If you want to stay on top of customer needs and expectations and make informed decisions, you must collect customer feedback.

From this article, you will learn 11 ways to gather customer feedback about your SaaS product. I also share best practices for collecting feedback and show you what to do once you get the data.

11 methods for collecting feedback from customers

Before I share the methods to collect actionable feedback, it’s important to remember to collect feedback from the right people at the right time. No matter your chosen method, this approach ensures you’re setting yourself up for success (more about this in the video below).

With that out of the way, let’s explore the 11 methods for collecting customer feedback.

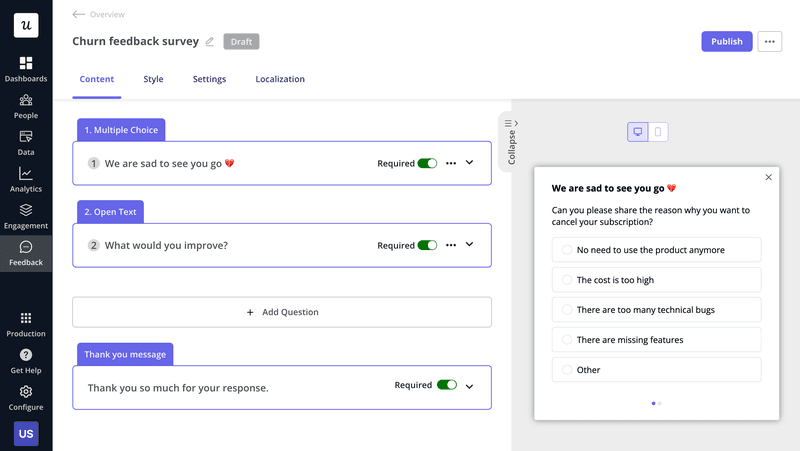

1. Surveys

Surveys are the backbone of customer feedback collection. They let you target specific user segments and gather valuable insights at scale.

Most product teams run customer feedback surveys in-app or via email. Both methods have their advantages:

- In-app surveys allow you to engage users (not B2B account administrators) when they’re actively engaging with the product and the experience is fresh in their minds. This increases response rates and feedback validity.

- With email surveys, you can reach inactive users, for example, to understand the reasons why they churned.

Popular survey types in SaaS include:

- Onboarding surveys.

- Net Promoter Score (NPS) surveys.

- Customer Effort Score (CES) surveys.

- Customer Satisfaction Score (CSAT) surveys.

- Product-Market Fit (PMF) surveys.

- Churn surveys.

How do you currently collect customer feedback from active users?

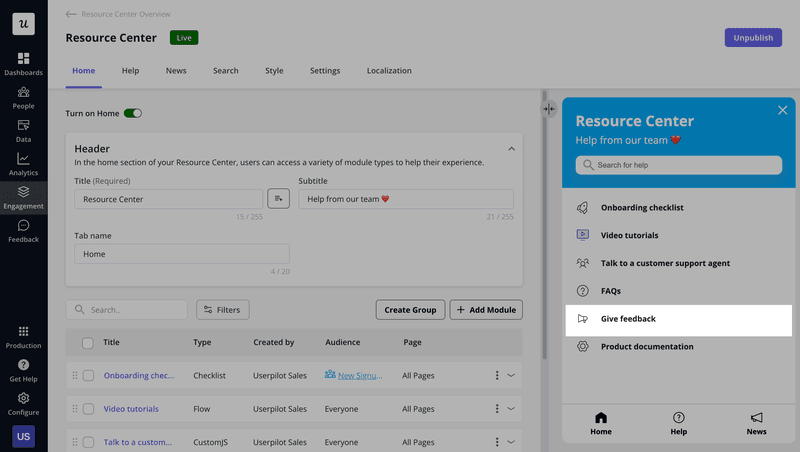

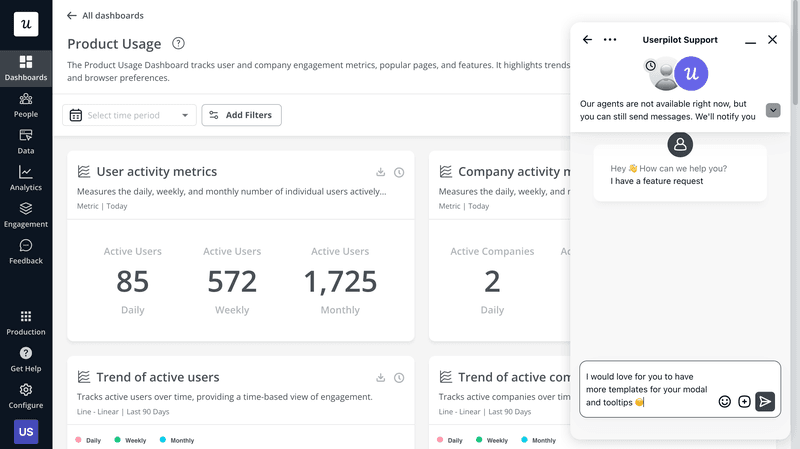

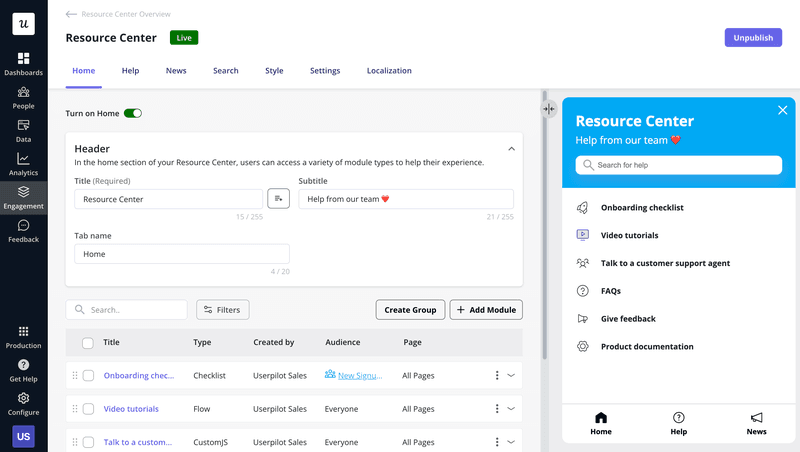

2. Feedback widgets

Feedback widgets are feedback forms accessible from the user interface on demand.

Use them to gather passive feedback and feature requests. Users can find the widget in the resource center and use it to submit their insights whenever they need to.

Passive feedback fills the gaps in the active feedback collected via surveys.

Think about it:

If the only way to submit feedback is a CSAT or NPS survey every 3-4 months, you will miss important insights that occur to users in the meantime. And you won’t be able to respond to urgent issues in time.

Also, your surveys sometimes appear at the wrong time, for example, when the user is working on an important task. To avoid disrupting their flow, they may dismiss the survey. A widget allows them to get back to it and submit their feedback when they have more mind space to think about it.

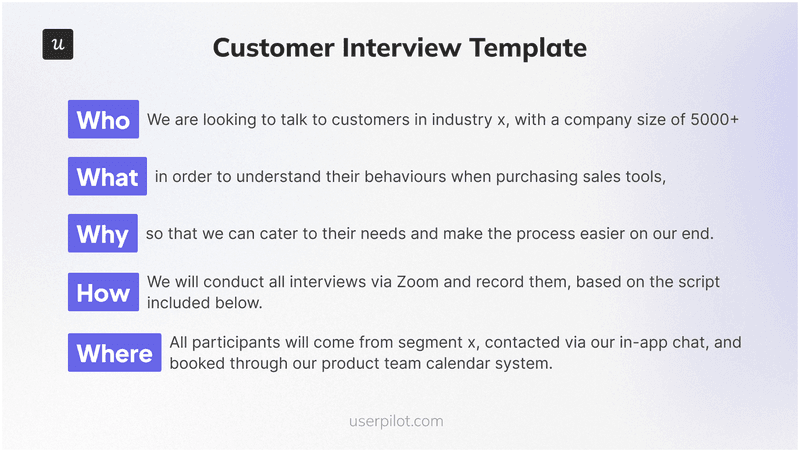

3. Interviews

Interviews are an excellent source of qualitative feedback, which you often can’t get from surveys. That’s because they are way more flexible. You can rephrase your questions or ask additional ones to drill down on ideas that come up but haven’t occurred to you before.

This applies to both individual interviews and focus groups.

Their main downside is that they’re difficult to scale even if you do them remotely. That’s why teams often conduct them as a follow-up to surveys.

For example, you could interview all your NPS detractors and/or users who bring up a particular problem.

4. User testing

User testing is a research method that looks into how users interact with a product or website.

The purpose? To identify usability issues and improve the user experience.

User testing can be moderated or unmoderated.

- In moderated tests, a facilitator guides the user through a task, asks questions, and observes their actions.

- In unmoderated tests, the user completes the task without any help. Their interactions are recorded and analyzed at a later time.

Modern user testing tools allow you to conduct both types of tests remotely and record both user actions and their faces. This gives a complete picture of how users respond to the product.

5. Customer behavior data

Tracking user behavior gives you objective insights into user behavior.

This is important for two reasons:

- Users don’t have a habit of reflecting on their behavior, so what they think they do sometimes differs a lot from what they actually do.

- Even if they know what they do, they can’t always explain it clearly.

The result? A skewed picture of what happens inside the product.

Product analytics solves this issue. One quick look at a session replay where the user clicks or scrolls, and their Paths can show you the exact sequence of actions they complete leading to an event.

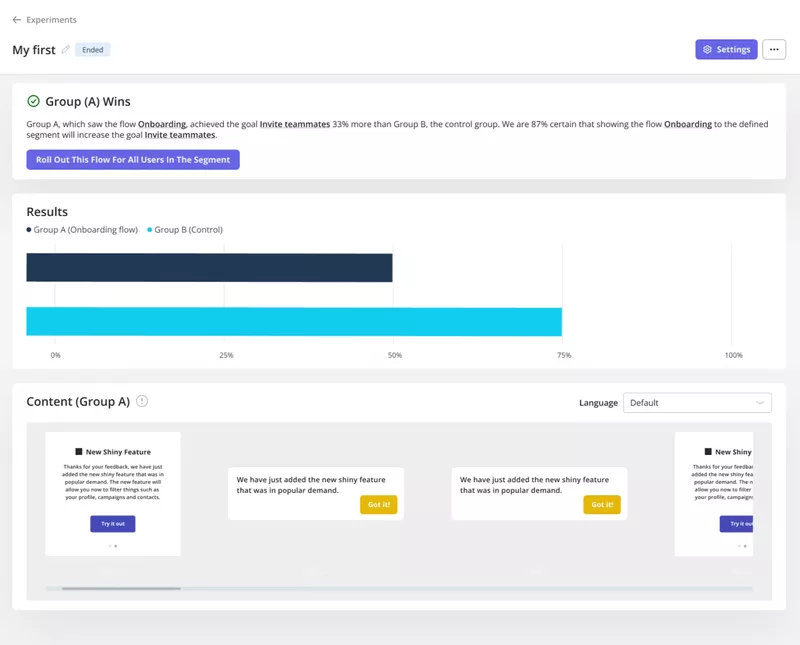

6. A/B testing feedback

A/B testing is another tactic used to collect customer feedback from user actions, not words.

Here’s how to do it:

- Split the test group into equal halves (hence the alternative name, split testing).

- Run two different versions of the same design, message, or feature in parallel.

- Measure user engagement, click-through rates, conversions, etc., and select the best-performing one.

Multivariate tests work in the same way, but you can test multiple variables at the same time.

Userpilot customers use split testing to optimize the design of their in-app onboarding flows and tweak their microcopy.

7. Social media monitoring

Users often choose to share their feedback about the tools they use with their followers on social media.

Such feedback is sometimes raw and unfiltered and, as a result, can offer you very genuine insights.

What’s more, tracking user feedback on social media allows you to engage with unhappy customers. This not only lets you find out how to improve their experience and satisfaction levels but also increases your credibility in the eyes of potential customers.

Positive feedback, on the other hand, can be used to add social proof to marketing efforts.

To track user feedback on social media, you need a social listening tool like Brand24 or Mention.

Such tools let you monitor all mentions of your product (or your competitors) on the web, analyze their overall sentiment, and identify common themes in feedback.

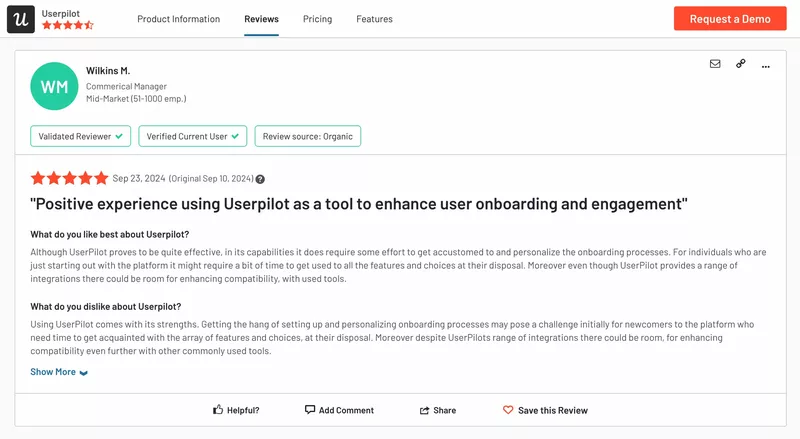

8. Online reviews

Online reviews on sites like G2 or Capterra help potential customers looking for software and companies. Thanks to them, customers can make better-informed purchasing decisions, and you also get insights into their pain points, needs, preferences, and expectations.

It doesn’t stop there.

You can also use them to assess the strengths and weaknesses of your competitors. Such understanding allows you to make better product development and marketing decisions.

For example, if users suggest the competitor lacks relevant features your product has, you can emphasize it more prominently in your marketing collateral.

9. Customer support interactions

What customers say to your customer service representatives and how they say it can reveal a lot about their attitude towards your product and the issues that are bothering them.

That’s why make sure to monitor and analyze:

- Support ticket data (categorize tickets based on the nature of queries to identify themes).

- Support call transcripts.

- Chatbot/live chat conversations.

But it isn’t just interactions with support or customer service teams that can be eye-opening. Your sales and customer success colleagues can also offer valuable insights.

The best part?

AI tools have streamlined the analysis of unstructured customer interaction data like phone calls or chats. So, there’s no need to sift through individual chats or transcripts.

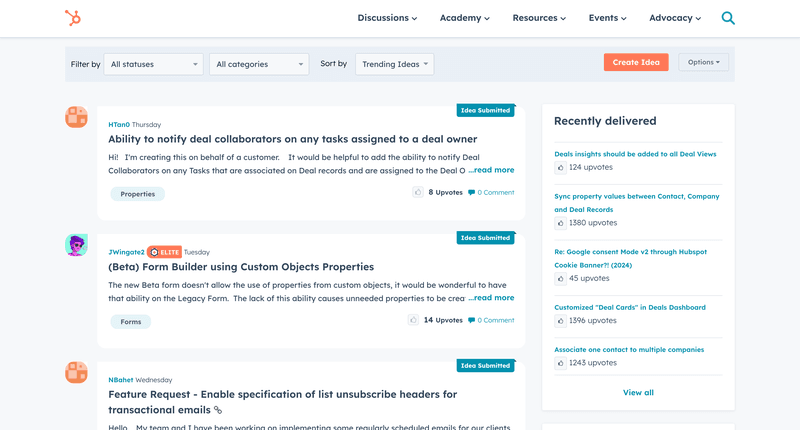

10. Community and forums

By monitoring user activity on community forums, you can often gauge customer satisfaction with your product and better understand their concerns or challenges.

For example, their questions can reveal recurring technical or usability issues or gaps in your onboarding and support materials.

What if you don’t run such a forum?

There are probably plenty of Reddit or Quora threads of your product. You can monitor users’ posts and comments on such forums using the social listening tools I mentioned above.

11. Feedback kiosks

Feedback kiosks aren’t perhaps the first method that comes to mind when you think about SaaS feedback.

However, they can still be useful.

Do you ever showcase your product at conferences or industry expos? Or organize live training events and meet-ups? If so, you can set up feedback kiosks to gather valuable feedback from attendees.

For example, you could use them to gauge the prospects’ perceptions after a product demo, gauge the reception of a new feature, or gather feedback about your product roadmap.

What to do after collecting customer feedback?

Collecting customer feedback is just the first step. Here’s what to do next.

Organize and categorize feedback

Organizing and categorizing your feedback helps you identify patterns and themes.

For example, you could divide customer insights into two buckets, positive and negative feedback, or categorize them by segments.

You can do it by exporting your feedback into a spreadsheet or database. Ideally, though, you want to work with a tool that allows you to do it without switching between tools.

With Userpilot, you can filter your feedback based on a wide range of user and account properties. For example, you can choose to see only feedback from users with a specific use case or those who have adopted a feature.

What’s more, Userpilot allows you to tag qualitative NPS responses for easy analysis.

Prioritize feedback based on urgency and impact

Once you filter and tag the feedback data, prioritize it.

First, do it based on your organizational goals.

For example, if you’re currently focusing on improving usability and functionality, like our customer Lavender, that’s what you start with.

Next, use more detailed criteria. Here, you can use one of the popular prioritization frameworks or create a scoring system reflecting your values.

I like to keep it simple at this stage, so use a matrix with two criteria: urgency and impact.

That’s how I quickly divide feedback into four categories:

- Highly urgent and highly important.

- Less urgent but highly important.

- Highly urgent but less important.

- Not so urgent or important.

And I tackle them in this order.

Communicate feedback with relevant stakeholders

Having prioritized the feedback, pass it on to the stakeholders.

You want this communication to be relevant. For example, if there are bugs, the development team must know. Bombarding people with information that they don’t need can lead to an overload and distract them from their key tasks.

At the same time, avoid creating silos by sharing only feedback snippets here and there. You still want teams to have a holistic view of what others are working on and where the product is heading for better alignment and resource allocation.

You should create a RACI framework outlining who should be Responsible, Accountable, Consulted, and Informed for/about each feedback item.

Take action on high-priority feedback

All of what you’ve just done will be pointless if you don’t act on the feedback, so it’s time to implement it.

What exactly you do depends on the issues you need to address.

Take your time here. Use problem-solving frameworks to get to the root cause of the problem.

For example, you may discover that users keep contacting your support teams about the same issues over and over again because your self-service support resources are lacking and not because there’s something wrong with the product.

Once you get to the bottom of the issue, don’t simply copy existing solutions. Look for innovative ways to solve your customers’ problems. That’s how you get ahead of the competition.

Close the customer feedback loop

While you’re doing all the work in the background, don’t keep your users in the dark.

Acknowledge their submission as soon as you receive it. Say thanks and explain your process for dealing with feedback.

Get back to them once you know exactly what solution you’re planning to implement. If you’ve decided not to act on the feedback, explain why. For example, the requested feature may not fit into your product strategy.

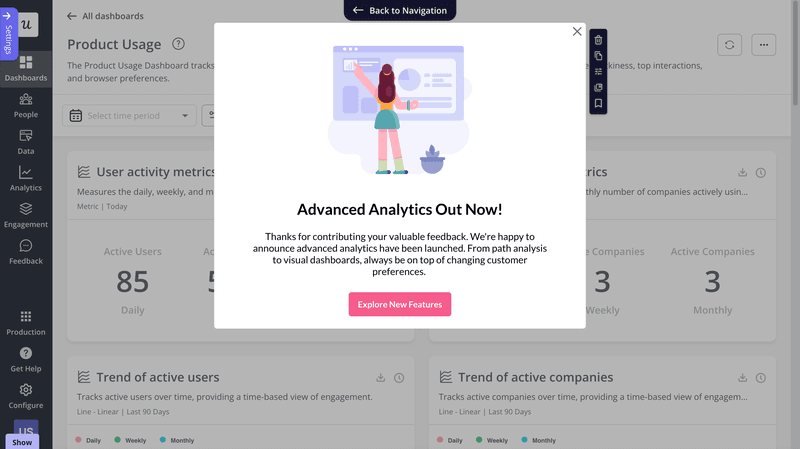

Finally, share the good news when the solution is ready. This could be via an email or in-app message, like the one below.

Best practices for getting high-quality customer responses

Still with me? Here are some best practices that will help you get detailed feedback.

Keep questions clear and short

How you phrase the survey questions has an impact on the quality of feedback.

How do you ensure question clarity?

- Avoid double-barrelled questions. Instead of asking, “How do you feel about the onboarding process and the new features?” ask two questions, “How do you feel about the onboarding process?” and “How do you feel about the new features?”

- Use simple language. Avoid jargon and overly technical terms or slang.

- Don’t lead respondents. The question “On a scale of 1 to 10, how excellent was our customer support?” implies the support was excellent. Ask, “On a scale of 1 to 10, how would you rate our customer support?”

Explain the purpose behind gathering feedback

Explaining why you’re collecting feedback and how you’re going to act on it to benefit users can increase the response rates.

Think about it:

Responding to surveys takes time and effort, no matter how well-designed they are. Unless users see how it will improve their experience, they may not bother to respond.

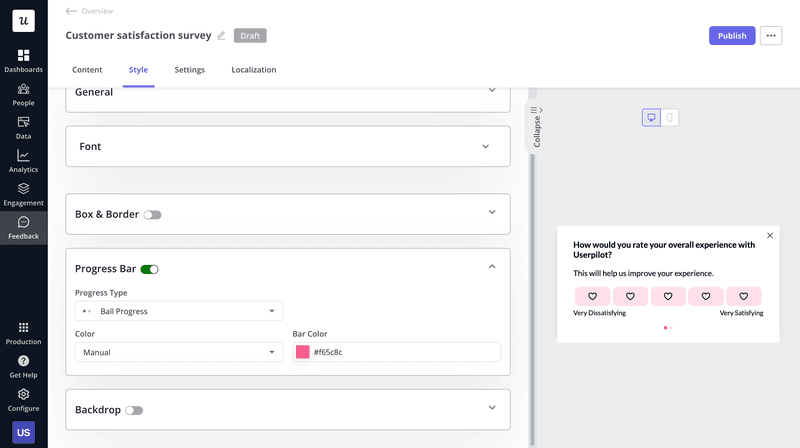

Add a progress bar to encourage responses

Progress bars show users how far into the survey they are and how many more questions are left. This sets clear expectations and reduces the risk they drop off once they realize the survey is too long (it should never be too long!).

Moreover, a progress bar can reinforce a psychological process called the Zegairnik effect.

Basically, humans have a drive to complete planned tasks and find it difficult to shift their focus until they complete them. A progress bar showing them how close they are to the end strengthens this urge.

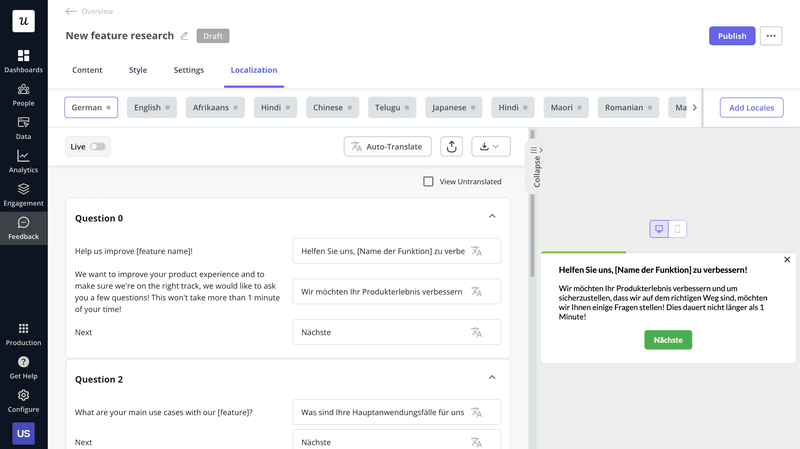

Localize the surveys

Which do you think is going to be more authentic, a feedback response in your mother tongue or in your learned language?

Your mother tongue, of course. Especially if the question is in your language, too, and you can understand it more accurately.

So, when creating surveys for speakers of other languages, localize them.

Feedback tools, like Userpilot, come with localization features that allow you to automatically translate the surveys.

It takes no effort whatsoever, so there’s no reason not to do it.

Collect feedback at different stages of the customer journey

Feedback collection isn’t limited to any specific stage of the customer journey. You can gather valuable insights at pretty much every touchpoint.

Here are some examples:

- When the user signs up for the free trial, you could send them a quick customer effort score (CES) survey to ask how easy it was.

- A survey towards the end of the onboarding process can help you optimize it for future users and identify areas where the user still needs help.

- Embedding a churn survey in your cancellation flow will help you understand the reasons why users drop off.

Use a variety of methods in your customer feedback strategy

In your feedback strategy, use various collection methods.

Why?

- It’s more inclusive. Not all users are willing to take part in interviews, but they might be happy to answer a quick survey question.

- Different methods are more suitable for different stages of the product lifecycle. For example, surveys won’t work at the early discovery stage when you don’t have a customer base yet.

- It’s more cost-effective. Interviews are resource-heavy, so using them when a survey is enough would be a waste of time.

- You get more diverse feedback. For example, interviews give you in-depth qualitative data, customer satisfaction surveys allow you to track trends over time, while social listening can reveal insights users aren’t ready to share directly with you.

Conclusion

Using a range of methods, like surveys, interviews, or social media monitoring, to collect customer feedback allows you to gain diverse insights into their problems and needs. It also helps you understand how your product is performing and identify opportunities for improvement.

If you’d like to learn how Userpilot can help gather actionable customer feedback, book the demo!

FAQ

What is customer feedback?

Customer feedback is the customer’s opinions, insights, and reactions about your products, services, or overall customer experience. It can come in various forms, including surveys, reviews, support interactions, or comments on social media.

This feedback provides you with a direct understanding of how users perceive your offerings.

Whether positive or negative, customer feedback is valuable because it reflects the real-life experiences of users interacting with the product. It allows you to assess what is working and identify areas where improvements may be needed.

Why is customer feedback important?

Gathering customer feedback is crucial for any organization that is serious about growth.

It allows you to stay connected with your changing customers’ needs and preferences and adapt and evolve accordingly.

What’s more, by collecting feedback, you can discover potential issues with their products or services early and address them proactively before they negatively affect customer satisfaction. Or worse, make them churn.

Finally, listening to feedback shows customers that you value your opinions, which builds trust, and strengthens relationships, and promotes customer loyalty.

What tools to use to collect customer feedback?

Collecting customer feedback via diverse channels requires a diverse tool stack.

Here are some tools worth trying:

- Userpilot for in-app surveys, passive feedback, and analytics.

- Typeform and Opinion Stage for email surveys.

- Brand24 for social media and forum monitoring.

- Lookback for user interviews.

- UserTesting and Maze for user testing.

- G2 and Trustpilot for online reviews.

- Optimizely and VWO for A/B testing.

- Zendesk (or any other help desk platform with robust analytics) for customer support feedback.

- Gong and Chorus.ai for phone call recording analysis.

When choosing your tools, look for software that allows you to collect multiple kinds of feedback and integrates well with other tools to reduce tech stack bloat and streamline data sharing.