What are the different marketing research methods product marketing teams can use to inform their strategies?

This is the main question the article answers.

You will also learn about different types of market research and how to conduct it step by step.

Let’s dive right in.

What is market research?

Market research is the process of gathering, analyzing, and interpreting information about a target market, competitors, and customers.

Such research helps SaaS companies make informed decisions about product development, marketing strategies, pricing, and customer acquisition.

The benefits of conducting market research

Let’s face it: market research requires time and resources. However, the investment is fully justified for a number of reasons:

- Market research helps you better understand your customers’ pain points, needs, and desires. Such insights are essential to building products that solve genuine problems and quickly achieve product-market fit.

- By understanding what your customers want, you can continuously improve your offerings and enhance customer satisfaction. This translates into higher customer retention and, ultimately, better business performance.

- Keeping a pulse on your market allows you to spot emerging trends and unmet needs. Such insights drive innovation to give you a competitive advantage.

- Understanding your competitors’ strengths and weaknesses can help you define your unique selling proposition.

- Whether you’re launching a new product or entering a new market, market research can help you test the waters before diving in and potentially save you from costly mistakes.

- With insights from market research, you can create more targeted, effective marketing campaigns that resonate with your audience.

- Market research provides solid data to back up your business decisions – so no more guesswork and acting on hunches.

Different types of market research to gather valuable insights

Market researchers rely on different kinds of research to obtain the necessary insights.

Let’s unpack the main ones.

Primary market research

Primary research is the original data you gather yourself. It’s tailor-made for your specific needs and usually involves direct interaction with your target audience, for example, through interviews or surveys.

Such research can provide up-to-date and highly relevant insights but is time-consuming and costly.

Secondary market research

Secondary research recycles information that already exists, for example, from industry benchmark reports or academic studies.

Data obtained in this way isn’t 100% relevant to your circumstances but can give you a good understanding of the trends in your niche. And it’s quicker and more cost-effective than primary market research.

Quantitative research

Quantitative market research deals with data that can be measured and statistically analyzed. In SaaS, this could be data from web and product analytics or quantitative survey questions, like NPS.

If conducted on a large enough sample, such research is very objective and allows you to identify trends and patterns over time.

However, it may not offer you the answers as to why users behave in a particular way.

Qualitative research

Qualitative market research complements quantitative insights by helping you explain the ‘why’ behind the numbers.

For practical reasons, it involves smaller customer samples than quantitative studies and uses techniques like interviews, focus groups, surveys, and session recordings.

Competitor research

Competitive research helps you understand your position in the competitive landscape.

It gives you an understanding of your competitors’ strategies, strengths, and weaknesses and allows you to identify market gaps and new opportunities.

Competitive analysis uses primary and secondary research to obtain qualitative and quantitative data.

9 Marketing research methods to execute

Let’s look a bit closer at market research techniques that you can use for each type of research.

1. Customer surveys

Customer surveys are the bread and butter of market research. They’re easy to administer, and you use them to gather both quantitative and qualitative data at scale. They can help you gauge customer satisfaction, gather product feedback, or understand market trends.

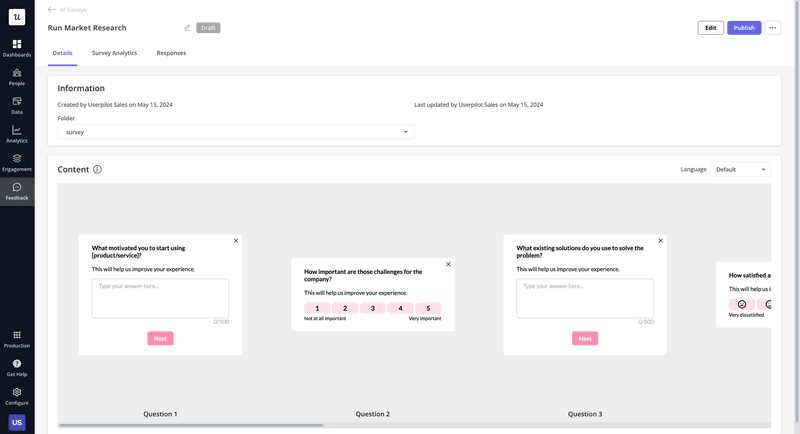

When collecting feedback from existing users, in-app surveys are particularly effective and have higher response rates than email surveys.

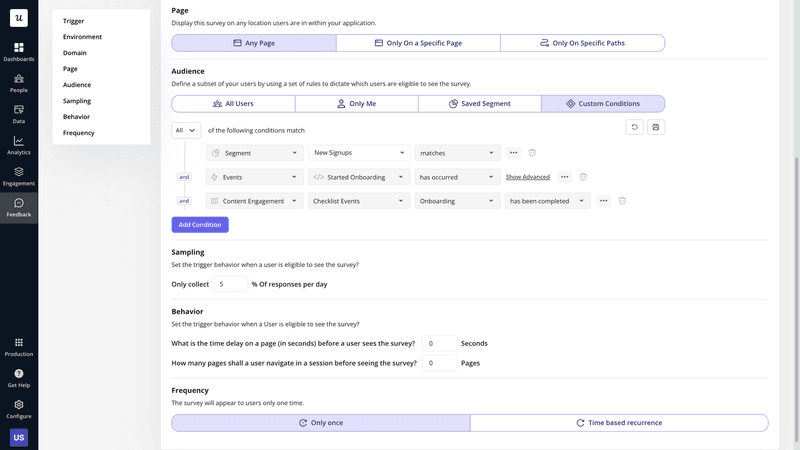

You can launch them with an in-app survey tool. Pick a template from the library, tweak the question, select the audience, and set how to send the survey. You can either pick a specific date and time or use event-based triggering to gather contextual feedback.

What if you don’t have users yet?

Tools like SurveyMonkey give you access to respondent pools you can target based on hundreds of criteria.

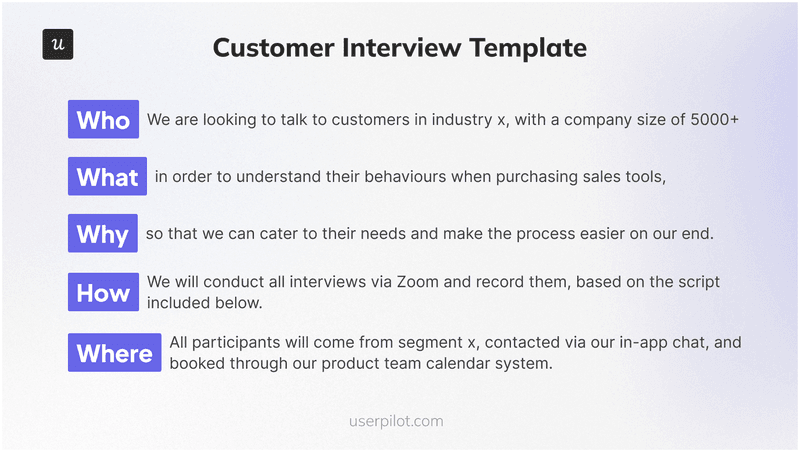

2. User interviews

User interviews are more time-consuming and resource-intensive, so conducting them at scale is difficult. However, nothing beats a one-to-one conversation when you’re after deep, nuanced insights.

That’s because they give you the flexibility to drill down on interviewees’ ideas.

It doesn’t mean that they’re completely unstructured.

To get the most out of the interview, they need to have a clear focus.

Here’s a template you can use to prepare for them.

How do you recruit interview participants? You can send in-app invites to your customers who meet the criteria or, again, lean into an interviewee pool available in tools like Hotjar.

3. Focus groups

A focus group brings together a small number of people, usually 6-10, from your target audience to discuss your product.

The interaction between participants can spark conversations and ideas that might not come up in individual interviews. And can reveal shared experiences, pain points, and desires that individual interviews might miss.

However, to get the most out of them, bring in a skilled moderator to guide the discussion and ensure all voices are heard and key topics are covered.

Otherwise, dominant personalities or groupthink can skew the results.

4. Observational research

Observational research involves watching how users interact with your product or service in their natural environment. This could be in-person observation or through tools like session recordings for digital products.

Why bother?

Because what people do is often more revealing than what they say. Observing customers can highlight discrepancies between reported and actual behavior or offer insights that users themselves might not be aware of or able to articulate.

This method can uncover usability issues, reveal unexpected use cases, and is particularly valuable for understanding the context in which your product is used.

5. Social listening

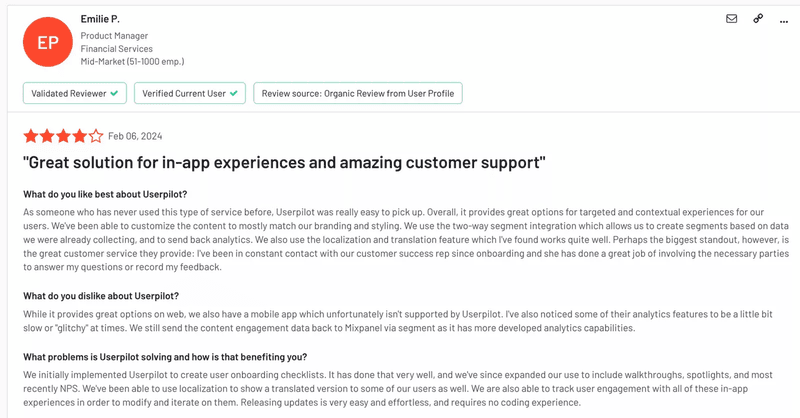

Social listening involves monitoring social media platforms for mentions of your brand, products, competitors, or industry. It can help you track sentiment, identify emerging trends, manage your online reputation, and even find potential customers or brand advocates.

How do you do it?

Monitor your social media accounts and review sites, and use tools like Hootsuite, Sprout Social, or Brand24 to monitor the broader expanses of the internet.

But don’t focus just on your online presence. Follow what users have to say about your competitor, too.

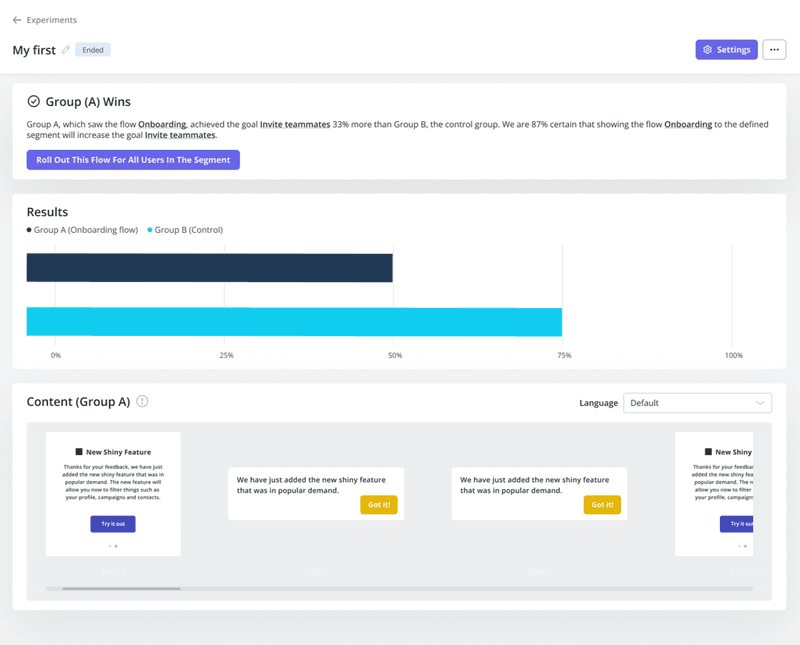

6. A/B testing

If you can’t decide on a version of your webpage, email, or product feature, A/B test them.

A/B testing involves comparing two options side by side to see which performs better.

This method is particularly useful for optimizing digital experiences. You can test everything from button colors to pricing structures, using real user behavior to guide your decisions.

What if you have more versions to test? Run multivariate tests.

7. Heatmaps

Heatmaps provide a visual representation of user behavior on your website or app. Using color coding, they show areas of high and low engagement.

They are particularly useful for understanding how users interact with your digital interfaces. It can reveal usability issues, help optimize page layouts, and show which elements are successful or unsuccessful at grabbing user attention.

8. Exploratory research

When you’re venturing into new territory, exploratory research helps you establish a foothold.

This kind of research is often qualitative and can involve literature reviews, expert interviews, or case studies. It’s particularly useful in the early stages of product development or when entering new markets.

The goal is to define problems more precisely, develop hypotheses, or establish research priorities. It may not provide definitive answers but can point you in the right direction for further, more focused research.

The secret to its success?

Asking open-ended questions and being receptive to unexpected findings.

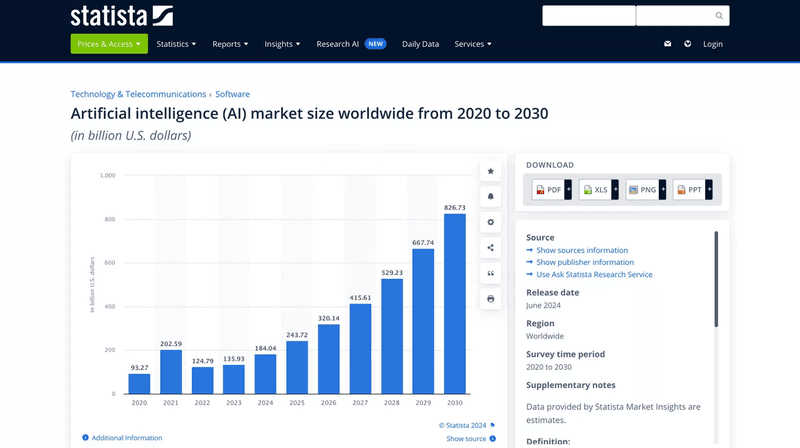

9. Public databases

Public databases, government reports, industry associations, and academic studies offer a wealth of information.

They can provide valuable context, market size estimates, demographic information, and trend data, which is a cost-effective way to get a broad overview of your market or industry.

Useful sources include:

- U.S. Census Bureau (or regional equivalents).

- Statista.

- Crunchbase.

- Product Hunt (to see what kinds of products get good traction).

- Pitchbook.

While this data isn’t tailored to your specific needs, it can provide a solid foundation for your research and help you identify areas for further primary research.

A step-by-step process on how to conduct market research

Let’s wrap up by exploring the market research process, one step at a time.

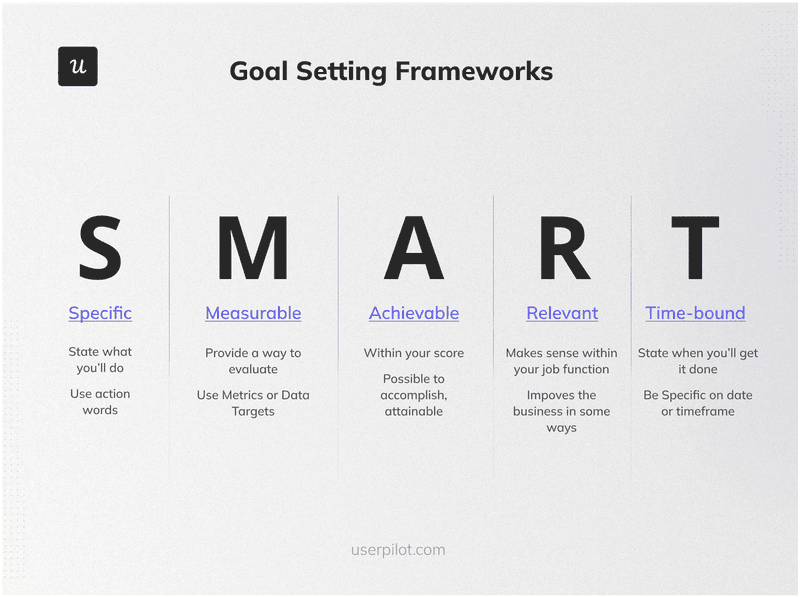

Define your market research goals

The process starts by setting clear goals for your market research project. They will determine what data you gather and how.

The goals will differ depending on your product maturity and high-level business goals.

Early on, your goals may be to identify underserved user needs or validate a product idea. And when you’re expanding into new markets, it could be to gauge the demand and potential customers’ willingness to pay.

Whatever your focus, make your goals specific. Use a framework like SMART if you’re only starting.

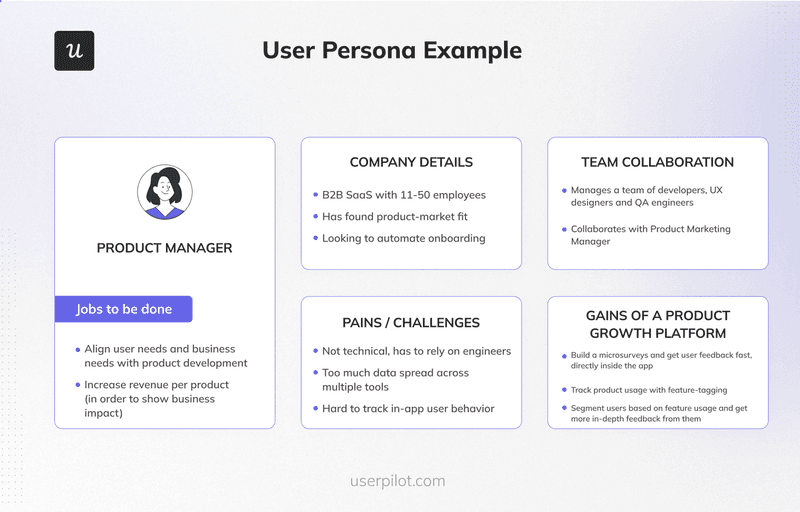

Identify the target market to research on

Knowing who to research is just as important as knowing what to research. So, the next step is defining your target market as precisely as possible.

If you already have a product in place, use your current customer base for clues. Who are your best customers? What traits do they share?

If not, start defining the target market with basic demographics like age, gender, location, and income.

Don’t stop there. Dig deeper into psychographics like interests, values, and lifestyle.

As you’re discovering more and more about your customers, segment them based on their needs and behaviors. Identifying these segments will help tailor further research and later – your products or marketing campaigns.

Use this information to create detailed customer personas.

Choose relevant market research methods

With your goals set and the target market defined, it’s time to select your research methods that are aligned with your objectives and audience.

Usually, a mix of methods provides the most comprehensive view.

For example, start with surveys and user behavior analysis and zero in on the key insights with interviews and focus groups. Or the other way round – use surveys to validate insights from an interview.

Of course, the choice of research methods depends. Balance the depth of insights you need with the resources available.

Don’t forget about your audience’s preferences. If your target audience is tech-savvy, they will happily take part in online surveys. Surveys won’t be very helpful when getting insights from my dad – a phone call might, though.

Collect data using the right tools

Time to put your research machine into motion and start collecting data using the right tools.

I’ve already mentioned a few options before, but here’s a more comprehensive list that can help you conduct effective market research:

- Email surveys: Typeform, MonkeySurvey, and HubSpot.

- In-app surveys: Userpilot.

- A/B Testing: Optimizely, VWO

- Interviews: Hotjar and Fullstory.

- Heatmaps: Hotjar and Mouseflow.

- Session recordings: Fullstory, Userpilot

- User behavior analysis: Userpilot, Google Analytics, Amplitude, and Mixpanel.

- Social listening: Hootsuite, Sprout Social, Brand24, and Mention.

Apart from the obvious things like pricing, functionality, or intuitive UI, pay attention to integrations so that you can seamlessly sync the data and analyze it in one place.

Analyze the data collected for valuable insights

Collecting market research data is only half the battle – the real value comes from analysis. The goal isn’t just to summarize what you found but to extract actionable insights that can drive business decisions.

Start by organizing your data. Clean it up, removing any duplicates or irrelevant information.

Use data visualization tools to help spot trends. Graphs, charts, and word clouds can make patterns more apparent. Leverage AI to extract insights from qualitative data, like survey responses.

In your analysis, look for patterns and trends. What common themes emerge from interviews? What correlations appear in your survey data?

Top tip: Make it a team sport. Bring in team members from different departments to get diverse perspectives on what the data might mean for your business.

Conclusion

The choice of market research methods isn’t as challenging as it might initially seem as long as you have a clear idea of what you want to achieve.

The success of the research process depends a lot on the tools that you have available. A well-integrated tech stack will help you collect the necessary data from the right customers and extract actionable insights.

![What are Release Notes? Definition, Best Practices & Examples [+ Release Note Template] cover](https://blog-static.userpilot.com/blog/wp-content/uploads/2026/02/what-are-release-notes-definition-best-practices-examples-release-note-template_1b727da8d60969c39acdb09f617eb616_2000-1024x670.png)