Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is a customer retention survey?

A customer retention survey is a questionnaire sent to customers to learn more about how they feel about a business and its product offerings.

With the right survey questions, businesses can get valuable insights into customer needs and use this information to continuously better your product and improve customer satisfaction.

Examples of customer retention survey questions

Creating a retention survey is only half the battle. The real work lies in choosing the right survey questions to ask.

Let’s have a look at some examples of good customer loyalty survey questions and discuss why they work.

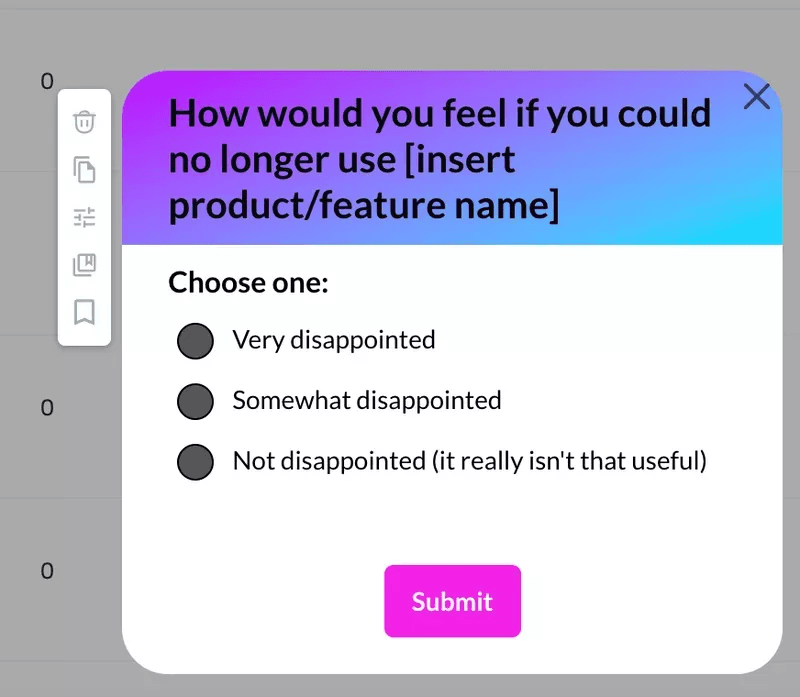

How would you feel if you could no longer use our products?

This is a question used in product-market fit surveys. Startups use these surveys in the early stages of product development to measure the degree to which a product satisfies market demand.

If at least 40% of respondents say they would be very disappointed, then you’ve managed to build a product that effectively addresses your target customers’ needs and brings value to them. It’s safe to assume you will be able to retain your existing customers and are ready to scale.

But if you find out that less than 40% of existing customers see any benefits in your product, your SaaS will struggle to grow. If this is the case, you should conduct more in-depth market and user research to determine where the problem lies: in the market or your product.

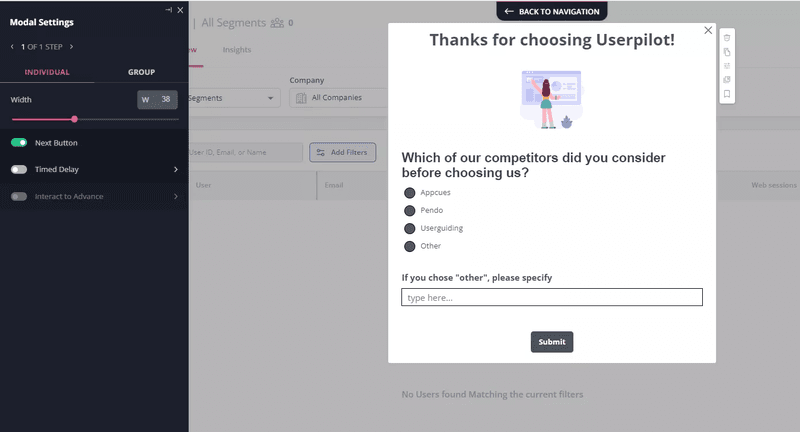

Which of our competitors did you consider before choosing us?

This is a great question to ask new SaaS users.

Before signing up for your product, your prospect has researched the market and evaluated a number of options. And just because they chose to give your software a try at the Consideration stage of their customer journey, doesn’t mean they will not switch to a competitor down the road.

Understanding which products your customers believe to be worthy alternatives can help you to better position your product, highlight your relative advantages over competitors and convince them that your offer is exactly what they need.

Maybe your platform has a feature that one of your competitors doesn’t? Market this feature in-app, and drive users to adopt it so they know what they will be missing out on if they don’t choose you over a competitor!

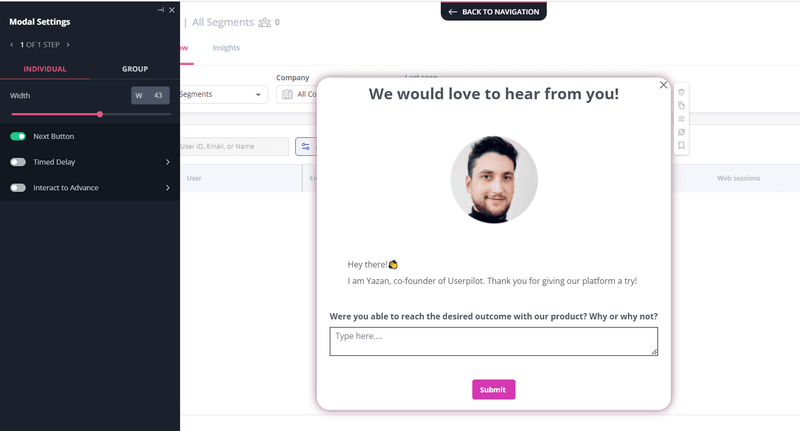

Were you able to reach the desired outcome with our tool? Why or why not?

Customers don’t just buy a product because it looks awesome, they purchase a specific outcome for their business and your product is just a tool to help them get there.

If your product lives up to customer expectations and solves their problem, they will keep coming back. If not, they are simply going to look for an alternative solution.

Knowing the reasons behind customer failure will allow you to iterate accordingly, remove the roadblocks that got in the way of the customer, and pave the path to customer success.

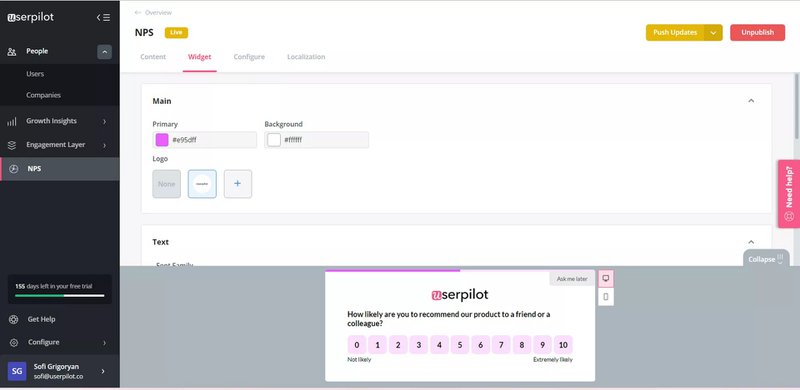

How likely are you to recommend our product to others on a scale of 0-10?

This is the classic NPS question that companies use to measure customer loyalty and predict business growth.

There are two main types of Net Promoter Score surveys: transactional and relational.

Transactional NPS surveys capture customer feedback after a specific interaction such as when the user completes primary onboarding or engages with customer service.

Relational NPS surveys are carried out at regular intervals (annual, quarterly, biweekly, etc..) to assess the overall health of the company.

After the survey, you can create customer segments based on scores and implement personalized retention strategies for each group.

For example, you can identify detractors, aka the lowest-scoring(0-6) customers who are at risk of churn. Then you can reach out to them directly to acknowledge their frustrations, ask follow-up questions to learn more about their struggles, and offer solutions.

In other words – NPS surveys enable you to identify and close the loop with dissatisfied customers, turning poor experiences into great ones.

You can also trigger NPS on mobile to effortlessly gather valuable user insights and boost satisfaction on-the-go.

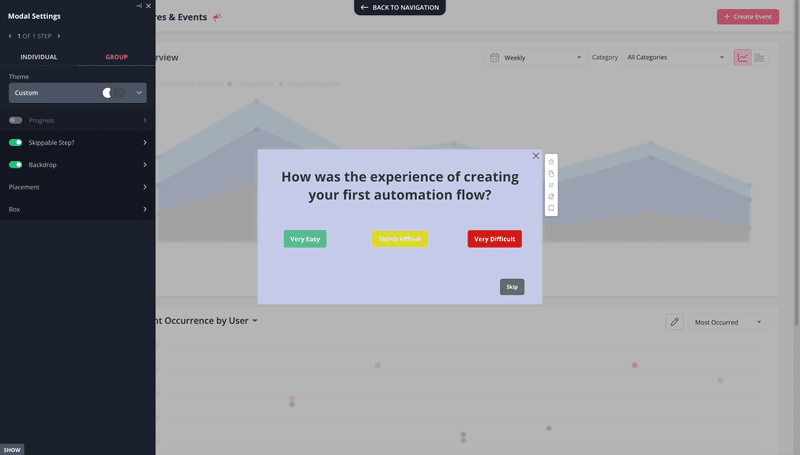

How easy was it to use our product?

This survey is known as the customer effort score (CES), and it measures how much effort it takes for customers to complete an action with your product.

Products that aren’t intuitive, don’t provide enough guidance or for some other reason require lots of mental energy to use, can cause negative emotions in users and lead to churn.

So how can you use data from this survey to improve your retention strategy?

First, trigger this survey after important customer touchpoints – such as when a customer engages with core features.

Then, you can investigate touchpoints that were ranked as high-effort by customers. Employing additional user research methods such as screen recordings will help you find where the friction lies and improve usability.

How would you rate the value for the cost of the product?

If customers don’t believe your product was worth the money, they are unlikely to renew their subscriptions once the current one expires.

The best time to ask this question is at least two weeks after a customer has purchased the product, so they’ve had time to experience its benefits.

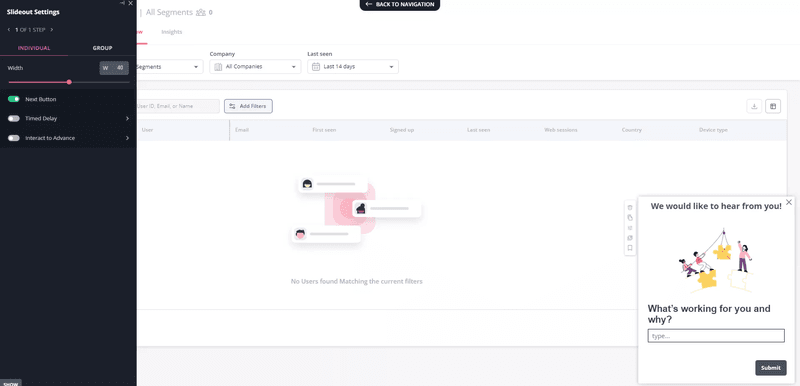

What’s working for you and why?

While open-ended questions are effective to uncover negative issues, don’t forget to ask customers what’s going well so you can build on your strengths!

Once you know your strengths, you can double down on them instead of unintentionally making changes to parts of the brand customers love.

This is a universal question, customers at each stage of the user journey can have something meaningful to contribute.

How would you describe our products?

Are your product vision and your value proposition being communicated effectively to your customers?

Do they perceive the product in a way that you intended them to, or are there gaps you can work on closing?

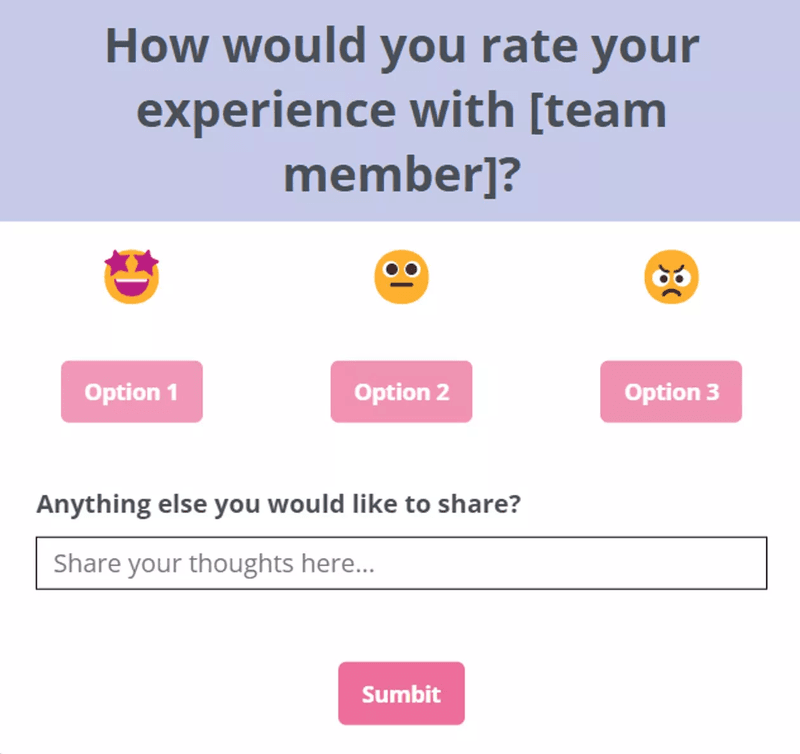

How would you rate your experience with {team member}?

Customer service can make or break your relationships. It’s not uncommon for customers to be generally satisfied with a product but churn after one frustrating customer service interaction.

That’s why you should send a survey after the customer engages with your support team to understand how a customer is left feeling.

Knowing that the customer had a negative experience, you can reach out to them and offer additional support to retain them.

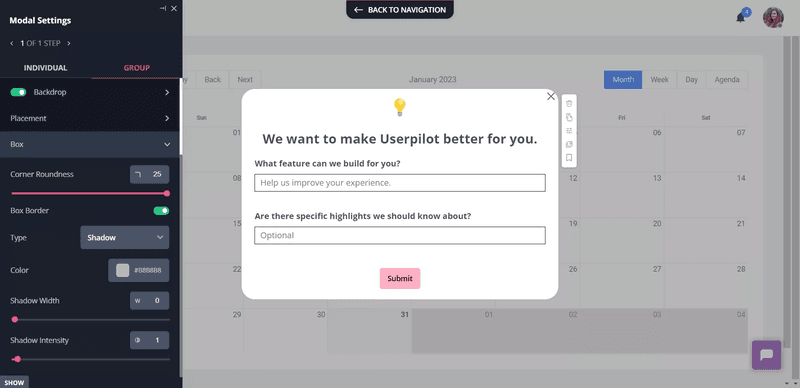

What are the most important features we’re missing?

If users expect to see a specific feature to get their jobs done and it’s missing, there’s a high chance they’ll move on to a competitor that has this functionality.

So, why not encourage feature requests and find out what features customers would love to see in your software?

Of course, you should proceed with caution and implement only the requests that are in line with your company’s vision. Otherwise, you risk falling into the feature fallacy trap and adding functionalities that don’t bring value to most of your target audience.

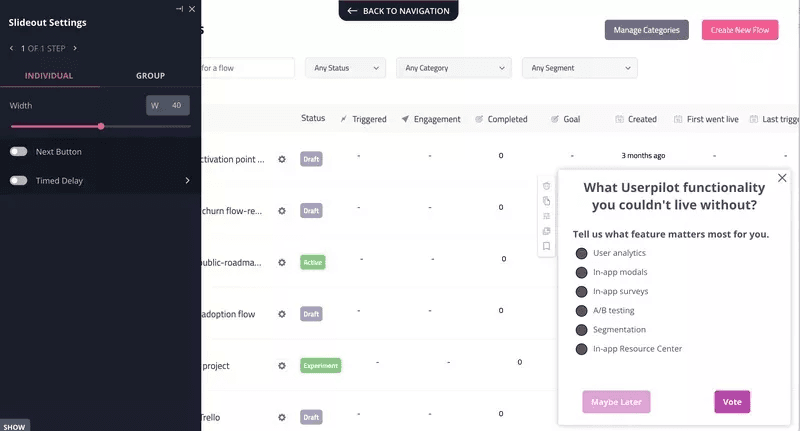

What functionality of [Product] you couldn’t live without?

SaaS companies usually offer a wide range of features, and most customers use only a handful of them.

Knowing what features are most important to a majority of your customers enables you to focus your resources on maintaining these killer features or making them even better.

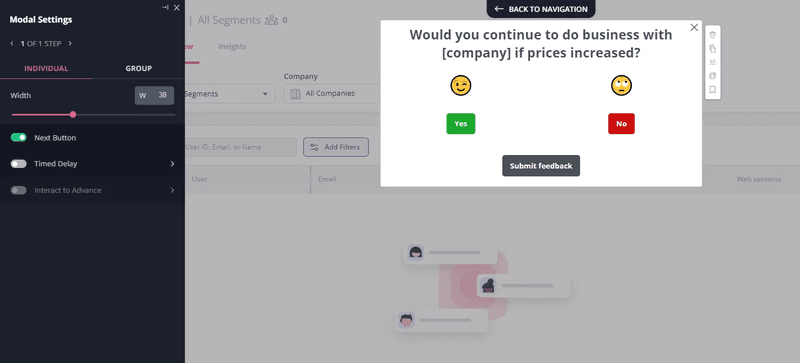

Would you continue to do business with [company] if prices increased?

Let’s be honest, with rising inflation and business operating costs, price increases are inevitable if you want to stay profitable.

Sometimes, you could be just one price increase away from losing a huge number of customers.

If you discover customers are using your product only because it’s the most affordable option at the moment, you have lots of work ahead.

You need to not only ramp up your product strategy but also focus on nurturing customer relationships and creating a truly loyal customer base that can overlook small price hikes.

It’s best to ask this question to your power users and customers with high lifetime value.

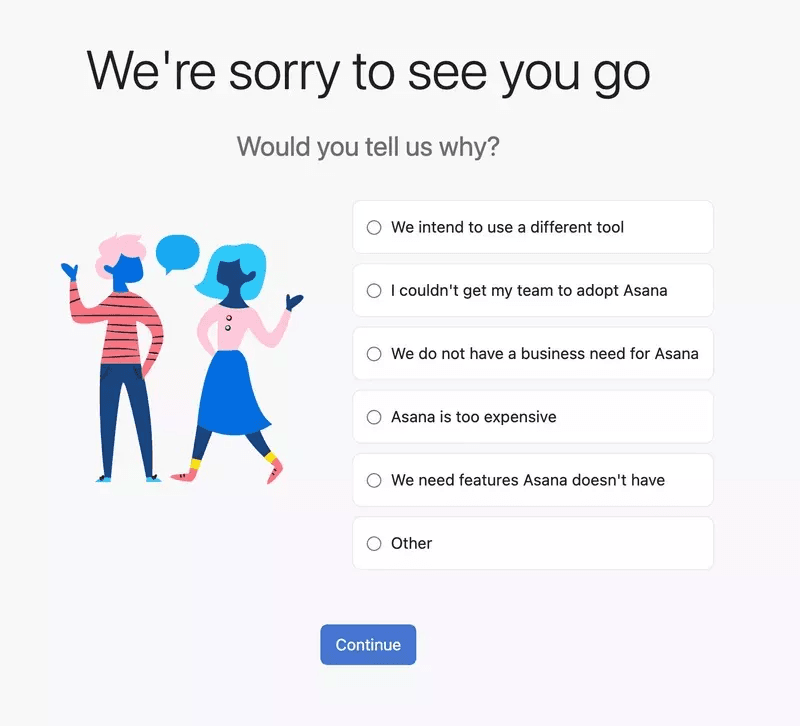

What made you cancel your subscription?

As much as you hate to see customers churn, sometimes it’s unavoidable.

However, it’s what you do after that matters. Rather than feel bad, learn from churn when it happens. Once you understand why people leave, you can fix the issues and retain the rest of your customer base.

A good example of handling churn like a pro is Asana’s churn survey. Sure, they’re sad to see a user go, but that doesn’t stop them from gathering insights that can help them improve their product.

Customer retention survey questions best practices

Let’s take a look at some of the best practices to take note of when crafting a customer retention survey template.

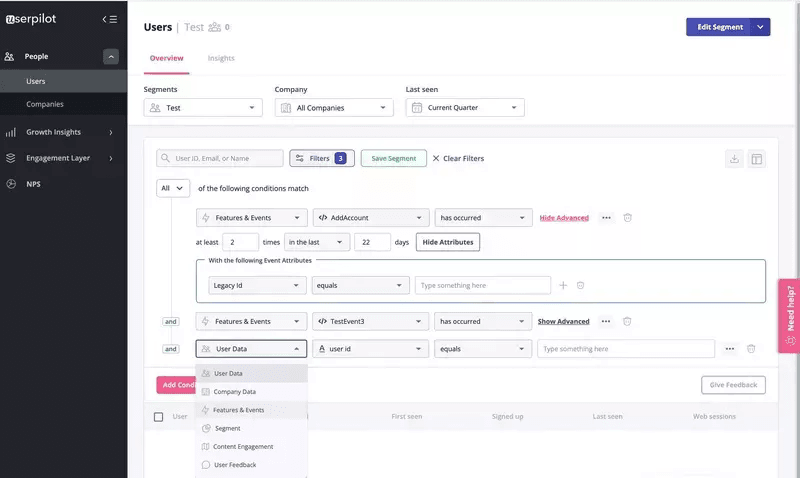

Use segmentation to ask audience-specific questions

It’s unprofessional to ask all users the same question. Each customer is unique – with different goals and different stages of their user journey, so some questions may be irrelevant to them.

For example, asking your trial users about their opinion on premium features would only leave them confused.

If you want to get accurate data and have higher response rates, you should personalize your customer loyalty survey template and compile relevant questions for each user segment.

You can use segmentation to reach specific audiences with targeted surveys.

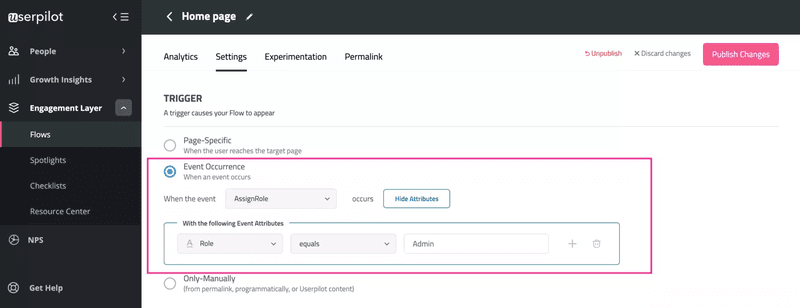

Send the surveys at the right time

Timing is very important when collecting feedback. You don’t want to risk sending surveys to customers while they are in the middle of an important task. This will only frustrate them.

One way to fix this is by triggering surveys contextually. When customers are presented with surveys at the right time, they’re more likely to respond.

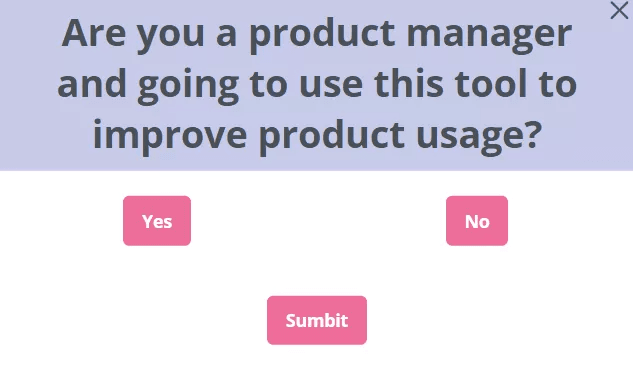

Ask one question at a time

You may be tempted to load your customer survey with many questions in an attempt to collect as much data as possible, thinking you are killing two birds with one stone. But that couldn’t be further from the truth.

Bombarding users with too many questions will only confuse and overwhelm survey respondents. This in return will lead to inaccurate data and decreased response rates.

That’s why you should stick to one main point at a time.

Remember, in most cases, it’s best to do several microsurveys at different intervals than one long one.

Avoid leading questions

Leading questions show bias, pushing users to answer in a certain way.

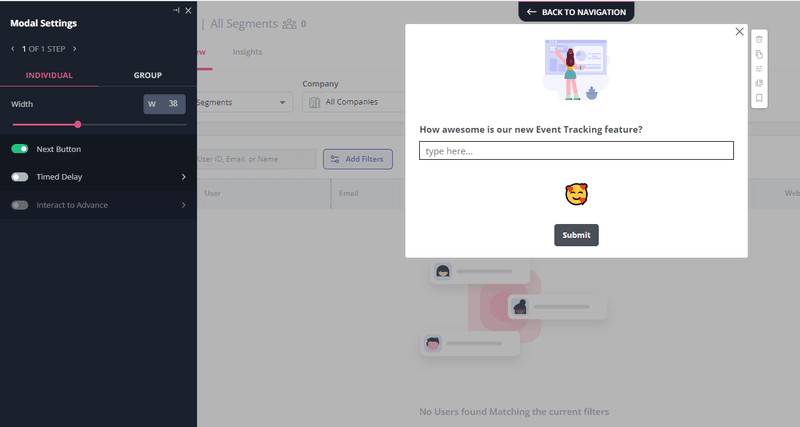

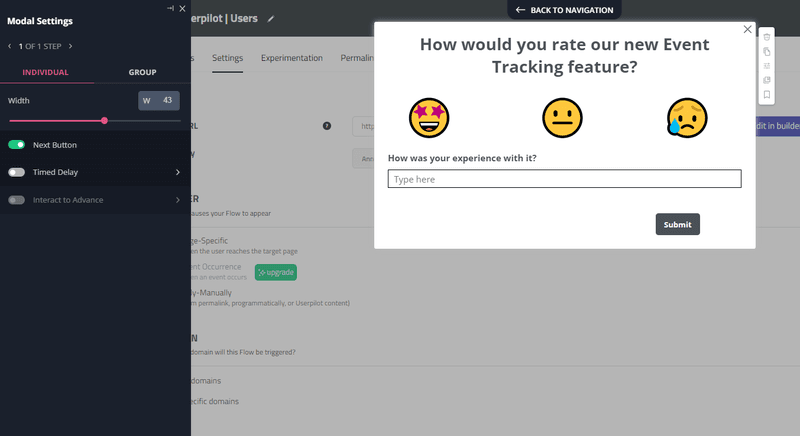

An example of a leading question in customer retention surveys is, “How awesome is our latest Event tracking feature?” This is a bad question, as it assumes that your customers find your new feature awesome to some extent.

However, if they don’t agree with your assertion, they either will dismiss your survey or give a response that doesn’t reflect their real opinion.

A better survey question is, “What do you think of our latest [x] feature?” This question lets them know that you are open to feedback – whether it’s positive or negative. And if it’s the letter, you are open to suggestions on how to improve.

Conclusion

When it comes to customer retention, there’s no one-size-fits-all solution. What works for one business may not work for another, which is why directly asking your customers is the best approach.

Want to create effective customer retention surveys code-free? Book a demo call with our team and get started!