In SaaS, market segmentation is essential to building a successful product and providing a personalized experience. But, while 89% of business leaders recognize that personalization is necessary for success, they also worry about the increasing hardship of getting high-quality user data.

For product marketing, this challenge is reflected in siloed data sources and a lack of tools to set up actually relevant segments that go beyond simple demographics, which results in generic messaging or promoting features for an “average” user that doesn’t exist.

That’s why I prioritize market segmentation. It lets me group our large customer base according to their demographic data, needs, interests, or behaviors to provide a relevant product experience.

So in this post, I’ll go over all the types of customer segments I use and share my market segmentation techniques that let me implement personalization in my work – without coding.

What’s your primary goal with market segmentation?

Which type of market segmentation are you most interested in?

How do you currently collect user data for segmentation?

Unlock your growth potential.

You’re ready to move beyond basic analytics. See how Userpilot can help you implement a powerful, no-code market segmentation strategy to drive growth.

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

What is market segmentation?

Market segmentation involves dividing your target market into subgroups of customers (or users) who share specific characteristics, such as needs, in-app behaviors, or attributes. Once you understand these smaller groups, you can craft marketing messages and build experiences that resonate with them.

Why market segmentation matters for product-led growth?

Market segmentation helps all kinds of businesses bring a product to a market, make effective sales, and improve online marketing efforts. For B2B SaaS, the benefits of market segmentation include:

- Stronger messaging and personalized experience: The only way to target a product experience that feels relevant to your users is through segmentation. If you don’t know the jobs-to-be-done (JTBDs), pain points, and goals of a particular audience, then your messaging will feel dull and generic.

- More informed product roadmap: Segmentation lets you understand the current needs of different types of customers and build features that cater to them. For example, you can examine feature requests from your high-value customers to prioritize them in your product roadmap.

- Efficient resource allocation: When you know which segments are most likely to convert and find value, you can invest in targeting them with your product marketing campaigns. This means less wasted ad budget and more efficient product development (since you’ll know what features you should prioritize).

- Improved customer retention and LTV: Customers stay with products that fit their needs and provide personalized experiences. This makes segmentation a building block to increase brand loyalty, and therefore user retention and customer lifetime value. Additionally, customers spend around 38% more when their experience is personalized

10 Types of market segmentation

I’ll explain 10 types of segmentation I use for product marketing, starting with the basic segments answering the “who”, “where”, “why”, and “how” questions about your customer base. Then I’ll introduce a few more segmentation types relevant to SaaS companies.

Demographic segmentation: The ‘who’

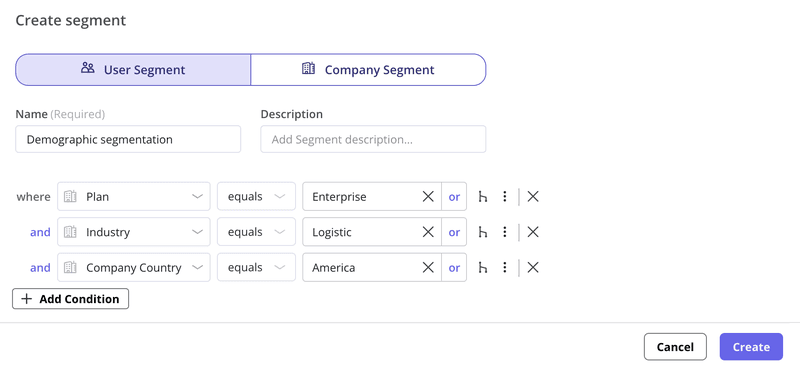

Demographic segmentation groups users based on personal or individual attributes, giving a solid background to your user personas. In B2B SaaS, however, collecting typical demographic information such as gender, family status, or age is less relevant and can easily muddle the picture. You should focus on job-relevant criteria, such as:

- Job title: The role of a user within a company (e.g., project manager, developer, UX researcher, etc.)

- Seniority: Whether the user is a junior, manager, or executive.

- Company size: The headcount of the user’s place of employment.

For example, a product analytics platform might be used by analysts, product managers, or even developers. Segmenting them would allow the company to develop and introduce relevant features based on their particular JTBDs.

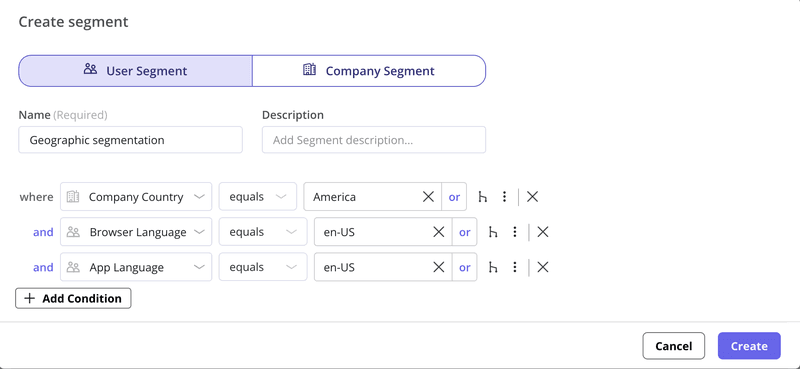

Geographic segmentation: The ‘where’

This type groups users based on where they live or work, such as region, country, or even timezone. In SaaS, geographic segmentation is useful for addressing localization needs or regulatory differences. Here are some of the basic variables:

- Language: This information will help further personalize the experience with content localization.

- Country: The user’s country of residence. It’s important to ensure the product complies with the local regulations, or to find out whether users have access to specific services (apps that are only available in the US or EU).

- Timezone: Useful for aligning marketing campaigns or events to the user’s usual time of using the product.

For example, for a fintech product available worldwide, it’s important to segment users based on their countries. This way, it can localize the app to the user’s language and adapt the services to comply with local regulations.

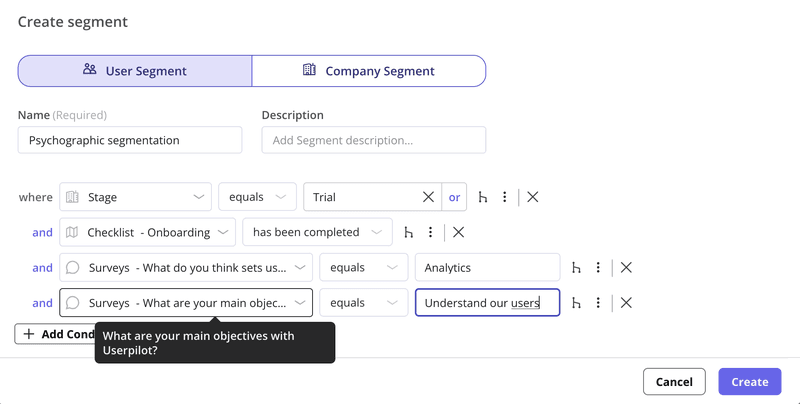

Psychographic segmentation: The ‘why’

Psychographic segmentation divides users based on psychological traits. It explores the “why” behind user choices, focusing on beliefs, hobbies, and values:

- Activities, interests, and opinions (AIO): These criteria include what the users do, what they like or what they find interesting, and what matters to them.

- Lifestyle: Defines common patterns in the user’s life.

- Personality traits: Adds a label to the user’s personal characteristics. Some users might be resistant to change, while more “innovator” users could be more open to participating in usability tests.

For instance, if my target customers have a high interest in AI tools, then I can design campaigns that promote our AI features. Or, I can adapt my campaigns to whether the user is on holiday, constantly traveling for business, or working remotely.

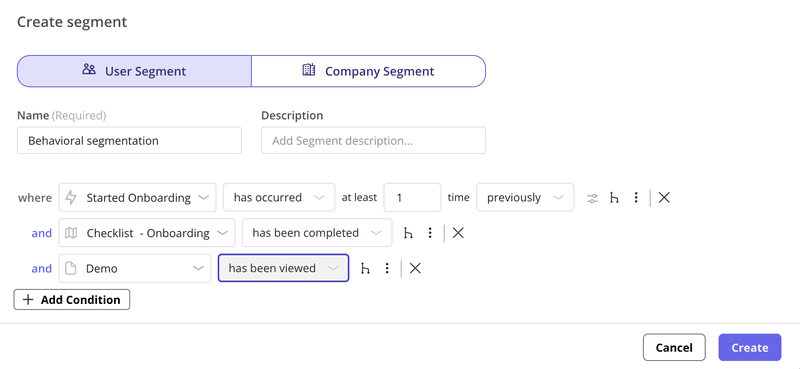

Behavioral segmentation: The ‘how’

Behavioral segmentation focuses on how users interact with your product. Are they power users who log in daily? Do they only use one core feature? Are they about to churn?

Unlike other types of segmentation, this one can only apply to an existing customer base. Here’s what it includes:

- Product usage patterns: Group users based on different activities within the product, including most-used features, explored use cases, or frequency of use.

- Feature adoption: Indicates the features a user has adopted based on their usage frequency.

- Purchase history: The upgrades or account expansion the user has purchased in the past.

For example, for users who have completed the onboarding process and activated the product, I can target in-app prompts that introduce them to relevant secondary features.

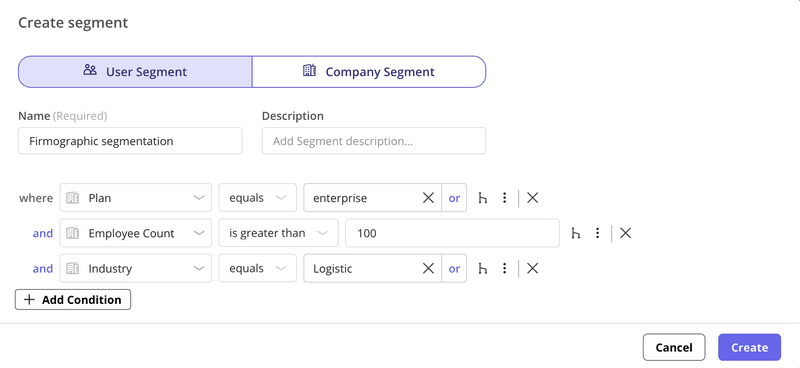

Firmographic segmentation

This segmentation groups customers at the account or company level, and is essential for any B2B company. These attributes can include:

- Industry: Differentiates clients in the tech sector from those in manufacturing or DTC.

- Company size: It groups accounts based on their number of employees. It helps design plans and pricing models for clients at different stages.

- Revenue: Defines the revenue range of clients. Those with higher revenue are more likely to be more valuable accounts.

For example, most B2B SaaS products offer plans for small startups, growing businesses, and enterprises. With proper segmentation, you’re able to adjust the capacity and services of each plan based on the business stage (e.g., enterprise clients often get access to a dedicated CSM or personnel training).

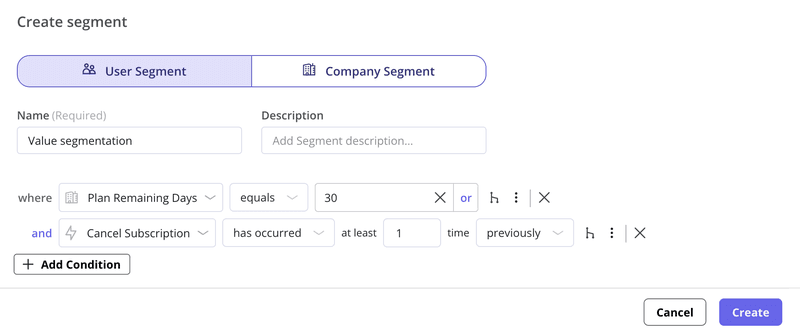

Value segmentation

This type of segmentation groups users based on the economic value they represent to the business. It helps to allocate an appropriate amount of resources to each audience. These are the attributes I tend to take into account:

- Plan tier: Tags customers based on their current plan, where those with higher-tier plans are more valuable.

- Customer revenue: This indicates the level of revenue you get from a customer. It’s more suitable if your pricing plans are customizable or usage-based.

- Days until renewal: Group users based on how many days they have left in their plans. It’s helpful to allocate extra resources to helping clients renew their plans successfully and avoid churn.

For example, account-based marketing strategies demand proper segmentation of prospects based on the potential value of a given deal.

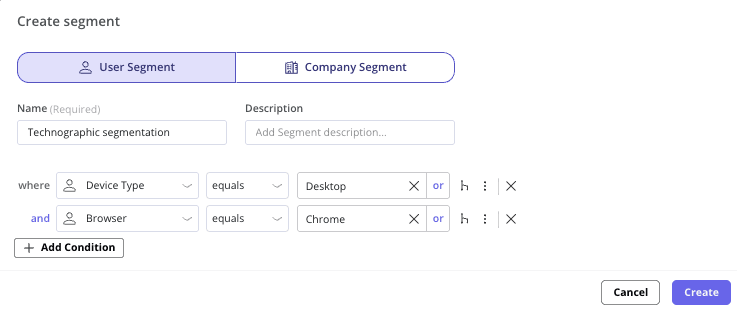

Technographic segmentation

Technographic segmentation categorizes users or clients by the tools, browsers, or devices they use. In SaaS, it involves these segmentation variables:

- Device: Defines the device on which the user interacts with your product, such as mobile, PC, tablet, etc.

- Tech stack: Whether a client uses a specific platform such as HubSpot, Intercom, Marketo, etc.

- Operating system: Grouping users based on their software, such as Windows, Android, and Mac.

For instance, if your product integrates with Salesforce, segmenting customers who are Salesforce users would help you personalize their onboarding or offer relevant upgrades.

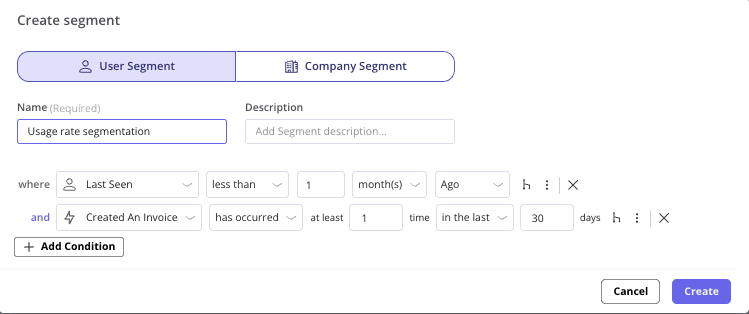

Usage rate segmentation

Usage rate (or frequency) segmentation groups users based on how often they use the product. It’s limited to your active customer base, and the potential criteria include:

- Log-in frequency: How often do the users log into your product, and do they use it regularly?

- Time spent in app: After logging in, how much time do they spend actively using a product?

- Feature use frequency: How often does the user engage with the features most relevant to their use case?

For example, if I segment dormant users, I can create a re-engagement campaign to get them back.

Seasonal segmentation

Seasonal segmentation groups users by time-based patterns, seasonality in their usage, or purchasing behavior. Some of these attributes include:

- Seasonal and cultural events: This lets me categorize clients by their engagement with seasonal or cultural activities, and anticipate their patterns in product usage during those times.

- Weather: Helpful for companies that offer weather-dependent clothes, accessories, or activities.

- Retail cycles: Segments clients based on recurring shopping patterns, e.g., “back to school” or holiday purchases.

For example, a fintech company might segment its users based on the tax season in their countries, anticipating increases in usage or targeting tax-related content before that period.

Generational segmentation

Generational segmentation groups users by age cohort. Although it’s more common in B2C, it can also be relevant in B2B because different generations may interact with software differently.

Here are a few common criteria:

- Age ranges: Groups users based on birth years.

- Assumed communication preferences: Takes into account communication channels and device types commonly preferred by a given age group.

- Technological adoption: Similarly, assumes how tech-savvy a given group is.

For example, let’s say you have a product that’s designed with user-friendliness in mind. The Gen Z and millennial segments may feel more comfortable using self-service resources or video tutorials to adopt it, whereas baby boomers might require proactive assistance from a support rep to adopt advanced features.

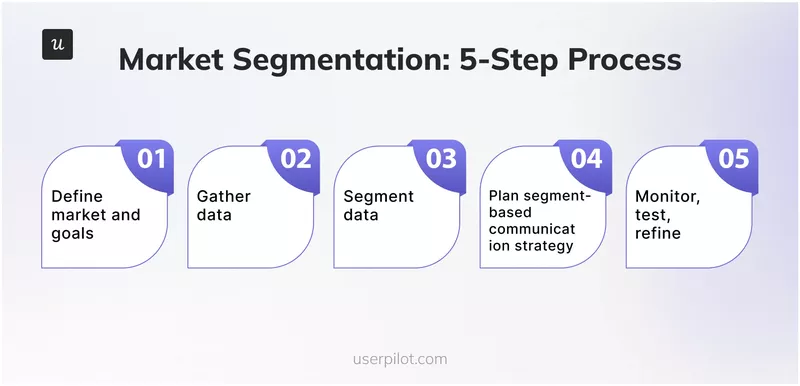

How I put market segmentation into practice: 5-step approach

Without preparation, researching and defining market segments can take weeks or months of research.

Below, I’ll show my marketing segmentation strategies, powered by Userpilot. Userpilot cuts some of this time by allowing me to collect customer data, create segments, and personalize in-app experiences, all without coding.

1. Define your market and goals through market research

This is the first step for all new products without an existing user base, or those who feel their market strategy needs some refining. Before segmenting customers, I need a clear picture of the broader target market and my target users:

- What problem does the product solve?

- Who are the people or businesses that need it?

- What are their general needs?

To answer these big questions, I must engage in market research to find data about our product demand, the competition, and where our product sits in the market. This involves looking at external sources of data, like industry reports, public databases, or market share.

Take a look at our guide to market research to learn more about the process.

2. Gather user data

Once I’ve done market research, my goal is to fill the gaps with more specific segmentation data. This usually involves internal data from different teams or product usage data collected via Userpilot. Here are the methods I use:

Run user interviews and focus groups

User interviews and focus groups are the best option for finding deep insights you can’t usually get with other methods. It uncovers how users feel about your product, their internal goals, and their emotional pain points.

Whether I run a one-on-one interview with an existing user or run a focus group depends on my research goals. Individual interviews are often the best choice to explore users’ purchasing habits or motivations. Focus groups are great for finding points of consensus and different opinions on a topic.

💡 Pro tip: If you’re looking to explore beyond your existing user base, you can use platforms like Respondent.io or User Interviews to connect with potential participants.

Send contextual surveys

Surveys help me collect both quantitative and qualitative data at scale, including demographics, firmographics, and goals. The type of insights will depend on the survey type. For example, a welcome survey can help me gather basic demographic information and main product usage goals, while an NPS or CSAT survey will uncover users’ satisfaction levels.

💡 Pro tip: You can target surveys to research groups or existing users for more specific insights. With Userpilot, I can trigger in-app surveys contextually when the user finishes the onboarding process, activates a feature, or closes a support ticket (increasing response rates) to receive feature-relevant opinions from engaged users.

Get insights from customer-facing teams

An overlooked research method involves tapping into internal resources that are commonly siloed within specific departments. My favorite is to reach out to customer-facing teams such as sales, support, and success to ask about the challenges, jobs-to-be-done, objections, and usage habits that users commonly mention. You can also ask them for the most relevant recorded calls and analyze them directly.

Track product usage and user behavior data

To create high-quality behavioral and usage-based segments, you need to gather data from existing users with an analytics tool that can track product usage.

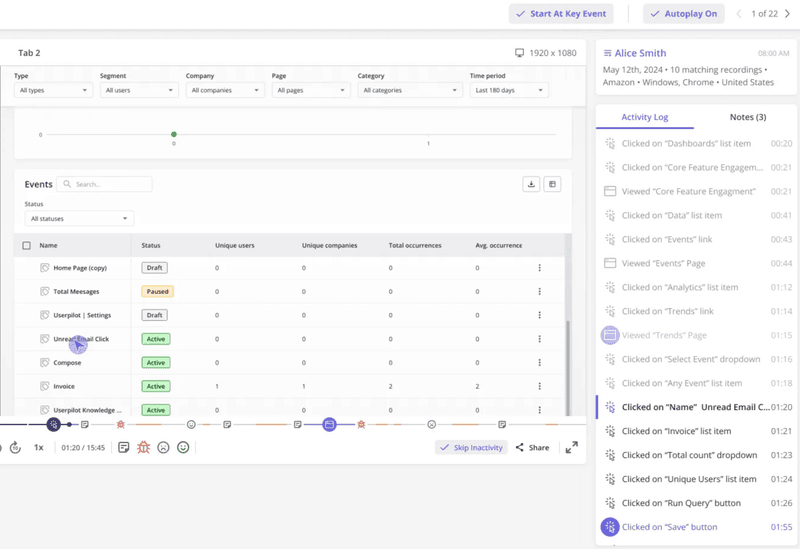

With Userpilot, I can gather page and event data without coding, thanks to autocapture. All I need to do is label the data I need with the Visual Labeler, and it will be available for retroactive data analysis.

For instance, I could:

- Monitor page views with page tracking to see which pages have the most visits.

- Perform path analysis to identify the least and most successful users.

- See how users interact with features without needing to ask developers for custom tracking.

- Observe how users adopt features and what events lead to it.

💡 Pro tip: Complementing behavioral data or survey replies with session replays will help you get more context on users’ struggles and common patterns. It lets you see why users get stuck on a specific page, validate hypotheses, and identify behavioral patterns among segments.

3. Sort data into segments

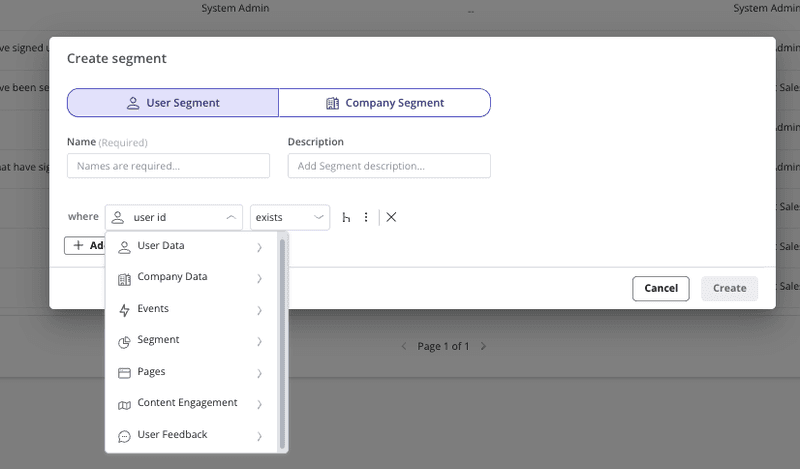

Once I’ve collected enough data, I start segmenting my customers. With Userpilot, you can create segments based on user profiles, company properties, events, page visits, or even past survey responses, and the segments will update automatically.

I recommend starting with segment types most relevant to your current goals. For example:

- If my goal is to personalize the onboarding experience, I’d start segmenting users based on their job titles, use cases, jobs-to-be-done, and behavior.

- In case I need to guide our product development strategies, I’d start with firmographics (company size, industry, etc), needs, user types (sorted by job role), JTBDs, and goals.

- If there’s an ABM strategy going on or I need to optimize revenue via account expansion, I’d start segmenting users by their plan tiers, ACV, and industry.

💡 Pro tip: These segments set the stage to create detailed customer personas, which are more representative than just a couple of data points. Take a look at our guide to creating user personas to learn more.

4. Create segment-based communication strategies

As a product marketer, my main use case of segmentation is to design highly-targeted campaigns based on our users’ profiles. So instead of a generic welcome tour, I can offer personalized onboarding that guides new users to their Aha! moment faster.

Userpilot excels here. I use it to build interactive walkthroughs, in-app messages, and feature announcements that appear only to relevant segments. For example, a user who picked up a specific template might get a product tour highlighting features related to that template, while a new “Admin” user might get a different tour focused on team management settings.

Not only that: segments created in Userpilot can be used on multiple communication channels, including web apps, mobile, and emails. So if a user drops off from a core feature, I can send a personalized email with a short-loom tutorial and ask them to come back, then trigger an in-app interactive walkthrough when they land on the app.

5. Monitor, test, and refine your segments and strategies

Your product and customers keep evolving, and so should your segments.

That’s why I highly recommend monitoring the behaviors and changes in user segments. These influence the messaging in my personalized marketing campaigns, our product roadmap, and my lifecycle strategies.

Here’s how I track relevant changes in users’ behaviors and preferences:

- I monitor in-app engagement via custom dashboards, which help me correlate different data sources, filter all data through selected segments, and track changes over time.

- I track user journeys through the product using funnel reports or path analysis to see how different user groups navigate the app.

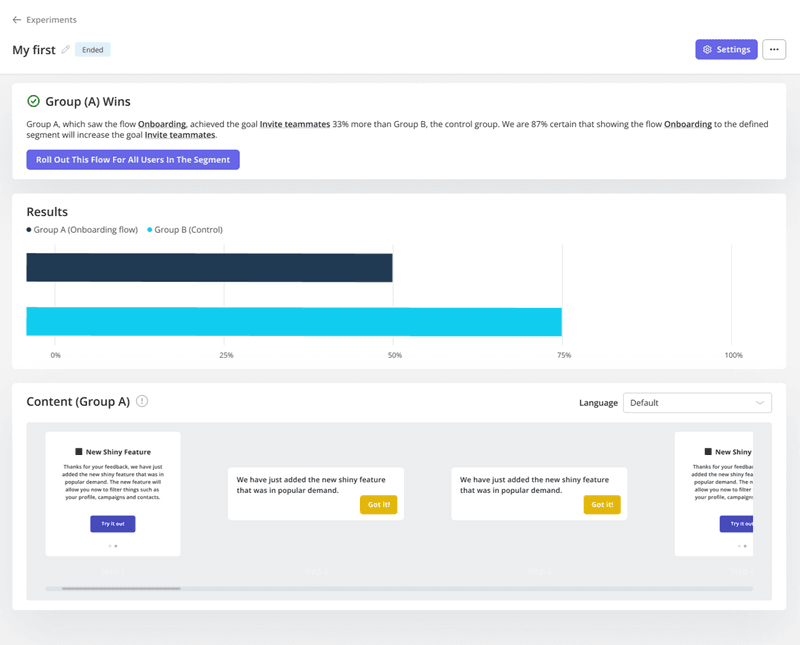

- I run A/B tests to see which communication flow resonates best with different segments. For example, I might test two different versions of a product tour to see which one leads to higher feature adoption.

Set up a market segmentation strategy with Userpilot

Implementing a market segmentation process is necessary for any business, but it’s particularly helpful for PLG strategies.

It enables hyper-personalization, which is becoming table stakes in a competitive market such as B2B SaaS, and helps achieve a tight product-market fit.

However, refined market segmentation strategies often get delayed due to a lack of research resources. That’s why I can’t recommend Userpilot enough. It provides a 100% no-code platform where non-technical teams can collect customer feedback, segment their users granularly, personalize the product experience, and get access to deep product analytics.

So if you need a product engagement and analytics tool to get started with an effective marketing segmentation strategy, book a Userpilot demo to start collecting data as soon as you install it.

FAQ

What are the common segmentation mistakes?

Here are a few frequent mistakes when segmenting customers:

- Segments are too small or too broad: If your segments are tiny, the cost of marketing to them might outweigh the returns. If they’re too big, you lose the personalization benefits.

- Not adapting to change: Customer needs, market trends, and product features are constantly changing. With Userpilot, you can keep track of these changes, adjust your strategies, and update your segment’s criteria if needed.

- Targeting non-buyers: You might identify a large segment, but if they don’t have the budget or a real need for your product, it’s not worth the investment. Always validate that your chosen segments actually have buying potential.

What is the difference between user segmentation and customer segmentation?

In B2B, the decision-maker isn’t the same person who uses the product.

Thus, user segmentation typically refers to grouping the end users of your product. It focuses on their behaviors, jobs-to-be-done, or profiles.

Customer segmentation in B2B is usually at the company level using firmographic data (company size, revenue, industry). It can also include individual stakeholders who make the purchase decisions at the company.

What are the best practices for market segmentation strategies?

- Collect diverse data: Combine quantitative data (usage stats, purchase history) with qualitative insights (user surveys, interviews) to define segments. This ensures you understand not just the “what” but the “why” behind user behavior.

- Create actionable segments: Each market segment should represent a meaningful difference in needs or behavior, and you should have a clear plan for how to act on each segment. If two segments respond the same way to your product, consider merging them.

- Avoid over-segmentation: Start with a handful of key segments and expand only if needed. You can often address many users with perhaps 5–10 well-chosen segments.

- Use the right tools: Use software that can update segments in real-time and that you can easily target content to them. They also reduce the manual labor and errors in segmenting.

- Test and iterate: Monitor how each customer segment performs and test different approaches. If something isn’t working (e.g., a segment isn’t responding to the marketing strategy you thought would work), adjust the segment definition or your messaging strategies.