With the vast number of people required to conduct research efficiently, orchestrating this symphony of manpower and resources can be incredibly challenging.

This guide will walk you through what research operations are, what role research operations managers play, which product analytics to track, and how you can get started with the process!

What are research operations?

Research operations — or ReserchOps — is the process of organizing people, resources, and processes to maximize the impact of research conducted along with the value it provides for an organization.

What does a research operations manager do?

Research operations managers have a fairly broad scope of work that includes responsibilities like:

- Strategic planning. This includes setting goals, charting procedures, and figuring out which OKRs or KPIs will be used to track progress.

- Resource allocation. A research operations manager is in charge of allocating available resources — such as cash, equipment, and personnel — in the most effective way possible to optimize the output of the department.

- Software acquisition. When it comes to selecting and procuring the necessary tools or software for the research process, research operations managers will often handle the vetting process — or at least have the final say.

- Participant management. The research operations manager is also responsible for recruiting study participants, collecting data, and managing the incentives offered to attract additional participants for upcoming studies.

- Employee onboarding/training. This could include hands-on training as well as the distribution of training material.

- Standard operating procedures. Research operations managers are in charge of creating guides, templates, internal wikis, and standard operation procedures (SOPs) that support both new and existing team members as they conduct research.

- Team collaboration and communication. The research operations manager is responsible for fostering collaboration within their own team and, where appropriate, facilitating the communication necessary for cross-team collaboration.

How to get started with the research process?

While research processes are often complex endeavors, breaking things down into the six core steps makes it a lot easier to comprehend and chart what needs to get done. The six steps of the research process are:

- Define objectives/goals

- Build a research team

- Establish standards/processes

- Recruit participants

- Select tools

- Analyze results

Let’s take a closer look at each of these steps in the sections below!

Define research objectives and goals

Before anything else, you’ll want to set user research objectives and goals to ensure that the rest of the steps are completed with this core mission in mind. Clearly articulate the purpose, scope, and (desired) outcome of the research being conducted to ensure clarity across your entire team.

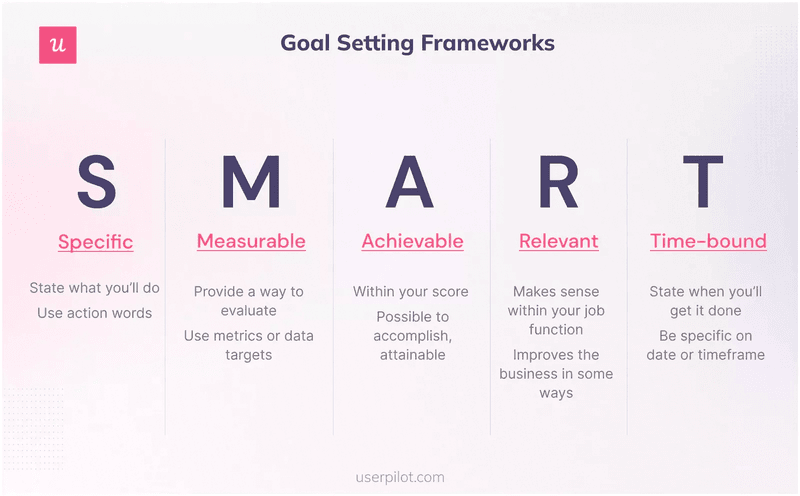

You can use goal-setting frameworks like SMART goals to streamline this process:

Build a research team

Speaking of your team, it’s time to decide:

- How many people you’ll need

- What each person does

- Which communication channel everyone will use

Once you know this, it’s time to loop everyone else in and ensure that every team member understands their role — as well as the contributions expected of them. Failure to clearly assign responsibilities could lead to scope overlap or underutilized personnel.

Establish standards and processes to support researchers

Next, it’s time to lay out the standards and processes that will support researchers as they conduct tests, experiments, or other aspects of the study. For instance, this could include the process for screening participants and what criteria are used.

Tip: You’ll want to avoid excessive participant filtering to avoid selection bias (and other types of bias) from tainting the results of your research.

You’ll also need processes for how to keep track of participants, which data to collect, and where to store that data. If you’re conducting UX research, the knowledge management features you need may already be baked into the software you’re using.

If not, you’ll need to build a new research repository from scratch to store all collected data.

Recruit research participants

Participant recruitment will be the next hurdle that you’ll need to overcome. User researchers who are trying to identify behavioral patterns in how people use a particular product or platform will likely use their own user base as the participant pool.

Of course, third-party services like Qualtrics are available for those who don’t have a large enough user base or don’t want to involve existing customers in their research practices.

Research teams can even post in a ResearchOps community to see if anyone is interested or has a reliable source of participants.

Cold email outreach is usually the last resort since it yields the lowest response rates.

Select tools to gather and manage research data

The research tools used could include survey platforms, analytics software, and product growth platforms — with a combination of the three research tools being the most common.

It’s also possible to get a full-suite product growth platform like Userpilot that includes all three in its native feature set.

For instance, Userpilot has path-tracking capabilities that help you analyze user navigation routes:

Analyze and iterate results for better research practice

Once participant data has been gathered by the software you selected, the final step of the process is to analyze the results from these research sessions. This is your opportunity to see if the outcome matches expectations, which hypotheses were proven/disproven, and what insights were uncovered.

You should also take this opportunity to improve the research process. This could include refining the methods used, addressing any challenges that were encountered while managing research participants, and re-training the research ops team.

A few questions to ask yourself when identifying areas to improve upon include:

- How easy was it to recruit participants?

- Was the data we collected helpful?

- Which insights are actionable?

Of course, the questions you ask (and the answers you get) will be different depending on the type of research being done.

If you’ve just completed a UX research process, then UX researchers may look at which features, bugs, and elements need to be added, removed, or tweaked.

7 user research methods for research ops

Conducting quality user research is easier said than done, but thankfully, there are a few methods that have stood the test of time. The sections below will walk you through the tried-and-tested research methods that a research ops team can use to gather useful data.

Qualitative research vs quantitative research

The distinction between qualitative and quantitative research is an important one to make. Qualitative research includes written survey responses, feedback from focus groups, and one-on-one customer interviews.

Quantitative research includes scalar ratings, aggregate scores like NPS, product metrics, revenue growth, and other forms of quantifiable (often numeric) data collection. When applying quality user research, a combination of both qualitative and quantitative data is usually required.

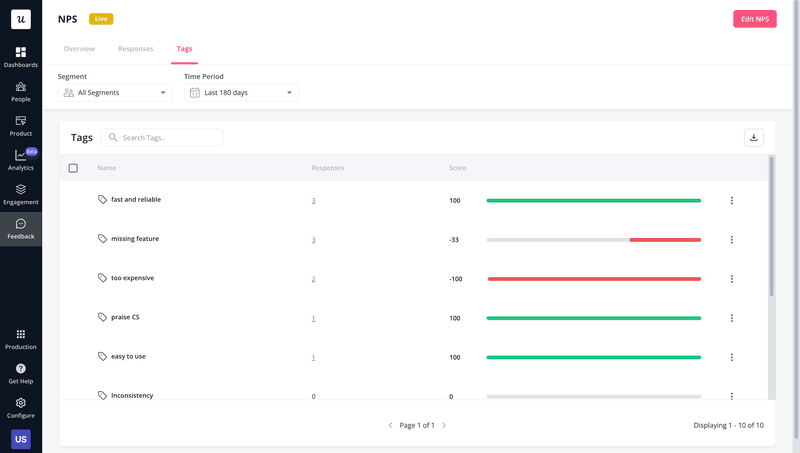

In the example of NPS scores, the qualitative responses written by users are paramount to interpreting their scalar ratings and validating the final Net Promoter Score for the business or product. Here’s an example of how Userpilot uses issue tagging to identify patterns in qualitative NPS survey responses:

Usability testing

Usability testing is a UX research method used to identify problems and areas for improvement while determining the overall “ease of use” for a product, platform, or service. There are a few different methods for conducting usability testing:

- Guerilla testing. Going to a public location and asking for feedback from strangers.

- Remote testing. Remote testing offers fast and cheap results (at the cost of validated accuracy).

- Lab testing. Lab testing helps you gather in-depth, reliable feedback from a small group of people.

- Five-second tests. Expose your product to a participant for five seconds to see what they noticed.

- First-click testing. First-click testing measures how easy it is for users to find their happy path.

- Card sorting. Print features/elements/content on cards then ask participants to categorize them.

- Session replays. Watching session replays will show you the journey taken and interactions made.

User interviews

One-on-one user interviews are the most in-depth form of research, but they’re also the most time-consuming approach a research project can take. Because of how much time (and sometimes money) these interviews take, it’s essential that you choose the right customers for these interviews.

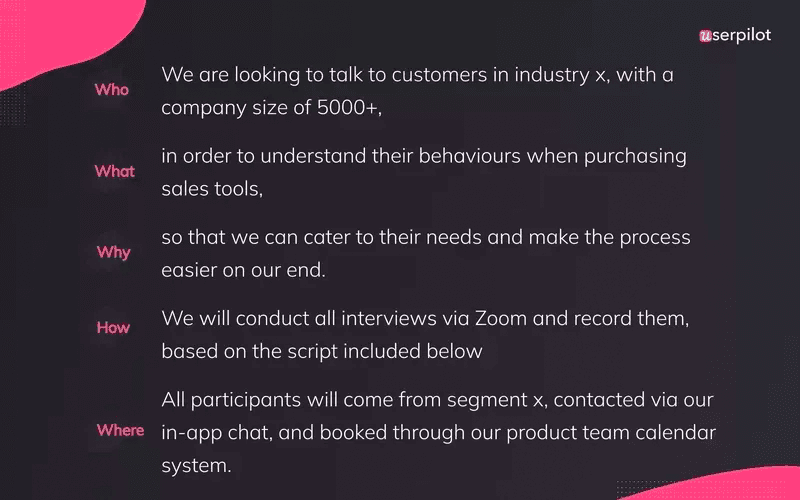

The questions you need to ask when trying to select subjects for user interviews will usually come in the form of who, what, why, how, and/or where. You can see examples for each of these question types in the graphic below to help you choose the right participants to interview.

Surveys

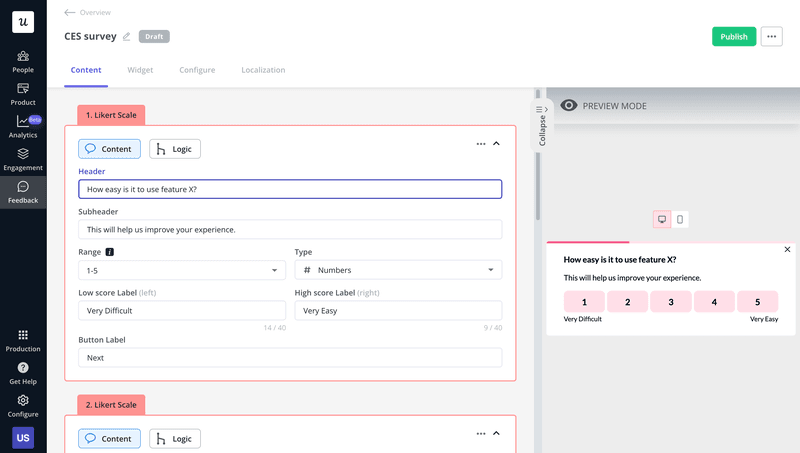

Surveys are a more scalable and cost-effective user research method that can reach more people in less time (especially with the help of automation software). For example, you can use in-app surveys to capture insights as the customer is actively using the product.

Here’s a look at Userpilot’s no-code survey builder:

Once you’ve decided how you’re going to deliver the surveys to your users, you’ll need to figure out which research questions to ask them. Good survey questions must be clear, concise, and appropriate — while observing all relevant research ethics.

Conversely, any vague, biased, or inappropriate survey questions should be avoided at all costs.

Focus groups

If you struggle to access research data through quantitative product metrics, then seeking out qualitative feedback in the real world may be your next best option. The main drawback of focus groups is how cost-prohibitive they are for early-stage companies — especially bootstrapped startups.

The average payout for focus groups is $75 to $150 per participant, according to data from Drive Research — but this may vary depending on country/region and session length. Still, most sessions will run you upwards of $5,000, and two sessions are usually the standard to get a representative sample.

Companies with a loyal customer base could consider recruiting existing customers into focus groups and offering to pay them with store/subscription credit instead of cash. This can offset some of the upfront costs of running focus groups.

Card sorting

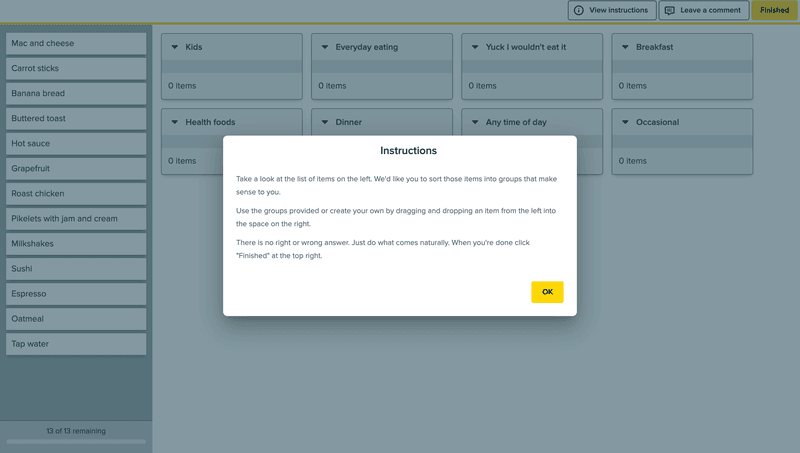

As alluded to earlier, card sorting is a testing format where you print concepts — usually features, elements, or content — onto physical cards, then ask your participants to group and categorize them based on their own preferences.

It’s okay to provide additional information about individual concepts when asked, but researchers should refrain from giving out any answers (or volunteering information) that would bias the participants towards/against sorting the cards in a certain way.

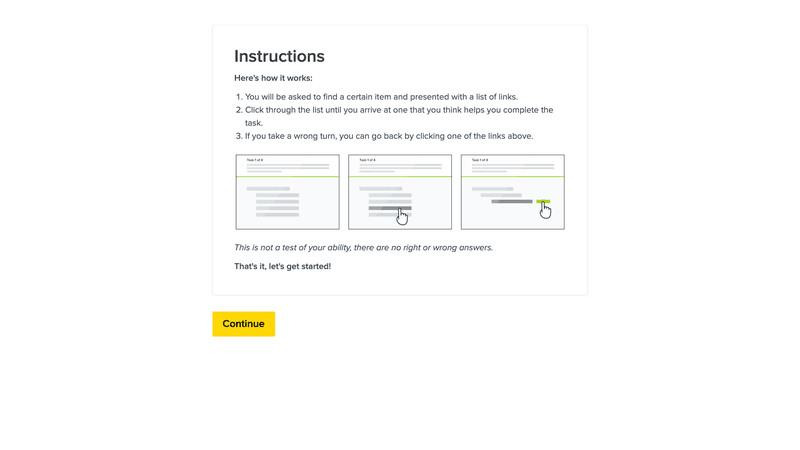

Here’s an example of how to provide clear instructions without influencing the participant’s card sorting:

Tree testing

Finally, we have tree testing which is a research method used by UX designers to evaluate how intuitive the website structure or product navigation is. These types of tests remove most content, graphics, and other clutter while only leaving navigational links.

This creates a wireframe-esque interface that serves as the sandbox environment for the test.

Researchers then ask participants to find specific items (such as features or pages) based on the visible structure and terminology alone. If participants struggle to navigate the website or product with the structure and links alone, then the UX research process indicates the need for tweaks to be made.

Tree testing is a type of UX architecture testing used to evaluate a proposed site structure by asking users to find items based on the website’s organization and terminology. This online test only displays the navigation links and removes any additional clutter.

Here’s an example of how to give tree testing instructions without providing any hints to participants:

Best tools for research operations

To ensure your research projects run smoothly and data analysis can be performed effectively, it’s important to have a research toolkit comprised of the tools that will be most helpful. We’ll show you three tools that are a must-have in any research team’s tech stack:

Userpilot for gathering research insights

Userpilot is a product growth platform that lets you gather data and also helps you with applying research insights through in-app guidance. Here’s an overview of how Userpilot can help you with gathering research insights:

- Event tracking. Userpilot tracks event data so you can track user behavior. You’ll be able to monitor various behavioral data types and see how users interact with your product during research experiments.

- In-app surveys. Userpilot lets you build in-app surveys that collect feedback, sort responses, and analyze customer sentiment — all without writing a single line code. This helps you survey your customers from within the product itself.

- A/B testing. A/B testing different variants of your product, feature, or interface will give you more UX data to work with. You’ll also be able to objectively identify the best versions that resonate with your user base most.

- Reporting. Userpilot’s advanced analytics supports multiple report types. These include user path analysis, funnel analysis, and trend reports that show you how your product success metrics are trending over time.

- Analytics. Userpilot also has other analytics dashboards built into the platform that show you other data like product usage, feature adoption, user engagement, and behavioral analytics. This helps you see the most important metrics at a glance.

Here’s a sneak peek at what Userpilot’s analytics dashboards look like:

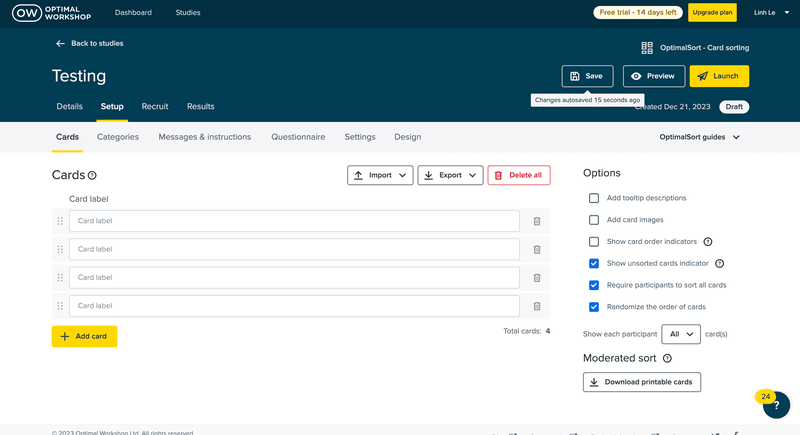

Optimal Workshop for conducting research

Optimal Workshop is a UX research platform that helps you set up and launch your research study. It includes features for card sorting, tree testing, and other efforts aimed at conducting user research in motion.

Here’s a look at Optimal Workshop’s card-sorting interface:

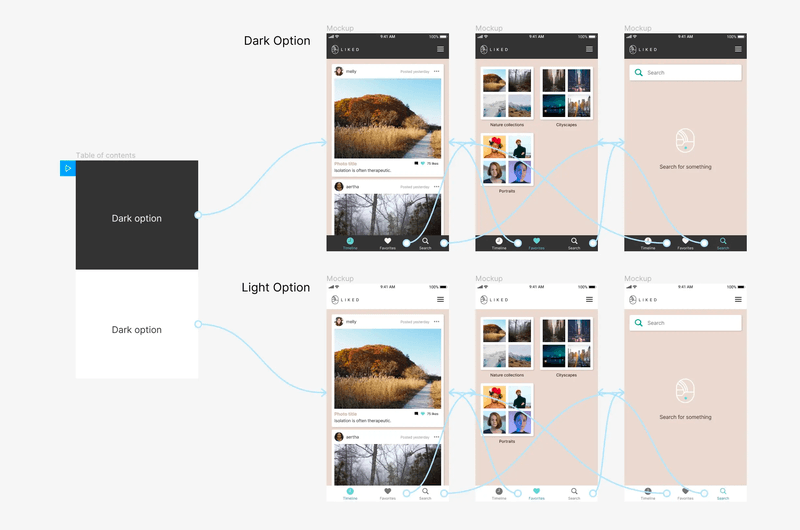

Figma for testing prototypes

Figma is a collaborative design tool that you can use to test prototypes with your team and show unfinished versions to study participants to get their feedback throughout the process. You could also use their collaborative whiteboard, FigJam, to brainstorm with focus groups or research team members.

This is what FigJam’s intuitive and minimalist interface looks like:

Conclusion

As you can see, research operations can support researchers in delivering the most actionable research findings. Regularly sharing insights gathered from research studies will help inform the business strategy based on the valuable insights accumulated in your data storage platform.

If you follow best user research practices, execute the processes needed to streamline workflows, and use the tools recommended in this guide, then you’re bound to scale research. If you’d like to combine scaling research with applying those insights, then it’s time to get your free Userpilot demo today!