Looking for micro survey templates to collect quick user feedback?

This article guides you through important surveys to implement across the customer journey. You will also learn best practices to ensure high response rates while collecting accurate feedback.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

TL;DR

- Micro surveys are a streamlined form of traditional surveys designed to gather specific information. These surveys are usually short and super-focused.

Unlike longer surveys, micro surveys help you:

- Collect customer feedback with minimal effort

- Avoid survey fatigue while gathering more data

- Get highly specific and insightful feedback for each touchpoint

Micro surveys to gather valuable insights:

- Welcome screen surveys

- Market research surveys

- Competitive analysis surveys

- Product-market fit surveys

- Customer experience surveys

- Trial expiration surveys

- Product research surveys

- New feature feedback surveys

- Churn research surveys

Best practices for actionable insights:

- Collect contextual feedback

- Write clear and concise questions

Ready to start using micro surveys to gather data? Book a demo and see how Userpilot helps companies like yours.

What are micro surveys and their benefits?

Micro surveys are short, focused surveys typically consisting of just a few questions.

These surveys have many advantages over traditional surveys. Among other benefits, they help you:

- Collect customer feedback with minimal effort: Imagine a quick, bite-sized snack instead of a full-course meal. Micro surveys are like that for customers. Short and focused, they require minimal time and energy to complete, increasing the likelihood of participation.

- Avoid survey fatigue: Survey fatigue occurs when users are overwhelmed by long or frequent surveys, leading to lower response rates or less thoughtful answers. Micro surveys, due to their concise nature, help in mitigating this problem. By asking only a few targeted questions, they reduce the cognitive load on respondents, maintaining user engagement and willingness to provide feedback.

- Get more specific feedback for each touchpoint: Instead of a broad overview, micro surveys can zoom in on specific interactions (touchpoints) customers have with your product or service. Focusing on surveying one aspect of your product and user experience at a time gives you precise user feedback at each journey stage. That way, you can always keep track of product health and make necessary changes with relative ease.

Micro survey templates to gather valuable feedback

Now that you’ve seen the importance of micro surveys, let’s delve into the different types and questions you can use to get the right responses:

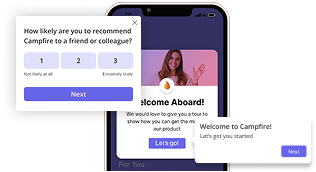

Welcome screen micro survey template

Welcome surveys help you gather information about new users, allowing you to tailor their onboarding experience.

Through a quick welcome survey, you can learn about user pain points, jobs to be done, and use cases. All these are vital for personalized onboarding.

Examples of questions to ask:

- What is your job title?

- What will you be using {product name} for?

- How large is your company?

Market research micro survey template

Use this template when you need to:

- Assess market demand

- Understand your target audience better

- Optimize your pricing for your target market

- Learn about market trends

The data from your market research surveys will inform product development and ensure what you roll out meets the demands and changing needs of your target audience.

So, what’s the best time to trigger market research surveys?

While the obvious answer is during product development, you can also do it at regular intervals to keep track of customer preferences.

Examples of market research survey questions to ask and gather insights to guide product decisions:

- How much are you willing to pay for {product name}?

- What is the problem that the product/service helped to solve for you?

- How do you search for the products you want to buy?

- What factors influence your decision to purchase?

Competitive analysis micro survey template

These surveys assess how well your product meets market demand. They focus on user satisfaction, product usability, and the relevance of features.

The data from competitor analysis is valuable in helping your product team devise strategies to gain a competitive advantage.

There’s no specific timing for competitive analysis; you can do it anytime as a part of your user and market research process.

Examples of questions to ask and get valuable user feedback:

- How would you compare our products to our competitors?

- Why did you choose to use our [product] over other options?

- Which other options did you consider before choosing [product name]?

Product-market fit micro survey template

PMF surveys let you understand whether your product addresses and solves the needs of your target audience.

Trigger them once you have a sizable customer base and are thinking of scaling. You know you’ve achieved product-market fit when at least 40% of users will be disappointed if they can no longer access your tool.

Here’s a simple PMF question to ask and understand if the perceived value of your tool is what you think it is:

- How would you feel if you could no longer use our product?

- Very disappointed

- Somewhat disappointed

- Neutral

- Not disappointed

Customer experience micro survey templates

These surveys help you gather feedback on specific aspects of the customer journey and spot ways to improve the overall product experience.

Some customer experience survey templates and when to trigger them:

Customer satisfaction micro survey template

Use CSAT micro surveys to measure customer satisfaction data at a granular level.

The best time to trigger these surveys is immediately after a specific engagement, like when a user interacts with a feature for the first time, immediately they finish contacting support, and so on. Timely customer satisfaction surveys will enable you to collect accurate user feedback. Making it a regular practice means you can quickly identify and address touchpoints that cause user dissatisfaction.

Use a Likert scale or smiley faces for your CSAT surveys. Examples of questions to ask:

- How satisfied are you with the assistance you received from our customer support team?

- On a scale of 1 to 10, how satisfied are you with our [product/service/company]?

- How satisfied are you with our onboarding program?

Customer effort score micro survey template

This survey measures how much effort users exert to interact with your product. It helps identify friction points and fix them to improve the user experience.

Examples of questions to ask:

- On a scale of 1-7, how would you rate the effort it takes to use our X feature?

- Was it easy to find the information you wanted in the resource center?

- How easy was it to interact with our team?

- How would you rate the ease of use and user interface of our product?

Net promoter score micro survey template

The primary purpose of NPS surveys is to enable you to measure customer loyalty and predict business growth.

The surveys can be transactional—triggered after specific interactions—or relational—triggered on a regular basis.

Implement both transactional and relational NPS to have a 360-degree view of the customer experience.

The standard NPS question goes something like this:

- On a scale of 0-10, how likely are you to recommend our product to a friend or colleague?

You can play around with it, but keep the main idea.

Here are some follow-up questions to enable you to get more out of NPS surveys:

- Why did you choose that score?

- What specific aspect(s) of our product/service influenced your rating the most?

- What improvements or changes would make you more likely to recommend our product/service?

Trial expiration micro surveys template

Send this micro survey to understand why users aren’t converting to paid plans at the end of their trial period.

The best time to trigger trial expiration surveys is when a user’s trial period is nearing its end or immediately after it expires. Examine the responses and find ways to boost conversion.

Example of questions to ask:

- What’s stopping you from upgrading your account today?

- What prevented you from purchasing a full subscription?

- Did our product meet your expectations during the trial?

Product research micro surveys

Trigger this survey when you need to collect general feedback to understand the user experience and develop ideas for new features.

Examples of product research survey questions to ask:

- What specific features of our product do you like the most?

- Is there anything missing from our product that you want to see added or improved?

- Did the product meet your expectations?

- Which integrations do you appreciate most?

You can make this an always-on survey, so users know they can submit feature requests at will. (It doesn’t mean you have to build everything they ask, but the responses will give you an idea of user needs).

New feature feedback micro survey template

Implement this micro survey to gather user feedback on newly released features, spot usability issues, and see how to improve.

To be effective, set your survey to trigger immediately after a user interacts with new features for the first time.

Examples of questions to ask:

- Please let us know how we can further improve this feature.

- How was your experience using {feature name}?

- Do you find this feature helpful?

Churn research micro survey template

This survey helps you uncover the reasons for churn. A good churn survey is also an opportunity to offer immediate alternatives based on user responses, increasing your chance of retaining them.

Churn surveys are best displayed in-app—right when a customer clicks the account cancellation button. This timing is important because most people won’t answer a survey they got via email after canceling their account.

Examples of questions to ask and draw conclusions on how to boost retention:

- What is the reason you are leaving {product name}?

- What’s the main reason you are canceling your account?

- Why did you decide to cancel your subscription?

Best practices for implementing micro surveys

While micro surveys are generally effective, everything depends on how you implement your surveys.

Follow these best practices to ensure you always gather quick and actionable insights:

Collect contextual feedback

Always ensure to trigger your surveys based on user actions and current experiences.

For example, don’t ask users to rate your customer service immediately they log into your tool. The survey isn’t relevant, and users will either ignore it or respond hastily and get back to work.

Userpilot makes it easy—you can set event based triggers for your surveys to ensure the user sees them at the right time.

Write clear and concise questions

Your survey questions should be simple, jargon-free, and to the point. Avoid asking for more than one feedback at a time, because it won’t let you collect meaningful data. For example, don’t ask for feature requests while triggering a CSAT question in the same micro survey just because you want to save time.

Users will be confused and not give you accurate responses. In the same vein, stay away from leading questions that could bias survey responses.

Conclusion

Micro surveys make everybody happy: they save responder time and help you collect valuable feedback quickly.

Ready to start researching user pain points and understanding what makes them happy? Userpilot grants you easy access to prebuilt micro survey templates. You can also build from scratch, customize your surveys, and implement event-based triggering to ensure all your surveys are contextual. Book a demo now to try it.