Go-to-Market (GTM) strategy is often treated as a simple launch checklist. However, I prefer to look at GTM as a comprehensive strategy framework that bridges the gap between shipped code and recurring revenue. A well-planned GTM maximizes profit potential, minimizes risks, and provides aclear structure that keeps teams aligned on shared goals.

The data confirms this approach: high-performing SaaS companies generate 67% of their total new revenue from expansion and customer retention rather than net new logos.

This distribution of value demands that product management teams look beyond the initial sale. While acquisition costs money, retaining existing customers creates compounding value. Getting the initial sale wrong imposes a double tax: the cost of acquisition and the eventual cost of churn.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is a go-to-market strategy?

A product go-to-market strategy is a comprehensive plan that specifies how you will reach your target market and achieve a competitive advantage. At its best, a GTM strategy functions as a ‘revenue operating system’ that unites sales, marketing, product, and customer success teams to deliver value.

People often confuse this with a marketing plan, but there’s an important distinction: a marketing plan is a timeline of tasks, while a GTM strategy is the why and how behind those tasks. It covers the entire customer journey, from the moment a user realizes they have a problem to the moment they become a loyal advocate.

Now you may ask, “Can’t we just launch to everyone and see who bites?”

The short answer is no. Broad launches create a “leaky bucket” where expensive, but irrelevant traffic is pushed into a product funnel.

A GTM strategy helps businesses avoid costly missteps such as targeting the wrong customer segments or entering a saturated market. Without this foundation, you risk targeting the wrong people or solving a problem that doesn’t exist based on market research. You might end up being a feature factory, churning out updates that nobody adopts.

Given that the average B2B customer journey spans 192 days from first touch to closed-won, you need a sustainable business model that can support this extended timeline.

GTM strategy vs marketing strategy

A GTM strategy defines how a product reaches customers and wins a position in a new market. It is particularly useful when launching a new product, entering a fresh market, or repositioning an existing product. GTM encompasses pricing, sales motion, distribution channels, and customer onboarding.

Marketing strategy, on the other hand, handles promotion, awareness, and lead generation for that product. It focuses on campaigns, content, and efforts to generate demand.

Think of it this way: GTM is the system, and marketing operates as one component within that system.

The 5 core components of a GTM strategy template

To move from a launch checklist to a strategic engine, I frame the GTM approach around five mutually exclusive pillars that the GTM strategy template includes:

- The Who: Audience Intelligence, including ICP, Personas, and Market Sizing.

- The What: Value Proposition, Messaging, and Problem/Solution Fit.

- The How: Pricing Models, Packaging, and Sales Motion.

- The Where: Distribution Channels and Demand Generation.

- The Secret: Onboarding and Activation (a.k.a. The Retention Layer).

Using templates to standardize the launch process ensures no critical components are missed.

How to create a GTM strategy template?

To build a comprehensive go-to-market strategy, you need to sequentially execute six interconnected steps. Each step builds on the previous one, which is why the first step in crafting your strategy is understanding business objectives and aligning them with overall organizational strategy. If we skip a component, the system collapses under its own inefficiency.

Step 1: Define your target audience

If you’re selling to everyone, you’re selling to no one. Your product simply does not resonate with your audience. That’s why targeting “all small businesses” fails as the definition is too broad to be useful.

Narrowing your audience can seem like you’re limiting your Total Addressable Market (TAM), but this specificity improves traction during the early stages. Dominating a niche is an easy way to succeed with your market expansion plans, as you already have market fit and a group of people who love your product.

Step 1.1: Define your ICP

An Ideal Customer Profile (ICP) describes the company that gets the most value from the product. Defining a precise ICP helps establish product-market fit by identifying target audience segments and their specific needs.

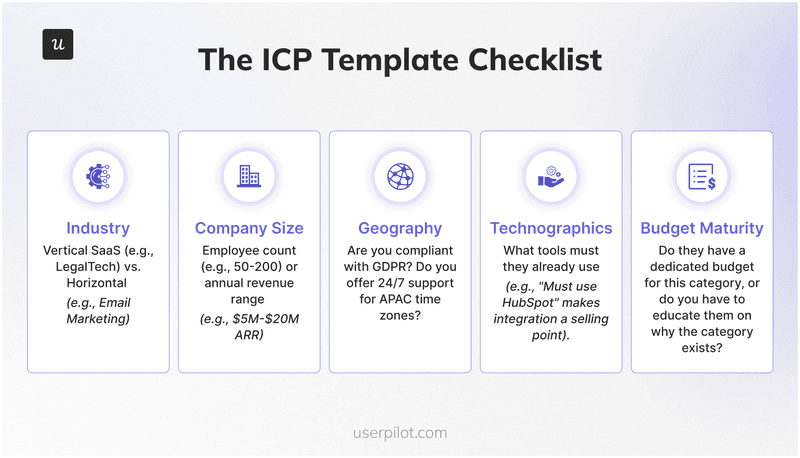

Firmographics like company size, industry, and budget provide the starting framework, but depth determines success. I focus on understanding the people inside that company to separate functional ICPs from useless demographic lists.

With the Blended CAC Ratio jumping 22% to $1.61 recently, efficient targeting of high-value customers has become essential to offset rising acquisition costs.

- Bad ICP looks like “Small businesses looking for efficiency.”

- Good ICP looks like “B2B SaaS companies with 50-200 employees using Salesforce who struggle with data syncing between their CRM and billing system, causing revenue recognition delays.”

Step 1.2: Build user personas

Even if you are targeting a company, it’s the people who are going to buy your software. Using frameworks like SWOT analysis and customer personas can aid in developing your strategy.

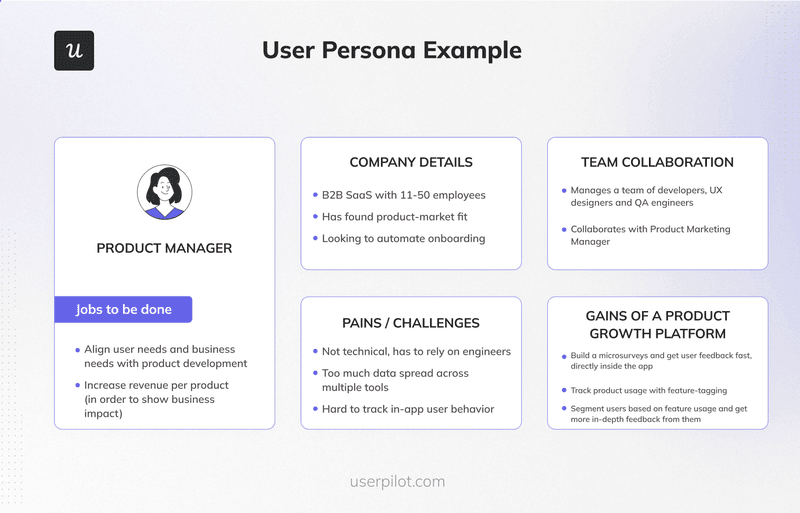

Data reveals that the buying process generally involves 6.3 stakeholders on average, which is why you should use a user persona template to satisfy individual roles within each customer segment that you are going to target.

Your GTM strategy needs consistent messaging for each stakeholder:

- The buyer (Economic buyer): This person asks if reducing revenue recognition delays from 14 days to 2 days justifies the $50K annual spend. My messaging here focuses on ROI, risk mitigation, and compliance.

- The user (End user): This person asks if syncing will happen automatically, so they can stop spending 8 hours weekly reconciling data in spreadsheets. My messaging for this persona focuses on workflow improvements and time savings.

- The blocker (IT/Admin): This person asks if adding another integration creates security vulnerabilities or breaks SOC 2 compliance. I’d focus on integration architecture and API documentation.

Step 1.3: Validate your ICP with research

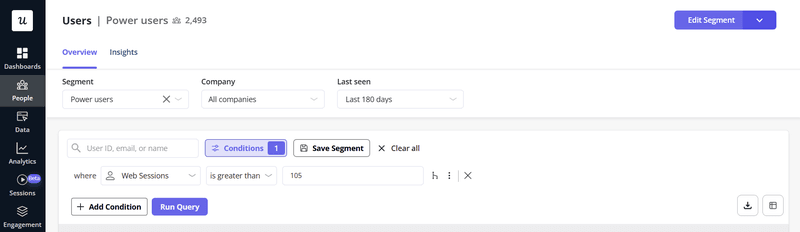

Stop guessing and start measuring. Begin with customer segmentation analytics to identify existing “Power Users.” Research competition and demand before tailoring your product’s value proposition and selecting your audience. Then, identify who logs in daily and never complains about price, and build a sales strategy to clone them.

Conversely, identify your “Anti-Persona” or the users who churn within 30 days and drain support resources. I explicitly exclude these personas to save sales efforts. You too can do this by tracking behavior with user segments in Userpilot.

Step 2: Creating the value proposition

Customers are not usually looking for “AI-powered dashboards.” They want clarity and a way to build promotion-ready reports. Your messaging must resonate with the specific “Jobs to be Done” (JTBD) of the personas and the problems that the product solves.

Step 2.1: Position against competitors

Before writing a single line of copy, you need to map the battlefield through competitor research. This thorough analysis allows businesses to understand their competitive advantage, which can generate revenue and interest in the product.

Product positioning defines your space relative to the alternatives your customers are currently using. You must decide if you are the premium choice, the fast choice, or the simple choice.

Look at product differentiation examples to see how successful brands carve out their niche in a saturated market. Being different often matters more than being better. If you try to compete on features alone, you enter a losing battle against incumbents with deeper pockets.

SaaS companies generally have three positioning lanes:

- The cost leader: The cheapest option. This is a dangerous race to the bottom in SaaS.

- The specialist: The niche expert, such as a “CRM for Dentists” versus Salesforce.

- The premium choice: The high-value, white-glove service option.

You need to explicitly map your strengths and weaknesses against these competitors. If your competitor has a 10-year head start on features, you cannot win on “comprehensiveness.” You might instead win on “speed of implementation.”

Step 2.2: Bridge the value gap by solving a specific problem in your messaging

Once you understand your position, you can define your value proposition. This is where you connect your unique strengths to the specific pain points identified in your ICP research.

- Completely avoid generic claims like “we make you more efficient.” Everyone says that.

- Instead, be specific. “We cut your invoicing time from 6 hours to 45 minutes per month.”

This is called a value gap. It represents the difference between what your customer expects and what they actually experience. Your messaging must promise to close that gap with measurable outcomes.

If you come across a table stakes claim like “Save time”, use the “So what?” test. You offer a 99.9% uptime SLA? So what? “So your team never loses transaction data during month-end close, eliminating the 14-hour reconciliation process that happened during Q2.”

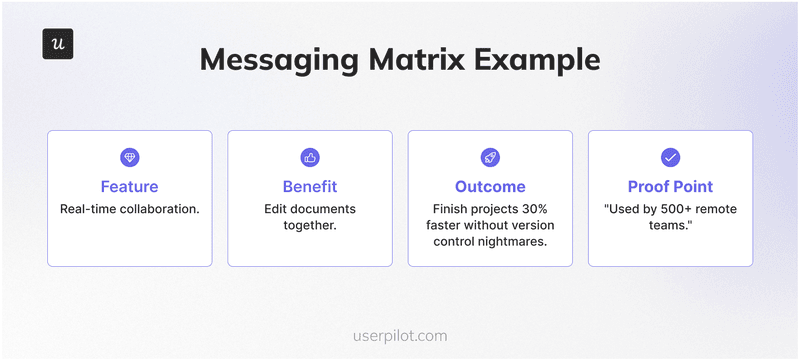

This value proposition will look different for each persona you identified in Step 1.2. You need to create a messaging matrix that maps each stakeholder to their specific pain point and your specific solution:

| Persona | Pain Point | Specific Outcome |

|---|---|---|

| CFO | Revenue recognition delays | Reduce from 14 days to 2 days |

| Operations Manager | Manual data entry | Eliminate 32 hours monthly |

| IT Director | Integration failures | Zero downtime migrations |

Also make sure you run message testing to see if your copy “connects” with your intended audience before spending your entire budget on ads.

Step 3: Choose your pricing strategy

Pricing is psychology. It signals the value of your product and requires careful consideration of factors like costs, competition, and customer value perception. $10/month can make your product seem like a commodity. On the other hand, $500/month signals a business tool.

Of course, not every product can be priced at $500 a month. So, here are a few SaaS pricing models you can choose from depending on the sales style you pick.

Step 3.1: Choose the pricing model

You can pick from standard SaaS pricing models based on your business goals:

- Freemium: This drives high acquisition but has low conversion. Benchmarks show freemium models achieve a median visitor conversion rate of 12%, which is significantly higher than time-boxed trials. I use this self-service model when the marginal cost per user is low and the network effects are high.

- Free trial: This creates high urgency. Giving users full access to the Pro plan for 14 days before downgrading them effectively uses the psychological concept of “Loss Aversion.”

- Usage-based: This offers perfect value alignment. Removing the revenue ceiling aligns your revenue growth with their usage growth, typically resulting in higher Net Dollar Retention (NDR).

Step 3.2: Determining the GTM motion

Choosing the right sales strategy is a key component, with options including self-service, inside sales, field sales, and channel models. The sales motion must match the price point (ACV) and complexity.

- Sales-Led: High touch. It requires demos and sales enablement with sales enablement tools. It works best for Enterprise deals >$10k ACV.

- Product-Led Growth (PLG): Low touch. The product sells itself, and users get value before they pay to attract customers at scale.

- Product-Led Sales (PLS): Hybrid. You can use PLG to acquire users cheaply, then use sales reps to close enterprise tiers once usage data indicates high intent.

Step 4: Defining distribution channels

It’s tempting to try and be everywhere, but diluted effort yields zero results. That’s why I execute one channel perfectly before diversifying. Your distribution strategy should identify the specific marketing channels through which customers will buy, whether through direct or indirect sales.

“Channel-Market Fit” focuses the GTM template on high-intent marketing channels. I ask where the audience congregates and meet them there.

For your own strategy, focus on high-intent channels to see initial traction.

If targeting developers, go to HackerNews or StackOverflow. If targeting HR directors, go to LinkedIn or SHRM. For B2B distribution, LinkedIn Ads generate a 113% ROAS, outperforming Google Non-Branded Search (78%).

Your end goal should be to balance inbound and outbound marketing efforts:

- Content/SEO: This builds high trust and has slow burn. But keep the distinction between content marketing vs product marketing in mind. Content marketing brings in (Top of Funnel), while product marketing helps switch (Middle/Bottom of Funnel).

- Paid/Outbound: Fast results, zero equity buildup. Paid channels stop working the moment you stop paying. I generally prefer this channel to validate messaging quickly before investing in SEO.

- Programmatic SEO: Build landing pages for “Alternative to [Competitor]” to capture high-intent search traffic and move prospects through the sales funnel.

- Marketplaces and partners: I borrow other people’s audiences. A robust market development strategy includes listing on marketplaces like Salesforce AppExchange to gain instant credibility and enter a fresh market.

Step 5: Planning the launch

The product launch is just one moment in time, but it’s a collection of multiple actions you have taken before that required careful orchestration. I use a product launch checklist to ensure nothing gets missed during the product launch process.

Preparing for a launch involves organizing promotional campaigns, making sure your customer support is ready, and equipping teams with sales enablement tools. Coordination between product development teams, marketing, sales, and support is mandatory to keep everyone on the same page and can significantly enhance the effectiveness of your launch.

I create a product launch timeline that gives space for beta testing. A GTM can lead to faster and more efficient launches by setting clear roles, processes, and milestones. I also test the product with real users before the big day, using beta testing feedback forms to catch bugs and usability issues.

Step 6: Activate and retain (the secret layer)

This is the secret layer I was talking about. A lot of market strategy templates will stop at the launch, but acquiring a user is meaningless if they do not stick around. Your GTM strategy should include a specific plan for user activation which is the moment the user realizes the value of the product. And you need to get them there as fast as possible.

For instance, if a user needs to watch 3 videos to just understand your product, they will churn. Instead, try to shorten time-to-value by following user onboarding best practices.

Here is how you can do it.

Step 6.1: Designing the user onboarding flow

Instead of sending users directly into an empty dashboard, I generally use in-app guides that help them discover new features.

Note: Add a visible SKIP button for these guides so people who want to explore manually don’t get annoyed by the forced prompts.

The Activation Toolkit includes:

- Interactive walkthroughs: Avoid video here. Instead, use interactive user guides that encourage the user to click the relevant buttons to proceed. This builds muscle memory right from the start.

- Checklists: Use the “Zeigarnik Effect.” A progress bar motivating a user to “Finish Setup” drives completion. You can build these into your apps using a checklist builder.

- Personalization: Personalize content based on role. A marketer needs a different onboarding path than a developer. So, ask for a user’s role in a welcome survey, then segment the onboarding flow accordingly to reach each market segment.

- In-app resource centers: Instead of forcing users to leave the app to read documentation, you can embed a resource center directly in the UI for on-demand help and build stronger customer relationships.

Step 6.2: Iterating based on feedback

A strategy will remain a hypothesis until you actually test and validate it. That’s why you should establish a feedback loop that allows you to iterate quickly and measure key performance indicators. A GTM strategy should include clear goals and KPIs to measure success and make data-driven adjustments throughout the launch process.

Maintain and review a “GTM Scorecard” weekly to understand performance before running out of runway.

Step 6.3: Tracking revenue-first metrics

Vanity metrics like pageviews and social likes may show you growth without affecting your bottom line in any way. Instead, setting measurable targets like Customer Acquisition Cost (CAC) and conversion rates helps track performance effectively. Begin focusing on GTM metrics that verify business health and align with business objectives:

- CAC vs. LTV: I aim for an LTV:CAC ratio of 3:1 or higher. Lower ratios indicate acquisition costs are too high or churn is eating into customer lifetime value.

- Activation rate: This is the percentage of signups reaching the “Aha!” moment. Establishing clear metrics such as adoption rate, revenue, and retention is crucial for tracking success. Only 34% of product-led companies track user activation rates, leaving a major blind spot in value realization.

- Churn rate: This is the primary indicator of product-market fit failure. High churn means filling a leaky bucket.

- Net Revenue Retention (NRR): Ideally, this should be >100%. An NRR above 100% means the business grows even without acquiring a new customer segment.

If you want to effectively monitor these critical metrics in one place, the best practice is to use Userpilot’s analytics dashboards. You get real-time visibility into activation rates, retention patterns, and revenue metrics so you can make data-driven decisions without switching between multiple tools or manually compiling reports from different sources.

Step 6.4: Iterating based on qualitative data

Quantitative data tells you what is happening, but you still need to know the why behind it. Qualitative data helps with that and reveals key metrics for improvement.

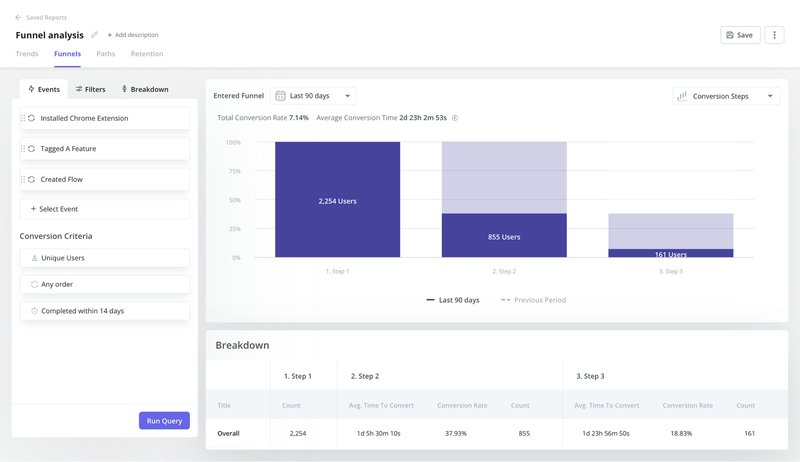

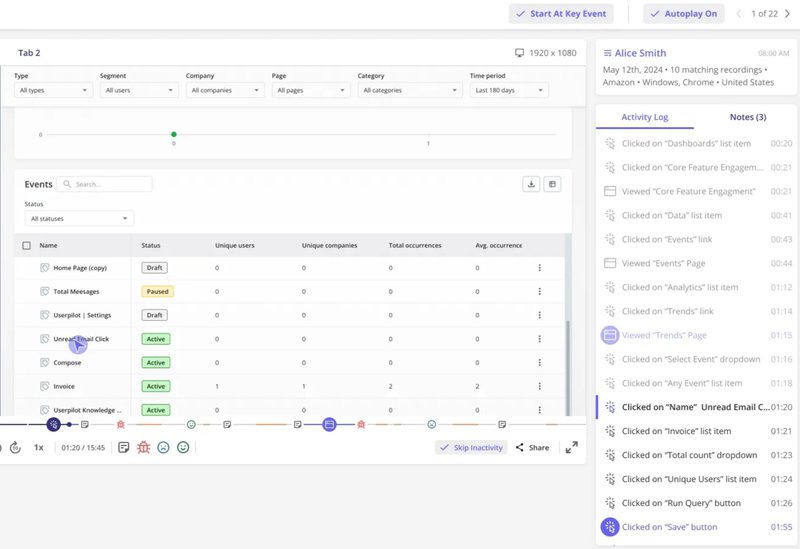

Use funnels to identify where users drop off and add session replay data to understand the reason. For instance, when you watch a real user struggle to find the “Settings” button, it often reveals a solvable friction point. On the other hand, if you had only seen the drop off from the dashboard, you’d never know what to actually fix.

Prioritizing these insights pays off: companies with Net Revenue Retention >100% grew nearly 2x faster than their peers in recent benchmarks and built stronger brand loyalty with their customers.

Building a repeatable GTM engine

A GTM strategy is a living engine rather than an archived document.

Markets keep changing, competitors adapt, and customer expectations rise. The strategy must be agile enough to pivot based on collected data while maintaining focus on success metrics and marketing goals. This approach helps businesses save money by reducing unnecessary spending on processes that do not help meet goals, leading to more strategic and focused allocation of resources.

So, stop planning in a vacuum. Use this GTM strategy template to build a repeatable engine that turns strangers into customers and leverages word of mouth marketing for growth.

Prioritize the “Who” to avoid wasting ad spend. Clarify the “What” to stand out even in a market oversaturated with competitors. And most importantly, master the “Retention Layer” to build a business that lasts and generates high sales volume. The market doesn’t need another feature; it needs your solution delivered effectively.

Now, go launch a successful product launch.

Want to make your GTM strategy more robust? Book a free demo with Userpilot to see how you can build activation flows, track retention metrics, and iterate based on real user behavior.

FAQ

What is the difference between a GTM strategy and a marketing strategy?

A GTM strategy defines how a product reaches customers and wins market position, and includes pricing, sales motion, distribution channels, and customer onboarding. Marketing strategy focuses specifically on promotion, awareness, and lead generation. GTM is the overarching system; marketing operates as one component within that system.

How long does it take to execute a GTM strategy?

Execution timelines depend on the sales motion and price point. Product-led growth (PLG) motions can show results within 30-60 days while sales-led motions for enterprise customers typically require 6-12 months for immediate success. The average B2B customer journey spans 192 days from first touch to closed-won and requires sustained effort across multiple touchpoints before conversion.

What metrics should you track for GTM success?

Focus on tracking revenue-first metrics: LTV:CAC ratio (aim for 3:1 or higher), activation rate (what percentage of users reach their “Aha!” moment), churn rate (monthly or annual), and Net Revenue Retention (ideally >100%).

What's better, product-led or sales-led GTM motion?

What’s better, product-led or sales-led GTM motion?

The GTM motion should match the price point (ACV) and product complexity. Sales-led works best for enterprise deals >$10k ACV requiring demos, customization, and long sales cycles. Product-led growth works for lower ACV products where users can experience value before paying. A hybrid approach is product-led sales (PLS) which combines both: PLG to acquire users cheaply and sales teams to close enterprise tiers once usage data indicates high intent.

How do I validate my ICP before spending on acquisition?

Analyze existing “Power Users” who log in daily and never complain about price. You can use customer segmentation analytics to identify common patterns in company size, industry, tech stack, and behavior. Conversely, I identify the “Anti-Persona” (users who churn within 30 days) and exclude them from targeting to save sales resources. I run small-scale tests with paid channels to validate messaging before scaling spend.