We asked several product managers why they seek a Mixpanel alternative and noticed a pattern: Most teams look for other analytics tools because Mixpanel’s event-based model assumes they already know which product questions matter. Unfortunately, fast-moving teams rarely have this information.

When you’re moving fast and testing hypotheses, waiting for dev sprints to define what metrics to track creates decision-making latency that compounds over time. For example, you may spot a drop-off in your signup flow, but acting on this insight often means exporting data, stitching together workarounds, and relying on third-party tools.

Cost adds another layer of constraint. Mixpanel’s event-based pricing, while more flexible than its former MTU model, still ties cost directly to usage volume. Teams end up choosing between comprehensive tracking and cost control. As products scale, analytics costs rise alongside engagement, forcing teams to trade off comprehensive tracking for cost management.

Below, we’ve compared six Mixpanel alternatives that matter most to product managers: automatic tracking, actionable insights, and pricing models that don’t punish success.

| Tool | Best for | Pricing | Key features | G2 rating |

|---|---|---|---|---|

| Userpilot | Product teams needing analytics + in-app engagement | From $299/month (annual); free trial | No-code event autocapture, in-app guides & surveys, session replays, product analytics, feature adoption tracking | 4.6/5 |

| Amplitude | Data teams requiring advanced behavioral analytics | Free plan available; paid from $49/month (annual) | Event-based analytics, cohort analysis, predictive analytics, cross-platform tracking, behavioral segmentation | 4.5/5 |

| Heap | Teams wanting automatic retroactive data capture | Custom pricing on request; free trial and plan available | Automatic event tracking, retroactive analysis, session replays, funnel analytics, data warehouse sync | 4.4/5 |

| Pendo | Enterprise product & CS teams | Free plan; custom pricing on request | Product analytics, in-app guides, feedback collection, roadmaps, session replay (add-on) | 4.4/5 |

| PostHog | Engineering teams wanting open-source flexibility | Free; usage-based paid pricing | Open-source option, product analytics, session replays, feature flags, A/B testing | 4.5/5 |

| GA4 | Marketing teams focused on web analytics | Free; paid from $12,500/month | Web analytics, acquisition tracking, event-based model, cross-platform reporting, Google ecosystem integration | 4.5/5 |

Try Userpilot Now

See Why 1,000+ Teams Choose Userpilot

Why you should consider a Mixpanel alternative

Teams rarely migrate because Mixpanel is “bad” software; they migrate because its workflow disconnects insight from action. These are the three friction points that force the switch:

- The engineering dependency: Mixpanel relies entirely on manual event tracking (the `track()` call). If you didn’t tag it, you can’t track it. This dependency significantly slows the marketing and product teams. In a fast-paced PLG environment, waiting for an engineering sprint to track a feature launch creates fatal latency.

- The insight-to-action gap: You can see what happened, but Mixpanel offers no native tools to fix it. You might know a funnel analysis showing a 40% drop-off at the “Invite Team” step, but you cannot act on that data inside the platform. You are forced to export CSVs and switch to third-party email or guidance tools. This gap between diagnosing the problem and launching a solution is too wide for agile teams.

- The growth penalty: Mixpanel’s pricing model is based on Monthly Tracked Users (MTUs). This model effectively penalizes you for growing. As your user base spikes, your bill increases(often unpredictably). Founders frequently dread their “viral moments” solely because they know their analytics bill is about to skyrocket.

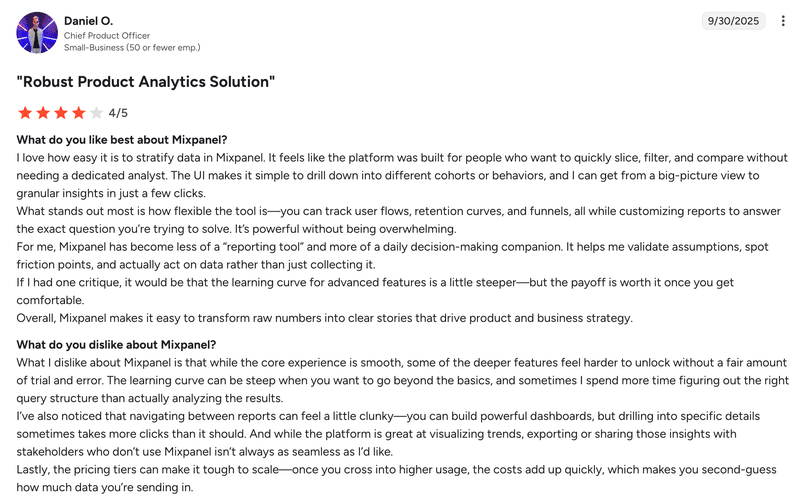

Mixpanel’s other flaws include:

- Steep learning curve: It can be a struggle to build reports beyond basic elements. Users report spending significant time configuring the setup before getting valuable insights.

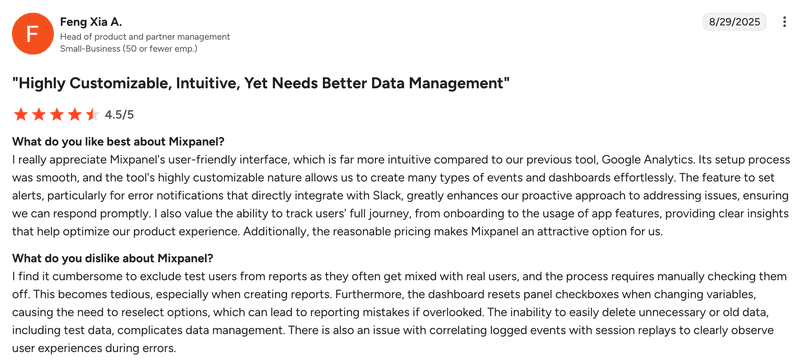

- Poor data management: You can’t easily delete old or test data, and dashboard checkboxes reset when changing variables. This leads to reporting errors if you forget to reselect filters.

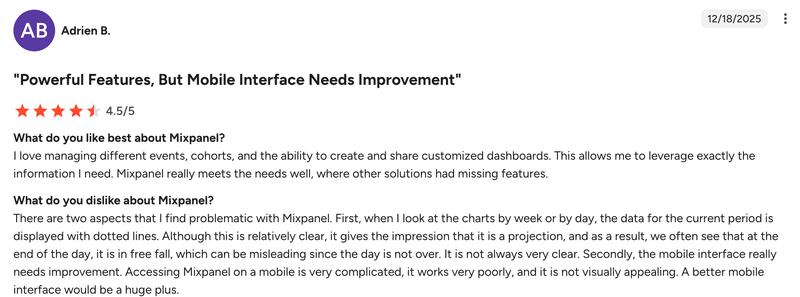

- Unsatisfactory mobile experience: Users report that Mixpanel’s mobile interface is poorly designed and difficult to navigate, forcing teams to rely on desktop access for basic analytics tasks.

Userpilot

Best for: Product and marketing teams who need to analyze user behavior and immediately act on it without engineering resources.

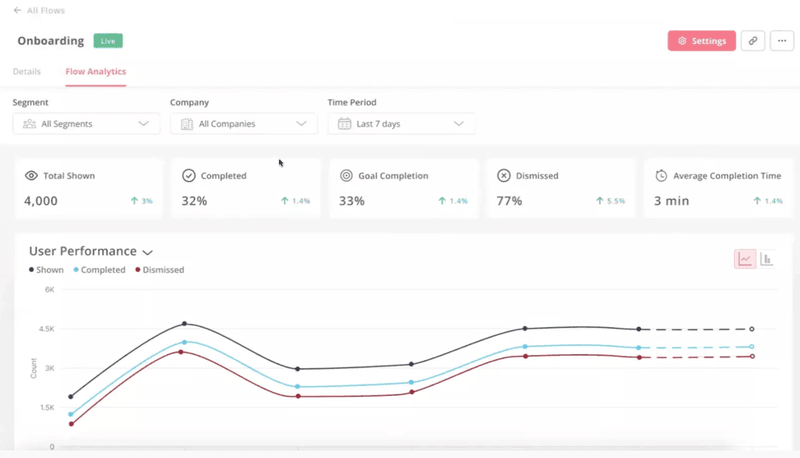

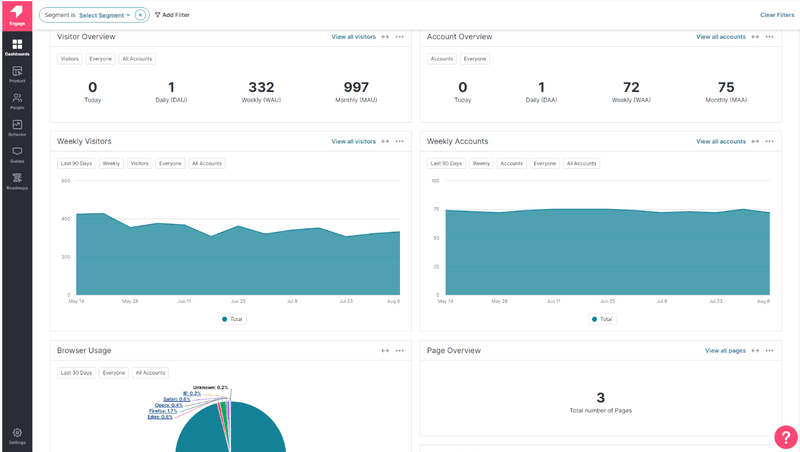

Userpilot operates as a complete product growth platform that bridges deep product analytics with in-app engagement tools. Unlike Mixpanel’s insight-only approach, our platform closes the loop between diagnosing friction and launching solutions: all within the same interface.

Key features

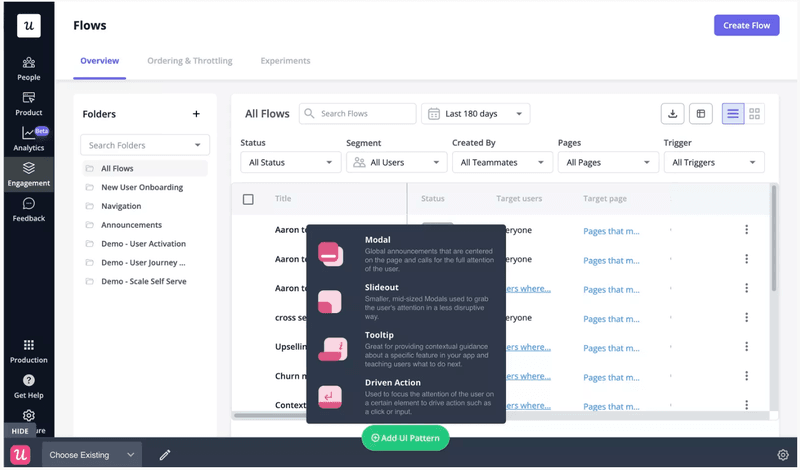

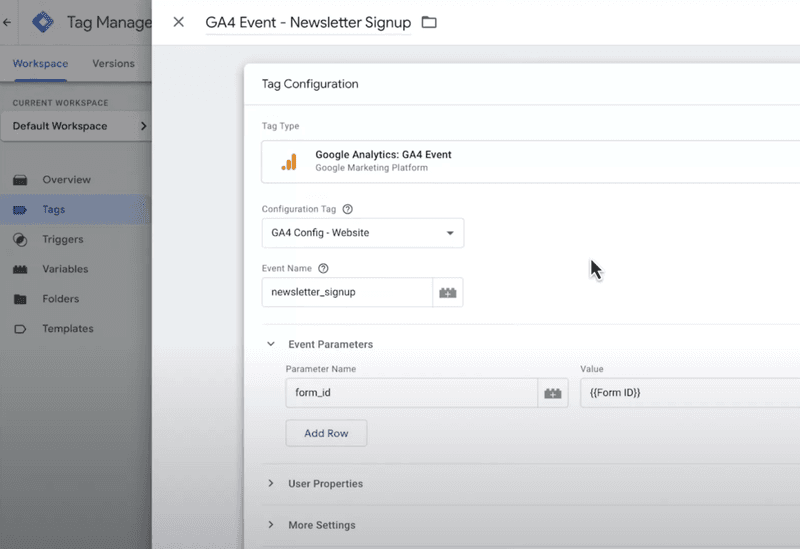

- No-code event autocapture: Automatically track every user interaction data without manual event tagging. Use our visual labeler feature to point-and-click on any UI element (buttons, forms, links) to start monitoring, with immediate access to historical data from before you labeled the event.

- Behavioral segmentation: Create dynamic user segments based on any combination of events, user properties, and engagement patterns. You can segment users who “completed signup but didn’t invite teammates” to target them with specific interventions.

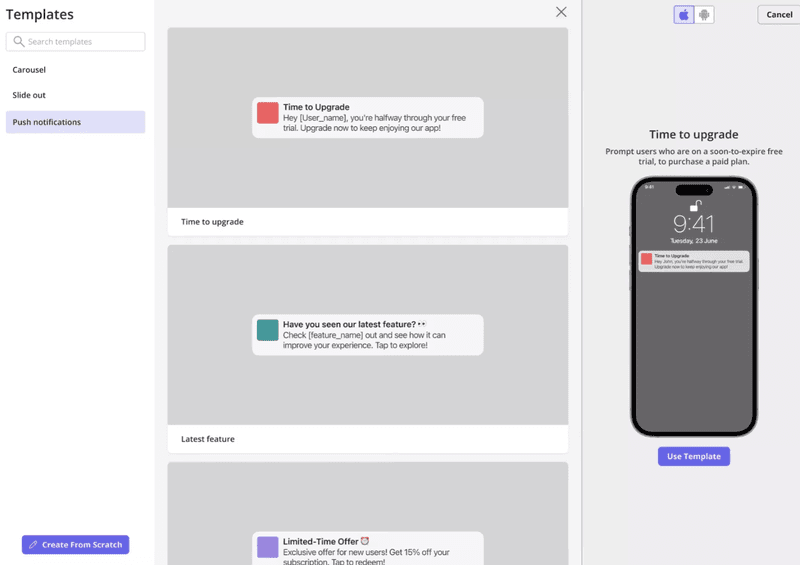

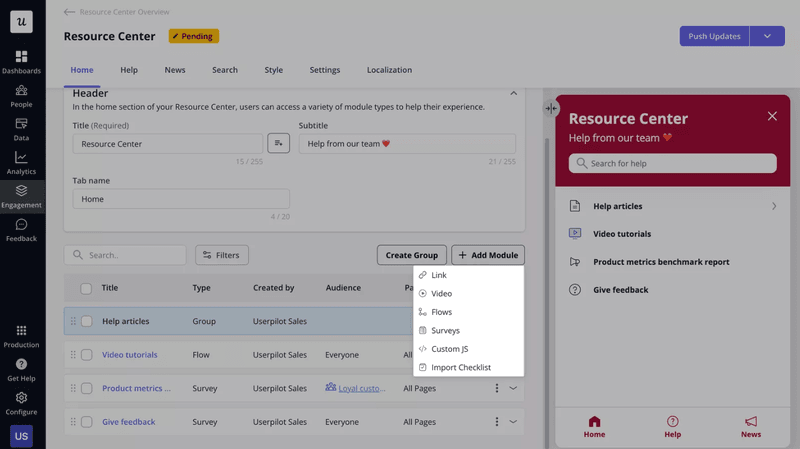

- In-app flows and guidance: Build contextual modals, tooltips, slideouts, and banners that trigger based on user behavior. You can also guide users through friction points the moment they encounter them, without leaving the analytics platform. You can also provide self-serve support with a resource center that reduces support tickets while giving you data on which help docs users actually need.

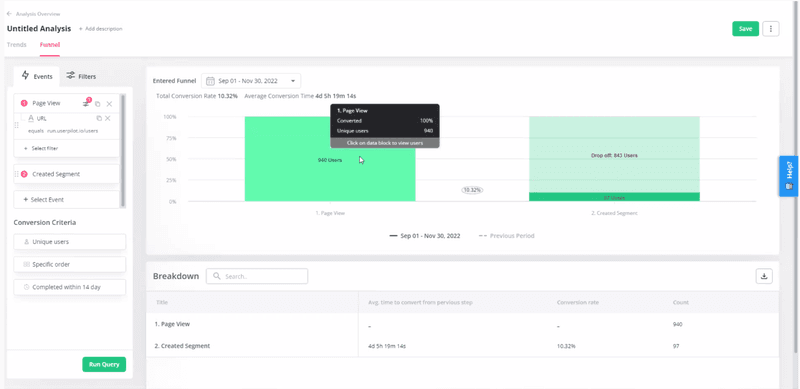

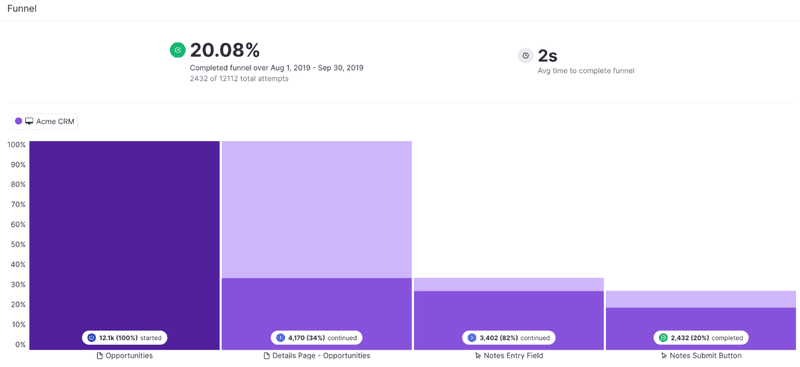

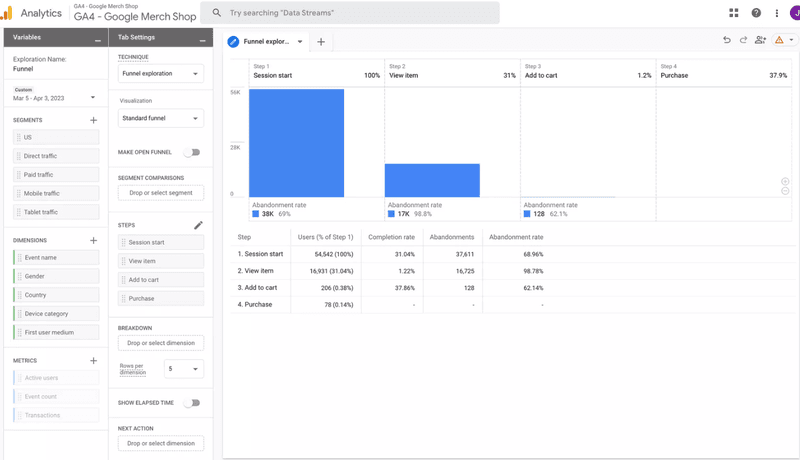

- Funnel analysis: Visualize step-by-step conversion paths to identify precisely where users drop off. Set up multi-step funnels (e.g., Signup → Profile Setup → First Action) and see completion rates, time to convert, and drop-off points.

- Trend reports: Track how specific events change over time to measure feature adoption, usage frequency, and engagement patterns. Compare trends across different user segments or time periods.

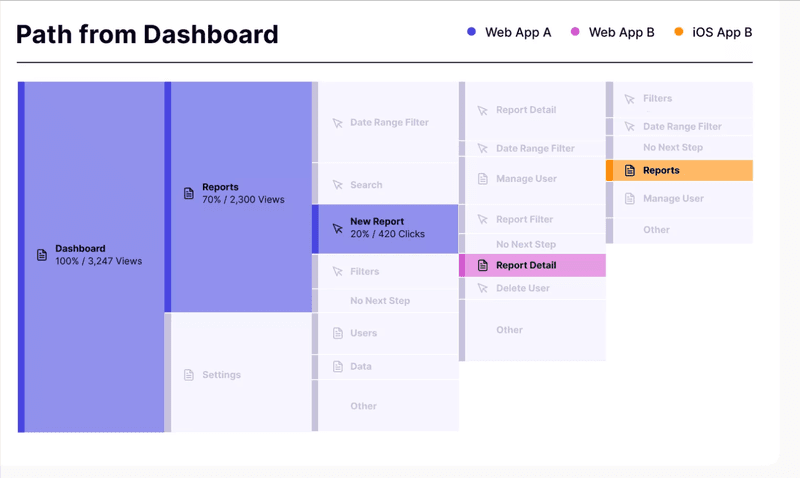

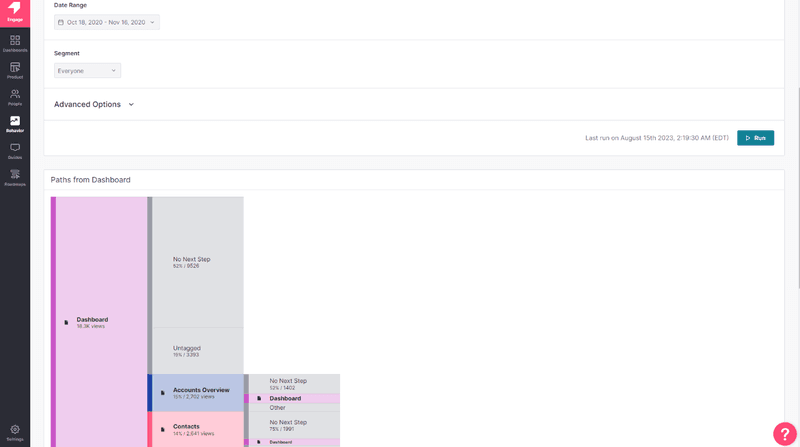

- Path analysis: Discover the actual routes users take through your product. This reveals unexpected customer journeys and identifies where users get lost or confused before converting.

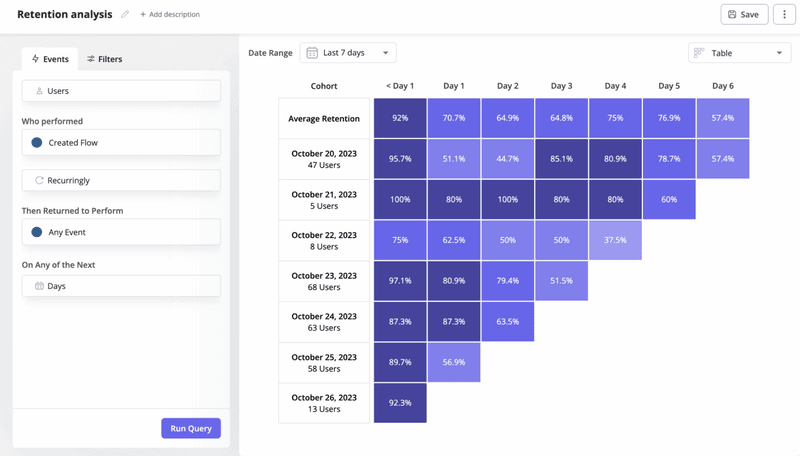

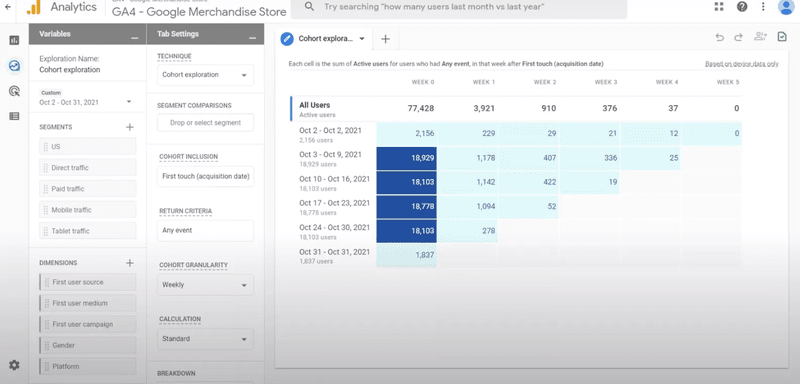

- Retention cohorts: Analyze week-over-week or month-over-month retention based on specific behaviors. You can see which user actions correlate with long-term retention and which cohorts are most likely to churn.

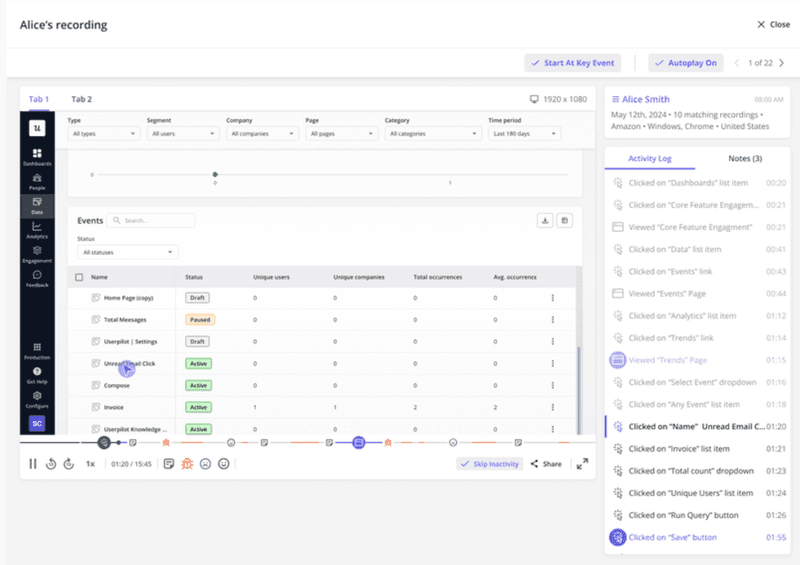

- Session replays: Watch real user session recordings to understand the “why” behind drop-offs. See precisely where users hesitate, encounter errors, or abandon flows, providing qualitative context to quantitative data.

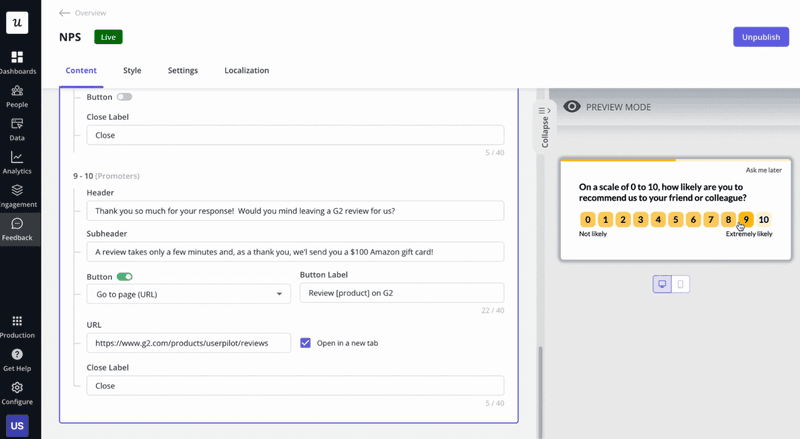

- In-app surveys and NPS: Gather user feedback at key moments in the user journey. Trigger microsurveys after specific events to understand user sentiment and validate product decisions.

- Cross-platform engagement (mobile + email): Extend product growth beyond the web with native mobile analytics and engagement. Build carousels, slideouts, and push notifications for iOS and Android apps, then coordinate with email campaigns to maintain consistent messaging across every touchpoint.

- Native integrations and data warehouse sync: Connect with your existing stack, including Amplitude, Heap, and even Mixpanel, to unify customer data across platforms. Export raw event data directly to your data warehouse for custom analysis, revenue attribution, and connecting product behavior to business outcomes.

Pros and cons

| Pros | Cons |

|---|---|

| Interface and no-code tools make setup and onboarding flows intuitive and accessible for non-technical team members. | Mobile analytics are available as an add-on only. |

| Responsive, helpful customer support that accelerates onboarding and issue resolution. | Some advanced features require Growth or Enterprise plans. |

| Analytics, user feedback, and in-app engagement are in one platform, helping product teams link behavior data with customer experiences. | Less suitable for pure data warehouse integration needs. |

| Affordable pricing with a transparent MAU-based model. |

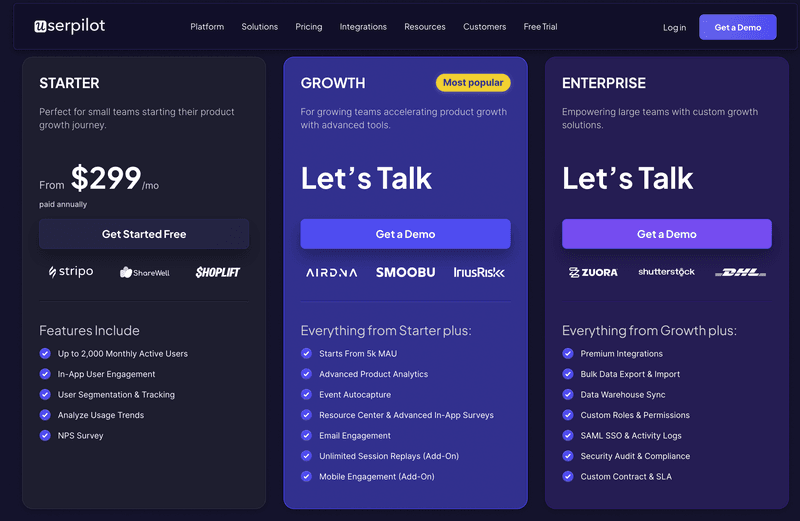

Userpilot uses a transparent MAU-based pricing model that scales with your user base:

- Starter: $299/month (up to 2,000 MAUs). Includes event autocapture, engagement flows, NPS surveys, and basic analytics.

- Growth: Custom pricing. Adds advanced product analytics, session replays, resource center, and unlimited feature tagging.

- Enterprise: Custom pricing. Includes all Growth features plus premium integrations, SSO, custom roles, and dedicated support.

Use this comparison table to decide between Userpilot vs Mixpanel:

| Choose Userpilot when: | Choose Mixpanel when: |

|---|---|

| You need to act on insights immediately with in-app guidance. | You only need analytics without engagement features. |

| Product managers need to launch experiments without engineering. | You have dedicated developers for manual event implementation. |

| Speed and cost predictability matter in a PLG motion. | You prefer complete control over event taxonomy from day one. |

Amplitude

Best for: Teams with data scientists who need complex correlation analyses and have engineering resources to maintain rigorous event tracking.

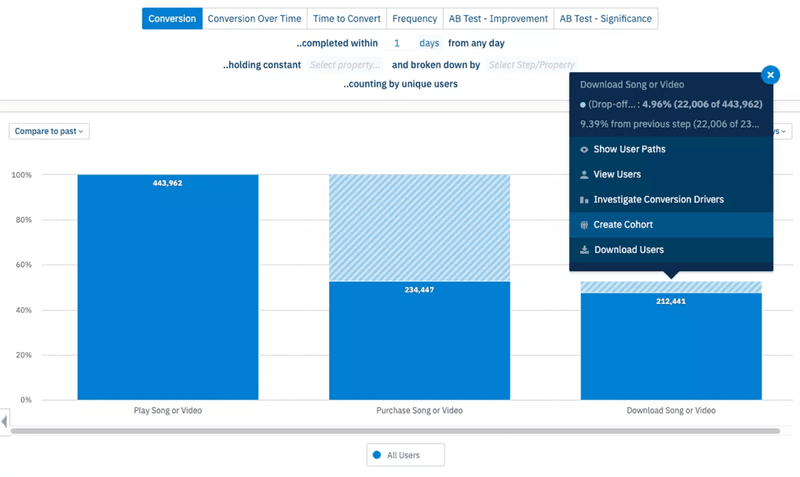

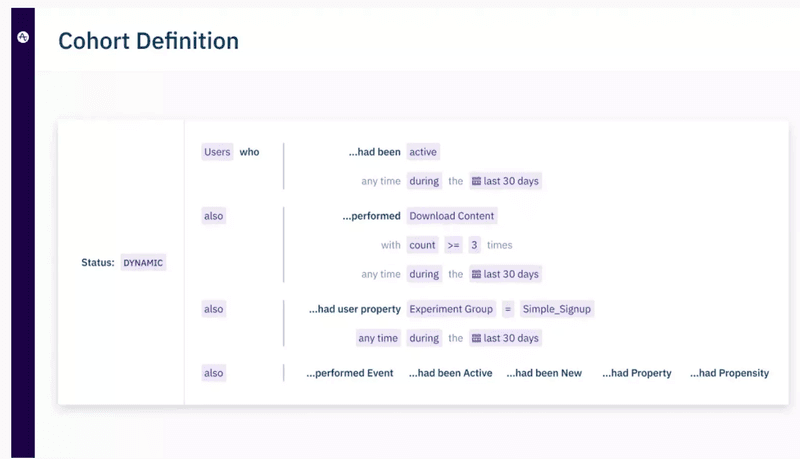

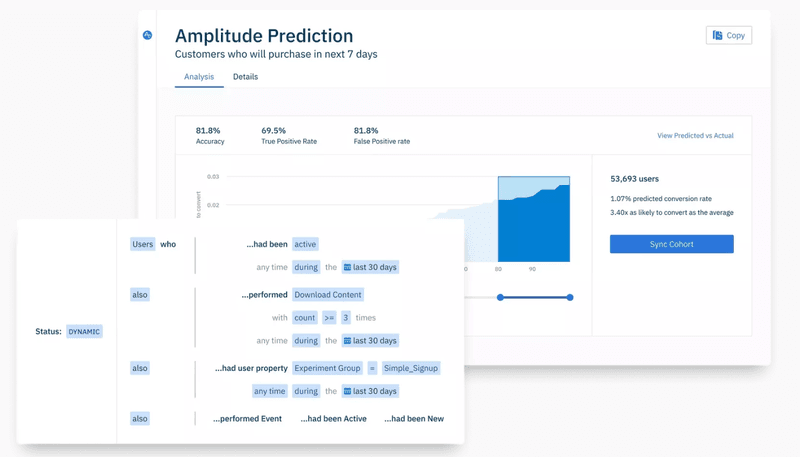

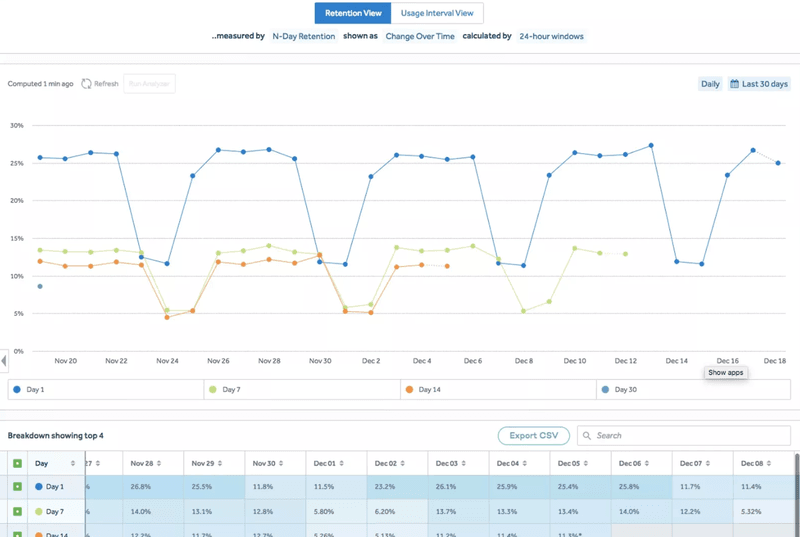

Amplitude is Mixpanel’s direct competitor for teams requiring deep behavioral analytics and advanced statistical modeling. It excels at predictive analysis and finding hidden patterns in user data, but like Mixpanel, it requires manual event implementation and lacks native engagement tools to act on insights.

Amplitude key features

- Compass (predictive analytics): Automatically identifies which user behaviors correlate with retention and conversion without manual hypothesis testing. Scans your entire dataset to surface hidden patterns, such as “users who complete X action within Y timeframe are Z% more likely to retain.”

- Behavioral cohorts with advanced segmentation: Group users based on shared actions, properties, or sequences like “users who triggered feature A but never reached feature B.” Track how different cohorts behave over time and compare against power users to identify optimization opportunities.

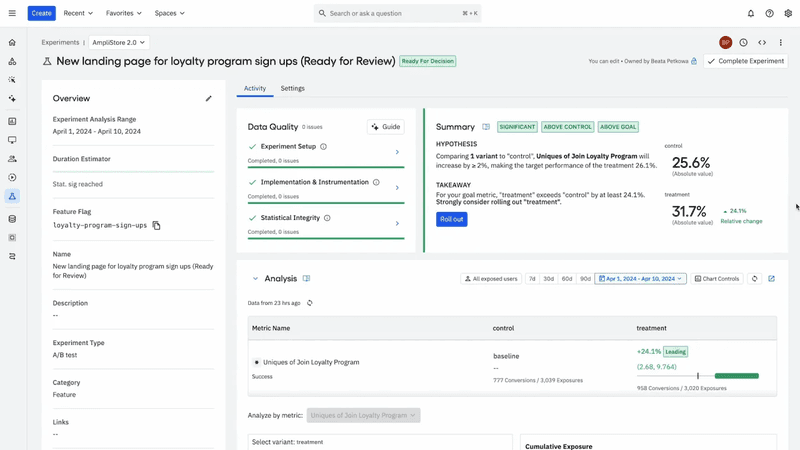

- Revenue LTV tracking with experiment analysis: Connect user behavior directly to revenue outcomes, tracking lifetime value by cohort, acquisition channel, or specific in-app behaviors. Analyze A/B test performance with statistical significance calculations to measure how experiments impact retention, engagement, and revenue.

- Cross-platform tracking with identity resolution: Unify user behavior across web, mobile (iOS/Android), and server-side events. Track users as they switch between devices and maintain consistent identity resolution across platforms for complete journey visibility.

- SQL-like query builder with data warehouse integrations: Write complex queries using Amplitude’s data taxonomy without needing direct database access. Export results to CSV or integrate with data warehouses like Snowflake or BigQuery for custom analysis.

Pros and cons

| Pros | Cons |

|---|---|

| Robust cohort analysis, behavioral segmentation, rich funnels, and retention reports help teams understand user behavior in depth. | The platform’s breadth and depth can feel complex and less intuitive for non-technical users. |

| Built-in predictive capabilities (e.g., Compass) and statistical tools make it easier to forecast trends and understand user paths. | Teams must define and track the right events, often needing engineering support to get meaningful data. |

| Strong support for tracking users across web and mobile applications, and integrations with data warehouses. | Costs can rise quickly as tracked user counts grow, especially at scale. |

| Session replay and deeper qualitative context are add-ons or separate products, so base analytics plans lack them. |

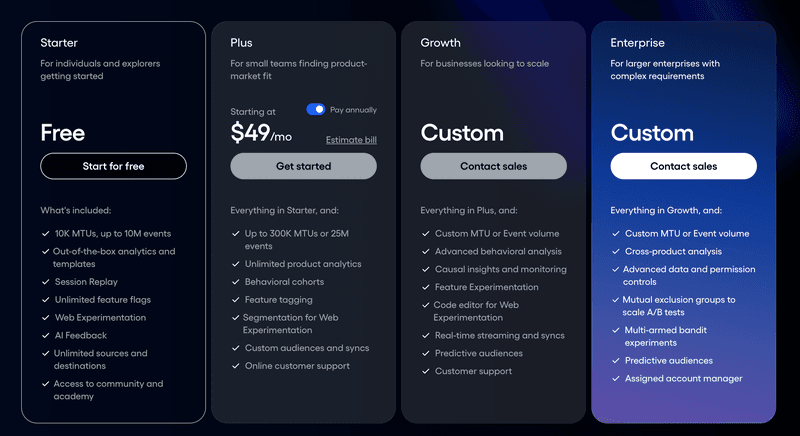

Amplitude pricing is based on Monthly Tracked Users (MTUs) and events:

- Free: For up to 10M events/month. Includes core analytics, session replay, and web experimentation.

- Plus: From $49/month(annually), up to 300K MTUs. Adds advanced features like unlimited product analytics, behavioral cohorts, and feature tagging.

- Growth: Custom pricing. Includes predictive analytics, advanced behavioral analysis, and real-time streaming and syncs.

- Enterprise: Custom pricing. Adds permission controls, capabilities to scale A/B tests, cross-product analysis, and a designated account manager.

When to choose Amplitude vs Mixpanel:

| Choose Amplitude when: | Choose Mixpanel when: |

|---|---|

| You need predictive analytics to identify retention drivers. | You want straightforward event analytics without ML predictions. |

| Your team includes data scientists who can leverage complex features. | You need a simpler analytics tool for product managers. |

| Cross-platform and warehouse integration are critical. | You want a focused, standalone analytics tool. |

See a detailed comparison in this best Amplitude alternatives guide.

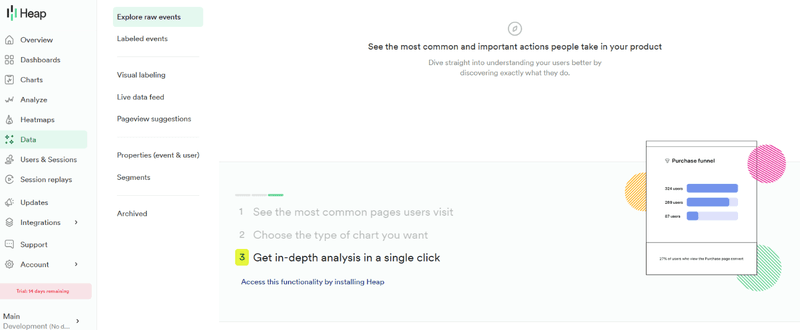

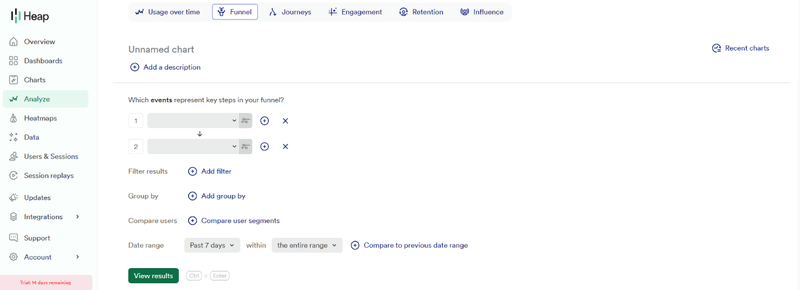

Heap

Best for: Teams who frequently forget to tag events or need to answer questions about historical user behavior that you didn’t explicitly track upfront.

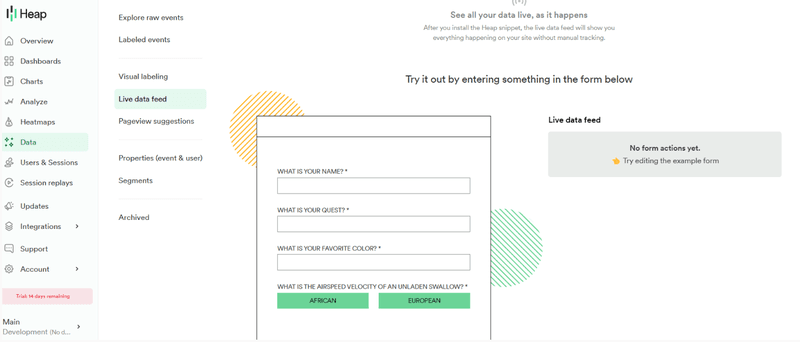

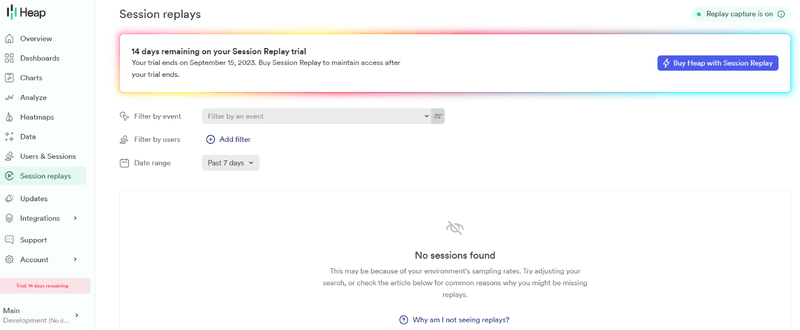

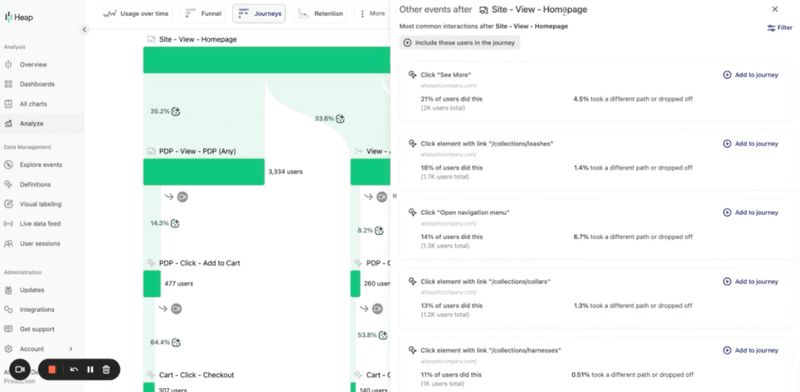

Heap’s core value proposition is automatic event capture with retroactive analysis. It tracks every click, swipe, and pageview without manual tagging, so you never lose data when someone forgets to tag an event. In other words, it provides the quantitative and qualitative data to optimize flows.

Heap key features

- Automatic event capture: Track how every user interacts automatically without writing code. Heap captures clicks, form submissions, page views, and element changes across your entire product from the moment you install it.

- Retroactive event definition: Define events today and instantly access historical data going back months. If you decide to track “clicks on the upgrade button,” you can see that data from before you defined it, eliminating the risk of lost insights.

- Visual event labeling: Point-and-click on any UI element in Heap’s visual labeler to define events. Label a button as “CTA Click,” or a form as “Signup Completion,” and the event becomes available in all your reports immediately.

- User journey mapping (Paths): Discover the actual routes users take through your product. Identify unexpected paths, common sequences, and where users get stuck between point A and point B.

- Data warehouse integration: Heap’s integrations enable you to sync captured events to your data warehouse (Snowflake, BigQuery, Redshift) for custom analysis. Export raw event data while maintaining Heap’s automatic capture benefits.

Pros and cons

| Pros | Cons |

|---|---|

| Heap captures all interactions out of the box without pre-defining events, and you can retroactively define events for historical data as well. | Automatic capture can generate lots of raw data, which teams need to govern carefully or risk clutter/noise. |

| Initial setup is fast, and it’s easy to start seeing insights quickly. | Steep learning curve due to the complexity of advanced features and the analytics interface. |

| Includes session replays (depending on plan), giving qualitative detail to complement metrics. | Session-based pricing can get expensive as usage grows. |

| Intuitive UI and strong reporting features that help teams explore user behavior. | Doesn’t include built-in in-app engagement or guidance features. |

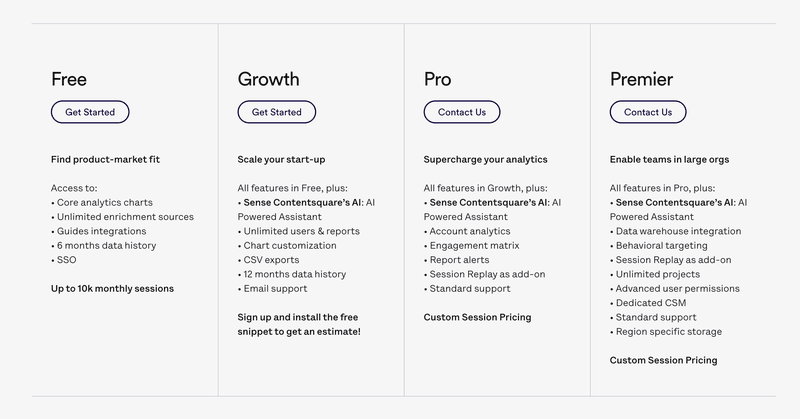

Heap uses session-based pricing rather than user or event-based models. A session is a period of user activity (e.g., on the web, a session ends after 30 minutes of inactivity).

- Free: Up to 10,000 sessions/month. Includes core analytics, 6 months of data retention, unlimited users, and basic support.

- Growth: Custom pricing. Adds unlimited users & reports, 12 months data retention, chart customization, and email support.

- Pro: Custom pricing. Includes account analytics, report alerts, priority support, and session replay(add-on).

- Premier: Custom pricing. Behavioural targeting, AI-powered assistant, dedicated support, and data warehouse integration included.

When to choose Heap vs Mixpanel:

| Choose Heap when: | Choose Mixpanel when: |

|---|---|

| You want to eliminate tracking blind spots. | You maintain a rigorous tracking plan from day one. |

| Product managers need to define events without engineering. | You have dedicated developers managing event implementation. |

| Retroactive historical analysis is critical for your workflow. | You prefer granular control and cleaner datasets. |

Read more in our review of Heap alternatives.

Pendo

Best for: Enterprises that want to consolidate multiple tools (analytics, in-app engagement, feedback) into a single vendor and aren’t price-sensitive.

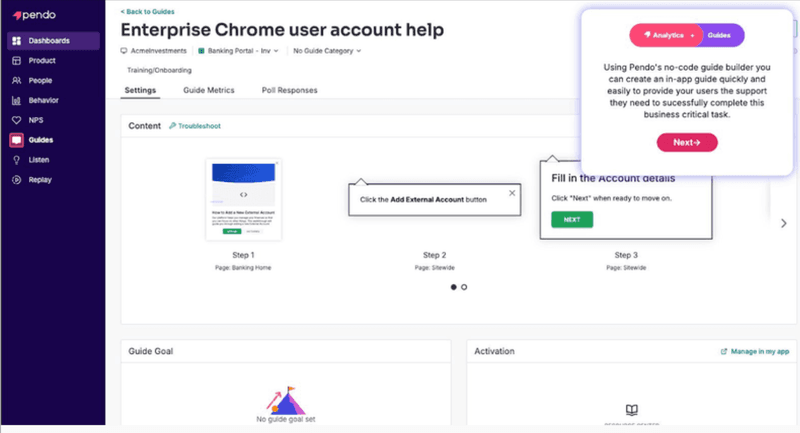

Pendo positions itself as an all-in-one software experience platform that combines product analytics, in-app guidance, user feedback, and session replays. It’s designed for enterprises looking to reduce their tech stack by replacing multiple point solutions with one comprehensive platform. However, this consolidation comes with significant trade-offs in agility and cost.

Pendo key features

- Product analytics platform with paths and funnels: Track feature adoption, user flows, and conversion rates through customizable dashboards. Build multi-step funnels to identify drop-off points, visualize actual navigation patterns, and measure retention across user segments.

- In-app guides and Resource Center: Create modals, tooltips, banners, and multi-page walkthroughs to guide users through your product. Build a self-service help hub where users access documentation and support without leaving your application, though a 1-hour data delay affects trigger timing.

- Session replay (paid add-on): Watch recordings of real user sessions showing clicks, scrolling, cursor movements, and form interactions. Filter replays by user segmentation, guides viewed, or frustration signals like rage clicking (30-day retention, 90-day available as an additional paid add-on).

- NPS surveys and Pendo Listen (Pulse tier/paid add-on): Deliver NPS surveys to active users in-app for higher response rates, then collect and organize detailed feedback, feature requests, and product ideas. Correlate NPS scores with usage patterns and prioritize roadmap items based on user demand.

- Orchestrate and Data Sync (paid add-ons): Build cross-channel user journeys combining in-app guides and email campaigns triggered by specific behaviors. Push Pendo data to your data warehouse (Snowflake, BigQuery, Redshift) or BI tools for custom analysis beyond native capabilities.

Pros and cons

| Pros | Cons |

|---|---|

| Analytics, in-app guidance, feedback collection, and user engagement are in one place, reducing tool fragmentation. | Pendo’s breadth and feature density make onboarding and advanced use challenging without training. |

| The ability to analyze historical behavior and get product usage insights, which helps inform decisions. | Custom pricing and add-ons make the total cost hard to predict and can be high for smaller teams. |

| Can analyze sata and get product usage insights, which helps inform decisions. | UI & navigation limitations, e.g., menu structures and interfaces are cumbersome, making exploration and reporting less fluid. |

| Users have reported specific data-related quirks and limitations in exports or detail granularity. |

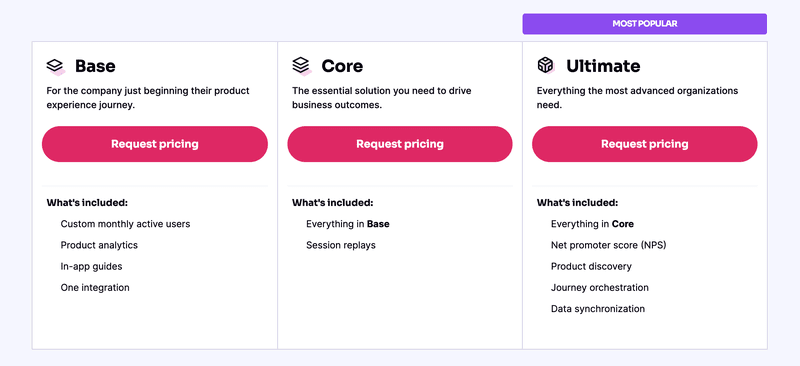

You must contact sales for a Pendo pricing quote. Based on community data from Vendr, the median customer pays $48,400/year, with pricing ranging from $16,900 to over $120,000 annually. Its plans include:

- Free: Up to 500 MAUs. Includes basic analytics, in-app guides, Pendo-branded NPS, and one-year data retention.

- Base: Custom MAU limits. Includes product analytics, in-app guides, and one integration.

- Core: Custom pricing. Adds one integration, session replay(as an add-on), and seven-year data retention to Base features.

- Pulse: Custom pricing. Adds one integration and completes session replay features.

- Portfolio: Custom pricing. Includes another integration, automated feedback triaging, feedback insights & summaries.

When to choose Pendo vs Mixpanel:

| Choose Pendo when: | Choose Mixpanel when: |

|---|---|

| You need analytics and in-app engagement in one platform. | You only need analytics without engagement tools. |

| You’re consolidating multiple vendors into one solution, and your budget isn’t constrained. | You want cost-efficient, flexible analytics. |

| You can support platform complexity. | You need faster, simpler workflows. |

PostHog

Best for: Engineering-led teams who value open source, need feature flags and experimentation tools, and want complete control over their data infrastructure.

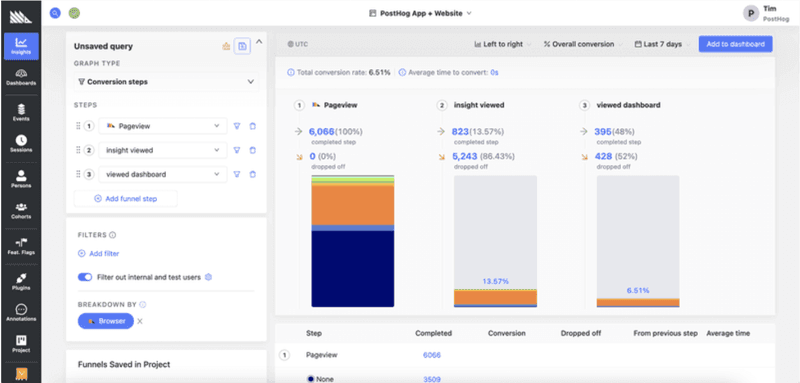

PostHog is an open-source product analytics suite designed specifically for engineers. It combines product analytics, session recordings, feature flags, A/B testing, and a SQL-based data warehouse in one developer-first platform. The key differentiator is the self-hosting option, giving you full control over user data.

PostHog key features

- Event-based analytics with session replay: Track customer behavior with PostHog’s event capture, then build funnels, cohorts, and retention reports to measure feature adoption. Watch video playbacks of real sessions showing clicks, scrolling, and navigation patterns, filtering by user segments or frustration signals to identify UX issues.

- Feature flags with edge computing: Control feature rollouts with granular targeting rules, toggling features for specific cohorts or individuals. Flags evaluate at the CDN edge with under 1 millisecond latency for optimal performance without network delays.

- A/B testing and experimentation: Run multivariate experiments with both Bayesian and frequentist statistical engines. Test changes on funnels, individual events, or advanced metrics like ratios, tracking unlimited secondary metrics to measure experiment impact across your entire product.

- SQL data warehouse with external sources: Query PostHog data alongside external sources (Stripe, HubSpot, Salesforce, Zendesk) using SQL. Join tables, create views, and build custom dashboards without leaving PostHog, or access your DuckDB data store directly for complete flexibility.

- Self-hosting option: Host PostHog on your own infrastructure (AWS, GCP, Azure) for complete data sovereignty. Essential for HIPAA, GDPR, and strict compliance requirements where data must stay in-house without relying on cloud providers.

Pros and cons

| Pros | Cons |

|---|---|

| Open-source provides the flexibility of modifying the platform or self-hosting for full data control and privacy. | Steep learning curve as navigating its depth and complex features requires time and expertise. |

| Includes product analytics, feature flags, session replays, and experimentation. | Self-hosting and proxy/configuration can be complex and require infrastructure skills. |

| Strong free limits (e.g., 1M events/month) and pay-as-you-grow pricing are appealing for startups and smaller teams. | Users note that it can lack specialized features like advanced account-level B2B analytics compared to purpose-built tools. |

| Many users highlight easy onboarding and an intuitive dashboard for core analytics, especially vs. some legacy tools. | Data collection is easy, but turning that into nuanced insights often needs technical skills or SQL access. |

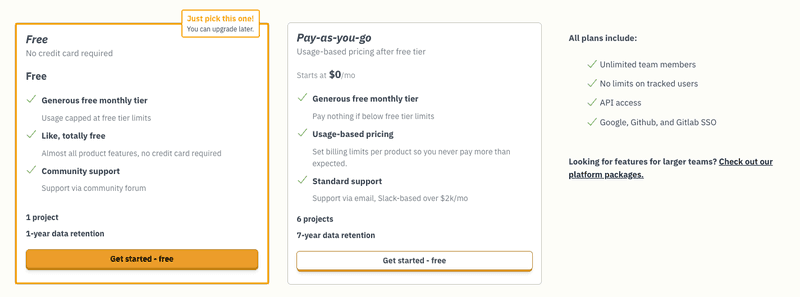

PostHog pricing uses a transparent usage-based model with generous free tiers. You only pay for what you use beyond the free limits:

- Free Forever: Usage capped at free tier limits (ideal for startups and MVPs).

- Pay As You Go: Usage-based pricing beyond free tiers, set custom billing limits per product.

- Enterprise: From $2,000/month – Adds SAML SSO, custom MSA, dedicated support, advanced permissions, audit logs, custom data retention.

When to choose PostHog vs Mixpanel:

| Choose PostHog when: | Choose Mixpanel when: |

|---|---|

| You want an all-in-one, developer-centric platform. | You only need product analytics. |

| Data control and transparency are non-negotiable. | You want a fully managed analytics service. |

| Your engineering team can manage the infrastructure. | You value simplicity and predictability. |

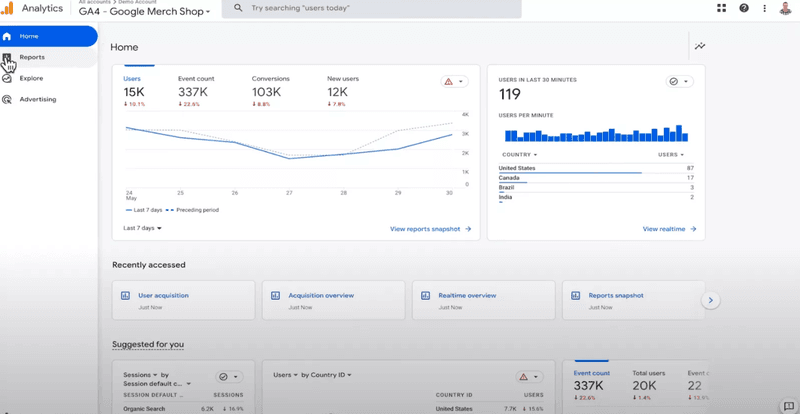

GA4

Best for: Marketing teams tracking website customer acquisition and conversion metrics.

Google Analytics 4 uses an event-based data model similar to Mixpanel, but relying on it for SaaS product analytics is a critical mistake. GA4 is primarily a web analytics platform that excels at answering marketing questions (where does traffic come from? which landing pages convert?) but falls short of the user-level granularity required for product-led growth. It’s built for marketers analyzing anonymous website visitors, not product teams building engagement strategies for known users.

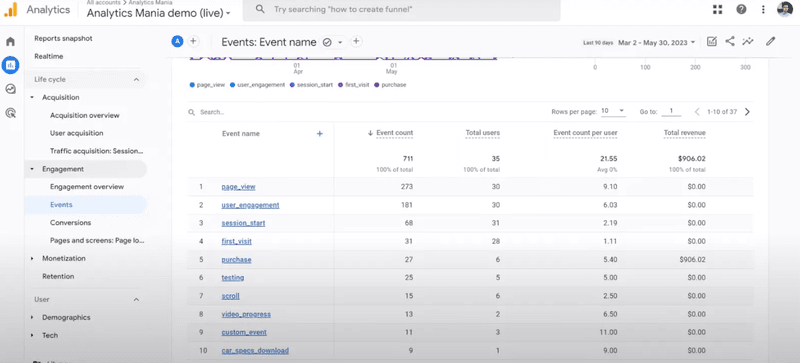

GA4 key features

- Acquisition and campaign tracking: Identify traffic sources, referral paths, and campaign performance across channels. Track how users discover your website and which marketing efforts drive the most qualified traffic to optimize ad spend.

- Google Ads integration with predictive audiences: Seamless connection to Google’s advertising ecosystem for campaign optimization and ROI measurement. Use machine learning models to predict churn probability and purchase likelihood, then export predictive audiences directly to Google Ads for targeted remarketing.

- Cross-platform event tracking: Follow user journeys from mobile app to website within a single property using a unified event-based data model. Define conversion events and measure interactions across devices without the session-based limitations of Universal Analytics.

- E-commerce tracking with funnel analysis: Monitor product views, add-to-cart events, purchases, and revenue through the complete purchase funnel. Build conversion funnels to identify where users drop off in checkout flows, analyzing landing page performance and form completions.

- BigQuery integration: Export raw event data to Google BigQuery for custom event analysis. Store data beyond GA4’s 14-month limit for user-level exploration reports, enabling long-term trend analysis and complex queries.

Pros and cons

| Pros | Cons |

|---|---|

| Completely free (standard version), so you can use it as a baseline analytics tool because there’s no licensing cost. | GA4 caps user-level data retention (typically 14 months), which frustrates teams doing long-term behavioral analysis. |

| Excellent for traffic sources, campaigns, funnels, and e-commerce performance, especially when paired with Google Ads. | Reviewers repeatedly note GA4 struggles with logged-in product behavior, feature adoption, and deep user journeys. |

| The unified event model for web and app data is seen as a step forward from Universal Analytics. | Ad blockers, sampling at scale, and regional GDPR restrictions lead to incomplete or unreliable datasets, according to many users. |

| You can export raw event data into BigQuery for deeper analysis. | Steep learning curve & confusing UI as some users cite GA4’s interface and reporting model as unintuitive, especially compared to older GA versions. |

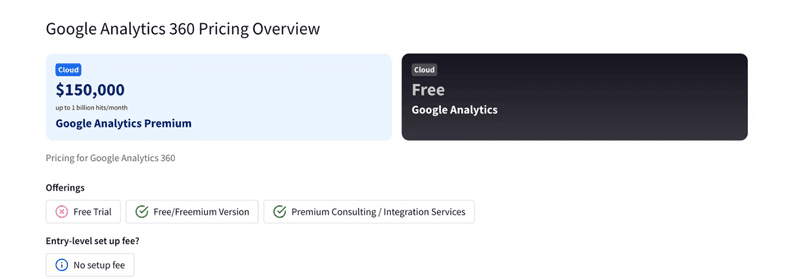

As for GA4’s pricing:

- Google Analytics 4 (Free): Unlimited usage for most businesses with up to 10 million events before data sampling begins, 14-month data retention for user-level data (2 months for demographics), and BigQuery export available (storage costs separate).

- Google Analytics 360: Starting at $50,000/year (custom pricing through resellers). Includes 25 million events/month, 50-month data retention, unsampled reports for accurate analysis, and dedicated support with advanced Google Marketing Platform integrations.

When to choose GA4 vs Mixpanel:

| Choose GA4 when: | Choose Mixpanel when: |

|---|---|

| You’re analyzing marketing and acquisition performance. | You need product usage analytics for SaaS applications. |

| Anonymous and aggregate data are sufficient. | You need user-level targeting for in-app engagement. |

| You have strict budget constraints. | You can invest in product-specific analytics. |

Make the best choice for your product team

Don’t choose the Mixpanel alternative with the prettiest charts. Choose the one that fits your team’s ability to execute. Here’s the decision list to help you:

- Need to act on insights without devs? Choose Userpilot. Auto-capture analytics with integrated engagement tools lets you identify friction and launch fixes in the same platform; no engineering required.

- Looking for deep data science correlation? Choose Amplitude. Compass and predictive analytics surface hidden patterns. Consequently, you’ll need technical resources for implementation and a separate tool for engagement.

- Need retroactive data safety? Choose Heap. Automatic capture prevents lost data from forgotten tracking, though session-based pricing can escalate quickly at scale.

- Consolidating enterprise tools? Choose Pendo. Get analytics, guides, and feedback in one platform. Plus, hour-long data delays and a steep learning curve.

- Need to self-host? Choose PostHog. Complete data governance for compliance-sensitive industries. You’ll trade open-source benefits for infrastructure overhead and maintenance costs.

- Tracking marketing websites? Choose GA4. Excellent for acquisition and traffic analysis. However, it’s not ideal for understanding how users engage with your SaaS application.

The goal isn’t just to have the most data; it’s to have the most useful data. If you want to experience the difference between watching data and using it, get started with Userpilot and try building a funnel or a flow on your own site today.

Userpilot strives to provide accurate information to help businesses determine the best solution for their particular needs. Due to the dynamic nature of the industry, the features offered by Userpilot and others often change over time. The statements made in this article are accurate to the best of Userpilot’s knowledge as of its publication/most recent update on January 8, 2026.