How does customer onboarding in banking work? Why do you need it in the first place?

These are just a few of the questions we answer in the article.

You will also learn the main challenges involved in the onboarding process in banking, best practices and explore the best onboarding software tools for the job.

Let’s dive right in!

TL;DR

- Customer onboarding in banking focuses on setting up the customer account and familiarizing them with the bank’s product or service.

- The process establishes the foundation for the bank-customer relationship. Consequently, it can impact customer satisfaction and loyalty.

- It also fulfills regulatory requirements and provides valuable data that can be leveraged to personalize services.

- The main challenge of customer onboarding in banking is reconciling two clashing needs: The need to comply with constantly changing regulations and to quickly enable users to start using the product.

- Unlike the typical customer onboarding process in banking, digital onboarding leverages technology to improve efficiency and enhance customer experience. It reduces costs, strengthens security, and enables data-driven decision-making.

- A step-by-step digital onboarding process in banking:

- Select customer onboarding software with engagement features, analytics, automation, integrations, and compliance certifications.

- Streamline the sign-up process by collecting only essential information.

- Welcome new customers and use surveys to gather profiling information to personalize their experience.

- Use checklists and walkthroughs to guide users quickly to product value.

- Implement digital solutions for remote identity verification, like Jumio or iProov.

- Use analytics to identify and improve areas of friction in the onboarding process.

- Collect and act on user feedback to enhance the onboarding experience.

- Best practices to improve the banking customer onboarding process:

- Personalize the onboarding process by focusing on features relevant to customer use cases to improve customer satisfaction.

- Use path analysis to visualize and optimize user journeys for different personas.

- Gamify the customer experience to increase engagement and make onboarding fun.

- Add product documentation to an in-app knowledge base for easy access.

- Automate the workflows within the onboarding process to increase efficiency and reliability.

- Userpilot is a product growth platform used for customer onboarding in various sectors, including banking. Book a demo to learn more!

What is customer onboarding in banking?

Customer onboarding in banking is the process of introducing new customers to the bank’s products and services and teaching them how to use them effectively.

Its goal?

To create a smooth, efficient, and secure experience that enables customers to realize the value of the bank’s offerings.

It usually involves steps like opening the account, identity verification, collecting the necessary data about customers, device registration for digital banking, and authentication setup.

Why is the customer onboarding process important in banking?

The customer onboarding process is crucial for banks for several key reasons:

- As a customer’s first interaction with the bank, it lays the foundation for the entire relationship.

- Effective onboarding helps customers quickly understand and use the bank’s services. This directly impacts customer satisfaction, loyalty, retention, and, consequently, customer lifetime value.

- The onboarding process allows banks to fulfill important regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, helping to prevent fraud and ensure legal compliance.

- Thorough verification processes during onboarding allow banks to assess and mitigate potential risks associated with new customers.

- A secure and transparent onboarding process helps build trust between the bank and the customer.

- Onboarding provides banks with valuable customer data they can use to offer personalized product recommendations and potentially increase revenue through upselling and cross-selling.

- A smooth and efficient onboarding process can be a key differentiator and give you an edge in the competitive industry.

Main challenges of customer onboarding in banking

Fintech and Insurance companies, including banks, had the second-lowest activation and adoption rates of all the industries we investigated for our SaaS Product Success Metrics Benchmark report.

Why?

Financial institutions face a number of unique challenges that make the onboarding process more complex than in other sectors.

Let’s explore two main ones.

Regulatory compliance changes

Challenge number one is evolving regulatory requirements.

These changes often require adjustments to the onboarding process, documentation requirements, and verification procedures. Banks must stay up-to-date with regulations like Anti-Money Laundering and data protection laws, often across different jurisdictions!

This constant adaptation can be resource-intensive and may lead to inconsistencies in the onboarding process.

Moreover, compliance changes can sometimes cancel any efforts to streamline the customer experience. Ensuring regulatory adherence while providing a user-friendly onboarding process is sometimes a big ask.

Time constraints of manual customer onboarding processes

Traditional manual onboarding processes are notoriously time-consuming. They involve multiple touchpoints across various departments, including legal, operational, and credit teams, each with its own procedures and checks that could take days, if not weeks, to complete.

Apart from increasing operational costs and making scaling difficult, such lengthy manual processes negatively impact customer satisfaction and retention.

Customers have little patience for activities that don’t directly improve their experience and delay their starting to use the product.

Benefits of digital customer onboarding in banking

Digital customer onboarding offers banks a number of benefits:

- It significantly improves efficiency and speed, reducing account opening times from weeks to minutes.

- It enhances customer experience by offering a convenient, user-friendly process accessible anytime and anywhere. This reduces the risk of customer churn.

- Banks can achieve substantial cost savings by reducing manual processing and physical infrastructure needs. Digital onboarding increases their capacity to acquire new customers without proportionally increasing staff.

- Advanced security measures like biometric authentication and AI-powered fraud detection improve protection against fraud and identity theft. Automated checks and audit trails make it easier to comply with regulations.

- Digital user interactions are easier to track and analyze. This enables data-driven decision-making and customer experience personalization.

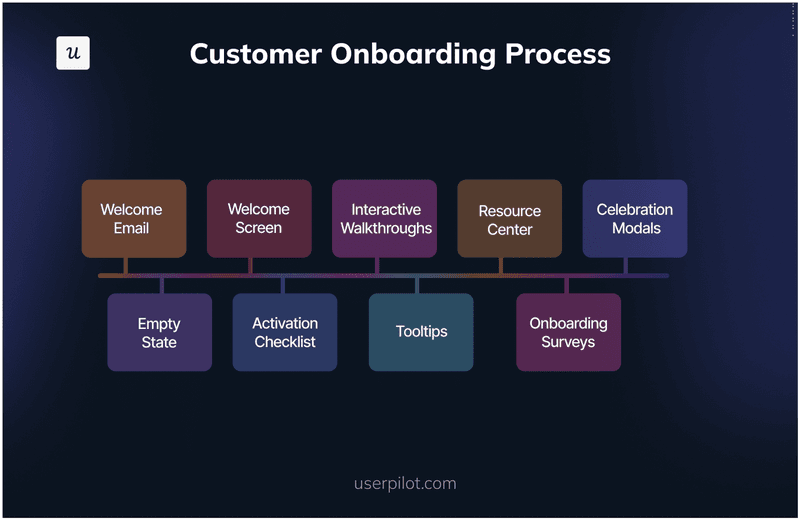

A step-by-step digital onboarding process in banking.

With the basics covered, it’s time to roll up your sleeves and build a comprehensive digital onboarding process.

Step 1: Choose a customer onboarding tool

Let’s start by choosing the right onboarding tool.

Here’s what your software needs:

- Customer engagement features to create onboarding experiences.

- Feedback and analytics capabilities to collect qualitative and quantitative customer data.

- Transparent and competitive pricing that remains affordable as your needs grow.

- Automation features to streamline routine tasks like identity verification and reduce error risk.

- 3rd party integrations to easily incorporate it into your existing workflows and seamlessly sync data with third-party systems.

- Certification ensuring compliance with industry regulations and data protection standards.

- Scalable platform that will support your growth as your needs evolve.

We’ll show you a few possible tools that match these requirements in the final section.

Step 2: Simplify the sign-up process

Sign-up is the very first stage of the onboarding process.

Many businesses unnecessarily complicate this stage, for example, by making them fill out complex forms.

Making your customers jump through too many hoops at this stage is a mistake. It delays the moment the customer can start realizing the product value and friction early on can discourage customers who aren’t 100 committed yet.

So, keep the sign-up form simple and collect only the essential information necessary to ensure compliance with regulations.

Step 3: Welcome new customers and collect customer data

When the customer sign in for the first time, greet them with a welcome message.

Or a welcome survey to collect profiling data. This will help you understand their needs and tailor the onboarding process to their unique needs.

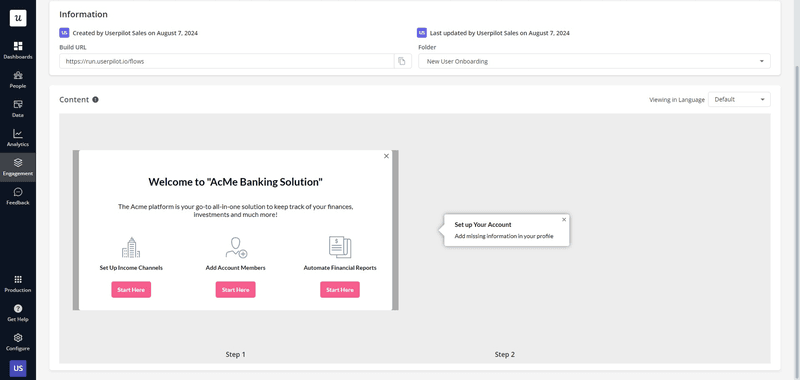

Step 4: Streamline customer onboarding process

The aim of the onboarding process is to lead customers to value as quickly as possible.

You can achieve this using tools like onboarding checklists and interactive walkthroughs, which guide users through the process step by step.

The key to success is minimizing the number of steps by eliminating unnecessary actions and tasks.

How can you know which tasks to include?

Product analytics tools can help. Look for features whose usage correlates with customer retention.

Build your onboarding flows around those features.

Step 5: Use digital identity verification methods

Traditionally, identity verification would involve the customer attending the bank branch.

Fortunately, it’s now possible to reliably verify one’s identity using digital solutions.

Tools like Jumio, Onfido, and iProove allow you to verify customer identity using biometric data, and with FaceTec, you can ensure that the person isn’t scanning their photo instead of their face.

The best part?

Their easy to integrate into the onboarding process via APIs.

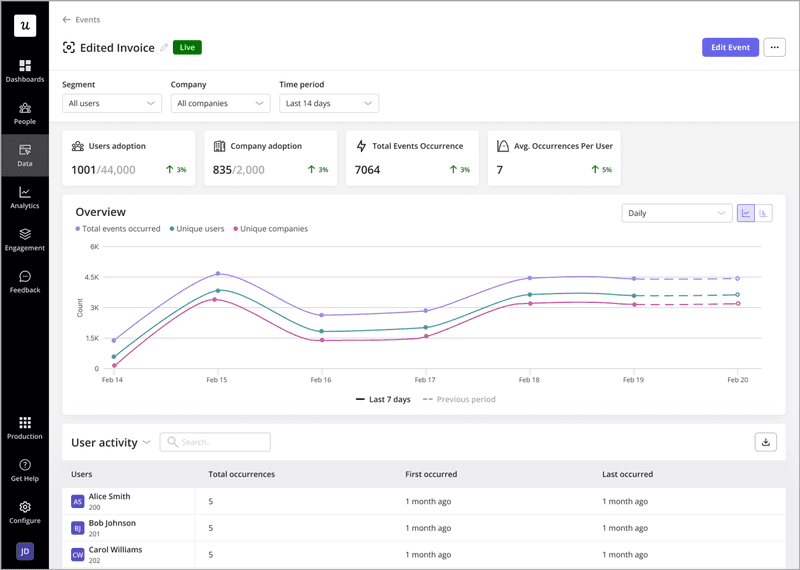

Step 6: Analyze customer behavior data to identify and improve areas of friction

As mentioned, friction can hurt user activation and customer retention. So it’s in your interest to make the entire process as smooth as possible.

Start by using analytics tools to track user conversions at different stages. By conducting funnel analysis, you can pinpoint the onboarding phase where users experience friction.

You can then investigate what exactly happens, for example, by studying session replays.

Once you understand the root cause of friction, tweak the in-app experiences to help users overcome it. Sometimes, an extra tooltip or a hotspot is all it takes to guide the user.

Step 7: Improve your onboarding processes based on customer feedback

Product analytics give you an excellent idea of how users engage with the onboarding flows. But they don’t always allow you to understand why. Or who you can improve them.

Solution?

Run onboarding surveys a few days in to check on your customers. In this way, you can identify issues early on and provide them contextual support.

In addition, enable a feedback widget to collect passive feedback. This gives users a chance to share their insights and submit requests whenever they feel like they need it.

Best practices to improve banking customer onboarding process

Now that you know how to structure and optimize the onboarding process, let’s look at a few best practices to improve its effectiveness.

Improve customer satisfaction with personalization

A private customer needs different banking app features than a freelancer or business owner. Introducing irrelevant functionality increases time to value and makes the user experience tiring.

So?

Using the data from the welcome surveys, personalize the onboarding process to their unique use cases. Once you know what the user wants to achieve, show them how to do it in the most direct way.

You can find the happy path using product analytics.

Improve customer journey mapping with path analysis

Path analysis is a powerful analytics tool that allows you to visualize user actions inside the product, either leading to an event or following it.

This could be particularly useful when mapping user journeys for different user personas and optimizing their onboarding flows.

Because let’s face it: customers don’t always behave how you expect them. While you might have an idea of what their journey looks like, you can’t be sure until you track it and map it out.

Gamify customer experience

As a bank, you need to ensure that your onboarding satisfies all the regulatory requirements.

However, you can still make it more enjoyable, quicker, and more effective by introducing elements of gamification into the process.

Shine does this by adding a progress bar to show users how long the process takes and to incentivize them to continue. And when a user opens a free account, celebratory confetti appears on the screen.

Other elements that can enhance customer engagement include:

- Animations to drive action, like PNC Bank’s “Punch the Pig.”

- Point systems and personalized rewards, like Natwest’s MyRewards.

- Financial goal setting.

- Challenges, like CIMB’s Octochallenge.

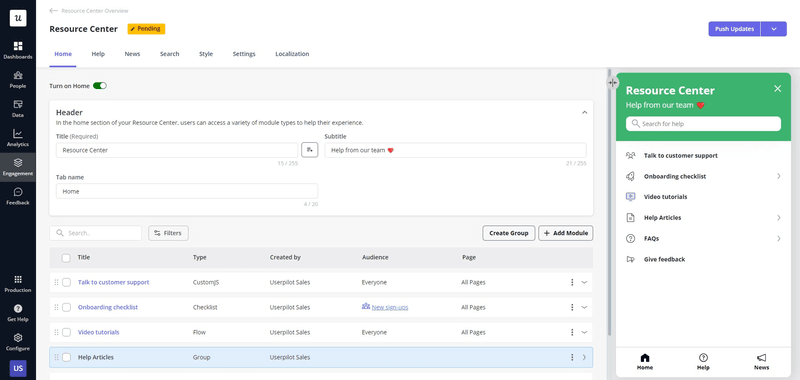

Add documentation regarding your banking services to your knowledge base

How can you ensure that users always have access to up-to-date documentation about your product or services? For example, current interest rates or the latest features?

The easiest way is to upload them to your in-app resource center.

This makes it easy to update the documents whenever your product changes.

Most importantly, users can easily access whenever they need without sifting through their emails or contacting customer services.

Mind you, such documents don’t have to be text-based only. You can add audiovisual resources, like tutorials, to make them more accessible to users with different preferences.

Automate workflows with the right tool

How can you automate onboarding tasks and processes to make them more efficient, safer, and more reliable?

Modern software tools offer lots of opportunities.

For example, you could:

- Use OCR software to extract and process uploaded text documents automatically.

- Employ chatbots to provide timely customer support.

- Use event-based triggering to launch onboarding flows and send notifications.

- Use API integrations to sync data between different tools and systems seamlessly.

- Implement automated credit scoring to pre-approve applications.

- Send automatic reminders, for example, about low balances or card expiry.

- Enable automatic identity verification to streamline login details recovery.

Customer onboarding tools to create a successful onboarding process in banking

Let’s wrap up by looking at three software tools you can use for customer onboarding in banking: Userpilot, Whatfix, and Creatio.

Userpilot

Userpilot is a user onboarding platform that helps SaaS companies improve user experience and increase product adoption.

Its key onboarding features include:

- UI patterns and flows (tooltips, banners, modals, slideouts, driven actions, spotlights).

- Interactive walkthroughs and onboarding checklists.

- User segmentation.

- User behavior tracking with event autocapture.

- Customer feedback surveys.

- A/B testing for onboarding flows.

- Flow, user path, and funnel analytics.

- Integrations with analytics tools for comprehensive customer journey tracking.

Userpilot is Soc 2 Type 2, HIPAA, ISO 27001 certified. It supports 2-Factor Authentication and Role and permission management, while identity verification is coming soon.

There are 3 Userpilot plans: Starter (from $299/month, billed annually), Growth and Enterprise (custom pricing).

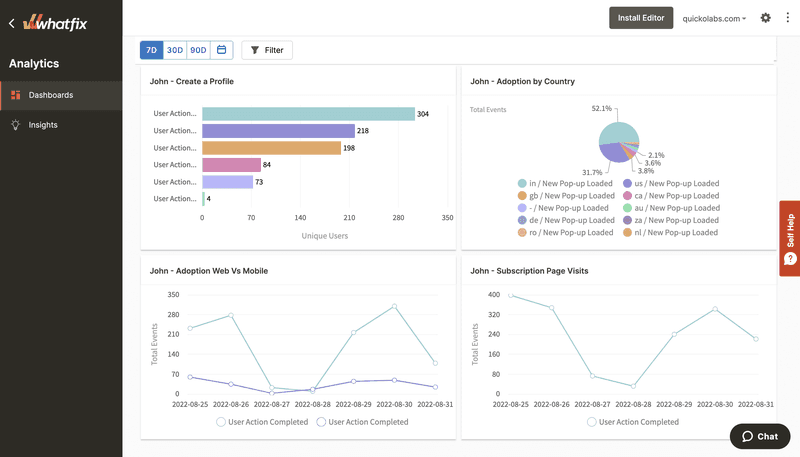

Whatfix

Whatfix is a digital adoption platform that provides a range of onboarding features designed to help organizations improve user engagement, accelerate product adoption, and enhance the overall onboarding experience for both employees and customers.

Its key onboarding features include:

- UI patterns (tooltips, pop-ups, beacons, etc).

- Interactive walkthroughs and checklists (task lists).

- Smart tips for contextual guidance.

- Guidance analytics.

- Multi-format content creation (you can export flows as videos, PDFs, slide decks, etc.).

- Integration with learning management systems.

While Whatfix doesn’t offer the same onboarding or analytics capabilities as Userpilot, it’s a solid tool for employee onboarding.

Unfortunately, Whatfix doesn’t provide pricing information on their website.

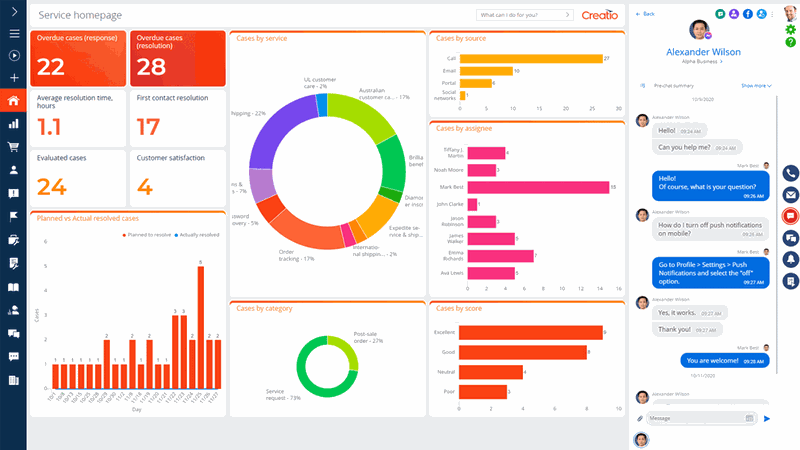

Creatio

Creatio is a low-code platform that offers a suite of CRM and process management solutions. It also provides robust onboarding features to help organizations streamline the adoption process for new users, whether they are employees or customers.

Its onboarding features include:

- Guided tours.

- Contextual tooltips and in-app notifications.

- In-app tutorials and training modules.

- Personalized learning paths.

- Self-service portal for support.

- Task management and checklists.

- Personalized role-based onboarding.

- Dozens of 3rd party integrations.

To obtain pricing information, you need to schedule a demo.

Conclusion

Customer onboarding in banking needs to satisfy regulatory requirements while enabling users to experience the product value with the least friction possible.

This is possible thanks to modern onboarding solutions, which, combined with digital ID verification tools, allow product teams to build streamlined and personalized onboarding processes for both their customer and staff.

If you’d like to learn more about Userpilot’s onboarding, analytics, and feedback capabilities, book the demo!