Asking the wrong product survey questions can have severe consequences. You don’t get the insights you need to make informed decisions and undermine customer trust. If they’re confused by your surveys, they will simply stop responding to them.

We’ve created this guide to help you avoid this.

In this article, you will find 16 product survey question examples along with their rationale and ideas on how to use the user feedback. We also share five best practices for writing survey questions and answer a few FAQs.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

16 product survey questions for collecting valuable feedback

Let’s get down to the 16 product survey questions I’ve hand-picked for you.

1. What is the primary problem our product solves for you?

This question helps you understand the main issue or challenge your users are trying to solve with your product.

Why ask this question: Knowing the specific problem your product addresses keeps your team focused on what matters most to customers. If you’re solving a real pain point, users are more likely to stick around.

How to use the insights: Use this info to inform your product roadmap and refine your product messaging. Prioritize features that help users achieve their goals and highlight the key benefits that resonate with users.

2. How satisfied are you with our product overall?

This is the go-to question if you want to measure customer satisfaction with your product.

Why ask this question: Overall satisfaction gives you a big-picture idea of how your product is performing in the eyes of your users. High satisfaction means your product satisfies their needs and offers a positive customer experience, while low satisfaction signals there are areas to improve or users start leaving.

How to use the insights: If satisfaction is high, follow up with users to understand what contributes to it and double down on whatever works. And ask for reviews or testimonials. If it’s low, focus on the specific user pain points to find out how you can resolve them.

Also, use the responses to calculate the customer satisfaction score so that you can track fluctuations over time.

3. How easy is it to use our product?

By asking this question, you can measure how user-friendly your product is.

Why ask this question: No one likes a complicated product. If users find it difficult to complete their tasks, they’ll flood your support team with questions. Or worse, give up and churn.

How to use the insights: If you hear complaints about usability, use product analytics and run usability tests to identify the root causes. For example, watch session recordings or study heatmaps to find confusing UI elements.

4. Which features do you use the most frequently?

This question helps you identify your killer features.

Why ask this question: Knowing which features bring the most user value allows you to prioritize your backlog items and allocate resources to initiatives with the highest ROI.

How to use the insights: Double down on the popular features by making them even better and consider sunsetting functionality that doesn’t deliver.

5. Are there any features you find difficult or confusing to use?

This question can shed light on specific usability issues or clunky features.

Why ask this question: If people are struggling to use certain features, they aren’t getting the full value out of your product, which will undermine your retention efforts.

How to use the insights: Use this feedback to simplify or redesign any confusing functionality. In the meantime, design in-app flows, like walkthroughs, and support resources to help users overcome the challenges.

6. What is the most frustrating aspect of using our product?

Responses to this question point out what frustrates customers about your product.

Why ask this question: Frustration, like any other negative emotion, reduces user satisfaction and ultimately leads to churn. By identifying the biggest annoyances, you can implement proactive measures to prevent it.

How to use the insights: Bring fixing the frustrating parts of the user experience to the top of your backlog. Investigate the issue and look for the most effective and creative way to resolve it.

7. If you could change one thing about the product, what would it be?

This asks users for their top suggestions for improvement.

Why ask this question: User requests can help you build a product that addresses user needs and offers a positive experience.

How to use the insights: If multiple users suggest the same thing, that’s a clear sign it’s an issue worth looking into. The responses can also help you prioritize your backlog items.

8. Which feature do you think we should prioritize for development?

This question asks users to help you decide which feature to focus on next.

Why ask this question: Getting user input on feature development ensures you’re building things they actually want, which means less wasted effort.

How to use the insights: Use this feedback to guide your product roadmap. If many users request a specific feature, that’s a clear priority.

9. Are there any tasks you wish our product could automate?

This question helps you identify aspects of users’ daily workflows that they want to automate.

Why ask this question: Automation can improve productivity and reduce the risk of errors, which translates into higher monetary product value. So, accommodating the requests may increase the attractiveness of your product.

How to use the insights: If multiple users request automation for the same task, look for the most efficient way to add it. Sometimes, it can be by building it from scratch, sometimes—by integrating with a 3rd-party solution.

10. How has using our product impacted your team’s efficiency?

This asks how the product is helping teams work more efficiently.

Why ask this question: Efficiency is a key factor that either accelerates business growth or stifles it. If your tool helps users complete their tasks in less time and use fewer resources, they can allocate them to other value-added activities, which increases the value of your product.

How to use the insights: If users are seeing significant efficiency gains, you’ve got a solid selling point. Make sure it’s in all the marketing and sales-enablement resources. If not, dig into what’s slowing users down and make improvements.

11. How has our product helped you achieve your business goals?

This question measures the real-world impact your product has on your customer business objectives.

Why ask this question: If your product is helping customers hit their targets, it shows you’re delivering genuine value. This boosts customer retention and their willingness to pay, for example, for premium functionality.

How to use the insights: Use these responses as case studies or testimonials to attract similar users. If users don’t see a clear benefit, follow up with them to understand where the product is lacking and how to better align it with their needs.

12. How would you rate the value for the price of our product?

This question gauges whether users feel they’re getting their money’s worth.

Why ask this question: If customers think your product is overpriced, they might leave for cheaper alternatives. Understanding their perception of value helps you adjust your pricing strategy and positioning.

How to use the insights: If customers feel the product is too expensive, consider adding more value through extra features or support. On the flip side, if they’re happy with the price, use that info to drive account expansion and reinforce your product’s value in your marketing campaigns.

13. How does our product compare to other similar tools you’ve used?

This question helps you see where your product stands against competitors.

Why ask this question: Understanding how users view your product compared to others gives you insight into what you’re doing well and where your competitors might have the edge. It’s also a chance to identify underserved user needs.

How to use the insights: If users prefer your product, emphasize those strengths in your marketing. If they favor a competitor, follow up to understand why and look for opportunities to improve.

For example, if they offer features that you don’t, consider adding them to your roadmap.

14. Why did you choose our product over competitors?

This question focuses on the factors that led customers to choose your product.

Why ask this question: Knowing what tipped the scales in your favor helps you emphasize your strengths and refine your unique selling points (USPs).

How to use the insights: Use these answers to refine your product’s positioning. Highlight the features, advantages, and benefits that customers consistently mention as reasons for choosing you.

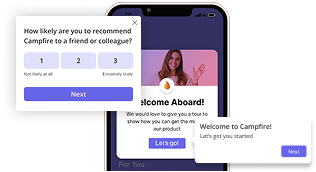

15. How likely are you to recommend our product to a colleague or friend?

This is the classic Net Promoter Score (NPS) question, measuring customer loyalty and willingness to recommend.

Why ask this question: A high NPS indicates satisfied users who could become brand advocates, while a low score is a red flag signaling that you’re failing to deliver value.

How to use the insights: A high NPS is a great opportunity to ask for testimonials or case studies. If it’s low, follow up to find out why and use that feedback to make targeted improvements.

16. Is there anything that might cause you to stop using our product in the future?

This question uncovers potential risks that could lead to churn.

Why ask this question: It’s always better to address issues before they escalate. By knowing what might cause dissatisfaction, you can proactively make changes.

How to use the insights: If there’s a recurring reason users might leave, make it a priority to fix. Whether it’s a performance issue, a missing feature, or a pricing concern, tackle it head-on to save customers from churning.

Tips for writing great product feedback survey questions

Have you found the survey questions you need above? If not, here are a few tips on how to write your own.

Avoid asking double-barrelled questions

Double-barrelled questions are confusing and skew the results.

Look at this one:

- On a scale of 1 to 5, how satisfied are you with the product performance and customer support?

The question is faulty because it asks the user about two different aspects of the product. If the user is extremely satisfied with the performance but extremely dissatisfied with the support, there’s no good answer to this question.

Breaking it down into two questions solves the problem:

- On a scale of 1 to 5, how satisfied are you with the product performance?

- On a scale of 1 to 5, how satisfied are you with customer support?

Translate survey questions in multiple languages to increase response rates

English is the language of international business; many SaaS businesses use it as a default language for their products.

With such a high prevalence of English, it’s easy to forget about users who don’t speak the language as their native tongue, which is a mistake, especially when it comes to surveys!

Here’s why:

First, surveys in your customer’s native languages provide more accurate and in-depth insights. That’s because users can understand the questions better and express their ideas more accurately.

Moreover, localized surveys have higher response rates. Questions in a foreign language add friction to the survey, and users may not have the time or confidence to tackle them. This introduces non-response bias to the survey results.

Finally, localized content increases customer loyalty. People truly appreciate it if you make the effort to use their language.

Except that it takes no effort because many feedback tools, Userpilot included, allow you to translate them automatically for your users.

Ask follow-up open-ended questions for deeper insights

Responses to close-ended questions, like multiple choice or rating ones, are easy to interpret. You can quantify them and use them to track trends over time.

However, they don’t do much to help you understand the ‘why’ behind feedback. Consequently, the results are often inactionable.

The solution?

Follow-up with open-ended questions.

For example, after asking, “How satisfied are you with the new feature?” follow up with “How could we improve this feature?”

Two things to bear in mind here:

First, open-ended questions take more time and effort to answer, so users may want to skip them. Give them the option to do so. Otherwise, they may not submit the survey at all. Quantitative insights only are still better than no insights at all.

Also, open-ended responses take more time and effort to analyze. Pick a feedback tool that allows you to tag such responses to organize and group them, for example, by specific features they mention.

Provide context wherever necessary in product feedback surveys

Context, or lack of it, can also affect user engagement with your surveys.

Look at these two questions:

- “Will you participate in our beta testing program?”

- “Will you participate in our beta testing program? We are launching a new feature and would like to invite a select group of users to participate in our beta testing program to gather feedback before the official release.”

Which of them are you more likely to respond to?

I bet the second one.

Asking “Will you participate in our beta testing program?” without context leaves respondents unsure about what they’re signing up for.

When you add the context, your users understand the purpose of the beta test and how their involvement will help improve the new feature.

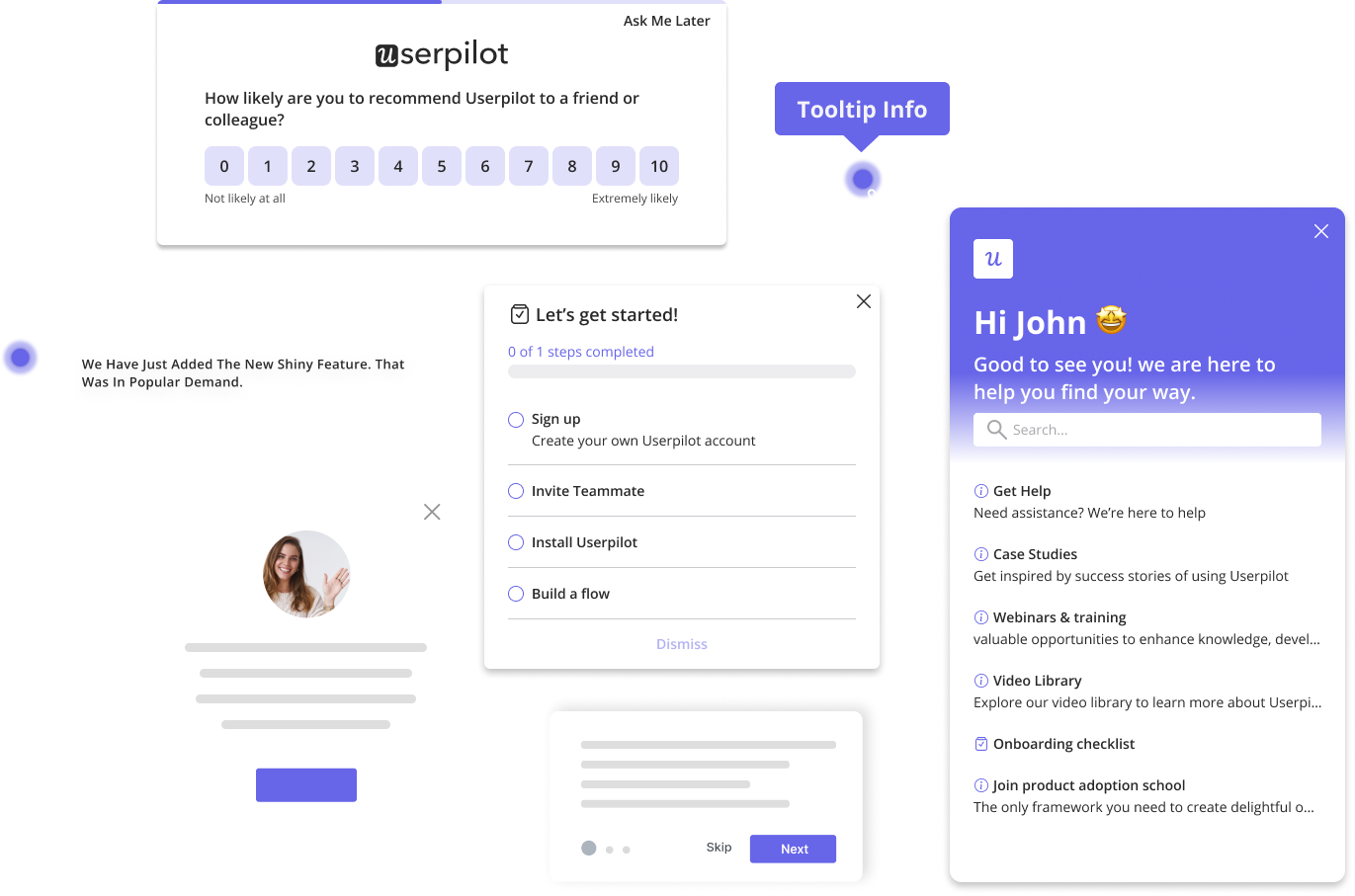

Pay attention to the visual elements of product surveys

The visual design of your product surveys can impact user engagement and completion rates. A well-designed survey looks professional and creates a smoother, more enjoyable experience for respondents.

Here are a few tips:

- Use your brand’s colors throughout the survey to create a cohesive and familiar look. This reinforces brand recognition and trust.

- Add a progress bar to reduce drop-offs by showing respondents how far along they are. It provides a sense of accomplishment and encourages them to finish the survey.

- Position your survey in a prominent place within your product or website to catch their attention. For example, embed in a pop-up modal or slideout.

- Avoid cluttering the survey with too many elements or long blocks of text. Use white space to separate questions.

- Stick to readable fonts and maintain a consistent font size throughout the survey. You don’t want your respondents to struggle to read questions, especially on mobile devices.

Conclusion

Running customer surveys only makes sense if you ask the right questions. The selection of product survey questions examples above allows you to investigate various aspects of the product performance and identify opportunities for improvement.

If you’d like to learn how Userpilot can help you run in-app surveys and gather actionable user insights, book the demo!

FAQs about product survey questions

To wrap up, here are responses to 3 frequently asked questions—about product survey questions, of course.

What are product survey questions?

Product survey questions are questions used to gather feedback from potential and existing customers about a product.

These questions are designed to assess various aspects of the customer experience, like its usability, functionality, or customer satisfaction.

For example, questions can ask users how easy the product is to use, which features they find most valuable, or what could be improved.

By asking such questions, you can gain valuable insights into customer expectations and needs, which is essential for informed product development.

How to make a survey for a product?

Always start creating product surveys by defining your goals. Are you testing a new feature? Or do you need to understand overall user satisfaction?

Begin by selecting a mix of question types, such as multiple-choice, Likert scale, and open-ended questions, which allow for a range of feedback.

Ensure that your questions are clear, concise, and specific to the product. For example, ask users to rate their satisfaction with a specific feature or describe any challenges they encountered.

Once the survey is ready, distribute it through appropriate channels like in-app, email, or social media to reach your target audience.

What are the different types of product surveys?

There are several types of product surveys that serve different purposes throughout the product lifecycle.

For example, welcome surveys help you segment your users based on their needs and personalize their experiences, and onboarding surveys give you insights into the effectiveness of your onboarding process.

Customer Satisfaction Surveys (CSAT) measure how satisfied users are with a product, Net Promoter Score (NPS) surveys assess how likely users are to recommend the product to others, while Customer Effort Score (CES) surveys focus on how easy the product is to use.

Finally, cancellation surveys capture feedback while the user is leaving and help you understand the reasons for churn.

Each survey type helps gather targeted feedback to improve various product aspects.