquisition – it’s about building something people want to keep using. Before you spend big on getting new users:

- Focus on retention first – make sure your current users are getting real value.

- Then optimize conversion – remove barriers that keep new users from experiencing that value.

- Only then scale acquisition – when you know you can keep the users you attract.

Want to build better product experiences that keep users coming back? Book a demo call with our team and get started!