Looking for the best way to do market research? From framing your initial question to extracting valuable customer insights, we’ll walk you through the lean market research process step-by-step. You will learn effective techniques for collecting and analyzing data, with practical tips on applying your findings to benefit your SaaS. Get ready to empower your decisions with real-world market intelligence.

What is market research

Essentially, market research is the process of understanding one’s target audience’s needs and wants to validate a new product, feature, or service idea. It involves probing and extracting answers based on empirical evidence instead of relying on hunches or speculative judgment.

Why should you do market research?

Understanding your consumers’ behavior and needs well through methodical market research is vital for informed decision-making when it comes to your product roadmap. These choices can make or break your SaaS company. Without thorough market research, you’re navigating blindly, basing crucial judgments on antiquated notions of customer habits, imprecise economic gauges, or untested assumptions rather than solid competitive analysis.

The outcome? Sharper marketing messages, savvy product development strategies, and an intimate grasp of both prospective buyers and existing customers’ preferences and needs.

Identifying your market research goals

Before you do anything – you need to determine specific and actionable goals of your market research project. Setting SMART (specific, measurable, achievable, relevant and time-bound) goals will help you stay on track, come up with better market research questions and achieve more reliable results faster.

For effective market research outcomes, your goals must be:

- Exact.

- Quantifiable.

- Attainable.

- Directly aligned with project requirements.

Having established unambiguous goals prior to delving into data analysis sets up a solid foundation ensuring pivotal questions, hypotheses, and indicators are systematically tackled during effective market research.

Market research methods

Now that you understand the role of well-defined research objectives, let’s examine the different types of market research and research techniques for realizing these goals. These methods are essentially your toolkit for extracting valuable insights and they fall into two broad categories: primary research and secondary research. Choosing between them depends on many factors such as your budget, time availability, and whether you’re looking for more exploratory research data or concrete answers.

Engaging in primary research is comparable to unearthing precious metals—it requires gathering new information straight from sources through several approaches including:

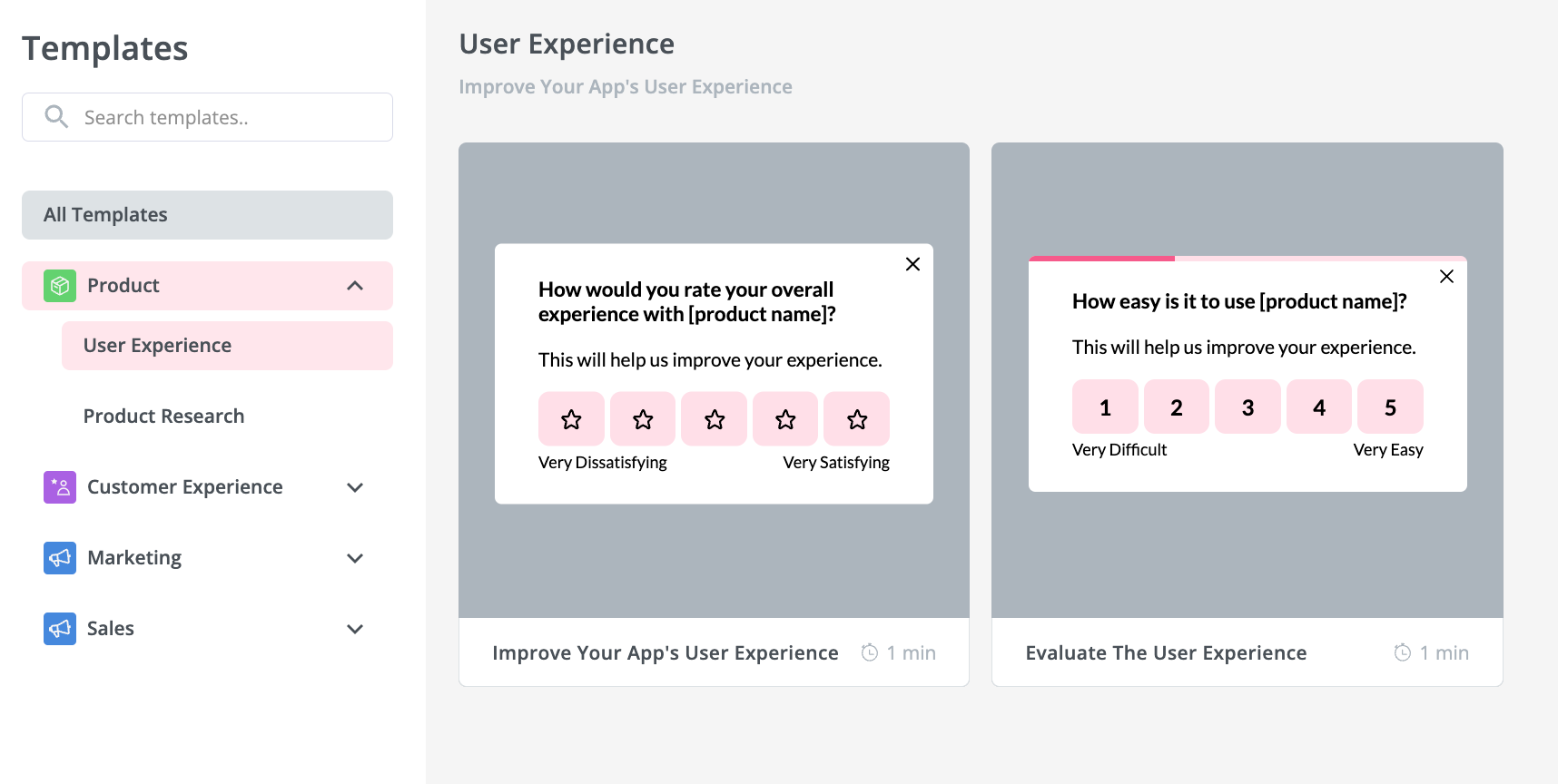

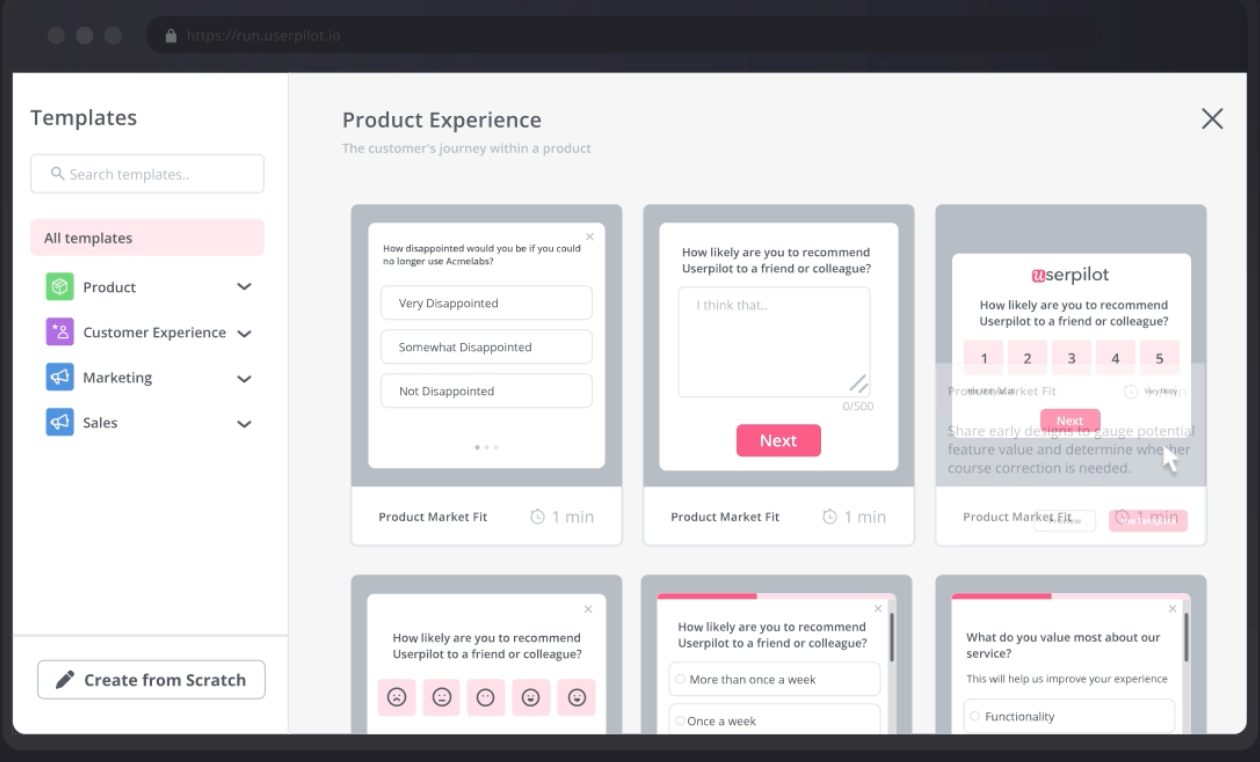

- Surveys (here – in-app survey templates from Userpilot).

- Interviews.

- Focus groups.

- Product trials.

This approach gives you first-hand insight into your target audience.

Conversely, secondary research uses already established datasets of primary data – which can add depth and reinforcement to your firsthand findings. For a 360 view of your market trends, combine both techniques – exploratory primary research and secondary channels of inquiry.

Let’s look a bit deeper into them now.

What is primary market research?

Market research uses primary market research as an essential tool. This involves collecting new data directly from your target audience using various methods, such as surveys, focus groups, and interviews.

Each method has its benefits. For example, observational studies allow you to see how consumers interact with your product.

There are many ways to conduct primary research.

Focus Groups: Hold discussions with small groups of 5 to 10 people from your target audience. These discussions can provide valuable feedback on products, perceptions of your company’s brand name, or opinions on competitors.

Interviews: Have one-on-one conversations to gather detailed information from individuals in your target audience.

Surveys: These are a common tool in primary market research and can be used instead of focus groups to understand consumer attitudes. Surveys use structured questions and can reach a broad audience efficiently.

Navigating secondary market research

While market research using primary methods is like discovering precious metals, secondary market research technique is like using a treasure map. This approach uses data collected by others from various sources, providing a broad industry view. These sources include market analyses from agencies like Statista, historical data such as census records, and academic studies.

Secondary research provides the basic knowledge necessary for conducting primary market research goals but may lack detail on specific business questions and could also be accessible to competitors.

To make the most of secondary market research, it’s important to analyze summarized data to identify trends, rely on reputable sources for accurate data, and remain unbiased in data collection methods.

The effectiveness of secondary research depends significantly on how well the data is interpreted, ensuring that this information complements the insights from primary research.

The role of qualitative and quantitative data in market research

In market research, there are two main types of data: qualitative and quantitative. Qualitative data explores the reasons behind consumer actions, collecting non-numeric information to understand consumer behaviors and motivations. For more on gathering and analyzing qualitative data, see How to Analyse Qualitative Data. On the other hand, quantitative data uses numeric data to measure consumer preferences, behaviors, and market sizes. To learn more about handling this type of data, check out User Analytics.

A thorough market analysis usually combines both qualitative and quantitative data. This approach provides a full view of the market by merging detailed qualitative insights with concrete quantitative statistics. For more on combining these approaches, refer to Generative vs. Evaluative Research.

Gathering qualitative insights

Qualitative research involves direct engagement with customers, like having detailed discussions. It includes observational studies that capture genuine consumer reactions. This type of research provides deep insights into consumer perceptions, brand comparisons, consumer behavior, and feedback on specific product features.

Studies on customer satisfaction and loyalty reveal effective strategies for keeping customers and what keeps them loyal, such as loyalty programs and quality customer service. The strength of qualitative research lies in its ability to dig deeper than just numbers, reaching insights that quantitative data might miss. By using qualitative data to customize experiences, businesses can increase customer satisfaction, interaction, and loyalty, leading to greater business growth.

Analyzing quantitative data

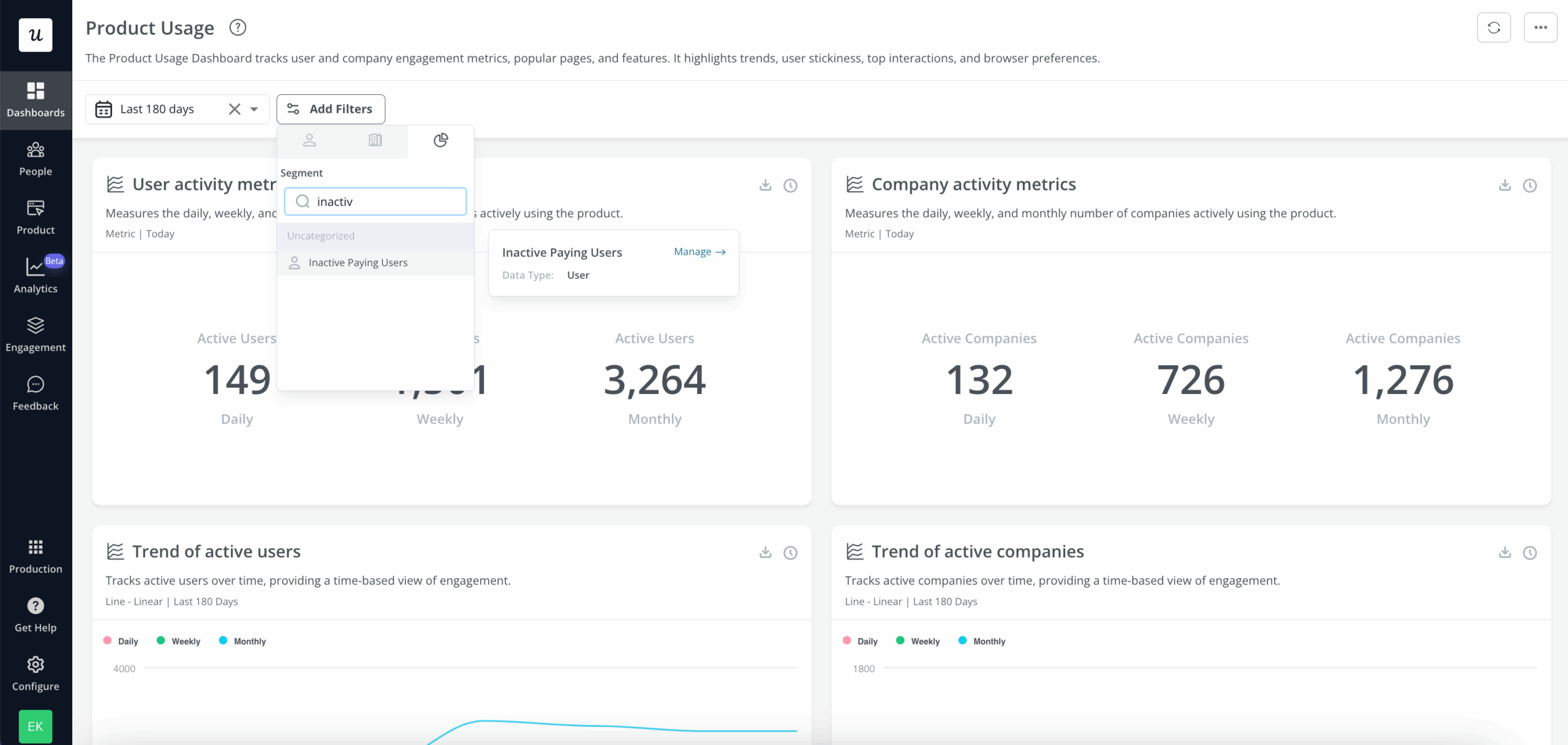

Quantitative research provides precision and the ability to measure findings using structured data collection methods like polls and surveys. Product analytics tools such as Userpilot, Amplitude, Heap, and Mixpanel are highly effective for collecting and organizing quantifiable data. This type of data is crucial for identifying trends and insights, which can help businesses track important performance indicators such as conversion rates or customer lifetime value, supporting their growth strategies.

Quantitative research data is divided into two types: discrete data, which includes countable numbers, and continuous data, which consists of numbers that can have fractions or decimals. These are vital for revealing important demographic information.

Segmenting your target market

Market research plays a key role in segmenting your target audience into manageable segments.

These market segments are typically grouped by similar needs or attributes, and display similar responses in marketing research surveys and initiatives. The full market segmentation process is vital for comprehensively grasping and satisfying the requirements of your targeted consumer base.

Accumulating demographic information forms the basis for executing effective market segmentation strategies. Businesses prioritize obtaining user data such as:

- Job functions.

- Organizational scale.

- Customer demographics profiles.

- Lifestyle choices.

- Values systems.

- Product usage patterns.

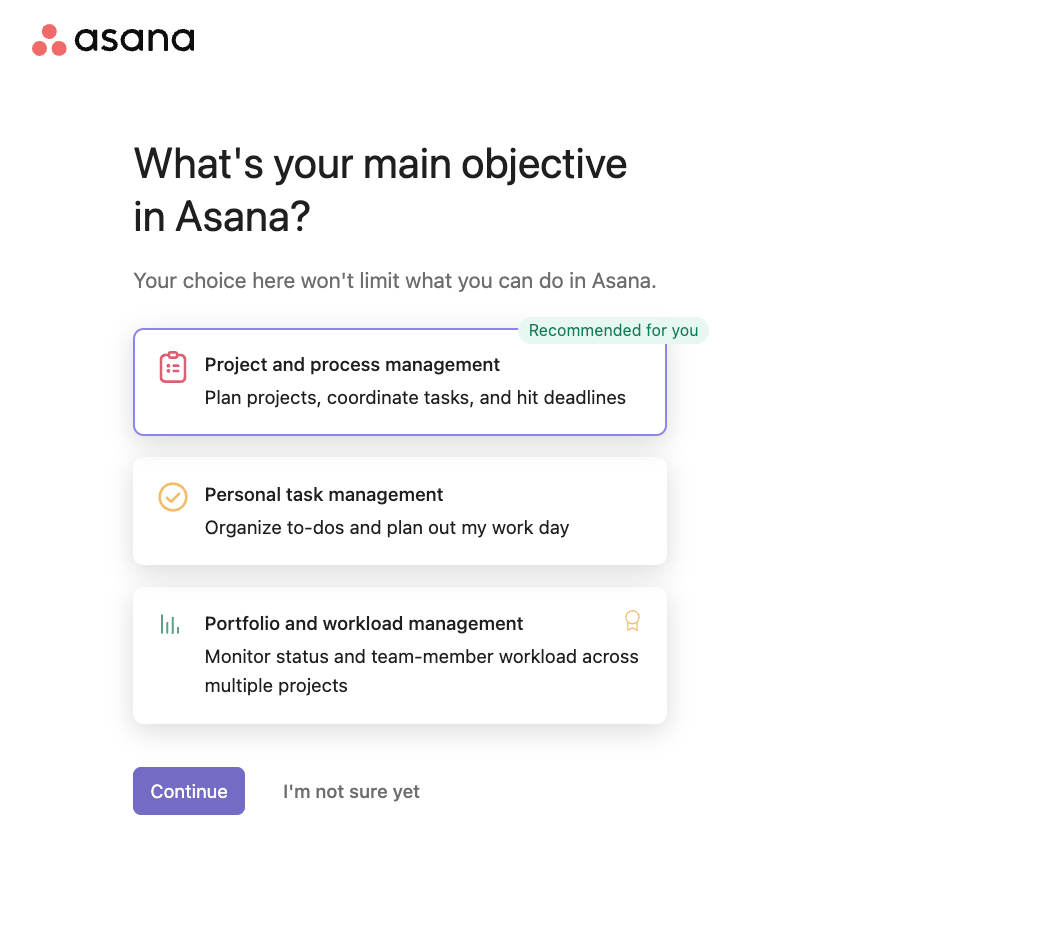

This information can be collected in the initial sign-up flow (through a signup flow survey; see the Asana example below) or by conducting comprehensive market research surveys.

At its core, successful market segmentation enables businesses to communicate effectively in their target customers’ dialects while catering explicitly to their distinct demands.

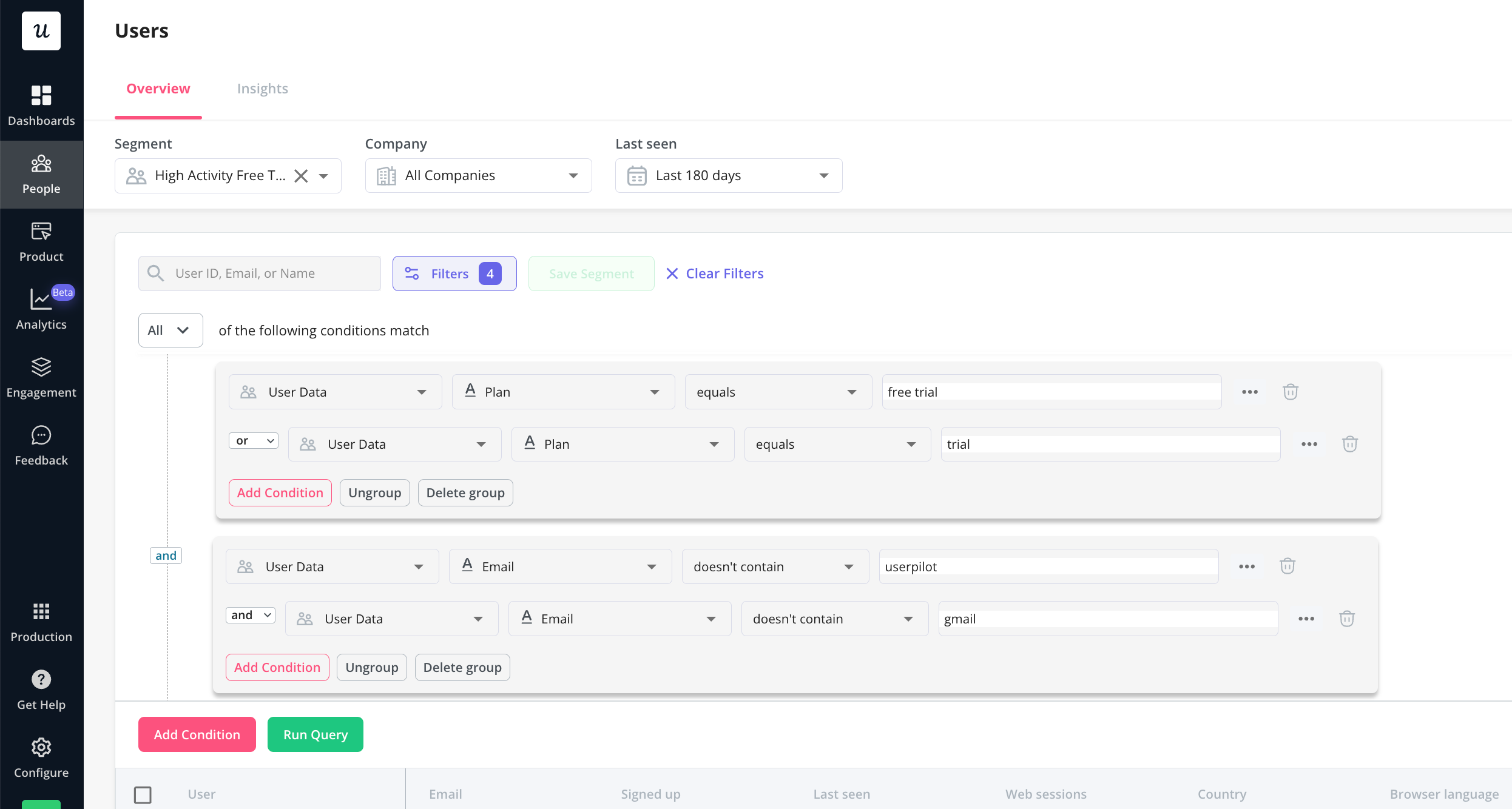

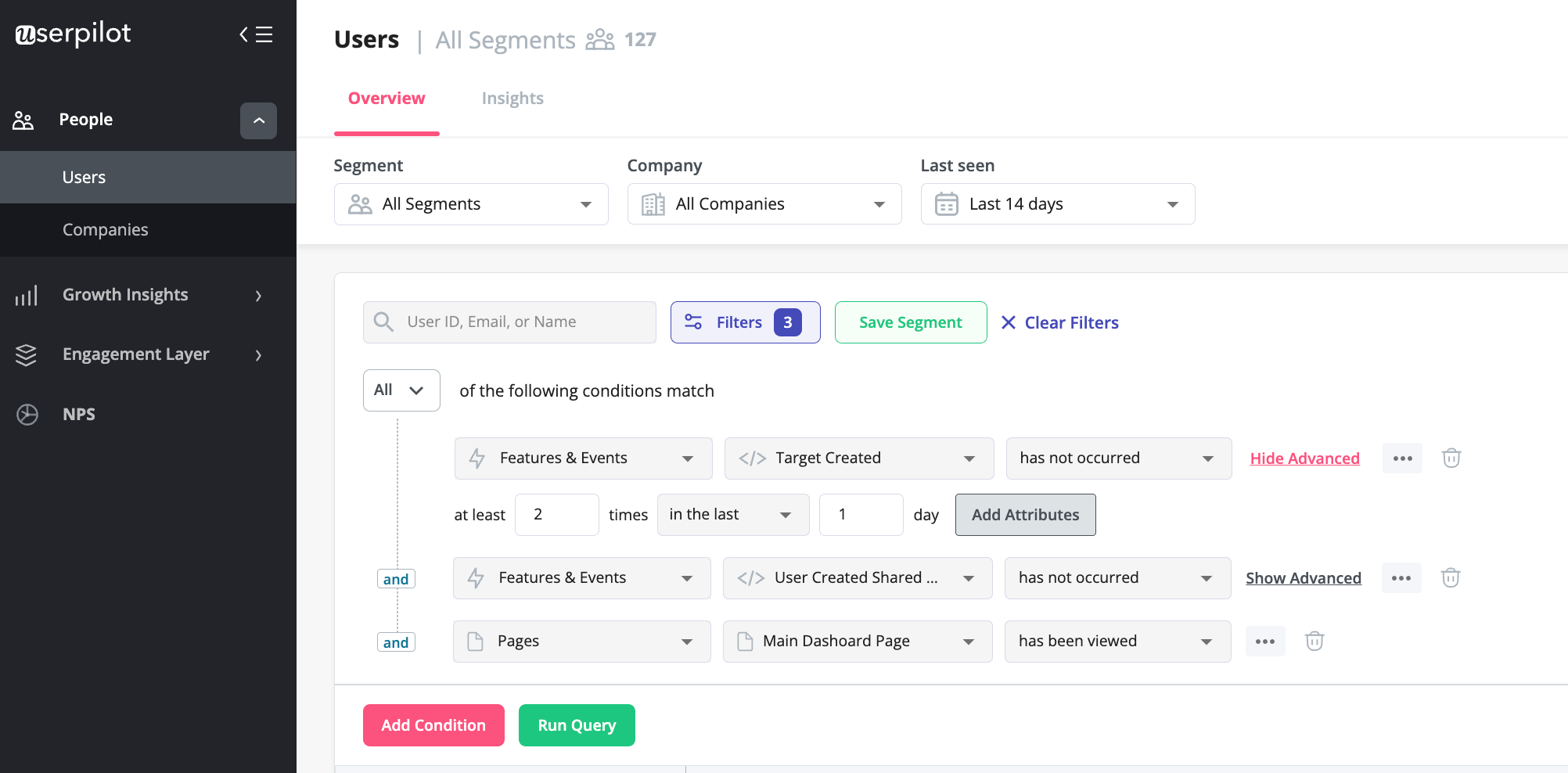

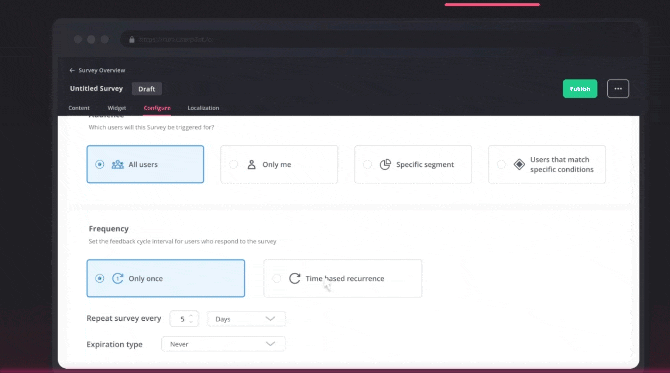

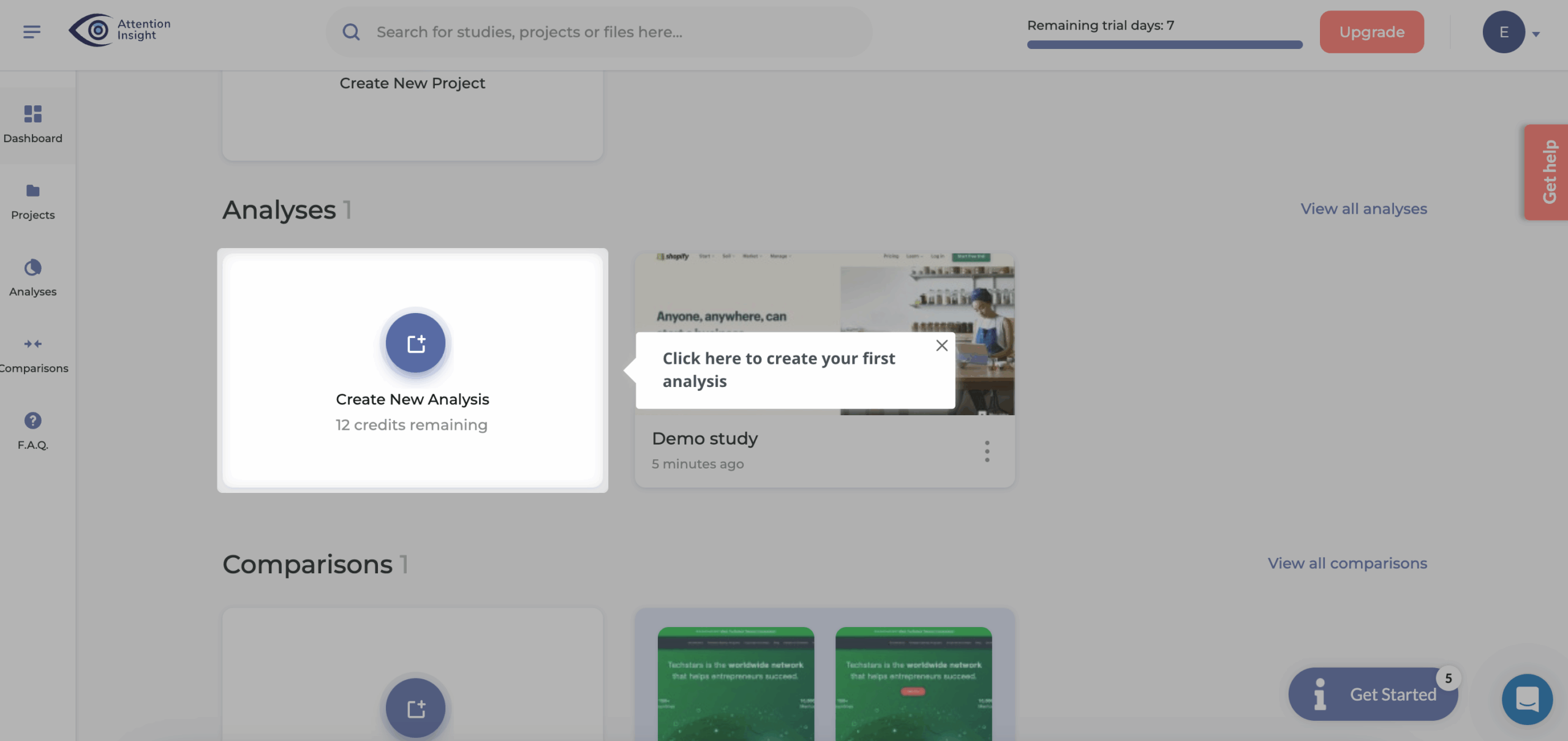

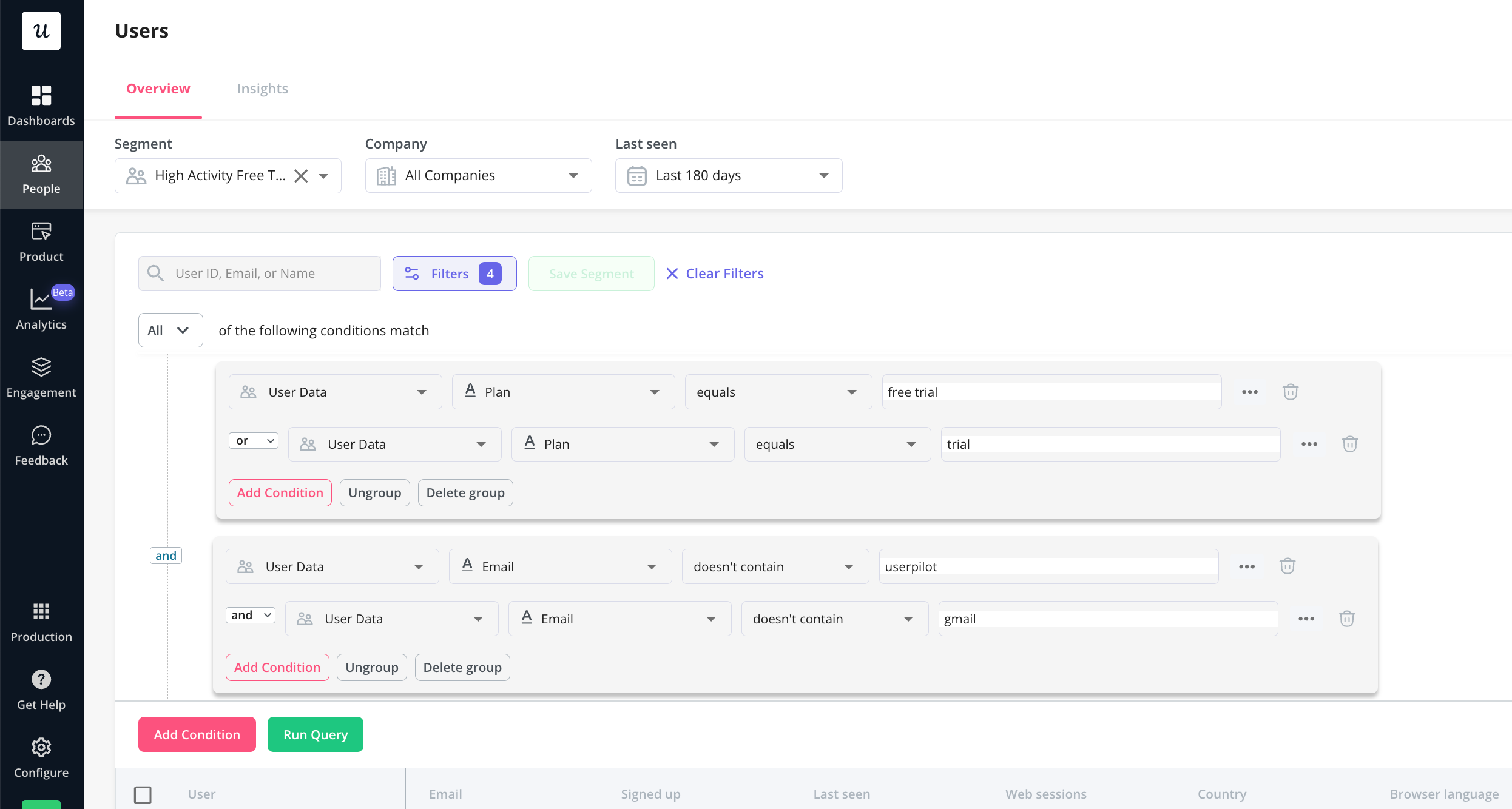

Userpilot allows you to easily segment your users not only by demographic information, company size, plan, or role – but also by their in-app engagement (behavioral segmentation):

In summary, the techniques used to create detailed analyses, like conducting specialized surveys and carefully collecting relevant participant information, are crucial for identifying groups within a larger target population. These groups are defined by usage patterns and broad demographic and economic indicators, enabling companies to not only reach but also deeply connect with each niche market they aim to capture.

Creating buyer personas based on your market research

Creating buyer personas is a strategic process that helps businesses better understand and cater to their target customers. Here’s how you can systematically approach creating effective buyer personas:

- Gather Initial Data: Start by collecting basic demographic information such as age, gender, location, and education level. This can come from existing customer databases, market research, or industry reports.

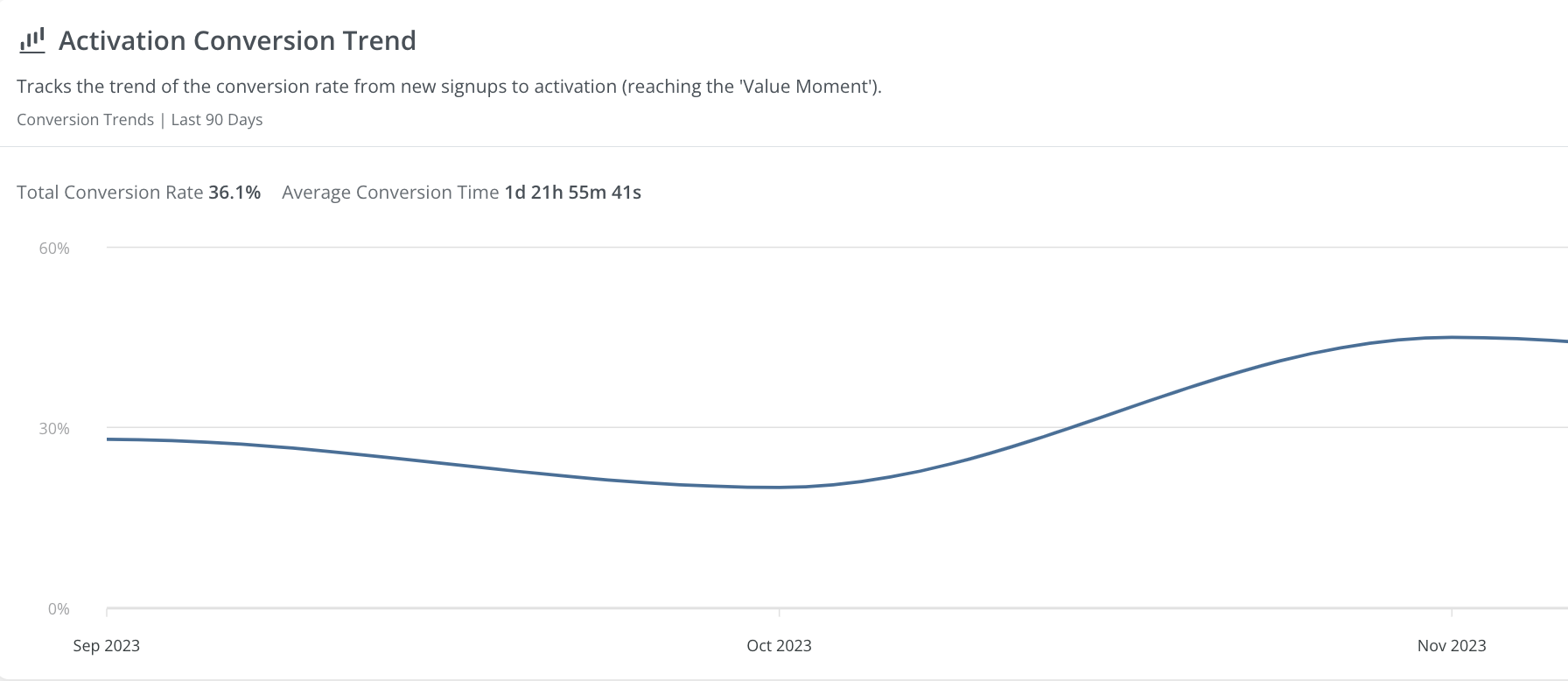

- Identify Behavioral Patterns: Look for common behaviors among your customers, such as purchasing habits, product usage, and brand loyalty. Understanding these patterns helps in crafting more detailed and accurate personas. You can use Userpilot’s trend analysis reports to get a better understanding of your user’s behavior:

- Conduct Surveys and Interviews: Engage directly with customers through surveys and interviews to gather qualitative data about their motivations, needs, and challenges. This step is crucial for adding depth to the personas, and providing insights into why customers behave in certain ways.

- Segment the Audience: Based on the collected data, segment your audience into distinct groups. Each segment should represent a type of customer with similar characteristics and behaviors. This segmentation helps in personalizing marketing and sales strategies effectively.

- Build Detailed Personas: For each segment, create a detailed persona that includes not only demographic and behavioral traits but also psychographics like interests, values, and lifestyle. Each persona should tell the story of an ideal customer, making them relatable for your marketing team.

- Refine Over Time: Buyer personas are not static. As you gather more data and the market evolves, revisit and refine your personas to keep them relevant and accurate.

- Utilize Tools Like Userpilot: Tools such as Userpilot can enhance this process by providing analytics that reveal how users interact with your product. This can confirm hypotheses or uncover new insights about user preferences and behaviors, which can be integrated into existing personas to make them even more accurate.

By carefully crafting and continually updating buyer personas, businesses can achieve a deeper understanding of their customers. This enables them to tailor their offerings and communications effectively, thereby enhancing customer engagement and satisfaction.

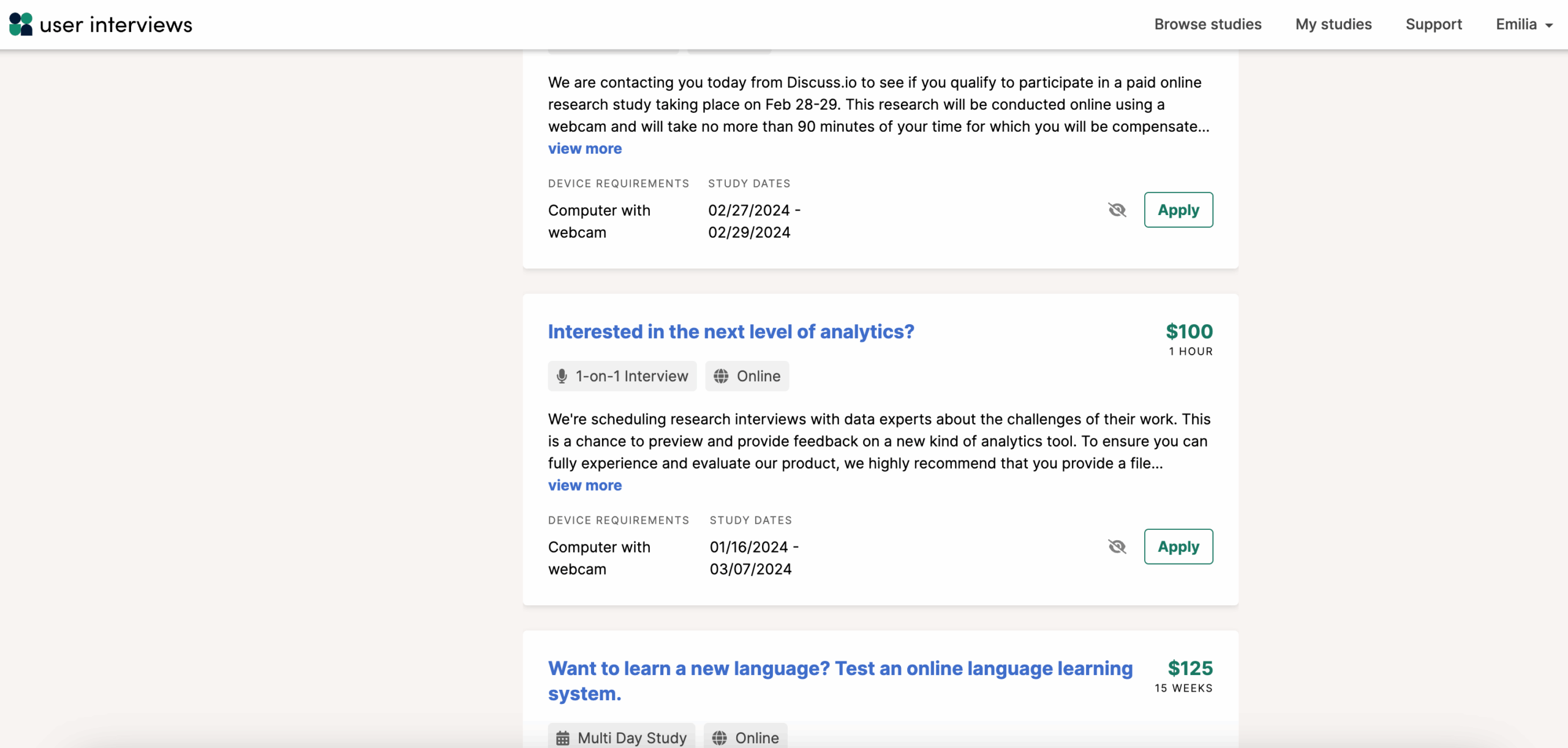

Recruiting participants for primary research

Choosing the right participants for primary research is a crucial step in market research. It’s important to find individuals who can provide relevant and meaningful consumer feedback, on your product or service, as this feedback is key to developing accurate user personas.

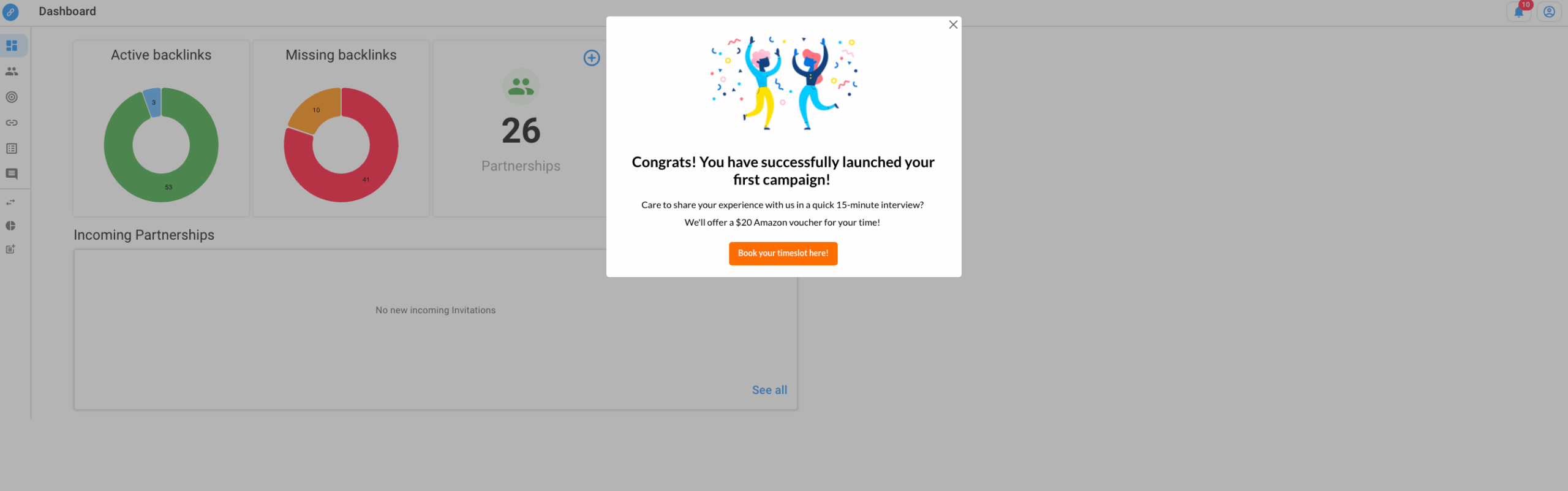

Userpilot can be instrumental in this process. It collects data on how users interact with and use your products, helping you identify who might be the best candidates for more detailed studies, such as interviews.

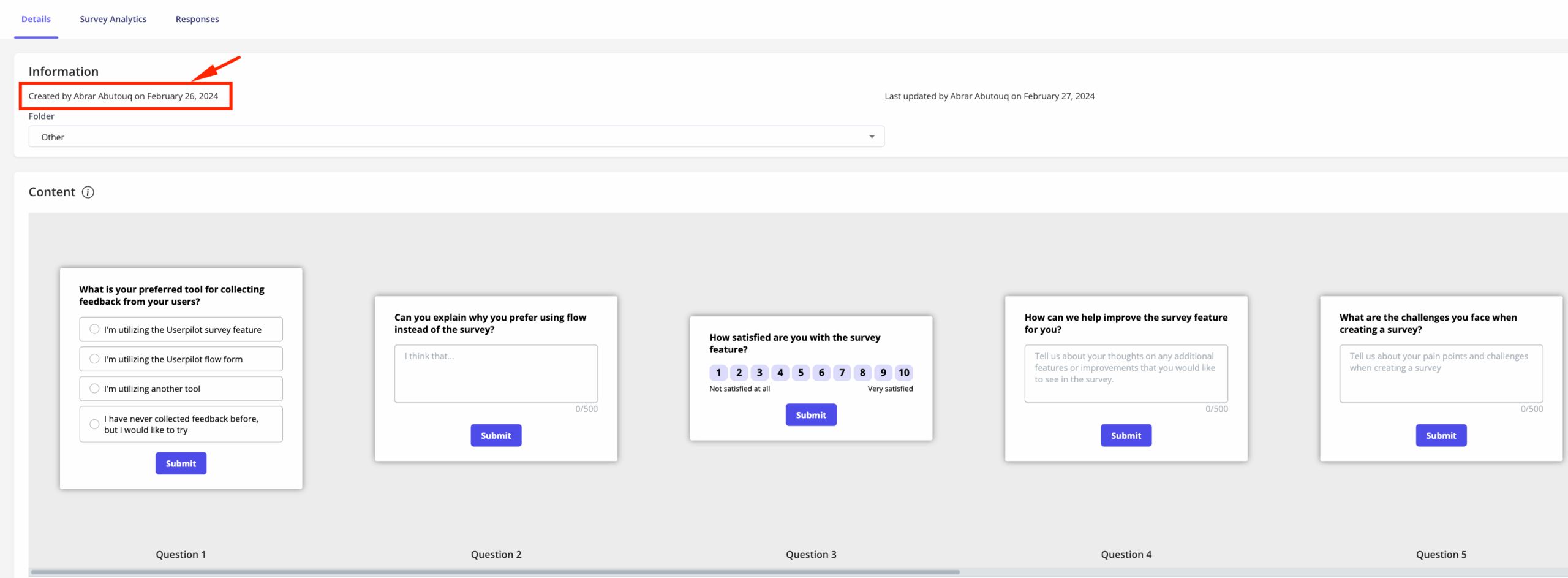

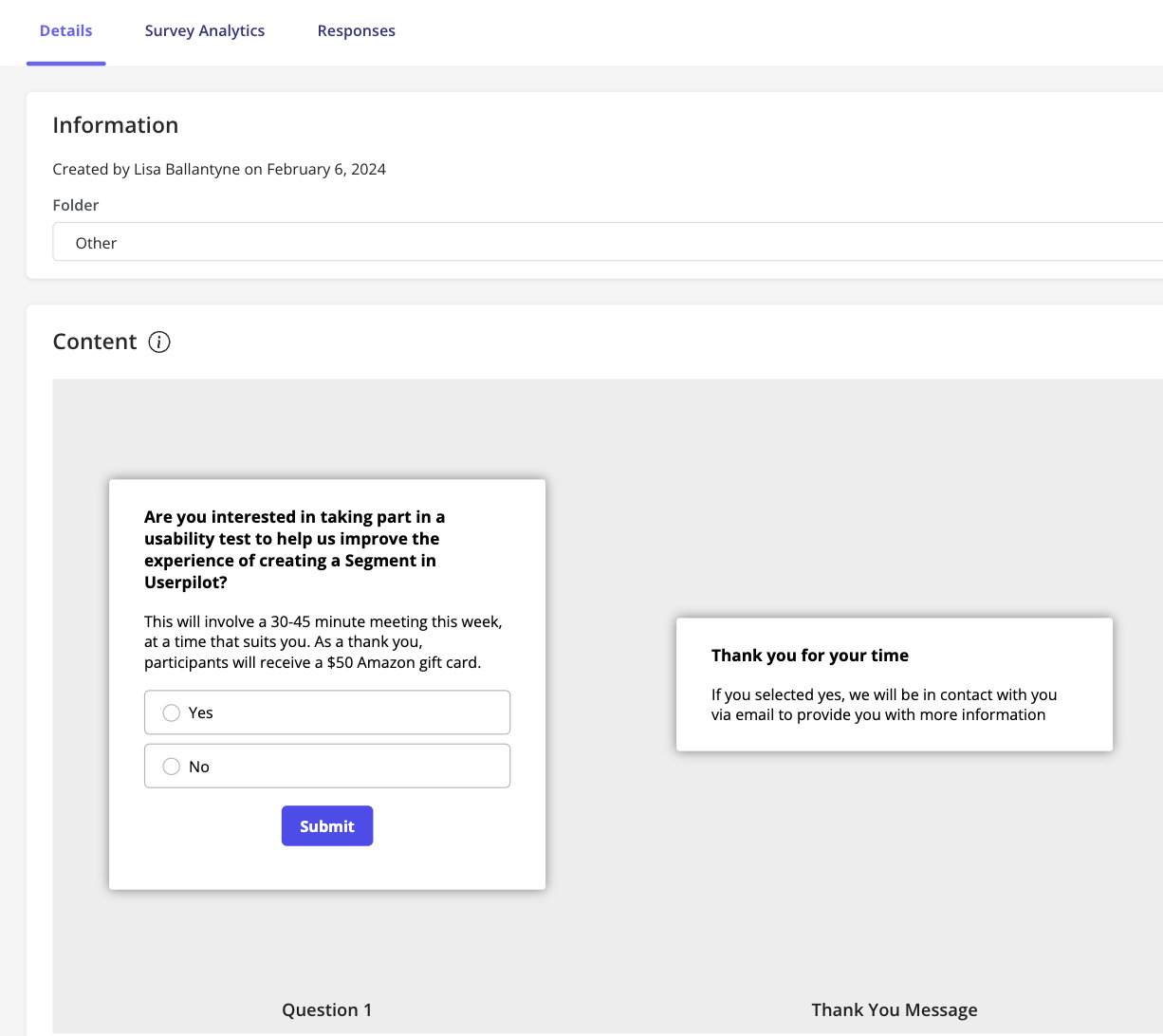

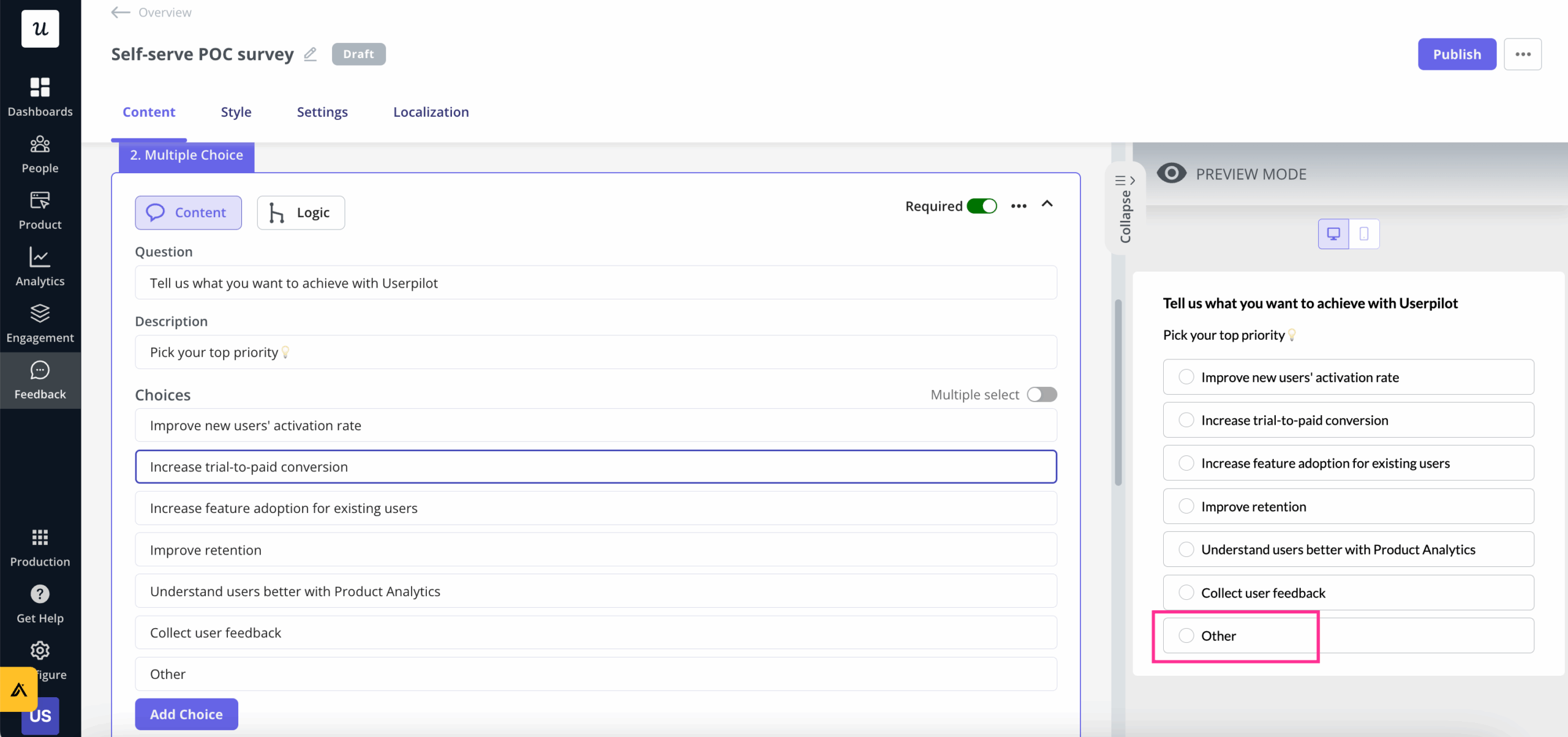

To efficiently recruit participants for interviews, Userpilot’s in-app features, such as in-app modals with embedded surveys can be extremely useful. You can use these tools to engage directly with users who meet your specific criteria, right within your app.

This method not only simplifies the recruitment process but also ensures that you’re interacting with the most relevant users. By leveraging these features, you can gather deep insights that significantly enhance the development of your user personas, ensuring your research is both timely and informed.

Competitive analysis for strategic advantage

Competitive analysis helps businesses understand their rivals’ strategies. It involves identifying which industries or markets to target and listing key competitors to gain a clear view of the competitive environment. This includes evaluating competitors’ market share, strengths, weaknesses, and potential entry barriers, often using tools like SWOT analysis.

By understanding competitors’ operations and past marketing efforts, businesses can craft new strategies, pinpoint opportunities, and learn from competitors’ mistakes. Employing market research, brand perception surveys, and market statistics, alongside analytical frameworks like Porter’s Five Forces Model, helps businesses uncover new opportunities and maintain a competitive advantage.

Ultimately, competitive analysis uses the understanding of competition to fuel business growth.

Conducting effective market research surveys

Primary market research often uses surveys as a cost-effective way to gather data. These surveys reach wide audiences and provide quick feedback. It’s crucial to carefully plan the creation and distribution of these surveys to ensure they are effective. Given the high amount of web traffic from mobile devices, it’s particularly important to make surveys mobile-friendly.

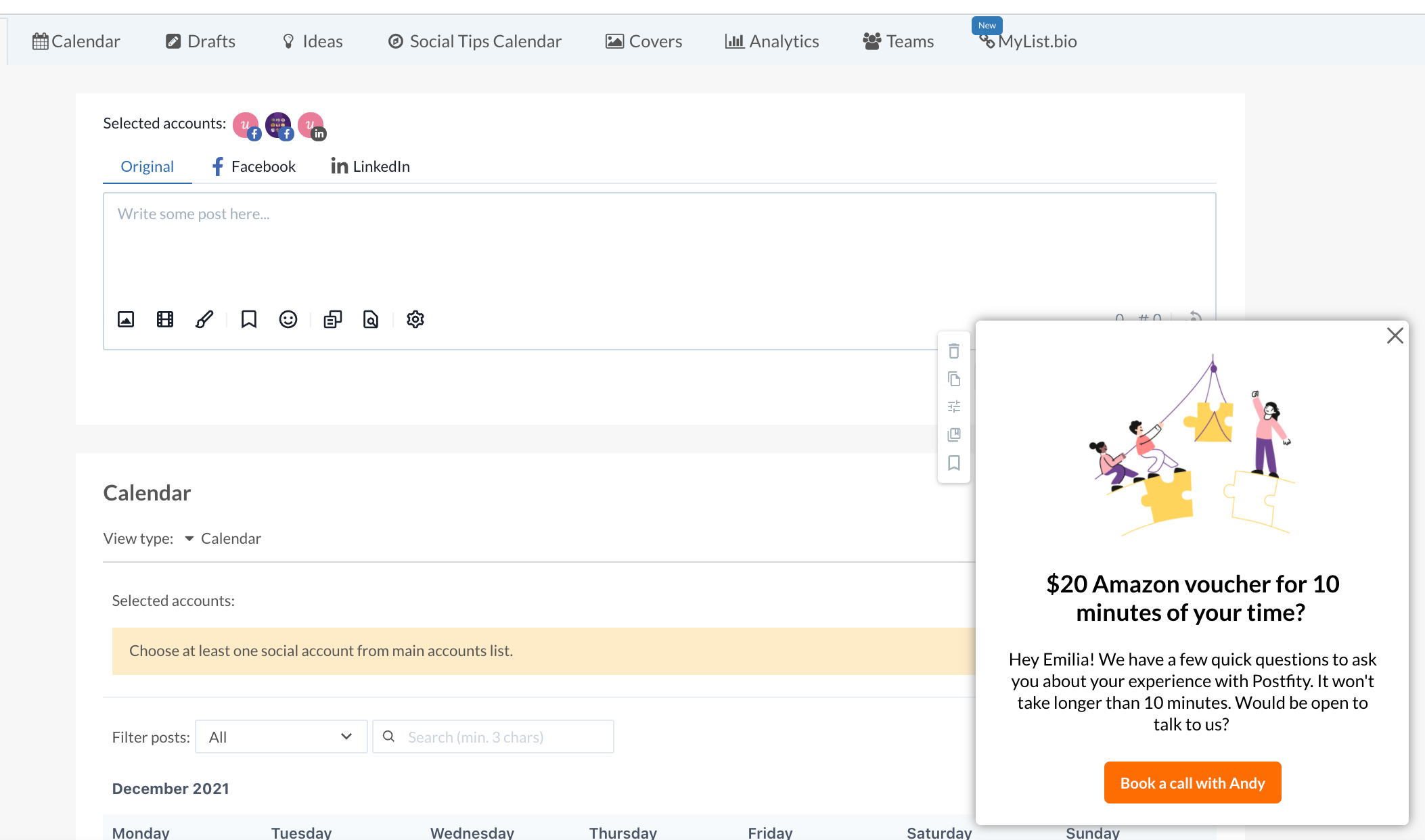

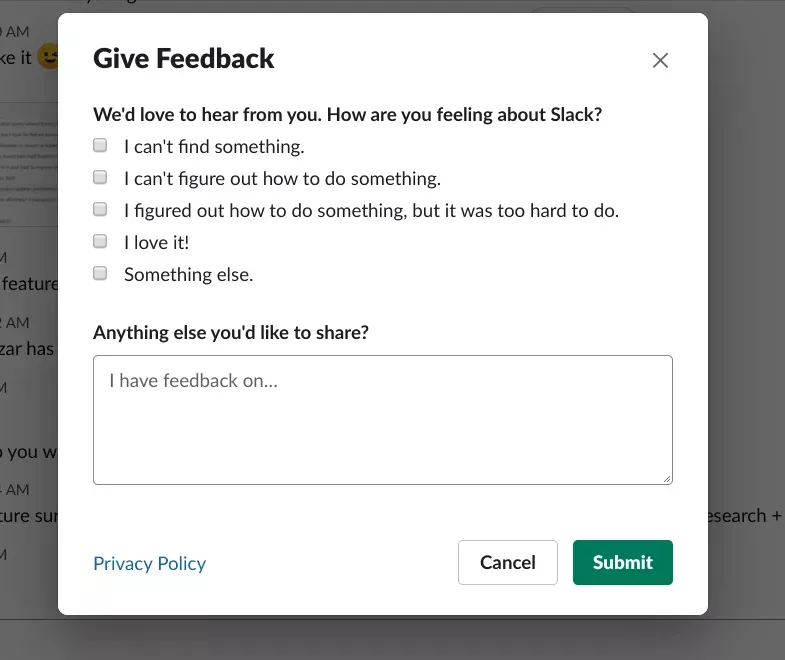

To get the most comprehensive data, include both quantitative (closed-ended) and qualitative (open-ended) questions in your survey. Offering incentives like financial compensation or vouchers can encourage participation, but it’s important to manage these carefully to avoid biasing the responses.

Well-designed surveys are like direct interviews with your target audience and are key to obtaining valuable insights about their views and experiences.

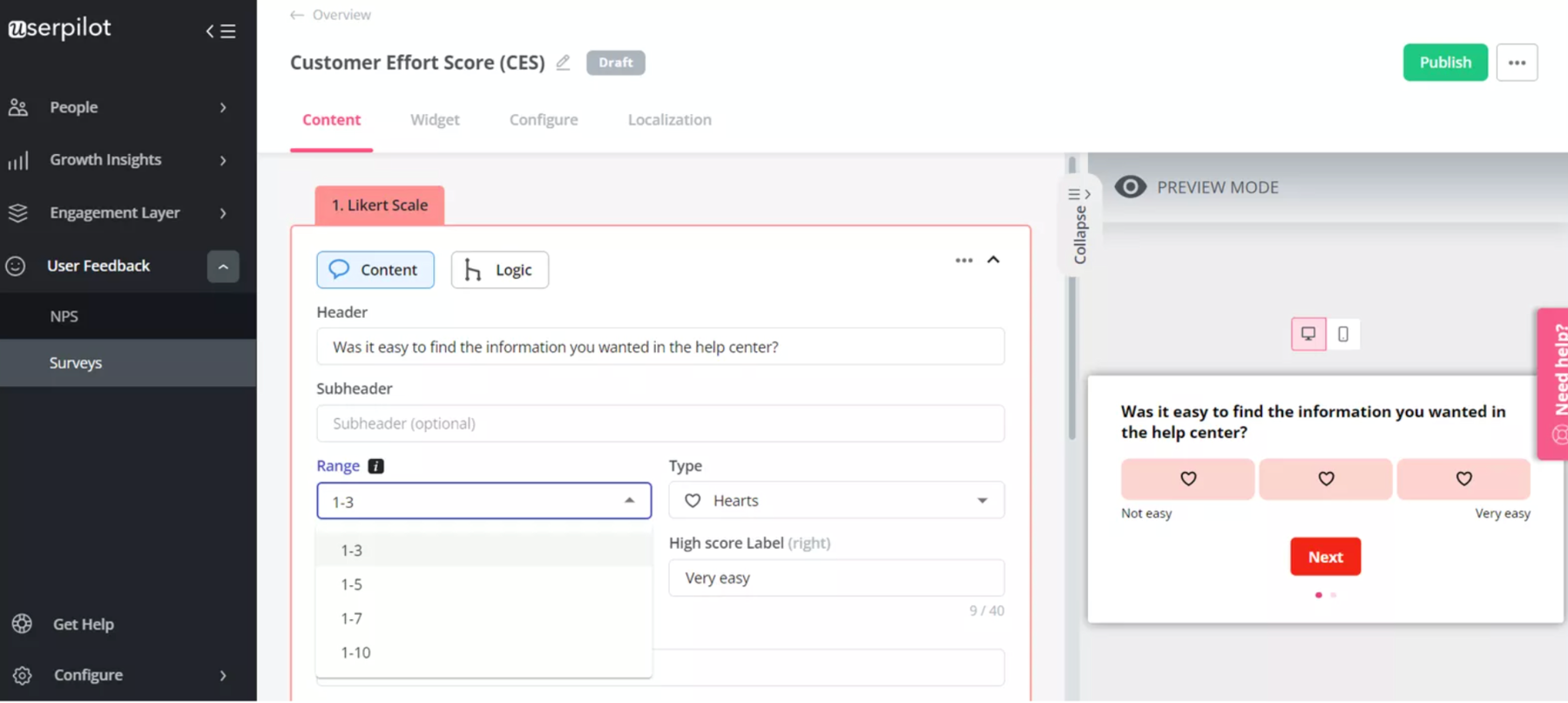

Userpilot offers over 50 in-app survey templates along with a bespoke builder, which are important tools for collecting the right responses. These features allow you to tailor surveys precisely to your needs, ensuring you gather accurate and relevant data directly from your users. By leveraging these templates and customizing them with the bespoke builder, you can effectively engage your audience and enhance the quality of insights you receive. This setup is crucial for conducting efficient and effective market research.

Analyzing and interpreting market research data

Once you have collected data through surveys, market research data analysis is the next critical step. It involves identifying patterns, establishing connections, and extracting insights that inform business decisions.

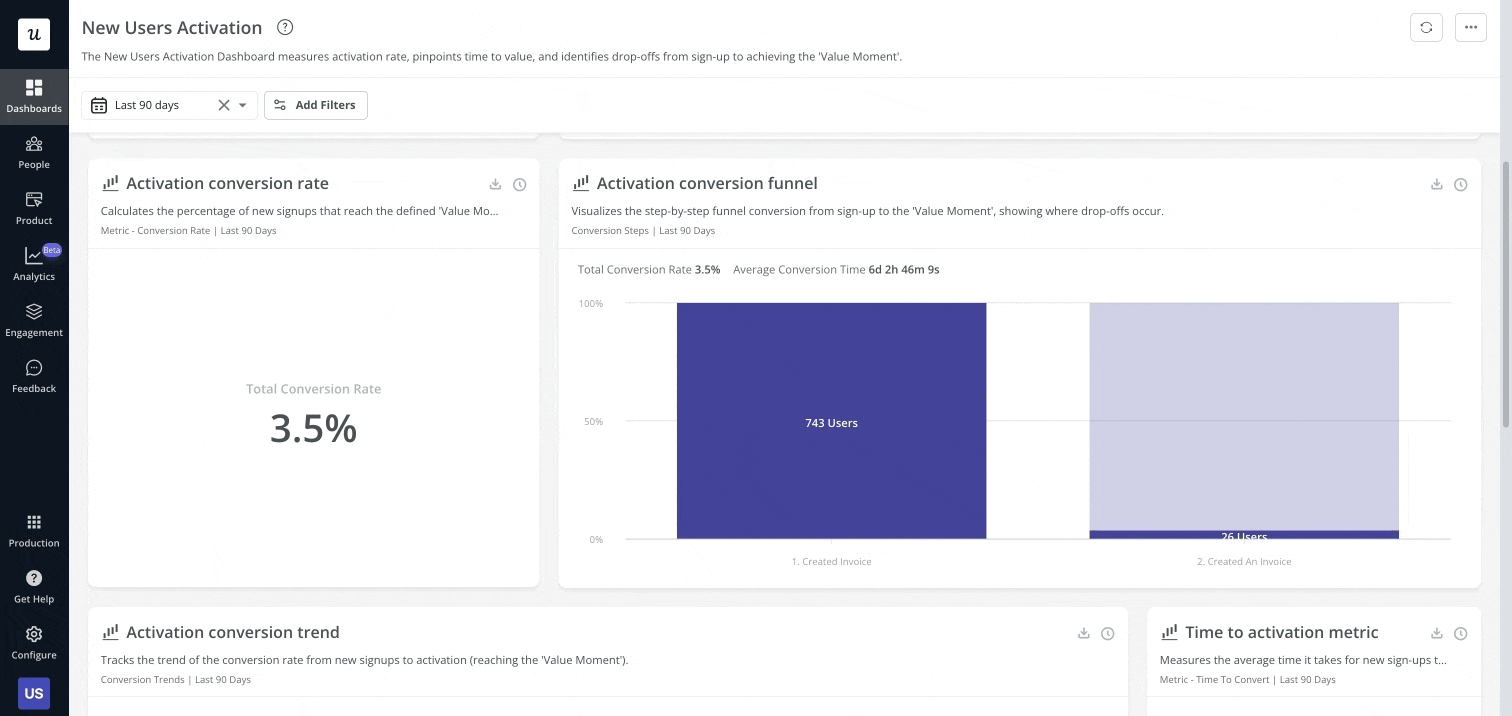

Userpilot’s analytics suite offers deep and easily accessible insights into your market research data:

This process starts with preparing the data by cleaning and organizing it to ensure accuracy and ease of analysis. Depending on the study’s goals, various analytical methods can be used, from simple descriptive statistics to complex multivariate analyses, all chosen to provide meaningful insights.

The core of this analysis aims to uncover market trends and understand industry specifics, which can highlight key factors such as impactful customer experiences, profitable products or services, and effective marketing strategies. Communicating these findings effectively involves presenting them in clear reports and using visual aids while making practical recommendations and addressing any limitations in the research scope or methods. Ultimately, data analysis transforms raw data into compelling narratives that offer actionable business intelligence.

Applying market research to product or service development

Market research is much more than just collecting data and uncovering insights; it’s a vital tool for driving business growth and guiding product development at every stage. Here’s how market research supports business throughout the product lifecycle:

- Concept Creation: Helps identify market needs and opportunities to inform the initial product idea.

- Building a Business Case: Provides evidence and data to justify investment in the new product.

- Product Development: Offers insights into customer preferences and feedback for refining product features.

- Market Introduction: Aids in strategizing the launch, targeting the right audience, and setting the right price.

- Lifecycle Management: Continuously gathers data on customer usage and satisfaction to enhance the product over time.

Consider a B2B SaaS company that develops project management software. By engaging in targeted market research activities like surveys and doing focus group call groups among its business clients, the company can:

- Understand Business Needs: Gain insights into the specific project management challenges and needs of different industries.

- Refine Product Features: Discover which software features are most valued by businesses, such as integration capabilities, user-friendliness, or specific tools for collaboration.

- Tailor Marketing Strategies: Identify the most effective communication channels and messaging that resonate with business clients, such as emphasizing efficiency gains or return on investment.

Market research guides businesses from the initial idea through to launch and beyond, acting as a strategic tool that ensures all actions are aligned with market demands and customer needs, ultimately aiming for successful business outcomes.

Utilizing tools for efficient market research

Using tools like Userpilot, SurveyMonkey, Google Forms, and Typeform, market researchers can reach a wide audience and get fast responses. These platforms help to design, distribute, and analyze surveys efficiently.

Userpilot stands out by allowing businesses to create targeted in-app experiences that engage users directly where they are most active—within the app itself. This direct engagement method improves the quality of the feedback collected as it relates to specific features or user experiences.

Userpilot also offers features such as demographic filtering and behavioral-based segmentation, which speeds up the process of finding and recruiting the right participants for market research.

These tools are essential for performing detailed and effective market research. They break down geographic and cultural barriers, offer access to diverse user groups, and enable businesses to conduct deep, actionable analyses across different market segments.

Translating research findings into business growth

Market research does more than just gather and analyze data; it aims to transform these insights into tangible business improvements. This process is crucial in guiding product development and helping increase a company’s market share by informing targeted strategies. For instance, a B2B SaaS company could use market research to:

- Tailor marketing strategies specifically for key user personas.

- Identify the most valued features for your users.

- Develop pricing strategies that appeal to companies of different sizes.

- Gain insight into the specific needs and expectations of their customers.

By implementing effective market research techniques, companies can customize their products or services to better serve their target audience’s needs, fundamental for stimulating company growth. Conducting personalized market research adds value, while collaborating with specialized firms may yield additional profound insights.

Conclusion

Market research is not just about collecting data; it’s about deeply understanding your customers, spotting opportunities, and making informed decisions that drive your business forward. It provides essential insights into the market and business environment, influencing how potential clients perceive your company.

By conducting competitor analysis and market research, organizations can:

- Connect with their target audience.

- Understand their competitive position.

- Plan strategically for future initiatives.

- Gain insights into customer perceptions of their brand, uncovering new perspectives or opportunities for improvement.

Since competitors also use market research to their advantage, engaging in these analytical processes is crucial for a comprehensive marketing strategy, aimed at business growth.

Start your own market research and journey today to pave the way to success.

FAQ

What is market research and why is it important?

Understanding their target market through collected information and insights, businesses can make informed decisions, diminish risks, and enhance marketing strategies with the aid of market research. This ensures that choices are based on reliable data, which is crucial for business success.

What is the difference between primary and secondary research?

To summarize, primary research entails the gathering of original data directly from the source, whereas secondary research utilizes previously compiled data sources to add perspective and reinforce conclusions derived from primary research.

How does market research guide product development?

By offering critical data on consumer habits and preferences, market research steers the enhancement of product features, thereby influencing decisions across all stages of a product’s life cycle and aiding in the evolution of product development.

What tools can be used for efficient market research?

Platforms such as Userpilot, SurveyMonkey, Google Forms, and Typeform can be leveraged alongside technologies that are driven by data to simplify the process of crafting, disseminating, and examining online surveys which play a crucial role in conducting market research effectively.

How can market research translate into business growth?

By informing product development, marketing strategies, and identifying opportunities for growth through enlightened decision-making, market research results can propel business expansion.