According to Userpilot’s SaaS Product Success Metrics Benchmark report, Fintech and Insurance companies had the second-lowest activation and adoption rates of all industries.

This is because the client onboarding process in financial services faces unique challenges.

What are they?

That’s one of the questions we answer in our guide. More importantly, we show you how to improve your onboarding and how Userpilot can help.

Let’s get started.

TL;DR

- Customer onboarding in financial services aims to integrate users into systems and educate them about product features, for example, in the banking sector.

- Effective client onboarding sets the tone for relationships, ensures regulatory compliance, improves efficiency through digitization, and can serve as a key product differentiator.

- Challenges involved in user onboarding include keeping up with regulations, ensuring data quality, overcoming legacy system limitations, implementing robust security measures, and providing ongoing staff development.

- The onboarding process includes streamlining account sign-up, automating identity verification, implementing in-app welcomes, guiding users with personalized checklists, offering self-serve support, and continuously iterating based on user behavior analysis.

- Best practices for digital onboarding in financial services include creating omnichannel experiences, using interactive walkthroughs, gamifying the customer experience, and regularly measuring customer satisfaction through surveys and interviews.

- When choosing onboarding solutions, institutions should consider functionality, pricing, scalability, integrations, automation features, and security certification.

- Userpilot offers a range of customer onboarding, feedback collection, and analytics features for financial services and products. Book the demo to find out more!

What is customer onboarding in financial services?

Customer onboarding in financial services involves integrating users into your systems and educating them about your products and services.

For example:

- Banks use the onboarding process to help users get familiar with their mobile app or what to do if they lose their credit card.

- Pension providers can use it to educate users about different funds and the risks involved, how to set up regular payments, or track their portfolio performance.

- Wealth management firms can use it to help users open their accounts or set up security features.

What’s your biggest challenge when you create a client onboarding process for your financial services company?

How would you describe your current onboarding workflow?

What is your primary goal for improving your client onboarding?

You’re ready to build a world-class client onboarding experience.

See how Userpilot can help you create a client onboarding process that delights customers and boosts efficiency.

Why is the client onboarding process important for financial services?

The client onboarding process sets the tone for the entire client relationship. It helps financial institutions make a positive first impression and build customer trust from the get-go.

Moreover, effective onboarding helps companies meet compliance requirements, like Anti-Money Laundering (AML) checks. This reduces the risk of fraud and helps prevent legal issues.

By digitizing and automating the onboarding process, you can also improve operational efficiency, reduce manual errors, and reduce the load on your staff. So that they can focus on higher-value tasks.

The best part?

A streamlined onboarding process enhances customer satisfaction by making it easier for clients to understand and access financial products and services.

Such a positive customer experience can lead to increased retention and loyalty, and encourage clients to explore additional offerings, driving account expansion.

What are the main challenges of customer onboarding processes in financial institutions?

Financial institutions face a number of challenges when onboarding their customers:

- Regulatory compliance: As a highly regulated industry, you have to stay compliant with all regulations. Understanding and maintaining these requirements throughout the onboarding process is crucial.

- Data quality and accuracy: Poor data can pose significant risks to your financial institution, so it’s important to implement robust collection and verification processes.

- Legacy systems: Outdated systems can hinder onboarding efficiency, and modernizing your tech stack can be costly.

- Data security: Banks are prime targets for fraud. Integrating robust security and fraud detection measures into your onboarding procedures can be complex.

A step-by-step guide to client onboarding in financial institutions

Here’s our 6-step onboarding process that you can use in your financial product.

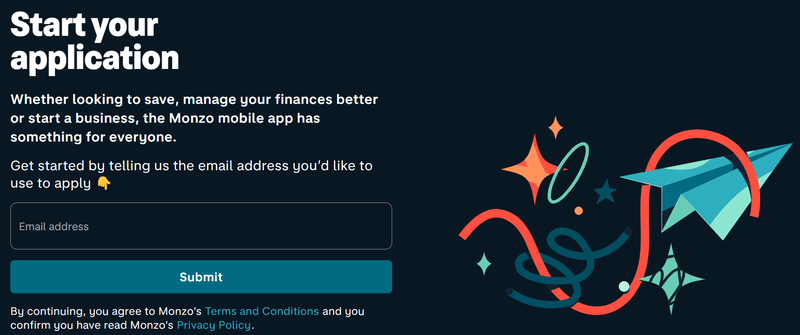

Step 1: Simplify the account opening process

As a financial company, you need to collect a lot of information about new customers. I get it.

The key here is to collect only the details essential to open the account. Otherwise, you’ll create excessive friction that may put users off.

Remember: You can always collect additional details once the user is inside the product.

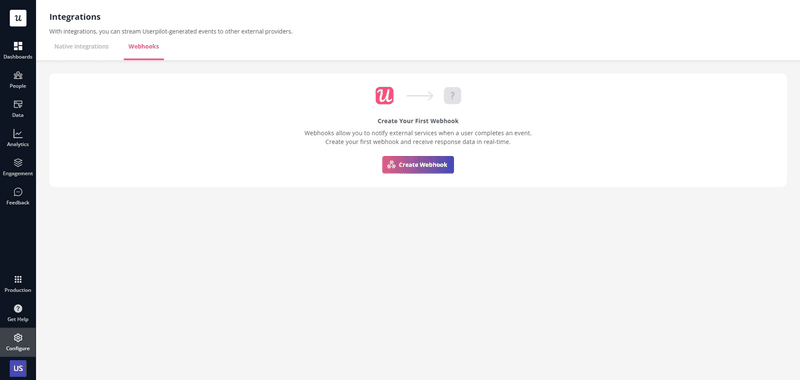

Step 2: Automate the digital identity verification

One of the areas that can slow down the onboarding process is identity verification.

Fortunately, some tools can streamline the process.

For example, Jumio and Onfido allow you to verify your customer ID online, ID.me and iProove provide biometric verification services while FaceTec can help you ensure that the person is physically present and not scanning their photo.

All you have to do is integrate them seamlessly into your onboarding process. Your engineers should help you hook them up to your onboarding tool through APIs or webhooks in no time.

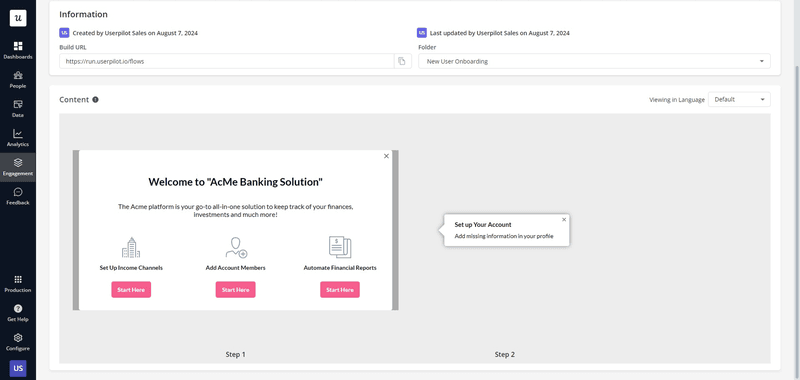

Step 3: Welcome users in-app

When the user logs into your product for the first time, welcome them by triggering a welcome screen.

Or a welcome survey to collect the additional data needed to personalize their user experience.

For example, you can ask them about their use cases and link the responses to onboarding flows that walk them through the features they need to achieve their goals.

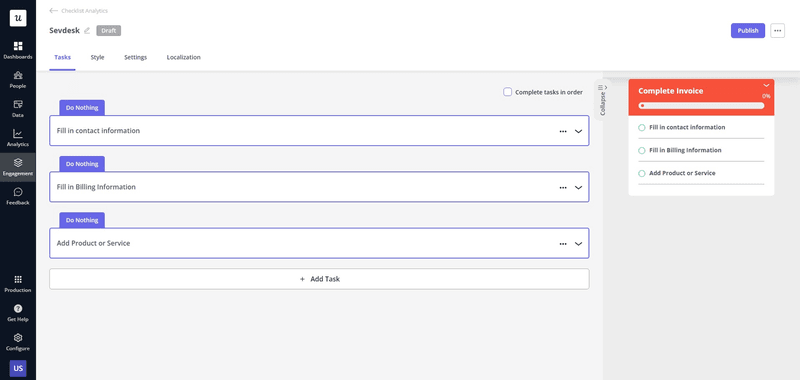

Step 4: Guide them to their goals with a personalized onboarding checklist

When it comes to digital client onboarding in digital products, checklists are probably the best tool for the job.

Why?

First, they give the onboarding process a structure. They take users through the process step by step, which reduces the risk that they miss an important step. Which could potentially have grave ramifications.

Secondly, they rely on strong psychological processes to drive user behaviors. People are wired to follow checklists and find it difficult to focus on other tasks before they complete the tasks you’ve set out for them.

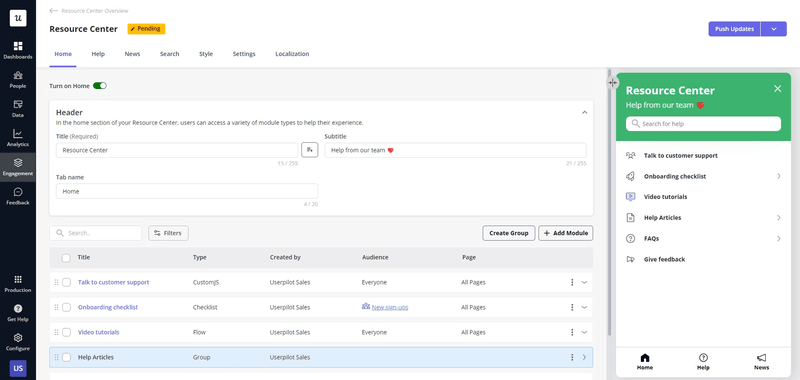

Step 5: Provide necessary resources for the self-serve customer onboarding process

In addition to the onboarding flows, provide customers with self-service support resources.

In this way, they can access assistance whenever they need it and without interacting with support agents. This reduces the time needed to resolve the issue and minimizes the disruption.

It also reduces the strain on the customer support team. As a result, they can better serve customers with complex problems they can’t tackle alone.

What self-service resources can you offer?

An AI-powered chatbot and a resource center with a knowledge base, product documentation, how-to guides, and video tutorials are more than enough.

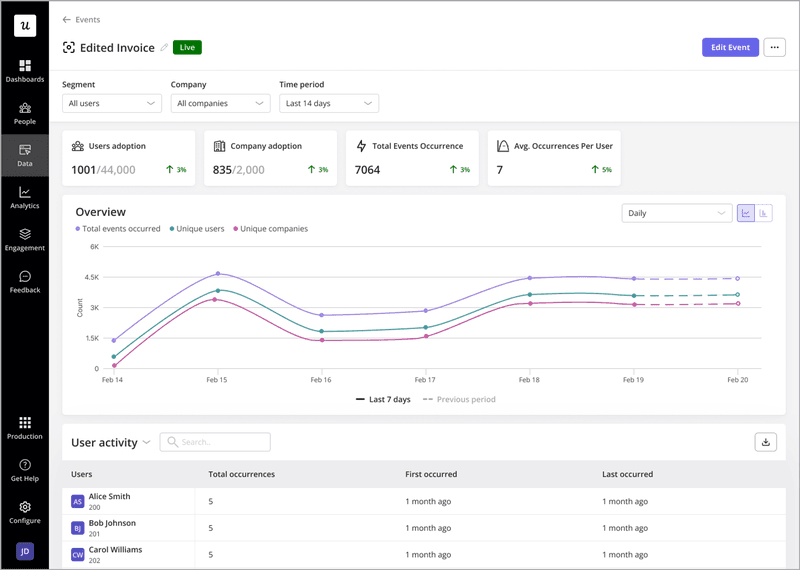

Step 6: Analyze user behavior and optimize the digital customer onboarding process

No onboarding process is perfect. And as user needs change, so should your onboarding.

To make informed optimization decisions, use product analytics tools to track user interactions with the onboarding flows and their behavior within the app.

For example, by conducting funnel analysis, you can find the stages in the onboarding process where users drop off. By optimizing the particular step, you can enhance the flow completion rate and, consequently, boost user activation.

Best practices for digital onboarding process in banking services

Now that you know how to organize the customer onboarding process, let’s look at the best practices for streamlining it and maximizing its impact.

Create an omnichannel customer onboarding experience

When onboarding your customers, customize the process to the different channels that you use.

For example, tailor the onboarding flows to the various devices on which users complete them. optimize them for the device type and ensure they cover the features that the user will use on a particular device.

Take advantage of different communication channels and their unique strengths.

For example, in-app flows are great for primary or secondary onboarding but only when the customer logs into the product.

If they don’t, you can send them email, text, or push notifications and prompt them to complete tasks like ID verification or upload documents.

Whatever channels you use, ensure a consistent experience. Ensure that branding and messaging are aligned across channels, consistently provide reliable information, and reflect your brand values.

Meet customer expectations regarding your services effectively with interactive walkthroughs

Interactive walkthroughs are sequences of in-app messages that guide users through a process step by step. They’re made up of UI patterns called tooltips and driven actions and are used in onboarding to drive feature adoption.

For example, you could link them to the checklist tasks to provide user guidance on how to complete them. Or to help users discover new or more advanced features.

By increasing the adoption of such features, you keep your users engaged and help them maximize the product value.

Gamify customer experience with incentives

Gamification makes the user onboarding more engaging and enjoyable.

You can inject a little bit of fun into the process and motivate your customers through:

- Quizzes and knowledge checks.

- Challenges and rewards for completing them, like fee waivers.

- Points for completing tasks and leaderboards.

- Social sharing.

- Exclusive content or features that get unlocked as the user progresses.

Customer onboarding may be a serious matter for financial institutions, but it doesn’t mean it needs to be boring.

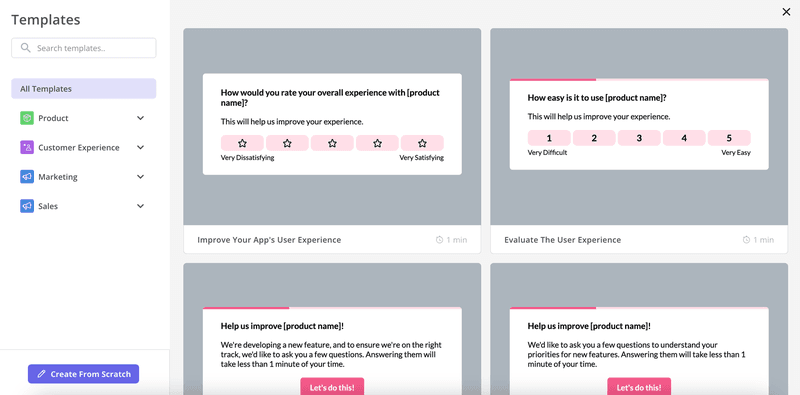

Regularly measure and improve customer satisfaction with your product

To ensure that your product keeps delivering value to customers and offers a positive experience, gather their feedback. And iterate on it.

Here are a few ideas:

- Conduct an onboarding survey 2-3 days after sign-up.

- Run customer satisfaction surveys every 3-4 months.

- Send contextual surveys to measure satisfaction with specific features.

- Enable a feedback widget to collect passive feedback and requests.

- Regularly interview existing and prospective customers to stay on top of their evolving needs and discover new opportunities.

What should you consider when choosing a financial services client onboarding solution?

When choosing an onboarding platform for your financial product or service, consider these criteria:

- Functionality: you need a tool to collect customer data via surveys, engage them across different channels, and analyze their interactions.

- Flexibility and scalability: choose one that you can adapt to your specific processes and that will support your growth as your needs increase.

- Pricing: the tool needs to fit your budget not only now but also in the future as your needs grow.

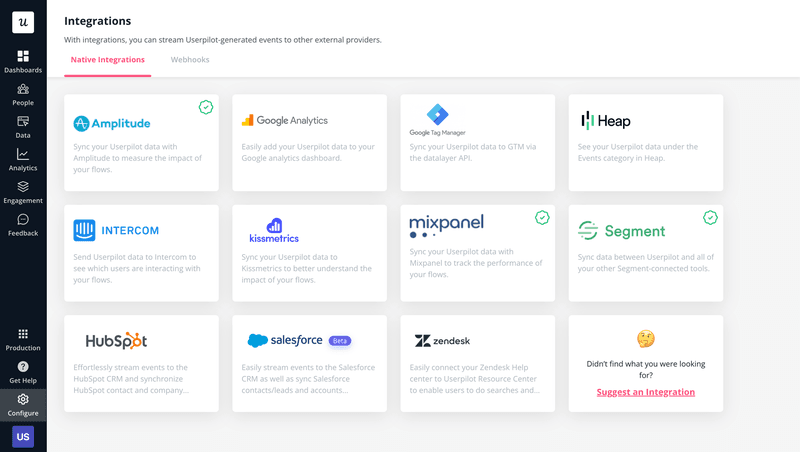

- Integrations: to seamlessly embed it into your existing systems and sync data with third-party systems.

- Robotic process automation: to automate routine tasks like document verification for increased efficiency and reduced error risk.

- Compliance: the tool needs to be compliant with industry regulations and data protection standards.

How to use Userpilot for client onboarding process in financial institutions

Userpilot is a product growth platform that ticks a lot of the boxes.

Here are the key features relevant to customer onboarding in banking and other financial services:

- UI patterns and flows for user engagement.

- Interactive walkthroughs and onboarding checklists.

- Resource center for self-service support.

In addition, Userpilot allows you to collect customer feedback via in-app surveys and a feedback widget.

It also offers analytics capabilities so that you can track and analyze user behavior inside your web app:

- Autocapture: tracks all in-app events without manually tagging them.

- Reports: Trends, Funnels, Paths, Retention.

- Session replays.

- User segmentation.

- Integrations with other analytics tools so you can track user engagement along the entire user journey.

Finally, Userpilot is compliant with Soc 2 Type 2, HIPAA, ISO 27001, and GDPR standards, offers a 2-factor Authentication, roles and permissions management, and identity verification is coming soon.

Conclusion

A robust client onboarding process in financial services is even more important than in other niches. It not only enables users to get the most out of your product but also ensures compliance with regulations.

If you’d like to find out more about Userpilot and how it can help you onboard your customers, book the demo!