Product-market fit (PMF) often gets discussed with an almost mystical quality, as though it’s some elusive state you stumble upon by chance. As a product manager at Userpilot, I’ve learned that PMF is nothing mystical at all. Understanding your customers deeply, building solutions that address actual problems, and tracking qualitative and quantitative metrics gets you to PMF.

This article outlines my proven product-market fit framework to identify, achieve, and sustain true PMF and turn an idea into a product that resonates deeply with its audience and secures a dominant position in its niche.

What is product-market fit?

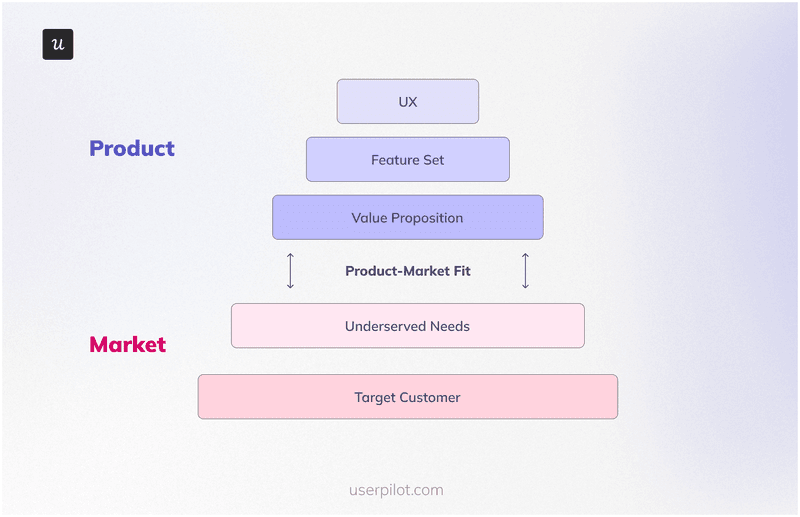

Product-market fit defines how well your product meets strong market demand. Marc Andreessen, who popularized the concept, puts it simply: “Product/market fit means being in a good market with a product that can satisfy that market.”

I see this as creating a product so compelling it practically sells itself, a solution potential customers seek out and advocate for among their peers. Successful product-market fit means your target audience uses your product frequently and would feel genuinely disappointed without access to it.

You don’t have to launch a perfect product from day one, but identify an unmet problem and craft a minimum viable product (MVP) that effectively addresses it. Even with imperfections, your initial offering must resonate strongly enough that early adopters become its biggest champions. Their advocacy initiates a powerful feedback loop that drives iteration, refinement, and organic expansion.

Why is product-market fit important for product success?

Without strong product-market fit, every other effort, including marketing, sales, development, and even fundraising, becomes unsustainable. Lack of product-market fit causes 56% of startup failures, starkly demonstrating PMF as the foundational element separating successful businesses from those that struggle.

Your product struggles to gain traction, leading to wasted resources, high customer acquisition costs, and ultimately, an unsustainable business model. Here’s why achieving product market fit is non-negotiable for product success:

Fuel sustainable, organic growth

When your product genuinely clicks with the target market, users integrate it into their daily workflows and continue using it regularly. This natural pull fuels product-led acquisition and dramatically reduces your customer acquisition cost (CAC).

Users become enthusiastic advocates who share their experiences with others, creating a self-reinforcing demand loop that drives adoption and generates powerful word-of-mouth marketing. Without this pull, you’re constantly spending more to acquire customers who might not even stick around.

Drive efficient resource allocation

Before achieving PMF, every dollar spent on growth initiatives, advertising, or scaling infrastructure is a gamble. However, a validated PMF provides clear confirmation that investments will yield positive returns.

This confidence allows us to allocate our precious development, marketing, and business development resources wisely, focusing energy and capital on enhancements and strategies that resonate with our user base so every investment moves the company and the product forward.

In fact, early-stage startups spend up to 3x longer validating target markets than founders anticipate, underscoring the importance of early, targeted validation to optimize how you deploy resources. Such a customer-centric approach from day one prevents wasteful pivots and failed initiatives.

Build stronger customer retention

Products achieving strong PMF resonate deeply with users, becoming indispensable tools that solve critical problems and integrate seamlessly into workflows. This deep connection leads directly to higher customer retention rates.

Satisfied customers finding constant, evolving value are also far less likely to churn. But user retention is also about developing lasting relationships, building loyalty, and making sure your product remains a core part of their tech stack. A product with a strong market fit organically encourages continued use and investment from the customer base.

Boost investor confidence

Venture capitalists and experienced investors look for tangible evidence of PMF above almost everything else. They want to see a viable business model, real market traction, and a clear path to scalability. Demonstrating strong PMF makes fundraising easier, validates your strategic vision, and instills confidence in investors that their capital will be put to effective use, driving substantial returns rather than chasing an unproven dream.

The investors want to see that your product has captured a significant market need and has the potential for widespread adoption and sustained revenue. In fact, founders generally overestimate intellectual property value by 255% before achieving product-market fit, underscoring how real market validation matters infinitely more than theoretical assets.

How to find product-market fit? 5-Step framework

Finding the right alignment isn’t a one-time event or lucky break. It’s a deliberate, structured process of continuous learning and adaptation. My team and I use a practical, step-by-step framework to uncover genuine market needs and build solutions that truly resonate.

This framework guides us from ideation through iterative validation and refinement so we build a product that the market eagerly embraces. Here’s my breakdown of how we approach achieving product-market fit:

1. Pinpoint your target customer

Before you build anything meaningful, you need to know exactly who you’re building for.

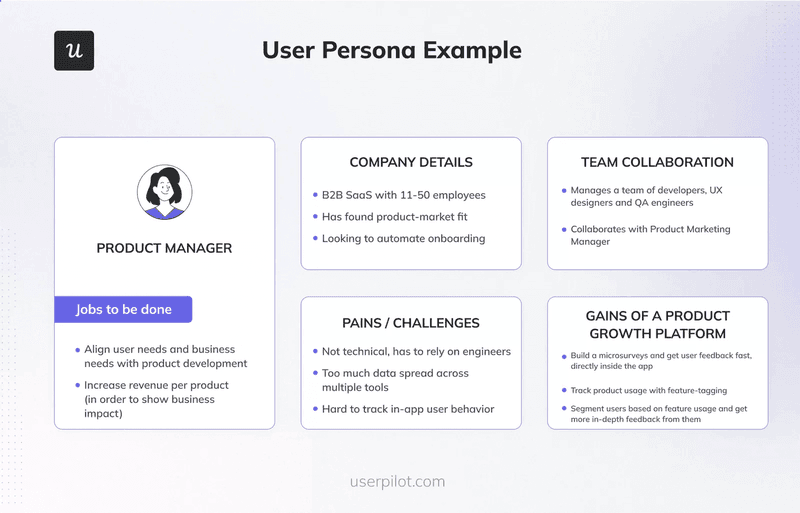

This means going far beyond general demographics and diving deep into user segmentation. I always start by creating detailed buyer personas, which are semi-fictional profiles reflecting your ideal customer’s goals, behaviors, and pressing pain points.

For instance, instead of saying we target “marketing managers,” we get specific: “Sarah, who leads a three-person growth team at a Series B SaaS company, manually tracking user behavior in spreadsheets because her current analytics don’t integrate with product data.”

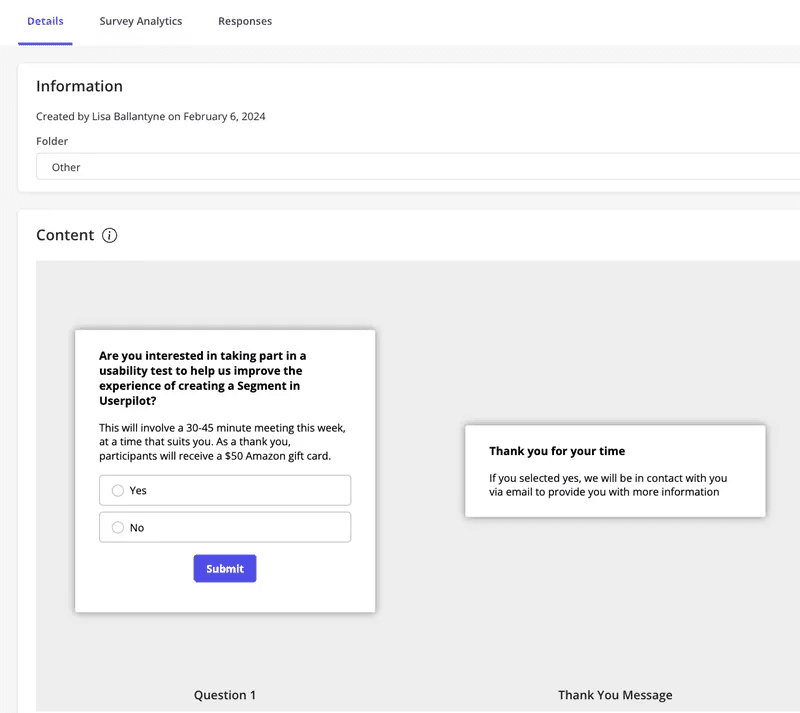

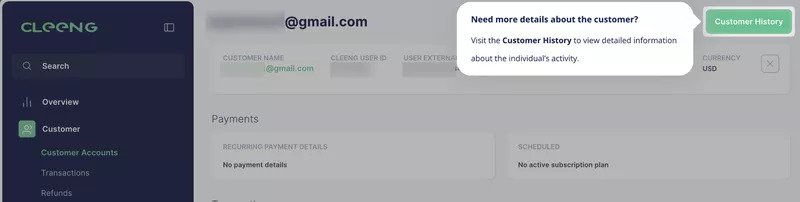

We also use a lot of data to craft these personas, including Userpilot to deploy user persona surveys to gather meaningful insights directly from potential customers.

Knowing who they are, what they do, what motivates them, and what their day-to-day challenges are is the first, most critical step in laying the groundwork for product-market fit, ensuring your solution is tailored to a specific, understood audience.

2. Discover users’ needs

This is arguably the most important step in the journey to product-market fit: identifying the problems your target customers face that no existing solution truly addresses. We call these “hair-on-fire” problems. That means strong market demands that people desperately want solved and actively seek solutions for.

To thoroughly understand customer pain points, you need rigorous customer research across multiple channels. We combine market research and various customer research methods to create a holistic view:

- Customer interviews: We conduct in-depth interviews with 15-20 potential users, asking open-ended questions about their daily struggles, workflows, current workarounds, and what they wish they could do but can’t. “Walk me through the last time you tried to accomplish X” reveals far more than “What features do you want?” because people often can’t accurately articulate their real problems.

- Customer surveys: We deploy in-app surveys or targeted email surveys to collect quantitative and qualitative data at scale. Questions like “What’s your biggest challenge with X?” or “What feature is missing from current tools?” uncover insights and validate qualitative findings, helping us prioritize the most acute market needs.

- Behavioral analysis: Using user behavior analytics, we observe what users actually do. People often can’t articulate their real problems accurately. We spot user friction points and unmet needs that users might not even realize they have. Tools like Userpilot allow us to track event data and user paths to understand actual behavior deeply, revealing critical gaps and opportunities that interviews miss.

- Competitive analysis: We meticulously examine what competitors offer and, more importantly, where they fall short. What gaps exist in their solutions or user experiences? What common complaints do their users have? I like to dig into G2 reviews, Reddit discussions, and support forums, looking for problems competitors dismiss as “edge cases” that actually affect a meaningful segment. The findings here highlight significant market gaps you can uniquely fill, creating a competitive advantage and positioning your product for stronger PMF.

3. Craft a powerful value proposition

Once you understand your customers and their unmet needs, you must articulate how your product solves them. Your clear value proposition is not just a feature list but the core, distinct benefit of making your product stand out from all alternatives and convincing users it’s the ideal solution.

My guiding question is always: “Why should a customer choose our product over every other option, or even doing nothing at all?”

This question forces clarity on the unique, indispensable value your product delivers, distinguishing it in crowded markets.

At Userpilot, our mission centers on helping product teams deliver personalized in-app experiences to increase growth metrics, focusing squarely on product adoption and user onboarding. This represents a clear articulation of our core values.

4. Build a Minimum Viable Product (MVP)

With a clear customer, validated unmet need, and compelling value proposition, it’s time to build. However, the key here is not to build everything at once. You want to focus on the smallest possible set of product features that can deliver your core value and allow you to test fundamental assumptions. This is your Minimum Viable Product (MVP).

The goal of the MVP is not perfection or completeness. You only need something functional enough to get into early adopters’ hands quickly and gather authentic customer feedback. An effective MVP tests your value hypothesis with real market feedback and is the fastest way to validate your core hypothesis and iterate toward true PMF.

AI and “vibe-coding” can dramatically speed up the MVP process. We explored this at our Product Drive summit in the session “Vibe Coding: A Game Changer for Experimentation and Finding Product Market Fit,” which demonstrated how modern development approaches accelerate iteration cycles. Watch the replay to learn how you can use these techniques in your own PMF journey.

5. Test and iterate

Getting your MVP in front of real customers and observing their reactions is vital. Product experimentation must be continuous, aimed at validating or invalidating your growth hypothesis regarding market demand and solution effectiveness. Here are key ways we test and gather feedback:

- Usability testing: We conduct rigorous usability tests to see how users interact with our MVP. Session replays are invaluable, letting you see your product through users’ eyes and uncover issues you might never find through surveys alone. Userpilot’s session replay feature allows us to filter by frustrated sessions, quickly pinpointing exactly where and why users struggle. Recruiting people for usability testing works best via in-app surveys. Lisa, our researcher, found much better response rates than email outreach by catching users when they were actively engaged. We have covered the full Userpilot case study on usability testing to show you how you, too, can achieve significantly higher participation rates using targeted in-app recruitment.

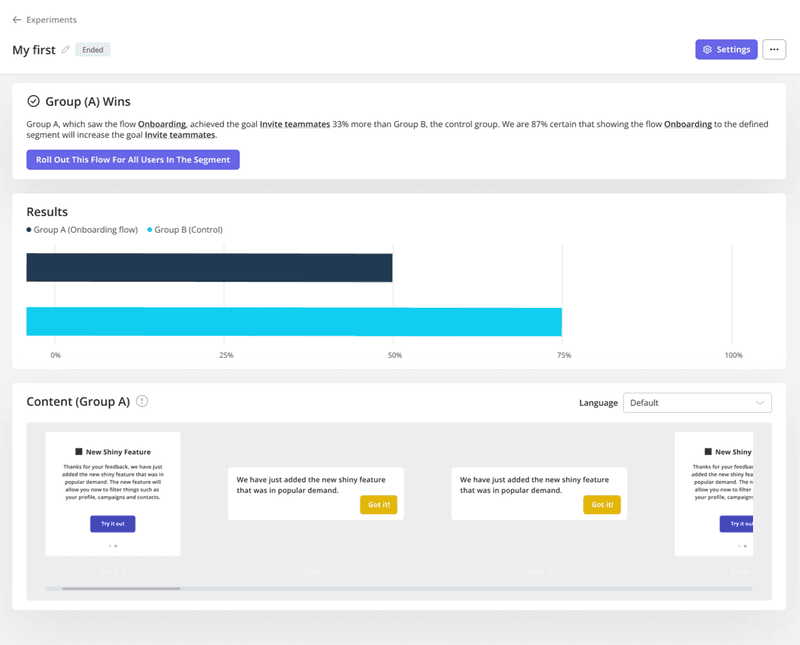

- A/B Testing: For specific features or onboarding flows, we run A/B tests. Does one version of a product tour lead to significantly higher activation rates compared to another? Userpilot’s experimentation tools allow us to compare different flows against each other, or against a control group, to measure their precise impact on user activation and other key metrics.

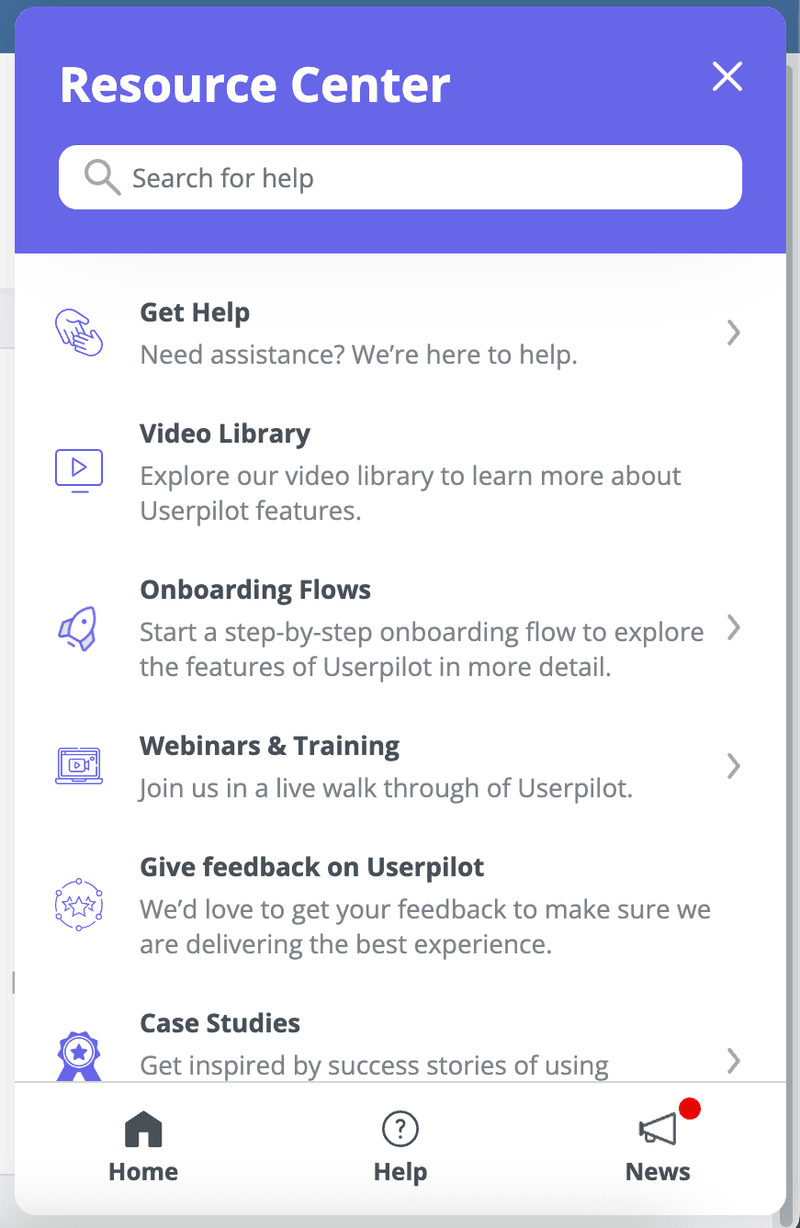

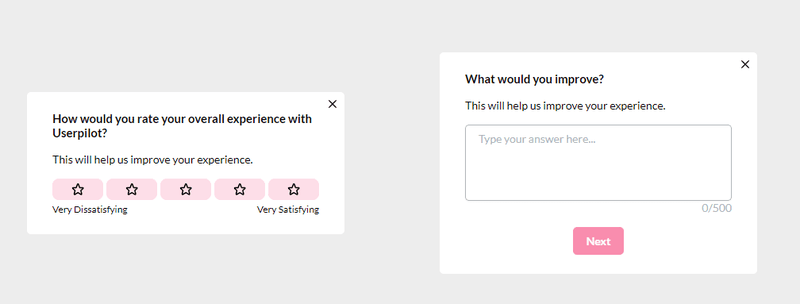

- In-app feedback: We deploy in-app feedback widgets and microsurveys to gather contextual feedback at critical moments. A prime example is asking users, “How disappointed would you be if you could no longer use this product?” (the Sean Ellis test). If less than 40% say “very disappointed,” you still have significant work to do. Userpilot’s NPS surveys and custom surveys are perfect for this, allowing you to ask follow-up questions based on their scores. Apart from running these microsurveys, you can also add an always-present feedback collection field to the resource center, so users have a permanent channel to share thoughts whenever they arise.

Based on this continuous feedback, you then refine your product. This might mean tweaking existing features, adding new minimum viable features, or even pivoting your target audience or core value proposition. It’s an intensive, focused feedback loop aimed at finding that elusive initial product market fit, continually adjusting until your solution perfectly aligns with market demand. Research shows that startups pivoting once or twice can increase user growth by 3.6x & generate 2.5x more returns, highlighting the value of this iterative approach.

How to measure product-market fit success? Key metrics

While you might “feel” alignment emerging through customer enthusiasm and rapid word-of-mouth growth, relying solely on intuition isn’t sustainable. Successful product-market fit must be measured with solid, quantifiable data and clear qualitative signals.

This section focuses on identifying the specific moment or threshold when you can confidently say, “Yes, we have product-market fit,” distinguishing it from ongoing monitoring and optimization. Here are the key metrics and signals I track to know when we’ve hit a milestone in our product market fit journey:

Quantitative metrics

Quantitative metrics are numerical measurements you can calculate and track inside a product analytics platform such as Userpilot. You can correlate these on dashboards to understand relationships between different aspects of user behavior and performance.

- Retention rate: Retention serves as a powerful indicator of sticky value. If users keep coming back and find sustained value over time, your product is genuinely indispensable. We track user retention daily, weekly, and monthly, especially for new user cohorts, to see how well we’re keeping customers engaged. Userpilot’s user retention Dashboard gives us a clear view of patterns over time.

- Churn rate: On the other hand, a high churn rate is a glaring red flag signaling existing users aren’t finding enough value. We meticulously analyze churn analytics to understand why users leave and address those underlying issues proactively. A low, stable churn rate is a strong signal that your product effectively solves user problems.

- Engagement metrics: These metrics tell you how actively and deeply active users interact with your solution. We closely monitor Daily Active Users (DAU), Weekly Active Users (WAU), and Monthly Active Users (MAU). A high DAU/MAU ratio signals deep integration into regular routines. Our product usage dashboard helps visualize these trends and monitor feature usage rate for core functionalities, confirming engagement with the product’s primary value drivers.

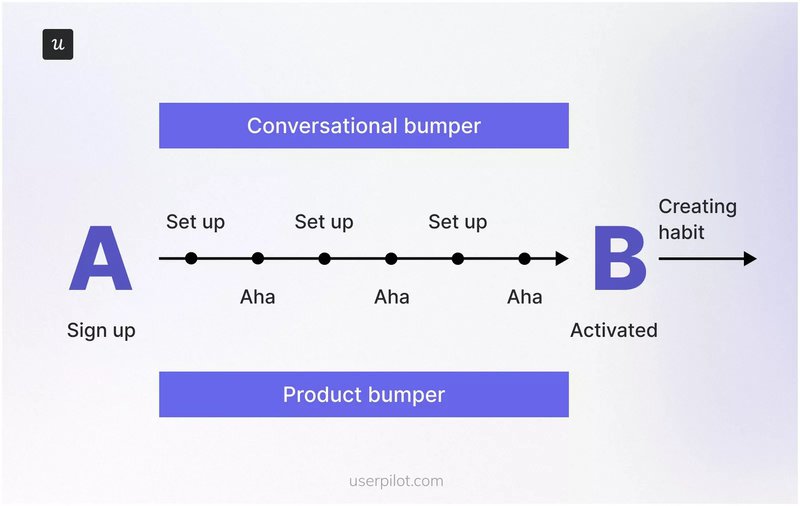

- Activation rate: How many new users successfully reach their “Aha!” moment and begin regularly using core features? A strong user activation rate is a direct sign that your product is delivering immediate, compelling value and is resonating quickly with new users, confirming the initial promise of your value proposition. Our new users activation dashboard helps us track this critical metric and optimize the first-time customer experience. Strong user activation rates directly signal that your solution delivers immediate, compelling value.

- Customer Lifetime Value (LTV) & CAC Payback Period: A healthy LTV:CAC ratio shows that the value each customer brings far outweighs acquisition costs, which is also a clear and quantifiable sign of sustainable product-market fit. We constantly monitor our CAC payback period to ensure economic viability, as efficient customer acquisition and high lifetime value are hallmarks of a product that truly aligns with market needs and business goals.

Qualitative metrics

Qualitative metrics and indicators encompass feedback collected both actively (surveys requesting feedback) and passively (finding reviews online, observing engagement patterns). These provide context behind the numbers and reveal why users behave the way they do.

- The “very disappointed” test: Asking users “How disappointed would you be if you could no longer use this product?” proves extremely telling. If over 40% say “very disappointed,” you’re likely on the right track towards PMF. You want to go as high as you possibly can on this number.

- User enthusiasm and advocacy: Are users actively promoting your product without prompting? Are they writing positive feedback in reviews, engaging in discussions on social media, or referring others? Organic customer advocacy powerfully signals your product has captured their loyalty and solved significant problems, signifying strong customer satisfaction and market adoption.

- Unsolicited feedback: Are you receiving numerous unsolicited feature requests, glowing testimonials, or creative use cases from users? A highly engaged customer base sees your product as essential and wants to see it grow and evolve with their needs, confirming your product provides undeniable value.

- Shortening sales cycle and high demand: Is your sales cycle naturally shortening? Are enough customers actively seeking out your product, perhaps even lining up to use it? High inbound demand, often seen in quick conversions and referrals, represents strong, undeniable PMF evidence. The market itself pulls your product into wider adoption. Figma grew to 4 million users before its $20B acquisition attempt in 2022, demonstrating startup success and strong PMF through organic growth and market pull.

What are the signs of gaps in your product-market fit?

Just as the above indicators signal a strong PMF, some equally stark red flags announce you haven’t found it yet. The earlier you recognize these deficiencies, the quicker you can stop wasting efforts, curb mounting costs, and efficiently course-correct.

- Low user engagement: When users sign up but rarely return, or they don’t engage deeply with core features, it’s a major warning sign. Consistently low sessions per user or very short product usage times clearly signal they aren’t finding sustained value. Adding engagement elements such as interactive guides can help diagnose the issue. Not only can these boost activation, but they may help identify UI mistakes. When users weren’t using a feature but started once they saw a tooltip pointing to it, the button placement was probably invisible. However, when these improvements don’t help, the solution itself likely isn’t actually useful enough.

- High churn rates: If a significant percentage of paying customers leave your solution shortly after joining, it indicates your product consistently meets their expectations or solves a problem significant enough to warrant continued use. We actively seek to understand specific cancellation reasons through targeted cancellation surveys.

- Over-reliance on discounts: Constantly needing deep discounts, aggressive promotions, or “loss leader” pricing to attract new users is a clear sign that your product’s perceived value doesn’t genuinely justify your price point. Your customers’ perceived value needs to increase significantly to command the full price.

- Poor sales conversions: When your sales team consistently struggles to close deals without extensive, high-effort persuasion, or when users on free trials fail to convert into paying customers, it suggests a significant disconnect between your offering and market demand.

- User misconceptions and frustrations: If users frequently misunderstand your solution’s core purpose, struggle to navigate key features, or express confusion, your messaging, onboarding, or UX design is likely unclear. I regularly use session replays to see users getting stuck, which proves invaluable for identifying specific instances of user frustration and pinpointing exact friction points requiring immediate attention.

- Inconsistent growth: Expansion that only materializes with exorbitant, unsustainable marketing spend, rather than through organic pull and advocacy, indicates a weak underlying foundation and lack of true PMF.

- Frequent product/market changes: If you find yourself constantly altering your product’s core features, significantly changing your product positioning, or pivoting your target market, it strongly suggests you haven’t yet found your stable, profitable niche.

What are the signs of strong product-market fit?

When product market fit is truly achieved, you observe powerful acceleration and a self-reinforcing cycle of growth, loyalty, and market pull. These definitive signs indicate you’ve hit that coveted sweet spot:

- Organic growth surpassing paid efforts: When a substantial portion of new customers comes through authentic word-of-mouth, direct referrals, and organic search, it represents the holy grail of sustainable expansion.

- Flattening retention curves: Instead of a steep, continuous drop-off in user engagement, your user retention numbers stabilize after an initial period, indicating that users are consistently finding ongoing, indispensable value. This shows that you’re achieving customer stickiness.

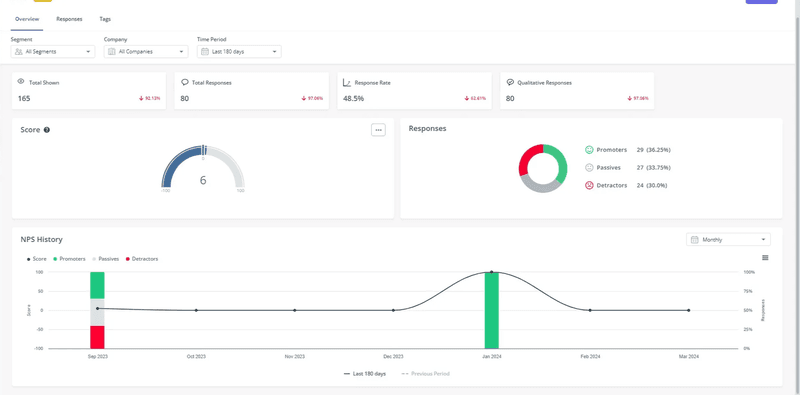

- Consistently high Net Promoter Score (NPS): Sustained high NPS, with a large proportion of promoters and very few detractors, means users actively recommend your solution. We meticulously analyze NPS responses to understand the drivers of enthusiasm. Customer stories from these promoters become powerful validation tools for prospects evaluating your solution.

- Unsolicited customer success stories: Users voluntarily share success stories and case studies about how your solution transformed their work or lives, often without prompting. They become powerful customer advocates, proving your value in real-world scenarios.

- Reduced sensitivity to price changes (pricing power): When your solution truly fits the market and delivers exceptional value, customers become less sensitive to price increases. They recognize the significant return on investment, which gives you considerable pricing power.

How to scale smartly after finding product-market fit?

Achieving alignment represents a monumental milestone, but it’s not the finish line. The challenge shifts from “finding a market” to “effectively serving that market at scale while exploring expansion opportunities.”

My focus post-alignment immediately shifts to three overarching strategic areas:

Ensure continuous customer understanding

Even with PMF validated, markets remain dynamic, and customer needs constantly evolve. Continuous customer research and robust feedback loops become even more critical to maintaining your edge here. We deploy targeted customer experience surveys and use sophisticated customer insight tools to gain a deeper understanding of market trends and customer expectations. Only by understanding what customers value can we anticipate these market shifts and adapt proactively.

Power your growth engine

Once you’ve identified what resonates with your target market, the next step is to make that success repeatable and scalable. This means investing heavily in robust customer onboarding automation to ensure every new customer rapidly and consistently experiences the solution’s core value.

With user engagement tools like Userpilot, I can build highly effective interactive onboarding flows, step-by-step checklists, and comprehensive resource centers entirely code-free.

These tools streamline the path to user activation, inform your product roadmap decisions, and significantly nurture your product-led growth strategy, turning prospects into engaged, loyal customers efficiently.

Increase customer loyalty and account expansion

After acquiring customers, your focus should move towards enhancing retention and driving profitable account expansion. This involves delivering exceptionally personalized customer service and implementing proactive support strategies that anticipate user needs. You can also consider loyalty programs that reward long-term engagement and referrals, turning happy customers into active evangelists. Then, use deep customer loyalty analytics to track and continuously improve these efforts.

Userpilot’s customer lifecycle management features help us personalize experiences and maintain relevance across the entire journey. Customer engagement tools, including context-rich mobile content like interactive carousels and timely slideouts, plus targeted email campaigns, help you reach users effectively wherever they are with highly relevant messages.

Achieve product-market fit and scale your software with Userpilot

Achieving and maintaining PMF means constantly adapting your understanding of your target market to meet their changing needs. With a relentless focus on understanding real customer problems, building deliberately with an experimental mindset, and measuring progress rigorously, you can create a solution people truly love and can’t live without.

But fragmented tools create blind spots and slow down your iteration cycles. You need a consolidated platform for data collection, benchmarking, and constant monitoring. Whether you’re pursuing growth-hacking strategies or building market share systematically, you need this single source of truth platform that combines behavioral analytics, customer feedback, and engagement tools in one place.

Userpilot serves as that consolidated platform. It helps you collect user data, benchmark performance against industry standards, and immediately act on insights to strengthen satisfaction. Unlike disconnected analytics tools, Userpilot lets you identify friction points through session replays and behavioral data, then instantly deploy engagement elements like tooltips, modals, and checklists to address those issues.

Ready to find your product-market fit faster? Book a demo to see how Userpilot accelerates your path through unified analytics, feedback collection, and in-app engagement.