Working out pricing for your company can be difficult, which is why you should consider perhaps the easiest-to-follow pricing strategy: cost-plus pricing. It’s a straightforward method that can be quick to implement to improve product growth, but it does come with certain disadvantages.

What is the cost-plus pricing?

Cost-plus pricing, or markup pricing, is a strategy where you add a fixed percentage to the unit cost of developing a product to determine its selling price.

While this method focuses strictly on the unit cost, it overlooks competitive prices, potentially making it less suitable for businesses in competitive markets.

The cost-plus pricing strategy explained

The cost-plus-based pricing method is inherently inward-looking, focusing more on internal factors, like production and direct labor costs, than external factors, like market demand or what competitors might be charging.

This approach might not be the most suitable for industries like SaaS. In such sectors, your products’ inherent value to users can greatly overshadow the fixed costs of producing the software. Therefore, simply marking up costs might undervalue your product’s worth.

However, there’s a silver lining to cost-plus pricing. Integrating it into your value proposition can foster trust and transparency.

A declaration like, “We’ll never charge more than X% above our costs,” can reassure potential customers they’re getting a fair deal, enhancing their loyalty and trust in your brand.

Cost-plus pricing calculation for your product

Cost-based pricing is where a desired profit margin percentage is added to a product’s unit cost to determine the final sales price.

At first glance, it might seem like a straightforward strategy for retail companies but for SaaS products, specific nuances exist.

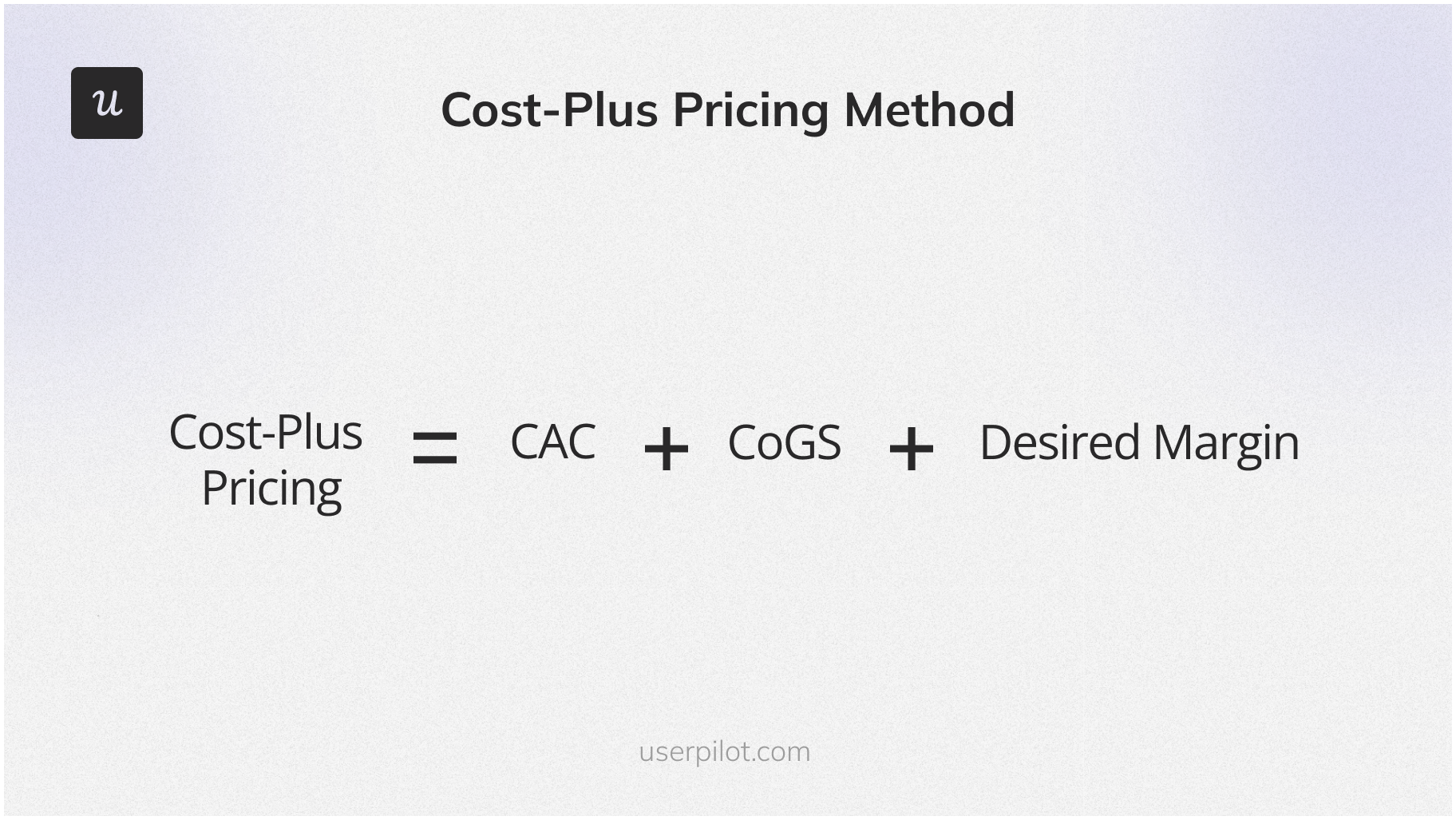

The formula for the cost-plus pricing model in SaaS is:

Selling Price = CAC (Customer Acquisition Cost) + CoGS (Cost of Goods Sold) + Desired Margin

- CAC (Customer Acquisition Cost): This is a distinctive factor for SaaS businesses. Unlike traditional businesses, where production costs are major, SaaS businesses often invest heavily in acquiring customers.

- COGS (Cost of Goods Sold): For SaaS companies, this generally refers to the direct costs of delivering the service to a customer. This might include server costs, support services, and other related expenses.

- Desired Margin: This is the amount of profit you want to make. It’s added to your total costs to ensure you’re not just breaking even but earning a profit.

What is an example of the cost-based pricing strategy?

Imagine you run a SaaS email marketing tool. The cost to acquire a new customer (CAC) is $100. Your CoGS amounts to $50 for each customer. You decide you want a profit margin (desired margin) of $75 per customer.

The appropriate selling price using this method is $225.

Selling price = $100 (CAC) + $50 (CoGS) + $75 (Desired Margin) = $225

Benefits the of cost-plus pricing strategy

Diving into the world of pricing strategies can seem daunting, but the cost-plus method stands out for its simplicity and predictability. Below, we explore these benefits in detail.

Simple to implement

At its core, the cost-plus method revolves around a basic formula, focusing on your production’s total cost and customer acquisition cost (CAC), then adding a markup percentage.

Unlike other pricing methods that require intensive market research or deep dives into competitor pricing, cost-plus pricing means you won’t be engaged in price wars or constantly trying to undercut competitors.

Easy to communicate price changes

One of the standout advantages of cost-plus pricing is the ease with which businesses can explain and justify their price levels and fluctuations.

If there’s a need to adjust prices – say, due to an uptick in production costs – the rationale behind such price changes is straightforward for consumers to grasp.

Provides a consistent rate of return

One of the primary appeals of the cost-plus pricing method is its consistent rate of return. Once you sum up the production and operational overhead costs accurately, you add a markup that guarantees a positive rate of return.

However, unexpected direct labor costs can fluctuate, and you might not easily predict them, which can eat into the set margins.

You can increase the arbitrary margin to counteract potential underestimations in variable costs to create a buffer against unforeseen expenses.

Drawbacks of the cost-plus pricing strategy

While the cost-plus pricing strategy has strong advantages, understanding its limitations is crucial for businesses. Let’s delve into some of the key disadvantages.

Can’t gain a competitive advantage

Cost-plus pricing can sideline the crucial aspect of market research. This pricing method overlooks external market dynamics by focusing primarily on internal costs. Market research is pivotal in crafting a holistic pricing strategy.

Without substantial market research, you’re navigating the market blindfolded when it comes to understanding consumer demand and the perceived value of your product.

Doesn’t take customers into account

The foundational idea of cost-plus pricing is to calculate costs and then add a margin. However, this strategy can often overlook the asking price the customer is genuinely willing to pay.

Cost-plus might not be the most effective strategy in the SaaS industry, where customers’ perceived value can vary widely.

Instead, SaaS companies might benefit from pricing models that factor in their unique value propositions and their target audiences’ specific needs and pain points.

Best practices when implementing the cost-plus pricing model

Here are some best practices to consider when implementing the cost-plus pricing model:

- Ensure all actual costs (direct and indirect) are carefully accounted for. Underestimating costs can lead to pricing that’s too low, which impacts profitability.

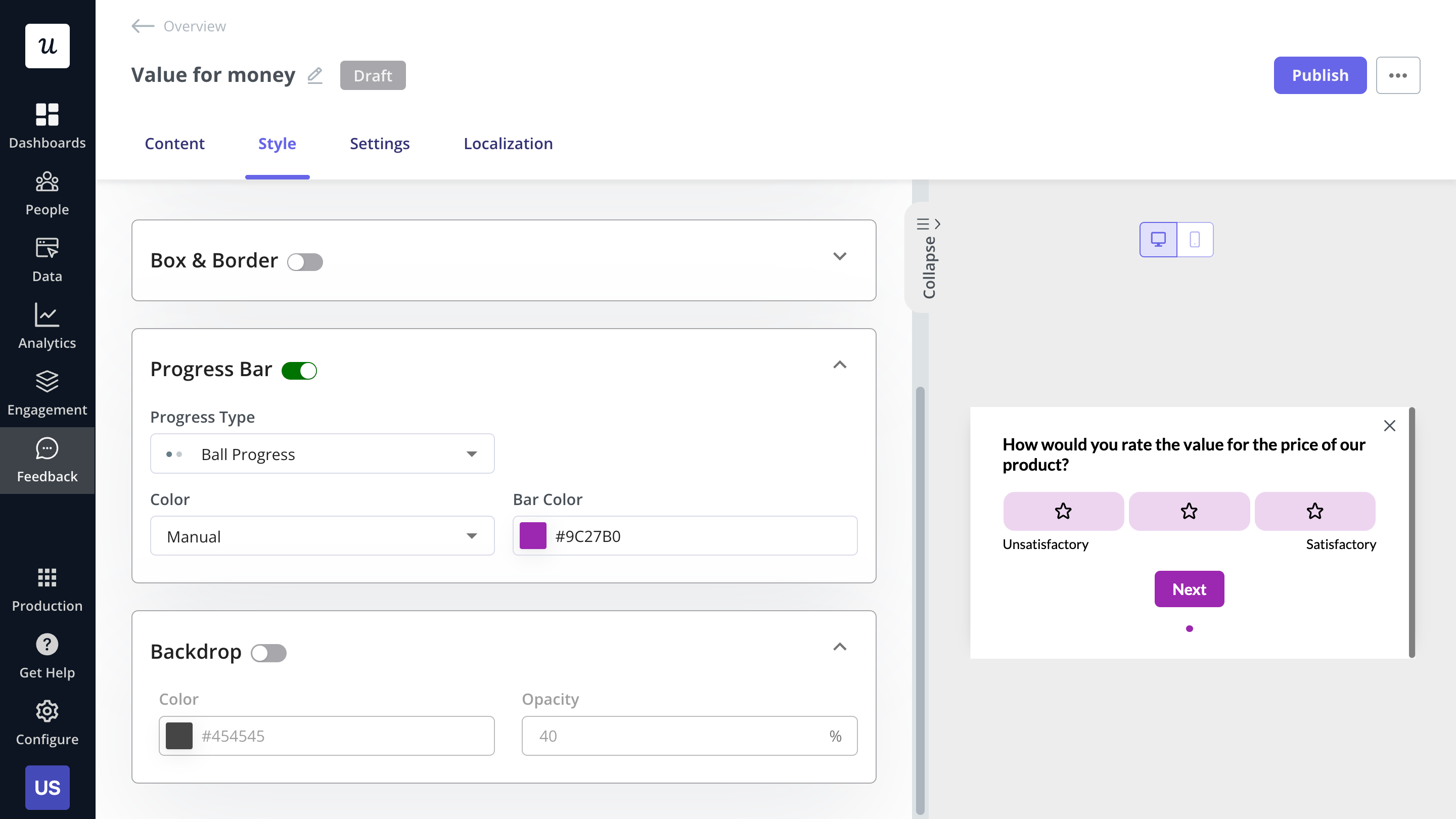

- Collect customer feedback to understand the sentiment behind your price plans. If users report the value for money is unsatisfactory, consider reducing the profit markup percentage.

- While cost-plus pricing is cost-focused, it’s still essential to understand competitor pricing and customer expectations. Adjust profit margins when necessary to stay competitive.

Other pricing strategies for SaaS to consider

While the cost-plus pricing method has merits, it’s not the only strategy SaaS companies can leverage. Let’s delve into some alternative pricing strategies:

- Value-based pricing strategy: The value-based pricing approach involves understanding what customers are willing to pay for the product’s benefits and solutions.

- Penetration pricing strategy: With this strategy, companies initially set a low price to gain a significant market share quickly.

- Competitive-based pricing strategy: This strategy revolves around competitor prices. SaaS companies using this approach will price their product in line with, slightly above, or below their competitors, depending on their product’s perceived value and market positioning.

- Captive pricing strategy: This strategy involves pricing a basic product in the lower range while keeping the essential complementary products or services priced higher.

- Skimming pricing strategy: Skimming involves setting high prices for a new product to “skim” maximum revenues layer by layer from those willing to pay more.

- Prestige pricing strategy: This strategy banks on the “premium” factor. Products are priced higher to give an impression of exclusivity or superior quality.

Conclusion

No matter the pricing strategy chosen, how you communicate product value is essential to justify the value for money of your product. Userpilot can help here. Use it to create code-free product experiences that reduce the time to value. Book a demo to learn more.