Switching off Mixpanel? Top Mixpanel Competitors & Alternatives to Consider

Mixpanel, while a robust product analytics platform for many, fails to meet the dynamic needs of modern Product-Led Growth (PLG) SaaS companies.

Its reliance on manual event tagging, lack of retroactive data, and siloed insights significantly hinder agility and prevent teams from truly understanding and acting on user behavior.

After extensive experience, I’ve found that evolving beyond Mixpanel is not just an option, but a necessity for driving real product adoption and growth.

This article details why those limitations are critical and explores the leading Mixpanel competitors, focusing on comprehensive, automated, and actionable solutions like Userpilot.

What’s your biggest challenge with tools like Mixpanel?

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

Why should you consider an alternative to Mixpanel?

While Mixpanel might be one of the more well-known names in the product analytics space, it has limitations that might not work for every team.

Here are some reasons you might consider other Mixpanel alternatives:

- Manual tagging slows development: One of the most persistent frustrations with Mixpanel is its heavy reliance on manual event tracking. This isn’t merely administrative overhead; it creates a substantial bottleneck that directly impacts product velocity. Engineering resources become heavily tied up, diverting valuable developer time away from building innovative features and crucial product enhancements. Critically, it also severely delays the ability to run experiments, test hypotheses rapidly, and launch new product iterations.

- Missing past data prevents deep retroactive analysis: Imagine launching a critical new feature, and a month later, you notice an unexpected drop-off in user engagement at a specific point. With manual event tracking, if that particular interaction wasn’t explicitly tagged in advance, that crucial data is simply lost forever. You cannot go back in time to analyze what transpired, making it impossible to diagnose root causes or uncover past behaviors. This profound lack of retroactive insight is a major drawback for product managers and data analysts alike.

- Siloed data limits organization-wide accessibility: Mixpanel, despite its strengths for data specialists, frequently fosters data silos. It is most effective for product managers and data analysts who possess a deep understanding of its specific data model and the intricate naming conventions of its events. However, what about vital cross-functional team members like UX designers, marketing specialists, or customer success representatives? These teams struggle to extract answers independently, often requiring technical assistance to pull reports or interpret dashboards.

Other reasons you might want to search for an alternative to Mixpanel are:

- You prefer a more intuitive and less complex solution: Mixpanel’s analytics are powerful but complex. Setting it up requires developers and manual tracking, which can slow down projects and make non-technical members dependent on technical support.

- You want to combine all your analytics needs in one place: Mixpanel is great at quantitative data, but lacks features like in-app surveys or autocapture for qualitative insights. This means you might need extra tools to fill the gaps, which complicates your tech stack and fragments your customer data.

- You want to cut costs: Mixpanel’s pricing is event-based, which means you pay for every user action it tracks, like button clicks, page views, or feature usage. As user activity grows, this can quickly get expensive. Considering it’s an analytics tool only, it’s not a cost-effective option.

What are the best Mixpanel alternatives and competitors: Comparison table

If Mixpanel doesn’t quite work for your team, there are plenty of other tools worth looking at.

Here are some top picks and what makes them stand out:

- Userpilot: Best for no-code analytics and engagement for product teams. Price starts at $299/month (billed annually), with a free trial available.

- Heap: Best for autocapture and live data feeds. Pricing available on request, with a free trial offered.

- Amplitude: Best for advanced user behavioral analytics. Free plan available; premium plans start at $49 per month.

- FullStory: Best for web analytics with visual insights like heatmaps and session recordings. Pricing based on user sessions, details available on request, with a free trial offered.

- PostHog: Best for cost-effective, self-hosted analytics solutions. Free plan available; paid plans based on usage.

- Hotjar: Best for qualitative insights like heatmaps, session recordings, and surveys. Free plan available; paid plans start at $39/month.

For a quick comparison:

| Tool | Best for | Key strengths vs. Mixpanel | Notable limitations | Pricing snapshot* | Choose when… |

|---|---|---|---|---|---|

| Userpilot | No-code analytics + engagement for product teams | Autocapture (no missed events), retro analysis, native session replay, in-app surveys (incl. NPS), and in-app guidance (tours, checklists) so you can analyze → act → measure in one place | Not a full CDP or classic web analytics tool; focused on product analytics & in-app | From $299/mo (annual); free trial | You want one platform to understand behavior and immediately drive adoption/retention without heavy dev work |

| Heap | Autocapture and retroactive analysis | Tracks user behavior automatically; retro tag later; live data feed; simpler path/journey views; built-in data governance | Can create “capture-everything” noise; lacks native in-app guidance/feedback—often needs extra tools | Pricing on request; free trial | You have limited engineering bandwidth and need fast time-to-value with historical analysis |

| Amplitude | Advanced behavioral analytics & experimentation | Deep cohorts/retention/pathing; built-in A/B testing & feature flags; ML insights; revenue/LTV analysis | Still relies on planned/manual event tracking; steeper learning curve for non-technical users | Free plan; paid from $49/mo | You have analytics resources and want enterprise-grade analysis + native experimentation |

| FullStory | Visual DX insights (replay + heatmaps) with product analytics | Best-in-class session replay, heatmaps, frustration signals (rage/dead clicks); strong qualitative context | Limited native feedback/in-app guidance; replay review can be time-intensive | Pricing based on sessions; free trial | Your priority is diagnosing “why” users struggle and fixing UX fast |

| PostHog | Cost-flexible, self-hostable product OS | Open-source + self-hosting; analytics + feature flags, A/B testing, replay, heatmaps in one stack; autocapture + SDKs | Some features feel more basic; free/self-hosted tiers may have retention/project limits | Free; paid usage-based | You need data control/privacy and like to own/extend your stack |

| Hotjar | Qualitative insights (heatmaps, recordings, surveys) | Heatmaps, session recordings, on-site surveys/interviews; great for understanding the “why” | Not a full event analytics platform; usually paired with a quant tool | Free; paid from $39/mo | You want quick, visual UX insights and direct user feedback |

| Mixpanel | Product analytics | Powerful funnels/flows/retention; fast self-serve at scale | Manual tagging, no retro data for untagged events, siloed access for non-analysts, event-based costs, basic replay | Event-based; can get expensive as volume grows | You have strong instrumentation/governance and mainly need deep quant analysis |

Explore other Mixpanel competitors and analytics tools alongside Adobe Analytics in Gartner’s report.

1. Userpilot

From my vantage point, Userpilot stands out as a genuinely exceptional choice, particularly for dynamic, product-led SaaS companies. It’s much more than just an analytics tool; it’s an all-in-one product growth platform meticulously designed to empower teams like mine.

Userpilot not only enables us to track customer behavior deeply but also provides the means to immediately act on those insights, driving adoption and retention without constant reliance on developers for every single change.

This comprehensive approach makes it a strong contender for product and marketing teams considering switching off Mixpanel.

Best analytics tool I have ever worked with

It is the most useful analytics tool I have ever seen in software industry. It has many good features like survey forms, onboarding tools, funnels, integrations etc. and also it is very easy to use as it is beginner friendly. — Anandkumar P., Information Technology and Services Company

Userpilot key features

- No-Code Product Analytics & Autocapture: Userpilot’s product analytics capabilities are purpose-built for product teams, offering a significant advantage over many traditional tools. We can effortlessly track product usage analytics, construct detailed funnels, analyze complex user paths, and segment users based on their behavior-all without writing a single line of code. This dramatically boosts our speed and flexibility. A cornerstone of this is our Autocapture feature, which automatically collects every click, text input, and form submission. This eliminates missed events and the need for upfront planning; the raw data is ready for retroactive analysis from the moment Userpilot is installed. We can easily use the Visual Labeler to turn these raw events into meaningful, labeled events for easy tracking and reporting, a stark contrast to Mixpanel’s manual setup.

- Session Replay & Visual Insights: We can literally replay user sessions to observe precisely how users interact with our product. This feature is invaluable for quickly identifying user friction points, understanding the “why” behind their actions, and seeing exactly where they get stuck. As a UX researcher, my team would attest that session replay is crucial for uncovering hidden insights, understanding nuanced customer behavior, and optimizing the overall user experience. You can even read how a product designer leverages session replay to inform their work, offering a depth of insight beyond Mixpanel’s basic offerings.

- In-App Feedback: Userpilot provides robust, native in-app surveys, including industry-standard NPS surveys and fully customizable forms. This allows us to collect direct customer feedback in real-time and in-context, helping us gauge user sentiment and iterate on product improvements with speed and confidence. This is a critical component for understanding the “why” that Mixpanel often misses.

- In-App Guidance: Beyond its powerful analytics, Userpilot empowers you to directly influence user behavior by creating engaging product tours, interactive user guides, contextual checklists, and comprehensive resource centers. These tools directly drive user adoption, activation, and feature discovery. The integrated AI-writing assistant is an excellent feature for generating or refining content for these in-app experiences, saving even more time and making it a standout among Mixpanel competitors for proactive product growth.

- Mobile app and email support: Userpilot extends its robust capabilities to mobile and email, offering comprehensive mobile analytics and engagement features. This enables us to easily build captivating carousels, informative slideouts, and targeted push notifications for both iOS and Android applications, ensuring a consistent product experience across all user touchpoints.

- Cross-Functional Team Collaboration: Userpilot is inherently designed for broad team use. Its intuitive, no-code builder means product managers can quickly create onboarding flows, launch feedback surveys, and analyze data without needing to write a single line of code. UX designers can leverage session replays and our upcoming heatmap features to directly inform UX improvements. Marketers can segment users and trigger personalized in-app messages to boost customer engagement and feature adoption. This commitment to data democratization empowers every team member to move faster and collaborate more effectively, directly addressing Mixpanel’s data silo issue.

- Data Sync & Integrations: Userpilot integrates seamlessly with essential tools like HubSpot, Salesforce, Amplitude, Heap, and even Mixpanel itself, allowing for a comprehensive data sync and a unified view of the customer journey analytics across your entire tech stack. Furthermore, Userpilot enables you to export raw event data directly to your data warehouse, offering unparalleled flexibility for custom analyses and deeper connections to business outcomes.

Userpilot limitations

Userpilot is primarily focused on web and mobile in-app experiences and analytics. While it boasts extensive integrations, it is not designed to be a full-fledged customer data platform (CDP) or a traditional web analytics tool, such as Google Analytics, which primarily focuses on initial acquisition traffic and general website performance metrics. However, for deep product analytics and in-app engagement, it consistently outperforms many specialized tools.

Userpilot vs Mixpanel: When to choose which

| Choose Userpilot when… | Choose Mixpanel when… |

|---|---|

| You want one platform to analyze and act (analytics + in-app guides, surveys, session replay). | You need deep, high-scale product analytics with advanced self-serve reports. |

| You prefer faster time-to-value with event autocapture before full tagging. | Your team is comfortable instrumenting events and managing schema/governance. |

| You want to ship in-app experiments/fixes without engineers and measure impact. | You’ll keep analytics and pair with other tools for engagement or surveys. |

| You like MAU-based pricing and optional add-ons (e.g., session replay, email, mobile). | Event-based pricing matches your budgeting, and you track high event volumes. |

| You need qual + quant in one place (surveys, replays, usage) to find the “why.” | You mainly need quant analytics (funnels, flows, retention, cohorts, metric trees). |

| You value role-based signals (PQLs, churn risks) tied to in-app actions. | You want real-time exploration across very large datasets. |

| You want no-code onboarding tours, checklists, banners, and surveys connected to analytics. | You have existing data pipelines/CDPs and want a mature analytics destination. |

| You prefer fewer tools and less integration overhead. | You’re fine with a best-of-breed stack and multiple vendors. |

| Your PM/CS/Marketing teams need a shared workspace to go from insight to outcome. | Your analyst/PM power users live in analytics daily and need maximum depth. |

| You plan to start quickly, then scale with AI-assisted insights and experiments. | You already run Mixpanel widely and want to double down on its analytics strengths. |

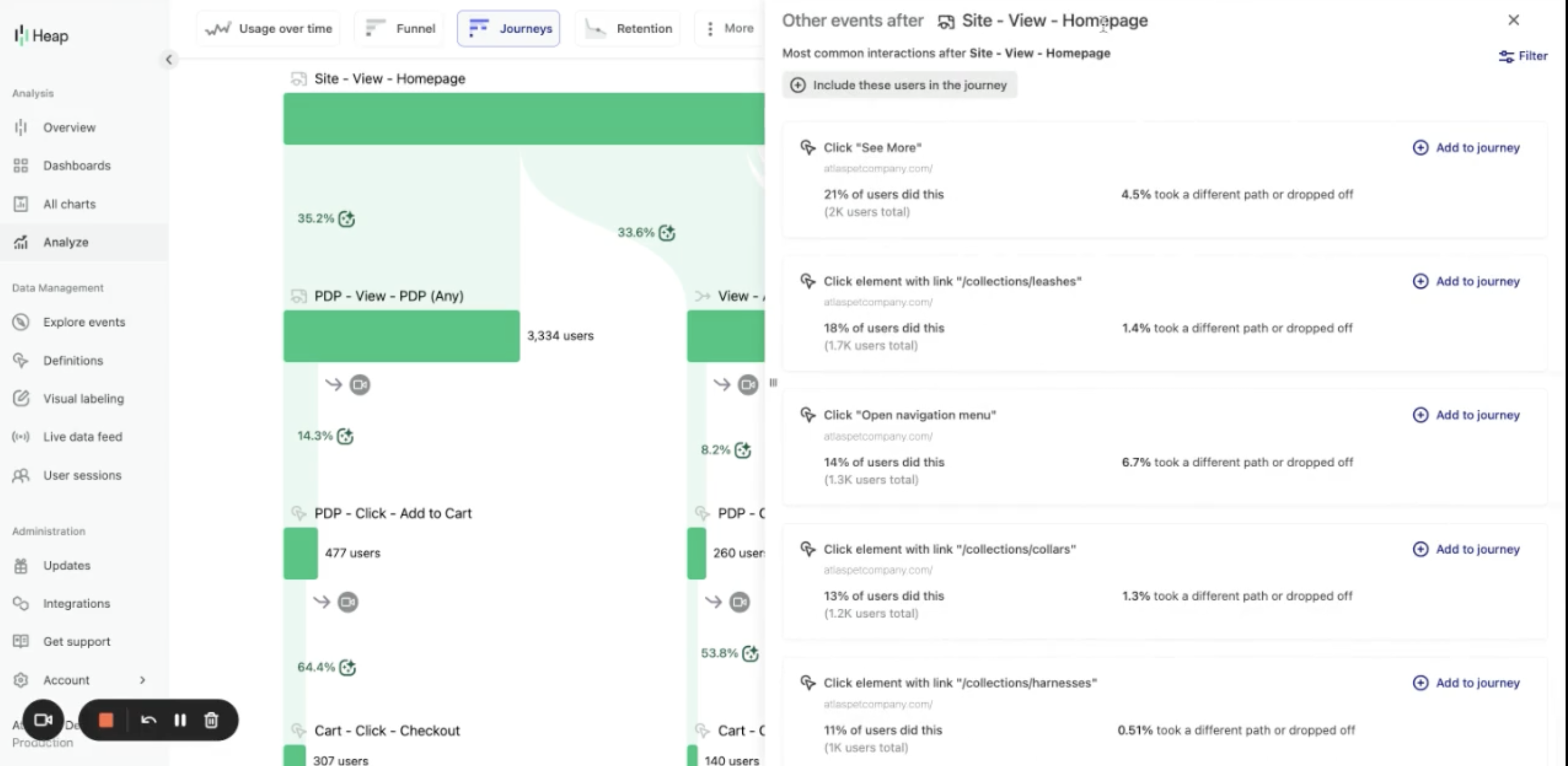

2. Heap

Heap is a popular choice for teams eager to significantly reduce the burden of manual event tracking. Its robust autocapture feature is a major selling point, allowing you to collect comprehensive user behavior data retroactively without requiring developers to tag every single event upfront.

This automatic data collection capability is notably similar to Userpilot’s autocapture, which my team finds incredibly valuable for agile development and a primary reason many consider it a leading Mixpanel competitor.

Learn more about Heap.

Heap key features

- Autocapture and post capture: Unlike Mixpanel, Heap automatically tracks all user interactions without requiring manual setup or coding, which saves you a lot of time and effort.

- Live data feed: Heap also offers real-time user behavior tracking, a feature Mixpanel doesn’t have, so you can act on insights immediately.

- User Journeys: Like Userpilot’s Paths, Heap helps you analyze customer journeys within your product. This can be a much simpler way to understand user flows compared to Mixpanel’s complex setups.

- Data governance: Heap has built-in features to clean, organize, and manage event data, which helps you get more accurate insights.

- Acquisition analysis: It offers clear insights into the performance of all your acquisition channels, which makes it easier to compare and analyze their effectiveness.

Heap limitations

While it captures an immense amount of raw data, effectively making sense of it all can sometimes be overwhelming without clear analytical goals. It lacks robust native in-app guidance or integrated feedback tools, meaning you’ll likely need to integrate other platforms for those crucial functions, adding to tech stack complexity.

For more comprehensive insights into tools that combine analytics with action, consider exploring Heap alternatives.

Heap vs Mixpanel: When to choose which

| Choose Heap when… | Choose Mixpanel when… |

|---|---|

| You want quick time-to-value with automatic capture of clicks, page views, and form interactions (minimal upfront tagging). | You need deep, precision event analytics with deliberate manual instrumentation and tight schema control. |

| You prefer to define events later and run retroactive analysis on past behavior. | You plan to build complex funnels, flows, retention and cohort analyses at scale. |

| Your team has limited engineering bandwidth and wants less dependency on dev cycles. | You have analytics/engineering resources to manage tracking, naming conventions, and governance. |

| You’re early-stage or exploring patterns and want to discover what matters before hardening the schema. | You require high-performance querying, custom properties, and fine-grained segmentation for power users. |

| You value broad behavioral coverage out of the box to spot obvious UX issues quickly. | You need rigorous accuracy and prefer to track only what you intend, not “everything by default.” |

| You want to reduce tool setup overhead and start learning fast. | You already run a best-of-breed data stack/CDP/warehouse and want a mature analytics destination. |

| You’re okay managing potential signal vs. noise trade-offs from auto-captured data. | You want clean, governed datasets with strong naming/versioning discipline over time. |

| Product managers need self-serve insights without heavy training. | Analysts/PM power users live in analytics daily and demand maximum depth and flexibility. |

| You’ll pair auto-captured insights with lightweight dashboards and quick wins. | You aim for advanced experimentation and metric trees tied to business KPIs. |

| You’re budget-sensitive and want lower lift to start, then refine as you grow. | You expect large event volumes and need real-time exploration and performance. |

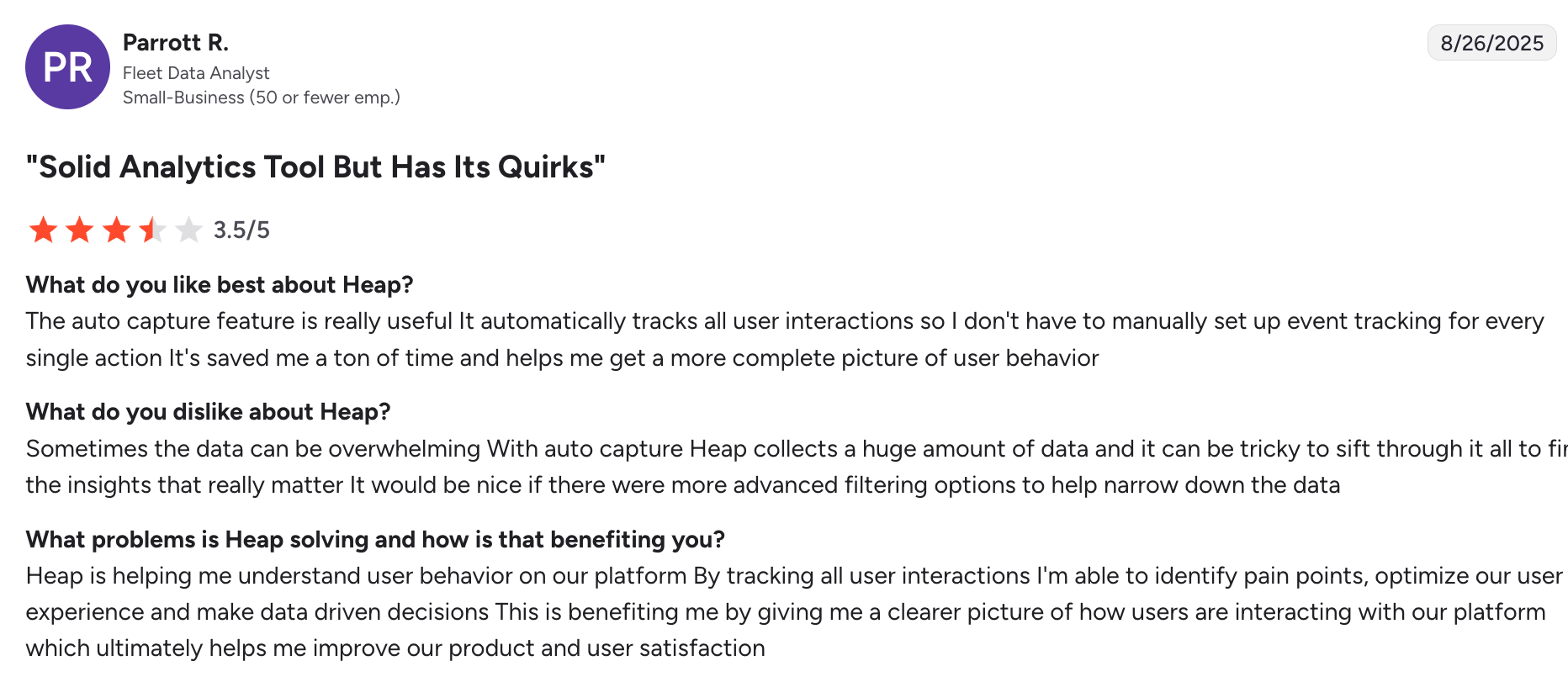

3. Amplitude

Amplitude stands as another powerful product analytics platform, specifically designed to help teams deeply understand user behavior with the goal of optimizing feature usage and driving higher engagement. It is frequently compared directly to Mixpanel due to its extensive event-tracking and behavioral analytics capabilities, making it a direct Mixpanel competitor for advanced analytical use cases.

Amplitude offers exceptionally strong behavioral analytics, highly flexible user segmentation, robust feature management tools, and comprehensive A/B testing capabilities. It also provides AI assistance for surfacing deeper, more actionable insights from your data, particularly useful for understanding complex user journeys and optimizing product flows.

Learn more about Amplitude.

Amplitude key features

- Behavioral cohort analysis: Amplitude’s cohort analysis is more advanced than Mixpanel’s, with different user segments and more options to help you analyze user retention and behavioral trends over time.

- Revenue tracking: Amplitude is also good at giving insights into financial impact by directly tracking revenue and lifetime value. This is not something Mixpanel offers natively.

- Built-in A/B testing: Compares user behavior in experiments to see which product changes work best. Unlike Mixpanel, Amplitude has this A/B testing feature built in.

- Comprehensive pathfinder reports: Amplitude’s path analysis maps complex user journeys in detail, whereas most tools tend to be more limited.

- Machine learning insights: Amplitude also uses machine learning and predictive analytics to highlight retention trends and user predictions.

Amplitude limitations

Much like Mixpanel, Amplitude still relies on a predominantly manual event tagging approach for specific, custom events. This means you typically need to define and instrument events beforehand, which can lead to similar retroactive data gaps if not meticulously planned and maintained.

Its learning curve can also be quite steep for non-technical users, requiring dedicated data analysts to extract its full value.

Discover more by checking out our Amplitude alternatives for broader functionality.

Amplitude vs Mixpanel: When to choose which

| Choose Amplitude when… | Choose Mixpanel when… |

|---|---|

| You want analytics + native experimentation/feature flags in one stack (Amplitude Experiment). | You want experimentation + feature flags tightly connected to analytics, or to analyze flags from any provider inside Mixpanel. |

| You like Amplitude’s MTU-based pricing (with event caps per MTU) and an on-site calculator. | You prefer event-based pricing with 1M monthly events free and add-ons as you scale. |

| You want built-in Session Replay alongside analytics and experiments. | You want Session Replay inside Mixpanel (web & mobile) with simple SDK enablement. |

| You like having a CDP/activation layer from the same vendor (Amplitude CDP/Activation). | You prefer piping data to/from your warehouse and other tools using Mixpanel’s Data Pipelines and Warehouse Connectors. |

| Your team wants AI-guided workflows and a broad growth suite under one roof. | Your power users live in self-serve analytics (funnels, flows, retention, cohorts) and want fast querying at event scale. |

| You value retro analysis + qualitative context (replay) to validate experiments. | You need flexible integrations and the option to bring your own flags/experiments and still measure outcomes in Mixpanel. |

| You prefer a single-vendor approach for analytics, testing, and data activation. | You’re best-of-breed oriented and want analytics that plug cleanly into a wider data stack (CDP, warehouse, feature flagging). |

| You want governed MTU usage (events per MTU limits defined by plan). | You want clear event accounting with documented Free/Growth/Enterprise tiers. |

| You’re leaning into product-led experimentation with first-party tooling. | You want newer first-party flags/experiments from Mixpanel tied to behavioral cohorts. |

| You want one vendor to manage analytics + experiments + replay now. | You prioritize price transparency at an event scale and like Mixpanel’s calculator. |

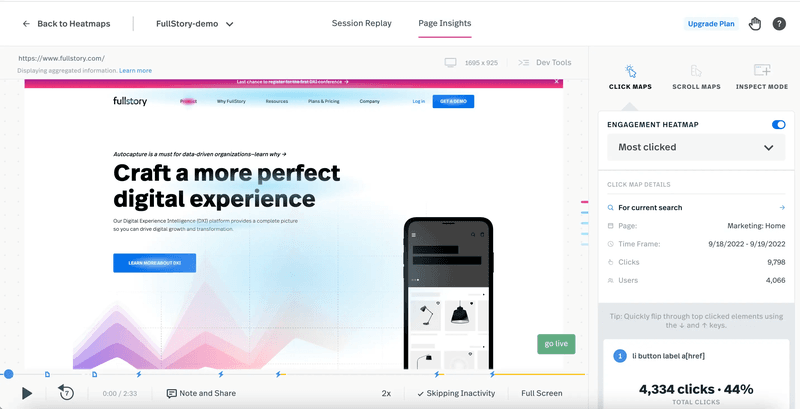

4. Fullstory

Fullstory is renowned for its “digital experience intelligence” approach, which expertly merges robust product analytics with advanced session replay capabilities and workflow optimization tools.

It excels at providing a deep, holistic understanding of the entire user experience by visualizing every user interaction data, offering a unique perspective compared to traditional Mixpanel competitors.

Fullstory offers truly excellent session replay features, often enhanced with AI-powered summaries, and is highly effective at identifying critical frustration signals like rage clicks and dead clicks. It combines this with solid product analytics, comprehensive customer journey analysis, and workflow optimization tools tailored for digital teams. Fullstory provides a full picture of the user’s interaction journey, capturing all technical and behavioral data.

Fullstory key features

- Heatmaps and click maps: Helps you visualize data, like where users click, scroll, or focus most on a page. Note that Mixpanel lacks heatmap functionality.

- Rage click detection and frustration signals: FullStory automatically flags moments of user frustration so you can quickly fix UX issues. Mixpanel doesn’t track user frustration signals.

- OmniSearch: Helps you locate specific user sessions, events, or interactions in large datasets. This detailed search capability is missing in Mixpanel.

- Session recordings: Unlike Mixpanel, FullStory allows you to replay user sessions in real time or on demand, offering a clear view of how users navigate your product.

Fullstory limitations

It lacks robust direct user feedback tools such as native surveys or polls, and doesn’t offer native in-app guidance capabilities to act on insights within the product itself. It can also be less effective at quantifying direct revenue impact from specific UX issues compared to platforms designed for that purpose.

Aligning and disseminating insights across diverse teams might also be challenging due to its strong focus on session replay as the primary output, which can be time-consuming to review at scale.

Compare further with Hotjar vs. Fullstory for more details on qualitative experience platforms.

Fullstory vs Mixpanel: When to choose which

| Choose FullStory when… | Choose Mixpanel when… |

|---|---|

| You want qualitative-first insights with best-in-class session replay and heatmaps to see why users struggle, then jump from a metric to the exact playback. | You need deep quantitative analytics — Funnels, Flows, Retention, Cohorts, and Metric Trees — with fast self-serve exploration. |

| You prefer autocapture to log all interactions automatically and enable retroactive analysis without prior tagging. | Your team prefers manual event instrumentation for high precision and schema control. |

| You want product analytics tied directly to replays, allowing you to investigate issues visually. | You like having analytics + native session replay in one platform for root-cause analysis. |

| Your focus is UX research and troubleshooting — identifying friction points, rage clicks, and broken journeys. | Your focus is growth analytics — understanding what drives activation, retention, and feature adoption. |

| You’re comfortable with a “capture a lot” approach and managing signal vs. noise later with filters and governance. | You want clear event-based pricing and robust data governance, privacy, and masking controls. |

| You value visual storytelling over numerical depth — insights that designers, PMs, and CS teams can act on quickly. | You value analytical rigor — insights for PMs, analysts, and data teams driving strategic product decisions. |

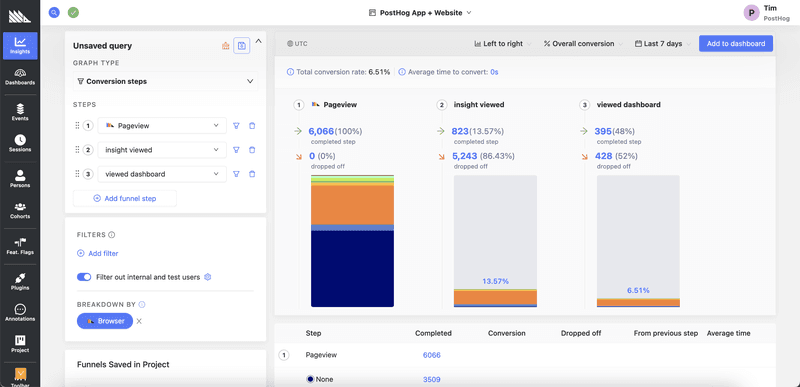

5. PostHog

PostHog is an open-source product analytics tool known for being simple, affordable, and flexible. Unlike most competitors, including Mixpanel, it allows self-hosted deployment, so you can have full control over your data and privacy.

Overall, PostHog is a solid choice for teams of all sizes, from startups to enterprises, that want advanced analytics without breaking the budget.

PostHog key features

- Open-source platform: Unlike Mixpanel and other tools on this list, PostHog is fully open-source. This gives you a lot of flexibility to access, modify, and customize the tool to suit your needs.

- Self-hosting option: Offers you full control over your data and privacy, ideal for security-conscious teams.

- Built-in feature flags: Lets you roll out, test, and control new features. Mixpanel requires third-party tools to achieve this.

- Event-based analytics: Tracks user actions at a granular level, similar to Mixpanel, but with the flexibility of open-source customization.

- A/B testing: Allows you to compare the impact of product changes directly within the platform, a feature Mixpanel offers, but without PostHog’s self-hosting advantage.

PostHog limitations

PostHog offers many features, but some feel basic compared to tools like Mixpanel. For example, its dashboards have limited customization options, which makes it harder to tailor reports. Its free and self-hosted plans also come with restrictions like shorter data retention and fewer projects.

PostHog vs Mixpanel: When to choose which

| Choose PostHog when… | Choose Mixpanel when… |

|---|---|

| You want open-source roots and the option to self-host for strict data control and privacy needs. | You want mature, battle-tested product analytics with highly polished self-serve reporting at scale. |

| You prefer a single product OS: analytics + feature flags, A/B testing, session replay, and heatmaps in one stack. | Your core need is deep quantitative analysis (funnels, flows, retention, cohorts, metric trees) with fast query performance. |

| You like automatic capture plus SDKs, then defining key events later (retro analysis) as your schema hardens. | You’re comfortable with manual event instrumentation and tight governance for accuracy and long-term maintainability. |

| You want experimentation tightly integrated with analytics and flags managed by the same team. | You may use any flag/experimentation tool but still analyze outcomes centrally in Mixpanel. |

| You need cost flexibility (self-hosting or usage-based cloud) and the ability to tailor the stack yourself. | You prefer a cloud analytics destination with robust integrations, workspace controls, and enterprise-grade admin features. |

| Your team is product-/engineering-savvy and likes to tinker, extend, or keep data in your own infra. | Your analysts/PMs are power users who live in reports daily and need maximum speed, segmentation depth, and reliability. |

| You want replay + analytics primarily for UX troubleshooting + iteration inside one toolkit. | You want analytics + (newer) native replay primarily for growth analysis across large event volumes. |

| You care about owning the pipeline (ingest, transform, route) and reducing tool sprawl with an all-in-one approach. | You’re fine with a best-of-breed stack (CDP/warehouse/ETL) and want analytics that plug cleanly into everything else. |

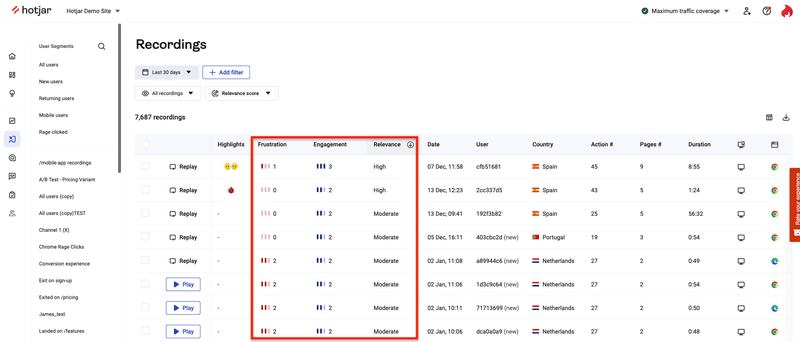

6. Hotjar

Hotjar distinguishes itself by focusing intensely on qualitative data, helping teams truly understand the “why” behind user behavior. It’s an excellent tool for visually interpreting user interactions and directly gathering user feedback, making it a staple for UX research.

This platform is trusted and used by 1.3+ million websites and apps, offering a different lens compared to traditional event-based analytics and serving as a qualitative Mixpanel alternative.

Unlike Mixpanel, which is more geared toward product analytics, Hotjar is all about user research. By combining behavioral data with direct user feedback, you can understand not just what users do, but why they do it.

Learn more about Hotjar.

Hotjar key features

- Heatmaps: Shows you where users click, scroll, and move on a page so you can identify areas of interest or confusion. While some other tools, like FullStory, also offer this, Mixpanel doesn’t.

- Surveys and feedback widgets: Collects user feedback to understand their needs and frustrations, which Mixpanel lacks as it doesn’t include in-app survey tools.

- Engagement zones: Highlights parts of a page that users engage with the most, so you can improve page layouts.

- Session recordings: Let you replay user sessions to see their journey and identify issues; Mixpanel doesn’t offer this feature.

Hotjar limitations

It is important to note that Hotjar is not a comprehensive product analytics platform in the same vein as Mixpanel or Amplitude. While it reveals how users interact visually and what they say, it doesn’t offer event-based analytics, detailed funnel analysis, or complex user path analysis.

You will almost certainly need to pair it with another tool for quantitative behavioral data to get a complete picture, as it fills a different niche than many other Mixpanel competitors.

Some users find Hotjar’s pricing expensive compared to similar tools, especially for features like feedback and session recordings. While there is a free plan, it comes with restrictions on recordings, page views, and data storage, which might not be enough for small businesses with high traffic.

Consider exploring Hotjar alternatives for more options that might integrate qualitative and quantitative.

Hotjar vs Mixpanel: When to choose which

| Choose Hotjar when… | Choose Mixpanel when… |

|---|---|

| You want qualitative UX insights first: heatmaps, session recordings, and on-site surveys/interviews (Observe, Ask, Engage) to see why users struggle. | You need deep quantitative analytics: powerful Funnels, Flows, Retention, Cohorts, Metric Trees, and fast self-serve analysis at scale. |

| You prefer a quick setup with minimal instrumentation and can layer in Trends plus simple Funnels for lightweight quant. | Your team will instrument events and maintain a clean schema for high accuracy and governance. |

| You want to watch journeys and then link directly from issues in Trends/Funnels to the underlying recordings/heatmaps. | You want analytics + replay in one place so you can jump from a drop-off to Session Replay (web & mobile app) for root-cause analysis. |

| Your priority is UX optimization and research (e.g., run user interviews with Engage) over advanced behavioral modeling. | You’re optimizing product growth metrics with complex segmentation and queries across large event volumes. |

| You like modular pricing by product (Observe / Ask / Engage) and want to start small. | You prefer a single analytics destination that plugs into your broader data stack and scales with event volume. |

Looking to migrate from Mixpanel?

If Mixpanel’s complexity or pricing isn’t working out for you, it’s time to move on. Consider Heap for in-depth user research, or PostHog for a more affordable, self-hosted option.

For a more complete solution with no-code analytics and autocapture, Userpilot might be the right choice. If you’re ready to migrate, Userpilot makes it easy with bulk import API. Transfer data from any analytics tool, including Mixpanel, and get up and running quickly without losing valuable insights.

Schedule a Userpilot demo to see how it can support your product goals.

FAQ

What are the main competitors of Mixpanel?

The primary competitors to Mixpanel in the evolving product analytics space include Userpilot, Heap, Amplitude, Google Analytics (GA4), Hotjar, Pendo, and Fullstory. Each of these platforms offers a distinct blend of analytics capabilities, user experience insights, and in-app engagement features, catering to diverse organizational needs and serving as strong Mixpanel alternatives. The best choice depends on your specific focus, whether it’s deep behavioral analytics, qualitative insights, or integrated product experience orchestration.

Is Userpilot better than Mixpanel for product-led growth?

From my professional experience as a PLG marketer, Userpilot offers a demonstrably more comprehensive and integrated solution for modern product-led SaaS companies, making it a superior choice for driving growth. It uniquely combines automatic event tracking (Autocapture), session replay, integrated in-app surveys (including robust NPS), and powerful in-app guidance (like intuitive product tours and actionable checklists) into one seamless, no-code platform. This empowers product, marketing, and customer success teams not only to deeply understand user behavior but also to proactively improve it without heavy reliance on developers. Userpilot excels at providing actionable insights that directly drive product adoption, activation, and retention, effectively addressing key limitations found in Mixpanel for PLG use cases and making it a top contender when considering switching off Mixpanel.

Can I use Userpilot and Mixpanel together?

Absolutely, you can! Userpilot offers a direct and robust Mixpanel integration. This valuable feature allows you to effortlessly send all Userpilot event data, such as flow completions, survey submissions, and specific button clicks, directly to your Mixpanel account. This capability significantly enriches your existing Mixpanel data with nuanced insights derived from Userpilot’s in-app experiences, helping you construct a much more complete and actionable picture of overall user engagement and product interaction. So, even if you’re not fully switching off Mixpanel immediately, Userpilot can enhance your current analytics stack.