The first time I saw a deal with negative revenue churn, it stung. For product managers and growth leaders, revenue churn isn’t just a metric, it’s a signal that something isn’t working.

Why? I’ve seen firsthand how customer churn holds SaaS products back. Even if you’re adding new customers, your product growth will be stuck if churned revenue outweighs expansion revenue.

In this article, I’ll cover how to calculate revenue churn, what causes it, and how to reduce it before it affects your product growth.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is revenue churn?

From my perspective, revenue churn measures the percentage of recurring revenue that I lose over a set period, typically a month or a year.

Think of it as the leaky bucket effect: the money that’s draining away due to customers downgrading their plans, canceling their subscriptions altogether, or simply not renewing when their contracts are up.

It’s critical for me in sales to monitor this monthly because it directly impacts my growth and overall revenue projections. Additionally, my team conducts weekly health checks on at-risk accounts using both product usage data and customer feedback.

How to calculate revenue churn?

Understanding my churn rate is non-negotiable. I can’t fix what I don’t measure. So, let’s break down how to calculate revenue churn rate.

Use the net and gross revenue churn formulas

Calculating revenue churn is straightforward. You don’t need complex tools. Most SaaS companies use Excel or Google Sheets to handle it. Here’s how:

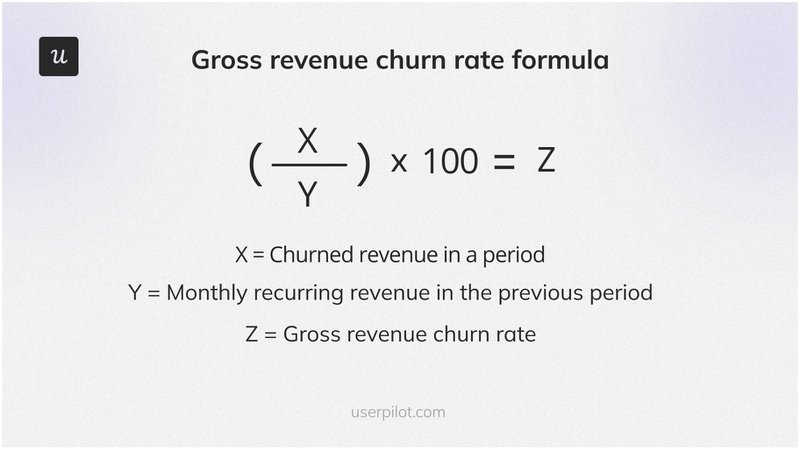

Gross revenue churn

It measures the total revenue lost in a given period due to customer cancellations and downgrades without accounting for any new revenue gained from upgrades or upsells.

Example: Let’s say your MRR at the start of the previous month was $100,000, and you lost $5,000 due to cancellations and downgrades. Your gross revenue churn rate would be 5% for that month.

A high gross churn rate is a red flag. If revenue churn tells you too much revenue is slipping away, it’s a sign that customers aren’t finding enough value to stay.

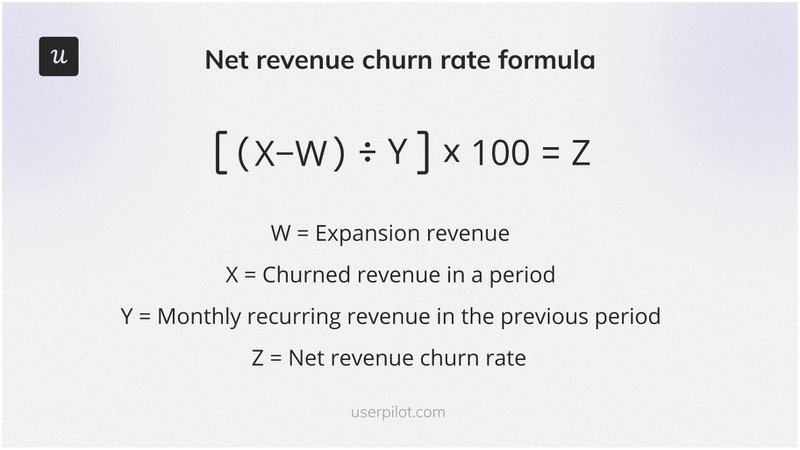

Net revenue churn

Net revenue churn gives a complete picture by factoring in expansion revenue gained from upsells, cross-sells, and add-ons. If net churn is negative, such a case means expansion revenue is outpacing business loss (exactly what you want).

Example: Imagine you lost $5,000 due to lower revenue churn but gained $3,000 from expansions and upgrades. Your net revenue churn would be lower because that extra $3,000 offsets some of the lost revenue.

SaaS companies prioritize net revenue churn because it balances both losses and gains. If gross churn is high but net churn is low, your expansion strategy is recovering churned customer revenue. However, retention and profitability need urgent attention if both numbers are high. Fix customer retention before focusing on new acquisitions: keeping existing revenue is far easier than replacing it.

*Formula reference: X = Churned revenue in a period | Y = Monthly recurring revenue (MRR) from the previous period | Z = Gross revenue churn rate | W = Expansion revenue (upsells, cross-sells, add-ons)

Build your own revenue churn calculation model

To effectively manage revenue churn, I’ve found it’s not enough to react to losses. That’s why I believe in building a tailored revenue churn calculation model. It’s about setting up a framework that reflects your specific customer journey and revenue streams.

Here are a few things to factor when deciding to build your own revenue churn calculation model:

- Engagement threshold: With a good customer base, you start to see what normal activity looks like. That helps me set benchmarks for key metrics like login frequency and feature usage. When a customer dips below that line, it signals something might be off, giving me an early warning to analyze potential churn.

- CSM health scores: My customer success team plays a key role here. Since they’re in constant contact with customers, they’re the best people to assign customer health scores based on product usage, interaction quality, and support history. These scores give me a quick, clear snapshot of customer health. When a score drops, I know we need to step in with personalized outreach to re-engage them.

- Churn forecasting models: I also look at historical data to spot patterns: sudden drops in logins, lack of new feature adoption, or decreased engagement. These patterns help me build models that flag at-risk customers. It’s not about predicting churn perfectly but about catching trends early and addressing issues before they escalate.

Is revenue churn or customer churn a more important metric to track?

When it comes to churn, I’ve learned that it’s not simply a matter of tracking one metric or the other. Both customer churn and revenue churn provide critical insights, but the reality is that resources aren’t always unlimited.

So, I’ve had to make decisions on where to focus my attention. Here’s how I approach it:

- Both are vital, but context matters: Ideally, I track both. Revenue churn gives me the hard financial numbers, showing the direct impact on our bottom line. Customer churn, on the other hand, reveals the health of our customer base.

- Prioritizing based on business reality: If I’m dealing with a business where a few high-value clients drive the majority of revenue, then revenue churn takes priority. Conversely, if we’re a high-volume business, even small customer losses add up. In that case, the customer churn rate becomes an early warning system.

What do you think is the biggest contributor to revenue churn for your SaaS product?

What are the causes of revenue churn?

When onboarding, engagement, or service gaps go unaddressed, businesses lose revenue and struggle to achieve negative churn, where expansion revenue outweighs churned MRR.

They all play out differently, but these are the most common reasons for customer churn.

- Poor onboarding. If customers don’t see value quickly, they struggle to adopt the product. Without a smooth onboarding experience, cancellations and downgraded subscriptions become inevitable.

- Lack of engagement. A strong start doesn’t guarantee long-term retention. If users stop logging in, underuse features, or disengage from product updates, they’re more likely to churn. One of the biggest warning signs we track at Userpilot is when retaining customers stops engaging.

- Misalignment with business needs. Sometimes, customer churn isn’t about dissatisfaction. Customers’ priorities shift, and if the product no longer fits, they move on.

- Budget cuts. Even happy customers leave when budgets tighten. If leadership doesn’t see a clear ROI, they’ll cut non-essential tools first.

- Losing internal champions. When a key stakeholder or product advocate leaves, their replacement might cancel, even if the product worked well.

- Technical issues or poor integrations. A product that doesn’t fit into a company’s existing stack creates friction. Eventually, existing customers find something easier to use.

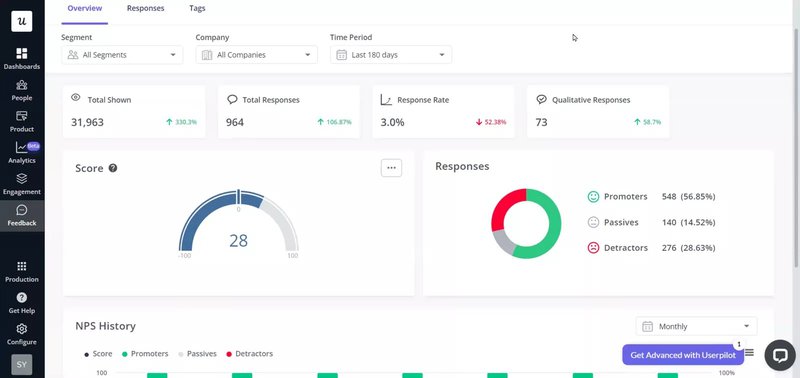

At Userpilot, we use NPS surveys and in-app feedback tools to catch disengaged users early. When existing customers show signs of churn, i.e., fewer logins, low feature adoption, or negative feedback, our system flags them as at-risk customers. This gives us time to step in, address concerns, and re-engage them before they churn.

💡 Take Unolo, for example. By using Userpilot’s NPS for sentiment monitoring and feedback prioritization, they achieved a 44% survey completion rate and a 0.5% to 1% churn reduction.

“I started using NPS, which was a really great feature because it gave us feedback almost instantly. This helped us get in touch with customers more quickly and understand their concerns with the product, which, in turn, helped us reduce our churn rate.”

– Subhash Yadav, Product Marketer at Unolo

How to reduce revenue churn rate?

Once I’ve identified why customers churn, my next step is to focus on what I can fix. Poor onboarding, low feature adoption, or lack of engagement? Those are areas where we can intervene.

But when churn happens due to budget constraints or shifting business needs, that’s beyond our control. No company can offer discounts forever, and sometimes the product just isn’t the right fit.

Userpilot gives me the tools to take action before customers churn. Here’s how I use it to reduce revenue churn:

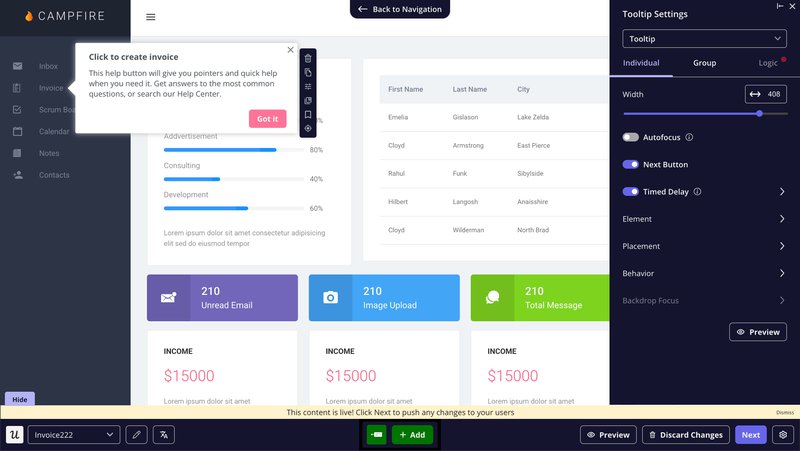

- Onboarding flow builder: I create customized onboarding experiences with tooltips, in-app messages, and guidance that help users navigate key features effortlessly. Faster onboarding means faster value realization, reducing drop-off.

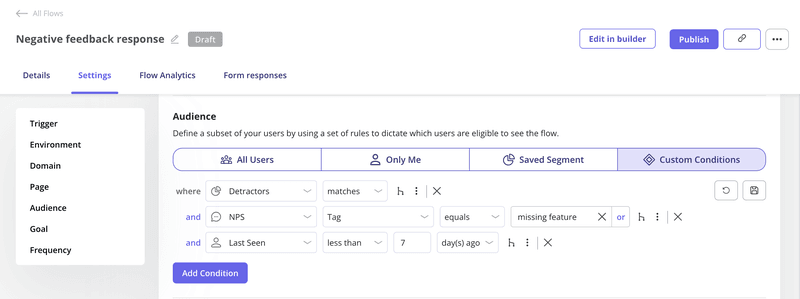

- Advanced targeting: I use data from user interactions, survey responses, and NPS scores to trigger personalized engagement. Reaching the right users at the right time makes re-engagement more effective.

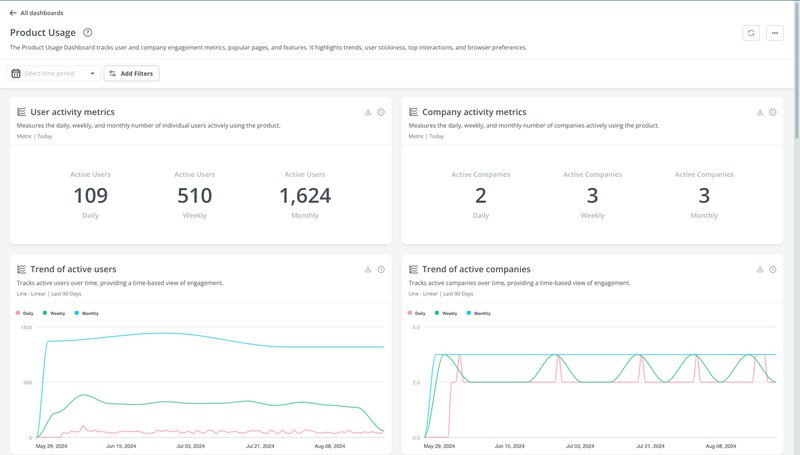

- Metric tracking: I monitor re-engagement efforts with Userpilot’s analytics dashboards. This helps me measure the impact of in-app flows and optimize them based on real data.

This is exactly how Cledara tackled their onboarding challenges. Their high-touch, live demo approach wasn’t scalable, so they turned to Userpilot. The results were immediate.

“With Userpilot, the advantage we had was that we get to control more of the experience and control more of how we display it (in-app messages) with plenty more formatting options.”

– Gerard Masnou, Head of Support and Operations at Cledara

They used Userpilot for in-app announcements, onboarding flows, and NPS surveys, outperforming their previous email-based approach. Within a week, they saw higher customer engagement and better onboarding efficiency. Userpilot gave them control over the user experience, directly impacting their revenue.

Tired of high revenue churn?

Churn isn’t a sudden event; it’s a gradual process, often starting with subtle signs like declining engagement or missed value opportunities. The good news is that these are issues you can address proactively.

Userpilot empowers you to tackle revenue churn with:

- Comprehensive analytics: Track product usage and identify at-risk users early through detailed reports.

- Actionable feedback: Utilize surveys and NPS to understand user frustrations before they escalate into churn.

- Insightful session replays: Pinpoint friction points and optimize user experience based on real-time interactions.

If you’re looking to reduce churn and build lasting customer relationships, Userpilot can help. Book a free demo to discover how we can transform at-risk users into loyal advocates.

FAQ

What is an example of revenue churn?

If a company starts a specific period of the month with $100,000 MRR and loses $5,000 due to cancellations and downgrades, the percentage of its revenue churn rate is 5% for that set period.

What is a good revenue churn rate?

A monthly revenue churn rate under 5-7% for SaaS companies is considered good. Anything above 7-8% signals retention issues that need the company’s immediate attention.

Is 20% churn high?

A 20% revenue churn rate is extremely high and indicates serious retention problems. Most successful SaaS businesses keep it well below 5% per month.