ICP Marketing 101: How to Find, Define, & Activate Your Ideal Customer Profile

No ICP marketing is just as bad as poor ICP marketing. From my experience, both quietly sabotage SaaS growth. And it often comes down to one mistake: chasing the wrong audience.

Target the wrong audience, and you will:

- Build features nobody asked for.

- Fill your pipeline with poor-fit leads.

- Watch churn climb.

In contrast, companies with a clear ICP cut waste and drive results. Our customers at Userpilot prove it in their product marketing: Impala doubled activation, while Attention Insight boosted trial conversions by 47% after narrowing their focus.

In this article, I’ll discuss how you can achieve similar results using ICP marketing. Let’s start from the top.

How would you describe your current Ideal Customer Profile (ICP)?

How do you currently gather data for your ICP marketing?

How do you activate your ICP insights across your company?

It looks like you’re ready to level-up your ICP marketing.

A well-defined and activated ICP reduces churn, cuts waste, and drives sustainable growth. Userpilot can help you uncover data-backed insights from your best customers and create the personalized in-app experiences that convert them.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What does ICP marketing mean?

ICP marketing means promoting and selling your product specifically to your ideal customer profile; the audience segment most likely to see value, stick around, and drive long-term revenue.

Note that there are two concepts here: ICP and marketing.

- An ideal customer profile (ICP) is a data-backed description of the type of customer who benefits the most from your product and delivers the highest lifetime value.

- Marketing means promoting, selling, or delivering products or services to a target audience to generate profit for a business.

Together, they focus your efforts on best-fit customers and cut resource wastage on unqualified leads.

However, it’s easy to confuse ICPs with buyer personas.

- Personas are descriptive: They capture demographics, pain points, motivations, and buying behavior to humanize prospects.

- An ICP is prescriptive: It defines the strategic fit criteria that guide your sales, product, and marketing efforts.

Think of personas as the universal set “who they are,” and an ICP as the subset “who you should target.” Let’s use these examples to make it clearer.

Examples:

- Persona: Marketing Manager at a mid-market company.

ICP: Marketing managers at 200–500 person SaaS companies with >$10M ARR, a three-person operations team, and adoption challenges. - Persona: Customer Success Lead looking for retention solutions.

ICP: CS leaders in B2B SaaS firms with churn above 8%, 50+ seats, and no formal playbooks. - Persona: Startup founder wearing many hats.

ICP: Seed-funded SaaS founders with <20 employees, piloting product-led growth, seeking scalable onboarding.

💡 Quick test to see if your ICP is too broad: Ask yourself, “Can I clearly state who isn’t a fit?” If you struggle to exclude non-ideal customer segments, your ICP is too vague. A well-defined ICP should sharpen focus, not expand it. For example, saying “any company with sales teams” is too broad. Narrow it down to “B2B SaaS firms with SDRs struggling to convert inbound leads.”

How to build your ICP for your marketing and sales efforts

1. Start with your best customers

The reason is simple: Your best customers already succeed with you.

They renew consistently, expand usage, and champion your product. And that makes them the clearest blueprint for who you should target.

So, how do you find these best customers?

- Run a report of your top 10–20 accounts by retention and expansion.

- Then, look for patterns in company size, industry, job titles, and buying triggers.

- Talk to CSMs and sales to spot the common thread: Who’s easiest to close, easiest to keep, hardest to lose?

- Finally, sharpen your definition by comparing “good fit” vs. “bad fit” accounts.

This sample comparison table can help:

| Criteria | Good fit | Bad fit |

|---|---|---|

| Company size | 200–500 employee SaaS | <20 employee agency |

| Onboarding support | Dedicated CS team | No onboarding resources |

| Growth potential | Expands usage in 6 months | Churns after trial |

| Tech maturity | Uses a complementary SaaS stack | Reliant on manual tools |

| Budget alignment | >$10M ARR | <$1M ARR |

With Userpilot, you can validate your assumptions with real data. For example, you can segment power users and layer in quick in-app surveys that ask, “What do you like most about us?” to confirm what drives adoption and expansion.

2. Layer in firmographic + technographic data

Once you’ve identified your best customers, the next step is adding structure with firmographic and technographic data. This will give both sales and product teams a clear filter: who to prioritize, and who to avoid.

- Firmographics are measurable traits like revenue, employee count, geography, and industry.

- Technographics capture what tools customers already use. For instance, if your product integrates tightly with Salesforce, then customers running Salesforce are a clear fit.

For example, a B2B SaaS may find that its sweet spot is mid-market companies (200–500 employees), ARR above $10M, and a modern GTM stack (HubSpot, Salesforce, Slack). By contrast, companies with <20 employees and no CRM might churn fast.

For such a company, the structured ICP checklist will look like this:

| Factor | Fit signal | No-go signal |

|---|---|---|

| Company size | 200–500 employees | <20 employees |

| Revenue | $10M+ ARR | <$1M ARR |

| Industry | B2B SaaS | Offline services |

| Geography | North America, W. Europe | Unsupported regions |

| Tech stack | Salesforce, HubSpot, Slack | No CRM, legacy tools |

3. Map behaviors and pain points

Beyond firmographics and technographics, your ICP should also include behavioral analysis. Why do customers behave the way they do? What problems are they trying to solve?

But why include behavior and pain points?

Because you need to identify not only who is a fit, but also why they buy and how they use your product.

- Behavioral signals reveal the how: product usage frequency, number of active team members, and willingness to upgrade for premium features.

- Pain points reveal the why: missed project deadlines, poor adoption of internal tools, or lack of visibility across teams.

For example, a SaaS project management tool might discover its ICP isn’t just “mid-market agencies,” but specifically agencies with 20+ active users struggling to track deadlines across clients. That pain point drives adoption more than company size alone.

For this tool, the behavior–trigger mapping table will look like this:

| Behavior patterns | Underlying pain point | ICP insight |

|---|---|---|

| Users abandon setup after step 3 | Setup is complex/unclear | ICP prefers tools with intuitive onboarding |

| Teams log in daily with 20+ active users | Projects require heavy collaboration | ICP = agencies managing multiple client projects |

| Frequent upgrades to premium features | Current tools lack advanced functionality | ICP values robust features, not just basic task tracking |

| Low engagement from smaller accounts | Product is advanced for small teams | ICP excludes <10-person teams |

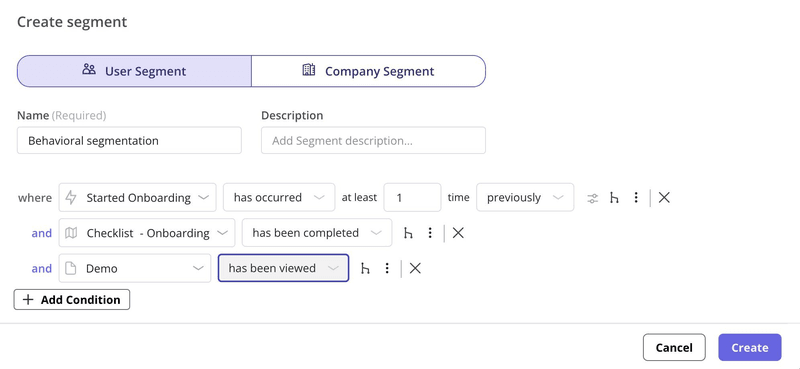

With Userpilot, you don’t need to guess these patterns. Using segmentation features like event tracking (e.g., abandoned setup vs. completed onboarding) and lifecycle filters (e.g., free trial vs. paying customer), you can group users by their behaviors and connect usage signals with the pain points to shape a sharper, data-driven ICP.

4. Validate with quantitative and qualitative feedback

The goal of this step is to confirm that your ICP is grounded in real-world results, not just educated guesses. To do that, you need to combine two types of feedback.

- Quantitative feedback to show which segments are truly profitable. Here, you’ll track retention, CAC/LTV ratios, and feature adoption across cohorts to see where revenue and engagement are strongest.

- Qualitative feedback, on the other hand, explains the why behind the numbers: This is where you conduct interviews or in-app surveys asking, “Why did you choose us?” or “What would make you switch?”

Insights from both will confirm whether your assumptions match customer realities.

For example, a SaaS analytics company may find mid-market users with 50–200 employees have the highest retention and fastest feature adoption. Meanwhile, smaller companies churn quickly despite high trial sign-ups, showing that “volume” isn’t the same as “fit.”

With Userpilot, you can run “mini ICP experiments” directly inside your product. For example, you can segment users by size or behavior, invite them to interviews through targeted modals, and offer incentives to boost participation.

5. Create an ICP scorecard

The final step, once you’ve defined your ICP traits, is creating a consistent, central scoring model. This will help marketing target the right accounts and sales avoid wasting time on poor-fit leads.

The goal? Increase close rates and reduce churn.

So, how do you create it?

- First, choose 3–5 key factors such as company size, pain point urgency, and tech compatibility.

- Then, assign “fit” or “misfit” signals for each.

- Lastly, score new leads accordingly.

Let’s use these two sample leads to better explain.

1. Lead A: 350-employee SaaS, HubSpot user, struggling with onboarding.

| Factor | Fit signal | Misfit signal | Score (Fit/Misfit) |

|---|---|---|---|

| Company size | 200–500 employees | <20 employees | (1/0) |

| Tech compatibility | Uses Salesforce + HubSpot | No CRM in place | (1/0) |

| Pain point urgency | Struggles with adoption | “Nice-to-have” interest | (1/0) |

✅ Total Score: 3/0 = Strong ICP fit

2. Lead B: 15-employee startup, no CRM, low urgency

| Factor | Fit signal | Misfit signal | Score (Fit/Misfit) |

|---|---|---|---|

| Company size | 200–500 employees | <20 employees | (0/1) |

| Tech compatibility | Uses Salesforce + HubSpot | No CRM in place | (0/1) |

| Pain point urgency | Struggles with adoption | “Nice-to-have” interest | (0/1) |

❌ Total Score: 0/3 = Poor ICP fit

💡 What if the score (fit/misfit) is (2/1)? Is that a good or bad ICP fit?

A 2/1 score (two fits, one misfit) usually means the lead is a borderline/cautious ICP fit. These leads meet most of your ICP criteria, but they have one weak spot, e.g., the company size is too small or there’s low urgency. And you can work around those if the “misfit” factor is less critical or can be solved later, e.g., they don’t use your ideal CRM yet, but plan to adopt one soon.

Verdict:

- Sales/customer success team: Flag them as “secondary priority” worth pursuing, but don’t overload the pipeline with them.

- Marketing: Avoid targeting them at scale, but don’t exclude if CAC/LTV data shows potential.

Activating ICP marketing and sales strategies

When your entire go-to-market motion speaks directly to your best-fit audience, you cut wasted spend, improve lead quality, and boost expansion revenue.

The key is translating ICP insights into actionable strategies across marketing, sales, and product. Let’s look at how.

Sharpen your messaging around ICP pain points

Messaging is one of the first things potential customers notice about you. So, your ICP clarity should start here.

- Don’t use generic broad copy like “Simplify your workflow.”

- Use your ICP’s real pain points: “Cut onboarding time by 40% for mid-market SaaS teams.”

That distinct shift turns vague value props into specific, urgent solutions.

Paddle, a SaaS revenue platform, is a prime example of this done right. Instead of chasing all businesses, they spoke directly to software founders frustrated with tax compliance.

Paddle perfect customer marketing message, Source.

To follow suit, make your messaging sharper by interviewing or surveying your ICP to capture the exact words they use.

Userpilot helps here: You can run in-app surveys that ask, “What’s your biggest challenge right now?” or “Why did you choose us over alternatives?” Then feed those phrases directly into website copy, ads, and onboarding flows. The outcome is messaging that feels like it was written for your ICP, not for everyone.

Invest only in channels your ideal customer actually uses

One of the biggest mistakes I see SaaS teams make is spreading acquisition dollars across too many channels. With ICP insights, you will prevent such waste.

ICP marketing shows you exactly where your best-fit customers hang out. For example:

- If your ICP is mid-market SaaS teams with 200–500 employees, LinkedIn and targeted review platforms (like G2 or Capterra) may yield higher-quality leads than broad Google Display ads.

- Conversely, if your ICP is early-stage startup founders, you might see more traction in communities like Indie Hackers or Product Hunt.

A fitting example here is Dropbox. They grew their initial user base by releasing a demo video on Hacker News rather than mass-market channels.

Tailor onboarding flows to each ICP cohort

Defining ICP cohorts helps you shape onboarding so each segment gets exactly what they need to succeed. In turn, you get customer retention.

So, instead of a one-size-fits-all flow, tailor the experience to the customer’s size, needs, and urgency. For example:

- SMBs want fast setup, templates, and automation to get value in hours.

- Enterprises, on the other hand, often prioritize integrations, SSO, and security reviews before scaling adoption across teams.

Slack understood that and tailored its product accordingly. Quick-start templates help SMBs onboard rapidly.

On the other hand, enterprise plans emphasize compliance and integrations.

Both paths supported the same vision but met different ICP needs.

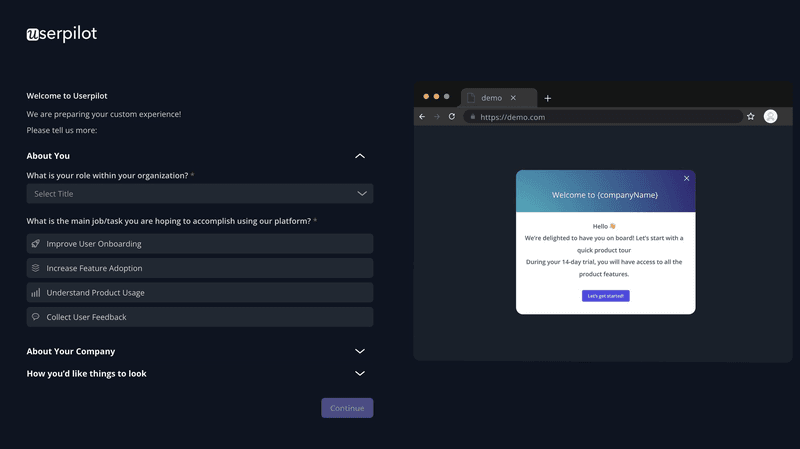

With Userpilot, you can replicate the same approach we use ourselves: ask new users about their role, company size, or goals, then personalize the onboarding. For example, startups might see quick setup tours, while enterprises get advanced analytics and multi-user training flows, no code needed.

Prioritize upsells for ICP customers showing buying signals

Your ICP already reveals which customers are the best long-term fit. When you combine that clarity with behavioral signals like frequent logins or feature adoption milestones, you get precise upsells.

And when customers see additional features as valuable accelerators rather than pushy sales pitches, you’ll reduce friction, shorten sales cycles, and improve conversion rates.

An example of this in practice is how HashiCorp prioritizes upsell.

- They track behaviors like creating new workspaces or building more infrastructure; clear signs that a customer is scaling.

- The customers are then prompted with advanced features and higher-tier options, while lighter users remain on entry-level tools suited to their needs.

By marrying ICP data with usage behavior, HashiCorp’s upsells feel like a timely solution to real needs, not a blanket promotion.

4 ICP marketing dos and don’ts for SaaS teams

Your ICP should be a tool that drives marketing strategy, not a static slide buried in a deck. Here’s how your team can keep it practical and effective.

1. Do: Build your ICP from real customers

Build on specific accounts that already succeed with your product—those who retain longest, expand fastest, and show high adoption. This eliminates bias and ensures your ICP reflects proven fit.

For example, if most of your sticky customers are 200–500-person SaaS firms with active product adoption, that’s your starting point.

To find yours, analyze your top 20 accounts for retention, expansion, and adoption patterns. Use these signals as the foundation of your ICP.

Don’t: Chase the dream ICP at the expense of real buyers

It’s tempting to target logos that look impressive on paper, but this can waste resources and slow growth. An ICP that’s too aspirational risks misalignment across marketing, sales, and product.

Instead, balance ambition with evidence. Define ICP around today’s wins, then expand gradually into new segments.

2. Do: Treat ICP as a living strategy

Markets shift, customer needs evolve, and product capabilities expand. A well-maintained ICP adapts to these changes.

For instance, your ICP today may be mid-market teams, but tomorrow it could expand to enterprise clients once your product matures.

Ideal response? Review ICP performance quarterly. Update it using revenue trends, adoption data, and customer feedback.

Don’t: Treat your ICPs as a static segment

A “set it and forget it” ICP quickly loses value. If you never revisit it, you risk chasing segments that no longer deliver retention.

So always build checkpoints into your go-to-market strategy. Don’t wait for churn to reveal when your ICP is outdated.

3. Do: Include behavioral signals

Firmographics show who might be a fit, but behavior reveals why they buy and how they engage. Combining the two reveals customers who are most likely to succeed.

Imagine noticing that customers with 10+ active users adopt features faster and renew more reliably than smaller teams.

Such an insight could save you thousands of dollars, separating best-fit accounts from poor fits. And you can only get it when you segment customers by usage frequency, team activity, and adoption patterns.

Don’t: Define ICP only on surface traits (size, annual revenue, industry)

Surface-level customer data is too shallow to guide strategy. Without behavior, you can mistake high-profile companies for great fits even if they churn quickly.

In short, always validate firmographics with product engagement. If adoption lags, revisit your ICP assumptions.

4. Do: Keep ICP specific and scalable

A clear ICP sharpens focus and improves targeting while leaving room to grow. The right balance makes your ICP a filter, not a cage.

Think: “200–500 person SaaS companies with adoption issues” instead of “all SaaS companies.”

Using the same model, define narrowly enough to exclude bad fits, but broad enough for natural expansion into related segments.

Don’t: “Over-narrow” your ICP

Over-defining can stifle your pipeline and exclude viable opportunities. If you box yourself in, growth slows unnecessarily, like ruling out all companies under $20M ARR when plenty of $15M ARR firms could thrive with your product.

Instead, use the “who isn’t a fit?” test. If exclusions outnumber inclusions, your ICP is too narrow.

Keep your ICP alive, not archived

An ICP is a living guide for every stage of your SaaS funnel. Companies like Impala and Attention Insight saw real impact by pairing a refined ICP with product experiences tailored to their ideal users. Impala doubled activation, while Attention Insight boosted trial conversions by 47%.

And you can achieve similar results if you do the same. This way, your marketing, sales, and onboarding will stay focused on the right customers.

Userpilot makes the entire process actionable. Within our tool, you can run in-app surveys, segment users, and personalize experiences without code.

Book your free Userpilot demo today and start turning ICP insights into measurable growth.

FAQ

What is ICP advertising?

ICP advertising targets marketing campaigns specifically to your ideal customer profile. Instead of broad, generic ads, you focus on the audience (successful customers) most likely to adopt and retain your product, reducing wasted spend and increasing conversion. For example, promoting a SaaS analytics tool to mid-market marketing managers with specific tech stacks.

Why is ICP used?

ICP (ideal customer profile) is used in marketing because it gives SaaS teams a clear, evidence-based definition of their best-fit, top customers. Instead of chasing “anyone who could buy,” ICP ensures marketing, sales, and product all focus on the accounts most likely to succeed and stay long-term.

What is ABM in marketing?

Account-based marketing (ABM) is a strategic approach targeting high-value accounts instead of individual leads. Here, marketing, sales, and customer success coordinate campaigns tailored to specific organizations, increasing relevance, engagement, and conversion, especially in B2B SaaS.