Are you trying to benchmark your business’s average customer acquisition cost against your industry?

Customer acquisition cost (CAC) helps you understand how much it really costs to win a new customer. Comparing your CAC to industry averages shows whether your growth model is efficient, sustainable, or at risk.

In this guide, we break down average customer acquisition cost benchmarks by industry, explain how to interpret them correctly, and show practical ways to improve your CAC without sacrificing growth.

Average customer acquisition cost summary

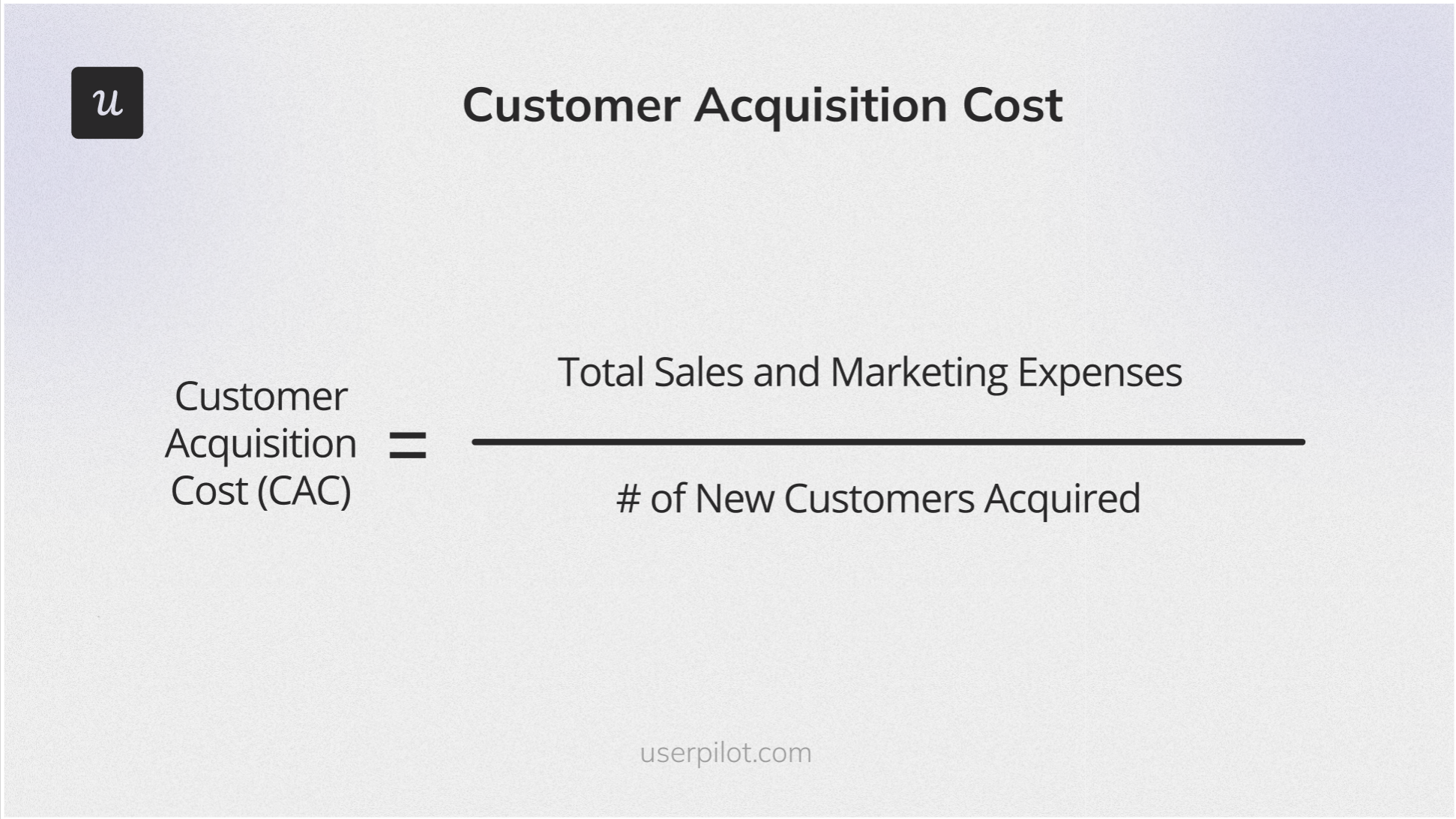

- Customer acquisition cost (CAC) measures the total sales and marketing expenses for acquiring new customers.

- You can calculate CAC by dividing total expenses by the number of new customers acquired in a specific period.

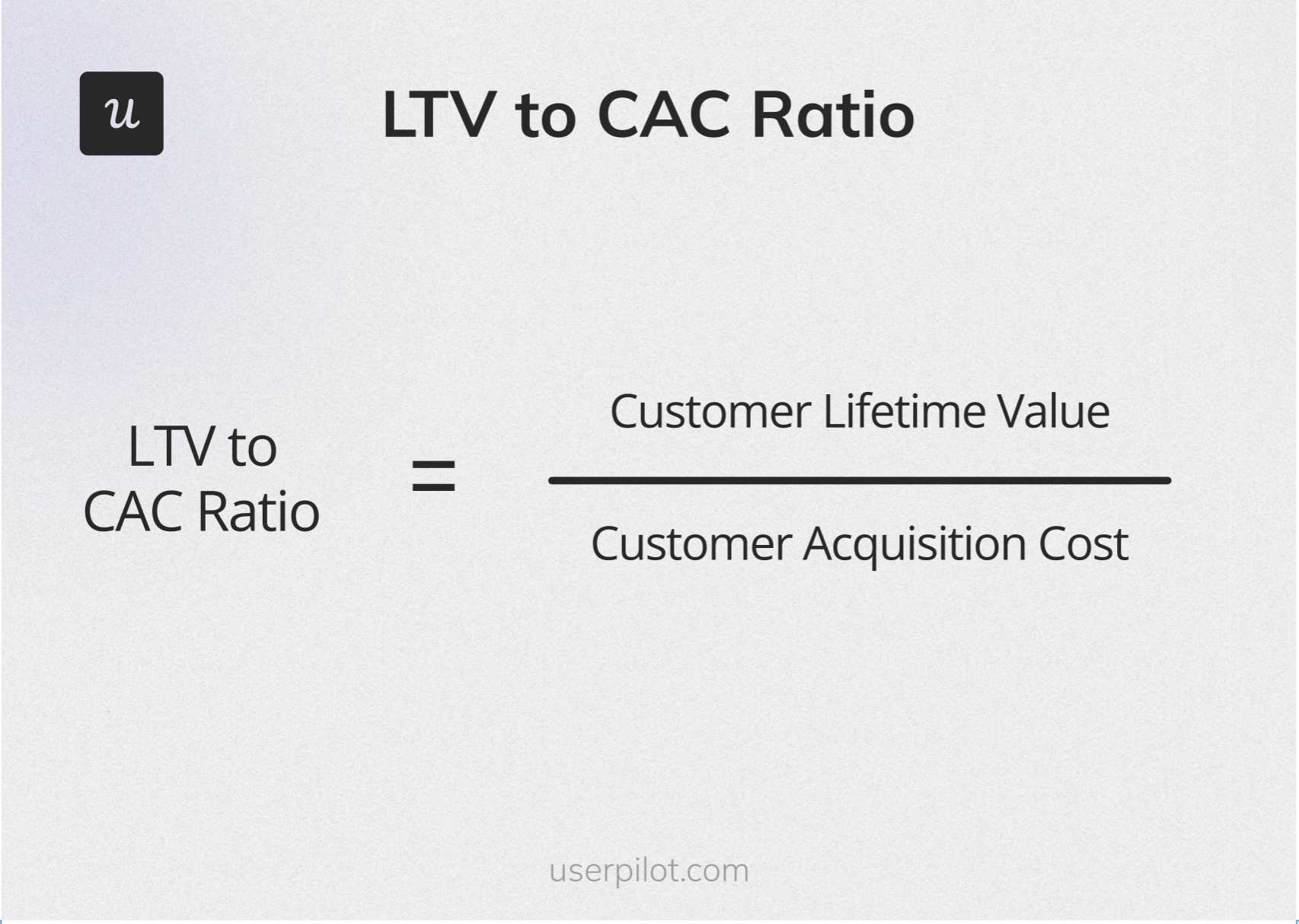

- A good CAC is significantly lower than customer lifetime value (LTV) – around a 3:1 or 4:1 LTV: CAC ratio.

- The average CAC varies across industries. For example:

- SaaS Industry: $702

- B2B companies: $536

- eCommerce businesses: $70

- To evaluate and improve CAC effectively, teams should:

- Compare CAC against industry benchmarks and business model norms

- Assess CAC relative to customer lifetime value (LTV)

- Identify which acquisition channels and segments drive the highest-quality customers

- Use product-led tactics to improve activation and retention, reducing reliance on paid acquisition

What is customer acquisition cost (CAC)?

Customer acquisition cost (CAC) is a crucial metric that reflects how much a business spends on marketing and sales to acquire a new customer.

CAC is most useful when viewed in context. On its own, the number says little. When compared against customer lifetime value (LTV), payback period, and industry benchmarks, CAC becomes a powerful indicator of growth efficiency.

To determine whether your acquisition costs are sustainable, it’s often helpful to compare CAC with customer lifetime value (LTV), which shows how much revenue a customer generates over time. This enables more informed decision-making around growth and profitability.

How to calculate customer acquisition cost?

You can calculate customer acquisition cost by following these steps:

- Choose a specific time period. Depending on your business cycle, it could be a month, quarter, or year.

- Calculate the total cost of acquisition. This consists of the sales and marketing costs, including ad spend, promotions, etc, you incurred in the specific period.

- Determine the total number of new customers acquired during the particular time period.

- Divide the total expenses you calculated by the number of new customers you acquired in the same period.

For example, your SaaS company spent $10,000 on marketing and sales efforts during July. During the same period, it also successfully acquired 100 new customers. The customer acquisition cost is then ($10,000 / 100) or $100.

What is a good customer acquisition cost?

A “good” customer acquisition cost (CAC) depends on your industry, business model, and how much value a customer generates over time. Evaluating CAC in isolation can be misleading, as average acquisition costs vary widely across industries and go-to-market motions.

To assess whether your CAC is healthy, you need to compare it against customer lifetime value (LTV). While CAC represents how much you spend to acquire a customer, LTV measures the total revenue that customer is expected to generate throughout their relationship with your business.

As a general benchmark, most sustainable businesses aim for an LTV to CAC ratio of 3:1 or 4:1. This means that for every dollar spent on acquisition, the customer should generate three to four dollars in revenue over their lifetime. Ratios below 1:1 indicate an unprofitable acquisition model, while significantly higher ratios may signal underinvestment in growth.

You can calculate your LTV: CAC ratio by dividing customer lifetime value by customer acquisition cost. Tracking this ratio alongside industry benchmarks helps you understand whether your acquisition efforts are efficient, scalable, and financially sustainable.

Average customer acquisition costs by industry

We’ll now go through the average acquisition costs by industry customer acquisition cost.

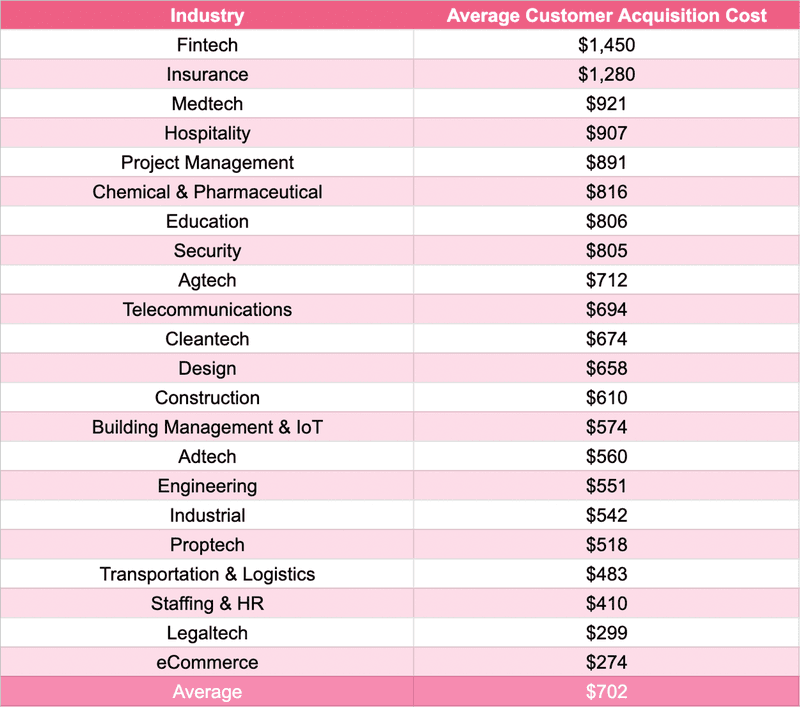

Average customer acquisition cost for SaaS

The average customer acquisition cost within the SaaS industry varies greatly across different business sectors.

According to First Page Sage,

- The average customer acquisition cost companies incur in the SaaS industry is $702.

- The highest customer acquisition cost is in the fintech industry, where businesses incur an average of $1,450 to acquire a new customer.

- In contrast, the eCommerce industry has the lowest customer acquisition cost, with an average of $274 to acquire a new customer.

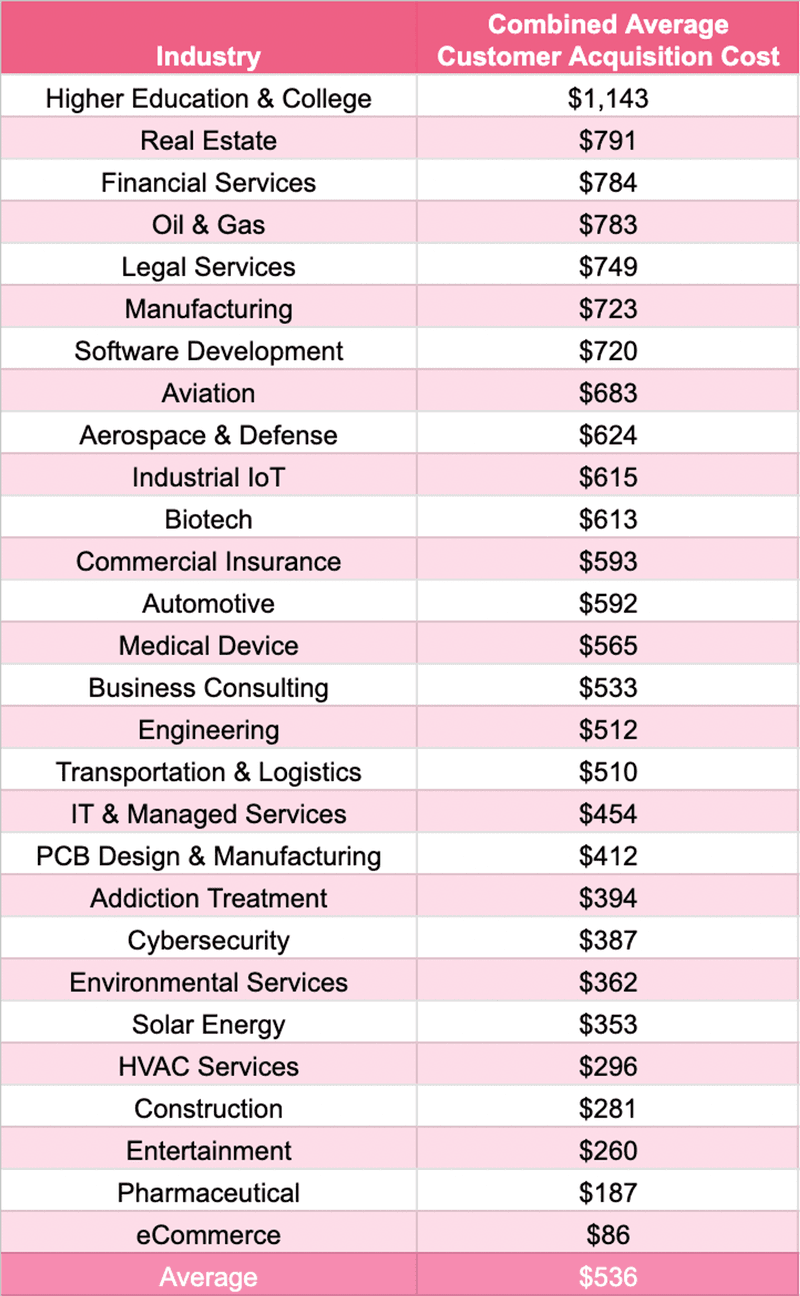

Average customer acquisition cost for B2B companies

The average customer acquisition cost for B2B companies is a combination of both organic and paid acquisition costs.

As per First Page Sage,

- Among the B2B companies, the average customer acquisition cost is $536.

- The highest customer acquisition cost is in the higher education and college B2B companies, with an average of $1,143 per new customer acquired.

- The eCommerce B2B has the lowest customer acquisition cost, with an average of $274 to acquire a new customer.

Here are the most B2B companies’ average customer acquisition costs.

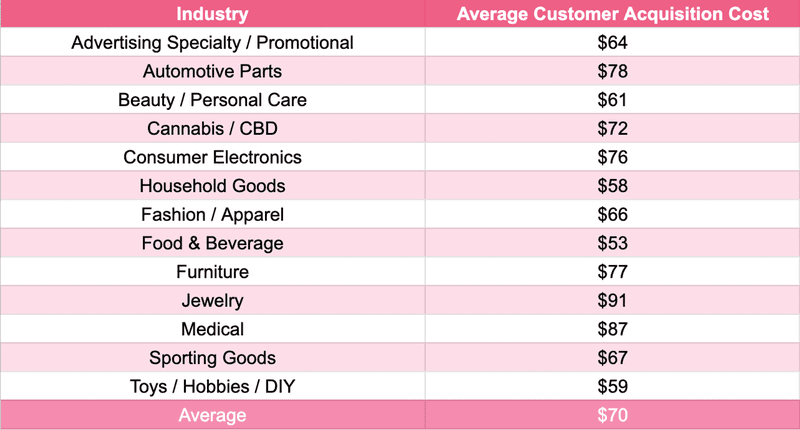

Average customer acquisition cost for e-commerce businesses

The average customer acquisition cost for various e-commerce businesses is also different because of the diversity of their industries.

According to First Page Sage,

- Among e-commerce businesses, the average customer acquisition cost stands at $70.

- The highest customer acquisition cost is in the jewelry e-commerce businesses, with an average of $1,143 per acquisition.

- On the other hand, the food and beverage industry has the lowest customer acquisition cost, where it incurs an average of $53 to acquire a new customer.

The full list of e-commerce businesses’ average customer acquisition costs is as follows.

How to improve CAC efficiency without increasing acquisition spend

Let’s go through how you can improve your customer acquisition efforts.

Analyze and optimize the performance of marketing channels

Analyzing and optimizing the performance of marketing channels is critical if you’re looking to improve your customer acquisition costs. By determining which marketing channels yield the best results, you can strategically allocate your resources and maximize the return on investment.

You can leverage analytical tools to track key metrics like conversion rates, click-through rates, cost per click (CPC), and cost per acquisition (CPA) for each marketing channel. These metrics provide valuable insights into the effectiveness of each marketing channel in acquiring new customers.

Then, you should analyze these metrics to identify your high-performing acquisition channels. You should make your marketing strategy by investing more resources in optimizing these successful channels’ performances.

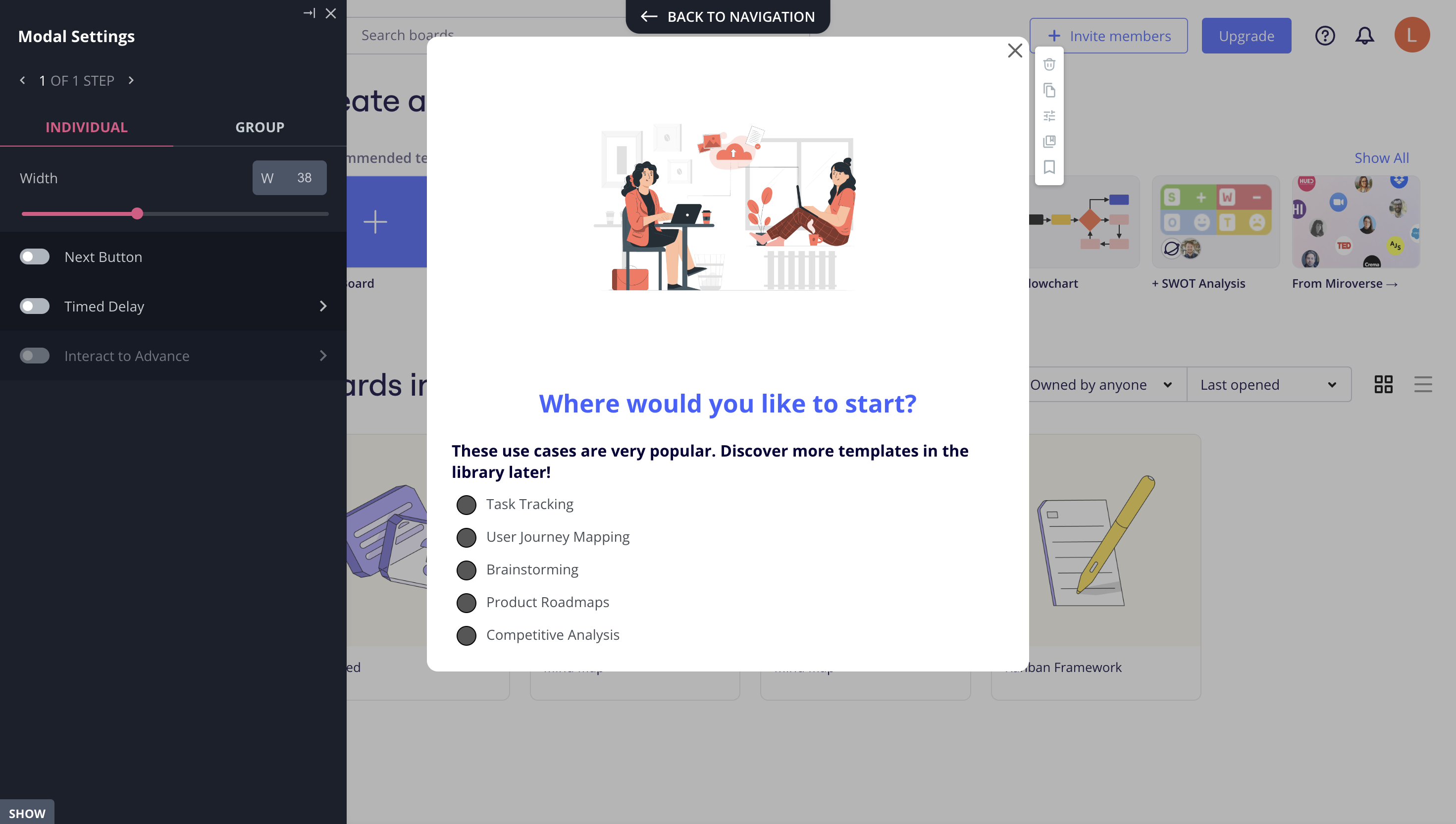

Offer a personalized onboarding experience

You can personalize experiences during the onboarding process to meet potential customers’ preferences and needs. It creates a lasting impression on the users and increases the likelihood of conversion into paying customers.

Customers who get a personalized onboarding experience are more likely to find value and engage with the product or service. As a result, they are more inclined to stick with using your product or service and less likely to churn. This increased user retention directly translates to a higher chance of conversion and lowers CAC, as there is no need for additional costly acquisition efforts.

In the SaaS industry, it’s a common practice to use welcome surveys to collect user persona data and then tailor onboarding flows according to their needs.

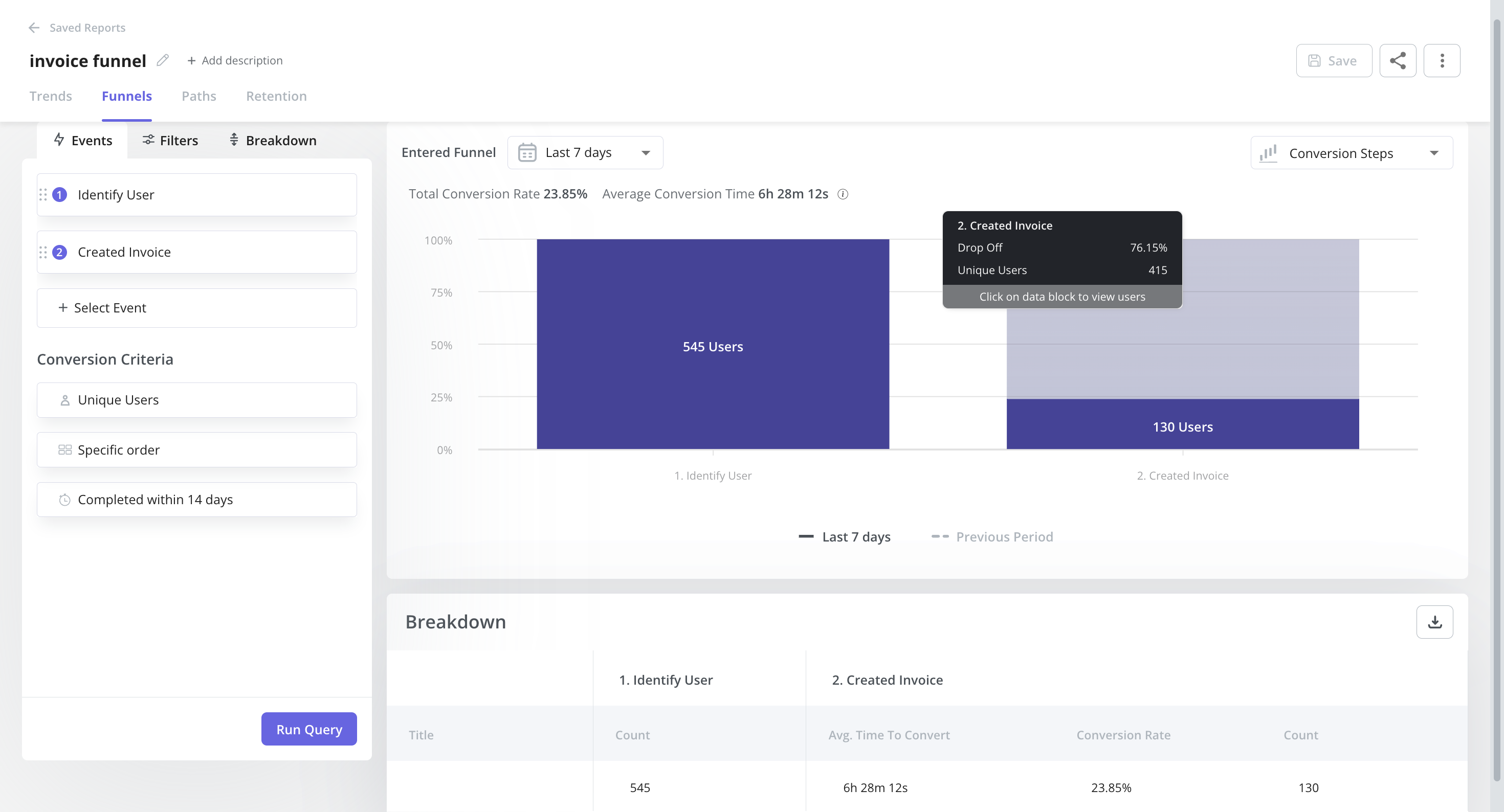

Optimize conversion funnels to increase conversion rate

An optimized conversion funnel significantly increases the conversion rate, creates more qualified leads, and reduces the CAC. For it, you should first outline the key steps from the initial interaction to the final conversion in your conversion funnel.

Then, you need to meticulously analyze the conversion funnels to pinpoint the areas requiring improvement. It enables you to identify any user friction or conversion leakage hindering the smooth progression of potential customers through the funnel.

You should then take proactive action to eliminate these friction points and eventually improve the conversion rate.

Go product-led growth to maximize customer lifetime value

A product-led growth strategy emphasizes a self-service model that allows users to explore, try, and experience the product before purchasing it.

Letting potential customers become familiar with the product’s value firsthand reduces the need for costly sales and marketing efforts.

The key to success with a product-led growth strategy lies in engaging users effectively within the product itself. You need to implement the right in-app engagement tactics to guide users toward the paid plans. It lowers your acquisition cost and ensures more user retention with increased customer lifetime value.

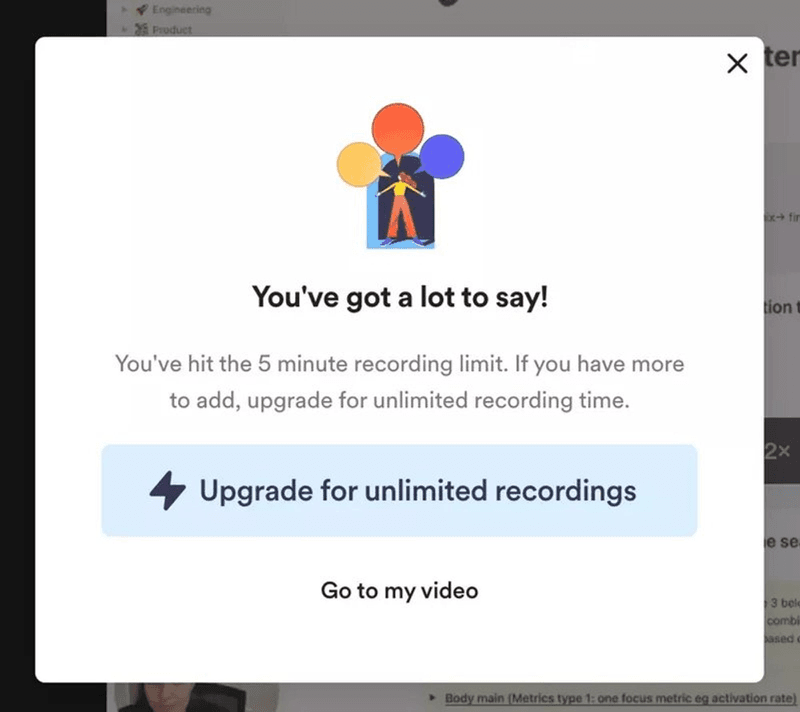

For example, you can set limits for feature usage and trigger upgrade messages when users reach limits. It helps the users realize the product’s full potential and pushes them to upgrade. Loom triggers upgrade messages when users reach certain feature usage limits and prompt users to take action.

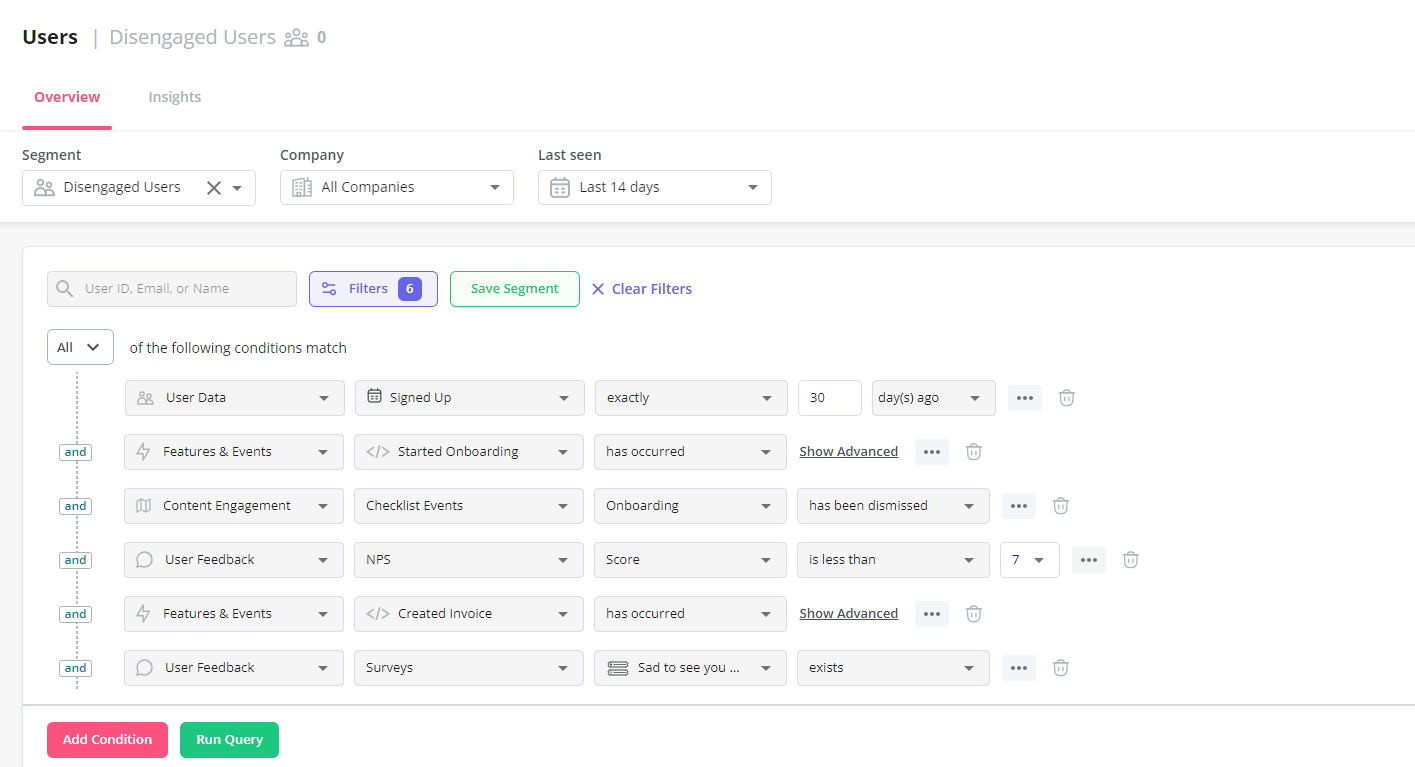

Segment customers for targeted marketing efforts

Customer segmentation is a powerful strategy to curate targeted marketing efforts to satisfy more customers. You can use it to deliver personalized experiences and offerings to potential customers and easily convert them.

For customer segmentation, you should utilize data-driven insights about your potential customers. After identifying the ideal customer profiles, you should target and segment those potential customers more likely to convert.

In the case of SaaS companies, segmenting customers based on in-app activities is highly effective. It enables the companies to understand customers better and create marketing campaigns that cater to the segment’s needs.

Companies can then trigger in-app marketing messages to encourage potential customers to take specific actions that lead to conversion. As a result, the overall cost to acquire new customers decreases since the companies have more customers acquired.

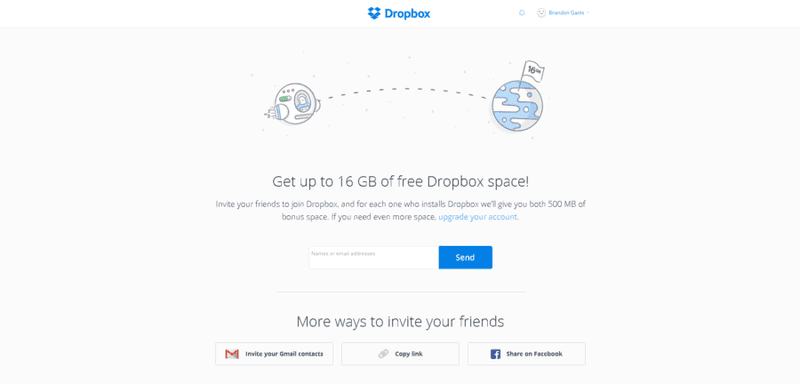

Implement referral programs to acquire new customers

Offering incentives or rewards to customers who refer new users helps you tap into your existing customer base as a valuable source of new leads. Referrals from satisfied customers also carry higher trust and credibility to ensure a better conversion rate.

Referral programs let satisfied customers advocate for the product or service through word-of-mouth marketing. Customers with positive experiences and incentives to refer others become your natural brand ambassadors.

This organic advocacy not only lowers CAC by reducing the need for costly marketing efforts but also fosters a strong sense of loyalty among customers. As a result, you acquire new customers at a reduced cost while creating a better possibility of customer retention from the beginning.

Conclusion

Understanding and optimizing your average customer acquisition cost is essential for building sustainable growth. Benchmarking CAC against industry standards helps you assess whether your acquisition efforts are efficient, and where they may be leaking value.

But benchmarks alone aren’t enough. Once you know where you stand, the real impact comes from improving the underlying drivers of CAC: conversion rates, activation, retention, and customer lifetime value. Reducing friction in onboarding, focusing on high-performing channels, and adopting a product-led approach all contribute to stronger LTV:CAC ratios without relying solely on higher spend.

If you want to go deeper into improving acquisition efficiency, the next step is connecting CAC benchmarks with a clear, product-led acquisition strategy.

Want to see how this works in practice? Book a Userpilot demo to learn how personalized onboarding, in-app engagement, and product analytics can help you lower CAC while driving long-term growth.