Collecting and acting on in-app feedback is the fastest way to close the gap between what you’re building and how your customers are interacting with it.

Where do you begin, though? What kind of user feedback do you need? How can you make sure your efforts aren’t wasted? And, which in-app feedback tools are available for you?

I’ll answer all these questions (and more) in this article.

What is in-app feedback?

In-app feedback allows users to share their thoughts and experiences while actively using an app. It provides real-time insights – helping you understand user needs, address issues, and improve the product.

In general, the in-app feedback you collect from users can be grouped into two:

General or relationship-related in-app feedback

These feedback efforts focus on the app as a whole and are often used to gauge user satisfaction levels. They include customer satisfaction surveys, NPS surveys, and feature requests, among others.

This involves asking questions like “How happy are you with our product?” or “How likely are you to recommend this product to others?”

Contextual or transaction-related in-app feedback

Contextual feedback is directly related to a specific app feature, experience, or interaction. It is displayed right after a user completes a specific process or interacts with a particular feature.

It includes everything from a new feature survey to an onboarding experience survey.

How are you currently collecting in-app feedback?

What’s your biggest challenge with in-app feedback right now?

What is your main goal with improving your in-app feedback process?

You’re ready to build a world-class in-app feedback system.

Userpilot can help you collect, analyze, and act on contextual user feedback to drive product growth. See how it works.

Why should you collect in-app feedback in SaaS?

There are many benefits of building your feedback mechanisms into your users’ in-app workflow. Some of these include:

- Higher response rate: In-app surveys catch users when they’re already engaged with your product. This makes them more likely to discuss their concerns/queries/delights with you.

- Get real-time feedback: In-app surveys can be made available around the clock, making them convenient for all users and more likely to be honest and accurate.

- Collect contextual feedback: Using tools like Userpilot, surveys can be triggered at the right moment: whether after a user completes a task, explores a new feature, or reaches a milestone. This ensures feedback is contextual, timely, and more insightful.

- Uncover friction points and pain points: In-app feedback widgets make it easier for users to inform you about bugs and other product usability issues.

- Improve user experience: Ultimately, as you better understand your users’ needs and concerns, you’ll be better equipped to improve the user experience.

How can you collect feedback in-app?

Product teams rely on different in-app feedback methods, which generally fall into two main categories:

Use in-app microsurveys to collect feedback

Also known as popup surveys, microsurveys are short forms with a few questions. They only appear when triggered, are typically very brief, and are often contextual.

Microsurveys are, thus, ideal to collect feedback on a specific feature, gauge specific experiences, measure customer satisfaction data, and more. NPS, CSAT, CES, and other contextual surveys fall into this category.

Use an in-app feedback widget for on-demand feedback collection

A feedback widget is a perpetually available tool that helps you collect real-time feedback. You can place a feedback widget anywhere within your app: perhaps as a standalone icon or as part of a resource center.

Feedback widgets provide users with a simple and convenient way to provide feedback on their experience with your app. This makes it ideal for feedback on-demand as customers can share their ideas and report issues at any time.

Best practices to follow when collecting in-app feedback

Now you know the different types of surveys you can trigger in-app, let’s consider some best practices to observe to ensure your surveys are insightful and impactful.

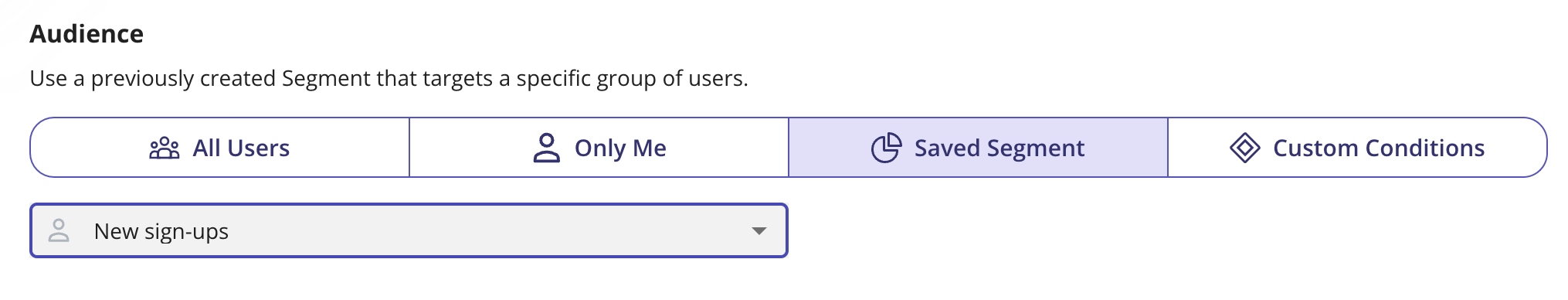

Gather in-app feedback from different segments for valuable insights

Not all users will be able to give you valuable feedback in every situation. Therefore, it’s important to identify and target only the right users for your feedback questions.

For example, you can’t ask a new user to provide feedback on an advanced feature they’re yet to use. Similarly, you can’t ask a power user to rate the onboarding experience they had gone through long ago.

Collect in-app user feedback contextually to increase response rates

Contextual feedback collection is where in-app feedback especially excels over traditional collection methods. It enables you to collect user feedback when the experience is still fresh in users’ minds.

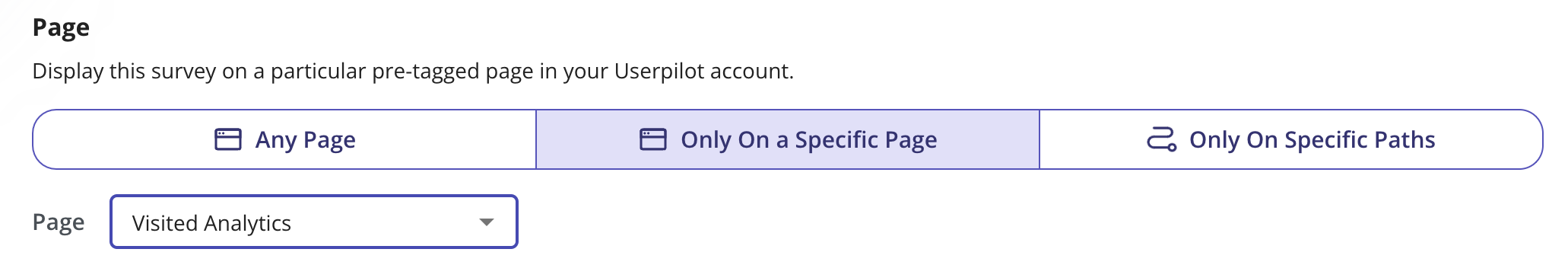

Trigger surveys contextually after an event has occurred to get the user’s thoughts before they fade or when they visit a specific page. For example, you can trigger a customer service survey immediately after a user interacts with your customer support team.

Make sure your feedback widgets are easily discoverable

Feedback widgets work best when they are easily discoverable and accessible. When placed in a consistent and accessible location, they encourage more users to share their thoughts.

You can place them in page headers or footers, as an icon on the app’s sidebar, as a top-level menu item, or as part of your in-app resource center.

Then, you can direct users to the widget using a simple tooltip to ensure they don’t miss it.

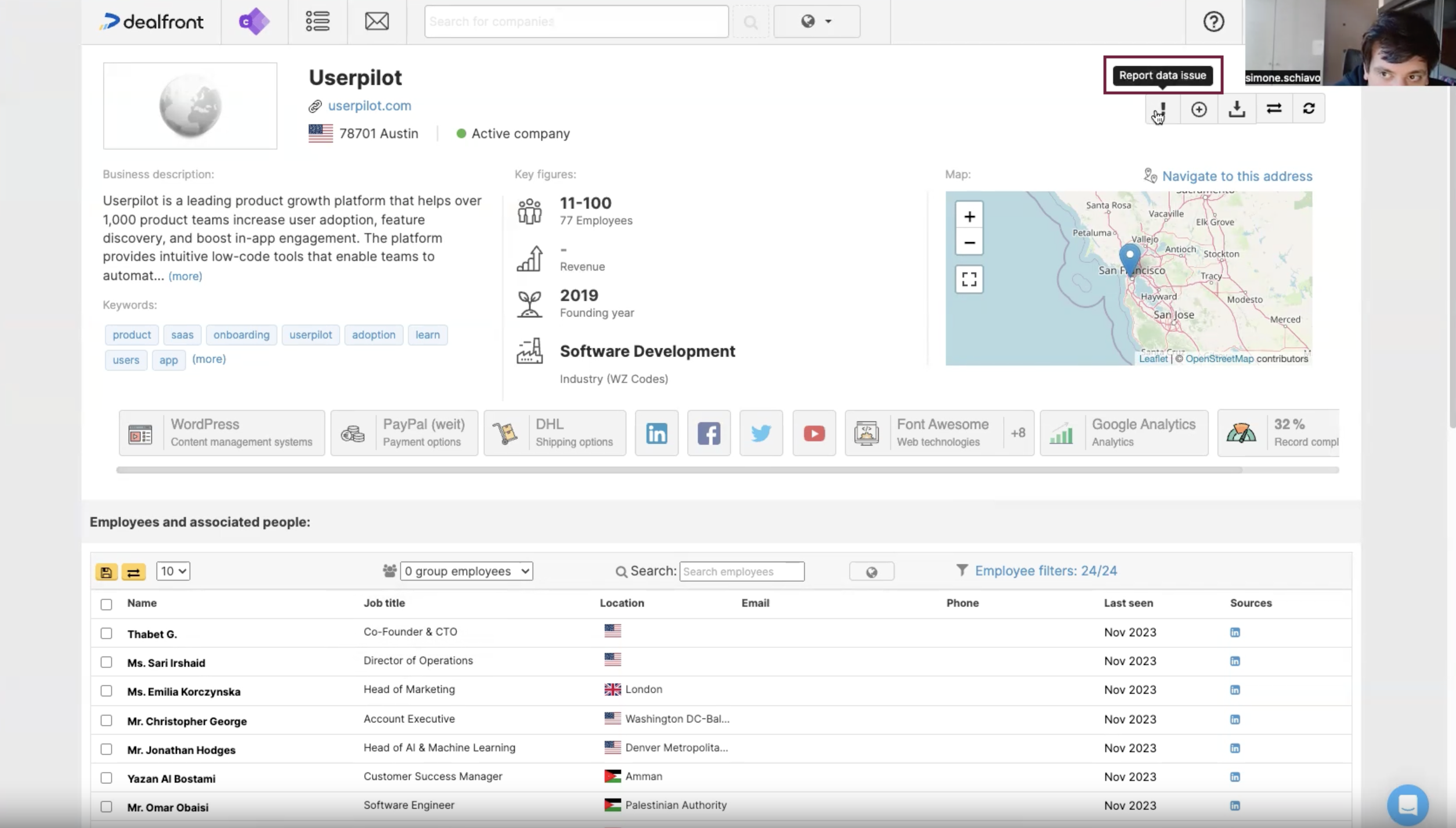

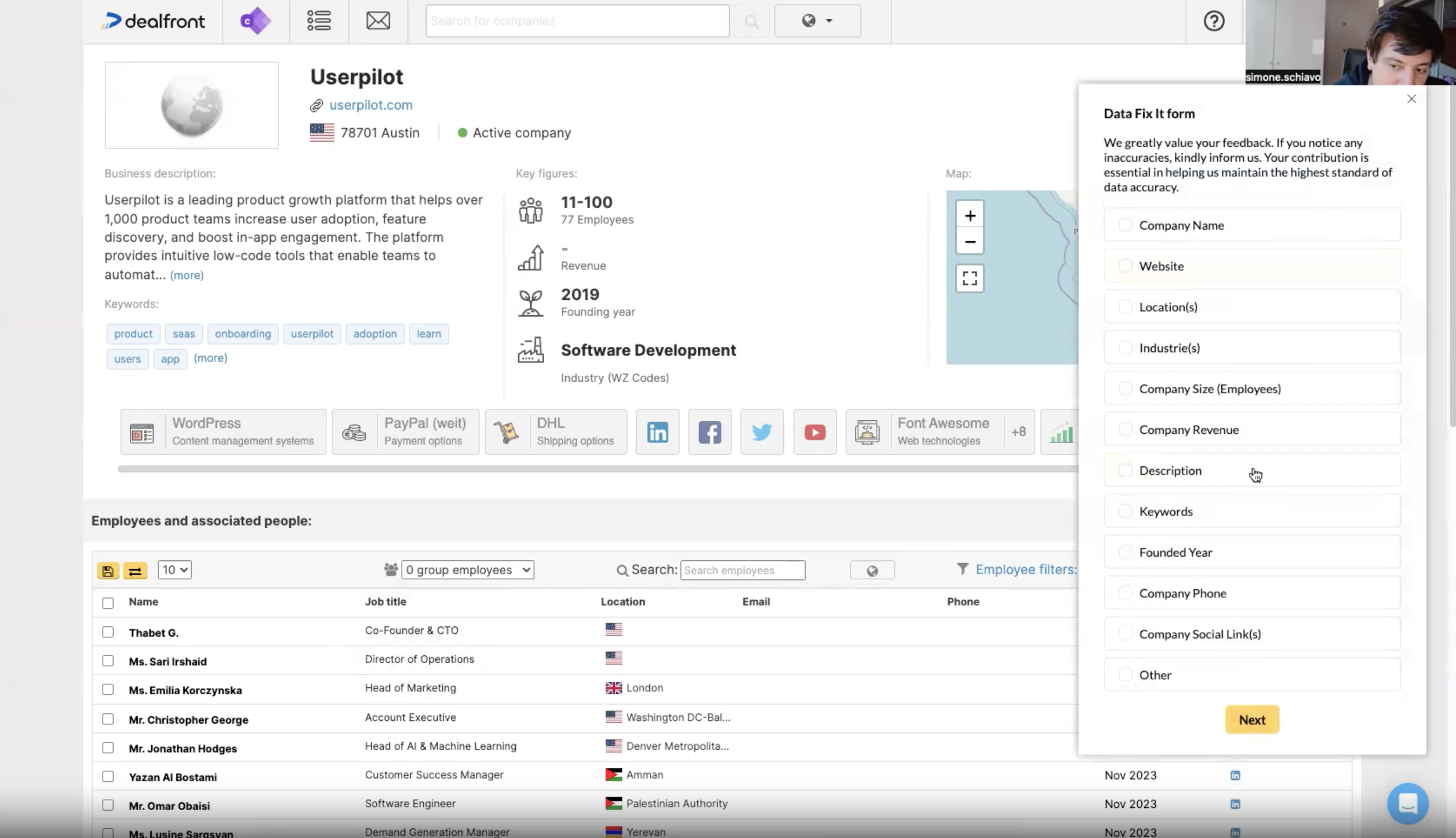

One company that executed this really well is Dealfront. Using Userpilot, they placed a feedback widget in a prominent spot within their UI, allowing users to report data inconsistencies effortlessly.

Clicking the icon triggered a quick survey for users to submit their findings.

The result? A nearly 50% survey completion rate, leading to significant improvements in data accuracy.

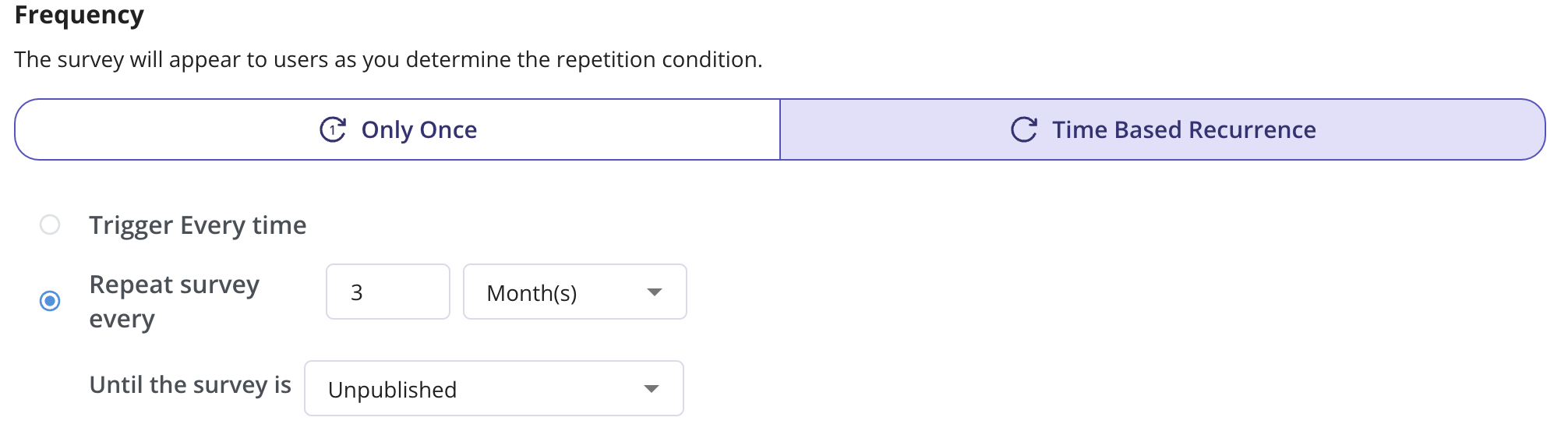

Collect user feedback periodically to track changes in user sentiment

As users become accustomed to your product and you implement certain changes, their opinions on the product may change. It’s important, therefore, that you collect feedback periodically to track these changes.

For example, you can send NPS surveys once every two or three months to track how your NPS score has evolved over that time. Similarly, you can trigger CSAT surveys each time you roll out new features.

The goal here is to see how users’ opinions change over time and determine whether you’re moving in the right direction. An increasing NPS score, for instance, is proof you’re doing something right – and vice versa.

In Userpilot, you can automate the delivery of surveys so you don’t have to worry about manually sending them after a while.

Analyze customer feedback with survey analytics

Gathering user feedback is only helpful if you analyze it and act on it to improve your product. Survey analytics helps you go beyond raw feedback data to identify patterns and meanings in responses.

For example, after launching a churn survey, analytics can help you identify the most common reasons why users churn. As you work to address it, you can also track how that reason evolves.

Survey analytics can help you prioritize your efforts and measure your progress. It can also help you uncover hidden gems or unexpected patterns that reveal new opportunities or issues.

Userpilot helps you to organize NPS responses by themes, making it easier to take action and enhance user experience.

Couple open-ended questions with close-ended questions for better insights

Although close-ended questions are easy to answer and analyze, they often miss out on the why behind the what. Paired with an open-ended question, it allows users to elaborate on their responses.

For example, an NPS or CSAT survey can tell you how a customer views your brand (through their rating) but not why they view it that way. A follow-up open-ended question, however, reveals the reason for their rating.

Keep open-ended questions optional, as making them mandatory can lower survey response rates.

Avoid bad survey questions when collecting user feedback

Crafting good survey questions is crucial for collecting accurate and valuable user feedback. To ensure your questions are of good quality, here are some bad questions to watch out for:

- Leading questions: These questions subtly nudge respondents towards a specific answer. For example, the question “Don’t you think our new feature is amazing?” nudges users towards a positive response.

- Loaded questions: These questions contain biased language based on an unverified assumption. For example, “What makes our product so much better than [competitor’s] product?”

- Double-barrelled questions: These are two questions fused as one, thus confusing the respondent. For example, “How satisfied are you with the app’s features and ease of use?”

- Biased questions: These questions favor a particular viewpoint through their structure, wording, or answer options. For example, “How was your experience with our customer service? [Excellent, Very Good, or Good]”

- Questions with double negatives: Using two negatives in a question can lead to confusion about the true meaning of your question. For example, “Was the [product feature] not unsatisfactory?”

👉🏻 That being said, below is a list of good survey questions that you can copy and use in your next survey.

- How would you describe your overall experience with our product?

- What’s one feature you find most useful?

- Is there anything about our product that you find frustrating?

- How easy or difficult was it to accomplish your goal using our product today?

- On a scale of 1 to 10, how likely are you to recommend our product to a friend or colleague?

- What’s one improvement that would make our product more valuable to you?

- How satisfied are you with the level of support you’ve received from our team?

- Did our product meet your expectations?

- What made you choose our product over others?

- If you could change one thing about our product, what would it be?

Always close the customer feedback loop

Closing the customer feedback loop involves responding to their feedback, and acting on it. This demonstrates to your customers that you listen, value, and act on the feedback they give you.

Closing the feedback loop increases trust in your brand and encourages users to share feedback in the future. Thankfully, it isn’t a complex task to complete, as you can automate a follow-up message.

Sometimes, though, you may need to trigger a more detailed message afterward to address concerns in the user’s in-app feedback.

Follow up on negative customer feedback with an email

Go beyond generic follow-up messages to show users with negative feedback just how much you care.

Thankfully, Userpilot offers two-way integrations with Salesforce and HubSpot that enable companies to set up seamless email triggers. Trigger an automatic email when users leave a low score to reassure them of your concern and get more information.

Your goal should be to identify the root cause of their concern and address it, potentially turning them from naysayers or detractors to promoters.

Ready to start gathering and analyzing in-app feedback?

Collecting and analyzing in-app feedback is crucial to ensuring you’re on the right path. By observing survey best practices and choosing the right in-app feedback tool, you can be sure to receive fresh, valuable insights from users.

Userpilot makes this process seamless. Book a demo today to see how it helps you collect, analyze, and act on user feedback to drive product growth.