The battle of Pendo vs Gainsight feels impossible when both promise the same thing: better user adoption. But after helping multiple product teams with their digital adoption needs over the past three years, here’s what I’ve learned: Pendo overwhelms users with configuration, Gainsight forces enterprise overhead, and neither delivers the user experience product managers need.

At Userpilot, I see teams switch from both platforms daily. In this honest review, I’ll show you exactly why: weighing the differences on analytics, in-app guidance, customer feedback, and total costs, including hidden implementation overhead.

Pendo vs Gainsight for product analytics

Winner: Both fail product teams, but Gainsight’s limitations are less painful

Comparing Pendo vs Gainsight PX on analytics means choosing between complexity and limitations. Pendo offers granularity if you manually tag everything and navigate dated UX. Gainsight PX looks polished but lacks the interactivity you need to track user behavior effectively. Neither delivers fast, actionable data for improving feature adoption.

Pendo Analytics: Complex and inconvenient to use

They market themselves as advanced analytics, but most teams spend more time configuring than analyzing. Pendo’s free plan offers limited views and basic NPS. Even paid tiers lack the analytical power teams need, feeling more like a reporting framework for end users.

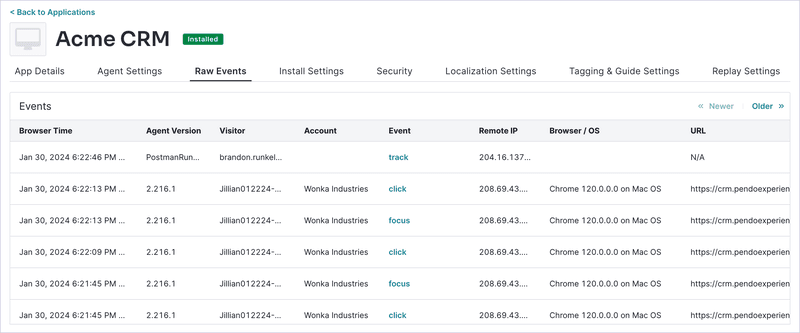

- Auto-capture with major asterisks: Pendo tracks clicks, page views, and form inputs automatically. But turning that user behavior data into meaningful insights requires manually tagging features using Visual Design Studio or inserting custom metadata. You’ll map every single element you care about before it becomes visible in reports.

- Data modeling is a chore: Want to analyze a funnel or compare usage trends across two time periods? There’s no native date comparison view. You’ll manually recreate reports or export data. Even filtering requires pre-set visitor/account metadata and manual event setup.

- No real drill-down capabilities: In most charts, you can’t click into a data point to see which users it represents. This basic interaction forces you to cross-reference between “Data Explorer,” “People,” or “Segments” modules to chase down answers.

- Account analytics are one-dimensional: You’ll see what features were used, how often, and by whom. But nothing about user sentiment, feedback, or qualitative context unless you’ve purchased additional modules like Pulse or Listen.

- No-code? Not really: You’ll need technical know-how to get anything useful out of Pendo analytics. From tagging elements to configuring custom segments, the tool assumes you’ve got data analysts on standby.

Even simple questions like “Did feature X drive activation this month?” can send you into a tailspin of tagging, exporting, or toggling between modules.

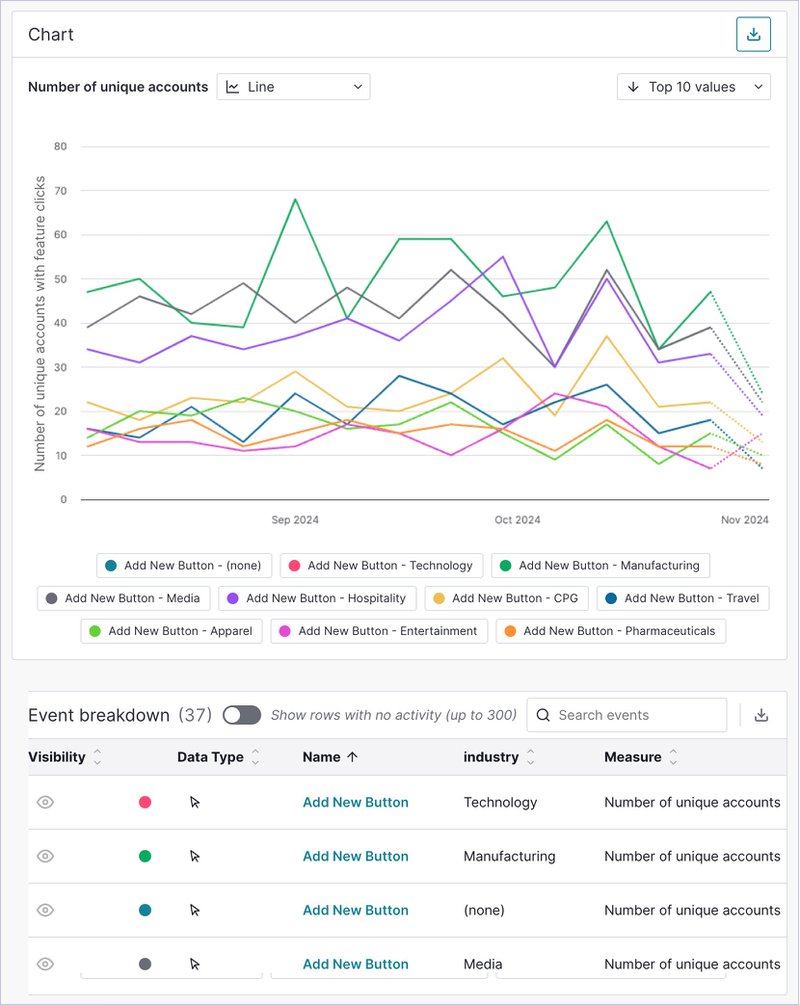

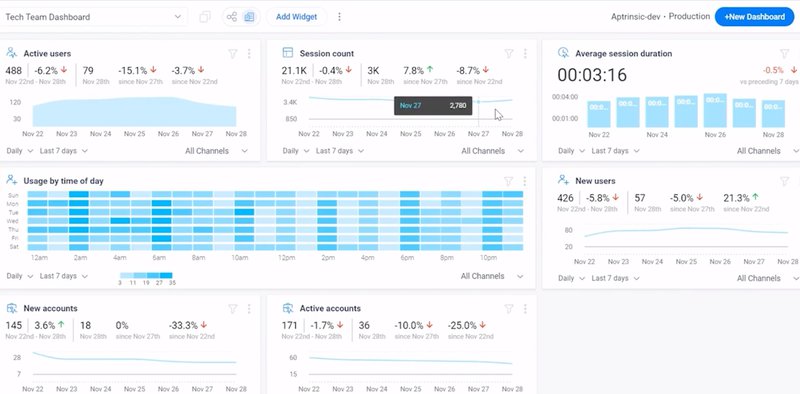

Gainsight Analytics: Made for CS, not product growth

Gainsight PX streamlines some workflows compared to Pendo, but it’s built for customer success reporting, not product iteration. The architecture reveals the priority: customer success operations over product iteration speed. At a glance, the dashboards look polished: adoption, retention, feature usage, new users, etc. But once you try to dig in, the limitations start stacking up:

- No interactivity: In a widget like “New Users,” you’d expect to hover and click to break down these user groups in detail. Not in PX. There’s no drill-down, just static visualizations. This blocks segmentation or investigating usage drop-offs without bouncing between different tools.

- Static reports, not exploratory analytics: PX offers basic visualizations (funnels, paths, usage charts), but they’re built for presentation, not iteration. You can’t click a funnel stage to see drop-off users or click a usage spike to investigate what triggered it.

- Segmentation is locked behind structure: PX does allow segmentation, but it’s rigid. You need well-defined user attributes piped in from a CRM or CDP. Want to build a quick segment based on behavior and survey scores? You can’t.

- Real-time data? Not really: Gainsight PX updates on a delay, which makes it hard to iterate on product decisions quickly. If you’re running onboarding tests or rolling out a new feature, you’ll be looking at stale metrics.

- Designed for account health, not user behavior: PX’s strength lies in aggregating usage across accounts and tying that to CS metrics. But that model doesn’t help when your focus is activation, engagement, or feature adoption at the individual level.

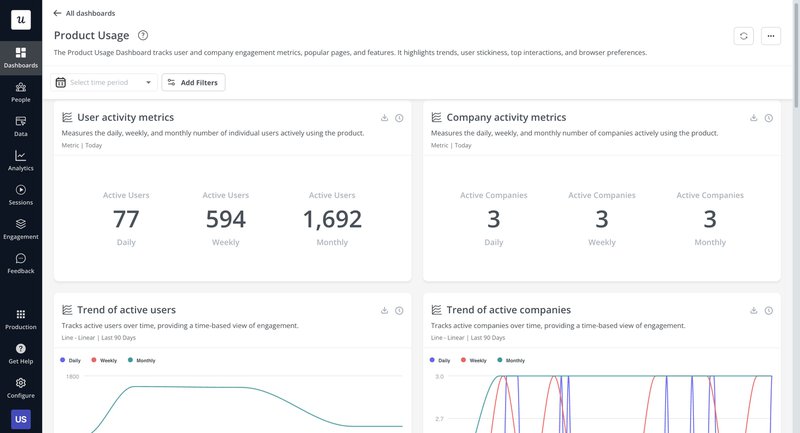

Our analytics in Userpilot are built for product iteration speed. Click any funnel step to see exactly which users dropped off. Hover over a usage spike to see what triggered it. Build behavioral segments and respond to user patterns in seconds, not hours.

What’s your biggest challenge with your current product analytics tool?

How do you currently create in-app guidance like tours or tooltips?

What is the primary goal you want to achieve with a tool like Pendo or Gainsight?

See why Userpilot is the best alternative to Pendo vs Gainsight.

You’re looking for a powerful, user-friendly platform to drive product growth without the complexity. Get a customized demo to see how Userpilot can help you achieve your goals.

Pendo vs Gainsight for in-app experiences

Winner: Gainsight PX wins on usability despite fewer features

Pendo overwhelms you with guide options but makes execution painful through constant back-and-forth between modules and CSS hacks. Gainsight PX offers basics with simpler workflows but limited flexibility. However, neither delivers the fast, intuitive user experience needed to design and iterate on onboarding flows without employee involvement or developer overhead.

Pendo Guides: Feature bloat at its finest

Pendo boasts a laundry list of guide types (tooltips, banners, lightboxes, walkthroughs, polls), but what looks powerful on paper quickly turns into a UI nightmare in practice. The user experience is clunky, over-engineered, and packed with small usability traps that slow down your team:

- It’s cumbersome to use: setting up no-code patterns like hotspots (pulsing beacons) simply doesn’t exist. Want an on-hover tooltip? Unless you’re comfy writing CSS, you’re out of luck; there’s no native trigger for that.

- The guide editor itself can feel overwhelming and unintuitive. Even basic tasks like editing content or steps aren’t immediately obvious. Users on Reddit have chimed in too:

“I did not like it one bit for in-app guides. It is glitchy, slow, unnecessarily complicated to implement and also very limited in triggers.”

- Styling guides are a multi-tab operation: Want to apply a theme? You’ll need to jump from the Guides section into the Themes panel, which opens the Visual Design Studio (VDS) in a separate tab. After styling your theme, it doesn’t auto-apply to existing guides. You’ll have to open each guide one by one, reapply the theme, and republish it. This is especially painful at scale.

- Customization is limited unless you write code: Out-of-the-box guide styling is pretty basic. Want to customize with gradient buttons or dynamic personalization like a user’s name or plan type? You’ll need to edit global CSS or inject agent metadata using custom code blocks. And yes, Pendo uses underscore.js for templating. So much for no-code.

- No built-in personalization: Unlike modern tools that let you insert user properties directly into your content, Pendo makes this impossible without developer help. You can’t say “Hi [First Name]” unless you’ve hardcoded that metadata into your app.

Compared to Userpilot, these are just ones among many out-of-the-box customizations we serve 😉.

Take Cuvama, who switched from Pendo to Userpilot after struggling to launch contextual flows:

“With Pendo, I could not do, or at least I didn’t know how to easily do, specific flows for specific companies.” — Leyre Iniguez, Customer Experience Lead at Cuvama

Or Shelterluv, who echoed the same frustration:

“One of the biggest feedback the team had about Pendo was like, we just don’t know how to use it. And it’s hard to figure out. We don’t have the time to just like, sit and read through everything to figure out how to use it.” — Matthew Brown, Senior Customer Solutions Manager at Shelterluv

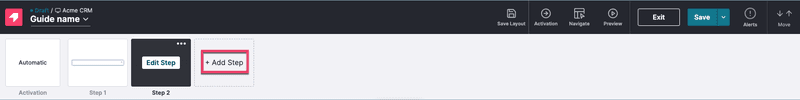

Gainsight PX: Clunky and less intuitive

Gainsight PX does offer in-app guidance, but it feels like an afterthought compared to dedicated onboarding and adoption tools. The features are there (tooltips, walkthroughs, dialogs, surveys), but the execution is clunky and better suited for customer success teams running engagements at the account level, not product managers iterating on onboarding flows.

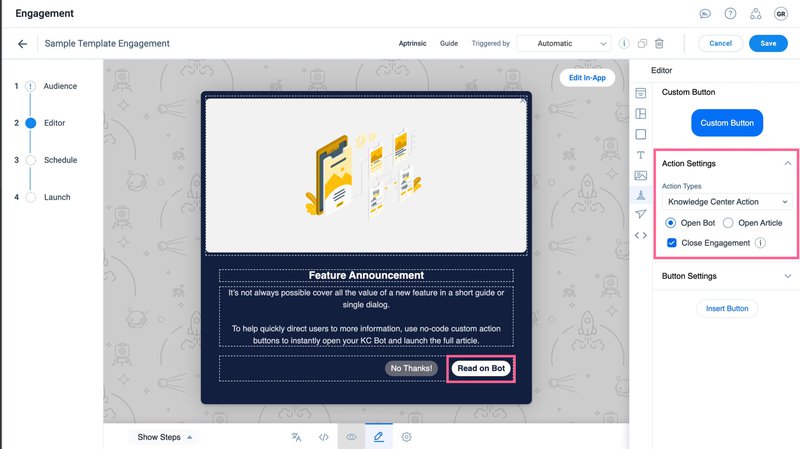

- Engagement builder feels outdated: Gainsight PX calls its in-app flows “Engagements.” You can choose from dialogs, guides, surveys, and announcements. But the builder itself isn’t intuitive. You’re piecing steps together in a rigid flowchart-like setup that makes even simple guides feel overcomplicated.

- Customization is surface-level: You can tweak copy, colors, and buttons, but anything beyond that (like branching logic or deeper personalization) takes effort.

- Targeting is limited: Engagement targeting relies heavily on pre-configured user/account attributes. If you haven’t synced your CRM/CDP cleanly, you’ll find yourself restricted. Behavioral targeting is possible, but the conditions are clunky to manage.

- No seamless preview or QA: PX makes it difficult to test engagements the way you would expect. Previews can be inconsistent, and switching between editing, testing, and publishing isn’t smooth.

- Maintenance overhead: Once live, engagements don’t scale well. Editing or updating requires republishing flows, and analytics on performance aren’t as actionable as you’d want. You’ll get completion rates, but drilling into why users drop off requires more work.

To be fair, Gainsight PX is more straightforward than Pendo when it comes to basic guide creation, but it’s still not intuitive enough for product teams that want to experiment quickly. It feels like PX bolted on in-app experiences to round out a CS-focused platform, rather than designing them as a core strength.

Pendo vs Gainsight for customer success

Winner: Gainsight dominates, Pendo barely qualifies

Pendo offers basic CS features (polls, resource center, session replay), but they’re fragmented and surface-level. Polls live inside guides, and the resource center lacks search analytics.

Gainsight has a dedicated CS suite with health scores, playbooks, and account views. It’s powerful but complex and resource-intensive for large enterprises only.

Bottom line: Pendo isn’t a CS platform. Gainsight is, but it requires serious budget and bandwidth.

Pendo for CS: Limited and surface-level

Pendo was never built as a customer success platform, and it shows. While it offers a handful of features CS teams can use (polls, session replay, resource center), none are purpose-built for deep customer success workflows.

- Polls live inside guides: Pendo treats polls as just another guide step. Fine for lightweight impressions, but useless for structured CS insights. You can’t trigger standalone surveys after onboarding or run recurring sentiment checks without embedding them in a guide. But our Userpilot treats surveys as a dedicated module. You can run NPS, CES, or custom feedback flows independently, with flexible triggers and targeting.

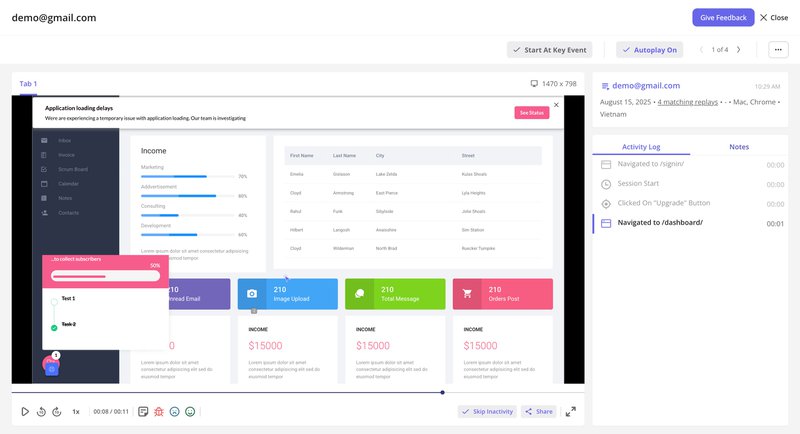

- Session Replay is gated: Replay can spot user experience friction, but it’s a paid add-on with limited scope. You can’t easily combine replay insights with analytics or survey results for complete account health views.

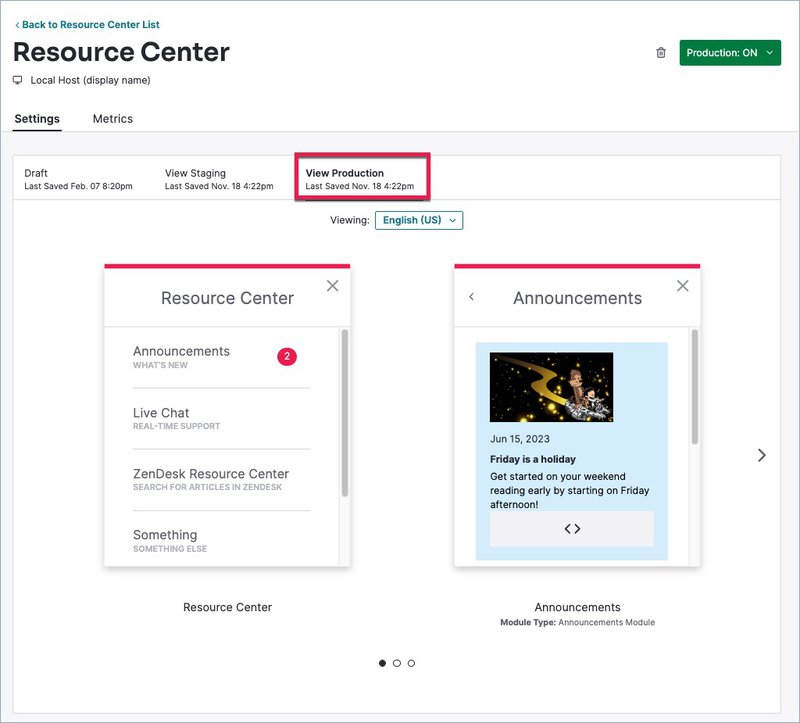

- Resource Center falls short: Pendo’s resource center widget lacks a global search bar with analytics. You can’t see what users search for (and fail to find), making it harder for CS teams to close knowledge gaps. Meanwhile, Userpilot not only lets you add search to your Resource Center but also tracks search queries to show what customers need most.

- No customer success workflows: Pendo doesn’t integrate with CS processes like health scoring, playbooks, or escalation paths. It’s not designed to serve CS teams beyond surface-level guidance.

For CS managers, Pendo feels like a “bonus add-on” to a product analytics tool rather than a real solution. You’ll get fragments of value, but not the depth you need to tie user feedback to actionable outcomes.

This is why former Pendo users consistently tell us Userpilot delivers the CS depth they were missing.

Gainsight CS: Powerful but high-maintenance

To be fair, Gainsight CS can be a great product for large enterprises with dedicated ops teams. It has an entire suite called Gainsight CS built specifically to help CS teams manage accounts, reduce churn, and improve retention. On paper, this makes it far more capable for CS use cases, especially when considering the importance of security. In practice, it comes with significant overhead.

Standout features in Gainsight CS:

- Customer Health Scores: Build detailed health scoring models combining product usage, survey responses, and account data. Helps CS teams prioritize at-risk accounts and proactively intervene.

- Playbooks and Workflows: Define standardized playbooks, like following up after low NPS scores or re-engaging inactive users. Automates repetitive tasks, ensuring consistency across teams.

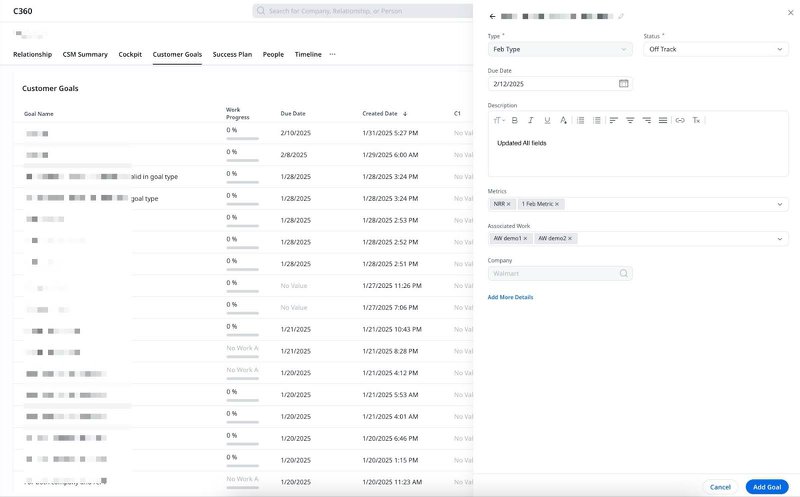

- 360 Account View: Aggregates data across touchpoints (emails, product usage, support tickets, surveys) so CS managers see the full customer journey in one place.

- Surveys and Feedback: Unlike Pendo’s polls inside guides, Gainsight includes robust survey functionality with flexible distribution and reporting tied to customer health.

- Renewal and Expansion Tracking: Integrates with CRM data for visibility into contract renewals, expansion opportunities, and churn risk.

The trade-off is complexity. Setting up Gainsight CS requires strong data pipelines from your CRM, product analytics, and support tools. The platform needs dedicated admins to configure, maintain, and train teams.

For companies without large CS functions, Gainsight is overkill. Most products need lightweight feedback collection tied to user behavior. In Userpilot, you can trigger an NPS survey when users hit their third feature, then segment responders by score and usage patterns. All without a dedicated CS platform.

Pendo vs Gainsight for pricing and ROI

Winner: Both are expensive, but Gainsight PX edges out with clearer CS value

When it comes to cost, neither Pendo nor Gainsight PX is designed with lean product teams in mind. Both price aggressively, hide key features in higher tiers, and scale expenses rapidly as usage grows.

Both platforms are costly, fragmented, and best suited for organizations with big budgets and dedicated ops teams.

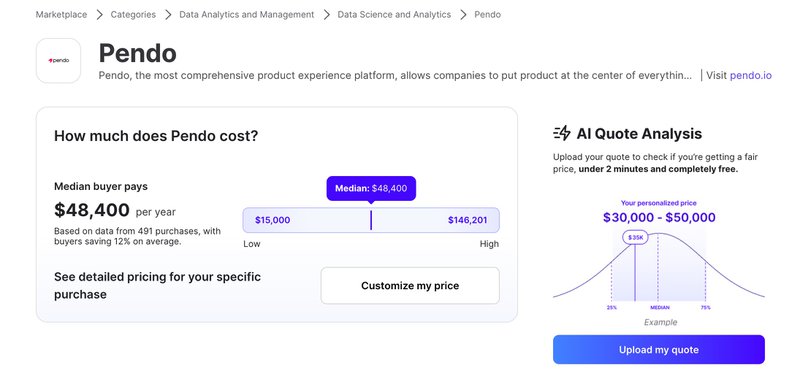

Pendo pricing: Expensive for what you get

Pendo’s pricing is a closely guarded secret, but trust me, it’s eye-watering. Their add-on model is like a nickel-and-dime scheme designed to bleed you dry.

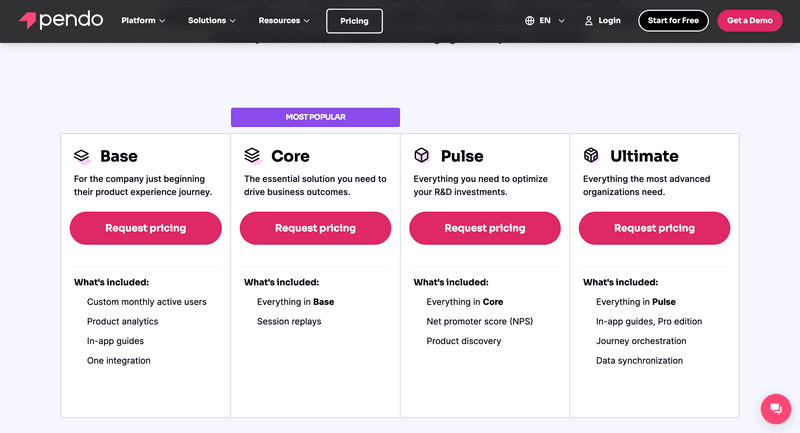

Thinking of using Pendo free? It’s more of a glorified trial.

- Median buyer pays around $48,000 per year: The low end starts near $15k, while enterprise deals can run well over $140k annually.

- Pricing scales with MAUs (monthly active users): Their “Base” plan includes product analytics, in-app guides, and a single integration, but anything beyond the basics quickly pushes you into higher tiers.

- Add-ons are everywhere: Want NPS? That’s the Pulse package. Need advanced guide orchestration or data sync? You’re looking at Ultimate. Even core features like Session Replay are hidden in the Core plan and above.

What other tools bundle as standard (like surveys, advanced targeting, or analytics flexibility), Pendo carves into separate upgrades. This creates ballooning budgets for those who thought they were buying a complete solution.

As Leyre Iniguez, Customer Experience Lead at Cuvama, put it:

“High price was one of the decision criteria to move from Pendo because we were paying lots, and we were not using it.”

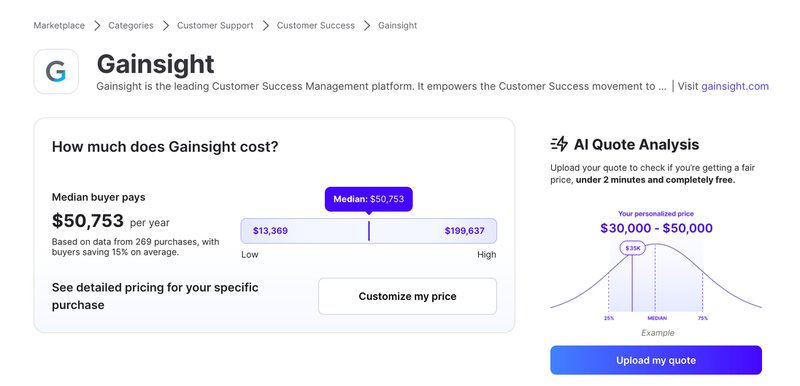

Gainsight pricing: Only makes sense for big budgets

Gainsight PX’s pricing isn’t much better. According to Vendr data, the median buyer pays around $50,753 per year, with smaller contracts starting near $13k and large enterprise deals reaching almost $200k.

The challenge is that Gainsight sells an entire ecosystem:

- PX (Product Experience): Focused on in-app guidance and analytics.

- CS (Customer Success): A full suite for health scoring, playbooks, and account management.

- Other add-ons: Renewal management, revenue optimization, and integrations that tie into CRMs or data warehouses.

On the surface, this looks comprehensive. In reality, it creates scattered pricing across multiple tools. If you want both product analytics and robust customer success workflows, you’ll need to license PX and CS separately, each with its own cost structure.

That means you’re stacking specialized modules, each priced at enterprise levels. For smaller or mid-market companies, Gainsight becomes an all-or-nothing investment where you’re either locked into the full suite or left with a partial solution.

Then, for enterprises with big budgets and large CS teams, that trade-off can make sense. For leaner product-led companies, it’s overkill: expensive, scattered, and resource-heavy to manage.

Is there any better alternative?

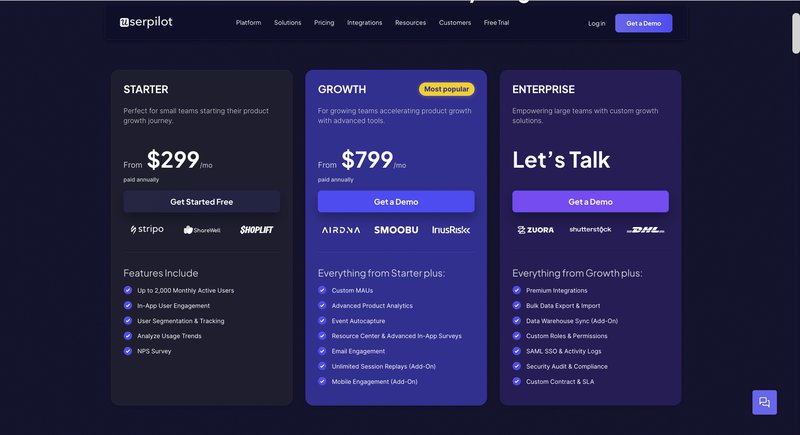

If you’re tired of choosing between Pendo’s bloated complexity and Gainsight’s enterprise-heavy stack, there’s a smarter option: Userpilot. It’s built specifically for teams that want end-to-end control over analytics, in-app guidance, and customer feedback, without hidden costs or operational headaches.

Here’s why multiple product teams consistently pick Userpilot over Pendo and Gainsight:

✅ Built for product teams end-to-end: Analytics, in-app guidance, and in-app surveys live in one place, so you don’t need a separate CS suite just to get adoption and insight.

As one former Pendo user put it:

“Because Userpilot is easier to configure and to work with, I’m getting much more value than with Pendo.” — Leyre Iniguez, Customer Experience Lead at Cuvama

✅ Predictable, transparent pricing: Public plans and flexible contracts with no nickel-and-dime add-ons. You know exactly what you’re paying for, and you get value from day one.

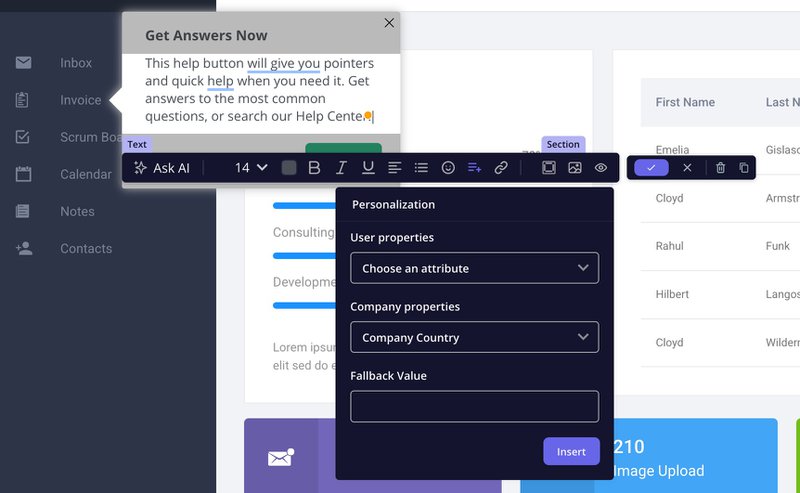

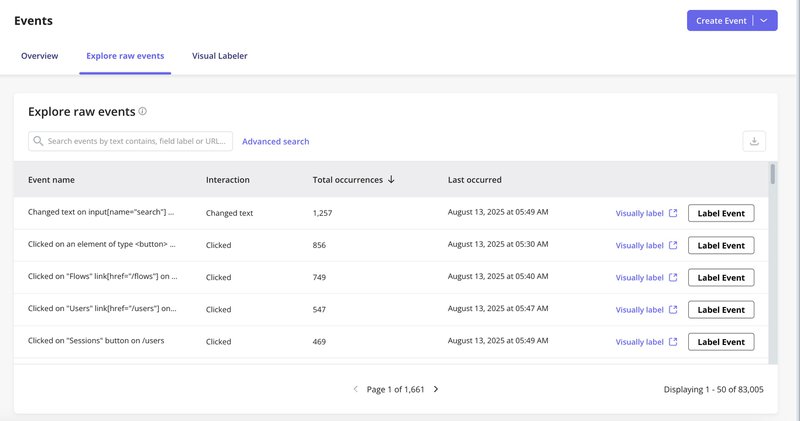

✅ Faster time to impact: Visual tagging plus autocapture, event-based targeting, and branching let you ship guides and experiments without engineering.

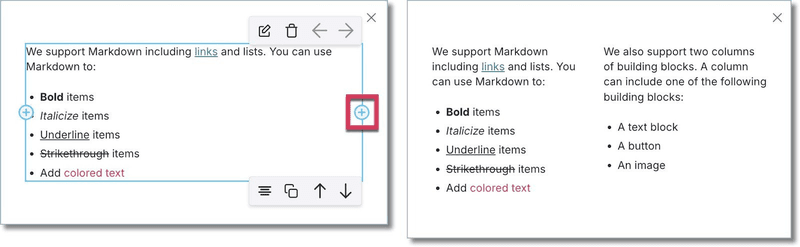

✅ Rich in-app toolkit on every plan: Product Tours, onboarding checklists, banners, tooltips, and an in-app resource center are available without forcing you into a premium bundle. Advanced analytics come with Growth and Enterprise plans, and Session Replay is available across all tiers.

✅ Plays nicely with your stack: Userpilot integrates with your CRM, CDP, and analytics tools so you can segment, personalize, and sync user behavior data in both directions.

✅ Enterprise-ready when you need it: Role-based permissions, SSO, localization, and governance controls make it a safe choice as you scale.

With Userpilot, you’re not just buying another tool. You’re investing in a platform that gives you speed, flexibility, and clear ROI. Something Pendo and Gainsight both struggle to deliver.

Make your switch to Userpilot for better value!

Pendo and Gainsight trap you with opaque pricing and expensive add-ons. Userpilot delivers transparent pricing, full-featured plans, and clear value at every growth stage.

| Userpilot | Pendo | Gainsight PX (+CS) | |

|---|---|---|---|

| Best for | Product teams that want one place for analytics + in-app + surveys. | Product orgs that want cross-channel experiences and product planning insights. | CS-heavy orgs that want PX in-app + CS Journey Orchestrator email and health scores. |

| Price range | Transparent pricing: from $299/mo (Starter), Growth & Enterprise tiers. | Quote-only bundles (Base/Core/Pulse/Ultimate). | Quote-only for PX/CS (modular suite). |

| Technical expertise required | ✅ No-code builder for flows, tagging, dashboards; optional APIs. | 🟡 VDS no-code for most tasks; advanced polish via CSS (themes/supplemental styles). | ✅ No-code editors + Product Mapper; admin setup for JO emails; SDK/tag install needed. |

| Supported channels (web / mobile / email) | ✅ Web & Mobile SDKs; Email: coming soon (note). | ✅ Web, Mobile, Email via Orchestrate. | ✅ Web & Mobile in PX; Email via PX Email Engagements and CS Journey Orchestrator. |

| In-app guidance | ✅ Tooltips, hotspots, banners, slideouts/modals, spotlights, standalone checklists, Resource Center. | 🟡Tooltips/lightbox/overlay, banners, walkthroughs, Resource Center; onboarding checklists via RC unless you are on Guide Pro Subscription. | 🟡 Limited with dialogs, sliders, tooltips, surveys, announcements; KC Bot. |

| NPS & in-app surveys | ✅ NPS, CSAT, CES in-app (styled, targeted) | 🟡 NPS and no native surveys but Polls as a building block in Guides | ✅ PX in-app surveys; CS can send survey emails via JO. |

| Resource center / help hub | ✅ In-app Resource Center with built-in search and custom modules. | 🟡 Resource Center modules (Guide List, Onboarding, etc.) + KB integrations (Zendesk/others) & no global RC search | ✅ Knowledge Center Bot with search & search analytics. |

| Autocapture | ✅ Raw Events autocapture (clicks, inputs, forms) in real -time + visual labeling; use in segments, triggers, reports. | 🟡 Auto Page + Feature clicks; Track Events for anything else (dev-sent), data updated hourly. | 🟡 Tracks pageviews/clicks via tag + Product Mapper; supports custom events. |

| Analytics dashboards | ✅ Custom dashboards aggregating trend/funnel/path/retention + survey KPIs. | ✅ Dashboard widgets for product, guide & usage KPIs. | ✅ Multi-dashboard with KPI/Report/Survey/Engagement widgets. |

| Analytics reports (funnel / retention / path / trend) | ✅ All four built-in (Trend, Funnel, Path, Retention). | ✅ Funnels, Paths, Retention (+ other behavioral reports). | ✅ Funnels, Retention, Path, trends via dashboards & reports. |

| Session replay | ✅ Native Session Replay available on all plan. | ✅ Native Session Replay (plan-based access). | ❌ Not a core PX feature (typically paired via other tools). |

| User / account profile | ✅ User & Company Profiles (sessions, events, properties, sentiment) + bulk/real-time identify APIs. | 🟡 Visitor & Account with only event, session details, and activity logs. | ✅ Audience & Accounts Explorer with Full Profile views. |

| Enterprise readiness | ✅ SSO (SAML), roles/permissions, SOC 2 (plus security controls). | ✅ SSO/SCIM, granular roles/permissions, SOC 2 (Trust Center). | ✅ SSO (NXT + PX), RBAC, SOC 2 / ISO security program. |

And if you’re already locked into a contract with Pendo? We’ll help you get out. Userpilot offers to buy Pendo contract through our buyout program (terms apply), so switching from Pendo is painless. You don’t need to wait for renewal season to escape an overpriced contract. Former Pendo users can now move to Userpilot easily.

Switching doesn’t have to be a headache. With transparent contracts, fair pricing, and migration support, Userpilot makes it easy to leave behind the complexity of Pendo and Gainsight’s bloat; additionally, it offers a streamlined transition process.

So, Pendo or Gainsight?

Both tools have their strengths, but neither fits most product teams perfectly.

- Pendo works for lightweight analytics needs, but quickly frustrates with steep learning curves, scattered data, and hidden costs.

- Gainsight PX is powerful for enterprises with mature CS teams, but most SaaS companies find the setup effort and enterprise pricing outweigh the benefits.

That’s why many teams switch to Userpilot: simpler, cost-effective, and built for product-led growth.

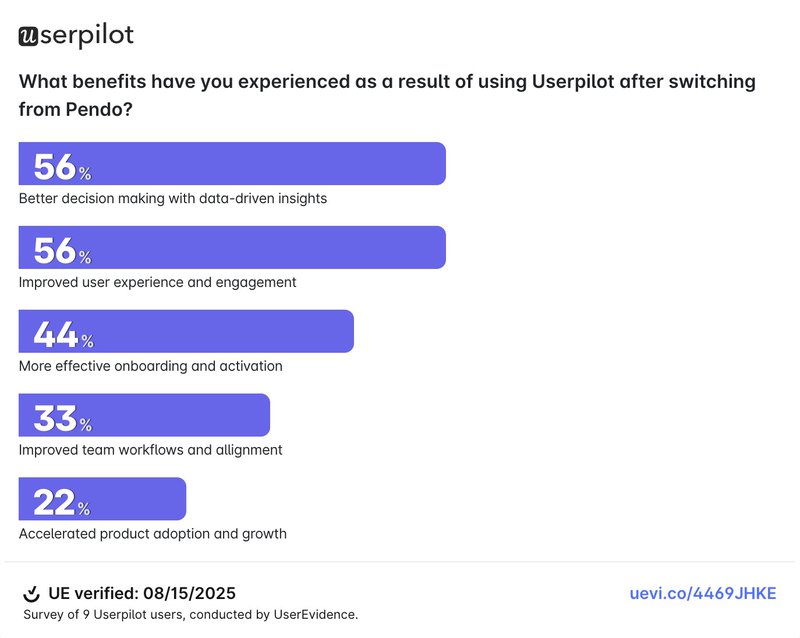

Former users consistently report better results with less complexity. 56% of customers who switched from Pendo to Userpilot saw better decision-making and engagement, proving the value of a more intuitive, cost-effective platform (UserEvidence, 2025).

The verdict: If you’re an enterprise with huge CS budgets, Gainsight might work. For an intuitive, cost-effective platform that drives product adoption without bloat, Userpilot is the clear choice.

Book a free demo with Userpilot to see real-time analytics and no-code guidance that work.

DISCLAIMER: Userpilot strives to provide accurate information to help businesses determine the best solution for their particular needs. Due to the dynamic nature of the industry, the features offered by Userpilot and others often change over time. The statements made in this article are accurate to the best of Userpilot’s knowledge as of its publication/most recent update on August 25, 2025.