![What are Customer Insights [+ Examples and Best Tools] cover](https://blog-static.userpilot.com/blog/wp-content/uploads/2023/10/what-are-customer-insights_d5b0926c8a80949116eed98bcd38ebb2_2000-450x295.png)

Customer insights provide intelligence and analysis about customer experience, activities, and preferences. Therefore, they are vital for effective product strategies and ensure resource allocation aligns with customer needs.

That said, let’s go over what type of data you can collect and explore some customer insights examples you can learn from.

What are customer insights?

Customer insights are deep interpretations of customer’s actions, preferences, and needs based on a wide set of user data.

For this, data is collected from various sources like purchase history, social media interactions, customer surveys, etc. It offers a detailed understanding of your customers, which is necessary to develop effective product strategies, enhance customer experiences, and ultimately drive product growth.

Why should you collect customer insight?

When it comes to creating a product strategy, collecting customer insights is essential to answer important questions about your users and how your product fits their needs.

So as a product manager, a customer insight strategy can bring many benefits to the table:

- It informs your decision-making so it can align with your customer’s preferences and desires.

- You can tailor your products and services to meet user’s individual needs.

- It guides feature development and app roadmap so you can keep enhancing your product.

- Provides the means to improve customer satisfaction and retention by creating a product with market fit.

- It helps you come up with tactics like re-engagement strategies to bring inactive users back.

9 Types of valuable customer insights to collect across the customer journey

Let’s explore nine types of data you can collect that can bring valuable customer insights to the table:

Market research

Market research data involves every type of intelligence about your target audience, competitors, and your position in it. It provides insights into the market size, growth potential, and avenues for product development.

This type of customer insight is incredibly valuable when defining your product management strategies, as it can identify gaps, competitive advantages, growth areas, and, most importantly, your customers’ needs.

How to collect market research data?

Conducting market research involves pooling data from a variety of sources, including:

- Industry and market research reports, as they usually offer a comprehensive examination of the market’s size, competitors, trends, and opportunities.

- Census data adds a layer of depth to your market’s demographics. And it is useful for learning facts about your audience’s common behavioral patterns, demographic profiles, and preferences.

- Digital channels like Google trends, audience research tools, and search volume data. They serve as viable sources of “search demand” and popular trends related to your industry.

- User persona surveys, where you can ask your customers about their professional info, company, jobs-to-be-done, and pain points. Thus, allowing you to tailor products, services, and experiences that meet the needs of your target market.

Customer behavior

Customer behavior data is, essentially, the collection of all user activities and transactions within your app. It revolves around what users do when they interact with your app, honing in on details such as the level of engagement, your app usability, and patterns in product usage.

This data is used to identify trends, opportunities, and pain points so you can address areas of friction and craft a more seamless user experience.

How to collect customer behavioral data?

There are multiple methods to gather behavioral data, such as the following:

- Feature tagging, which involves assigning tags to specific elements or features of your app, gives you the ability to track whenever a customer interacts with them.

- Event tracking, where you define the “server-side” events you want to track (a purchase, the submission of a form, or achieving a goal). Each time a user triggers an event, the system captures it so you can get a comprehensive view of the customer’s behaviors.

- Session recordings, which are video replays of the browsing sessions of your users. You can observe how they navigate your app, how much time they spend on different features, what they click on, and more.

Purchasing data

Purchasing data refers to the customer’s purchase behavior. In SaaS, it can offer more than just tracking every purchase, as it also involves upgrading patterns, decision-making processes, and the overall path to the purchase

With this data, you can find conversion drivers that influence users to purchase a plan or upgrade.

How to collect purchasing insights?

Collecting purchasing data usually involves tracking every transaction information, such as the plan, subscription, and type of products purchased, the retention of those purchases, and even the times these purchases are usually made.

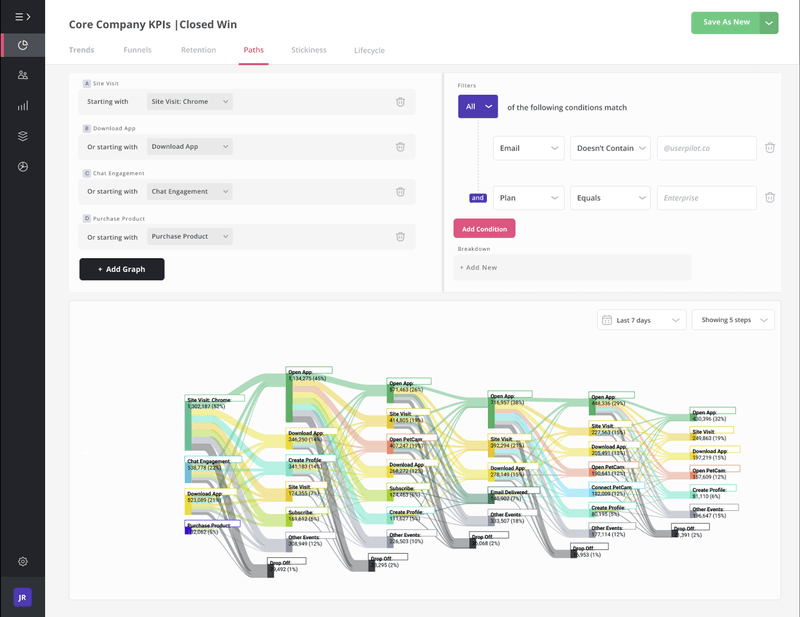

However, you can go deeper and use event tracking to trace the conversion path that leads to a satisfying purchase. This way, you can use path analysis to determine the “happy path” (i.e. the steps customers typically take starting from the entry point until they complete a transaction).

Customer sentiment

Customer sentiment data essentially revolves around the perspectives, emotions, and satisfaction levels your customers associate with your brand—whether positive, negative, or neutral.

Your business can leverage customer sentiment data to:

- Guide your product development to build an app that meets customer’s demands.

- Guide your product development to build an app that meets customer’s demands.

- Foster deeper customer relationships to enhance brand loyalty.

How to collect customer sentiment data?

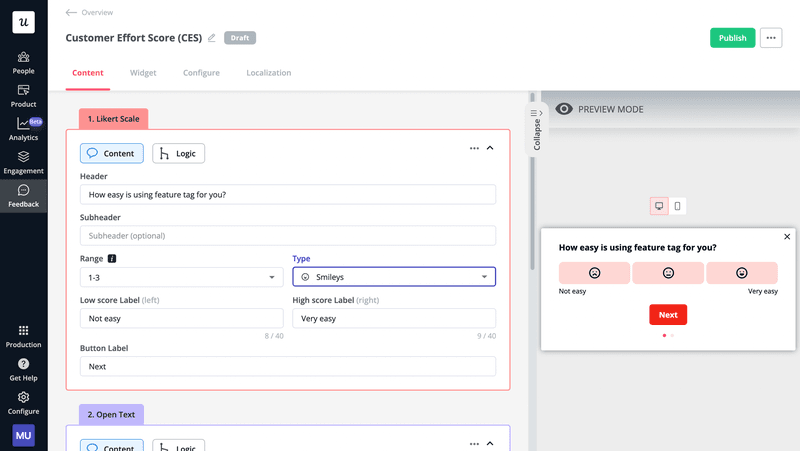

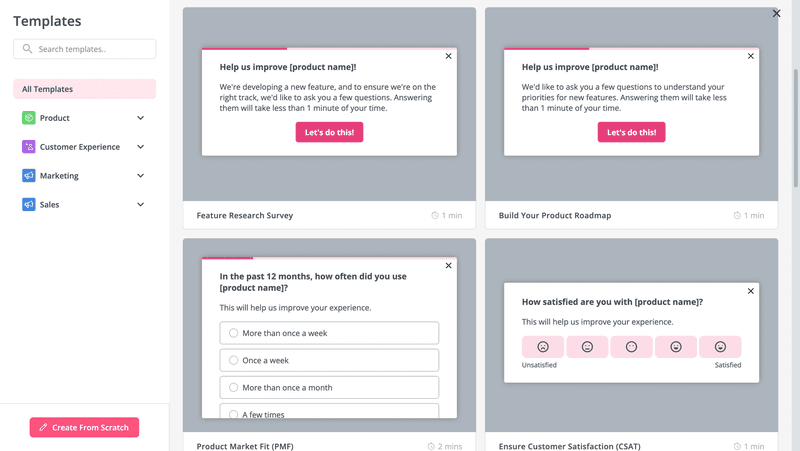

In-app surveys such as Net Promoter Score (NPS), Customer Satisfaction (CSAT), and Customer Effort Score (CES) are the best for collecting sentiment data.

Unlike other forms of feedback, these surveys use a variety of formats (Likert scale, star ratings, etc.) for qualitative feedback, are automatic, and can be triggered at different touchpoints or after specific user actions.

For instance, after a customer purchases an upgrade, you can launch an NPS or CSAT survey asking them to rate their experience. This allows you to measure the efficacy of your services in real-time and, even better, capture user sentiments when they are still fresh.

Customer feedback

Customer feedback is first-hand information about your customer’s experience and opinions about your brand’s products, services, or overall performance. And it comes in two forms: qualitative and quantitative data.

Qualitative feedback is inherently subjective and nuanced, it brings detailed insights into customers’ experiences, opinions, and emotions. On the other hand, quantitative feedback provides objective, measurable data that can be analyzed and compared using statistical analysis.

A combination of these provides a comprehensive understanding of your customers so you can make better decisions when it’s time to adjust your product strategy.

How to collect customer feedback?

The best way to collect a good balance of qualitative and quantitative feedback is through transactional and relational surveys.

Transactional surveys are typically triggered immediately after a key interaction has occurred within your app (i.e. ask about the buying experience after a user completes a purchase).

On the other hand, relational surveys assess the overall relationship and sentiment a user holds towards your app or brand. They’re often delivered at regular intervals (quarterly or yearly) and can include questions that gauge the likelihood of a user to recommend your app to others or their overall satisfaction with their experience.

Customer service data

Customer service data is derived from your customers’ interactions, behavior, and engagement with your customer support. It provides details about customer experiences, pain points, feedback, and the overall level of satisfaction with your service.

How to collect customer service data?

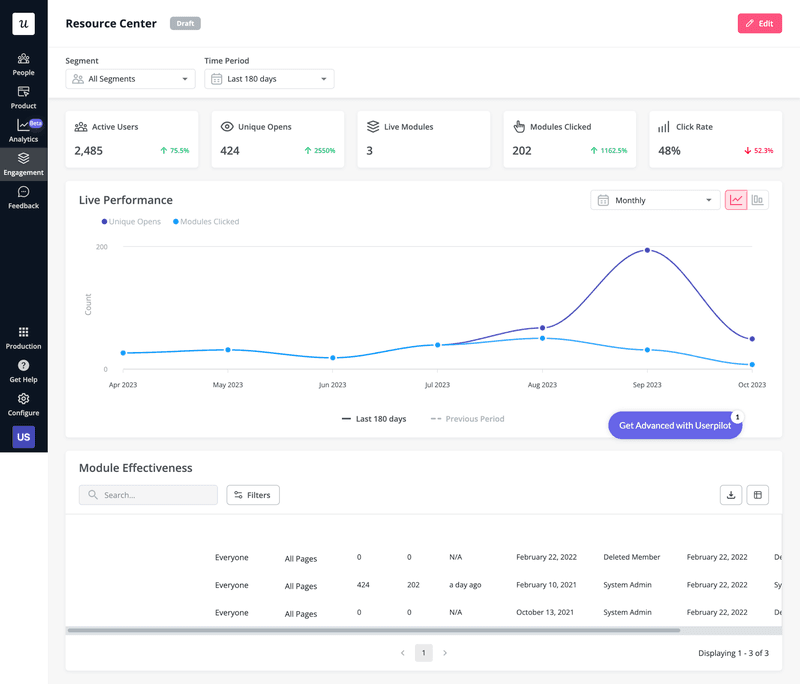

Customer service data can be sourced from multiple touchpoints including customer support calls, emails, social media interactions, live chat transcripts, and interactions with your knowledge base (like in the screenshot below).

This way, you can identify solutions that led to successful outcomes and incorporate them into your customer service processes.

Social brand mention

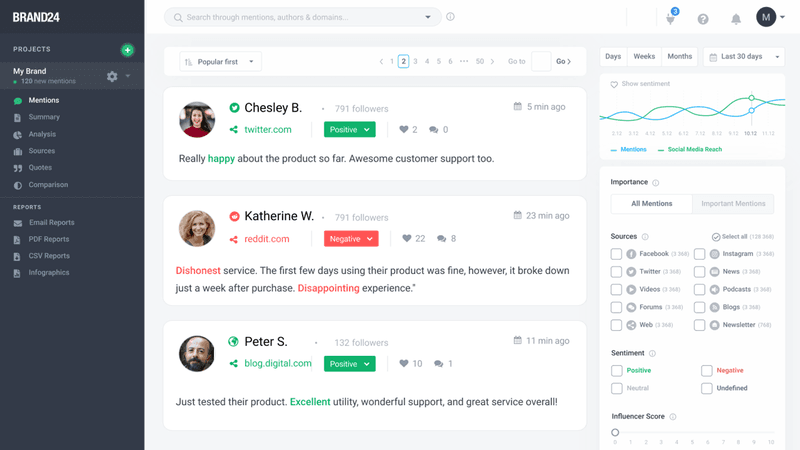

Social brand mentions tell you how your brand is perceived on social media platforms. It measures your customer sentiments based on online discussions about your product or service.

How to monitor social brand mentions?

Social listening tools give you eyes on the whole internet and are the best way to monitor brand mentions.

For example, with Brand24 you can collect brand mentions by simply adding keywords like your brand name and product names. Then, you receive an instant notification the moment those keywords are mentioned on social media platforms.

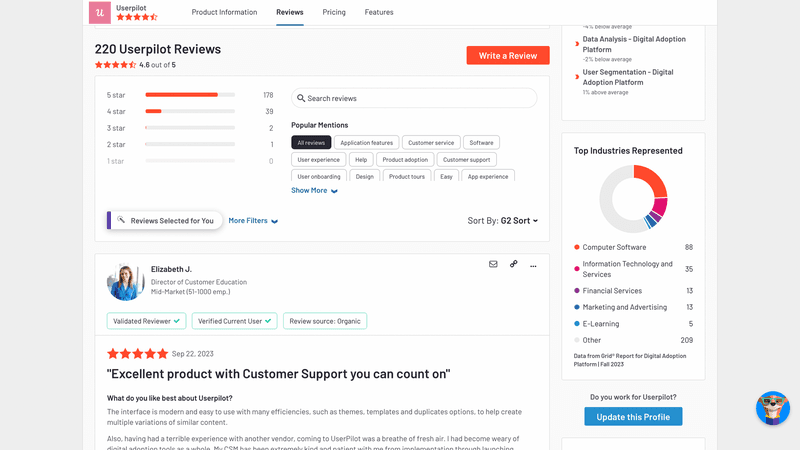

Online reviews

Online reviews provide insights into how your customers perceive your product or service compared to your competition. And they can highlight the attributes that customers value most, such as specific features, ease of use, customer support, pricing, and so on.

How to monitor online reviews?

The best source of online reviews will highly depend on your business model.

In SaaS, for example, your reviews on sites like G2 or Capterra are critical brand’s reputation and gaining valuable customer insights. This means setting up a profile for your company on these platforms will give you the opportunity to take in, process, and respond to what your customers are saying about your product or service.

Competitor reviews

Competitor reviews are any kind of data about your competitors that can tell you how your product or service fares against them. It can uncover areas where you excel or fall short and whether your product features are unique or just a ‘me too’ in the market (essential for product development, product management, and marketing).

How to monitor competitor reviews?

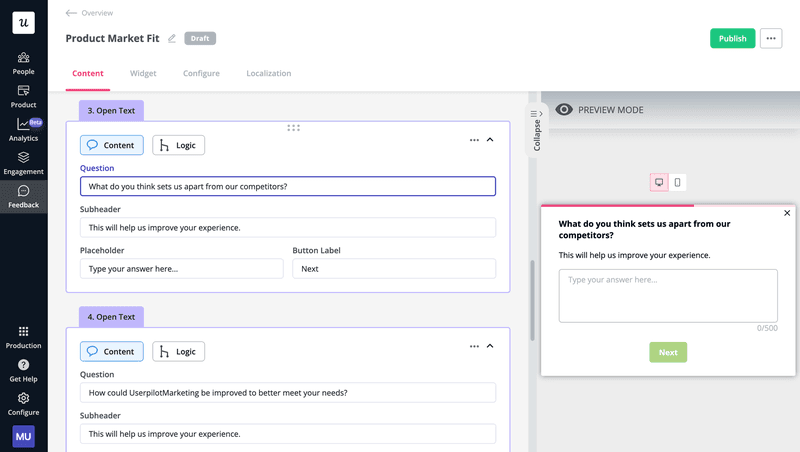

There are a few ways to monitor competitor reviews. One of them is through your own in-app surveys, where you can simply ask your customers why they’d choose your product over the other alternatives (like in the screenshot below).

Another method is simply watching over online reviews of competitors on sites like G2, Trustpilot, and even social media platforms.

Examples of how to leverage customer insights

After gathering all kinds of data and getting a deeper understanding of your customer needs, desires, and pain points, how can you capitalize on this knowledge, exactly?

Let’s explore some examples of how you can leverage customer insights to drive growth:

Use customer data to deliver personalized experiences

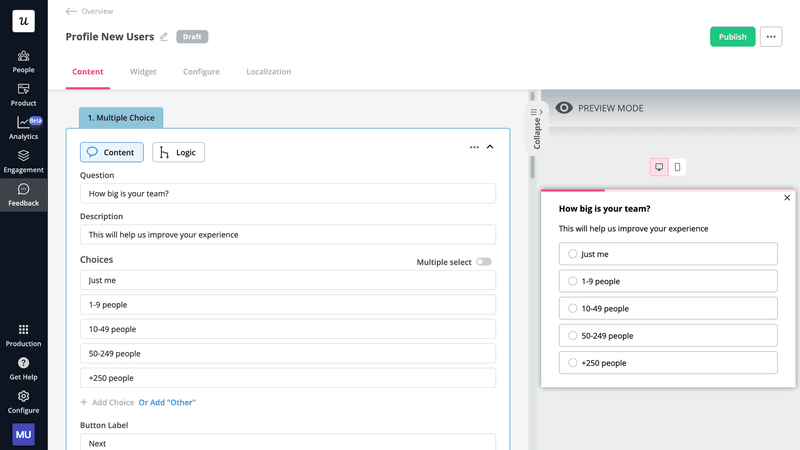

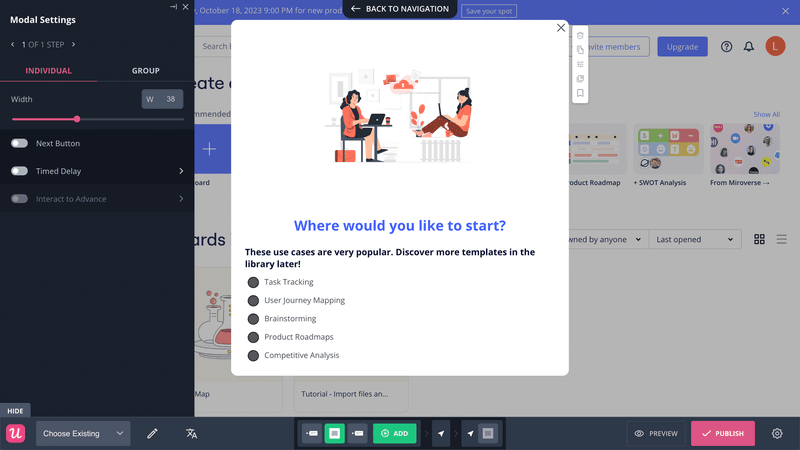

Welcome surveys are excellent for gathering actionable data about your customer base, such as their preferences, professional info, use cases, and expectations.

All you need to do is to trigger it the moment they access the app’s dashboard.

The magic happens when you use their input to personalize the product experience to match their needs and preferences. For example, when you trigger an onboarding flow that’s relevant to the user’s use case and goals—cultivating a sense of personal connection that improves customer engagement and retention.

Act on customer feedback to increase customer satisfaction

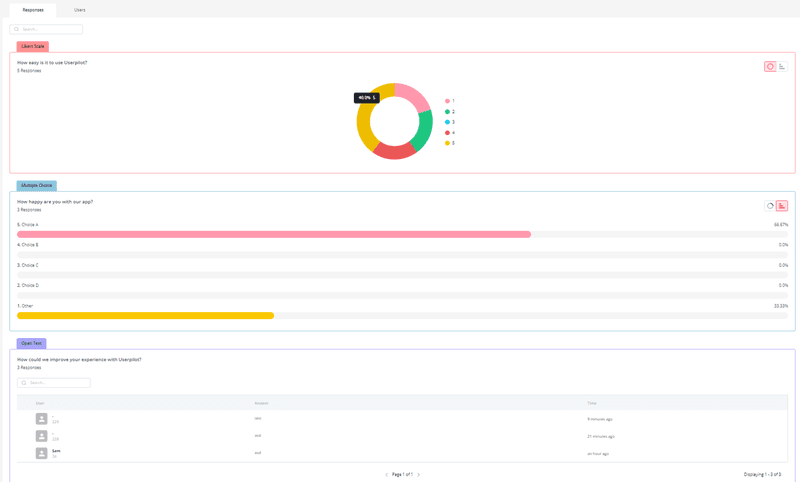

Surveys are a reliable channel to identify patterns and trends, as well as recognize problematic areas of your app.

However, collecting customer insights is useless if you don’t act decisively on the feedback. And with action, we mean more than just fixing bugs or making minor interface tweaks.

For this, consider addressing an underlying need that is not being met, just like matching your onboarding process with your user’s jobs-to-be-done (JTBDs) or developing a customer success strategy that leads users to their real goals.

Take time to actually listen to your user’s feedback and solve the root of the problem. Only then you’ll improve customer satisfaction.

Optimize conversion funnel to increase conversion rate

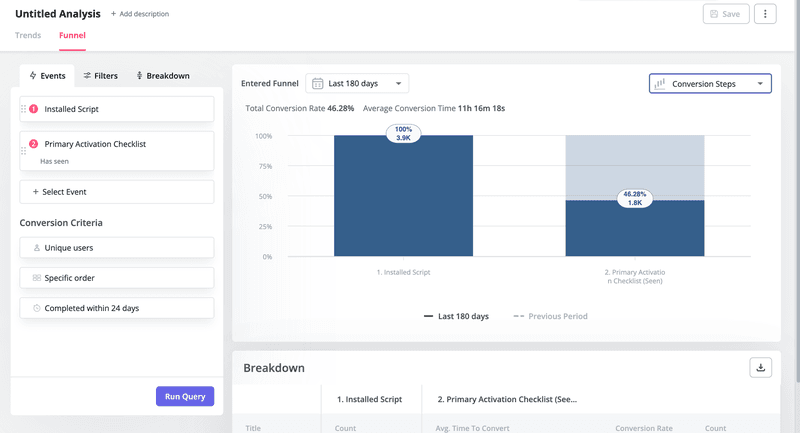

When collecting customer insights, event data becomes particularly useful for tracking each step involved in your conversion funnel, such as visited websites, in-app activity, and purchases.

This allows you to perform funnel analysis, where you can visualize your conversion funnel to identify drop-off points and areas of friction within the conversion process and then fix them (like in the screenshot below).

For instance, if a disproportionate amount of users are abandoning the checkout process on the payment page, this could indicate an issue with your payment methods, usability, or how you communicate your pricing.

Refine help documents and provide proactive support

As we covered earlier, analyzing and categorizing customer service data (such as support logs, queries, tickets, and user feedback) can provide a lot of insights that can help you enhance your process.

For example, if you identify a common issue or query among new users, you can create or update your help center resources and provide proactive support by:

- Making them easily available inside the product experience (with an in-app knowledge base).

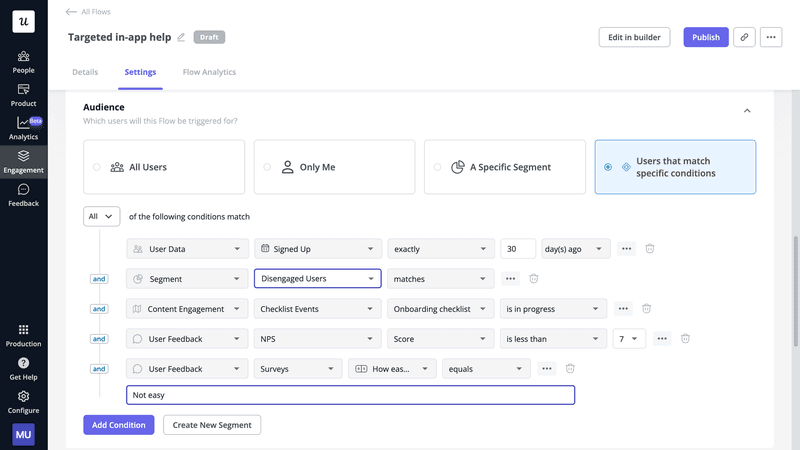

- Using segmentation to trigger contextual help to disengaged users (like in the screenshot below).

- Updating the onboarding flow to address common objections and questions before users even think about them.

By being proactive, you not only improve the in-app experience but also help reduce incoming support tickets relating to the same flagged issue.

Conclusion

Gathering customer insights is a necessity for most SaaS businesses. And those who take the time to get to leverage data to know their customers intimately are the ones who will remain competitive and profitable.

But as we said, you need the right tools to unlock these valuable insights. So why not book a Userpilot demo to see how you can upgrade your customer research game?