![5 Types of B2B Customer Insights for SaaS and How to Collect Them [+Best Tools] cover](https://blog-static.userpilot.com/blog/wp-content/uploads/2023/04/5-types-of-b2b-customer-insights-for-saas-and-how-to-collect-them_45e6489d2ac604c4c87c5b9cfc79cbd5_2000-450x295.png)

What are the different types of B2B customer insights for SaaS businesses?

When your product is catering to other businesses, it can be difficult for sales reps and other teams to understand the needs and experiences of the clients, especially if the client company sells multiple products.

However, customer insights can help your teams understand all aspects of your B2B partners. This post will take you through the 5 types of B2B insights, discuss the methods of collecting them, and show you the best tools for analyzing customer sentiment.

Summary of B2B customer insights

- B2B customer insights are the knowledge and information gained by companies that focus on businesses as individual customers.

- Collect market research insights from industry reports, census data, Google trends, user persona canvas and surveys, social listening, discovery interviews, and customer reviews.

- Get early product feedback via alpha testing, beta testing, minimum viable product, closed focus groups, Product Hunt launch, PMF surveys, and early product reviews.

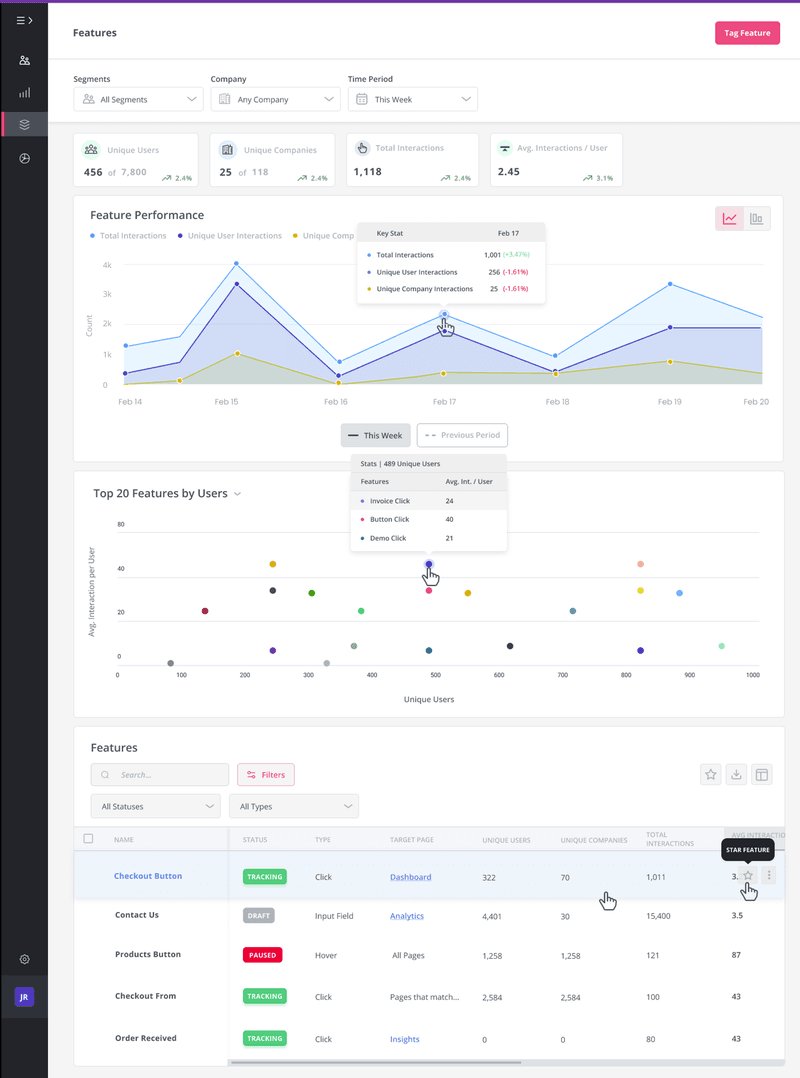

- Use session recordings, click tracking, feature usage, customer journey interactions, eye tracking, and cohort analysis to understand user behavior.

- Send voice-of-the-customer surveys like CSAT, CES, NPS, and feature surveys to collect and analyze customer feedback.

- Use customer journey maps, application integrations, customer analytics, and CRM tools to collect cross-department insights.

What are B2B customer insights?

B2B customer insights refer to the knowledge and information companies have about their customers in the context of other businesses. These companies can leverage the insights to drive value for themselves and their customer’s business.

For SaaS, these B2B insights can encompass data such as:

- Businesses that are most likely to use your software.

- Their challenges and pain points.

- Their overall satisfaction level with your product.

- The most critical features and functionalities of the product.

B2B customer insights vs B2C customer insights

B2B insights focus on businesses as customers, while B2C insights focus on individuals as customers.

B2B and B2C clients also differ in terms of their customer base, data sources, sales cycles, and marketing approaches.

For example, B2B sales cycles are typically longer and more complex, often involving multiple decision-makers, while B2C sales cycles are shorter and more transactional.

What are the different types of B2B customer insights?

There are 5 types of B2B customer insights:

- market research insights

- early product feedback

- in-app customer behavior

- voice-of-customer insights

- cross-department insights.

Market research insights

Market research insights can help you understand customer segments, market size, and growth, as well as preferences. These insights can inform product development, pricing strategy, and marketing decisions.How to collect market research insights?

1. Market Research Reports, Industry Reports, and Census Data

You will find some reputable sources that provide existing reports on potential target markets. Demographic research data help you create and understand different customer profiles.

Data sources like Statista, Pew Research Center, Census Bureau, or Office for National Statistics give you more general demographic data (even though it’s more applicable for B2C customer insights).

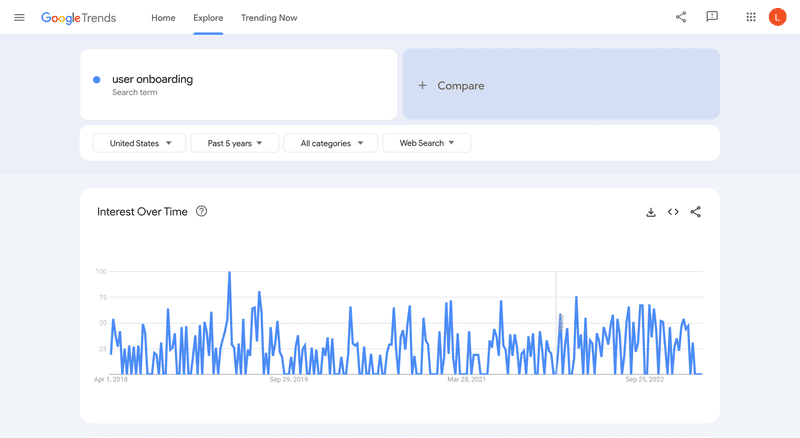

2. Google Trends & Search Volume Data

Use Google Trends to track the popularity of specific keywords over time. This will reveal new and emerging trends in your industry.

In addition, you should monitor competitor popularity by looking at the keyword search volume data.

Keywords with higher search volumes indicate greater popularity and customer interest.

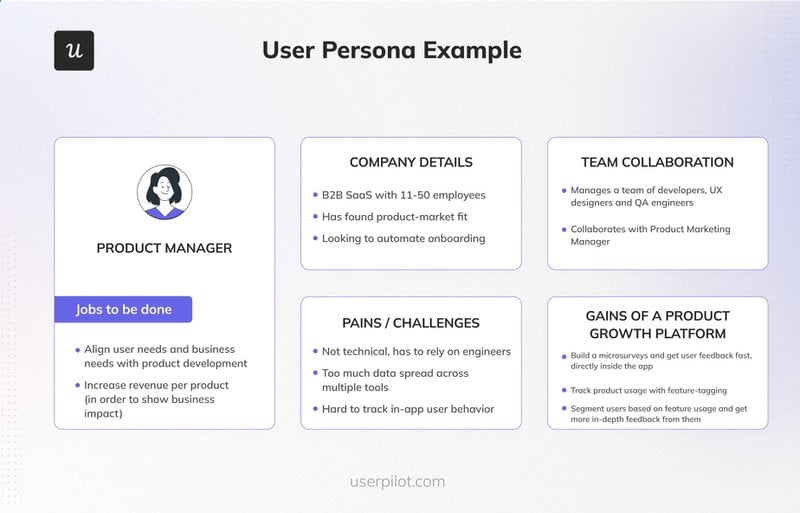

3. User Persona Canvas

The user persona canvas is a document that represents your customers’ goals, problems, desires, emotions, jobs to be done, etc.

For B2B customers, create buyer personas that are targeted to the key stakeholders who make purchase decisions. These stakeholders could be C-suite or other senior executives of the organization.

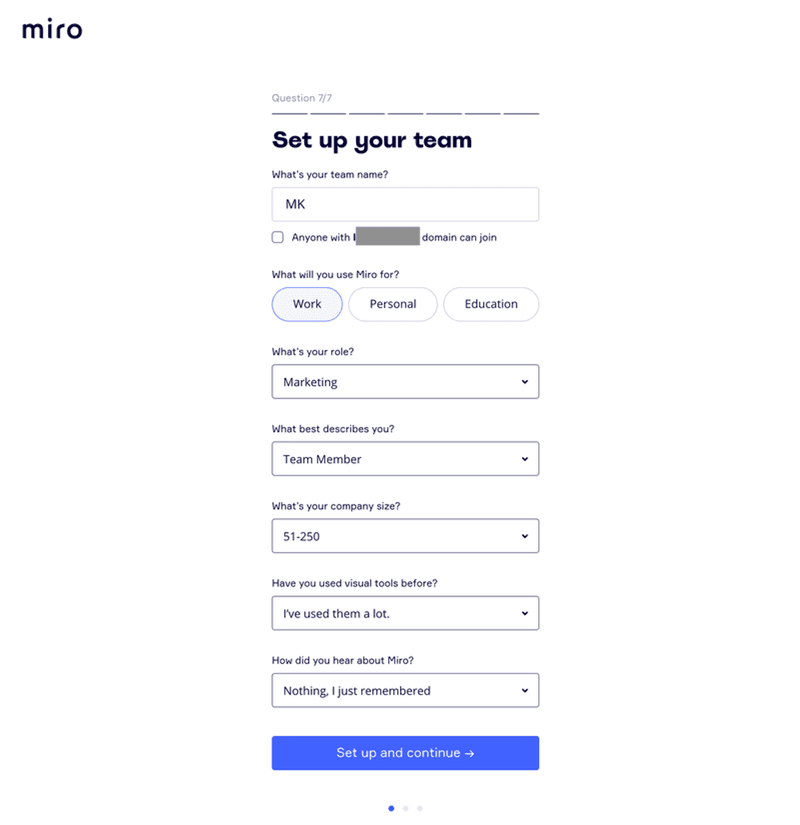

4. User Persona Survey

Trigger user persona surveys in-app to make it convenient for customers to answer and maximize response rates.

Welcome screens and sign-up flows help you collect data like company name, roles, goals, jobs to be done, etc.

5. Social Listening

Social listening involves analyzing customer interactions on social media to make data-driven decisions.

By tracking tagged and untagged brand mentions, you can assess brand health and understand audience sentiment toward competitors.

Trending content and user sentiment analysis can provide valuable insights into your target market.

6. Discovery Interviews

Organize discovery interviews to get to know your potential customers even more deeply.

Ask questions that will lead to concrete facts about customers’ lives and their worldviews. Try to get specific examples from the past. For example, you can ask when they encountered a specific problem, what it was, how they solved it, and what alternatives they looked into.

Furthermore, you should avoid collecting bad data like compliments, fluffy promises, and generic claims. Don’t fish for compliments by going into the details of your product. Divert the conversation to the main point when people start using generic terms like ‘always’ or ‘never’.

7. Competitor reviews

Watch out for reviews on software review sites like Capterra and G2. You will not only see reviews on your product but also find customers’ opinions on rival companies. This will help you identify competitors’ strengths and weaknesses and strategize accordingly.

Early product feedback

Get data and early product feedback based on soft product releases or minimum viable product (MVP). They act as planned ‘rehearsals’ before a full launch so that you can update your product features and achieve product-market fit.

How to collect early product feedback?

1. Run an Alpha Test internally

Alpha tests come at an earlier stage of the product life cycle than beta tests. They are commonly designed for employees instead of end users to get internal feedback.

However, the alpha versions of your product are usually less stable and carry more bugs because they aren’t consumer-ready.

But once your minimum marketable product (MMP) is stable enough, you can launch a less-controlled beta testing phase.

2. Run a Beta Test

Beta testing gives you honest feedback from a subset of end users. It offers real-world customer insight into product design, improvements, bugs, and the latest features.

3. Closed focus groups

Select a mix of ideal customers that are representative of your target market to hold focus group discussions.

Such discussions enable customers to share their opinions and experiences with your product’s beta version and competing products. The insights will help you maximize your product’s value offering.

4. Pre-orders of Minimum Marketable Product

While the MVP version has enough features to attract early adopters, the MMP functionalities are based on feedback from the MVP.

At this stage, the features are enough to distinguish you from competitors through value creation.

In addition, the minimum marketable product places more emphasis on the customer experience. MMP pre-orders allow you to target a subset of customers and assess their interactions with your product, including customer service and sales processes.

5. Product Hunt Launch

Launch your product on Product Hunt, a community-driven platform that displays products to a tech-savvy audience.

With more than 5 million visitors every month, Product Hunt is free for product managers to access one of the most trusted sources of feedback and reviews.

The platform helps you create a buzz in the market by garnering thousands of app downloads, web visitors, and even loyal customers.

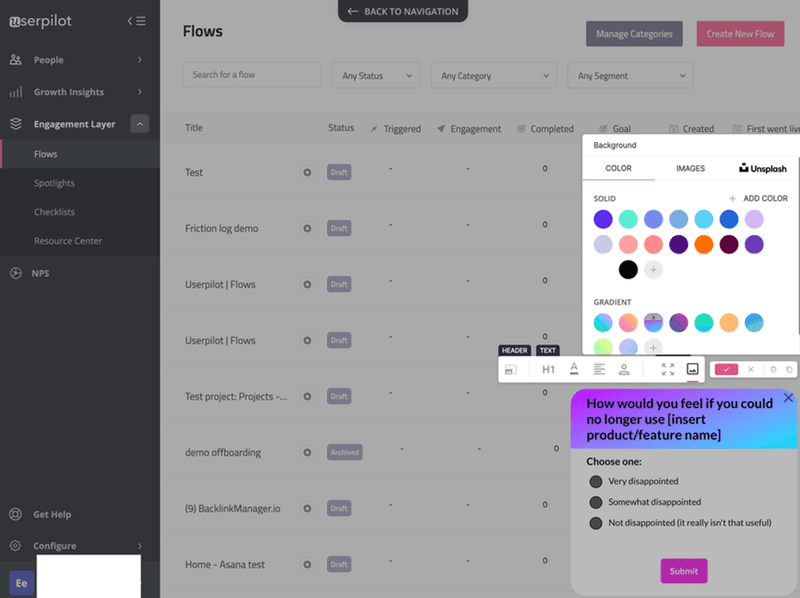

6. PMF surveys

Product-market fit (PMF) surveys reveal whether you have the right product in the right market. If your product cannot generate sufficient demand among the target market, the buzz would one day die down, and any growth wouldn’t be sustainable.

Below is an example of a PMF survey that asks users how they would feel if they could no longer use your product. At least 40% of your customers should choose ‘very disappointed’ for your product to be profitable and sustainable.

7. Early product reviews

You can still get early product reviews after fully launching your product. Use customer satisfaction surveys to collect feedback from customers who are in the trial run or are upgrading from trials.

You can also survey customers from different segments, such as active users, inactive users, early adopters, etc.

In-app customer behavior insights

Monitor in-app customer behavior to analyze and interpret user interactions inside your product. For example, you can see which features they use and which they don’t, where they experience friction, and how often they engage with each feature.

How to collect customer behavior insights?

1. Session recordings

Session recordings let you record and track real actions taken by customers as they navigate your product and complete actions.

They usually capture any type of activity ranging from scrolls and mouse movements to clicks and keystrokes. You can replay recordings to study specific user experiences and analyze user behavior.

2. Click tracking

Track dead clicks and rage clicks to find friction areas and improve customer experiences.

Dead clicks are very frustrating since nothing happens when a customer clicks on any UI element, thus disrupting the smooth flow you want to achieve. Rage clicks are a physical show of frustration where users click an area/element of your site multiple times in rapid succession.

3. Customer journey interactions

As displayed below, a custom event lets you add multiple events under a given topic, e.g., a dashboard.

You can track these custom events at various touchpoints across your customer journey to get a deeper understanding of user behavior. They also make it much easier to customize experiences for specific user segments.

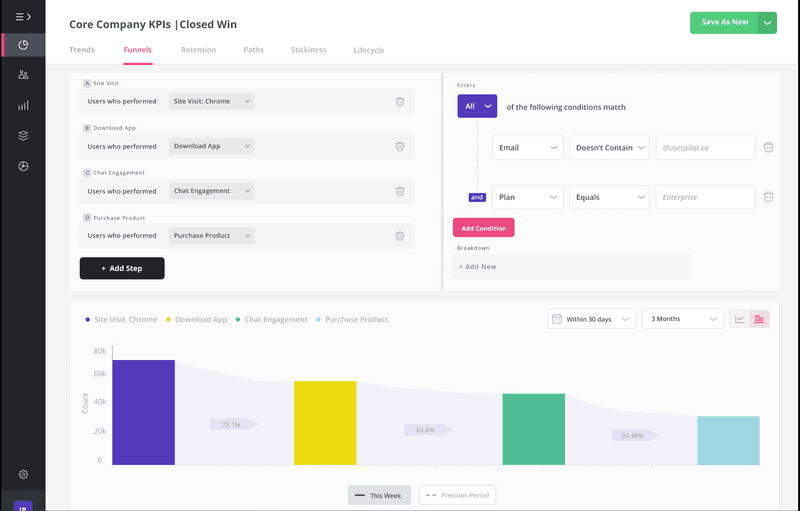

4. Cohort analysis

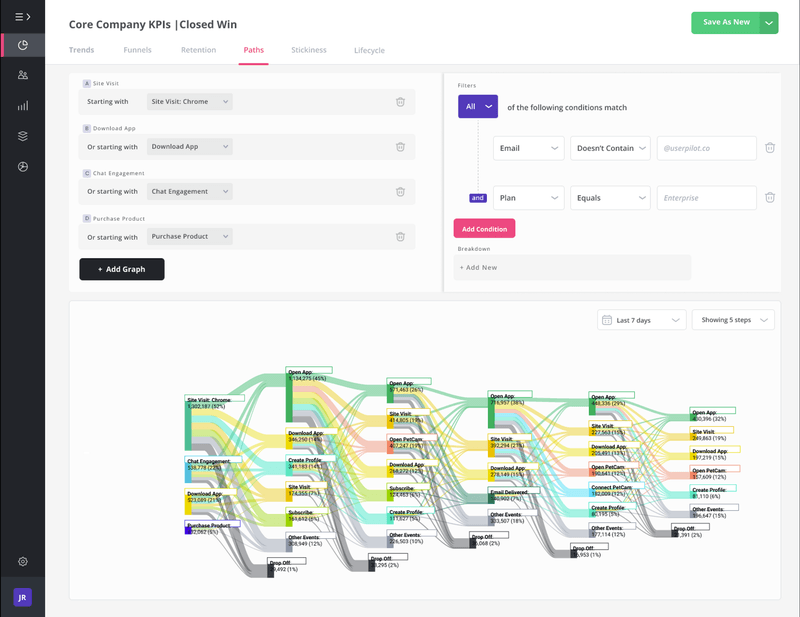

Cohort analysis helps you check how a subsection of your customers is interacting with your product and improve onboarding. You can improve your retention strategies by combining behavioral cohort analysis with funnels and paths.

- Funnels – Funnel analysis allows you to identify customers who convert at each step of the sales or conversion funnel and see the drop-off rate at each step.

Combined with cohort analysis, you can learn if users who sign up for different subscription packages or at different months are more or less likely to drop off at a particular step.

- Paths – With paths, you need to pick up a starting point at a time and observe customer paths from these points. This lets you identify where users face obstacles in their journey, eg. from clicking the ‘add to cart’ button to completing the purchase.

Along with cohort analysis, path analysis will help you find patterns that result in positive or negative customer experiences.

5. Eye tracking

Eye tracking tools like Gazepointer use webcams to record and assess the eye movements of customers and display them in heatmaps.

You can use the insights to adjust your UI layout, color patterns, or font sizes to attract customers to relevant elements and remove distractions in their pathway.

Voice-of-the-customer insights

Voice-of-the-customer insights are user feedback on their experiences with your product. Let’s see how you can collect B2B customer opinions to understand their behavior, struggles, and preferences.

How to collect voice-of-the-customer data?

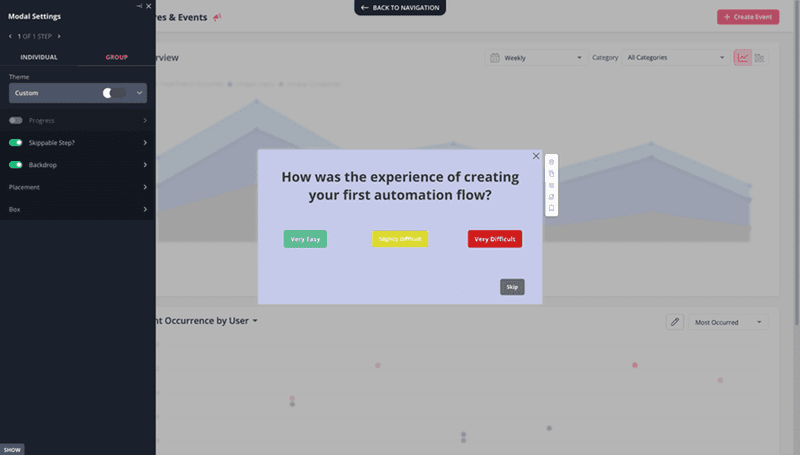

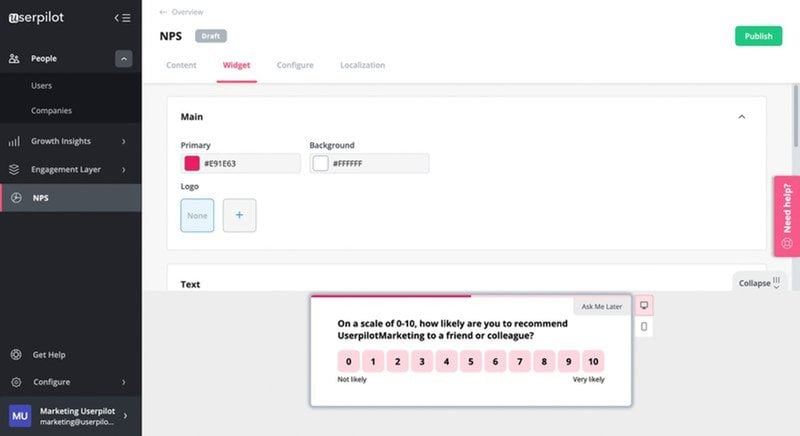

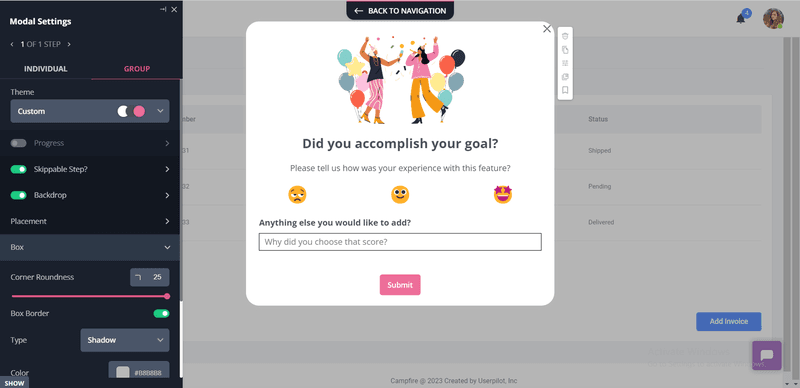

Voice-of-the-customer surveys ask qualitative and quantitative questions to analyze customer sentiment about your product. Let’s discuss 4 of the most essential VoC microsurveys that you can trigger at multiple touchpoints to cover the whole customer journey.

- CSAT survey: Customer satisfaction score surveys measure users’ satisfaction with your brand, product, or particular experiences, like a conversation with the support team. An example is shown below.

- CES survey: Customer effort score surveys are sent after customers complete a key action or interact with a core feature to check for friction points. It typically uses a disagree-agree scale.

- NPS survey: Net Promoter Score measures users’ overall satisfaction level. NPS surveys ask users to rate their likelihood of recommending their product to others on a scale from 1-10. A qualitative follow-up question will help you dig deeper into the motivations of your promoters and detractors.

- Feature surveys: Feature surveys are used for collecting feedback on specific features on topics like feature usability, feature requests, etc. They help increase user engagement and avoid launching features that won’t bring in profits.

Internal marketing, sales, and product management insights

Cross-department insights on internal marketing, sales, and product management help align business metrics and activities. They prevent data silos and encourage cross-department collaboration.

How to collect internal marketing, sales, and product management insights?

- Customer analytics strategies: Customer analytics involves analyzing user journey, engagement, experience, behavior, retention, and loyalty. Departments should share insights and collaborate on strategy development.

- Build customer journey map: It highlights the main touchpoints in the user journey that involves all departments – from sales teams to customer success and product teams.

- Use CRM tools (i.e, Salesforce, Hubspot): They offer insights into user interactions and purchasing behavior and use historical data to make sales forecasts.

- Use the same reporting tools for organization-wide data visualization: For instance, you can use Userpilot for advanced in-app analytics that allows integration with great analytics tools like Mixpanel, Heap, etc.

Wrapping it up

Make sure you don’t miss out on any of the 5 customer insights we’ve discussed to gain success with your B2B customers.

Want to collect B2B customer insights? Get a Userpilot demo to achieve customer success and product growth.