“The customer’s voice is the most valuable asset you have—if you know how to listen,” says Julie Zhuo, former VP of Design at Facebook. Yet in 2025, while 92% of companies run customer surveys, studies by Gartner show 75% of them are asking the wrong questions at the wrong time—turning potential insights into mere noise.

The gap between gathering feedback and gaining valuable insights is costing companies millions in missed opportunities and lost customers. In this article, we’ll explore how to run customer feedback surveys that bring actionable insights based on our internal analysis of hundreds of surveys.

What is a customer feedback survey?

A customer feedback survey is a questionnaire asking a user for their comments, opinions, and feelings about your product.

These surveys cut through assumptions by revealing both general user sentiment and granular pain points in the user experience. Armed with this data, you can make confident decisions about product improvements and prioritize changes that actually matter to your customers.

Are customer surveys the best feedback collection method?

There’s no right answer to that question. Customer feedback surveys work well for specific circumstances and goals.

If you’re looking for a fast and cost-effective way to collect feedback at different stages of the product lifecycle, surveys are an excellent choice.

Let’s take a closer look at the pros and cons of user feedback surveys.

Benefits:

- Scalability: Surveys are a quick and cost-effective way to reach a large audience.

- Structured data: The uniformity in the type and format of responses makes it easier to analyze patterns over time.

- Flexibility: You can use surveys to collect feedback at any stage of the product lifecycle, from concept testing and prototyping to post-launch.

- Targeted and specific feedback: It’s possible to tailor surveys to specific user segments and collect highly targeted insights.

Limitations include:

- Risk of bias: You might not be able to ask follow-up questions to clarify users’ responses. As a result, you may be left having to do some guesswork using the collected data, which could include a variety of biases like non-response, recency, confirmation, and anchoring. This could skew your insights from the survey.

- Risk of fatigue: Surveys that appear on the screen every few minutes disrupt the customer experience and drive users away.

What’s the main reason you’re exploring customer feedback surveys?

How do you prefer to analyze feedback?

It’s clear you need a powerful and flexible solution for your customer feedback surveys.

Userpilot lets you launch targeted surveys (like NPS, CSAT, PMF, and more) contextually, pair quantitative and qualitative data, and act on feedback instantly—all without writing a single line of code.

Types of customer feedback surveys

Depending on your goal, you can choose from different types of customer feedback surveys, such as:

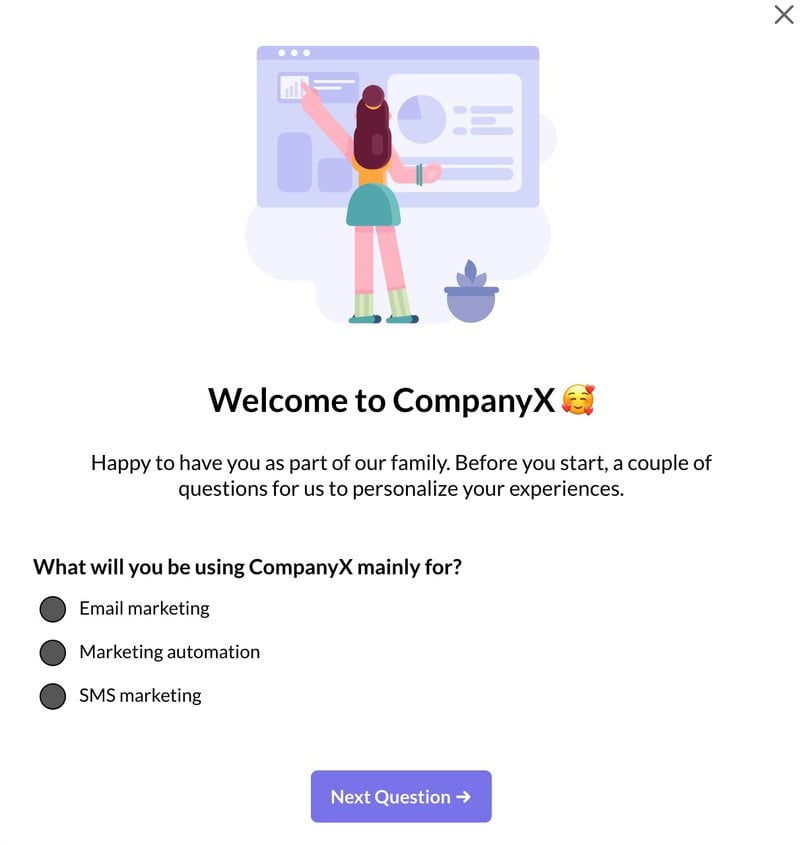

- Welcome surveys: These are surveys that you send to users right after they sign up to understand a user’s expectations and jobs to be done. The data collected via these surveys can help you craft personalized onboarding flows for users.

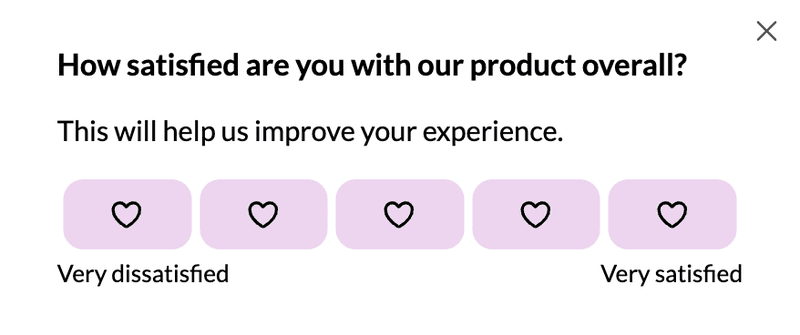

- Customer satisfaction (CSAT) score surveys: These surveys ask users how satisfied they are with a certain aspect of your product – be it specific features, or customer support. They usually include a rating scale question, followed by an open-ended question where users can explain why they feel a certain way.

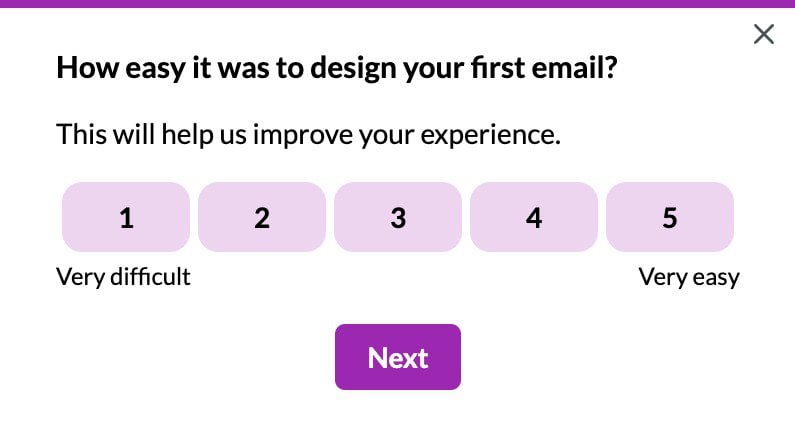

- Customer effort score (CES) surveys: They help you measure how much effort users have to make to perform specific tasks. So, it makes sense to deploy them right after a user completes an action. The recency of the experience ensures that users give accurate responses, enabling you to spot issues quickly.

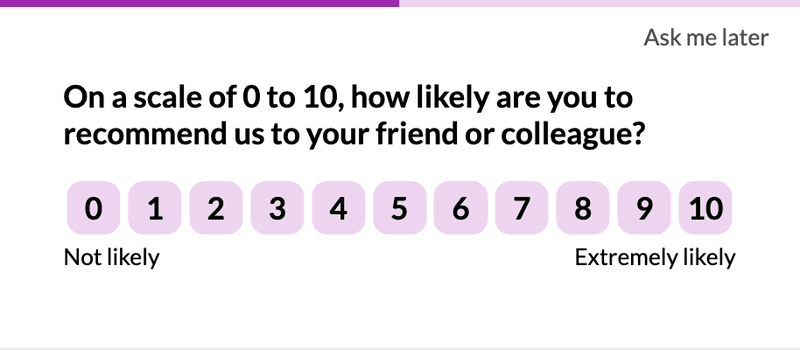

- Net Promoter Score (NPS) surveys: They provide insights into customer sentiment and loyalty by asking how likely they are to advise others to use your product. Based on NPS survey responses, you can divide users into 3 segments—promoters, passives, and detractors. You should work on the concerns of detractors and passives to increase your retention rate, so be sure to ask them follow-up questions.

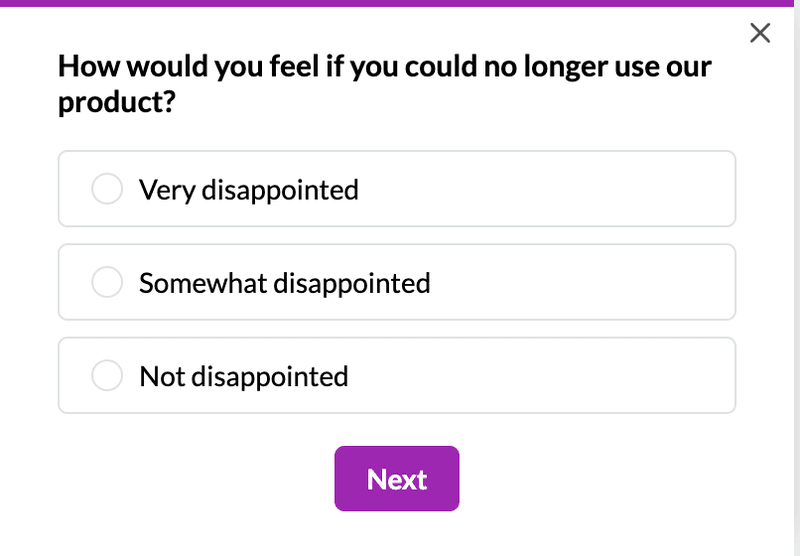

- Product-market fit surveys: These surveys help you understand how well your product aligns with user needs. Typically, they include a question like “How disappointed would you be if you could no longer use our product?” Typically, according to the Sean Ellis test, if the “Very disappointed” category makes up 40% or more of the responses, you’ve achieved product-market fit.

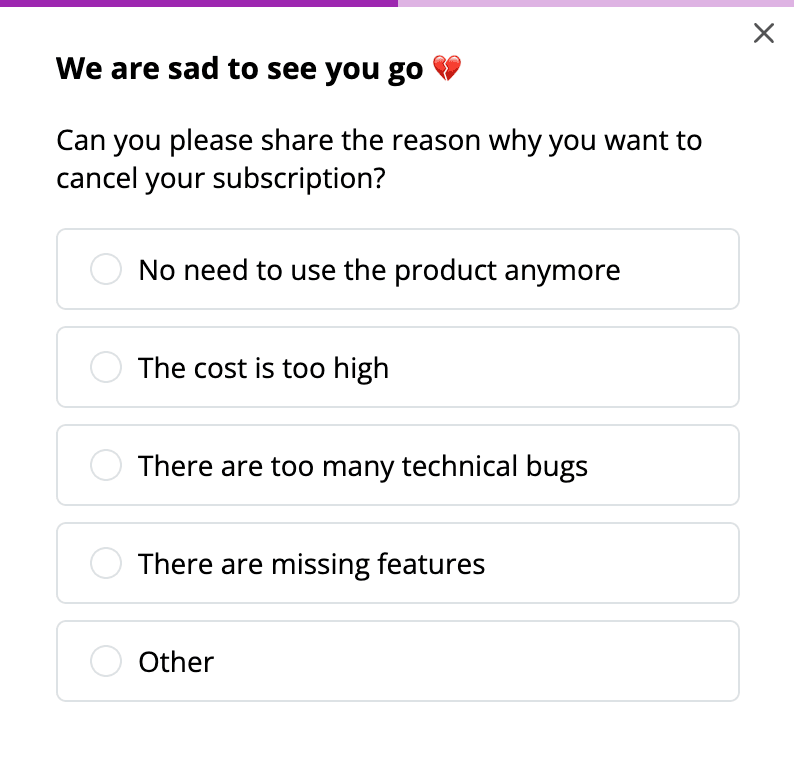

- Exit surveys: Also known as churn surveys, exit surveys ask users why they decided to stop using your product. They help you identify specific factors that cause churn, such as poor customer support or a steep learning curve. Resolving them will help you win customers back.

Best practices for creating customer feedback surveys

Now that you have a clear idea of different types of customer feedback surveys, here are a few tips to make the most of them:

Mix different question types for comprehensive insights

You must use both close and open-ended questions for your surveys as they can help you collect nuanced feedback, enabling you to act better on it.

Close-ended questions are those that offer pre-defined answer options to users. They come in different formats like multiple-choice, rating scales, or yes/no answers. And they are a win-win for both customers and you as they’re easy for users to answer and simplify analysis for you. This way, you can find trends and patterns in data quickly.

Open-ended questions give users the option to write detailed feedback and could be in the form of text, videos, images, or even interviews. They offer insights into the reasons behind specific ratings and reactions. At the same time, users get to talk at length about their problems. Using them, you can identify the factors behind certain trends you’ve observed with close-ended questions.

Avoid flooding surveys with too many open-ended questions, though, as they take longer to answer.

Write clear and unbiased survey questions

Your surveys (and questions) should be short, but they must convey the right meaning to users. And that makes it important to phrase your questions correctly. A weirdly structured question could lead to inaccurate responses.

Typically, avoid using:

- Leading questions that include some sort of an assumption or direct the users toward a particular answer.

- Loaded questions that are complex and include assumptions about your users.

- Double-barreled questions that involve collecting customer feedback on multiple topics. Here’s an example:

A good idea for writing clear questions is to read your questions from the users’ perspective and figure out if they convey the required message. Test them out with a few of your colleagues and collect their feedback as well.

Trigger your customer feedback surveys contextually

Imagine this—you purchase a new product, and after a week, you receive a survey asking about your experience. The chances are you won’t remember the nitty-gritty of what you liked (or didn’t like) about it.

That’s what happens with poorly timed surveys. They get vague responses (or none at all). On the other hand, when you send a survey when the experience is still fresh in users’ minds, they’re more likely to respond with thoughtful answers.

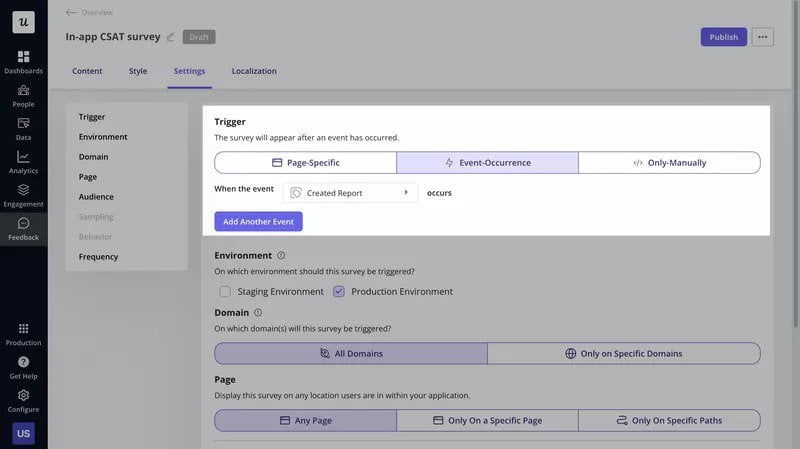

But how do you get the timing of feedback surveys right? The answer is event-based triggering.

With event-based triggers, you can send surveys when users perform specific actions or complete key milestones. For instance, you could launch a CSAT survey after a user talks to a customer support agent.

Localize your customer satisfaction surveys

Translating surveys to a user’s native language makes them more personal, which in turn improves response rates. That’s because it diminishes language barriers and allows users to express their opinions and thoughts more accurately.

Localization is particularly crucial when you cater to a global user base. You might have customers who are more comfortable using their local languages. But how do you ensure region-based localization? That’s where automation comes in. Survey tools (like Userpilot!) automatically localize surveys based on a user’s region, so all you need to do is create them in a single language. We take care of the rest.

Explain why you are collecting feedback and how it will benefit the user

How do you encourage users to participate in feedback surveys? One clever tactic is to highlight how it’ll help you (and them).

A simple sentence like “Your feedback helps us personalize your experience” can do the magic. You can also highlight specific actions you’ll take, such as improving an existing feature or developing more support resources.

In an interview with Userpilot, Meagan Glenn, Senior Program Manager at Lavender, an AI-powered email assistant, emphasized the importance of being transparent with users when collecting feedback. “To increase survey responses, we’ve also outlined clearly how the responses will impact product development,” she remarks.

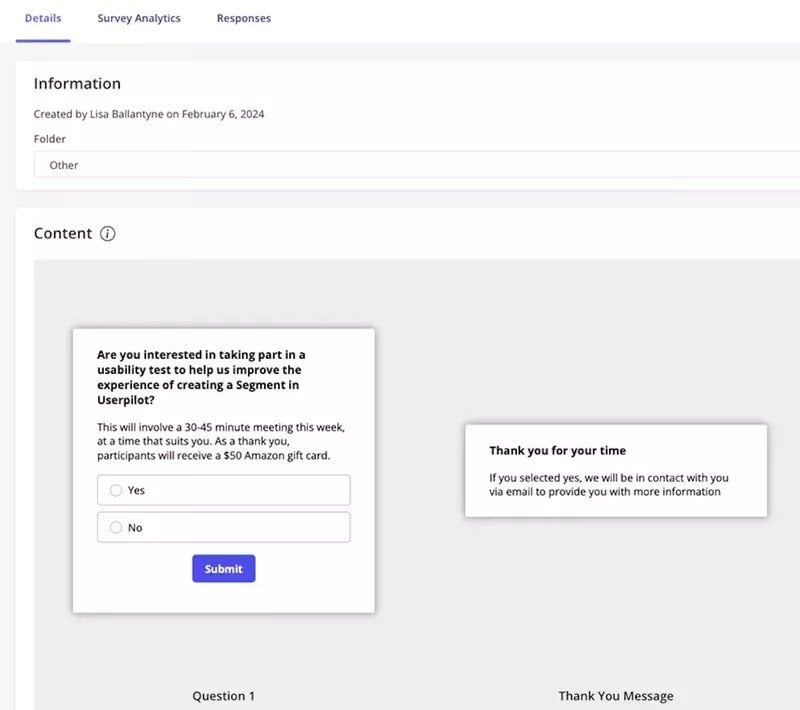

Offer meaningful incentives to increase the response rate

Incentives are particularly useful for encouraging participation in long surveys. Choose a reward that’s relevant and valuable to users. Examples include early access, free trials, and gift cards.

But incentives are a double-edged sword and could skew your survey data. Here’s how:

- People may try to quickly wrap up the survey to gain the reward. So, their answers might not involve a lot of thought.

- Users might answer questions in a way that they think will please you. It could stop them from providing honest answers.

- Incentives could attract users who are solely after the reward. They may not necessarily be your target audience.

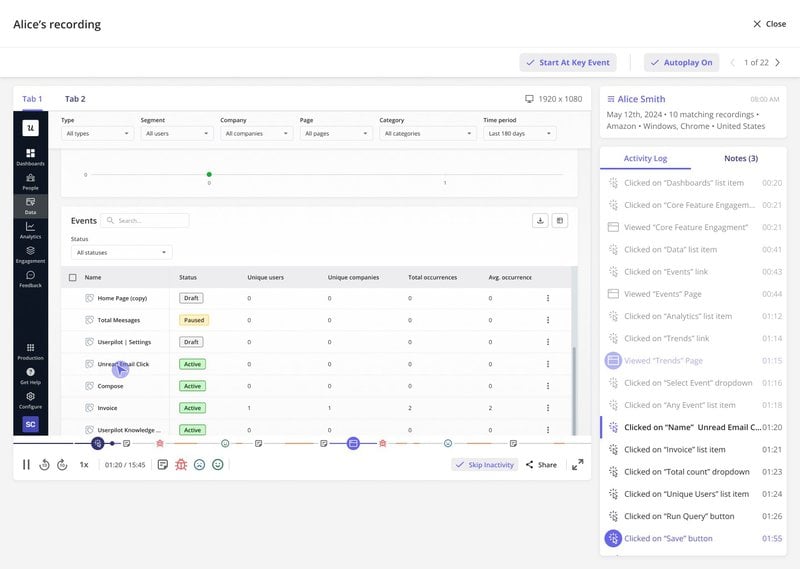

Pair survey responses with behavioral data for a holistic view

Survey responses offer insights into user sentiment and pain points, but they don’t paint the full picture of user behavior.

That’s where user behavior analytics comes in handy. Analyzing behavioral data helps you understand how users engage with your product and give more context to their feedback.

For instance, you can combine data from session recordings with NPS survey responses to understand why detractors have a negative perception of your product. With it, identify precise areas where these users struggle and remove those roadblocks to elevate their experience.

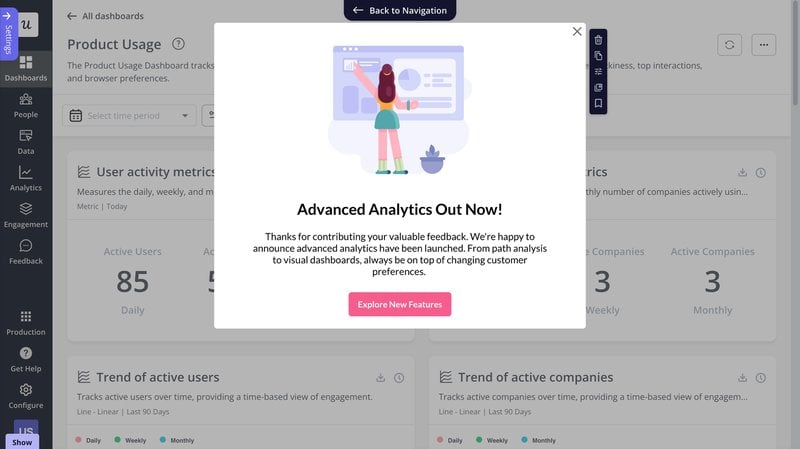

Follow up with customers to close the feedback loop

You’ve sent out your survey, collected user feedback, and implemented changes based on the gathered insights. That should complete your job, right? No. You’ve left the feedback loop open.

The feedback loop entails multiple stages, including:

- Collecting feedback: Use surveys, customer interviews, reviews, and social media posts to collect user feedback.

- Conducting analysis: Analyze qualitative and quantitative feedback collected from users with tools like Userpilot and identify common issues for each user segment.

- Act on feedback: Organize feedback based on your business priorities and implement it. But take time to find the root cause of the demands and work on that instead of blindly acting on what customers request.

- Follow-up with customers: Finally, inform your customers about the changes you’ve made based on their feedback. You can do this via in-app messages (like the image below) or through other modes like emails. This step closes your feedback loop.

And it’s called a loop as it’s a continuous process that kickstarts again once you’ve followed up with customers.

Great customer satisfaction survey examples from leading companies

Before you start creating customer feedback surveys, take a cue from the following examples:

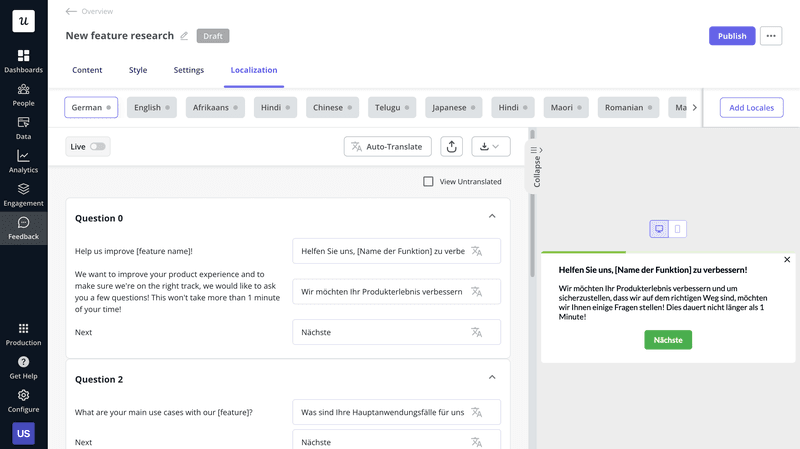

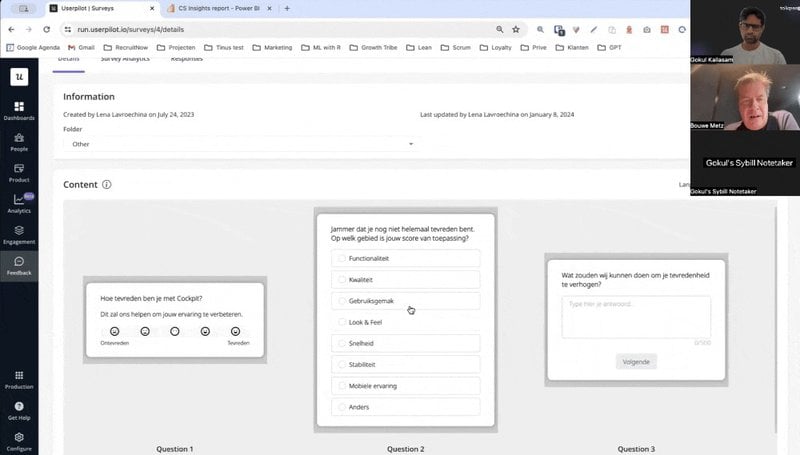

RecruitNow’s localized survey

RecruitNow is an Applicant Tracking System (ATS) that helps hiring managers streamline all stages of the recruitment process.

The company conducts CSAT surveys twice a year to identify satisfied customers and areas of improvement.

The survey comprises 5 questions of different types, including Likert-scale, multiple-choice, rating, and open-ended ones.

The company is based in the Netherlands and the survey is created in Dutch.

However, RecruitNow has also built a presence in German and Austrian markets. They leverage Userpilot’s localization feature to automatically translate the survey into relevant languages and maximize response rates in these regions.

Userpilot’s on-demand feedback survey

Userpilot is an all-in-one product growth platform that helps create personalized in-app flows, collect customer feedback, and track user behavior.

In addition to event-based surveys, at Userpilot we also leverage on-demand surveys that users trigger themselves from the main interface.

In the following example, the platform launches a survey asking users about their experience when they click on the feedback button. As the user has chosen to fill out the survey, they’re likely to share honest and in-depth feedback. Note how the survey is non-intrusive and also gives options for both quantitative and qualitative feedback.

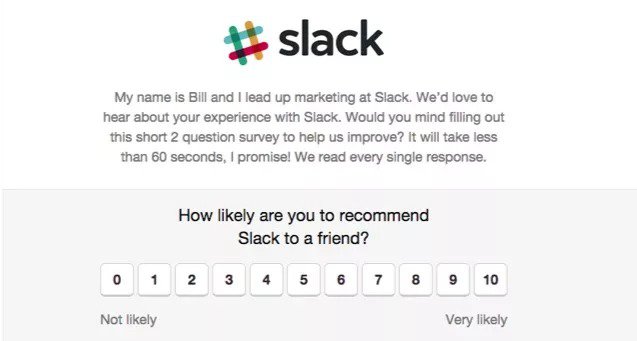

Slack’s personalized NPS survey

Slack is a widely used workplace communication platform.

At first, it may come across as just another NPS survey. But on closer look, you’ll note that the text above the survey is phrased like a DM from Bill, Slack’s Head of Marketing, rather than a request to fill out a survey. This personalization can greatly improve the response rate.

The message clearly outlines how many questions the survey includes and how long it’ll take. Plus, it emphasizes how much the company values user feedback.

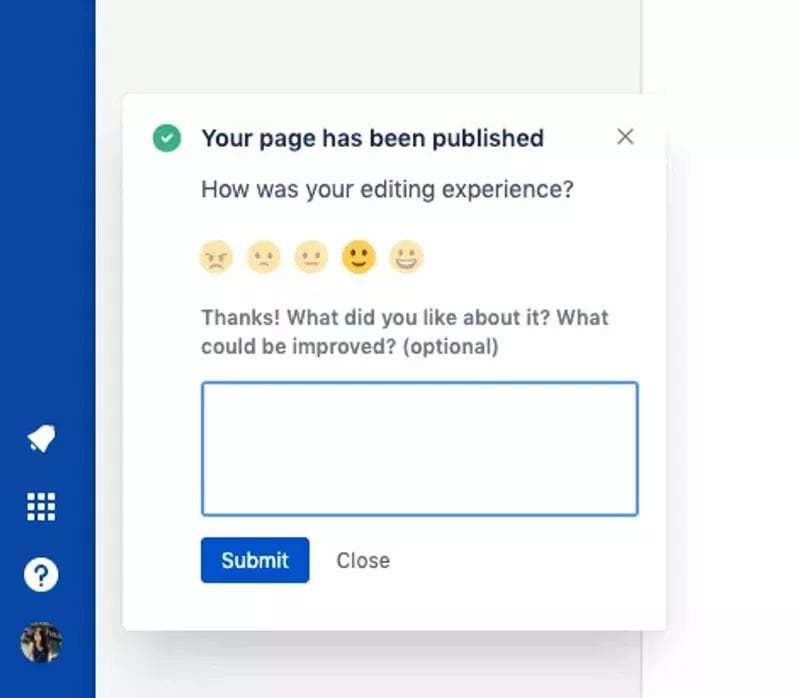

Jira’s granular in-app survey

Jira is an agile project management tool that’s particularly popular in the software industry.

The platform uses contextual triggers for these surveys, meaning they’re launched when a user completes a task and can vividly recall their experience.

In the following example, the survey is triggered when a user finishes editing and publishing a page. It includes a close-ended question asking users to rate their experience and an open-ended one asking for suggestions to improve the process.

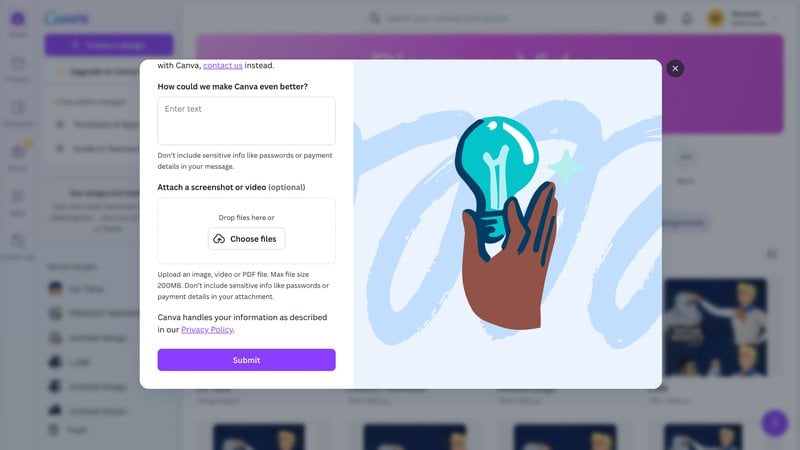

Canva’s detailed product improvement survey

True to their brand, Canva’s surveys have a beautiful design with a neat graphic design on the right side, as can be seen in the image below.

But what makes the survey stand out is the fact that Canva provides users with the option to upload screenshots and videos to support their text-based answers.

The visual support enables customers to provide in-depth feedback through which you can zero in on the issues they face, eliminating the need to send several follow-up messages to understand what exactly is wrong.

How to launch customer feedback surveys with Userpilot

Userpilot lets you create and implement a variety of in-app surveys, including NPS, CSAT, and CES surveys, minus any coding. Here’s what a happy customer had to say about them:

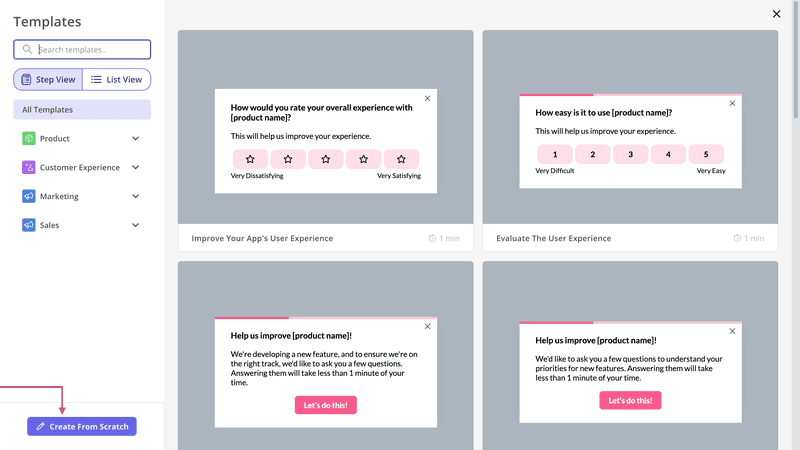

Let’s now take a look at the steps you need to follow to create CSAT surveys and measure customer satisfaction:

Step 1: Log into your Userpilot dashboard and choose a customer satisfaction survey template from the library. You also have the option to build a survey from scratch.

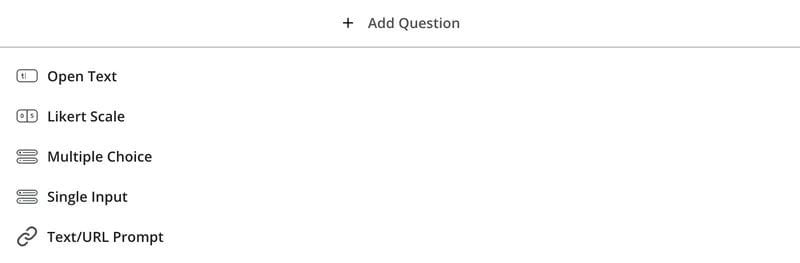

Step 2: Tweak the customer satisfaction survey questions if needed or add new ones. You can choose from different types of questions, such as the Likert scale and multiple-choice questions if you’re after quantitative data. Alternatively, use single input, text/URL prompts, and open-ended questions to collect qualitative insights.

Step 3: Next, head to the Style tab to customize the survey appearance. Choose the primary color, background color, border width, and fonts. You can also choose from different positions for the survey.

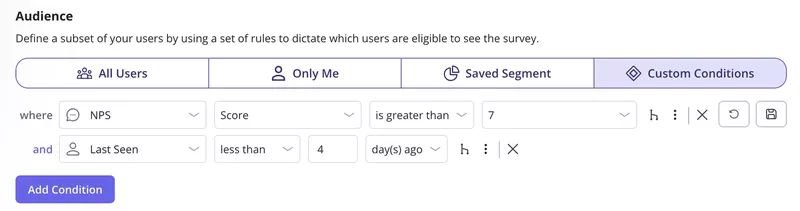

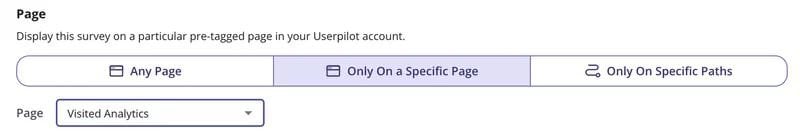

Step 4: The next step is to select the target user segments in the Settings tab. You can choose to launch the survey for all users or a saved segment. You also have the option to define new audience segments with custom conditions.

Step 5: Finally, it’s time to define where and how to trigger the survey. Do you want it out on a particular page or any page? Would you like to launch the survey on a specific day or when a user completes an action? Do you want to display the survey to users at a specific point in the customer journey? Define the criteria here to optimize the timing of your in-app surveys.

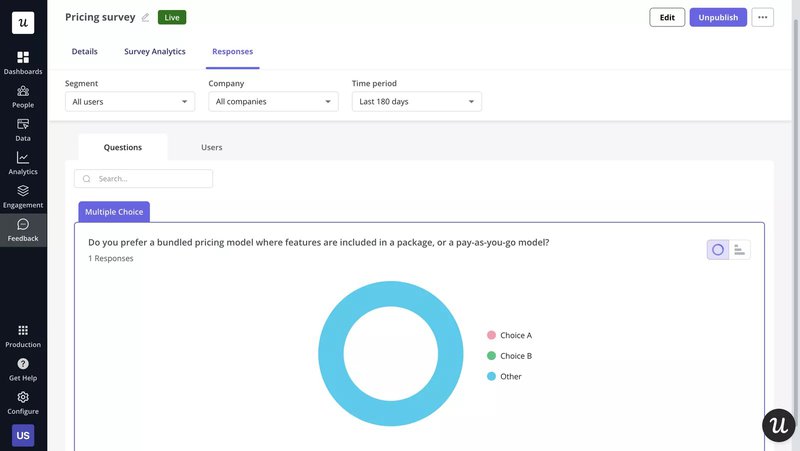

Step 6: Analyze your survey responses and customer satisfaction score to identify the common issues highlighted by the users. Then, prioritize improvements to your product to boost customer satisfaction.

Start creating customer feedback surveys

Customer feedback surveys take the guesswork out of the equation and show you exactly what users want. While close-ended questions give trends, open-ended ones help you dig deeper. Pairing these insights with user behavior tracking can simplify the path to future product development, paving the way to a product that users love.

Userpilot offers a vast library of customizable survey templates with advanced branching logic and event-based triggers. Schedule a demo to understand how it helps streamline customer feedback collection and user behavior tracking.

FAQ

How often should I survey my customers?

If you want to assess overall customer satisfaction and sentiment, semi-annual or annual surveys are a smart choice for your customer service team. On the other hand, if your goal is to improve user onboarding, weekly or monthly surveys might work better.

What response rate should I aim for?

A response rate between 5% and 30% is considered acceptable for most surveys. However, it can vary depending on the type, length, timing, incentives, and target audience of a survey. Also, in-app surveys usually get more responses than those sent through email or text messages.

How do you write a customer feedback survey?

Take these steps to write your survey:

- Identify the goal of your feedback survey (understanding product usage, demographics, psychographics, etc.).

- Determine the number and types of questions (close/open-ended) to be asked based on the goal. Try to keep them to a maximum of 3 questions.

- Write your questions with the mindset of one question = one goal. Don’t overstuff them and keep them neutral.

- Make answering optional for users so they don’t feel forced to write an answer.