How can you increase your subscription renewal rate to ensure your revenue keeps climbing?

In this article, we’ll cover:

- Why subscription renewal is important to prioritize in SaaS.

- The two different types of churn, and the most common causes for them.

- Strategies to increase your subscription renewal rate and drive product growth.

What is a subscription renewal?

A subscription renewal happens when a customer keeps their subscription for a product into the next billing cycle (they don’t cancel).

SaaS businesses typically run on a subscription service model – customers purchase a subscription to a plan that grants them access to the software. Customers are billed a recurring payment on a monthly or annual basis to continue using the software.

Why does subscription renewal matter for SaaS?

A higher renewal rate translates to higher lifetime value, MRR, and revenue.

It’s also cheaper to retain existing subscribers than acquire new ones, so prioritizing your subscription renewal rate should be top of mind for every company.

Types of subscription renewals

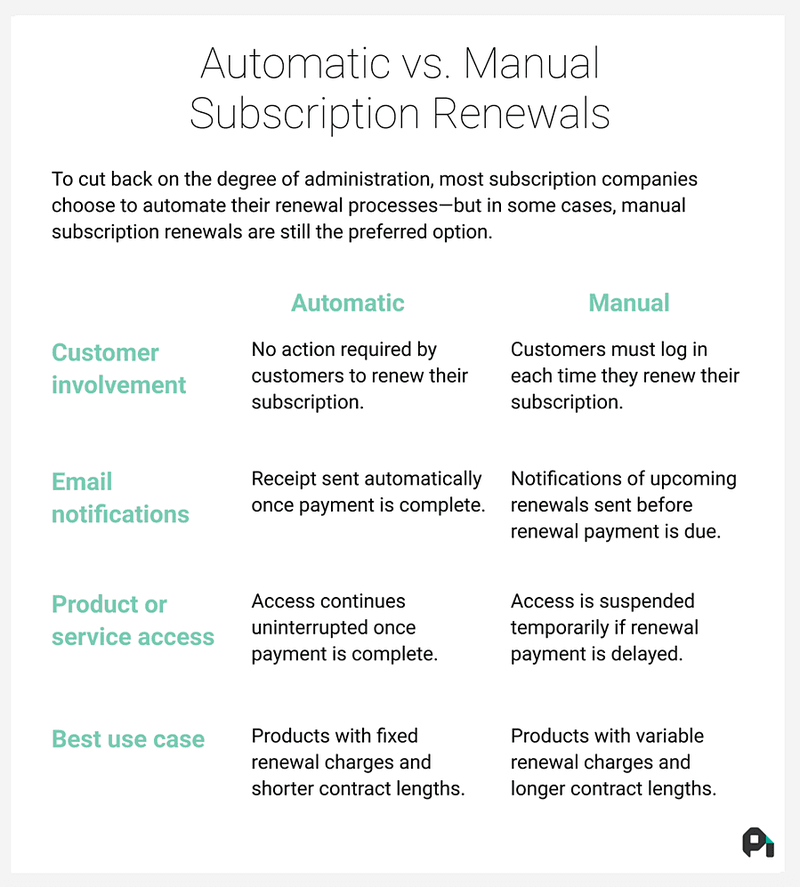

There are two main types of subscription renewals in SaaS: automatic renewals and manual renewals.

Automatic subscription renewal

With automatic renewals, the subscription renews without any customer action. A recurring payment is charged to the payment method on file automatically without customer input. To stop automatic renewals, customers must cancel their subscriptions.

Manual subscription renewal

With manual renewals, customers have to renew themselves by taking some sort of action by either confirming they want to renew or entering their payment method again. Automatic payments do not happen. If the customer doesn’t take action to renew, the subscription expires.

Notable causes of subscription renewal failures

Here are the top five reasons why a customer’s subscription renewal fails.

Voluntary churn

When a customer ends their subscription or downgrades on their terms, it’s called voluntary churn.

There are a few common reasons why customers choose to stop using a product or service.

For one, a bad onboarding experience can set their experience off on the wrong foot. They may decide to either cancel their plan or choose not to upgrade to a paid plan after testing out the free trial.

Another reason why customers voluntarily churn is that the product doesn’t help them achieve their goals. If they sought out your product as a solution to an issue they face or a goal they want to reach and your product didn’t deliver, they leave.

Missing features can also cause voluntary churn. If customers start a new subscription but realize that the features they’re seeking are unavailable, they’ll move on.

Three other factors that frustrate customers and cause them to leave are frequent bugs, bad UX/UI, and a sudden increase in pricing.

Involuntary churn

When a user’s subscription doesn’t renew because of a renewal payment failure, this is called involuntary churn. Failures most often happen because of expired cards, billing address errors, and insufficient funds.

Payment failure due to expired cards

Payment failure due to expired cards is almost inevitable for every long-term customer at some point. Customers add a card on file but after months or years of using your product, that card eventually reaches its expiration date.

This especially happens with yearly subscriptions. Chances are high that the card they first used will expire at some point during the year.

Customers forget their subscription is up for renewal

While this is mostly a non-issue for subscriptions that automatically renew, sometimes churn happens because customers forget to renew their plan in time.

For manual subscriptions, customers need to complete payment themselves when their plan expires. Sometimes they procrastinate and leave it until it’s too late or just plain forget, missing the subscription renewal date.

Hard declines due to stolen credit card information

Credit cards are reported stolen or lost all the time, automatically making the card inactive. Customers may forget to update the payment gateway with their new card details. When the subscription renewal date comes up and the card on file is charged, there’s a hard decline, so their account churns.

Dark patterns SaaS companies use in their billing

Dark patterns are sneaky UI tricks that some companies use in their billing process to cheat their way to subscription renewal. Here are a few common dark patterns to avoid.

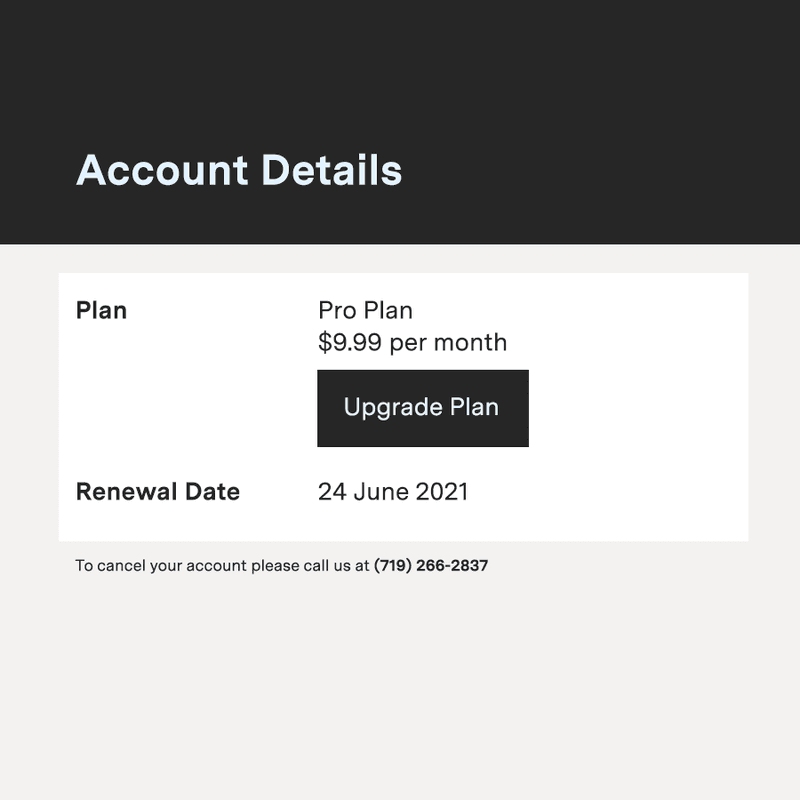

Making it difficult for customers to cancel

Some SaaS companies make it difficult to cancel on purpose. They do this by hiding cancellation buttons, or they make users call a customer service line to cancel.

While this may lead to some extra renewals by capitalizing on a customer’s impatience, it negatively affects customer satisfaction. Those customers will cancel at some point anyway, but they’ll now leave with a bad impression.

Not notifying users when the free trial converts to paid

Another dark pattern that’s often used is not notifying people first before their free trial is automatically upgraded to a paid plan. For trials that require payment information up-front, plans are usually automatically upgraded after the trial period’s over.

It’s common courtesy to send a notification email and in-app message to let customers know before the subscription period starts to give them the chance to back out.

Auto-renewing monthly subscriptions without the user’s consent

Make sure it’s clear to users whether monthly subscriptions will be renewed automatically or not. A renewal payment should never be a surprise.

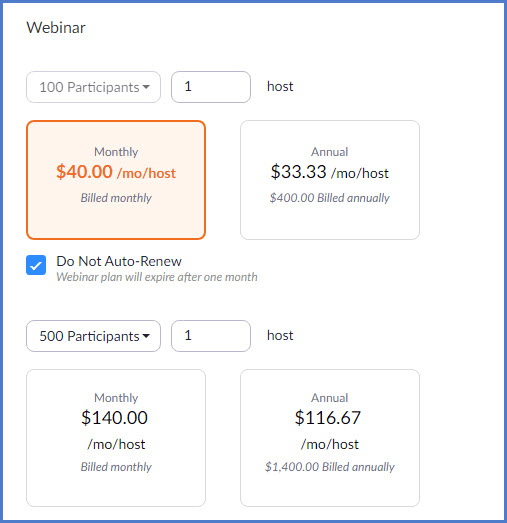

Here’s a good example from Zoom where they give users the option to opt out of auto-renewals by checking a box during sign-up.

Ways to reduce voluntary churn and boost subscription renewal rate

Decrease your voluntary churn rate by boosting subscription renewals with these three strategies.

Provide continuous in-app guidance and drive repeated value for users

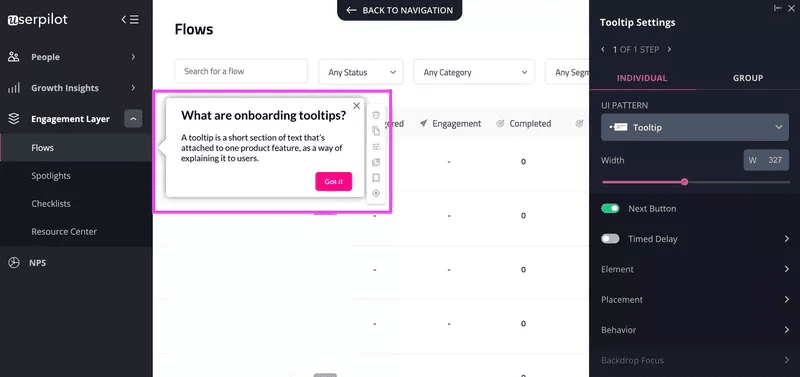

Educate users with contextual in-app guidance in different forms, such as interactive walkthroughs, tooltips, and hotspots. This will help them maximize product usage and achieve their goals faster.

To do this, monitor in-app user behavior and trigger a helpful flow whenever a user gets stuck or seems ready to step it up.

For example, help active customers discover advanced features by triggering tooltips to show them around.

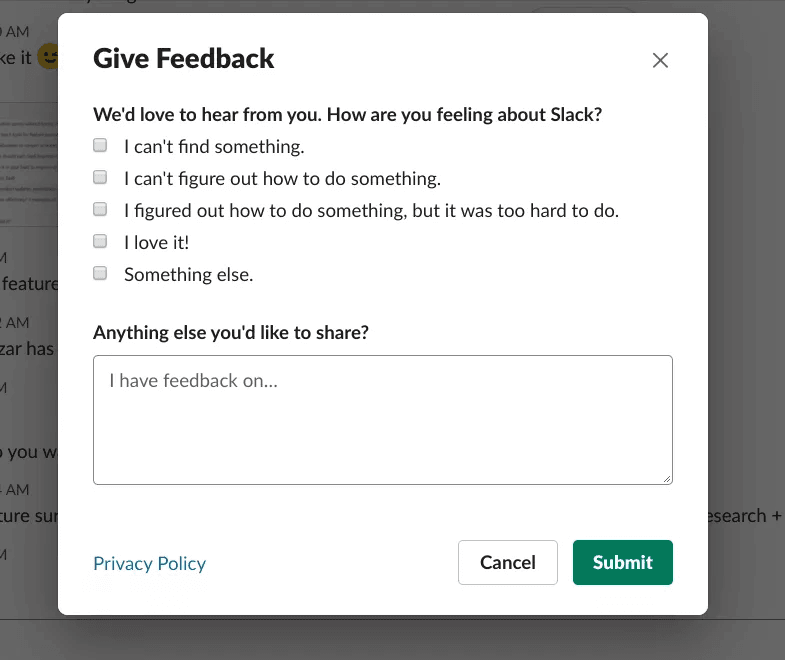

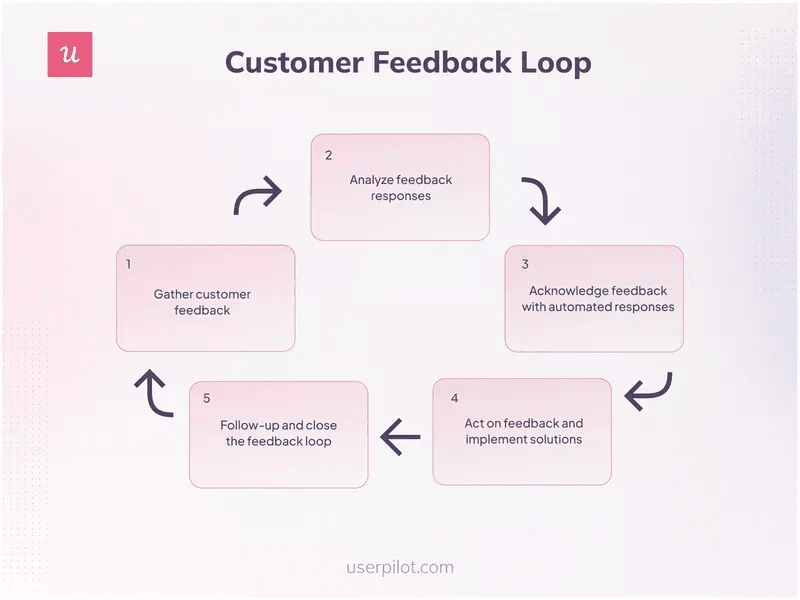

Routinely collect customer feedback and act on it

Improve your product and the user experience by listening to customer feedback.

To collect feedback at scale, use in-app surveys with quantitative and qualitative questions.

Analyze the feedback and then act on the highest-priority issues. To close the feedback loop, reach out to those who gave you negative but helpful feedback, and either let them know that you added the requested features, fixed the bugs, or offer them 1-on-1 help.

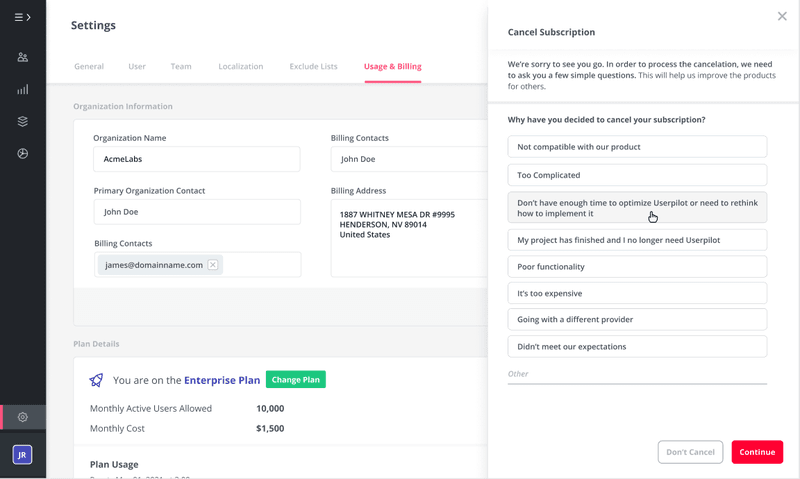

Offer alternatives to churning with offboarding flows

Offboarding flows not only help you understand why users churn, but also give you the chance to retain them with enticing alternatives. Use a multi-choice survey with predefined answers to understand the primary reason for their cancellation request.

Then, offer personalized alternatives based on their reason. For example, if they don’t have the budget to pay for their subscription at the moment, you could offer them a discounted rate for a few months.

How to reduce involuntary churn and prevent payment failures

Involuntary churn is reversible or preventable if you take these steps to prevent payment failures.

Use in-app pre-dunning messages

Notify customers either before a credit card expires or simply to remind them of an upcoming subscription renewal.

This can be limited to upcoming renewals for yearly subscriptions since it might be annoying to your monthly subscribers to get those emails every single month.

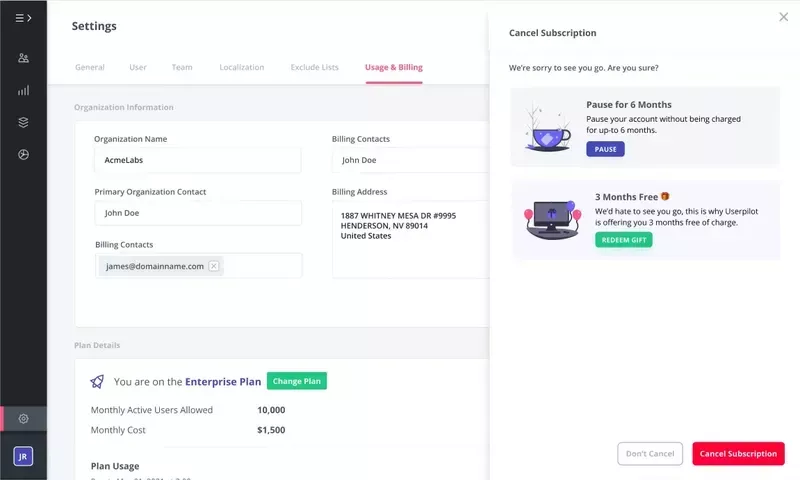

Send payment reminders via email

Payment reminders should be sent both by email and with in-app messages to ensure your customers actually see them.

Check out this payment reminder from Booking. They send a reminder for an upcoming stay and they prompt you to verify the payment method so you don’t lose the booking.

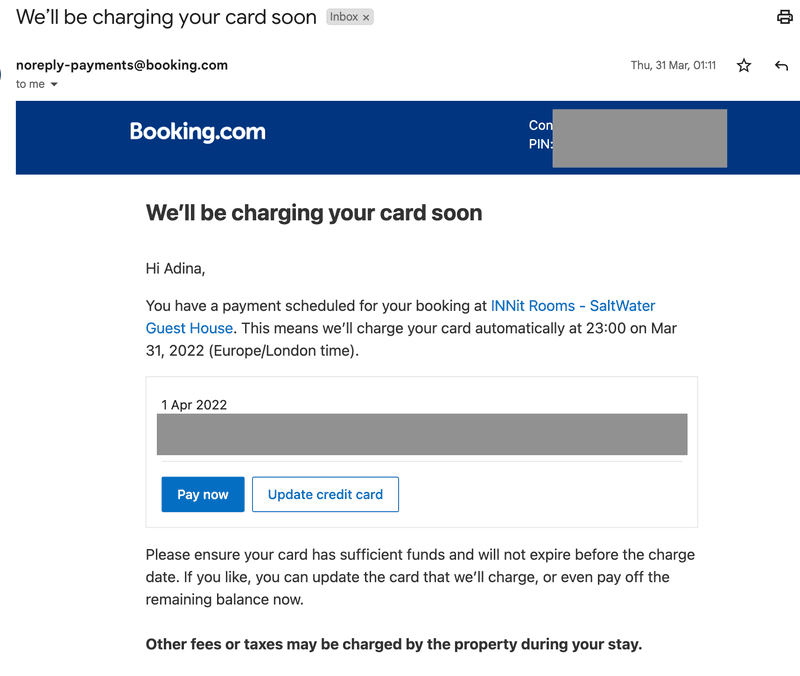

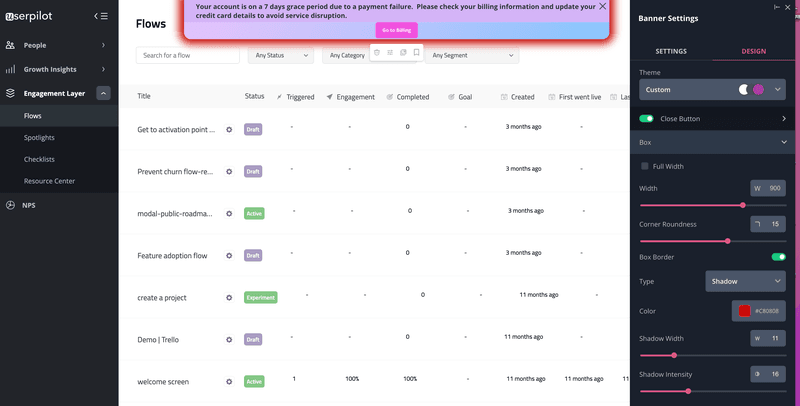

Offer grace periods and give users a chance to fix payment failures

Offer grace periods by letting users still use the app for a limited time, but keep reminding them that something went wrong with their payment method.

That way, users won’t get frustrated, especially if payment is out of their hands. Sometimes the end user isn’t the same person handling the billing. They may not have access to the company card, so they need time to let the responsible person know to update the payment method.

But, if you cut them off right away, you’ll interrupt their workflow – just for a soft payment failure that will be fixed shortly. That impacts customer satisfaction.

Here’s an example from Storychief – they don’t restrict app access when the payment fails, but they limit its functionality so you’re motivated to fix the issue quickly.

That being said, you should consider adding a grace period where you don’t restrict the app functionality to avoid workflow disruptions. Pausing product usage is the last resort since that has long-term effects.

Instead, add an always-on banner to your product dashboard reminding the customer to fix their payment with a button that leads to the billing page.

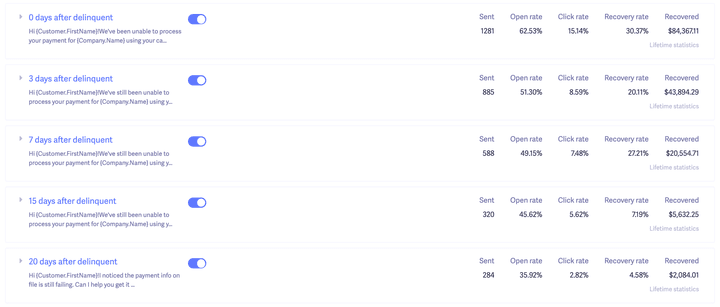

Send post-dunning emails and give users the last chance

Give customers a chance to rectify the issue with post-dunning emails.

These emails notify the customer multiple times about their payment failure, but they don’t cut off access to their subscription.

Here’s an example from Baremetrics, where they send post-dunning emails up to 20 days after a payment failure.

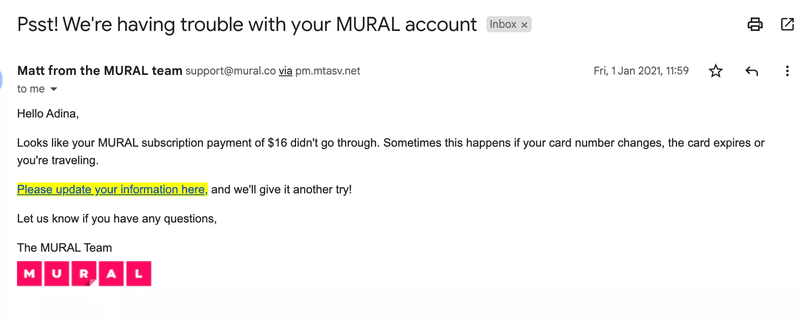

And here’s an example of a post-dunning email from MURAL that uses a friendly tone with a direct link to update billing information.

Conclusion

Subscription renewals are the lifeline to your monthly recurring revenue.

Since it’s cheaper to retain an existing customer instead of trying to acquire a new one, optimizing your subscription renewal rate by building better product experiences and reducing voluntary churn will have a big impact on profitability.

In the meantime, don’t forget about involuntary churn. Develop a solid communication strategy and use in-app messaging tactics to keep your customers informed on their payment status and make sure payment failures don’t occur.

Want to build product experiences and send-in app messages code-free? Book a demo call with our team and we will help you to get started.