Wondering how to trigger user feedback surveys the right way?

This article covers the necessary details. You will learn:

- The importance and types of feedback surveys.

- Examples of customer feedback questions for useful insights.

- Best practices to help you collect accurate user feedback and have healthy response rates.

Summary of a user feedback survey in SaaS

- A feedback survey is a questionnaire designed to gather information about a user’s experience with a specific product, service, website, app, or any other interactive element.

- Feedback surveys help you learn about customer expectations, collect feature requests and validate product ideas, find areas of improvement, and improve user satisfaction.

- Types of feedback surveys include customer research surveys, Net Promoter Score (NPS) surveys, customer satisfaction surveys, customer effort score (CES) surveys, user experience surveys, and churn surveys.

- Common types of survey questions include Likert scale questions, close-ended questions, open-ended questions, and follow-up questions.

- Best practices for creating customer satisfaction surveys include:

- Opt for the right survey tool.

- Collect feedback periodically.

- Use survey segmentation for personalized survey experiences.

- Avoid asking bad survey questions.

- Utilize localized survey questions.

- Analyze survey performance to improve survey responses.

What is a feedback survey?

A feedback survey is a questionnaire designed to gather information about a user’s experience with a specific product, service, website, app, or any other interactive element.

The goal is to understand the user’s perceptions, opinions, and needs by collecting feedback to improve the overall product experience.

Why is it important to conduct feedback surveys?

Feedback surveys play a critical role in product development. When implemented correctly, feedback surveys help you:

- Learn about customer expectations: Surveys provide direct insight into what customers expect from your brand. By analyzing user responses and spotting patterns, you can generate rich customer insights to help you align your offerings with customer needs, leading to better user experiences.

- Collect feature requests and validate product ideas: As users interact with your product, they occasionally spot missing features they expected. Feedback surveys are the best way to find out about this, as most users don’t go out of their way to request new features. Additionally, you can use surveys to validate new product ideas before investing significant resources into development.

- Find areas of improvement: Targeted feedback surveys help you dig into the product experience, uncover user pain points, and find experience gaps. These insights let you decide which enhancements to prioritize.

- Improve satisfaction and customer loyalty: When customers feel heard and see their feedback implemented, it significantly boosts their satisfaction and loyalty towards your brand. Customer loyalty also correlates with increased spending and repeat business. Your satisfied customers are more likely to continue renewing and expanding their accounts.

Types of customer feedback surveys

Feedback surveys come in various formats, each designed to gather specific information and insights. Here are the most common types and how to implement them.

Customer research surveys

These surveys are comprehensive and designed to gather detailed information about customers’ perceptions, experiences, and expectations regarding your product or brand in general.

Customer research surveys build a foundation for all your future customer-centric decisions. They help you define your ideal customer profile, refine marketing strategies, and identify potential product-market fit.

Trigger this survey type when considering entering a new market, developing a new product, or making significant changes to your tool. You can also conduct occasional customer research to gather feedback from your existing customers and know if your product helps them meet their goals.

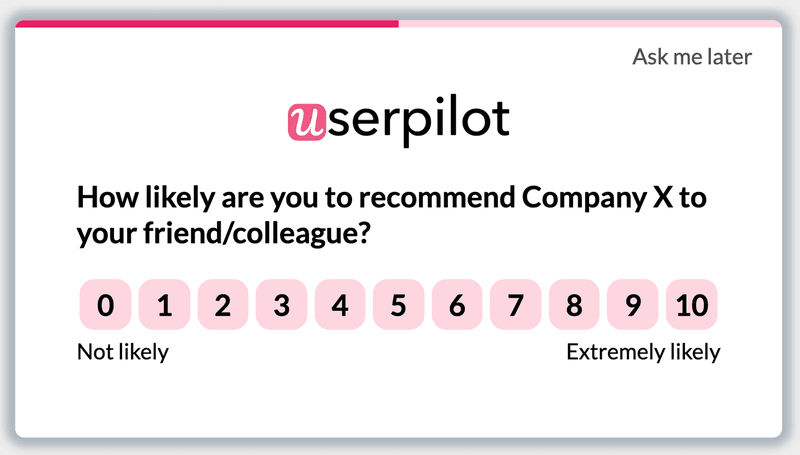

Net Promoter Score (NPS) surveys

NPS surveys ask a single question: “On a scale of 0-10, how likely are you to recommend our company/product/service to a friend or colleague?”

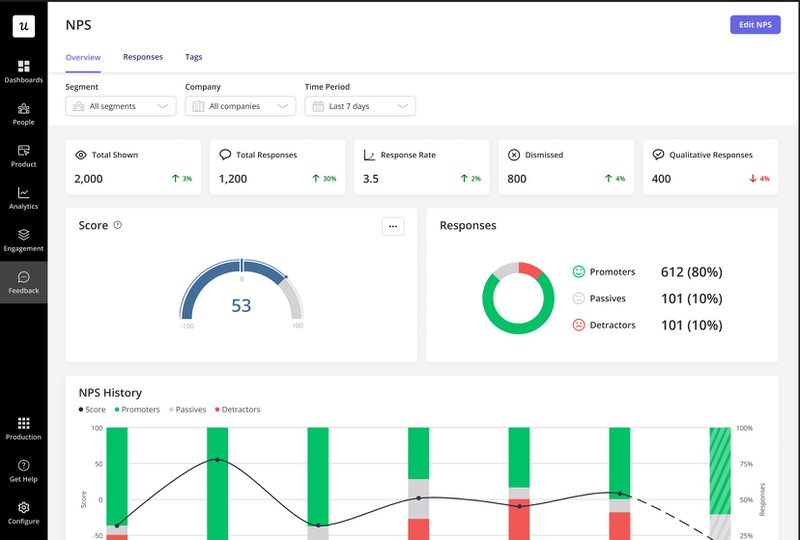

This survey is one of the easiest ways to measure customer sentiment and loyalty—especially if you’re using a tool like Userpilot that makes it super easy to calculate and analyze NPS responses.

When is the best time to trigger NPS surveys?

Short answer: it depends on your needs. You can make it transactional—triggering your surveys after customer interactions to know how the experience was. Or make it relational—sending NPS surveys at regular intervals in the customer journey to understand long-term customer satisfaction.

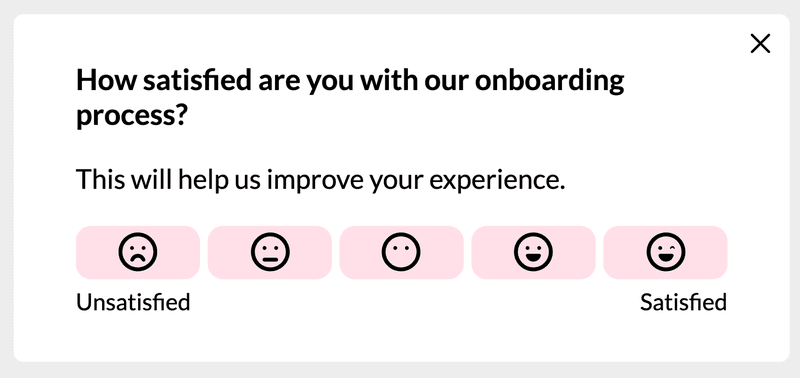

Customer satisfaction score (CSAT) surveys

CSAT surveys measure customer satisfaction with your product or specific interactions along the customer journey. The survey typically asks a question like, “How satisfied were you with your experience?” and provides a scale, often from 1 (very unsatisfied) to 5 (very satisfied).

To get comprehensive insights, follow up your customer satisfaction surveys with open-ended questions like, “What part of the customer service did you like the most?” or “We’re sorry to hear you weren’t satisfied. What went wrong in this experience?”.

The best time to trigger customer satisfaction survey questions is immediately after the user completes the interaction in question. For example, don’t ask about your onboarding experience a month after the user finishes the initial onboarding process. Why? The experience is no longer fresh in their minds, so you’re not likely to get accurate feedback.

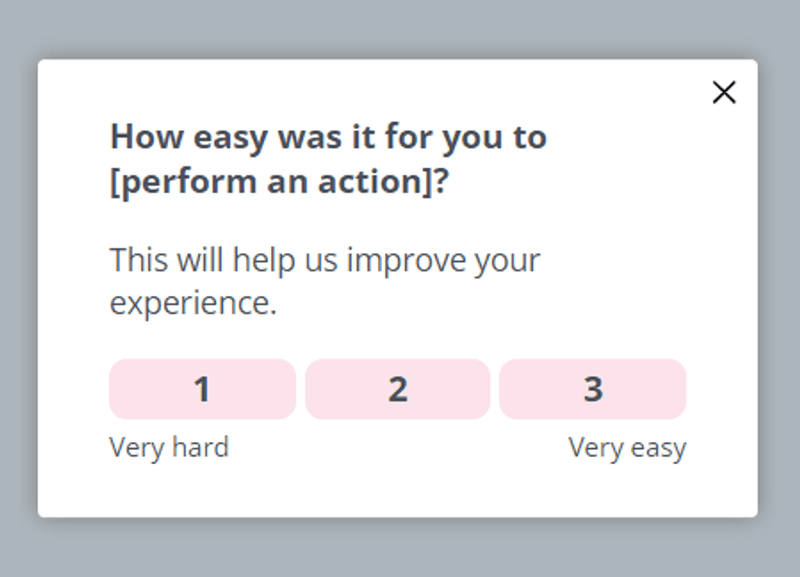

Customer effort score (CES) surveys

While customer satisfaction surveys provide an immediate measure of customer happiness, CES surveys help you understand the user-friendliness and efficiency of your product or service.

Customer effort score surveys are most effective when triggered after specific interactions, such as completing a purchase, resolving a service issue, or using a new feature. Like customer satisfaction surveys, trigger your CES with emoticons or a numeric scale. Example:

User experience survey

UX surveys focus on understanding how users interact with your product, often including questions about usability, design, and the overall user experience.

By triggering user experience surveys at regular intervals in the user journey, you’ll gather insights to help you create a smoother and more enriching product experience.

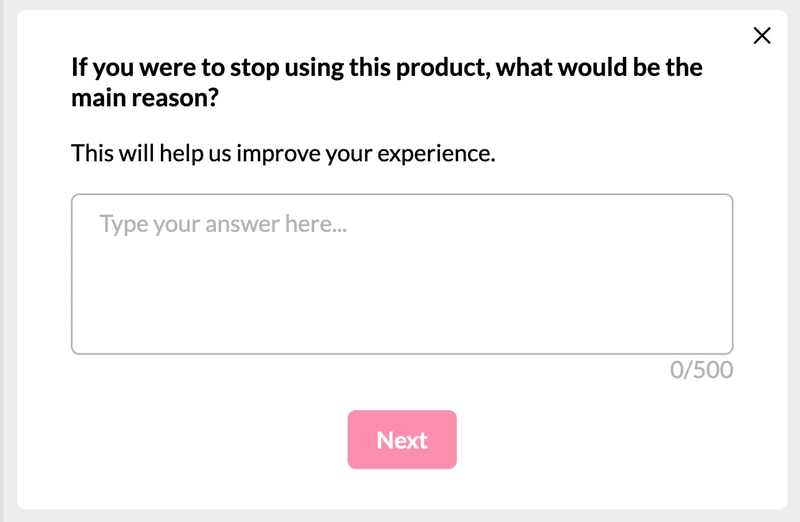

Churn surveys

These surveys help you understand why customers want to leave your product. Making churn surveys a part of your account cancellation flow helps gather insights to improve long-term retention.

The standard practice is to set your churn survey to trigger immediately after a user clicks the account cancellation button. However, you can also send feedback questions like the one below to collect random feedback and identify at-risk users.

24 Examples of customer feedback survey questions

Now that you’ve seen the types of feedback survey questions, let’s get more granular and explore different survey questions you can ask to generate in-depth feedback.

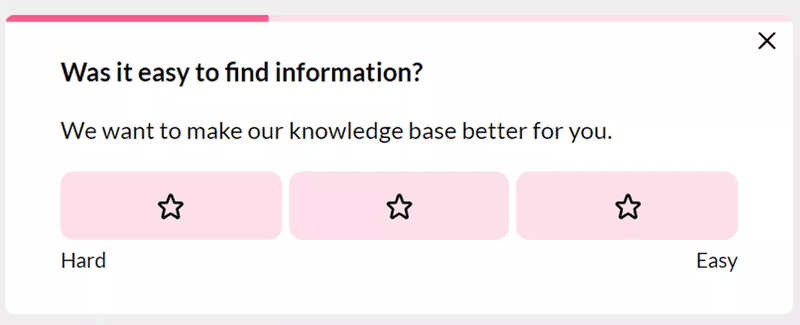

Likert scale questions

These questions help you gauge user attitudes, opinions, or feelings on a scale, offering a range of options from one extreme to another. Likert scale questions are useful for measuring the intensity of respondents’ feelings.

Examples:

- Was it easy to find information in our help center?

- On a scale of 1 to 5, how would you rate your experience with our customer service team?

- How strongly do you agree that our pricing is competitive compared to similar products? (Strongly disagree, Somewhat disagree, Neutral, Somewhat agree, Strongly agree)

- How intuitive did you find navigating our new interface? (Not intuitive at all, not very intuitive, somewhat intuitive, mostly intuitive, extremely intuitive)

- On a scale of 1 to 5, how easy was it to navigate our website?

- On a scale of 1 to 3, was it easy to find information?

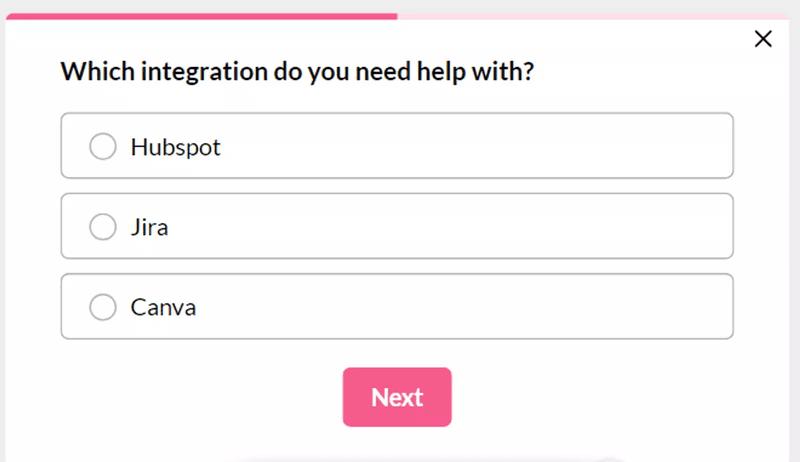

Close-ended questions

These feedback survey questions give users a predefined set of answer options to make responses easier. Use them when you just need to get quick, straightforward quantitative data.

Examples:

- Which integrations do you need support with?

- How did you hear about us? (social media, a friend, google ads, podcast, others)

- How often do you use our product? (daily, weekly, monthly, rarely)

- Which communication channel do you prefer for receiving updates from our company? (In-app messages, email, social media, none)

- What is your primary reason for using our SaaS solution? (Increased efficiency, cost savings, improved decision-making, all of the above.)

- Which feature of our product do you find most useful? (Feature A, Feature B, Feature C, Other)

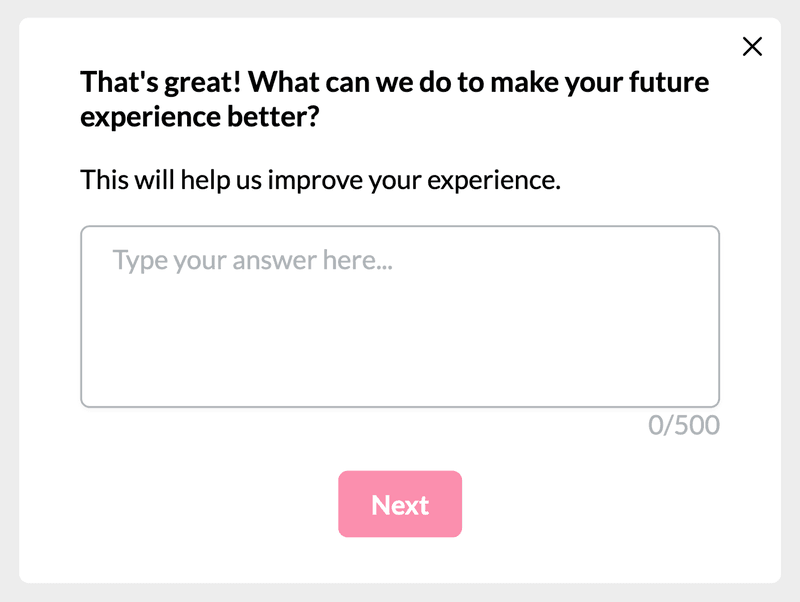

Open-ended questions

These are the opposite of close-ended questions—they let users provide feedback in their own words.

Trigger open-ended questions if you want to get detailed qualitative insights for better decision-making.

This question type requires more effort from users and can take time to analyze, but the insights you’ll get are worth it.

Examples:

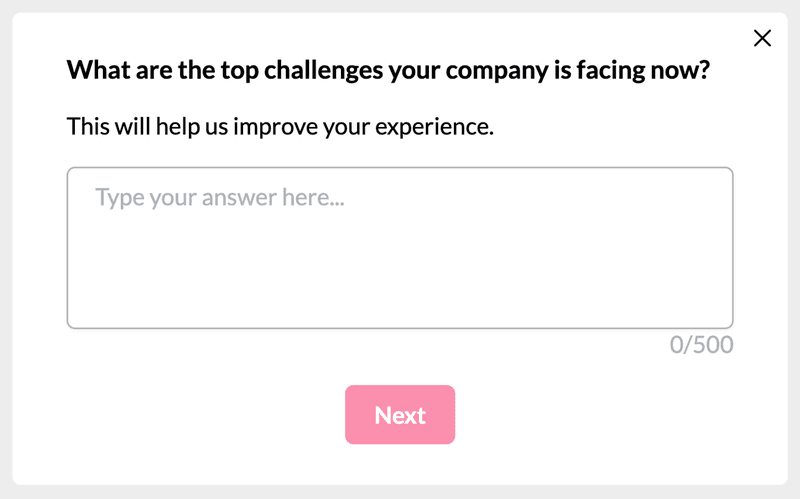

- What are the top challenges that your company is facing at the moment?

- What improvements would you like to see in this product?

- What could have done to make your interaction with our customer service representative smoother and more efficient?

- How do you think we can improve our customer onboarding and training materials?

- What are your overall first impressions of the new feature?

- Thanks for renewing your account! To help us improve, what were your initial hesitations, if any, about renewing your subscription?

Follow-up questions

These are additional queries you prompt after a respondent provides an initial answer. They serve to dig deeper into the initial response, clarify ambiguities, and help you gain a more nuanced understanding of your user’s experience or opinion.

You can use follow-up questions in various survey contexts, depending on your goal. Examples:

- Thanks for the question! How should we get back to you?

- You recently rated your experience with our knowledge base as poor. Can you tell us more

- You rated our product quality highly. What aspects of the product contributed to this rating?

- Given your interest in Feature A, what additional functionalities would you find helpful

- You found the website difficult to navigate. What changes would make it more user-friendly for you?

- Regarding the improvements you mentioned, how do you think these would enhance your experience with our product? (proceed to provide options)

Best practices for creating customer feedback surveys

Implement these best practices to consistently generate high-quality customer satisfaction feedback with good response rates.

Opt for the right survey tool

You’ll struggle to create effective surveys if you use a platform that doesn’t have enough features to meet your needs.

There are so many survey tools on the market, and it can be difficult to choose the right one. To make it simple, here are some must-have features to look for.

- Custom surveys: This ensures everything you roll out matches your brand identity.

- Survey analytics: What’s the point of having a survey tool if it can’t help you analyze the results and generate quick customer insights?

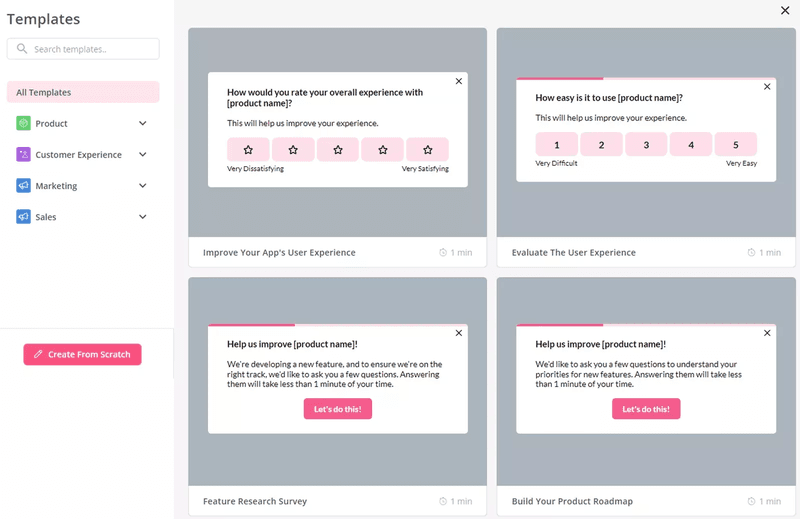

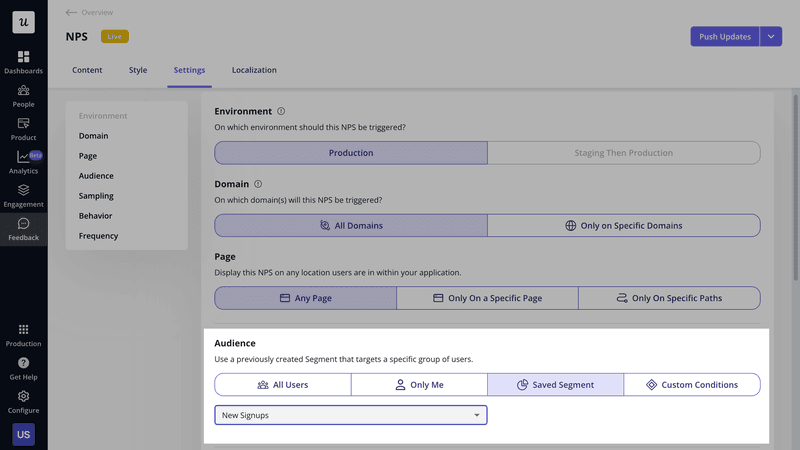

- Multiple trigger options: Surveys work best when triggered contextually. For example, you shouldn’t be sending customer satisfaction surveys that ask users about their customer service experience when they didn’t contact support in a recent time. The survey isn’t contextual, and the response quality will be poor. The right survey tool helps you avoid this mistake.

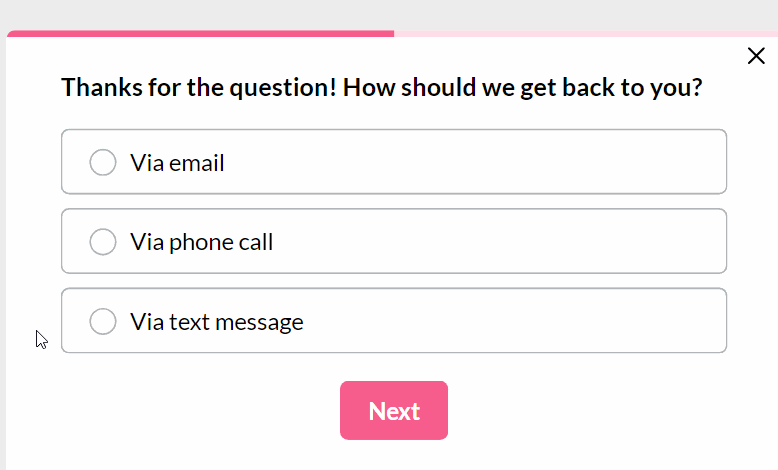

Userpilot’s survey tool lets you trigger in-app surveys that are customizable and have a variety of question types. The platform also has customer satisfaction survey templates to make feedback collection easy.

Collect customer feedback periodically

Don’t wait for problems to arise before surveying users. Trigger regular feedback surveys to keep up with changing customer satisfaction and expectations.

But, of course, you must strike a balance. Avoid over-surveying, as it can lead to survey fatigue and reduce response quality.

Use survey segmentation for personalized survey experiences

Avoid sending generalized surveys. Segment users based on their use case, in-app behavior, journey stage, or any other relevant factor. Then, trigger surveys that are relevant for each group.

For example, you can create different surveys for different user personas based on the features they use the most.

Avoid asking bad survey questions

Poorly designed questions can lead to inaccurate data and hinder your understanding of customer sentiment.

Avoid:

- Complicated questions: Phrasing questions in a way that is too complex or technical.

- Loaded questions: Asking questions that contain an assumption or controversial statement.

- Leading questions: Phrasing surveys in a way that suggests a particular answer or influences the respondent’s response.

- Double-barreled questions: Combining two questions into one. This confuses users who might have conflicting answers for the two questions.

- Biased questions: Questions that are worded or structured in a way that favors a certain response or point of view, skewing the results.

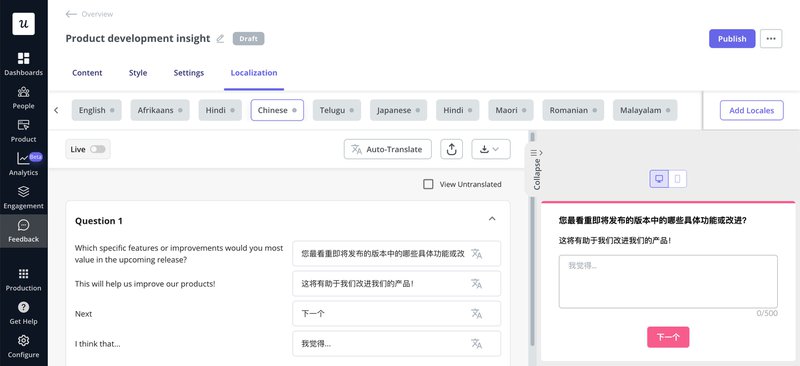

Utilize localized survey questions

Personalize the user experience by localizing questions.

Imagine a user is randomly trying out a new feature of your product. Instead of an English survey, you decide to trigger localized customer satisfaction survey questions, asking them what they think about the new release. They will be glad to see the questions and be motivated to provide in-depth feedback.

Analyze survey performance to improve survey responses

Survey analytics help you understand what makes your feedback surveys effective and areas you need to improve.

When analyzing, look at key metrics like response rates, drop-off points, time taken to complete the survey, and quality of response.

With the right survey tool, you can even segment different elements of your survey and monitor the impact of design, content, verbiage, and trigger conditions. All these will help you improve response rates and feedback quality.

Conclusion

As you go ahead and implement the different survey types, keep in mind that the survey loop isn’t closed until you get back to users.

Don’t leave customers hanging after collecting feedback. Appreciate them for their response and let them know you’re working on the complaints. For cases where you can’t make any immediate changes, still communicate with users. Taking this approach ensures you build trust and maintain user willingness to provide feedback.