With 700+ reviews on G2, Qualtrics is one of the most recognized customer experience platforms on the market. Large organizations use it to run enterprise-scale, multichannel feedback programs backed by deep analytics.

But in practice, it comes with trade-offs I ran into quickly:

- Pricing sits at the high end and isn’t published upfront.

- The feature set can feel overwhelming for smaller or lean SaaS teams.

- Advanced workflows often require training or a dedicated insights team.

More importantly, Qualtrics largely stops at collecting feedback and market research. For product managers, this prompts a question: How do you turn feedback into action without adding another complex tool to your stack?

To answer, I searched for more agile Qualtrics alternatives with simpler setups and clearer paths from insight to action. In this guide, I share my findings and what you can realistically expect from each.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

Why do SaaS teams look for Qualtrics alternatives?

Qualtrics’ strengths (enterprise surveys and experience programs) don’t always match teams’ day-to-day needs. And this reflects in user reviews.

On G2, users praise Qualtrics’ powerful survey logic and analytics, but frequently mention high costs and a steep learning curve. As one reviewer, Tanishka G, puts it:

“…it is a powerful platform for collecting customer feedback and analyzing survey data at scale, but can be expensive. For using its advanced features, some training might be needed.”

Trustpilot reviews echo similar frustrations, especially around pricing transparency. Stefan summarized it bluntly:

“…their pricing is a company secret, and you are forced to deal with sales representatives who give you the highest price they can before eventually negotiating an agreed-upon contractual service agreement. The price varies depending on where you are, and the U.S. price was nearly 5 X the one I agreed to based elsewhere.”

That combination (cost, complexity, and opaque pricing) makes SaaS teams turn to Qualtrics alternatives. Even with that, choosing the right alternative is more about ‘fit’ than replacing Qualtrics ‘feature-for-feature.’

So, ask yourself:

- Where will the tool sit? Is it in-product or primarily post-interaction/external research?

- Who will use it daily? Research analysts with deep BI skills, or PMs and growth teams seeking quick, actionable signals?

- What decisions will it unblock? Does it move you from insight to action?

- What’s your team’s maturity? Some teams grow into Qualtrics as their research function matures. Others outgrow it because adoption slows due to complexity.

💡 Bottomline: Not every Qualtrics alternative needs to be a full replacement. A lighter, product-centric tool might be the more practical choice.

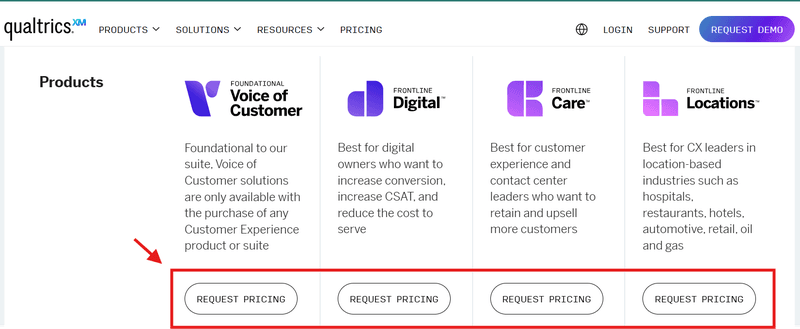

What’s the hidden cost of legacy suites?

Qualtrics’ pricing is locked behind “Request Pricing.” Meaning that quotes typically require sales engagement and multi-year contracts.

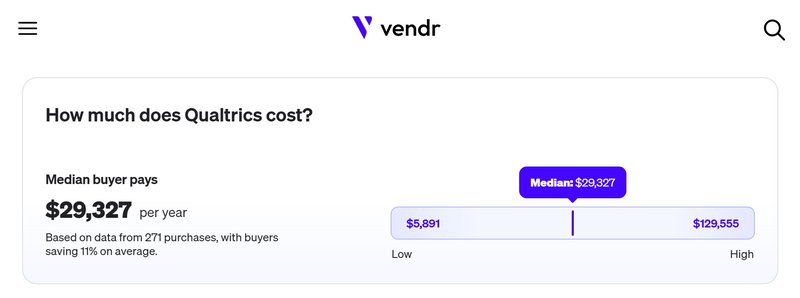

Thankfully, Vendr data (from 271 purchases) reveals the median annual contract value as $29,327.

But licensing is only part of the cost. You also need to factor in:

- Time to implement: Multi-month rollouts delay time-to-value. If your team spends 3 months setting up surveys and governance, that’s three months of missed insights, slower iteration, and unresolved churn drivers.

- Training overhead: Teams pay for external help to manage the steep learning curve. One user reported spending an additional $5,000 just to analyze feedback data collected with Qualtrics.

- Support burden: Mixed support experiences make companies assign a dedicated internal owner. However, even a part-time admin (10–15 hrs/week) quickly adds thousands in annual labor cost.

Together, these hidden costs slow execution and inflate the total cost of ownership.

How I evaluated and ranked these Qualtrics alternatives

I compiled a list based on how SaaS teams use feedback tools day-to-day. Then, I evaluated the list with input from product and growth teams, plus verified reviews from G2, Trustpilot, and Reddit.

Finally, I picked eight tools that turn insight into action with minimal setup and overhead. Check them out below.

8 Powerful Qualtrics alternatives

Here is a glance at what each Qualtrics alternative offers:

| Tool | Best for | Who uses it | Pricing |

|---|---|---|---|

| Userpilot | In-app feedback, behavioral segmentation, and acting on insights | Product managers, growth teams, SaaS product teams | Paid plans from $299/month |

| Pendo | Product analytics and digital adoption at scale | Product ops, enterprise PMs, internal tools teams | Enterprise pricing (quote-based) |

| Hotjar | Qualitative UX insights via heatmaps and session recordings | UX designers, product teams, marketers | Paid plans from $40/month |

| UserTesting | Moderated and unmoderated user research | UX researchers, product discovery teams | Custom pricing (enterprise-focused) |

| Maze | Rapid product discovery and prototype testing | Product managers, designers, and UX researchers | Paid plans from $99 |

| Sprig | Continuous in-product surveys and feedback | Product teams, growth teams | Custom pricing |

| Qualaroo | Targeted surveys and intent-based feedback | Product, growth, and UX teams | Paid plans from $19.99/month |

| Survicate | Multi-channel surveys across product and marketing | Product, marketing, and CX teams | Paid plans from $49 |

1. Userpilot

Best for: Product-led SaaS teams that want to collect feedback and act on it within the product.

G2 rating: 4.6/5 ⭐

Userpilot is an all-in-one product experience and feedback platform that helps SaaS teams understand user behavior, capture contextual feedback, and immediately respond with targeted in-app guidance.

Unlike Qualtrics, Userpilot doesn’t stop at insights. It closes the loop with the following features.

Userpilot key features

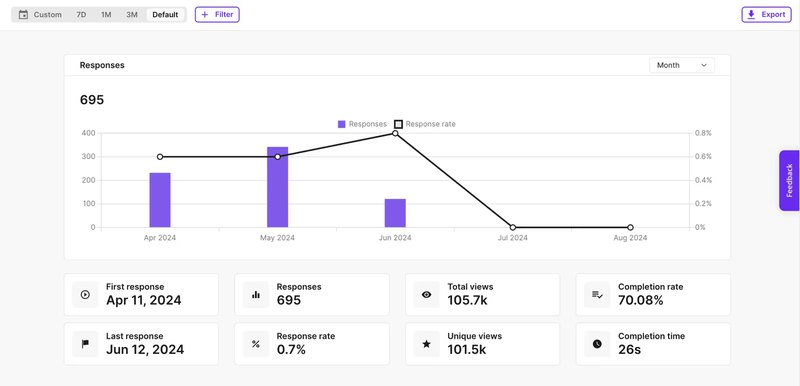

- In-app surveys (NPS, CSAT, microsurveys): Userpilot helps you collect feedback directly inside your product while the experience is still fresh. You can trigger NPS, CSAT, or short microsurveys based on user behavior, page views, feature usage, or customer journey stage. This makes feedback contextual, timely, and tied to actions.

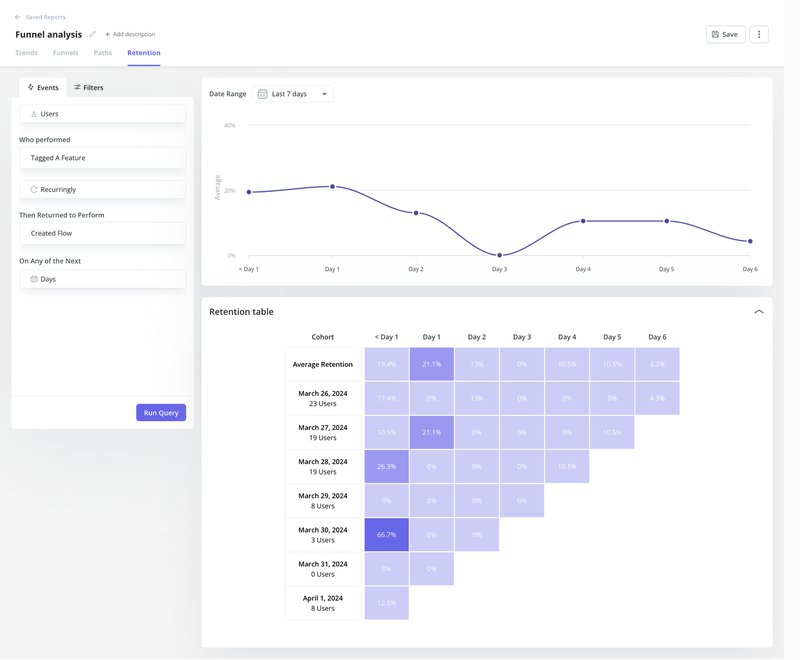

- Product analytics for activation, retention, and feature adoption: Userpilot includes built-in product analytics to track how users move through key flows. You can measure activation rates, retention over time, and feature adoption without exporting data to a separate analytics tool. And with funnels and trends cohorts, you’ll easily spot where users drop off and which behaviors correlate with long-term retention. This is how you connect feedback to outcomes.

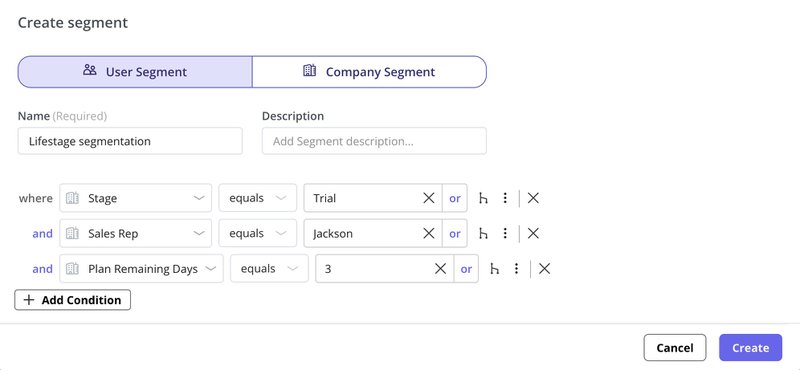

- Segmentation based on events, attributes, and lifecycle stage: Segmentation in Userpilot goes beyond basic demographics. You can group users based on real product events, custom attributes (e.g., plan, role, or company size), and lifecycle (e.g., new, active, or at-risk). These segments update dynamically as behavior changes. With that, you can target feedback, onboarding, and interventions to specific users.

- In-app flows (tooltips, modals, checklists): Userpilot guides teams to act on insights immediately by launching in-app experiences. First, you build no-code tooltips, modals, slideouts, and onboarding checklists. Then, you trigger those when users hit friction points. This way, you close the feedback loop early and turn insights into action.

Pro

- Userpilot helps product teams collect feedback and act on it immediately through in-app guidance, without exporting data or relying on additional tools. Justin B, Director of Product Management at PracticeTek, summarized it:

Con

- It is not intended for large-scale external research, panel-based studies, or academic-style survey programs.

Userpilot pricing

Userpilot offers transparent, usage-based pricing with plans starting from $299/month billed annually (Starter). It also comes with a generous free trial you can use to test the tool before committing to any paid plans.

Other plans include Growth and Enterprise, which are custom quotes.

Overall, the pricing scales with MAUs. There are no multi-year contracts or hidden fees.

2. Pendo

Best for: SaaS and enterprise product teams that want deep product analytics combined with in-app guides and feedback across large user bases.

G2 rating: 4.4/5 ⭐

Pendo is a product experience platform that blends product analytics, user segmentation, in-app guidance, and feedback capture. Product teams use it to understand how users behave inside their product, target specific segments with contextual messaging, and measure adoption across features. It’s especially popular in larger or cross-functional orgs that need robust insights and governance.

Pendo key features

- Product analytics.

- In-app (web-based and mobile apps) guides & messaging.

- User segmentation.

- Session replay and discovery.

Pro

- Pendo’s comprehensive analytics make understanding user behavior in depth and correlating it with in-app experiences easy.

Con

- Reviewers say Pendo pricing is expensive, and setup requires significant time or technical support. Samantha, IT Manager, on G2, puts it simply:

Setting up Pendo to track and guide users is something that calls for developers guide. The pricing model for Pendo is something that is very expensive and premium.

Pendo pricing

Pendo offers a free tier for up to 500 monthly active users. It includes basic product analytics, in-app guides, NPS, and roadmaps.

Beyond that, pricing is custom-quoted, based on MAUs, and is sorted into Base, Core, and Ultimate tiers. And you can (and should) request a demo before committing to any of the three.

3. Hotjar

Best for: Digital marketers, product teams, and CRO professionals who want visual insights into how users interact with websites.

G2 rating: 4.3/5 ⭐

Hotjar is a qualitative analytics tool focused on user behavior. It visualizes website visitor interactions and captures direct user feedback. This helps product teams and marketers understand what users do on a site and why they behave in a certain way.

Hotjar key features

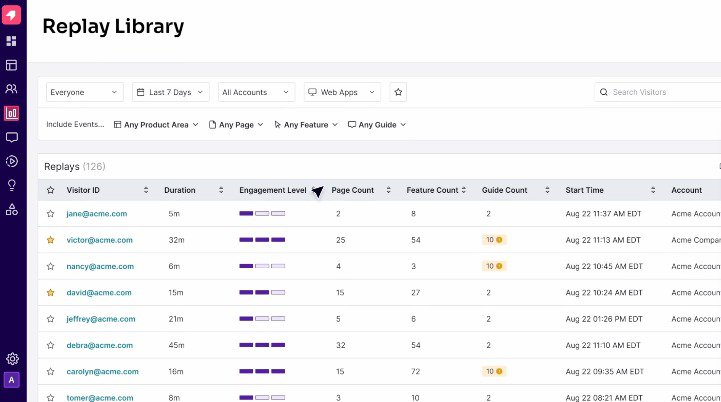

- Session recordings and playbacks of all visitor interactions.

- On-site polling (survey) and feedback widgets capture user sentiment.

- Filtering & Segmentation: Target sessions by behavior (e.g., rage clicks, errors).

- Integration with analytics, tag managers, and marketing stacks.

Pro

- Hotjar is intuitive and easy to set up. The best part is its powerful heatmaps and session replays, which make it easy to find UX issues fast.

Con

- Session recording limits and pricing structure on lower plans. Niccolo on Capterra shared more details:

The basic price above free is quite expensive. You cannot see trends and data for free. just heatmaps and recordings. You’re very limited to 35 recording/day on free plan. Also, in the recording sections, you can easily get overwhelmed by not-relevant recordings, where users just idle.

Hotjar pricing

Hotjar offers a generous free basic plan. It includes up to 200K monthly sessions with core features such as dashboard, Session Replay, and heatmaps.

The paid plans are

- Growth: $40/month billed annually.

- Pro and Enterprise: custom pricing.

4. UserTesting

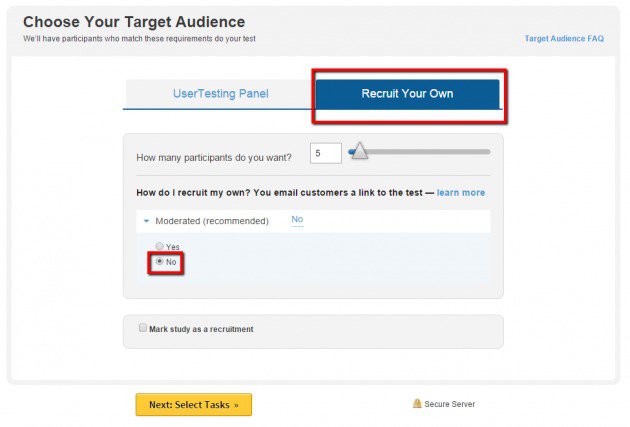

Best for: Teams and marketers that need fast, qualitative user feedback on websites, apps, and prototypes.

G2 rating: 4.4/5 ⭐

UserTesting is a user research and usability testing platform that helps teams gather feedback. The tool records video sessions, live interviews, and tests on digital experiences. This helps researchers and product marketers understand usability issues and customer perceptions straight from target users.

UserTesting key features

- Video & screen recording to capture users completing tasks and speak-aloud feedback.

- Participant Panel: Recruit testers based on criteria from a global pool.

- Built-in templates and dashboards to ease test analysis.

Pro

- UserTesting Panel gets a lot of raves from users. They say it’s easy to navigate, especially to recruit participants.

Con

- High pricing and costs make it less accessible for smaller teams. Hence, they’ll have to do a large qualitative data analysis with manual effort. Sameer S. said:

…some users have reported several drawbacks. These include high costs, particularly for smaller teams or startups, and the potential for overwhelming data volume without advanced analytics tools to distill key insights.

UserTesting pricing

It has three tiers (Advanced, Ultimate, and Ultimate+), and they all have custom pricing.

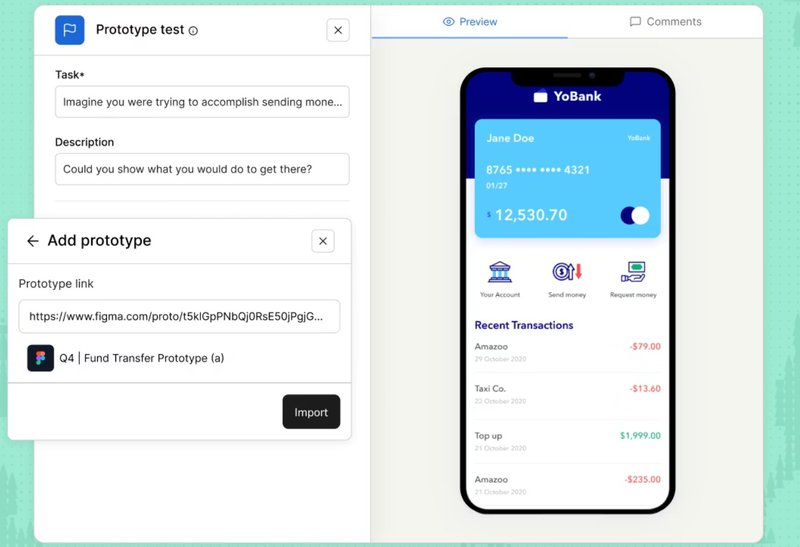

5. Maze

Best for: UX designers, product teams, and researchers who need to confirm prototypes, features, and flows with users.

G2 rating: 4.5/5 ⭐

Maze is a user research and product discovery platform with actionable, shareable insights. Product teams, designers, and researchers use it to run usability tests, prototype validations, and surveys. It integrates with design tools such as Figma, Adobe XD, and Sketch to streamline workflows.

Maze key features

- Prototype testing & task flows.

- Surveys & feedback collection for user responses linked to tasks.

- Heatmaps & metrics to visualize user clicks and completion rates.

- Automated and quick reporting.

Pro

- Users praise Maze’s intuitive interface and automated reporting.

Con

- The essential features are limited to paid tiers. According to Marledvuka on G2:

Maze has a free plan that lacks intensive testing capabilities. Some restrictions limits us from handling large projects.

Maze pricing

Maze offers a free plan with one study and five seats per month. The paid plan includes:

- Starter: $99/month.

- Enterprise: custom pricing.

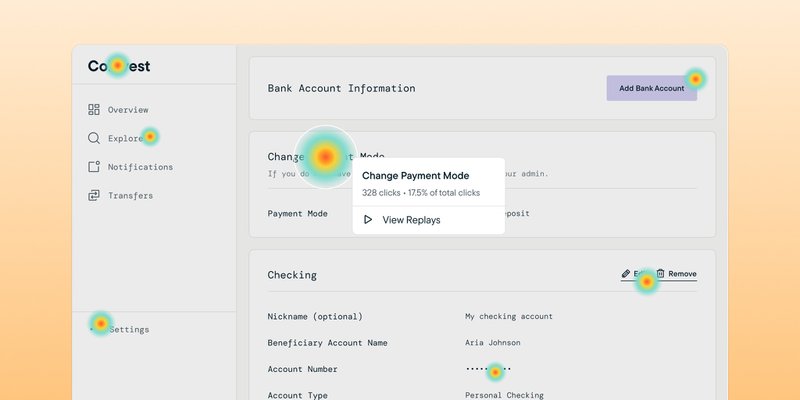

6. Sprig

G2 rating: 4.5/5 ⭐

Best for: UX researchers and product teams that need in-product user insights and behavioral analytics.

Sprig is an AI-augmented product experience and user research platform. CX, UX, and product teams use it to understand users’ behavior on apps and websites. And it works for both startups and enterprise environments.

Sprig key features

- In-product micro-surveys to capture contextual feedback where users interact.

- Session replays & heatmaps for visual behavioral analytics.

- AI-driven analysis for rapid insight synthesis.

Pro

- Users praise Sprig’s real-time insights collection. This user on G2, explained it more:

As a Product Manager, I love how easy and intuitive it is to understand the trends and themes at the survey and individual question level. I also enjoy being able to double-click into responses and identify the specific user that left feedback so I can follow up or investigate their usage on other platforms.

Con

- While Sprig is great for creating multiple study types, users have complained that its analytics could be better. Gab said:

Some analytics might not be enough for more advanced insights, which we need to delegate to other BI tools. Exporting data is not as straightforward as we thought.

Sprig pricing

It has a free trial with limited access. The paid tiers are three, and they are all custom pricing:

- Research Core.

- Digital Experience.

- Digital behavior.

7. Qualaroo

G2 rating: 4.3/5 ⭐

Best for: Real-time in-context customer feedback and surveys targeted to specific user behaviors across platforms.

Qualaroo is a feedback and survey tool that helps you collect insights from users. Product and growth teams use it to collect on-the-spot feedback (via Nudge™) on websites, inside apps, or via email.

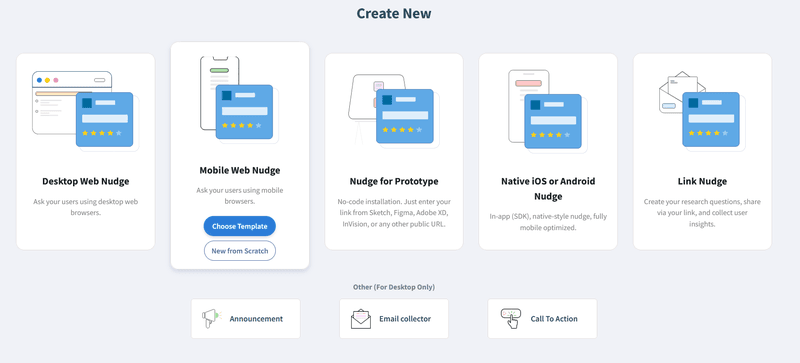

Qualaroo key features

- Nudges™.

- Advanced targeting & segmentation.

- NPS/CSAT/CES tracking and sentiment analytics.

Pro

- Users speak highly of Qualaroo’s targeting and customization. It segments users without disrupting the in-app or website experience. Akshay said:

We can throw up a survey in minutes without messing with a bunch of settings, which is great when we need quick feedback. The targeting options are solid too (we can ask the right people the right questions instead of blasting everyone).

Con

- While the tool is intuitive, it could use some dedicated tutorials for new users. This user said:

Would be nice if there were more customization options for the survey design. Also, while the tool is intuitive, having a bit more support for first-time users. maybe a built-in tutorial?

Qualaroo pricing

Qualaroo offers a generous free trial where you can enjoy up to 50 responses forever free. This also includes 500 emails & 10k pageviews.

The paid plans are three (billed annually):

- Essentials: $19.99/month.

- Business: $49.99/month.

- Enterprise: $149.99/month.

8. Survicate

G2 rating: 4.6/5 ⭐

Best for: Businesses needing omnichannel customer feedback and survey automation at a large scale.

Survicate is a customer feedback platform that creates surveys, gathers feedback across different channels, and analyzes results with AI. Product teams, marketers, and UX researchers use it to understand user behavior and measure satisfaction. It also helps make data-driven decisions to improve products and customer experience.

Survicate key features

- Multi-channel survey deployment (web, email, in-app, mobile).

- Smart analytics & dashboards with trend tracking.

- AI-assisted question building and response categorization.

- Integrations with CRM and tools like HubSpot, Salesforce, and Slack.

- NPS/CSAT/CES metrics to measure customer satisfaction.

Pro

- Survicate is known for its ease of use despite the many features it has.

Con

- While Survicate has flexible survey designs, its licensing structures are not as flexible. According to Ifeoma:

Survicate has unattainable licensing structures, which restrict growing companies from using this app. The app has numerous features that demand articulate settings, and this expands the learning curve or process.

Survicate pricing

Survicate has a free plan for beginners to collect up to 25 responses per month. The paid plan includes:

- Starter: $79/month.

- Growth: $49/month.

- Volume and Pro: $299/month.

- Enterprise: $499/month.

How to choose the right Qualtrics alternative for your team

Use this 3-way framework to reach a decision:

The integration test

Check whether data flows both ways. If you use Salesforce or HubSpot, for example, scores and responses should appear directly on contact or deal records. Otherwise, integrations will require data exports or add-ons. As a result, insights may stall, and adoption will follow.

The channel test

Ask where users naturally engage, and then, meet them there. For B2B SaaS, this meeting point is live inside the product. In this case, in-app feedback is a better fit than email surveys to capture intent in context. The latter (external channels) will arrive too late and dilute the behavioral signals.

The verdict

Product-led SaaS teams need tools that connect insight to action in context. In other words, choose a tool that makes you learn and act within the same workflow. For large, governance-heavy orgs, that’ll be enterprise research suites. In contrast, lightweight survey tools will suffice for simple research.

If your goal is (and should be) to understand why users churn and fix it fast, choose a tool like Userpilot. It triggers behavioral surveys, unifies data, and turns feedback into in-app action without delays.

Stop doing “research” and start driving growth

Research alone doesn’t move a product forward. Growth is only possible when feedback turns into decisions, and then into action.

Legacy research tools (like Qualtrics) miss that mark. They leave a gap between “learning” and “fixing.” Surveys get launched, reports get shared, and yet momentum stalls.

The right Qualtrics alternative closes that gap. It captures feedback in context, links it to real user behavior, and helps teams act without waiting on handoffs or long implementation cycles.

That’s where tools like Userpilot stand out. It helps product teams move from listening to improving in the same workflow.

If growth through improved customer satisfaction is the goal, book a demo now to test it!

Userpilot strives to provide accurate information to help businesses determine the best solution for their particular needs. Due to the dynamic nature of the industry, the features offered by Userpilot and others often change over time. The statements made in this article are accurate to the best of Userpilot’s knowledge as of its publication/most recent update on January 28, 2026.

FAQ

Who is the biggest Qualtrics competitor?

Qualtrics competes with platforms like Medallia, SurveyMonkey, and Userpilot. The enterprise data collection suites focus on governance and research depth, while the product-led tools focus on in-app feedback and actionable insights.

Is there a free version of Qualtrics?

Yes, but it is limited. Most meaningful features require paid plans and sales engagement. Many alternatives offer free trials or freemium plans with quicker time-to-value.

Is SurveyMonkey or Qualtrics better?

SurveyMonkey is a simpler (comes with survey templates), more flexible (custom branding), and cheaper survey software. Qualtrics is better for enterprise research programs. However, neither is ideal for in-product, customer feedback surveys and rapid iteration in SaaS.

Which survey platform is best?

The best CX management software and platform depends on your goal. For external research, enterprise tools work well. For SaaS teams focused not just on collecting customer experience surveys but also on activation, retention, and growth, in-product platforms like Userpilot are a better fit. Besides, it’s a drag-and-drop tool.