As a product manager, you’re constantly juggling multiple priorities, from delivering exceptional user experiences to launching new features. But without tracking the right product-led growth metrics, it’s easy to lose sight of what truly matters. Chasing vague or irrelevant KPIs can lead to wasted resources, overlooked user needs, and even customer churn.

This guide aims to help you prevent all that. I’ll explore the 10 most critical product growth metrics every PM should track, along with actionable strategies to help you improve your key performance indicators and steer your product toward success.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

Introduction to product-led growth

Product-led growth is a business model that puts the product at the center of customer acquisition, conversion, and retention. Instead of relying solely on sales or marketing, a product-led growth strategy empowers users to experience value firsthand—often through free trials or freemium offerings—before making a purchase decision. This approach not only accelerates user acquisition but also reduces customer acquisition costs by letting the product do the heavy lifting.

By focusing on delivering value quickly, product-led growth companies can increase the customer lifetime value and generate more revenue from existing customers through expansion revenue and upsells. Monitoring net revenue churn is also crucial, as it reveals how much revenue is lost versus gained from your customer base over time. Ultimately, a successful product-led growth strategy hinges on tracking the right metrics—such as customer lifetime, expansion revenue, and net revenue—to ensure that the product is driving sustainable business growth.

Product-led growth metrics vs traditional product analytics

Before we dive into details, let’s set the record straight on what distinguishes PLG from traditional product analytics metrics. Traditional analytics mainly focuses on product usage data, such as page views, clicks, sessions, and feature usage. While useful for some team members, these are often vanity metrics that lack business context.

Product-led growth metrics, on the other hand, connect user behavior directly to revenue outcomes. They help PMs answer questions like:

- Are users reaching value fast enough?

- Which features actually drive retention and expansion?

- Where does friction prevent users from converting or upgrading?

7 Core product-led growth metrics you should track and why

1. Feature adoption rate

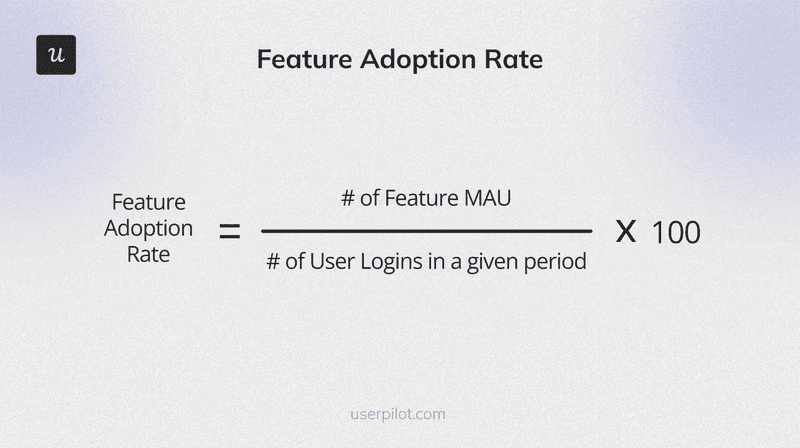

What it is: The share of your active user base that has engaged with the new feature at least once.

Formula: To calculate the feature adoption rate, divide the number of the feature’s monthly active users (MAUs) by the number of user logins in a period of time, and multiply it by 100.

Why track it: Adoption rate reveals initial interest and discoverability of a particular feature. If only a small slice of users ever try a feature, I find that it may be hidden behind a confusing UI or lack clear value.

How to track it: In Userpilot, you flag that event and pull an adoption report without writing extra code. Combine this quantitative view with user interviews to gain a deeper understanding of why some users click through while others never engage.

2. Net Promoter Score (NPS)

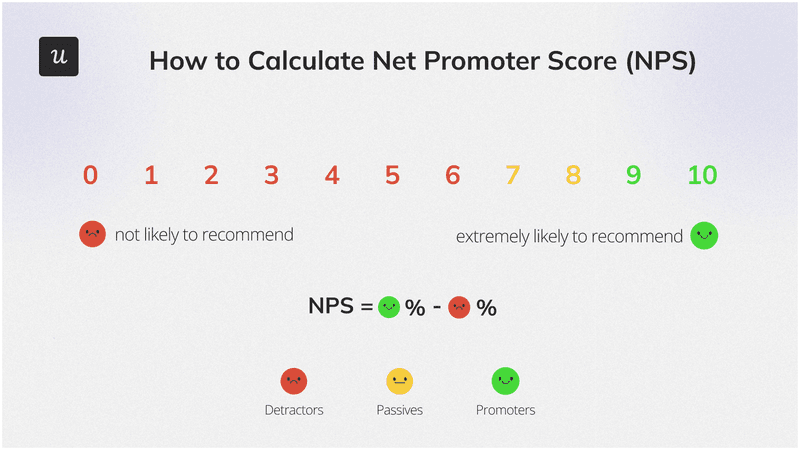

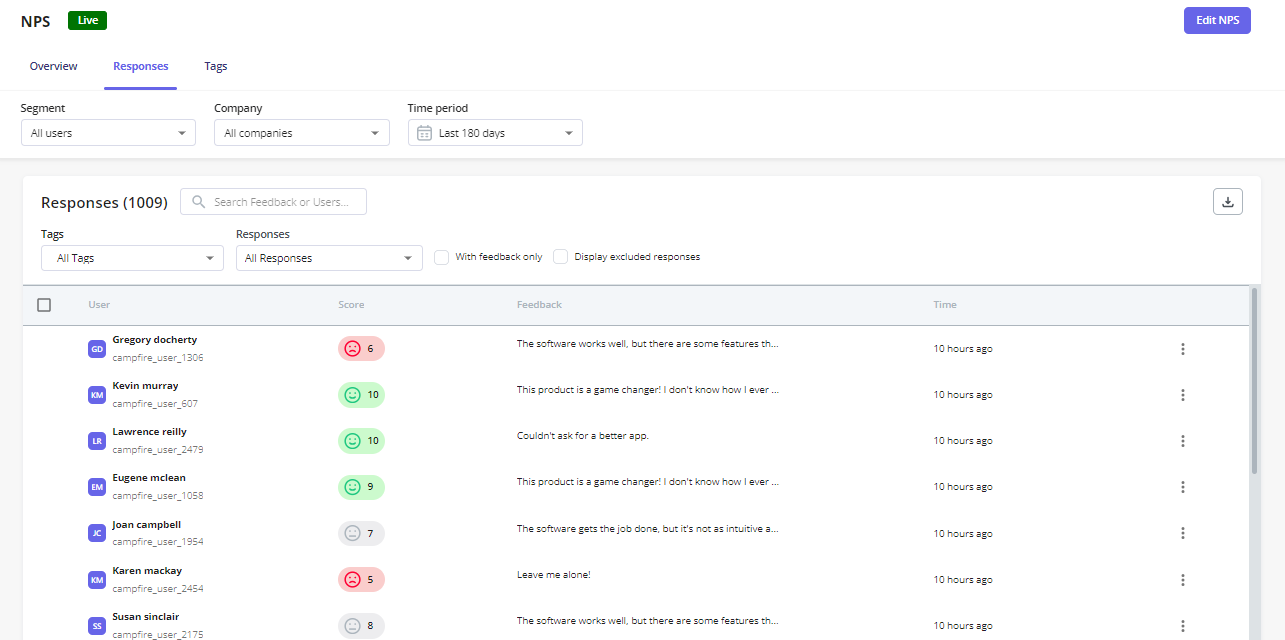

What it is: A measure of user sentiment and user satisfaction based on how likely users are to recommend the feature to a colleague or friend.

Formula: Total % of promoters – total % of detractors = Net Promoter Score

Why track it: NPS moves beyond click counts to capture attitudes. NPS is a direct measure of user satisfaction and gauges user loyalty by asking how likely users are to recommend the product to others. A high NPS indicates that your feature delights users, while a low score suggests that expectations are not being met or that there is friction.

How to track it: Deploy an in-app NPS survey after users complete a core action, like trying out a new feature. Userpilot’s survey widget captures scores and open-text feedback, allowing you to pair a quantitative score with qualitative comments on what users love or dislike. This way, you can successfully meet user expectations and offer maximum value.

3. User retention rate

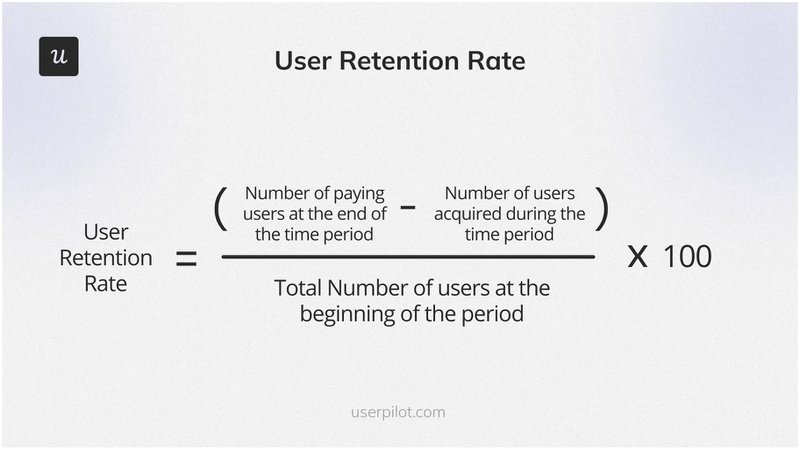

What it is: The percentage of users who continue to engage with the feature (or product) over successive periods. This is also known as the customer retention rate.

Formula: [(Ending Customers – New Customers) / Beginning Customers] * 100 where ending customers is people ending their engagement with your product, new customers are one that newly signed on, and beginning customers are the number of customers a business has at the start of a defined period (e.g., month, quarter, year).

Why track it: User retention (customer retention) rate measures the percentage of users who continue to use the product over a given period. High retention rates indicate a strong product-market fit and user satisfaction, while low rates signal issues with engagement or value delivery. A feature that attracts clicks but fails to bring users back will not drive lifetime revenue.

How to track it: You can define cohorts based on the date of first feature use. Use cohort reports in your analytics tool to monitor how many users return week after week. Pair this with post-use surveys to learn what keeps your most loyal users engaged.

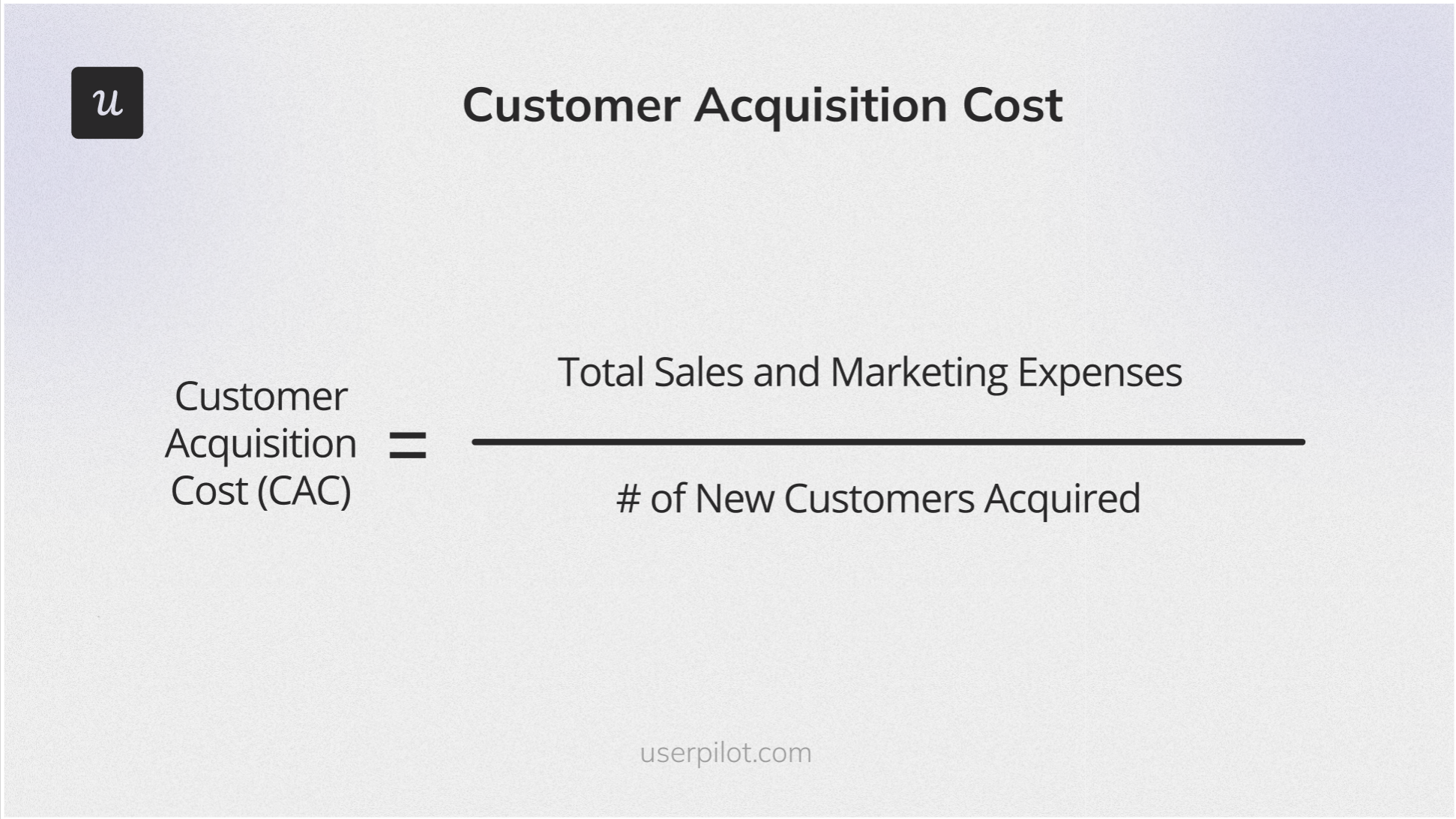

4. Customer acquisition cost (CAC)

What it is: The average cost required to acquire a new customer, including marketing, sales, and onboarding expenses. CAC is a key metric for measuring the cost of new user acquisition, helping you evaluate how efficiently your customer journey and flywheel strategy attract and convert potential users.

Formula: Total sales and marketing spend ÷ Number of new customers acquired

Why track it: Customer Acquisition Cost (CAC) is the cost incurred to acquire a new customer. CAC helps you understand whether a product is economically sustainable. If acquisition costs rise faster than the value generated by users, growth becomes inefficient.

How to track it: Pull cost data from your marketing and sales tools, then attribute new customer sign-ups to campaigns or feature-led flows. Combine this with product analytics to see whether customers acquired through feature-driven experiences are cheaper or more expensive to convert.

5. Time to value (TTV)

What it is: Time to value (TTV) is the amount of time it takes new users to reach their first aha moment or activation event. It measures the amount of time it takes a user to experience the first meaningful value from your product or feature.

Formula: Time between sign-up (or feature discovery) and first key value event

Why track it: Shorter TTV strongly correlates with higher activation, retention, and satisfaction. If users struggle to reach value quickly, they are more likely to churn before fully adopting the feature. The faster users realize value, the more likely they are to continue using and paying for the product.

How to track it: Define a “value moment” (e.g., completing a workflow, generating a report, or publishing content). Track timestamps between onboarding events and that action. Key onboarding steps like importing customer data and managing customer data can significantly reduce TTV, as users often need to complete these before deriving full value. Optimizing for quicker TTV is a two-step process: understand customers’ jobs to be done (JTBD) and onboard customers so they can get value ASAP. Use in-app guidance, checklists, and tooltips to reduce friction and accelerate value realization.

6. Activation rate

What it is: The percentage of users who complete a predefined set of key actions, known as activation events, that indicate they have successfully activated the product or feature. An activation event is a specific user action or milestone that demonstrates the user has experienced the core value or ‘aha moment’ of your product.

Formula: (Number of activated users ÷ Total new users) × 100

Why track it: Activation rate shows whether users understand how to use your product and reach early success. The activation rate quantifies the percentage of users who reach specific activation points that are crucial indicators of long-term retention. Each product has distinct activation events that demonstrate the value it offers to users. A low activation rate often signals unclear onboarding, poor feature discoverability, or misaligned expectations.

How to track it: Define activation criteria (e.g., completing onboarding steps or using a core feature). Users who complete an activation event are typically activated users—these are typically activated users who are most likely to become long-term customers. Track these events in your product analytics and run experiments with onboarding flows to see which experiences drive higher activation.

7. Product-qualified leads (PQLs)

What it is: Product-qualified leads (PQLs) are typically activated users who have completed a key action within your product and seen its value. These users have demonstrated strong buying intent through product usage behavior.

Formula: Users who meet predefined usage thresholds (e.g., feature usage, frequency, or depth)

Why track it: PQLs are more reliable than traditional marketing-qualified leads because they are based on actual product engagement. PQLs are valuable to product-led teams because they are closer to conversion than marketing and sales-qualified leads. Product qualified leads (PQLs) are users who have experienced enough value to become potential paying customers. Features that generate more PQLs directly contribute to revenue growth.

How to track it: Set usage-based criteria (such as repeated use of premium features or hitting usage limits). Analyze the behavior of existing paying customers to help define PQL criteria and inform targeting strategies for potential customers. Sync these signals with your CRM so sales teams can prioritize outreach based on real product value signals.

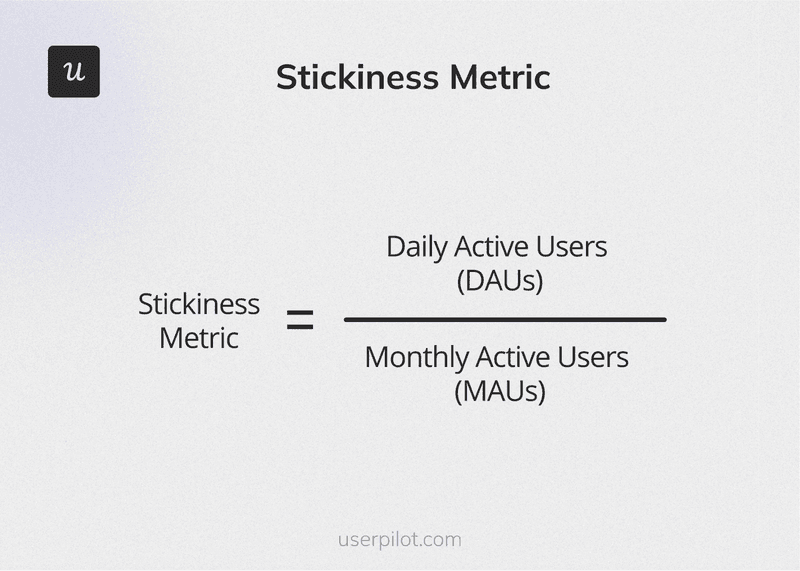

8. Monthly active users (MAU)

What it is: The number of unique users who actively engage with your product or a specific feature within a month.

Formula: Count of unique users performing at least one meaningful action in a month

Why track it: MAU provides a high-level view of product health and engagement. Tracking feature-level MAU helps you understand which capabilities drive habitual usage versus one-off interactions. Tracking MAU alongside monthly recurring revenue gives a more complete picture of SaaS growth, helping you correlate user engagement with revenue trends. User Growth Rate, which indicates the month-over-month increase in new users or free trials, can also be tracked using MAU data.

How to track it: Define what “active” means for your product (e.g., login, feature usage, or task completion). Monitor trends over time and segment MAU by feature, user role, or plan type.

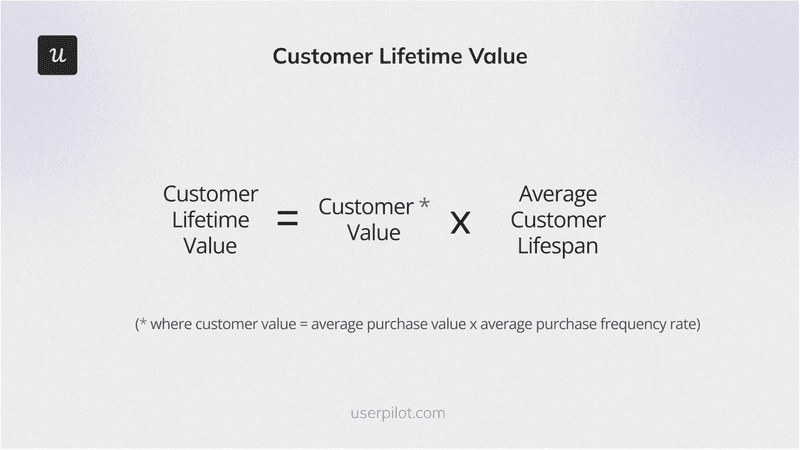

9. Customer lifetime value (CLV)

What it is: The total revenue a customer is expected to generate over their entire relationship with your business. Customer lifetime value (CLV) predicts the total revenue a company can expect from a user over their entire relationship with the product. High CLV indicates a strong product-market fit, effective monetization, and user loyalty. Customer lifetime value (CLV) predicts the total amount of revenue you can expect from a single customer throughout their entire relationship with your company.

Formula: Average revenue per customer × Customer lifespan.

Why track it: CLV helps you determine how much you can afford to spend on acquisition and retention. Features that increase retention, expansion, or usage frequency directly raise lifetime value.

How to track it: Combine billing data with retention metrics. Segment CLV by valuable customer segments to identify the most profitable customer groups. Customer success teams use this information to allocate resources and retain high-value customers. Tracking your most profitable customer is important, as losing them can significantly impact revenue and provides strategic insights for retention and upselling. Segment CLV by feature adoption to identify which features contribute most to long-term customer value.

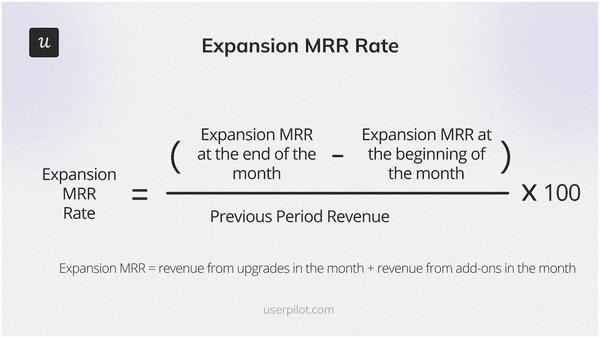

10. Expansion revenue

What it is: Expansion revenue measures the revenue generated from existing customers through upsells, add-ons, and cross-sells. It also measures the additional monthly revenue generated when existing users upgrade plans or purchase extra products or services.

Formula: Revenue from upgrades, cross-sells, and add-ons within a period

Why track it: Expansion revenue is more cost-effective than attracting new customers and demonstrates product value for existing customers. It shows whether your product continues delivering value after initial purchase. Features that encourage deeper usage or unlock advanced capabilities are often key drivers of expansion.

How to track it: Track feature usage against plan upgrades and add-on purchases to generate expansion revenue from existing users. Identify which features are most commonly used before expansion events and double down on promoting them to the right users. Tracking both new and expansion revenue is important for understanding overall revenue growth.

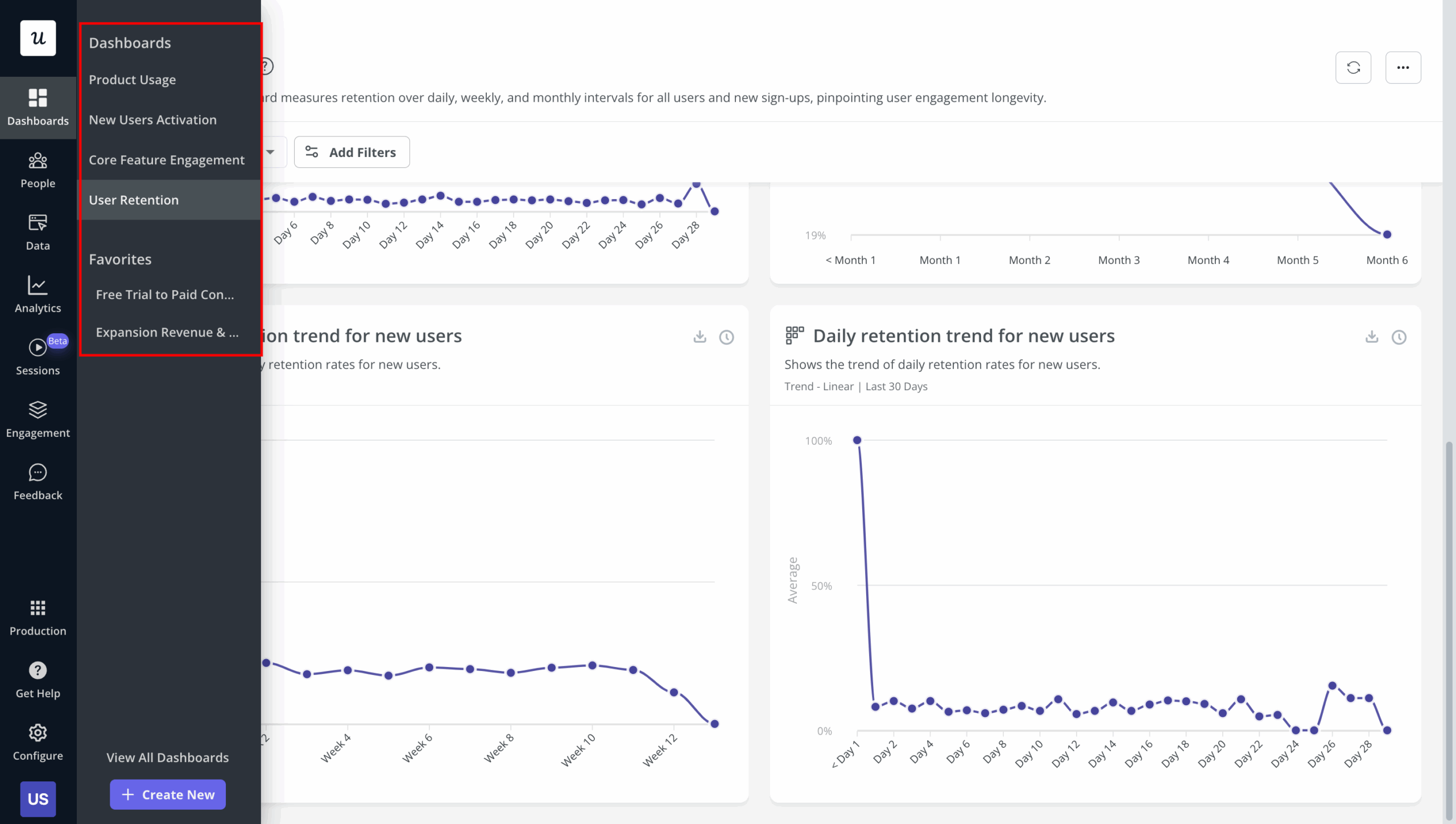

How an all-in-one platform simplifies PLG tracking

Tracking product-led growth metrics across the customer lifecycle can be challenging. When product analytics, onboarding, surveys, and CRM data live in separate tools, teams waste time stitching insights together instead of acting on them.

An all-in-one PLG platform like Userpilot enables teams to track the entire customer journey and all key PLG metrics in one place, providing a holistic view of user experience and lifecycle. Such a platform should track key metrics for Product-Led Growth (PLG), including Activation Rate, Time to Value (TTV), User Retention/Churn, Monthly/Daily Active Users (MAU/DAU), Product-Qualified Leads (PQLs), Free-to-Paid Conversion Rate, Expansion Revenue, Net Revenue Retention (NRR), and Customer Lifetime Value (CLV).

Instead of manually defining events across multiple tools, you can:

- Track feature adoption, activation, and retention inside the same custom dashboard.

- Tie qualitative feedback (NPS, surveys) directly to user behavior.

- Build paths and funnels to track drop-off points.

- Watch session replays to understand the reasons behind user actions.

- Trigger in-app experiences (tooltips, modals, checklists) based on real usage signals.

Most importantly, insights don’t just sit in dashboards. When a drop in activation or time to value appears, product teams can immediately respond with targeted onboarding flows, closing the loop between measurement and execution.

![10 Free Product Roadmap Templates You Need in 2026 [+Free Download] cover](https://blog-static.userpilot.com/blog/wp-content/uploads/2026/01/10-product-roadmap-templates-you-need-in-2026-free-download_d8269f0b0b9749f6ad7b519ab7ac1833_2000-1024x670.png)