79% of marketing-generated leads fail to convert into sales. Most of that waste comes from routing based on form fills instead of behavior.

A VP who has been using your product daily receives the same follow-up as a student who has downloaded one ebook. Sales teams waste hours chasing low-quality leads while real buyers wait for a response.

Lead scoring software fixes this. It ranks prospects by combining who they are (job title, company size, budget) with what they do in your product (feature usage, login frequency, hitting limits). The right lead scoring tools separate qualified leads from noise automatically.

Automated lead scoring identifies the most promising leads so sales can focus on accounts ready to buy. That’s the difference between a busy pipeline and a productive one.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is lead scoring?

Lead scoring is the process of ranking prospects based on how likely they are to buy. Traditionally, teams score leads using static attributes like job title, company size, or industry. That data still matters, but it’s not enough on its own.

In SaaS these days, lead scoring has shifted from who someone is to how they behave. Product usage matters more than job title, and feature adoption matters more than company size. Behavioral data points like login frequency, upgrade attempts, and billing configuration reveal whether someone is casually exploring or actively getting value.

This shift lets sales teams distinguish between window shoppers and power users before anyone picks up the phone.

Why lead scoring matters for sales teams

Lead scoring isn’t a “later” problem. It’s how sales teams protect their scarcest resource: time. Without it, reps treat every signup as a potential deal and waste critical minutes sorting through low-intent leads, missing the short window when high-intent buyers are ready to engage.

Lead scoring surfaces the right prospects the moment intent peaks, improving speed-to-lead and sales velocity. It also aligns sales and marketing around a shared definition of what a qualified lead looks like, reducing friction, cutting wasted calls, and improving feedback loops on lead quality.

Most importantly, it keeps sales teams focused on conversations that matter, boosting confidence, follow-up speed, and overall performance.

Lead scoring vs lead routing vs qualification

I often see these three terms used interchangeably, but they are distinct mechanical parts of the revenue engine. If you confuse them, your funnel will break.

| Concept | Airport analogy | What it does | What question it answers | What it does not do |

|---|---|---|---|---|

| Lead scoring | Metal detector | Assigns a numerical score (e.g. 0–100) based on intent signals like actions, engagement, or product usage | How strong is this lead’s intent compared to others? | Decide sales readiness or assign ownership |

| Lead qualification | TSA agent | Applies a clear status (qualified or not) based on agreed criteria such as score thresholds, fit, timing, or account relevance | Is this lead ready for sales involvement right now? | Measure intent on a spectrum or decide routing |

| Lead routing | Gate assignment | Assigns qualified leads to the right sales owner or motion (enterprise, SMB, territory, nurture) | Where should this lead go next? | Score intent or determine qualification |

Types of lead scoring models

Not all points are created equal. A reliable lead scoring model pulls from multiple data layers, each adding clearer intent signals. The strongest scoring models combine fit, engagement, and product behavior instead of relying on a single source.

Layer 1: Explicit scoring based on fit

This layer includes demographic and firmographic data. It forms the baseline and answers: Is this even a potential customer?

- Job title: Decision-maker, influencer, or no buying authority?

- Company size: Does the organization fall within your target budget range?

- Industry: Does the account match your ideal customer profile (ICP)?

This layer is necessary, but it’s static. A VP of Engineering at a large enterprise may look perfect on paper while having zero intent to buy. Explicit lead scoring data on its own produces false positives.

Layer 2: Implicit scoring from marketing engagement

This layer captures how leads interact with your sales and marketing efforts. It answers: Are they paying attention?

- Did they open or click recent emails?

- Did they attend a webinar?

- Did they download a whitepaper or case study from your marketing campaigns?

These signals need careful weighting. Many engagement metrics are shallow. Patterns matter more than single actions. Repeated pricing page visits within 48 hours signal a stronger intent than a one-off click.

Layer 3: Behavioral scoring from product usage

For SaaS teams, this is the most informative layer. It tracks behavioral data inside your product and answers the most important question: Is the user getting real value?

Product usage lets you distinguish between casual exploration and meaningful adoption. A user who logs in once and disappears behaves differently from one who returns frequently, invites teammates, sets up integrations, or hits usage limits.

This is where lead scoring becomes most powerful: identifying whether a user has reached their ‘Aha!’ moment, the point where your product’s value becomes clear. Leads who reach that moment are far more likely to convert and expand, making product behavior one of the strongest predictors of revenue.

Lead scoring signals that help sales qualify faster

I’ve seen companies assign points for visits to the ‘About Us’ page. That’s a mistake. When you score leads effectively, you prioritize signals that correlate with revenue, not curiosity.

The goal is to help sales focus on the most promising prospects, the accounts actively evaluating, adopting, or preparing to buy. These lead scoring signals generally fall into three categories.

1. Commercial intent signals

These actions suggest that a user is thinking about the commercial side of the relationship.

- Viewing billing or upgrade settings: When a free user clicks into billing, upgrades, or payment methods, they’re signaling interest in moving beyond evaluation.

- Reviewing legal or security documentation: Downloading SOC 2 reports, security overviews, or compliance documentation often indicates procurement or IT review. While not always an immediate buying signal, it strongly suggests evaluation-stage intent.

- Pricing page frequency: A single visit usually reflects early research. Repeated visits within a short time frame often indicate budget discussion or internal comparison. This behavioral data point is one of the strongest predictors of near-term conversion.

2. Product adoption signals

These signals show whether the product has become part of the user’s workflow based on the lead’s behavior patterns. They’re less about interest and more about adoption.

- Core feature usage: Repeated use of the product’s primary functionality is one of the strongest indicators of value realization. This is where product stickiness metrics become meaningful for identifying promising leads.

- Session frequency: Frequent logins over time suggest habit formation and reliance on the product, not casual experimentation.

3. Expansion and upgrade signals

Lead scoring isn’t limited to new business. It also plays a key role in identifying upsell and expansion opportunities among potential customers.

- Hitting usage limits: Repeatedly encountering paywalls or usage caps often signals that the current plan no longer fits the account’s needs. These data points provide valuable insights into account expansion readiness.

- Integration setup: Connecting the product to tools like Slack, Salesforce, or email systems increases switching costs. These integrations usually indicate deeper commitment and long-term intent.

What separates scoring tools sales trust from those they ignore

You cannot scale behavioral lead scoring with a spreadsheet. Modern lead scoring solutions require a tech stack that supports near real-time data flow across product, analytics, and sales systems.

When a user takes a meaningful action inside your product (inviting a teammate, attempting to upgrade), that lead data needs to move quickly from the product to your lead scoring system and then into the CRM.

Long delays break automated lead scoring. If scoring updates take hours, sales reaches out after interest has cooled.

A functional lead scoring platform usually includes three layers that work together.

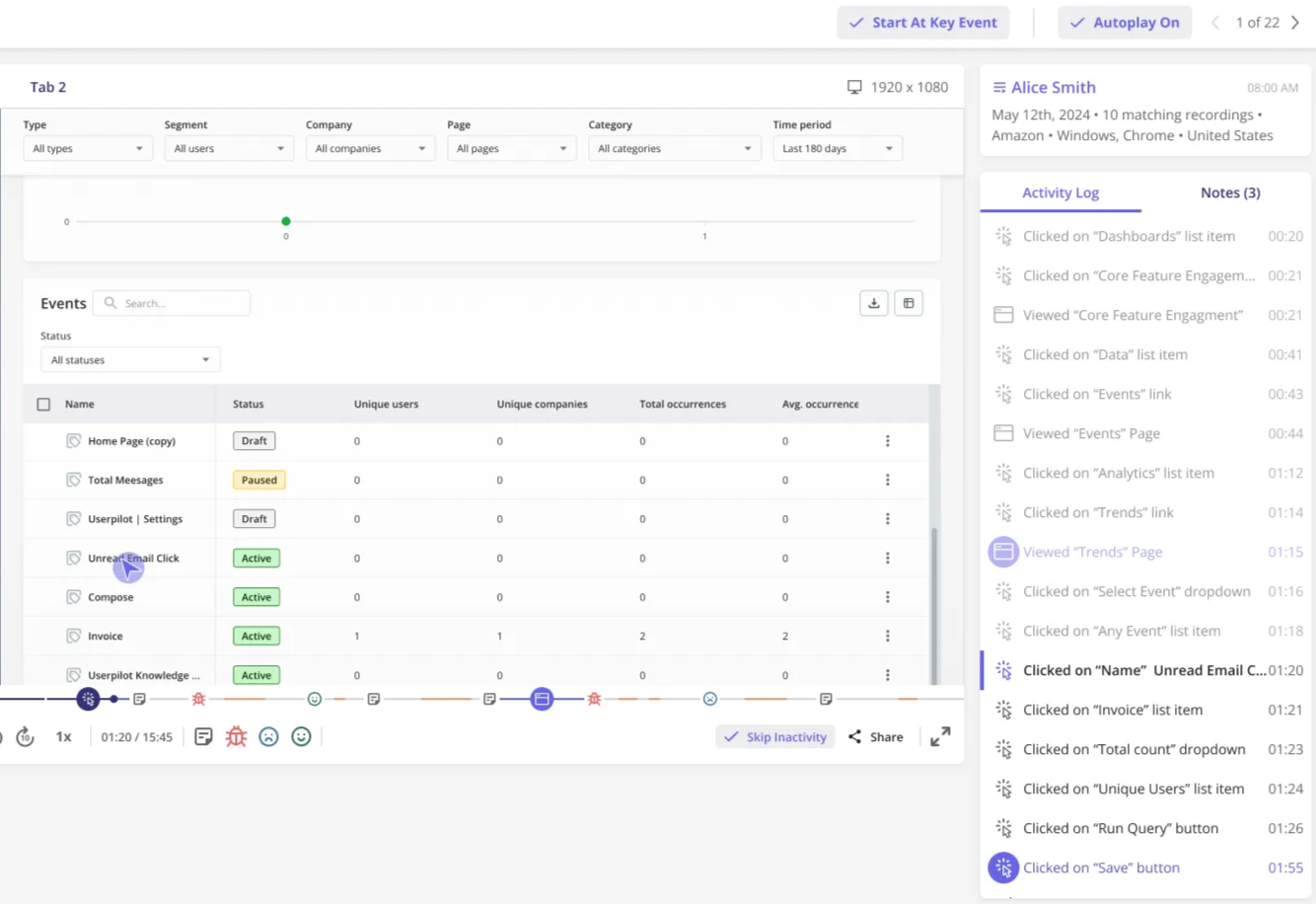

- Product adoption platform: Tools like Userpilot sit directly on top of your application and capture in-product behavior without requiring engineering work for every interaction. This layer tracks usage patterns and behavioral data points that don’t exist in traditional CRM and marketing tools. Userpilot’s lead scoring capabilities include visual event tracking, so you’re not waiting on developers to instrument every button click.

- Analytics layer: Platforms such as Mixpanel or Amplitude aggregate behavioral data and help teams identify which actions actually correlate with conversion, expansion, or churn. This is where your scoring model becomes evidence-based rather than assumed. The best lead scoring software connects analytics directly to scoring logic.

- CRM: The final destination is your CRM, typically HubSpot or Salesforce. Sales needs to see lead scores, qualification status, and recent activity directly on the contact or account record. If the score lives outside the CRM, it rarely influences real sales behavior. This is why bi-directional sync between your lead scoring platform and CRM matters.

How to roll out without breaking your funnel

The most common mistake in the lead scoring process is over-engineering the model on day one. Teams spend months designing complex matrices with dozens of signals, launch them, and realize they’re sending wrong leads to sales. Start simple. Complexity should come from evidence, not assumptions.

Phase 1: Prioritize high-intent handraisers

Before building any algorithm, make sure you’re not missing the highest-intent signals. Anyone who requests a demo or submits a “Contact sales” form should be treated as sales-ready.

These leads can be scored at the top of the range or bypass scoring entirely and route directly to sales. What matters is speed. Delayed follow-up at this stage often costs deals. Many teams miss opportunities here by over-analyzing secondary engagement data instead of just calling.

Phase 2: Filter out low-quality leads

Negative scoring is essential for reducing noise and helping you prioritize leads effectively. If a user signs up with a personal email domain or identifies as a student during onboarding, that signal should lower their priority or route them into a self-serve path.

This filters out leads unlikely to convert and keeps the sales process focused on accounts that match your target profile. Score up for strong intent signals, score down for poor fit.

Phase 3: Continuously refine your scoring model

A lead score is a hypothesis, not a verdict. Your lead scoring criteria need continuous validation to stay accurate.

Create a regular feedback loop with sales leadership to review outcomes. Use lead conversion data from closed-won deals, stalled opportunities, and disqualified leads to refine your model.

If inviting teammates correlates strongly with conversion but carries little weight in your scoring model, adjust it. Your scoring criteria should evolve alongside your product and your buyers, not remain fixed. This is where rules-based lead scoring falls short: static rules can’t adapt to changing buyer behavior the way a regularly updated model can.

Sales teams don’t need more leads

They need better ones.

Lead scoring separates qualified leads from noise by tracking who someone is and how they behave in your product. Score leads based on behavior, and sales stops chasing students who downloaded an ebook. They start calling VPs who invited their team, set up integrations, and visited pricing three times this week.

Start with five signals that match your closed-won deals, get sales feedback quarterly, and adjust your weights as buyer behavior changes.

Userpilot tracks product behavior and scores leads automatically without engineering support. Book a demo to see how it works.

FAQ

How do you do lead scoring?

Lead scoring works by assigning point values to signals that indicate fit and intent. Start with firmographic data (job title, company size, industry), marketing engagement (email clicks, webinar attendance), and behavioral data from product usage (feature adoption, login frequency, integration setup).

Leads accumulate points as they take meaningful actions. Once they cross your threshold, they become sales-qualified leads ready for follow-up. Review your lead scoring criteria quarterly based on closed-won deals to maintain scoring accuracy.

How do I choose the right lead scoring tool?

Choose lead scoring software that pulls data from your product, marketing automation platforms, and CRM in real time. The right lead scoring platform should support custom scoring logic, negative scoring for poor-fit leads, and display scores directly inside your CRM where sales works.

Look for tools that track behavioral data, not just form fills. The best lead scoring software makes scores actionable by triggering alerts when leads hit thresholds, not just showing numbers in dashboards.

Which is the best tool for lead generation?

There’s no single best tool for lead generation. The right choice depends on your go-to-market motion. Marketing-led teams rely on inbound campaigns and content, while product-led teams generate leads through free trials and in-app engagement.

Lead scoring tools become critical once volume increases and qualification becomes the bottleneck. If you’re product-led, prioritize scoring software that tracks product behavior, like Userpilot.

Should I use predictive lead scoring?

Predictive lead scoring model uses machine learning to identify patterns in historical conversion data and score leads based on those patterns. It can be powerful if you have thousands of leads and clean data, but it’s overkill for most early-stage teams.

Start with rules-based lead scoring using 5-10 signals you know correlate with revenue. Once you have 6+ months of conversion data and predictable patterns, consider predictive lead scoring software. Traditional lead scoring gives you more control and transparency, which matters when you’re still learning what drives conversions.