Having a hard time understanding what your customers really want?

This is partly because many companies have shifted fully to a data-driven approach instead of talking directly to customers. While product data is valuable, it often lacks qualitative insight into customer sentiment, unmet expectations, likelihood of referral, and the reasons behind user behavior.

Ignoring this kind of customer feedback comes at a real cost. Increased churn is one consequence, with 56% of customers quietly switching after a negative experience without ever sharing feedback. On top of that, dissatisfied customers often spread negative word of mouth. This matters because 96% of buyers read customer reviews before choosing a product, especially negative ones.

Fortunately, there are ways to avoid these outcomes, starting with prioritizing customer feedback. One of the simplest and most effective ways to do that is through Net Promoter Score surveys.

This guide focuses on practical NPS survey best practices for SaaS teams, including when to trigger surveys, how to increase response rates, and how to act on feedback effectively.

What is a Net Promoter Score (NPS) survey?

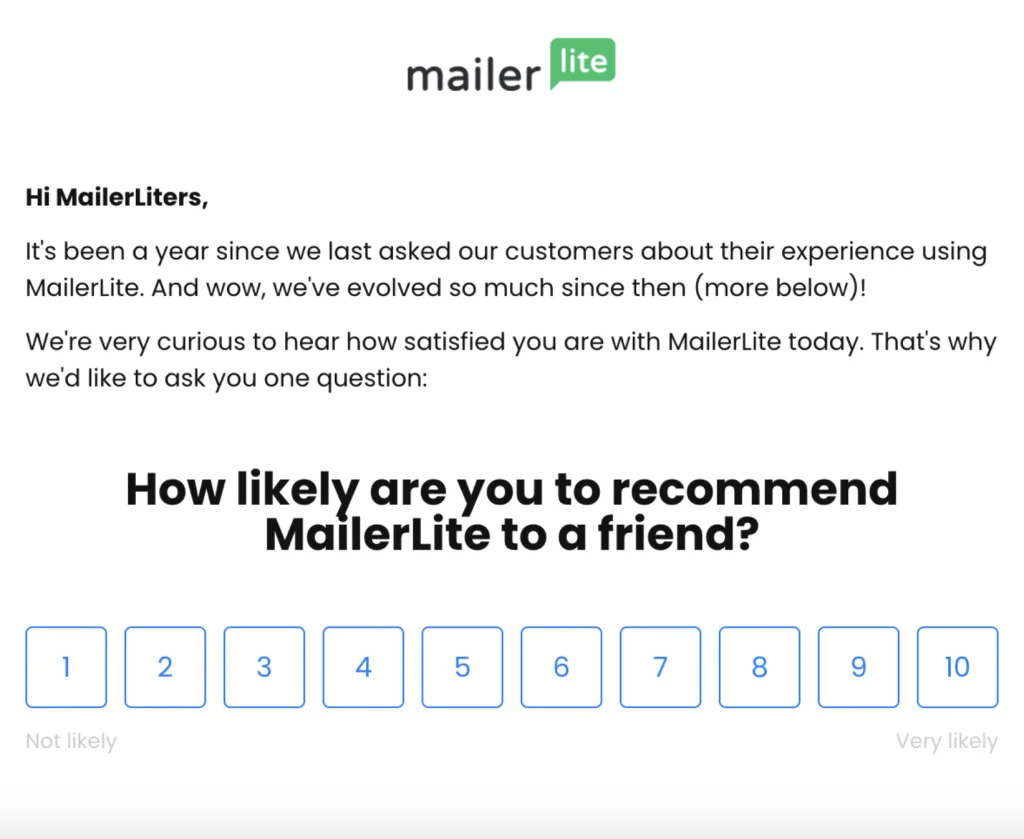

Net Promoter Score is a type of survey used to measure the likelihood of user referrals on a scale of 0 to 10.

Typically, NPS surveys include two elements:

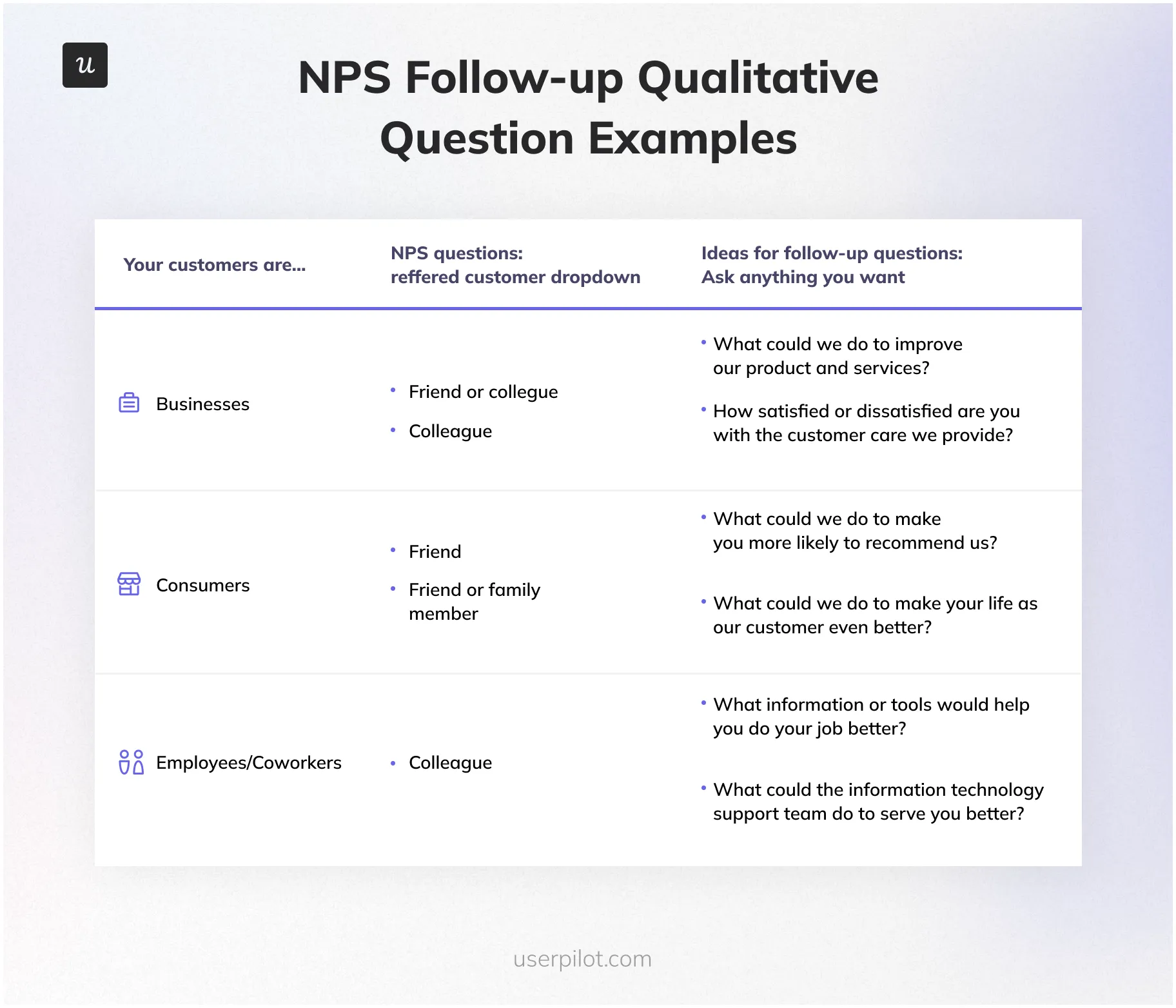

• A rating question asking how likely users are to recommend your product

• A qualitative follow-up question to understand the reason behind the score

Responses are grouped into promoters (9–10), passives (7–8), and detractors (0–6), giving teams a quick snapshot of customer sentiment.

NPS surveys work well because they’re simple, quick to complete, and provide clear insights into customer satisfaction.

What are the two types of NPS surveys?

Before applying the best practices below, it helps to understand the two high-level categories of NPS surveys. These differ mainly in when they are sent and what type of feedback they capture.

Relationship NPS surveys are used to measure overall customer sentiment toward your product or brand. Teams typically send them at regular intervals to track long-term loyalty and changes in perception over time.

Transactional NPS survey are triggered after a specific interaction, such as completing onboarding, using a feature, or contacting support. They capture feedback tied to a particular moment in the customer journey.

Both types can be useful, but they serve different purposes. The best practices in this guide apply regardless of which type you use.

If you want a deeper breakdown of when to use each survey type and how to structure them, see our guide to the different types of NPS surveys.

Why NPS response rates matter

- More accurate representation: Greater survey responses include a broader spectrum of all customer opinions instead of just a few loyal customers skewing the results.

- Better product decisions: With more reliable NPS data, you can make informed decisions that benefit all your users.

- Increased retention: These product improvements lead to better customer experiences and, ultimately, increased customer retention.

But you only unlock these benefits if you focus on improving your NPS response rates in the first place. Because imagine the flip side where you don’t have enough NPS data. Your decisions will be based on incomplete insights, leading to incorrect conclusions and, eventually, higher churn.

So, to collect enough NPS data, you first need to go back to the drawing board and design effective NPS surveys.

13 NPS survey best practices for your SaaS

Customers today are tired of filling in endless surveys. If the survey is too long, complicated, or just boring, 67% of respondents will simply abandon it midway.

That’s where these NPS survey best practices come in. They’ll show you how to reduce friction in your survey in every way possible, optimizing it for greater response rates.

1. Optimize your NPS survey timing

Time your NPS survey right for maximum engagement and increased responses. For instance, use tools to set up triggers for automatically sending surveys after certain actions, like successful feature adoption or task completion.

Otherwise, if you send it too early, users won’t have enough experience to base their rating on. Similarly, if you send it too late, users won’t remember how their experience went, resulting in inaccurate responses.

2. Design a user-friendly Net Promoter Score survey

The goal of your NPS survey is to get users from point A to point B as seamlessly as possible without triggering any survey fatigue.

This requires keeping the survey short and concise, making it quick and frictionless to complete. Here are small changes you can start with to accomplish this:

- Use simple language.

- Clearly label instructions.

- Minimize the number of required fields.

- Add progress indicators to show users how far they’ve come.

- Incorporate a visually appealing survey design that isn’t too text-heavy.

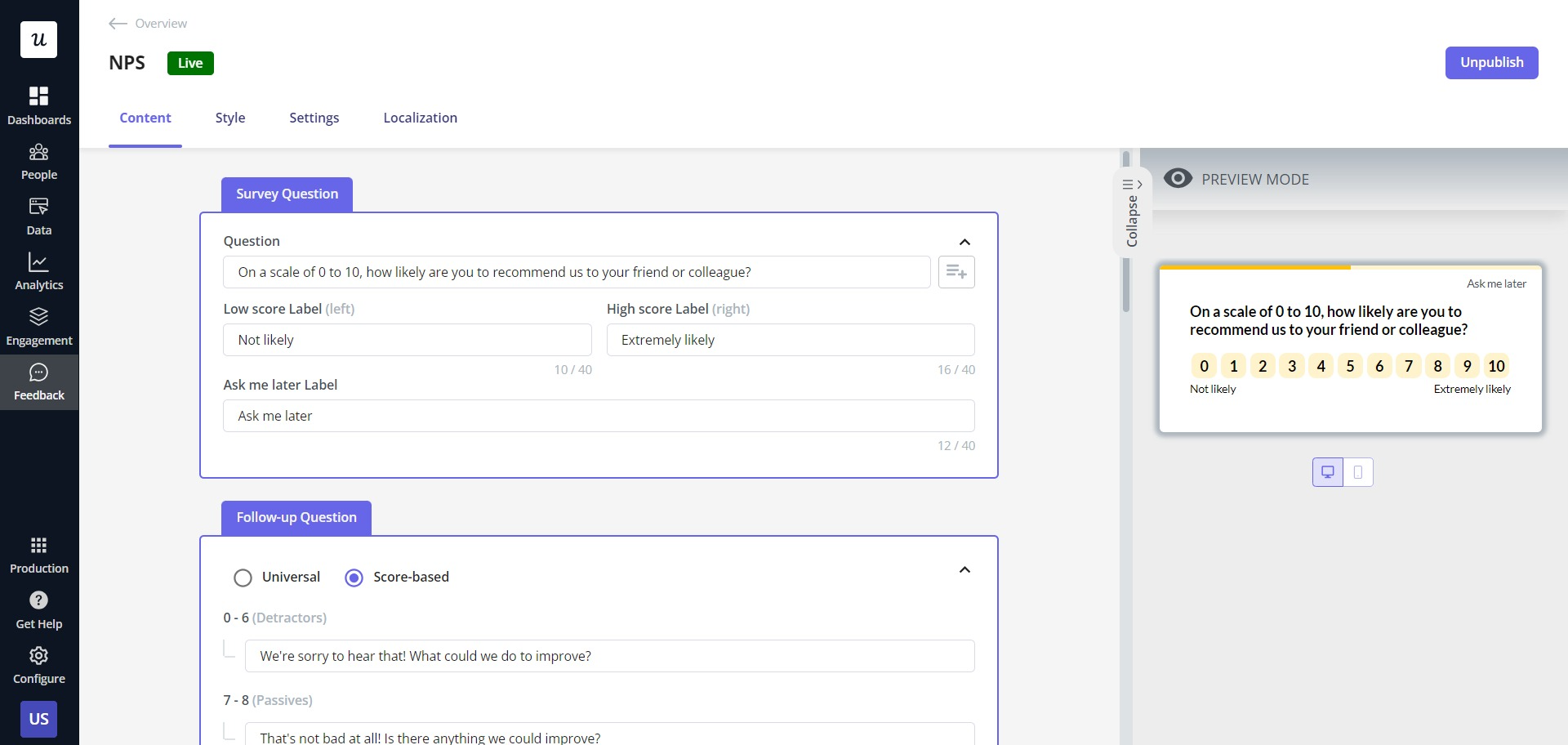

Userpilot can help with this, providing pre-made templates to choose from or letting you build entirely customizable ones. You can add your logo, customize the color theme, tailor question formats to match your brand’s voice, and more.

Create, customize, and analyze NPS surveys, along with targeting specific users and easily visualizing responses.

3. Choose your NPS survey distribution method carefully

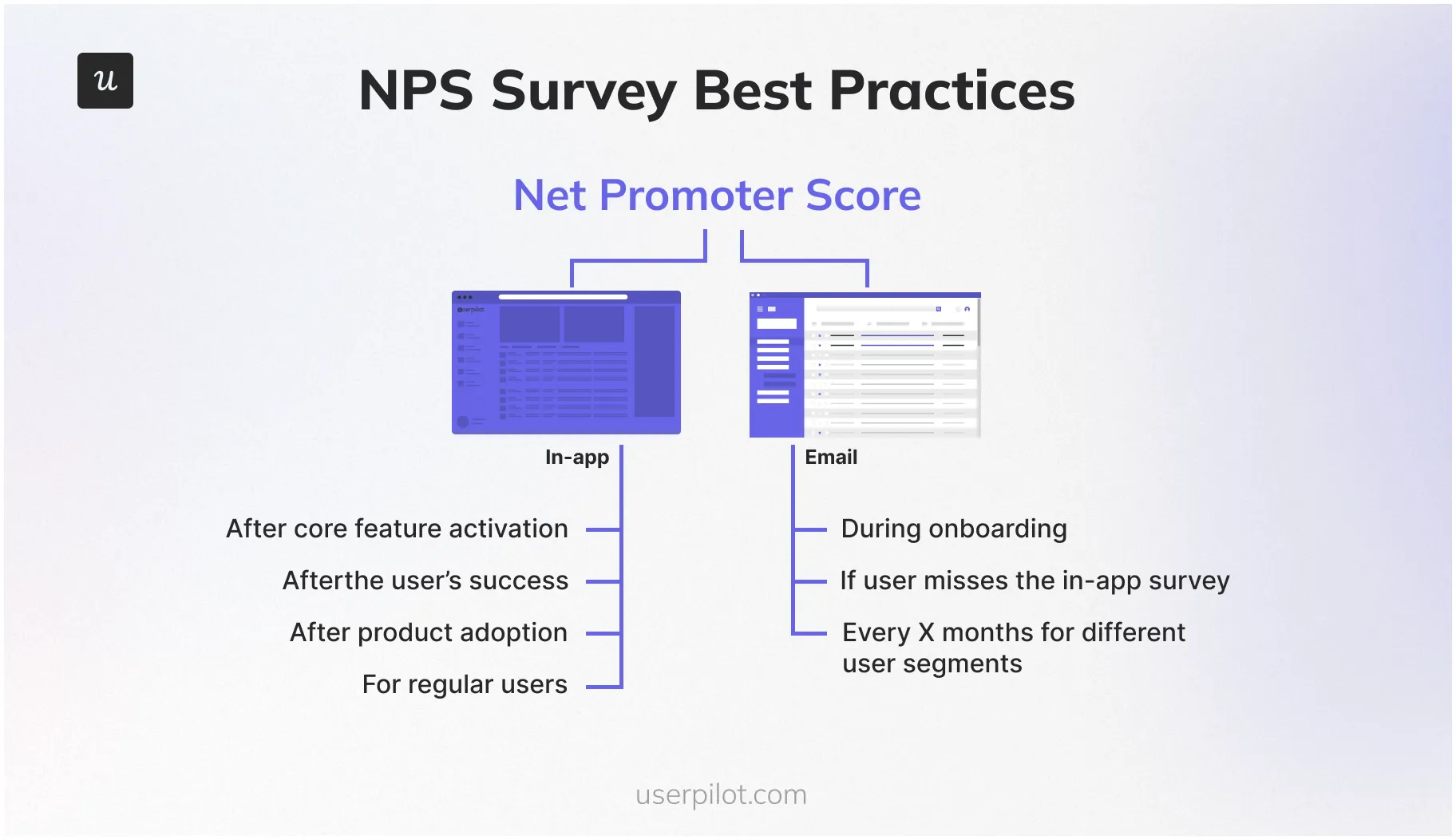

Users are most engaged when they’re in-app, resulting in an average response rate of 92% to in-app interactions.

So, if you’re looking for higher response rates, in-app surveys are the way to go. They’re more contextually relevant since they’re immediately sent after a key customer interaction. This way, you can capture timely and accurate feedback from users while the experience is still fresh in their minds.

However, if the goal is to get broader feedback or follow up with certain user segments, then pick email surveys. For example, you’d use email surveys to bring back disengaged users. Sending them in-app surveys wouldn’t make sense since these users aren’t logging into your app in the first place.

In-app NPS surveys capture feedback during active usage, offering more context, while email surveys can reach less engaged users.

4. Personalize your surveys for different customer segments

Which one sounds better?

“How likely are you to recommend this feature?” vs. “Hey Sara, congratulations on generating your first report! On a scale of 0-10, how likely are you to recommend this feature to your team?”

We all know the second question just feels better. More human, targeted, and relevant, creating a better customer experience. And more likely to get a response, too. The research backs it up: Personalizing surveys can improve response rates by 48% at times.

So, tailor your survey questions and messaging for specific customer segments based on their demographics, usage patterns, subscription tiers, etc.

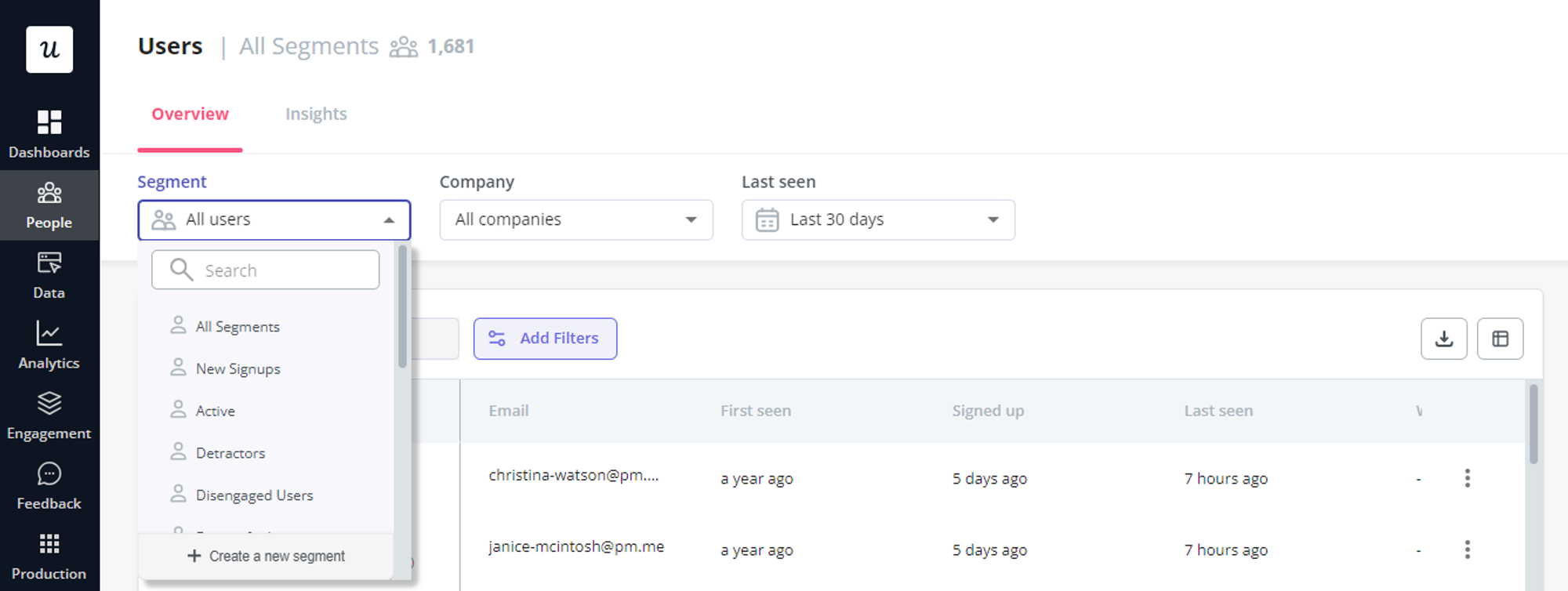

Create hyper-targeted user segments using advanced filters based on user data, behavior, and engagement.

5. Localize your NPS surveys

Offering surveys in users’ native languages helps them understand the content better, maximizing the likelihood of responses.

Plus, it shows respect and inclusivity for cultural diversity and translates into a more seamless customer experience. But localizing your surveys doesn’t just improve customer satisfaction. It boosts revenue too, with 84% of businesses enjoying greater revenue growth from localization.

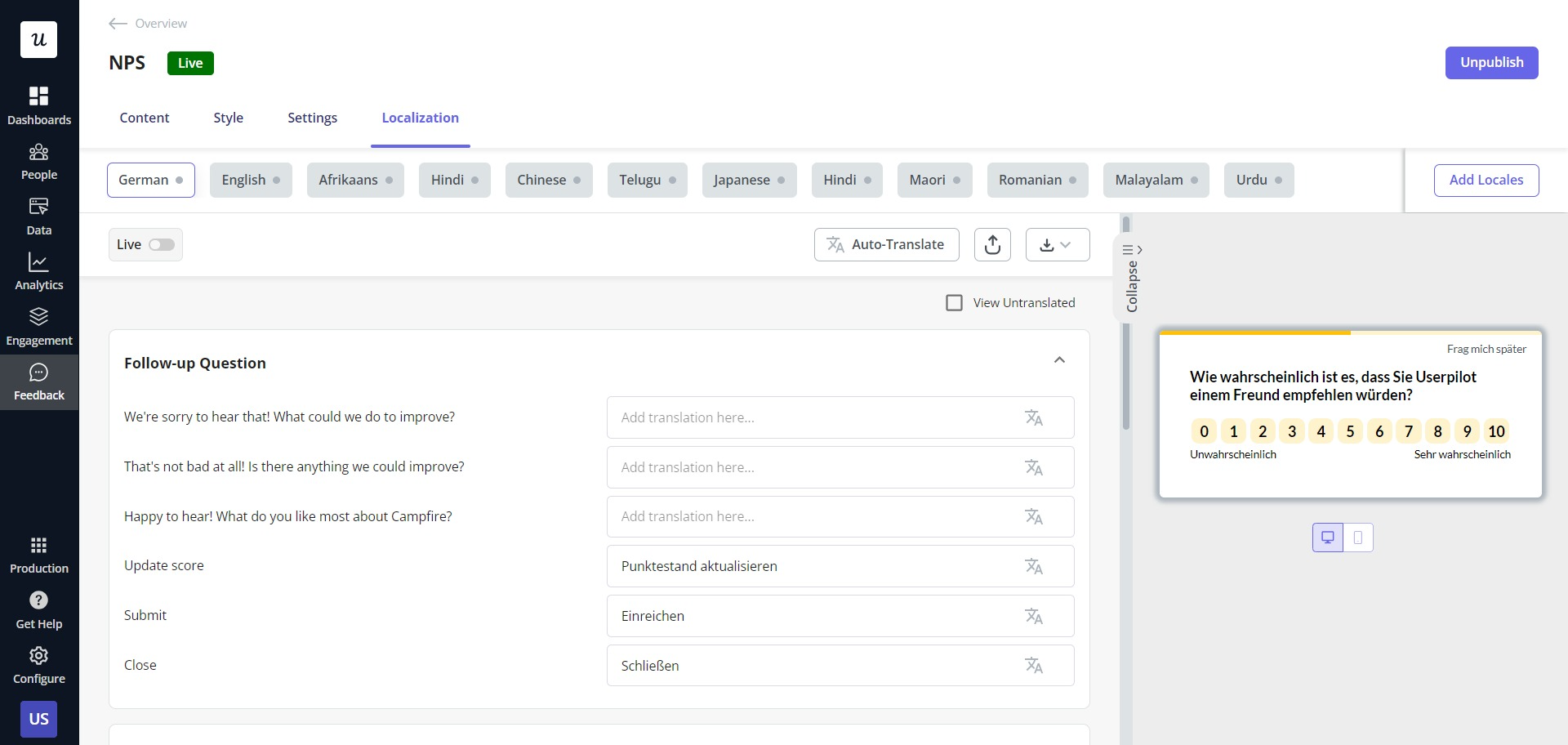

However, manually translating your NPS surveys is an unnecessarily time-consuming task. Instead, take the smart, error-free route and use tools to automatically localize customer experiences.

Localize surveys by translating content into 32 languages, either automatically or manually, based on user preferences.

6. Look for trends in the responses and tag them

Simply calculating your NPS score and collecting customer feedback isn’t enough. You also need to act on the feedback.

This means tagging and categorizing all the qualitative responses to identify any recurring themes and patterns.

For example, you may notice a trend of multiple users mentioning “unintuitive UI” in their qualitative feedback. So you can tag these responses under “intuitiveness” or categorize them under “performance issues”. This way, it becomes easier to pinpoint improvement areas and prioritize action items for each of the three segments: promoters, passives, and detractors.

Group similar responses via response tagging to easily identify customer pain points and prioritize improvements.

7. A/B test your NPS surveys to boost response rates

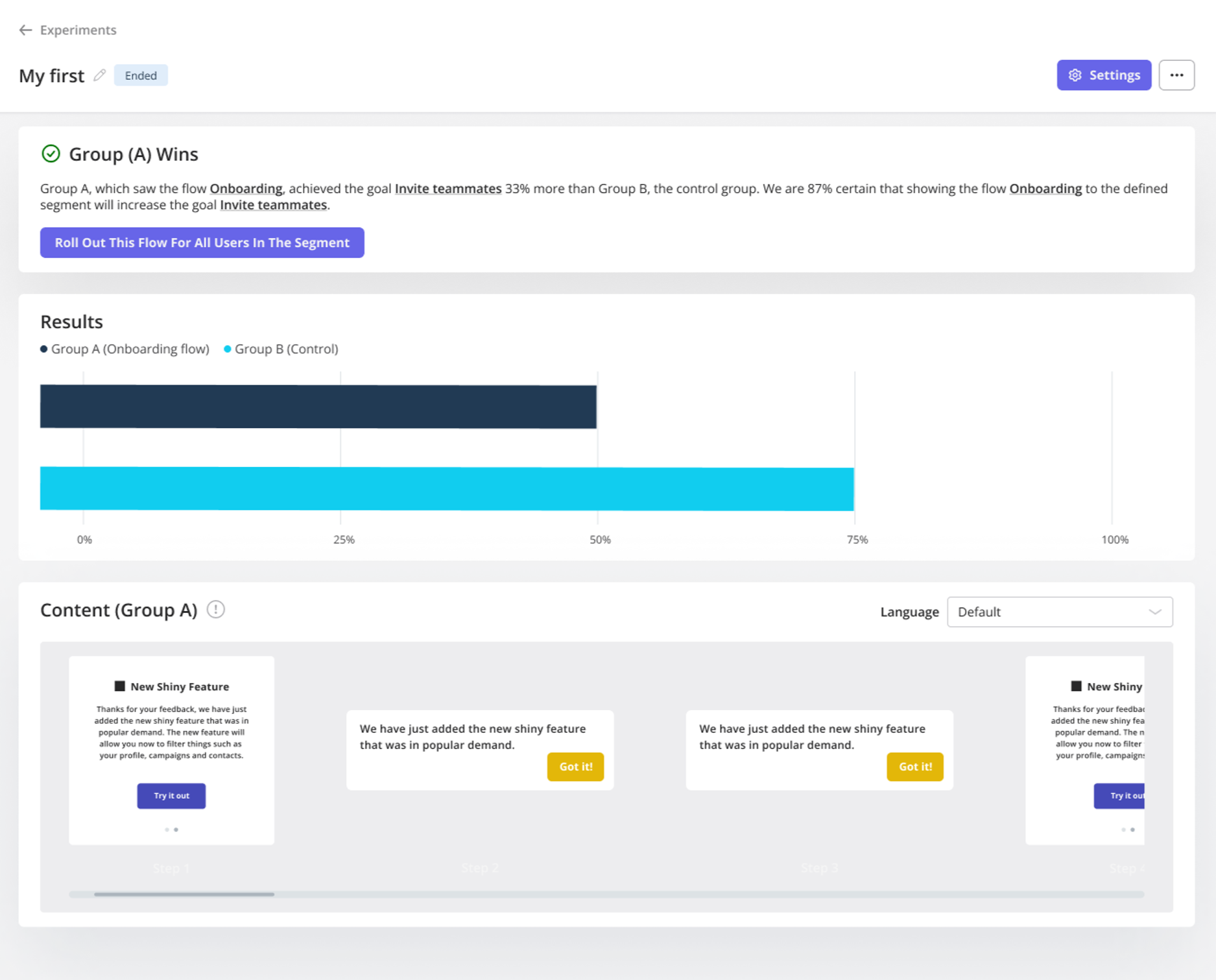

A/B testing compares two versions of a webpage or app design to determine which performs better.

For NPS surveys, the variations don’t have to be too big. Experiment with different question formats, message tones, and delivery times to maximize response rates.

Play around with the survey design, too. For example, see what gets a higher completion rate, like a simple text-only question or a question with a visual slider scale.

Experimenting like this allows you to identify what resonates best with your audience and make changes accordingly.

Run A/B tests to measure the impact of in-app changes, measure performance, and optimize accordingly.

8. Use the right NPS survey tool

Choose a complete customer survey solution that lets you build, capture, analyze, and act on your NPS data. To narrow down the search, look for a tool that offers all these key features:

- Customization to tailor survey questions and design.

- Integration with your existing workflow.

- Survey analytics to understand NPS data for actionable insights.

- Survey delivery options across several platforms, e.g., email, SMS, and in-app.

- Data security compliance and privacy features.

One tool worth considering is Userpilot, which simplifies NPS survey creation, deployment, and analysis. Let’s look at an example of the tool in action.

CYBERIZ, an e-commerce platform, redesigned its admin panel to improve the customer experience. But there was no way of knowing whether the redesign was successful.

So CYBERIZ leveraged Userpilot’s in-app surveys, localized in the right language, to measure customer satisfaction with the new design. CYBERIZ also used the surveys to identify beta-tester recruitment, so the product team didn’t have to compile a list of testers manually themselves.

Quickly recruit testers by streamlining the process with Userpilot’s in-app surveys for targeted participant collection.

9. Optimize your surveys for a smooth mobile experience

Over 95% of users now use a mobile phone to go online. And mobile phones account for 63% of the world’s web traffic. These usage trends mean many users now access your SaaS products on their smartphones or tablets.

So, to increase responses and reach a broader audience, make sure your surveys are fully responsive and optimized for mobile devices.

This way, you can create mobile onboarding flows, feature announcements, and surveys, and perform mobile analytics, all without coding. So you can track the behavior of mobile users and personalize their experiences through advanced segmentation.

10. Close the feedback loop

Closing the feedback loop means acknowledging and responding directly to customer feedback. Especially negative feedback, with 53% of customers expecting a reply within a week.

Getting back to customers demonstrates that you’re listening and taking action to address their concerns. Once customers see that you value their opinions, they feel more connected to your brand, which translates into greater customer loyalty.

11. Offer incentives for participating (judiciously)

Research shows that offering an incentive can boost survey responses by 30% at times. These can be small incentives, such as discounts or exclusive content, to encourage greater participation.

However, avoid over-reliance on these incentives, as they can attract low-quality feedback from users outside of your target audience.

Instead, use these incentives for specific customer segments. For example, an extended trial period is great for the at-risk segment, motivating them to engage with your product more and provide feedback.

12. Provide context and a clear explanation for the “why” of the survey

Users are more likely to respond if they’re given some context about what the survey is for.

So, explain how you’ll use the customer’s feedback and highlight the benefits of participating in the survey.

Consider something simple like “Your feedback helps us better prioritize product improvements. Complete this quick survey to help perfect our next feature rollout, and enjoy early access once it’s ready!” This emphasizes the impact of their feedback and entices users to participate in exchange for exclusive access.

13. Implement effective follow-up strategies

Lastly, always remember to follow up. If you don’t, customers might feel ignored, like their voice doesn’t matter, ultimately damaging your brand reputation.

To make the follow-ups relevant, try personalizing them based on NPS scores. For example, here are some follow-up questions you could ask for each of the three categories:

- Promoters: “We’re thrilled you’re enjoying the analytics feature. Is there anything else we can do to make your experience even better?”

- Passives: “Thank you for your feedback! What improvements would make this analytics feature more valuable for you?”

- Detractors: “We’re sorry to hear you’re not satisfied with the analytics feature. Could you provide more details on what went wrong so we can work on fixing it?”

NPS survey template: What questions can I ask?

That’s because there is no one-size-fits-all survey template. Instead, the structure depends on several factors, such as:

- Targeted customer segment.

- Customer journey touchpoint.

- Triggering event (e.g., free trial expiry or customer support interaction).

- Behavior over time.

- Customer pain points.

- Survey distribution channel.

In addition to these, there’s also the matter of what type of questions to use. Let’s go over the options to determine which one to add to your survey.

Strategic Framework: Choosing the Right NPS Survey Questions

Following NPS survey best practices means recognizing that there is no one-size-fits-all approach. The structure of your questions should change based on several strategic factors, including your targeted customer segment, the current journey touchpoint, and the specific triggering event (such as a free trial expiry or a customer support interaction).

When designing your survey, you must strategically balance two types of inquiry:

-

Quantitative rating scales: These are the primary questions used to calculate your core metrics (NPS, CES, or CSAT). The best practice here is consistency; use a standard 0-10 or 1-7 scale so you can track loyalty trends over time without confusing the user.

-

Qualitative open-ended follow-ups: These are essential for identifying the “why” behind the score. Best practices suggest using these sparingly to avoid survey fatigue, focusing them on Detractors to identify friction or Promoters to find expansion opportunities.

💡 Pro tip: To maximize your results, always include a qualitative follow-up question. This provides the deeper insights needed to identify the specific reasons behind customer satisfaction or dissatisfaction.

For a complete library of specific question examples, ready-to-use flows, and proven structures, see our dedicated NPS survey template guide.

Qualitative follow-up questions provide deeper insights into NPS scores, helping identify specific reasons behind customer satisfaction or dissatisfaction.

Get the most from your NPS surveys

These NPS survey best practices are great for improving response rates. But simply gathering customer feedback isn’t enough. NPS is a tool for sparking change, and every response is an opportunity to build stronger relationships, refine your product, and create brand advocates.

As you optimize your NPS strategy, remember that every survey response is a conversation, not just a number. While this guide focused on execution, you can explore our NPS survey templates for inspiration or learn about the different types of NPS surveys to refine your approach.

FAQ

What is a good NPS score?

What counts as a “good” NPS score will keep changing based on your business type, lifecycle stage, etc. For example, within the SaaS industry, the benchmark for the average score is 36. So, anything beyond 36 would be considered a good Net Promoter Score.

How often should I send NPS surveys?

Best practice dictates sending relationship NPS surveys every quarter or semi-annually. This helps maintain consistent customer feedback while not annoying them by reaching out too often.

Transactional NPS surveys are sent immediately after specific interactions when the experience is still fresh in the customer’s mind. This ensures more accurate feedback that isn’t influenced by time or memory bias.

How do I calculate NPS?

Here are the steps for calculating your NPS score:

- Divide survey respondents into 3 categories: Detractors (0 to 6), Passives (7 or 8), or Promoters (9 or 10).

- Calculate the percentages for each category.

- Apply the NPS formula = [% Promoters] – [% Detractors].

NPS score calculation considers both promoters and detractors, offering an accurate snapshot of customer satisfaction and loyalty trends.

What should I do with negative NPS feedback?

Start by acknowledging the negative customer sentiment expressed so the customer feels heard. Next, investigate the reason behind such feedback and take action where possible with targeted improvements.

Lastly, always close the feedback loop by communicating the resolution to the customer. This lets customers know you value their input and are committed to improving their customer experience.