What are marketing surveys?

Marketing surveys are a method of soliciting customer feedback and collecting market research data using a questionnaire.

Why should you be conducting market research?

Marketing surveys come with multiple benefits. Here are some things you stand to gain:

- Understand the needs and expectations of your user personas: Through market research, you’ll learn the general needs of your target market and try to weigh them against what you currently offer.

- Enhance your product and features: Market research can help you collect new feature ideas and also validate your existing product ideas. For example, you can release a survey asking customers and potential customers what they think about a specific feature. If a good percentage of them responded positively, then that’s a sign the market needs it.

- Stay ahead of the competition: By gathering opinions about your top competitors, you’ll uncover gaps you could fill to make your current customers happy and attract more users.

- Make changes to your marketing strategy if needed: Through marketing surveys, you’ll uncover the demographics within your target customers and learn more about their needs. With this information, you can adjust your messaging, campaign channels, pricing, and other elements of your strategy.

Different types of marketing surveys for qualitative and quantitative research

By now, you may be wondering how to conduct marketing surveys and begin reaping the benefits listed above. This section shows you various survey types and how to approach them correctly.

1. User persona survey

Persona surveys help you identify the needs, pain points, jobs to be done, and behaviors of target users and break them into segments based on shared traits.

Moreover, you can use the insights generated to create user-centric products, tailor your marketing campaigns, and also personalize the product experience for each persona.

An effective way to collect user persona data is to send your surveys to new sign-ups as part of your welcome flow. Examples of questions to ask in user persona surveys:

- What will you be using {product name} for?

- How large is your company?

- What is your job title?

- Mention some significant obstacles you face in your professional life

- What do you want to achieve with [software]?

2. Market research survey

Market research surveys let you collect and analyze data about your market. The data obtained will enable you to assess market demand, understand your target audience better, optimize pricing, jump on market trends, etc.

In general, you’ll have enough insights to inform product development and tailor products to meet audience needs.

Send market research surveys at regular intervals, especially when planning product launches.

Examples of market research survey questions include:

- How much are you willing to pay for [product name]?

- What is the problem that the product/service helped to solve for you?

- How do you search for the products you want to buy?

- What factors influence your decision to purchase?

3. Brand awareness survey

Trigger this survey to measure your target market’s awareness and perceptions of your brand and generate insights to improve brand positioning.

Make brand awareness surveys a regular practice, especially after a crucial marketing campaign. Doing this helps you gauge your efforts and consistently push the correct narrative about your company.

Brand awareness survey question examples:

- Describe [brand name] in one sentence.

- How do you feel about [brand]?

- Do you currently use the product of this brand?

- Which of the following products have you tried? (Select all that apply)

- How did you hear about us?

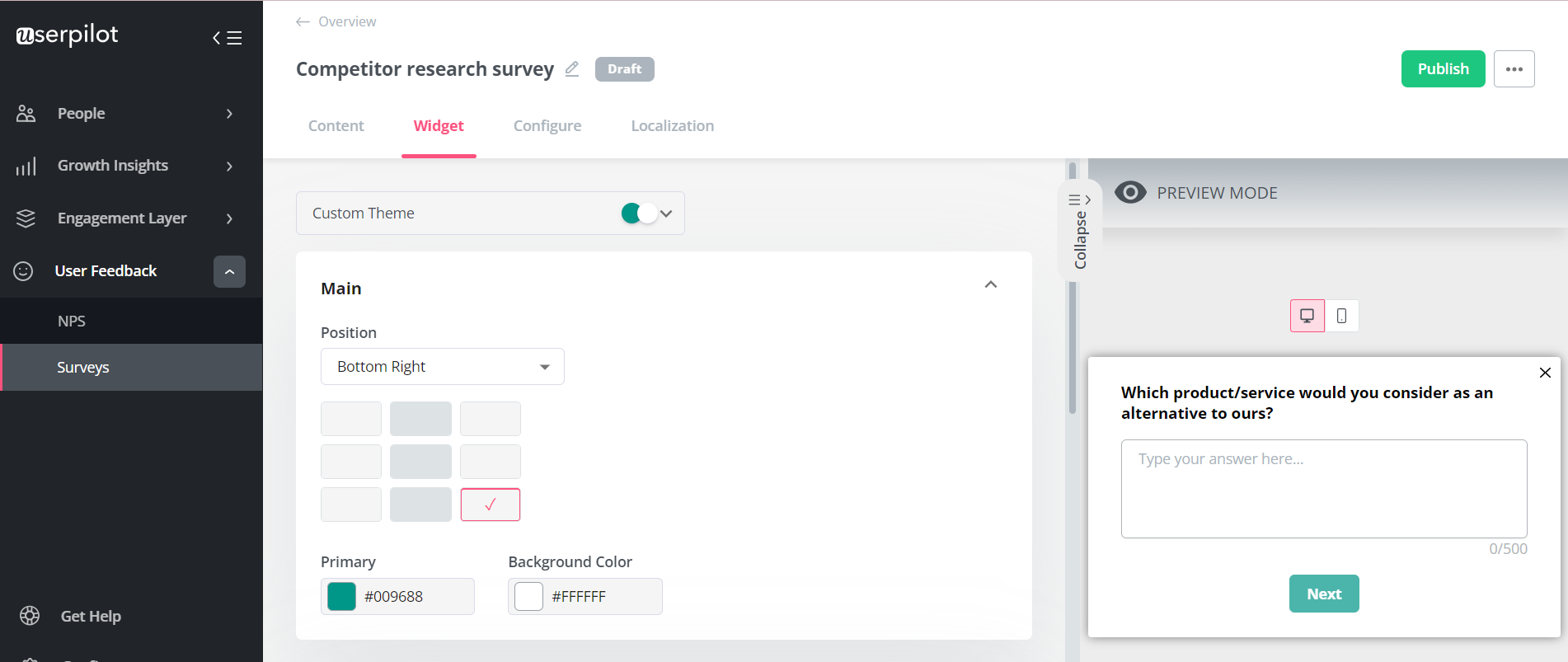

4. Competitor research survey

Run this survey to analyze your relative position to competitors. Focus your questions on competitor pricing, marketing strategies, analysis of their products and services, etc., and use the data to devise strategies and gain a competitive advantage.

Example of questions to ask:

- Which product/service would you consider as an alternative to ours?

- How would you compare our products to our competitors?

- Compared to our competitors, is our product quality better, worse, or about the same?

- What do you think about our pricing?

- Why did you choose to use our [product] over other options?

- Which other options did you consider before choosing [product name]?

5. Product research survey

Product surveys give you a general idea of what users think of your product. Collecting this data can help you prioritize the product roadmap and find ways to improve the product experience.

Product research survey questions examples:

- What specific features or aspects of our product do you like the most?

- How easy or difficult was it to use the product?

- Is there anything missing from our product that you want to see added or improved?

- Did the product meet your expectations?

- How would you rate the ease of use and user interface of our product?

- What add-ons will you like in our product?

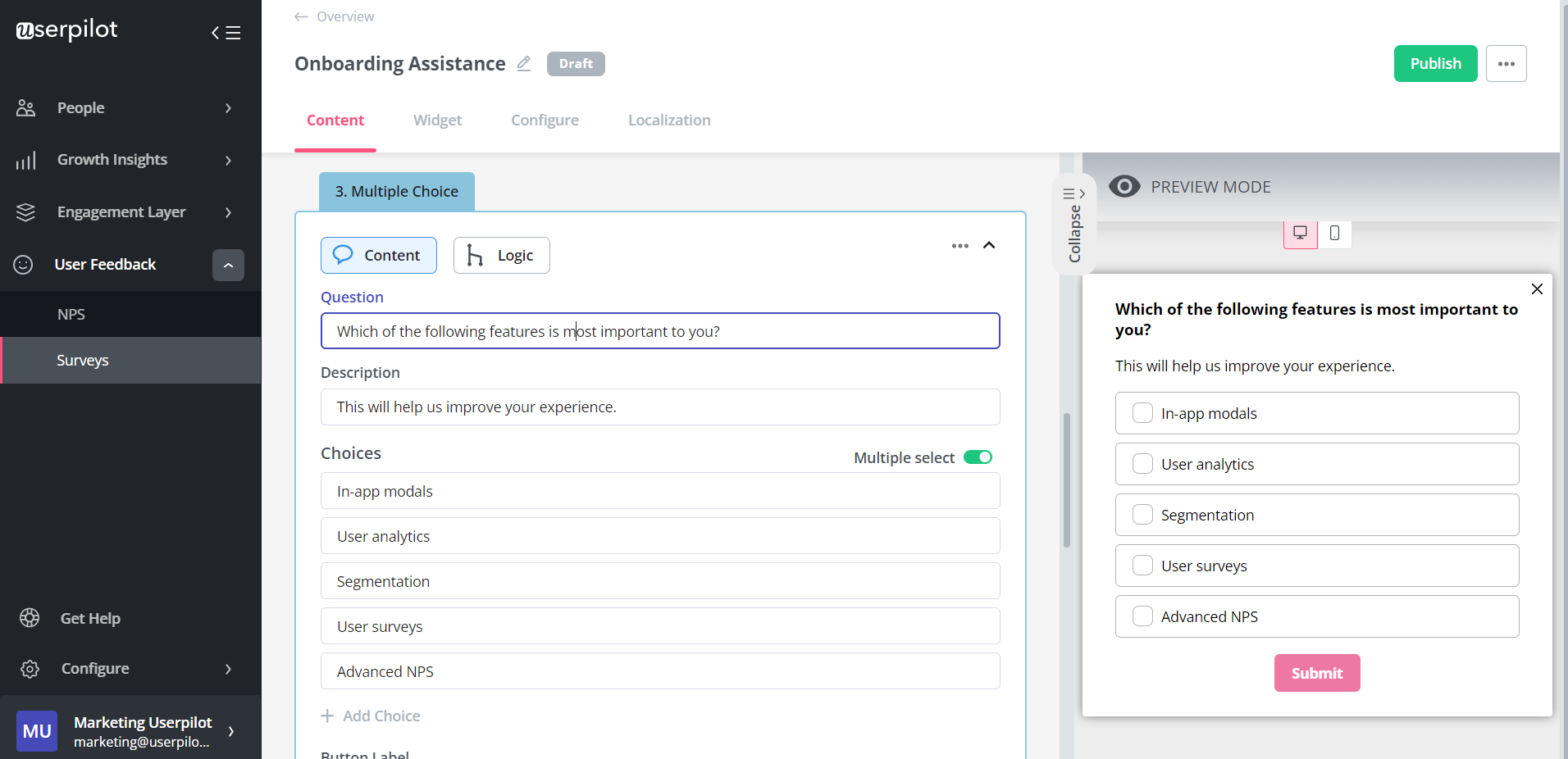

6. Feature research survey

Similar to product research, this narrows the focus to specific features. You can trigger this survey immediately after first-time interaction with a feature, when beta testing a feature, or after you’ve launched a new feature.

Example of feature research survey questions to ask existing customers:

- Please let us know how we can further improve this feature.

- How was your experience using [feature name]?

- Do you find this feature helpful?

7. Product-market fit (PMF) survey

PMF surveys help you understand whether your product addresses and solves the needs of your target market.

The data uncovered will let you know if there’s a demand in the market you’re selling and whether you’re moving in the right direction.

Example of the typical PMF survey:

How would you feel if you could no longer use our product?

- Very disappointed

- Somewhat disappointed

- Neutral

- Not disappointed

You’ve achieved product-market fit if over 40% of respondents will be disappointed that they can no longer use your product.

8. Net Promoter Score survey (NPS)

This survey uses an 11-point scale (0-10) to measure customer loyalty and predict business growth.

The standard question is usually something like:

“On a scale of 0-10, how likely are you to recommend our product to a friend or colleague?”

NPS survey respondents are classified into three:

- Promoters: They love your tool and rate you 9 or 10

- Passives: They’re neutral, so they rate you 7 or 8

- Detractors: This group are unhappy with their experience and rate you between 0 and 6

Subtract the percentage of detractors from the percentage of promoters to get your Net Promoter Score.

The NPS surveys you trigger can be transactional (sent after purchases, onboarding, customer service call, etc.) or relational (sent regularly to keep in touch with customers).

How you send your surveys totally depends on your objectives, but we recommend using both transactional and relational NPS so you don’t miss out on any insight.

Speaking of insights, it’s hard to know what the customer thinks by just seeing their rating. That’s why it’s a good idea to send quantitative follow-up questions that give respondents enough room for expression.

Examples of follow-up questions to ask:

- Why did you choose that score?

- What specific aspect(s) of our product/service influenced your rating the most?

- What improvements or changes would make you more likely to recommend our product/service?

- How can we improve your experience?

- What do you like most/least about [product name]?

9. Customer satisfaction survey (CSAT)

CSAT surveys measure customer satisfaction data at a granular level, providing you with insights to improve the user experience.

Trigger your CSAT surveys after specific engagements—e.g., when users interact with a feature for the first time, after contacting support, immediately after a customer renews their accounts, etc.

Measuring user satisfaction at every touchpoint reveals friction areas so you can investigate and fix them.

CSAT surveys are typically measured with smiley faces or a Likert scale having 1-5 answer statements.

Mobile surveys are a quick way to measure customer satisfaction, gather real-time feedback, and boost engagement.

Examples of questions to ask:

- How would you rate your interaction with our support team?

- How satisfied are you with [product] so far?

- Did [feature] meet your expectations?

10. Customer effort score (CES) survey

This survey measures the perceived effort a customer exerts to complete an action while engaging with your business.

CES is similar to CSAT in many ways. For instance, they serve the same purpose—identifying the friction points in the user experience —and use the same Likert scale.

Examples of CES questions:

- How easy was it to [perform action]?

- On a scale of 1-7, how would you rate the effort it takes to use our X feature?

- Was it easy to find the information you wanted?

11. Content evaluation survey

Trigger this one if you want to assess the effectiveness of your resources/help guides. The responses will enable you to improve the quality of the training content you produce and increase in-app engagement.

Set your evaluation survey to trigger after a user engages with the training material. Some questions to ask include:

- How helpful did you find this resource?

- Have you found what you were looking for in this article?

- Which types of content did you find most valuable and informative? (e.g., interactive walkthroughs, blog posts, video tutorials, etc.)

- Did you find the content easy to consume and understand?

12. Exit surveys

Exit or so-called churn surveys aims to understand the reasons behind churn and reduce cancelations by offering alternatives before letting customers go.

Set your exit surveys to automatically trigger when a customer clicks the cancelation account button. Ensure the survey is delivered in-app right at the moment your customer is about to cancel. Not everyone will go ahead and answer a survey they got via email after they finished closing their account.

Examples of questions to ask:

- What is the reason you are leaving [product name]?

- What’s the main reason you are canceling your account?

- Why did you decide to cancel your subscription?

What are the best tools for creating market surveys?

When selecting a survey tool, go for something that:

- Allows you to build multiple survey types.

- Can analyze survey responses to generate rich insights.

- Is easy to use even if you don’t have experience creating your own market research.

The tools below help you do just that.

Userpilot – best for short in-app surveys

Userpilot is a product growth platform that helps PMs and PMMs drive product adoption.

With Userpilot, you can:

- Choose from a variety of survey templates and customize them to your brand. You can also build from scratch if you want—all code free.

- Userpilot lets you customize in-app mobile surveys with any type of question and trigger.

- Dig into survey analytics to see how your surveys are performing. A glance at the results dashboard will show you how many people completed the survey, where most respondents dropped, etc.

- Trigger surveys contextually based on user behavior using custom events and segmentation.

- Localize the survey content to make the survey include global audiences.

- Tag qualitative NPS responses and analyze patterns easily.

Typeform – best for long-form market research surveys

Typeform allows you to include multiple questions in your surveys. You can freely move between different response types in the same survey—e.g., Likert scale, qualitative questions, yes/no questions, etc.

More importantly, the platform has extensive survey templates to save you time and mental energy.

Once your survey is ready, you can generate a link and embed it on any platform that allows it.

For example, Userpilot seamlessly integrates with Typeform, so you can include your Typeform surveys while building with our app.

Conclusion

Marketing surveys come with lots of benefits for your company.

Gathering responses from your target audience helps you shape your offerings to the market need and consistently stay ahead of the competition. You’ll drive acquisitions and long-term retention faster that way.

Ready to get started with marketing surveys? Get a Userpilot Demo now to see how our platform can help you build and analyze different surveys.