10 Important Retention Metrics For SaaS And How To Improve Them26 min read

Tired of tracking retention metrics that get you nowhere? You’ve come to the right place.

For SaaS businesses, customer retention is the easiest way to achieve growth. To achieve that, you need to first have an accurate idea about how your product is performing. Tracking the right customer retention metrics not only helps you do that but also allows you to find opportunities to improve the overall experience for your customers and increase customer loyalty.

In this article, we’re covering 10 of the most important retention metrics you need for your SaaS business, and how you can improve each of them to have increased revenue. Let’s get right into it!

Get The Insights!

The fastest way to learn about Product Growth, Management & Trends.

TL;DR

- Retention metrics allow you to measure the performance of your business in retaining customers and their revenue.

- For best results out of your customer retention efforts, pick the most relevant metrics for your product, instead of measuring every metric you can get your hands on.

- Your own product is the best source of retention benchmark.

- Customer retention rate is the percentage of customers retained over a specific period and can be improved by adding an in-app resource center to provide self-service support.

- Customer acquisition cost (CAC) in SaaS is the average cost spent to acquire a paying customer and is better utilized by using product analytics.

- Customer Lifetime Value (LTV) refers to the average amount of money your SaaS business earns from a user over the time they are a paying customer, which you can improve with a solid secondary onboarding strategy.

- MRR is the amount of revenue that a SaaS business can expect each month, which you can use to forecast your future cash flow.

- Customer Churn Rate calculates how much of your customer base you are losing during a specific period. You can reduce it by closing the feedback loop after collecting feedback through CSAT or CES surveys.

- Net MRR Churn rate indicates the percentage of the money you’re losing in a specific month because of customer churn, which you can reduce by sending churn surveys built with Userpilot.

- Existing Customer Revenue Growth Rate is the portion of the total MRR generated from existing accounts through upsells, cross-sells, or add-ons. Use in-app messaging to communicate with customers contextually and improve this key metric.

- Net Promoter Score involves collecting feedback on a scale of 0-10 as an answer to a question about the likelihood of customers to promote your product.

- Customer Stickiness tells you how often users are coming back to your app. You can improve it by increasing feature adoption and customer engagement.

- The customer health score is a retention metric used to understand the “health” of a customer, which you can improve through in-app guidance.

What are retention metrics?

Retention metrics allow you to quantify the performance of your business when it comes to retaining customers and their revenue. Key customer retention metrics like Lifetime Value and MRR helps you measure and evaluate your relationship with your loyal customers.

How is retention measured?

Customer retention cannot be measured by a single universal metric. Instead, different metrics offer you different insights on customer retention. You can pick the ones that are more relevant for your product, and gauge your product health based on them.

Before measuring customer retention, you need to clearly define what it means for your SaaS business and what stage it is in. Based on the different goals you set, you’ll be probably looking at different metrics that highlight different aspects of your product.

For example, if you want to gauge the financial health of your business, check metrics like LTV to CAC ratio. You can also just check LTV to understand the overall health of your product.

Why are retention metrics important?

Understanding your customers is essential for running your SaaS business smoothly. While customer acquisition metrics offer you insights on short-term business growth, customer retention metrics help you plan your business strategies in the long run.

A survey by SaaS Capital found that for every 1% increase in revenue retention, the valuation of a SaaS company increases by 12% in five years. This is an incredible opportunity for business growth, as retaining customers costs you 25x less than acquiring new ones.

You should measure customer retention metrics as tracking the right ones offers you insights into why customers are staying or leaving. You can then identify the ones who are most likely to stay with your business and create strategies to retain customers and keep them engaged.

What is a good retention rate in SaaS?

If you’re looking for benchmarks, your own product is the best source of it. SaaS products cater to a wide range of needs of consumers, and also have different sales processes. As different types of products have different sets of users, no one figure can be used as a benchmark for customer retention rates.

A Mixpanel report shows the average monthly retention rate for all industries at below 5%. But this varies a lot across industries, with retention in the eCommerce industries dropping as low as 1%.

But you cannot compare customer retention rates between two SaaS businesses unless they offer nearly identical products, identical business, and sales processes, AND have the same pricing structure.

A 5% customer retention rate has different implications for two products that have an average contract value of $50 vs $500. Moreover, the size of the existing user base also comes into the equation. Some businesses can thrive with 100 new users annually, while some businesses can struggle with 1000.

10 key customer retention metrics for SaaS

Tracking more metrics won’t necessarily give you more useful insights on customer retention. You need to pick the ones that suit your business goals and product type. While you might find other metrics that can help you measure retention, here are some of the key ones you’re most likely to benefit from.

- Customer Retention Rate

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV or LTV)

- Monthly Recurring Revenue (MRR)

- Customer Churn Rate

- MRR Churn Rate

- Existing Customer Revenue Growth Rate (Expansion Revenue)

- Net Promoter Score (NPS)

- Customer Stickiness

- Customer Health Score

Customer Retention Rate metric

Customer retention rate indicates the percentage of customers retained over a given period. This is one of the most vital retention metrics to track. You get an accurate idea about what portion of your customer base renewed their subscription with you during that period and take action if you see that you’re losing customers.

Why is customer retention rate important?

Customer retention rate gives you a basic but important insight – if your customers are satisfied enough to continue using your product. Understanding customer behavior is crucial for saas companies.

However, you should combine this metric with the Customer Churn Rate (discussed later in this post) to get the exact picture. You can use these metrics to get an idea about your future earnings.

You can also use it to keep tabs on customer satisfaction levels. If you lose more than get new customers, it indicates unresolved issues within your product or service.

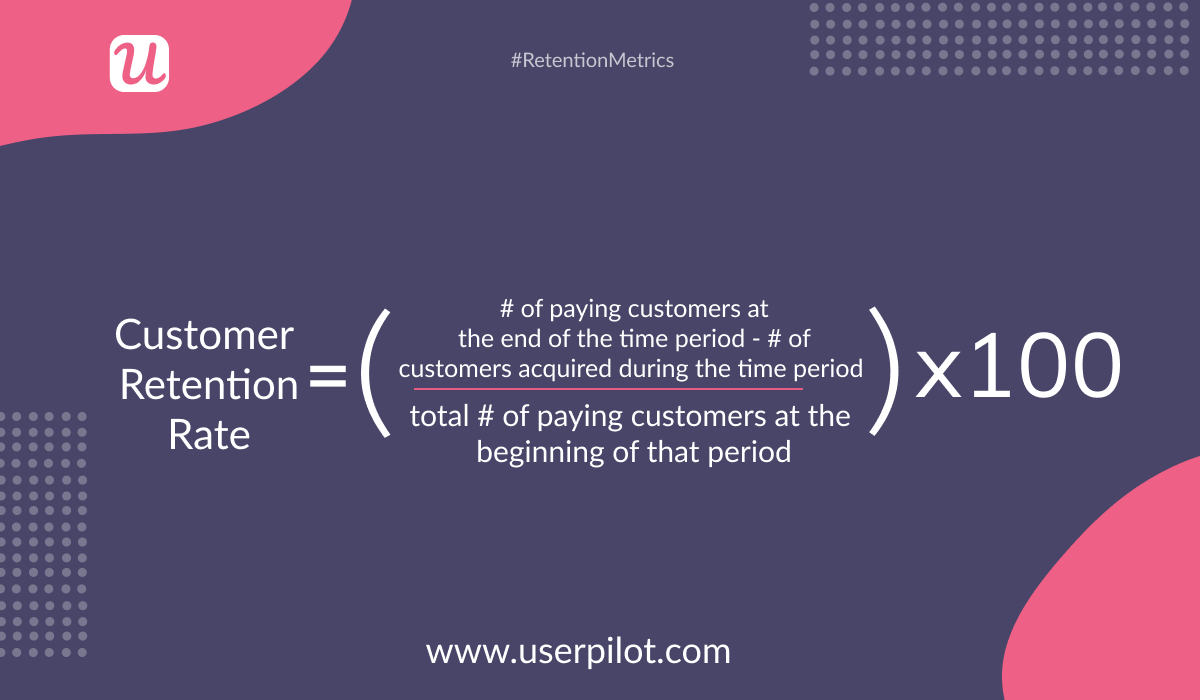

How to calculate customer retention rate?

First, set the time frame for measuring the customer retention rate. This depends on your goals and product. It could be monthly, quarterly, or even annually. Next, find out the following:

- The total number of paying customers at the start of the period.

- The total number of acquired customers during the time period.

- The number of paying customers at the end of the period.

Then you divide the number of paying customers at the end of the period minus the number of new customers acquired during the period by the total number of paying customers at the start of the period and multiply it by 100.

Improve customer retention rate with self-service in-app support

Self-service in-app support helps provide fast answers where and when users need it. It improves their overall experience and lowers frustration. Better customer satisfaction eventually results in better customer retention rates. A Zendesk research has also shown that great customer experience is more important than ever.

If your users don’t understand your product, they are highly likely to churn and won’t repeat their purchase. This means you need to make information more accessible to them. This makes sense when you consider the perspective of the customers.

It gets very frustrating for them to face issues during onboarding which they don’t know how to fix. Taking the help of customer support staff can take hours (or days in some cases). This is where self-service support can be a savior for customer success managers.

Adding an in-app resource center is one of the most efficient ways of providing self-service support. Not only it helps customers solve their issues faster, but also keeps them inside the app, improving engagement.

You can also link your documentation or other educational resources in the in-app resource center, including in-app experiences, open chat, and more.

Customer Acquisition Cost (CAC) metric

Customer acquisition cost (CAC) in SaaS is the average cost spent to acquire a paying customer. In case you’re wondering, the cost to acquire a non-paying user is calculated using CPA or Cost Per Acquisition.

Why is Customer Acquisition Cost (CAC) important?

Measuring CAC helps you understand how much every new user is costing your business. This allows you to better optimize your marketing budget and make efforts to bring out the best results at the lowest cost.

How to calculate Customer Acquisition Cost (CAC) rate?

First, you need to find out the total sales and marketing expenses for a particular period and the number of paying customers acquired during that period.

Then you divide the total sales and marketing expense by the number of customers acquired to get the CAC value.

Improve Customer Acquisition Cost (CAC) with product analytics

Product analytics will help you better utilize the CAC metric. You can look at the usage data and do cohort analysis to identify the most active and profitable users. Cohort analysis helps you see what a subsection of your users or a “cohort” is doing within your product.

You can filter the engaged, healthy users, and cross-reference this with acquisition sources. This will help you to identify your most profitable sources. You can then optimize your budget allocation to the channels and mediums that bring in the users who are more likely to be profitable for you.

Customer Lifetime Value (CLV or LTV) metric

Customer Lifetime Value (known as CLV or LTV) refers to the average amount of money your SaaS business earns from a user over the time they are a paying customer.

Why is Customer Lifetime Value important?

SaaS businesses rely on recurring payments as it’s a subscription basis business model. So measuring the total amount spent by a customer has to be measured over time. Tracking the LTV gives you an idea about future revenues.

This retention metric also helps you optimize your acquisition budget, as you don’t want to spend more than what you’ll get in return.

How to Calculate Customer Lifetime Value rate?

Before you get to calculating LTV, you need to calculate two other things:

- The average revenue per account (ARPA), which you can find out by dividing the total MRR by the total number of accounts

- Customer churn rate, which you will learn to calculate later in this post.

Now, divide ARPA by customer churn rate to find out the Customer Lifetime Value.

Improve Customer Lifetime Value with secondary onboarding

Despite popular belief, onboarding should not be limited to only newly acquired customers. Although this primary onboarding does help you improve day 1 retention, you need a secondary onboarding strategy to boost LTV.

Secondary onboarding helps your customers get familiar with new features and relate these to their use cases.

You can use UI elements like Checklists, Experience flows, and Native tooltips to create an engaging secondary onboarding process – all of which can be created using Userpilot.

Secondary onboarding makes sure that your users remain engaged with your product throughout the customer journey, and eventually upgrade their plans or pay for add-ons. This will make sure that LTV experiences steady growth.

Monthly Recurring Revenue (MRR) metric

Monthly Recurring Revenue or commonly known as MRR is the amount of revenue that a SaaS business can expect each month. It’s an important metric to track as it helps you predict the profitability and future cash flows of your business.

Why is MRR important?

In the general sense, MRR helps you understand if your product marketing is driving growth or not. As mentioned before, it also offers a way to forecast your future cash flows and budget.

This is especially important as it can get tricky to keep track of all sorts of customers, as SaaS models often have multiple pricing tiers or upgrade options. MRR summarizes your entire revenue in one metric, allowing you to get an overall idea of business profitability.

How to calculate MRR?

First, calculate the average revenue per account or ARPU by dividing the total revenue of your business for a month by the total number of customers. Then you can multiply the ARPU by the number of accounts you have in that month to get the Monthly recurring revenue or MRR.

How to improve MRR?

Improving MRR isn’t that simple. You need to tackle this from multiple fronts – reduce churn, push upgrades, and more.

You can improve MRR by boosting customer acquisition efforts. But you also have to be careful not to go all in. On the other hand, you also need to focus on your existing users, which will help you increase the ARPU.

You can do so by generating revenue through upsells, cross-sells, and add-ons. Boosting customer retention efforts will also help you improve MRR in the long run.

Customer Churn Rate metric

Customer churn rate indicates how quickly you are losing your customers. It calculates the number of customers you are losing during a specific period which means you don’t meet your customers’ expectations.

Why is Customer Churn Rate important?

Customer churn rate is one of the key retention metrics to track. You need to first understand at what rate your customers are leaving so that you can create a robust customer retention strategy to decrease the number of churned customers.

You can then try to figure out how and why they are leaving. If you can identify the stage in the customer journey in which your users tend to drop out, it becomes easier to craft strategies to offer them more value.

Creating such well-crafted product experiences will help you significantly reduce your customer churn rate.

How to Calculate Customer Churn Rate rate?

You can calculate the customer churn rate by first dividing the number of lost customers during a period by the number of customers at the start of that period, and then multiplying the result by 100.

Improve Customer Churn Rate rate by closing the feedback loop

You need to be constantly collecting feedback through various customer satisfaction surveys such as CSAT or CES.

CSAT on-the-spot measurement of a customer’s experience with a specific product or feature, which you can measure at different touchpoints in the user journey. This will help you understand how satisfied your users are with your product and what is your loyal customer.

You can also use CES, which measures the users’ ease of use in using a feature or performing an action within your product. You should follow up on the initial score, which will offer you valuable insights into the usability of your product.

Collecting this feedback isn’t enough. You need to act on the feedback you collected to remove friction, and then get back to the customer to close the feedback loop.

Net MRR Churn Rate metric

Net Monthly Recurring Revenue (MRR) Churn rate indicates how much revenue you’re losing in a specific month because of customer churn. This doesn’t take expansion MRR into account, so you get a more accurate picture of customer churn.

Why is Net MRR Churn Rate important?

MRR is the oxygen of SaaS business models. If net MRR churn is more than 0, it indicates that you have earned less money than in the previous month.

This can act as a warning sign for you to take immediate actions to prevent it from happening again. While an ideal net MRR churn is negative, your goal should be to at least keep it around zero.

How to calculate the Net MRR Churn Rate rate?

To calculate the net MRR churn rate, you need to first subtract Expansion MRR from Churned MRR. Then divide the result by starting MRR, and multiply it by 100.

Reduce Net MRR Churn Rate with churn surveys

The first step to reducing churn is to identify what’s causing it. Churn surveys are a great way of doing exactly that.

Churn surveys or exit surveys are a subset of microsurveys, which consist of a brief questionnaire sent to a user after they decide to cancel or downgrade their subscription plan. It allows you to collect actionable customer feedback, which can help you improve your product to reduce churn.

You can add multiple-choice survey questions or ask an open-ended question. Here’s an example of an in-app churn survey built using Userpilot.

You can automate personalized responses to users taking the survey, providing them with alternatives to canceling their accounts.

Existing Customer Revenue Growth Rate (Expansion MRR rate) metric

The Existing Customer Revenue Growth Rate or the Expansion MRR Rate is the portion of the total MRR generated from existing accounts through upsells, cross-sells, or add-ons.

Why is the existing customer revenue growth rate important?

Your probability of successfully selling to existing customers stands at 60-70%, making it a reliable option to push growth. If you also consider the high CAC, it makes more sense to sell to existing customers.

The existing customer revenue growth rate will help you understand the potential of pushing upsells to your customers, and in turn, growing your revenue. This can also help you to coordinate your efforts to achieve a negative net MRR churn rate.

How to calculate the existing customer revenue growth rate?

First, subtract the Expansion MRR at the beginning of the month from the expansion MRR at the end of the month. Then, after dividing the result by the expansion MRR at the beginning of the month, multiply it by 100.

Increase existing customer revenue growth rate with in-app messaging

Communicating with your customers contextually is important if you need to convince them to upgrade or buy an addon. This is where in-app messaging becomes an essential tool.

In app-messaging helps you interact with your users inside your app using contextual and timely messages, allowing you to push the upgrade at the most relevant opportunity possible.

You can point out features to the users who might find them useful. Miro does it perfectly by making all boards public by default and promoting private boards as a premium feature.

It sends this reminder whenever a user is trying to create a new board. This way it can convince users to upgrade to a premium plan if they feel the need to create private boards.

Net Promoter Score (NPS) metric

Net Promoter Score is obtained by asking existing customers a question about their likelihood to promote your product. Respondents can answer on a scale from 0 to 10. Here, 0 indicates “Not Likely” and 10 indicates “Very Likely”.

Why is Net Promoter Score important?

NPS by itself may not amount to much. But when it’s cross-referenced with user behavior metrics, NPS can help you gain valuable insights on customer satisfaction patterns.

NPS is a quick and easy way to capture how customers currently feel about your product. You can use these insights to shape your onboarding strategy, allowing you to reduce churn and boost retention.

How to calculate Net Promoter Score?

Before we get to the calculation let’s get familiar with the three types of NPS respondents – Detractors, Passives, and Promoters.

Detractors are users who respond 6 or lower on your NPS survey, Passives are the ones responding with a score of 7-8, and Promoters are those who respond with a score of 9-10.

To get the NPS metric, subtract the percentage of detractors from the percentage of promoters. Your NPS can range anywhere from negative 100 to positive 100 depending on your promoter-detractor ratio.

Improve Net Promoter Score by turning detractors into promoters

Detractors are not likely to recommend your product due to issues they are facing with it, or simply because it offers no value for them. On the other hand, promoters love your product and are getting continuous value from using it.

While NPS score surveys help you find detractors, you can’t know exactly why they are detractors. A follow-up question can help you get that feedback. Keep the question open-ended to get the most useful answers.

Here’s an example of asking a qualitative follow-up question, where the respondent can answer right away after they have taken the initial NPS survey.

To capture this crucial feedback from your mobile audience as well, Userpilot now also enables triggering NPS surveys directly within your mobile app.

Unless you’re a robot, raw NPS data won’t make much sense to you. Start analyzing it to find patterns that can help you prevent it from happening in the future. You can also track usage patterns of satisfied users, which you can try to replicate with others.

You also need to show that you care about the detractors. Automating your responses can help you do that instantly after they have taken the NPS survey.

Customer Stickiness metric

Customer Stickiness or DAU to MAU ratio is a product usage metric that tells you how often users are coming back to your app.

Here, DAU or Daily Active Users is the number of active users interacting with your product each day. MAU or Monthly Active Users indicates the number of active users interacting with your product each month.

Why is Customer Stickiness important?

Customer stickiness indicates that the product is “sticking” with the users, or it’s being valuable to them with continued usage. This can also be a testament to your product quality, which is crucial for SaaS businesses.

Low customer stickiness can be a warning signal for increased churn rates. This usually means that your existing customers aren’t benefiting from your product, which can lead to low customer engagement, and possibly churn.

Customer stickiness can also be a predictor of potential account expansion. If users are getting repeated value from your product, then they are more likely to go for upgrades or add-ons.

How to calculate Customer Stickiness rate?

You can measure customer stickiness rate as the ratio of your daily active users (DAU) to monthly active users (MAU).

Improve Customer Stickiness by increasing feature adoption and engagement

When existing customers are engaged with your product, they are likely to discover features better. This will lead to increased product usage, as the customers get more and more value from the product. At this point, you can say that your product “sticks” with the customer.

Increasing feature adoption and customer engagement requires continuous effort on your part. But that’s what SaaS products are all about. You need to focus on continuous improvement, helping your users discover and adopt features that are the most relevant for them.

Customer Health Score metric

The customer health score is a metric used to understand the “health” of existing customers, or their likelihood of growing, staying consistent, or churning.

Why is Customer Health Score important?

You can use the Customer Health Score to predict the future course of your relationship with a customer.

It can help you identify your power users, and find opportunities for account expansions. It will also help you to reach out to customers with low scores proactively and resolve issues that require your attention.

Another important aspect of tracking customer health scores is the ability to determine customer success and failure patterns, which can help you improve your product by removing frictions.

How to calculate Customer Health Score?

Calculating the customer health score is a multi-step process. First, define how you are going to use the customer health score, and the customer segment it applies to. Next, determine the customer actions that are impacting the score, and assign a number to each of these actions based on their importance to your product and user persona.

Now, track the number of times a user takes action over a specific period, and calculate the total action value for each action by multiplying the number of times the action was completed in the last x days by the impact score.

Here’s what the table looks like.

Finally, you can add all action values together to get the total customer health score for a user, which looks like this:

Customer Health Score = total action value #1 + total action value #2 + total action value #3 + …

Improve Customer Health Score with in-app guidance

If you notice a low engagement pattern among customers with low health scores, you can use in-app guidance to lead them to success.

In-app guidance involves using short messages to offer guidance and support to your users, driving user engagement. Hootsuite, a social media management tool, is a great example of using in-app guidance to boost user engagement.

Hootsuite offers “wise guides” that are targeted around key features such as “Adding a social network”, which can easily guide users to completing their desired actions.

Conclusion

Tracking the right customer retention metrics is crucial if you want to focus on the growth of your SaaS business. But keep in mind that not all metrics are equal. Some might be spot-on for your product, while some not so much.

The key here is to find the right combination of metrics that can help you get the most relevant insights and are consistent with your business and product goals.

Want to get started with measuring retention metrics? Get a Userpilot Demo and see how you can help your customers find value at every step of the user journey!