I’ve yet to come across a SaaS business that doesn’t want to increase its Customer Lifetime Value (or LTV for short).

It stands to reason: why wouldn’t you want to increase the amount of money you make from each of your customers during the time they work with you?

But LTV is often a poorly understood metric, especially if you come from a more traditional business environment: one more concerned with acquisition than retention.

Let’s take a deep dive into what LTV is, how to measure it, and how to increase it.

Boost Your Customer Lifetime Value

Take this short quiz to see how your customer lifetime value stacks up and what you can do to improve it.

How do you currently measure customer lifetime value (LTV)?

What is your biggest challenge in increasing customer lifetime value?

How often do you engage customers with secondary onboarding for new features?

What best describes your approach to gathering customer feedback?

Ready to boost your customer lifetime value?

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is LTV – Lifetime Value?

Let’s get some definitions out of the way first.

LTV stands for “Lifetime Value.” It refers to the average amount of money a business earns from a user over the time a user is a paying customer.

It stands to reason that your SaaS business will want to keep a close eye on this metric and look to increase it wherever possible.

But before you can do that, you need to know…

How do you calculate LTV?

This can be as simple or as complicated as you need it to be.

The easiest way to calculate LTV for a given user is to sum the amount of revenue they have paid you over their time as a customer. You can think of this as Gross LTV.

You could add up all your Gross LTV numbers for each customer and divide by the number of customers to get an average.

Slightly more sophisticated is the Net LTV calculation. To work this out for a given user, add up all the revenue they have paid you, but subtract the cost of acquiring them and servicing their account.

I like this model because it gives a more accurate reflection of your earnings per customer. Put another way, it doesn’t matter much if you make an average of $2000 in revenue per customer but spent $500 to acquire them and another $1200 on customer service!

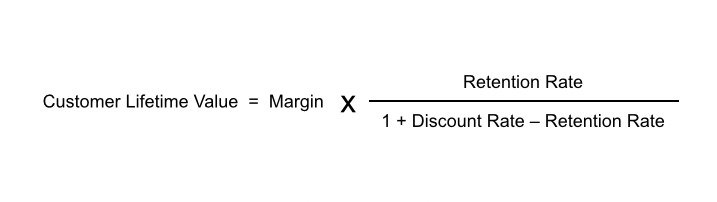

If you want to get really fancy and factor in retention rate and inflation, you might consider the following formula:

For this approach, the default discount rate is often set at 10%, as a way of simulating the cost of inflation and other typical business fluctuations.

Who should measure LTV?

LTV is an especially useful metric for businesses that have high transaction rates and a large customer base, so if your SaaS falls into this category, you will definitely want to keep an eye on this metric.

Conversely, if you have 6 clients, of which 2 are enterprise-level and the rest are variable 3-figure amounts per year, it’s probably a better idea to worry about increasing acquisition rates than it is to measure LTV.

For most SaaS businesses, the responsibility for tracking LTV will fall on the CFO, just as it would for other key financial metrics.

If your SaaS business is really small, it might even be the CEO who takes the lead on monitoring this.

Why does LTV matter for SaaS?

The simplest answer to this question is that improving LTV improves the overall profitability of a SaaS company.

But the key thing about the SaaS business model is that most of the profits come from repeat subscription payments, not just one single transaction.

This makes sense when you think about it. SaaS companies spend a huge amount on developing and maintaining their product. It’s impossible to recoup that investment if a single customer pays you $20 one time.

According to SaaSScout,

- Retaining 5% of customers will increase SaaS profits by at least 25%

- 77% of customers have stuck with a brand for more than 10 (!!!) years

Put simply: the longer you can retain customers, the more money they pay you per subscription, and the lower your costs per user, the higher your LTV will be.

The predictive value of LTV

From an executive perspective, the really useful thing about calculating LTV is that it can be used to project revenues and investments in the future.

Let’s illustrate this with an example.

- Company ABC has 50 employees. The LTV is measured by the CFO on a monthly basis.

- The company turns over $1.7 million per year.

- The average gross LTV per customer is $7500, spread over 5 years.

- The VP of Sales checks the Sales CRM (shoutout to Pipedrive) and sees that Company ABC can expect 10 new sales per month.

- The VP of Customer Success checks Zendesk and sees that 4 customers are churning per month.

Putting all this together, this company is gaining an average of 6 new customers per month. Each customer pays an average of $7500 over 5 years or $1500 per year.

So for each month that goes by, the CFO can estimate an additional 6 x $1500 of gross revenue per year, so $9000.

This is a very useful number to know. The CFO can now allocate funds to HR to hire new team members in a way that is financially responsible.

So now that you know why LTV matters, you’re probably asking yourself…

How do you increase LTV?

Here are a few strategic options to think about.

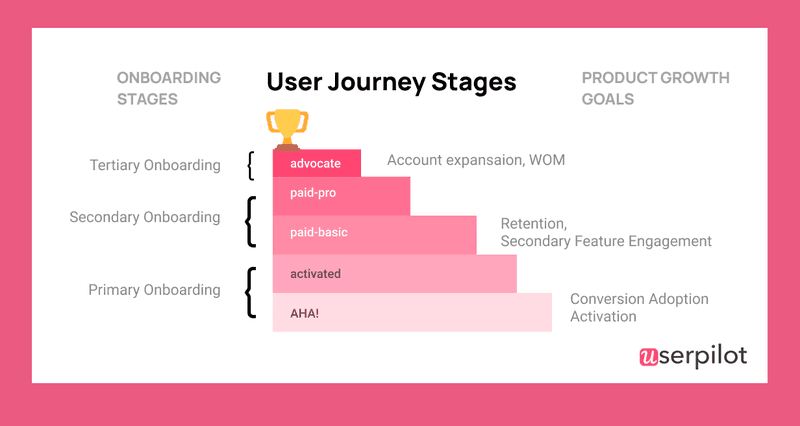

1. Don’t forget secondary onboarding

There’s a tendency in the SaaS world to think of onboarding as a one-time activity that should occur in the first few days after a new customer is acquired.

There’s some truth to this perspective. Initial onboarding is indeed very important: maximizing Day 1 retention is a real struggle for a lot of SaaS businesses.

But assuming your customer has activated, the way to increase LTV is to keep them around as long as possible.

This means that you don’t want to just leave them to their own devices whenever you release a new feature that might help them.

Rather, you want to show it to them and teach them how to use it — provided it’s relevant to their use case, of course. Generic product tours still suck at every stage of onboarding!

Consider using the following UI elements for secondary onboarding, all of which can be created with Userpilot:

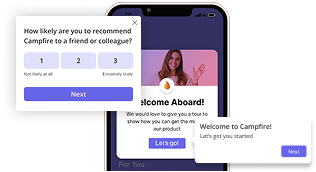

And for your mobile platform, you can onboard and engage mobile app users by creating personalized messaging, push notifications, and surveys.

If you want to learn more about how to use an individual UI element, just click on the relevant link.

After secondary onboarding is complete, onboarding — in the sense of user education — never really ends. You can even conceive of “tertiary onboarding,” “quaternary onboarding” and “evergreen onboarding.”

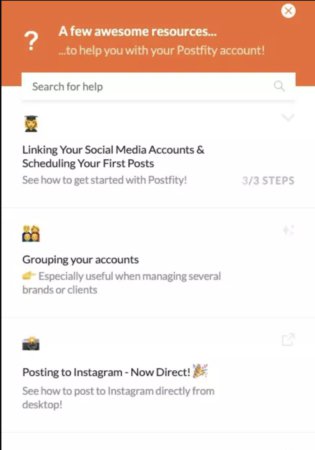

2. Embed a Help Center into your product

Contrary to what you might think if you’re a developer, SaaS customers often churn due to poor customer service, as opposed to a product being buggy.

The way to maximize LTV is therefore to show customers that you care about them and are willing to listen to their concerns.

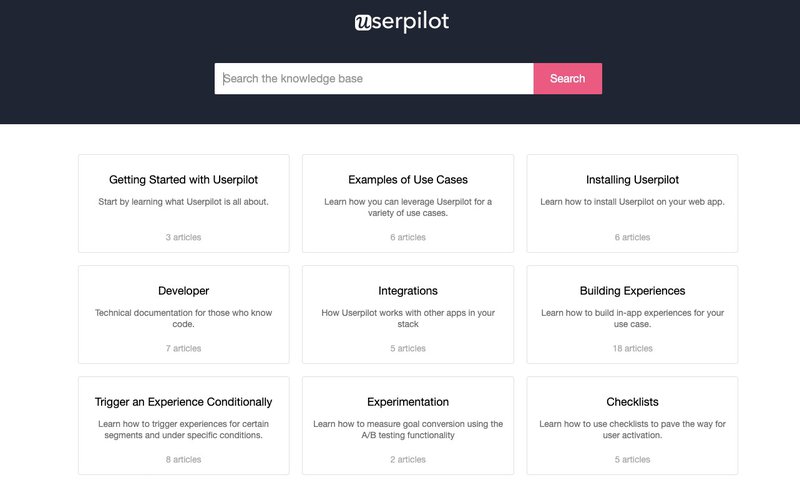

Since hiring multiple customer service agents on salary is often prohibitively expensive, many SaaS companies solve this problem by creating a dedicated knowledge base. This is a scalable repository of FAQs and guides that lives on your company’s website.

For example, Userpilot’s knowledge base looks like this:

But even this way of showing customers that you care is insufficient to prevent some users from leaving before you hit your LTV targets.

Don’t believe me? Just think of a time that you spent looking for the help section of a website when a product bugged out.

As a culture, we’re terrible at deferring gratification, and want our problems to be solved immediately.

This is why the Help Center exists. A Help Center is a small widget that allows users to access self-service support articles — but without having to leave your app.

Most Help Centers contain a mixture of the following elements:

- FAQs

- How-tos

- Best practices

- Troubleshooting

- Video guides

From a user’s point of view, a Help Center translates into a faster solution to any problems or queries they might have. The user is now able to self-diagnose many issues without talking to a customer support agent.

That speedy response time means less customer frustration, less willingness to churn and, therefore, a higher LTV for your business.

Userpilot is a great tool for building help centers that are styled to your brand. Click here to see how this works.

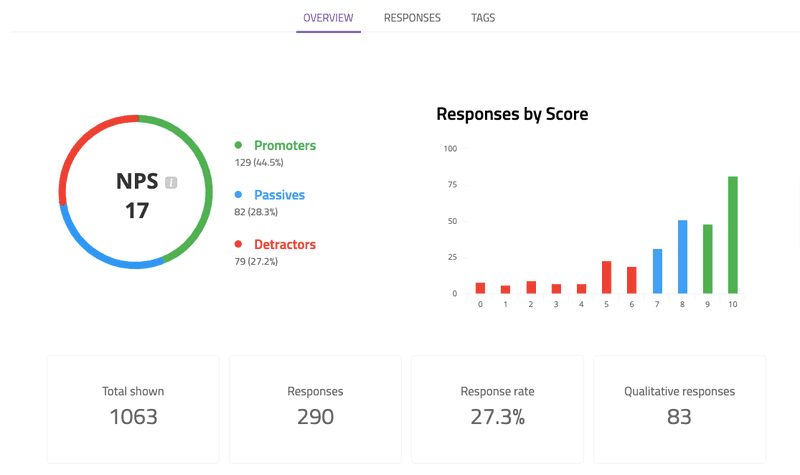

3. Follow up if you get a negative NPS score

Of course, even if you create a Help Center and a great onboarding experience, there are still times when customers will give you negative feedback — perhaps through a negative NPS score.

If you leave a critical customer alone, there’s a good chance they’ll churn and bring down your LTV.

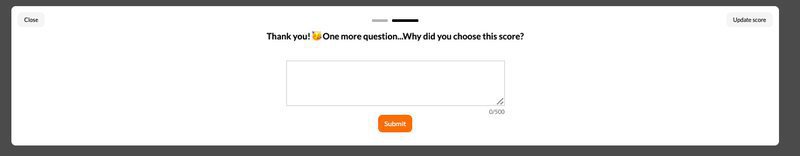

But a negative NPS score in and of itself only tells you that your customer is dissatisfied. Crucially, it doesn’t tell you WHY.

In order to know how to prevent this customer from churning, you, therefore, need to follow up to get more information from them.

Now, you could follow up manually by sending the customer an email or giving them a call. Your customer may well appreciate this personal touch, but it’s very time-consuming and expensive to do this in all instances.

Another way you could follow up would be by looking at the session recordings provided by tools like Hotjar and Logrocket. These tools record a user’s mouse movements and clicks inside your product, so that you can see where the problem is.

While session recordings are a very useful weapon to have at your disposal, it will still take you a lot of time to comb through the recordings until you find the information you need.

Perhaps you can justify that level of investment for an enterprise customer, but I suspect that even this doesn’t scale that well.

The most automated way to follow up on negative feedback is through a qualitative microsurvey.

This is a small survey that appears in-app with perhaps 1-2 questions on it. You can set it to automatically trigger according to certain conditions, such as when a user gives you a negative NPS score.

Because it’s so short and appears inside your product, it’s very easy for users to fill out with minimal friction.

There’s a good chance that using a microsurvey will give you the information you need to prevent the customer from churning, thereby maximizing LTV in the process.

You can build microsurveys with Userpilot. Click here for details.

4. Create content to educate your customer

Have you ever kept using a product just because its content was so good? Or have you ever stopped using a product, but kept reading their company blog, only to go back to the same product a few months later?

I know I have.

These are both examples of a business using content to maximize LTV.

As a general rule, the more complex your SaaS product is, the more necessary it will be for you to educate your audience with content.

The different types of content you might consider creating include:

- Blogs (like this one!)

- Videos

- Podcasts

- Ebooks

- Infographics

- Case studies

- Interviews

Like with the Help Center example, you should aim to have your customers educate themselves self-sufficiently, without always reaching out to you directly by email. This will build trust over time.

Userpilot practices what it preaches in this area. Collectively, we spend hundreds of hours each month planning, creating and sharing helpful content.

Crucially, our content is actionable and specific. If you spend some time on this blog, you’ll see it’s replete with screenshots, step-by-step guides and examples.

This is a far cry from the vagueness of most content on the Internet, and keeps our customers coming back to us month after month.

5. Add valuable product features and upsells

A lot of these tips so far have focused on how to increase LTV by preventing churn.

While it’s true that retaining customers for as long as possible will correlate with high LTV, there are also other fundamental business metrics that impact LTV.

The simplest of those to understand is profitability.

To recap from earlier, Net LTV is a metric that takes into account both the revenue acquired from a customer and the cost of servicing them.

It’s normally quite difficult in the SaaS world to reduce costs and maintain the operational standards your customers expect, so:

The majority of SaaS businesses tend to lean towards increasing revenue rather than cutting costs.

This is comparatively easy to do for a digital product compared to a physical one. The more features you provide, the more value you add, so the more you can charge your customers per month.

Just make sure that the features that you add are things that your customers actually want. User analytics tools like Canny can be really helpful in this regard as a way of summarizing feature requests and ensuring the most popular ones get prioritized.

We previously reviewed Canny here.

If the feature you’re adding only provides value for a particular audience segment, consider making it into an optional upsell.

For example, a classic upsell in the SaaS world is the provision of complex security and reporting requirements to enterprise customers for an additional fee.

The more such features you can upsell, the higher your Average Order Value (AOV) will be, and your LTV will increase accordingly.

Conclusion

After reading this article, you should be in a position to:

- Understand what LTV is

- Understand why it matters

- Know how to measure it

- Know how to increase it for your SaaS

If you’re looking to make use of microsurveys, secondary onboarding, and a Help Center as ways of maximizing LTV, you should know that Userpilot allows you to do all of these things. And you won’t even need to use code.

Book a free demo today.