In SaaS, building a product that fits perfectly with your user’s needs is indispensable—and that’s where the voice of customer survey comes into play.

If you truly want to achieve product-market fit and product growth, listening to your customers is non-negotiable.

So, in this post, we’ll talk about what defines a VoC survey, how to create them, and what tools you can use to implement them inside your app without coding.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is a Voice of Customer survey?

Voice of customer surveys are qualitative and quantitative surveys that aim to uncover your customer’s thoughts or feelings about your product or service.

Voice of Customer survey vs. Voice of The Customer (VoC) program

Using VoC surveys and VoC programs interchangeably is like swapping tactics with strategies.

A VoC program constitutes the whole processes and tools used to gather and analyze customer feedback in order to implement strategies to grow your business.

On the other hand, a VoC survey is only one channel to collect user feedback during a VoC program. These are often complemented with other data sources such as conversations with sales reps, customer interviews, and focus groups to get a wider understanding of your customer’s needs.

Why do you need a Voice of Customer survey?

You don’t conduct VoC surveys for the sake of it.

Other than listening to your customer’s sentiments about your product, VoC surveys are important for many reasons, including:

- Finding out if your product lives up to expectations and helping you improve customer satisfaction.

- Discovering customer pain points you would’ve never found out otherwise and developing your product around it.

- Segmenting your user base and personalizing the product experience.

- Identifying at-risk customers and proactively preventing churn.

- Minimize negative feedback on online reviews and protect your brand’s reputation.

Examples of great VoC survey questions

Your customer survey questions depend on whether you want qualitative or quantitative feedback. Yes-or-no questions are often used as quantitative data, while qualitative surveys use open-ended questions to allow for deeper responses.

It also depends on the type of survey. Here are some examples:

Overall customer satisfaction questions

Customer satisfaction questions are great for understanding how happy your users are with the overall product experience.

- How would you rate the usefulness of our product? (scale)

- What’s working for you and why?

- What about our product would you improve if you could?

- Did you manage to achieve your goals with our product?

Customer service questions

The customer experience isn’t only about the product. It also includes customer service.

So, it’s also important to ask users to rate your customer service team with questions like:

- Was the service representative able to answer your questions?

- What is your preferred type of communication method? (choice-based)

- How would you rate your experience with our team members?

Product usage and feature questions

Those questions collect feedback on specific parts of your product, For instance, you can trigger an in-app survey after the user has interacted with a particular feature and ask one of these questions:

- What are the most important features we’re missing?

- What do you think about our new feature?

- What functionality of [your product] you couldn’t live without?

Customer retention and loyalty questions

You can also ask questions to assess how your retention and loyalty efforts are going and:

- How likely are you to renew your subscription?

- If the pricing were to change, would you still buy from us?

- How likely are you to recommend our brand to your friends or colleagues?

What are the main types of VoC surveys?

Now, it doesn’t matter what questions you use without understanding the type of survey you’re doing.

For the voice of customer surveys, there are three main types that are essential:

Customer effort score surveys (CES)

Customer Effort Score (CES) is a customer experience metric that measures the product’s ease of use.

CES surveys are normally triggered contextually after the user engages with a key feature or completes a key action.

Once you identify a user with a high effort score, try to look deeper to find where the friction lies. For example, you could ask follow-up questions and check session recordings.

Customer satisfaction score surveys (CSAT)

Customer satisfaction score surveys (CSAT) measure your users’ satisfaction with your product, brand, and overall experience.

To spot sources of friction, you should trigger customer satisfaction surveys at different touchpoints in the user journey to understand how each experience makes customers feel. Take an example from Hubspot, which triggers CSAT surveys upon customers interacting with the support team.

Net Promoter Score (NPS surveys)

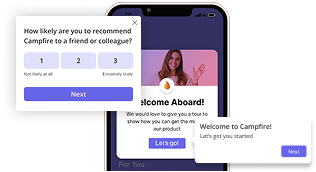

The Net Promoter Score (NPS) surveys measure how likely users are to recommend your product or service to others on a scale from 1 to 10. Where 0 means “Not Likely” and 10 means “Extremely Likely.”

NPS surveys can be transactional, which are sent just after purchase to get immediate feedback. Or relational, which are sent periodically to keep tabs on customer satisfaction levels.

But as a VoC survey, it’s used to find out how many promoters and detractors you have, often including follow-up questions to dig deeper into them.

How to conduct a Voice of the Customer survey

So what’s the process to get started with VoC surveys?

For us, it doesn’t take more than five steps. Let’s go over each of them:

Start with building your VoC plan

Before sending VoC surveys, start thinking about what you want from them. Do you need feedback on specific features? On your customer service? Or maybe there’s a pain point you must uncover?

Whatever information you’re looking for, define what you’ll do with it. For instance, you could track responses from NPS surveys to set up interviews with detractors and find out about sources of friction across the customer journey.

Use a tool to build your survey

If you care about your time and money, you must use a tool to create your surveys (especially if you don’t know how to code).

The convenience of implementing an idea in minutes is too good not to ignore. For example, Userpilot has many predesigned survey templates that you can quickly customize for branding (while also allowing you to build it from scratch if you want more control).

So, make sure to choose the right tool for your needs.

Analyze the collected customer data

After collecting significant responses, analyze your customer feedback to identify potential trends and patterns in your user base.

For example, you can look at different user segments to see if there’s a noticeable difference in their responses.

Or if you asked open-ended questions, tag responses and try to find if there’s a correlation between certain responses and scores.

Close the feedback loop

Customer research doesn’t stop after analyzing the data.

It’s also important to create a continuous communication loop with your user base and keep updated on what’s happening behind the scenes. That could be asking them more questions based on their previous answers, letting them know that you fixed the bug they reported, or explaining to them why you can’t implement their feature request.

The goal here is to make them feel heard and ensure that their feedback is being taken seriously.

Voice of Customer survey best practices

Creating VoC surveys, analyzing responses, and implementing changes can be good enough framework to get you started.

However, there’re a couple of best practices (seven, actually) that can potentially improve your response rates and help you find deeper insights.

Keep the surveys short and focused

It’s in your best interests to keep VoC surveys focused on specific themes – that will help you not only get more accurate responses but also avoid survey fatigue.

No need to panic that you will get limited data by keeping your surveys short. You can do several microsurveys across different intervals and complement your data if you feel like some important info is missing from the puzzle.

Trigger customer surveys contextually

Context is everything when collecting feedback. You should be mindful of the user journey and send out surveys when it makes sense.

For example, you it would be unprofessional to ask a free trial user to give their opinion on a premium feature, right?

To prevent this from happening, you can use segmentation to reach specific questions.

Collect both quantitative and qualitative feedback with your surveys

You must collect both qualitative and quantitative feedback to get thorough insights from your VoC surveys.

Close-ended questions (quantitative) will give you facts about your user base, but qualitative questions will help you understand the “why” behind those facts.

The best approach is to combine both types of questions in your surveys. Including quantitative questions that are easy to respond to with open-ended questions where customers can expand on their thoughts, like in this example:

Eliminate leading questions

It’s possible to ask bad survey questions. And one of them is leading questions.

Leading questions are biased and will degrade the quality of your responses, as they mislead users to think in a way that’s too favorable for you. For example:

The question above assumes that the customer had a positive experience with your product, making the user feel like they must give a positive or neutral answer.

So make it a point not to assume customer’s answers while writing a survey questionnaire and make them unbiased, like this one:

Offer an incentive when you need extended feedback

You can add incentives such as coupons, gift cards, or access to premium features to show gratitude and motivate your users to give detailed feedback.

However, only do this for long surveys. Otherwise, there’s a risk that your customers would respond just for the benefits instead of providing real value.

Add images or micro-videos to make your survey engaging

People want to interact with people, not brands. Hence it’s a good idea to make your survey invitations more personal by adding pictures of team members, a fun animation, or a personalized message to increase response rates.

Tools like Userpilot allow you to embed any media into your in-app surveys, and it’s pretty easy to do.

Use both active and passive VoC surveys

There’s also active and passive feedback. And you need both to keep a healthy two-way communication with customers and build brand loyalty.

Active surveys pop up when the user takes a specific action (using a feature, contacting support, etc.), prompting them to take the survey at that moment. While passive surveys are less intrusive and always available in the UI, like this survey from Miro:

Best tools for creating Voice of Customer surveys

As said earlier, you need to use software to create VoC surveys on the go without worrying about coding or asking the dev team to help you out.

Here are our two recommendations:

Userpilot – best for creating in-app microsurveys code-free

Although Userpilot can easily help you create customized surveys quickly, it’s not the only thing it does.

Userpilot also allows you to:

- Create user segments and trigger relevant surveys with personalized messages.

- Trigger in-app surveys based on in-app events such as clicks, feature usage, etc.

- Customize in-app mobile surveys with any type of question and trigger.

- Send automated messages to survey participants to improve the user experience.

- Embed surveys created with Typeform inside your app.

Typeform – best for creating long-form external VoC surveys

Typeform allows you to create long-form surveys and feedback forms with an abundance of templates to choose from.

It’s great for sending long-form surveys via email or embedding them directly in your app. Its Logic Jump feature allows you to personalize survey questions and analytics for tracking survey engagement.

However, Typeform long-form surveys can disrupt the product experience by redirecting users out from the product—unless you leverage its Userpilot integration to remove this friction altogether.

Wrapping up

Feedback is essential for growing any SaaS business. And with the knowledge to create a voice of customer survey, all you need to do is take action.

So make a VoC plan, design your surveys, and start gathering customer feedback so you can stop guessing.

And given that you’ll need software for this, why not try a Userpilot demo to see how quickly you can build in-app surveys that get responses?